That's all for real-time market coverage for Thursday. Thank you for joining us today!

Nifty continues its momentum for the 2nd consecutive day

Nifty nearly 83 points away from reaching its all time high

Nifty reclaims 26,200 mark after 13 months: fail to close above 26,200

Eicher Motors and Bajaj Twins gain the most in Nifty

Eicher Motors and Bajaj Twins gain over 2% for the day

Benchmark Indices outperforms Broader Market Indices

Nifty Financials and Oil & Gas lead the rally in Nifty

Bajaj Twins and HDFC bank gain the most in Nifty Financials

Broader Market Indices end flat for the day

Mahindra & Mahindra Financial Services, Hitachi Energy gain the most Nifty Midcap

Mahindra & Mahindra Financial Services gain nearly 5% for the day

TV18 broadcast and Jaiprakash Power Ventures gain the most in Nifty smallcap 250

Nifty Oil and Gas snaps 2-day losing streak

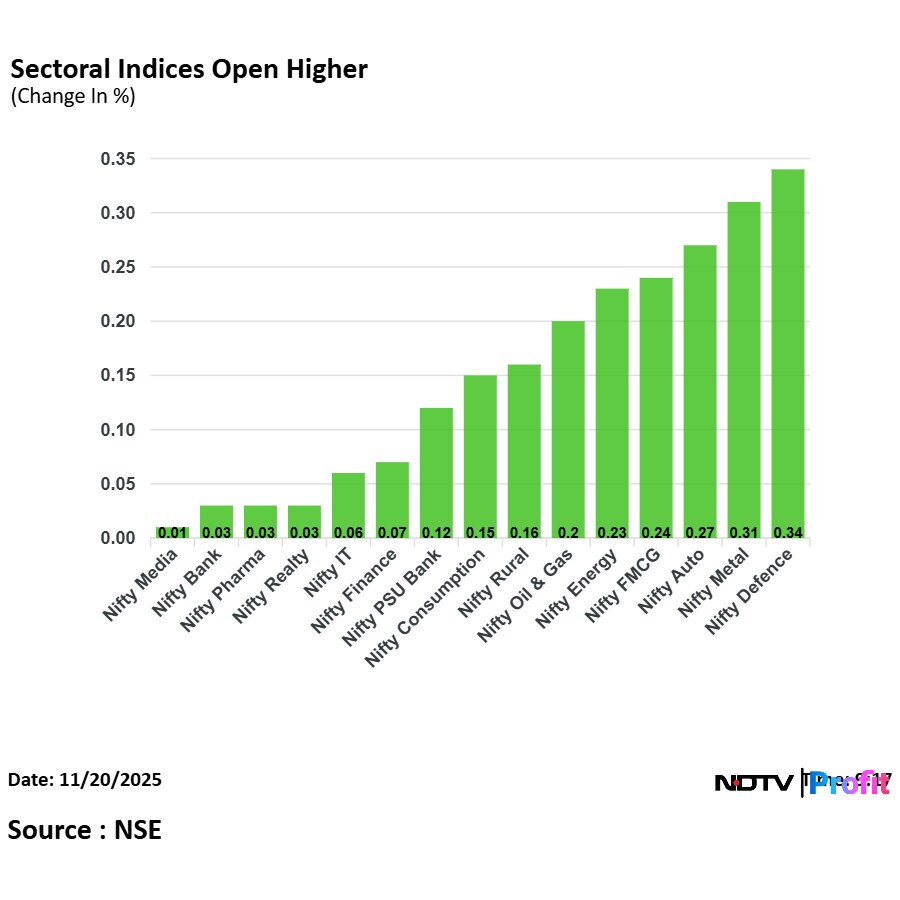

Nifty Auto, Metal, Financial Services, Banks, IT and FMCG gain for the 2nd consecutive day

Nifty continues its momentum for the 2nd consecutive day

Nifty nearly 83 points away from reaching its all time high

Nifty reclaims 26,200 mark after 13 months: fail to close above 26,200

Eicher Motors and Bajaj Twins gain the most in Nifty

Eicher Motors and Bajaj Twins gain over 2% for the day

Benchmark Indices outperforms Broader Market Indices

Nifty Financials and Oil & Gas lead the rally in Nifty

Bajaj Twins and HDFC bank gain the most in Nifty Financials

Broader Market Indices end flat for the day

Mahindra & Mahindra Financial Services, Hitachi Energy gain the most Nifty Midcap

Mahindra & Mahindra Financial Services gain nearly 5% for the day

TV18 broadcast and Jaiprakash Power Ventures gain the most in Nifty smallcap 250

Nifty Oil and Gas snaps 2-day losing streak

Nifty Auto, Metal, Financial Services, Banks, IT and FMCG gain for the 2nd consecutive day

Rupee closed 12 paise weaker at 88.71 against US Dollar

It closed at 88.59 a dollar on Wednesday

Source: Bloomberg

Tata Mutual Fund bought 3.27% stake in Tega Industries. The total shareholding of Tata Mutual Fund at 5.36% post acquisition, the company said in the exchange filing.

Brokerage CLSA has reiterated its High Conviction Outperform rating on Nvidia Corp. with a target price of $270, citing strong results and upbeat guidance that challenge the growing narrative of an AI slowdown.

The firm noted that Nvidia’s latest quarter delivered a 3.5% revenue beat on the top end of guidance, its best in four quarters, and projected Q4 FY26 revenue at $66.3 billion, ahead of the $64 billion estimate. CLSA highlighted steady momentum, surging token consumption, and high usage despite chip shortages as key drivers.

Greenpanel Industries Ltd., India’s largest manufacturer of Medium Density Fiberboard (MDF), is looking for a sharp pivot towards aggressive growth, supported by the company's recent commissioning of a new production line in Andhra Pradesh.

Speaking to NDTV Profit, Himanshu Jindal, Chief Financial Officer of Greenpanel Industries, talked about the company's growth strategy going forward after a period of operational headwinds, even declaring that the worst is over.

Lloyds Engineering signed two contracts with Poland-Based Kliver Polska. The company will develop prototype of towed reels and prototype of test stand for company.

Goodluck India Ltd.'s Goodluck Defence & Aerospace received $6 million export order for supply of M107 ready-to-fill shells, the company said in the exchange filing.

Market momentum has been excellent; markets had laid a strong foundation and hence this move today

If Nifty closes above 26,200 today, it can open up more room for another 500 points

Participation is still not high; so though market is at near high, portfolios are still nt near those levels

Domestic money has won over Foreign Institutional Investors

Source: Gautam Shah, Goldilocks Global Research to NDTV Profit

PVR INOX opened a six-screen multiplex in Pitampura in Delhi. The total multiplex screens in India and Sri Lanka at 1,767, the company said in the exchange filing.

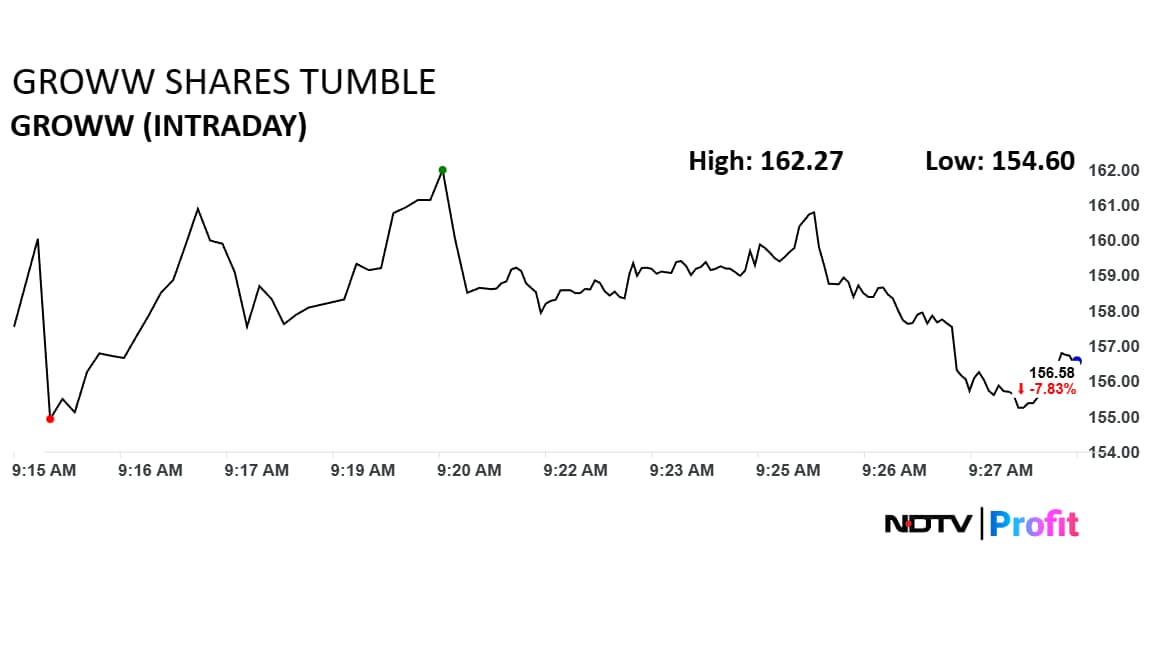

Billionbrains Garage Ventures Ltd., parent company of trading application Groww, delivered one of the most spectacular listings of 2025, surging nearly 90% within days of its Dalal Street debut and briefly becoming the market’s newest fintech star. Frenzied buying, extremely low free float and strong retail enthusiasm sent the stock into repeated new highs as traders chased momentum. But the euphoria didn’t last.

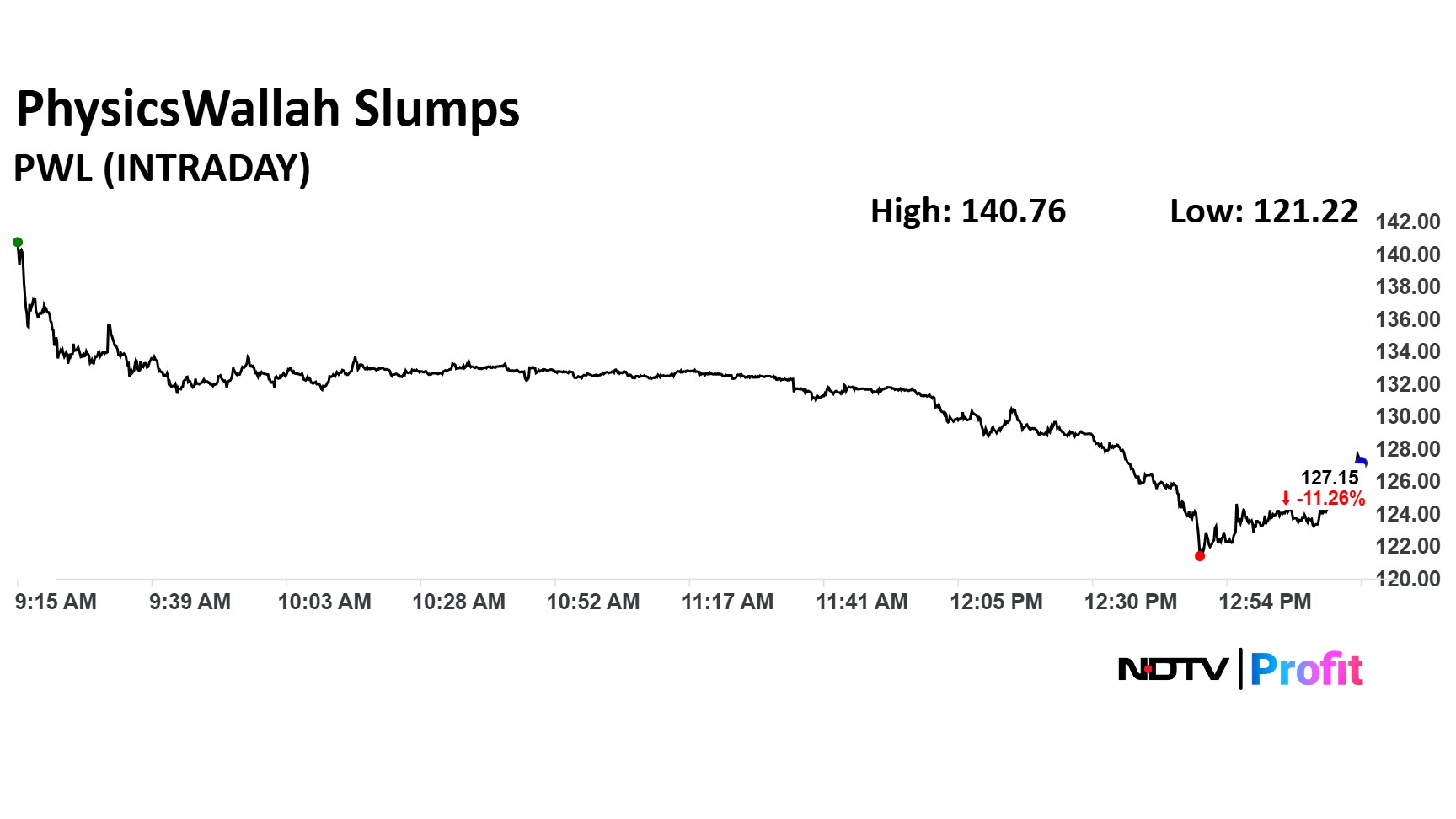

PhysicsWallah share price slumped 15.40% to Rs 121.22 apiece. It was trading 10.98% down at Rs 127.93 apiece as of 1:20 p.m.

PhysicsWallah share price slumped 15.40% to Rs 121.22 apiece. It was trading 10.98% down at Rs 127.93 apiece as of 1:20 p.m.

Texmaco Rail & Engineering received Rs 6.4 crore order from the Central Railways for platform works at Kalyan Station in Mumbai, the company said in an exchange filing.

Transrail Lighting received new orders worth Rs 548 crore. It added new country in the MENA region, the company said in the exchange filing.

City Union Bank opened a branch in Aligarh, Uttar Pradesh. The total number of branches are now at 893, the company said in an exchange filing.

Gujarat Industries Power commissioned the fourth phase of 600 megawatt solar power project in Kutch. The total capacity commissioned at Kutch Power Plant is now at 465 megawatt, the company said in the exchange filing.

Japan's benchmark 10-year government bond yield advanced 8 basis points to 1.845% so far today. The yield level rose to the highest since 2008 as investors await for Prime Minister Sanae Takaichi's stimulus package.

The focus is on Takaichi's upcoming spending plans as it has stroked fears of further worsening of Japan's fiscal condition.

Epack Prefab Technologies signed a memorandum of understanding with MASCOT South Asia LLP for capacity addition in Gujarat.

The company will increase capacity by around 50,000 tonnes in the first phase. It will invest around Rs 110 crore in the first phase for capacity addition in Gujarat, the company said in the exchange filing.

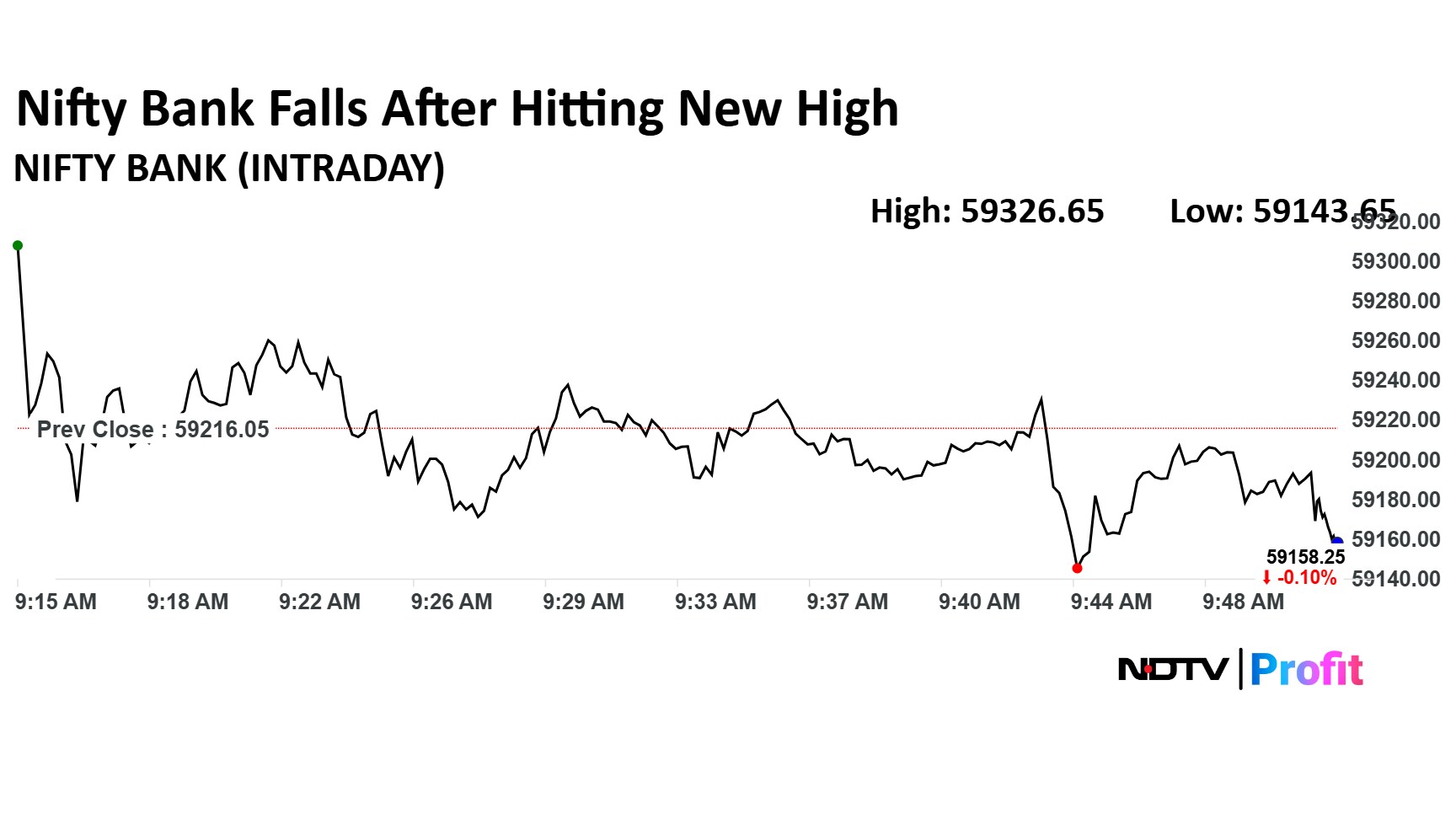

The NSE Nifty Bank index rose 0.19% to 59,326.65. It was trading 0.08% down at 59,161.95 as of 10:17 a.m. Punjab National Bank, HDFC Bank Ltd., and Kotak Mahindra Bank Ltd. were top gainers in the index.

The NSE Nifty Bank index rose 0.19% to 59,326.65. It was trading 0.08% down at 59,161.95 as of 10:17 a.m. Punjab National Bank, HDFC Bank Ltd., and Kotak Mahindra Bank Ltd. were top gainers in the index.

Tesla is expanding its India footprint with the launch of its first full-scale centre in Gurugram later this month, signaling a major push to boost volumes and retail visibility in the domestic market. The move comes as the US electric carmaker faces global headwinds, from slowing demand in China to investor caution, NDTV said.

Fujiyama Power Systems Ltd. listed at discounts on exchanges. It listed at Rs 220 apiece on National Stock Exchanges, which indicated a discount of 3.5%.

The stock listed at Rs 218.4 on BSE Ltd., which implies a discount of 4.2% from the issue price of Rs 228 apiece.

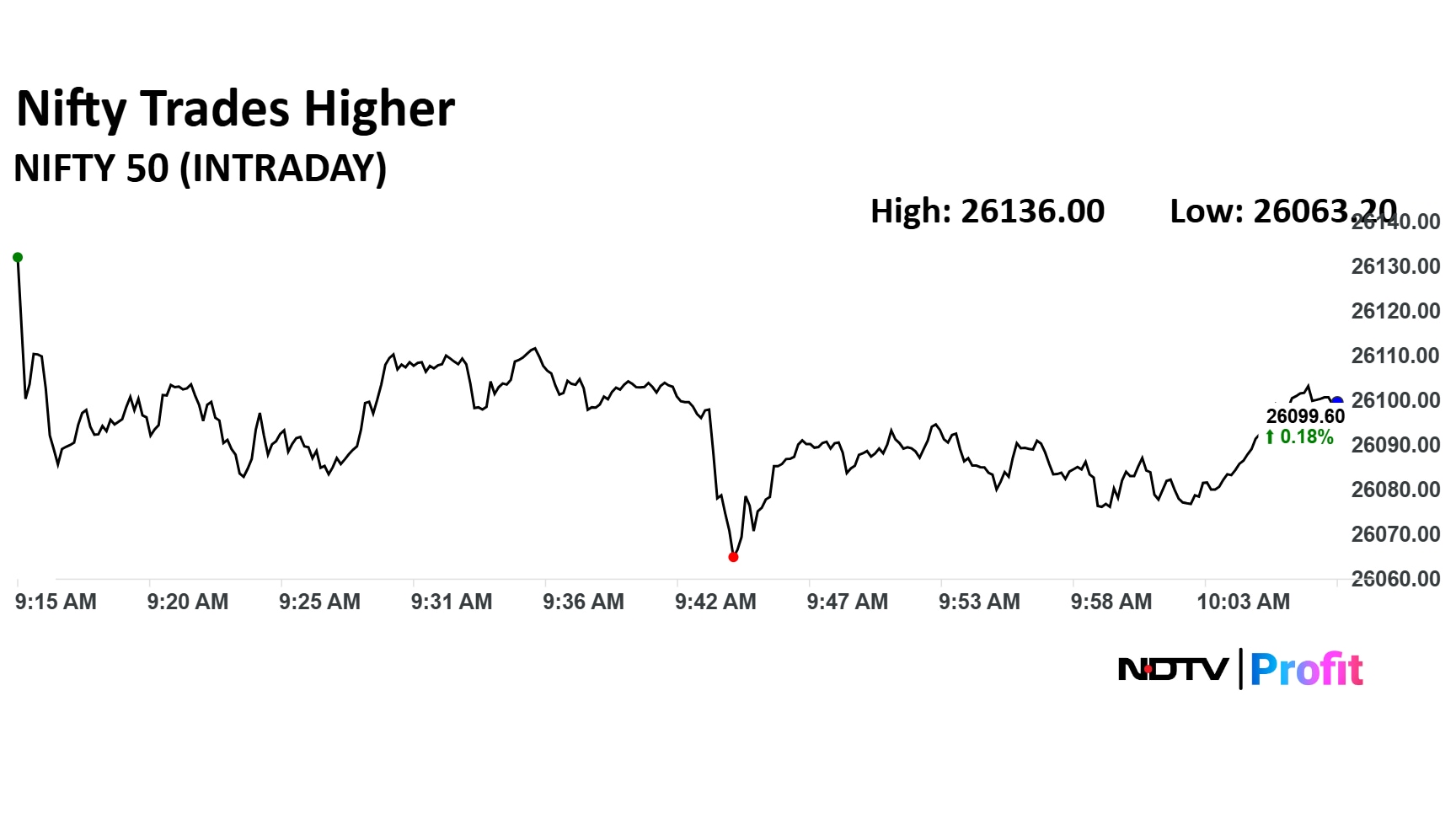

The NSE Nifty 50 index was trading 0.17% higher at 26,096.30 as of 10:03 a.m. The index is 181 points away from its life high level os 26,277.35

The NSE Nifty 50 index was trading 0.17% higher at 26,096.30 as of 10:03 a.m. The index is 181 points away from its life high level os 26,277.35

Citi Research maintained a Buy with a target price Rs 4,875, which implied a 14.4% upside

Maintained as one of top picks within India industrials

Have an ongoing OW Cummins India / UW ABB India pair trade idea

Industrial segment weakness seen in 2QFY26 is likely transitory

Steady demand seen for powergen from real estate, construction, and infrastructure sectors

Future datacenter demand from colocation providers is likely to be steady

Avenir Investment RSC, an affiliate of Abu Dhabi-based International Holding Company remains fully committed to its proposed investment in Sammaan Capital, despite ongoing allegations surrounding the firm, sources familiar with the development told NDTV Profit.

IHC has agreed to acquire a 43.46% stake in Sammaan Capital for $1 billion, a transaction that remains subject to regulatory and legal approvals.

Hester Biosciences's board approved appointment of Ashish Desaid as chief financial officer, the company said in the exchange filing.

Shares of Billionbrains Garage Ventures Ltd., the parent company of Groww, is once again facing immense pressure on Thursday's trade, as the stock continues to tumble after a mega rally post listing.

The stock is currently trading at Rs 155, which accounts for a fall of more than 8%. This comes after the scrip had touched the lower circuit in trade on Wednesday.

Shares of Billionbrains Garage Ventures Ltd., the parent company of Groww, is once again facing immense pressure on Thursday's trade, as the stock continues to tumble after a mega rally post listing.

The stock is currently trading at Rs 155, which accounts for a fall of more than 8%. This comes after the scrip had touched the lower circuit in trade on Wednesday.

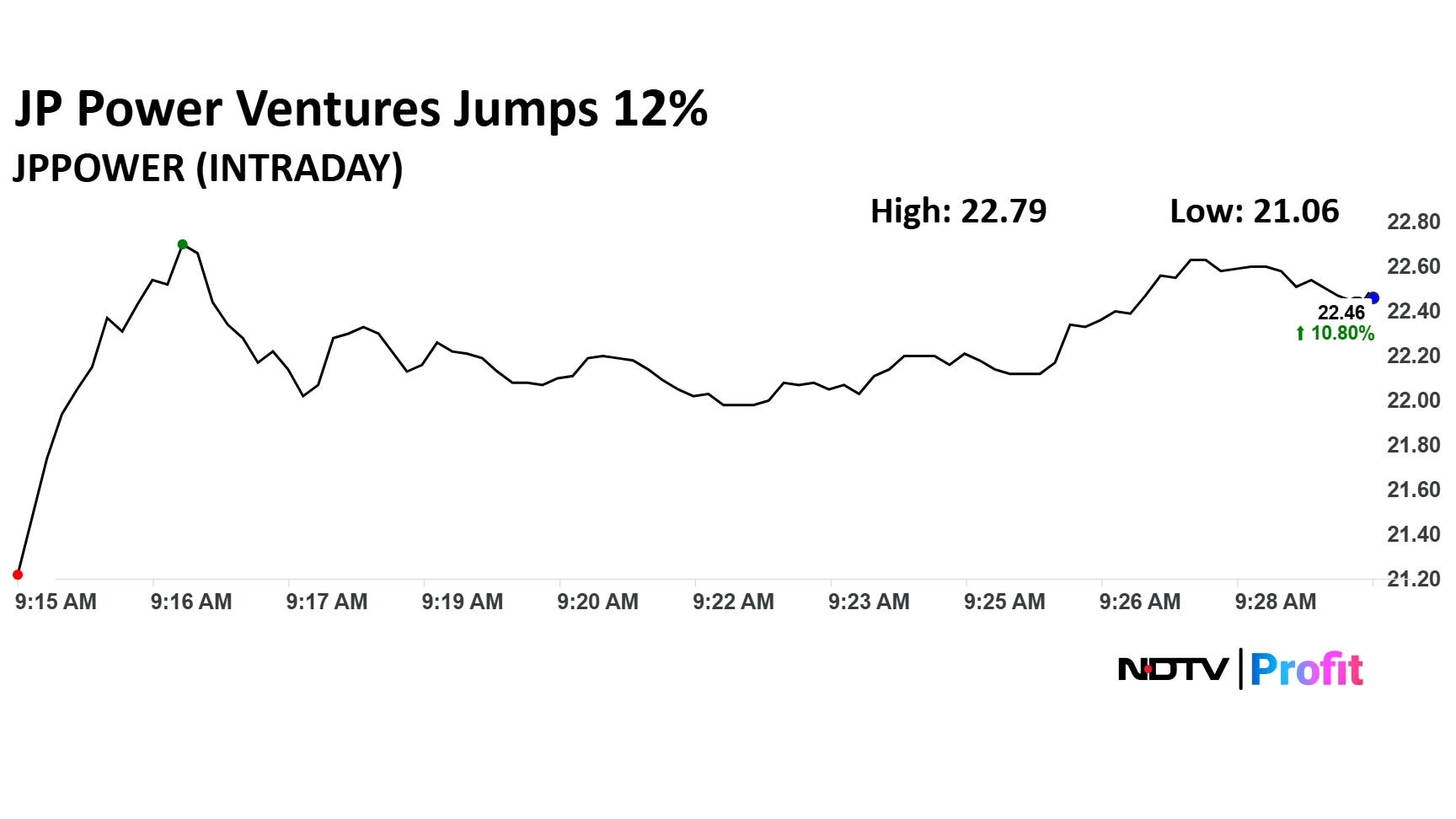

Jaiprakash Power Ventures share price jumped 12.43% to Rs 22.79 apiece. It was trading 10% higher at Rs 22.28 apiece as of 9:31 a.m.

Jaiprakash Power Ventures share price jumped 12.43% to Rs 22.79 apiece. It was trading 10% higher at Rs 22.28 apiece as of 9:31 a.m.

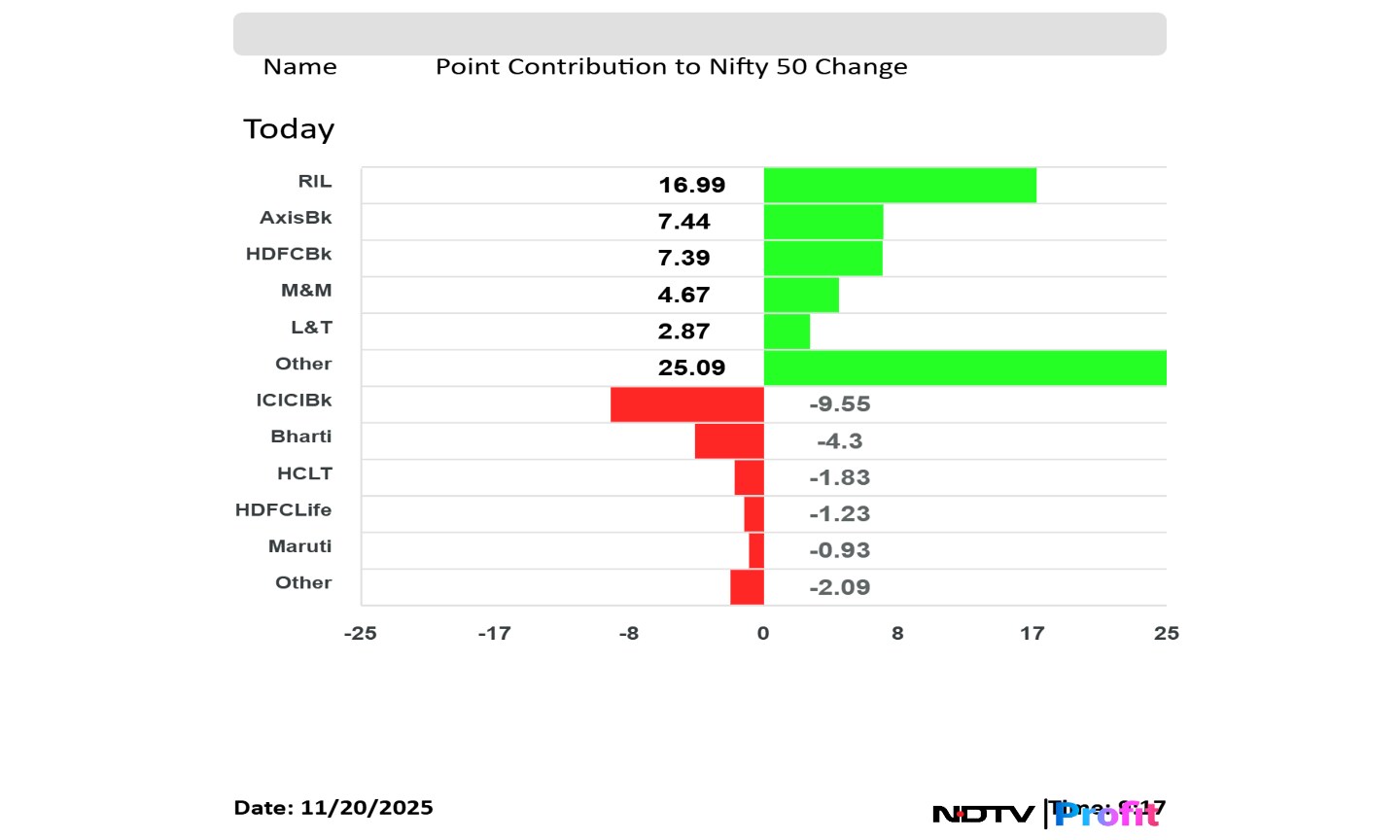

The NSE Nifty 50 and BSE Sensex extended gains as Reliance Industries Ltd., Bajaj Finance Ltd., and Axis Bank Ltd. shares led. The indices were trading 0.16% and 0.17% higher, respectively as of 9:20 a.m.

The NSE Nifty 50 and BSE Sensex extended gains as Reliance Industries Ltd., Bajaj Finance Ltd., and Axis Bank Ltd. shares led. The indices were trading 0.16% and 0.17% higher, respectively as of 9:20 a.m.

Rupee opened 3 paise weaker at 88.63 against US Dollar

It closed at 88.59 a dollar on Wednesday

Source: Bloomberg

BofA remains constructive on financials, real estate, REITs and autos because of these are rate-sensitive and part of the domestic cyclicals story. On a defensive front, the global brokerage prefers exposure to hospitals, telecom, and regulated power utilities.

Va Tech Wabag Ltd. received Asian Development Bank-funded 'large' DBO order from the Nepal Government. The company will use the fund to build Sundarijal Water Treatment Plant in Kathmandu Valley, the company said in the exchange filing.

Shares of newly-listed fintech major Pine Labs Ltd. will be in focus on Thursday's trading session after Emkay initiated coverage on the counter, offering a rather cautious note.

The brokerage firm has initiated coverage with a 'reduce' rating while setting a price target of Rs 210, which suggests a potential downside of almost 13%.

NDTV Profit curated these five stocks from recommendation of various brokerages for Wednesday's session. Analysts chose stocks from information technology, infrastructure, financial, and broking spaces for Wednesday's session.

The NSE Nifty 50 and BSE Sensex are expected to extend gains as indicated by the GIFT Nifty. The futrue contract of GIFT Nifty was trading 0.27% or 70.50 points higher at 26,142 as of 7:54 a.m.

Find the recommended stocks for Thursday's trade here.

Nvidia Corp. delivered a surprisingly strong revenue forecast and pushed back on the idea that the AI industry is in a bubble, easing concerns that had spread across the tech sector.

Sales will be about $65 billion in the January quarter, the chipmaker said in a statement on Wednesday. Analysts had estimated $62 billion on average, according to data compiled by Bloomberg.

Read the full Bloomberg article here.

The GIFT Nifty was trading 0.31% or 81 points higher at 26,152 as of 6:51 a.m., which implied a higher open for the benchmark index NSE Nifty 50.

Fears of artificial-intelligence bubble subdued following robust earnings report from Nvidia Corp. Hence, IT stocks will likely gain in Thursday's session.

Apart from IT stocks, NBCC (India) Ltd., Max Healthcare Institute Ltd., NTPC Green Energy Ltd., Varun Beverages Ltd., Bharat Petroleum Corp Ltd. shares will likely be in focus.

The Nifty 50 closed up 142.60 points or 0.55% higher at 26,052.65, while the Sensex advanced 513.45 points or 0.61% to 85,186.47.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.