Overseas investors stay net buyers for the second consecutive day of Indian equities on Monday

Foreign portfolio investors mopped stocks worth Rs 1,261.13 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net sellers and off loaded equities worth 1,032.92 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 135471 crore worth of Indian equities so far in 2023, according to data from the National Securities Depository Ltd., updated till the previous trading day.

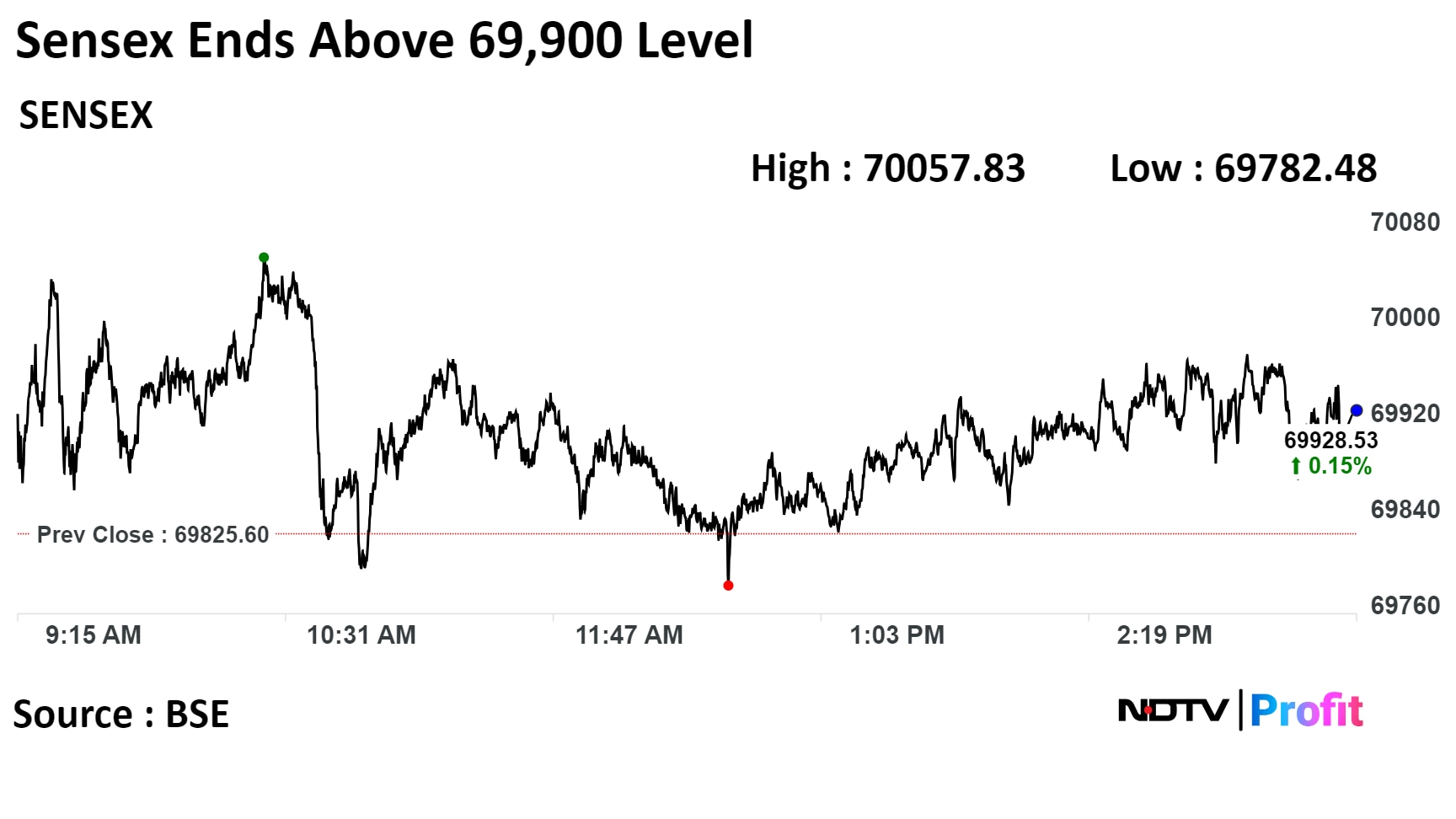

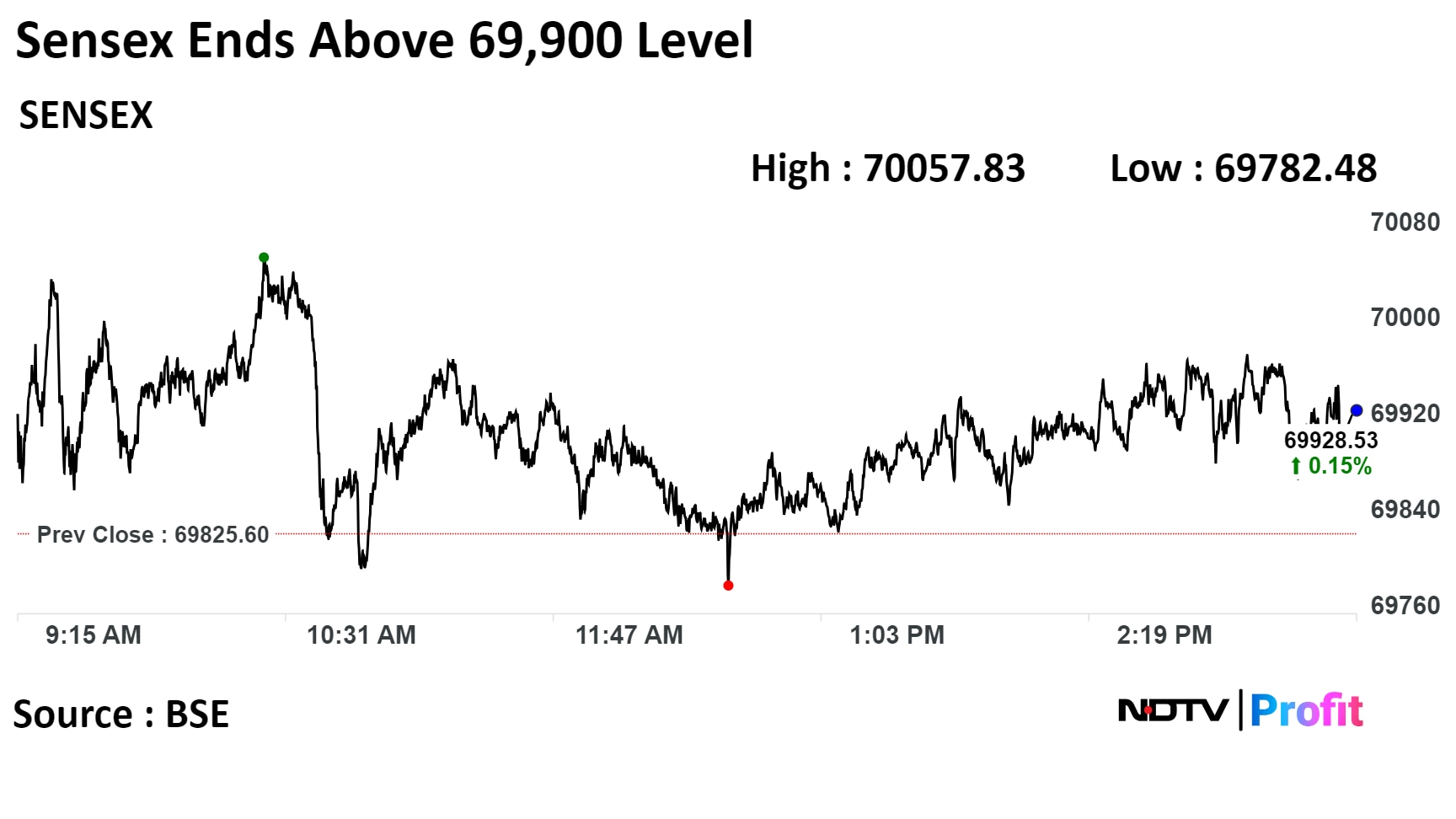

The S&P BSE Sensex closed 102.93 points, or 0.15% higher at 69,928.53, while the NSE Nifty 50 was up 27.70 points, or 0.13% at 20,997.10.

The yield on the 10-year bond closed flat at 7.28% on Monday.

Source: Bloomberg

The local currency closed flat at 83.39 against the U.S dollar on Monday.

Source: Bloomberg

Benchmark indices closed higher in the second consecutive session after they had broken their seven-day gaining streak on Thursday.

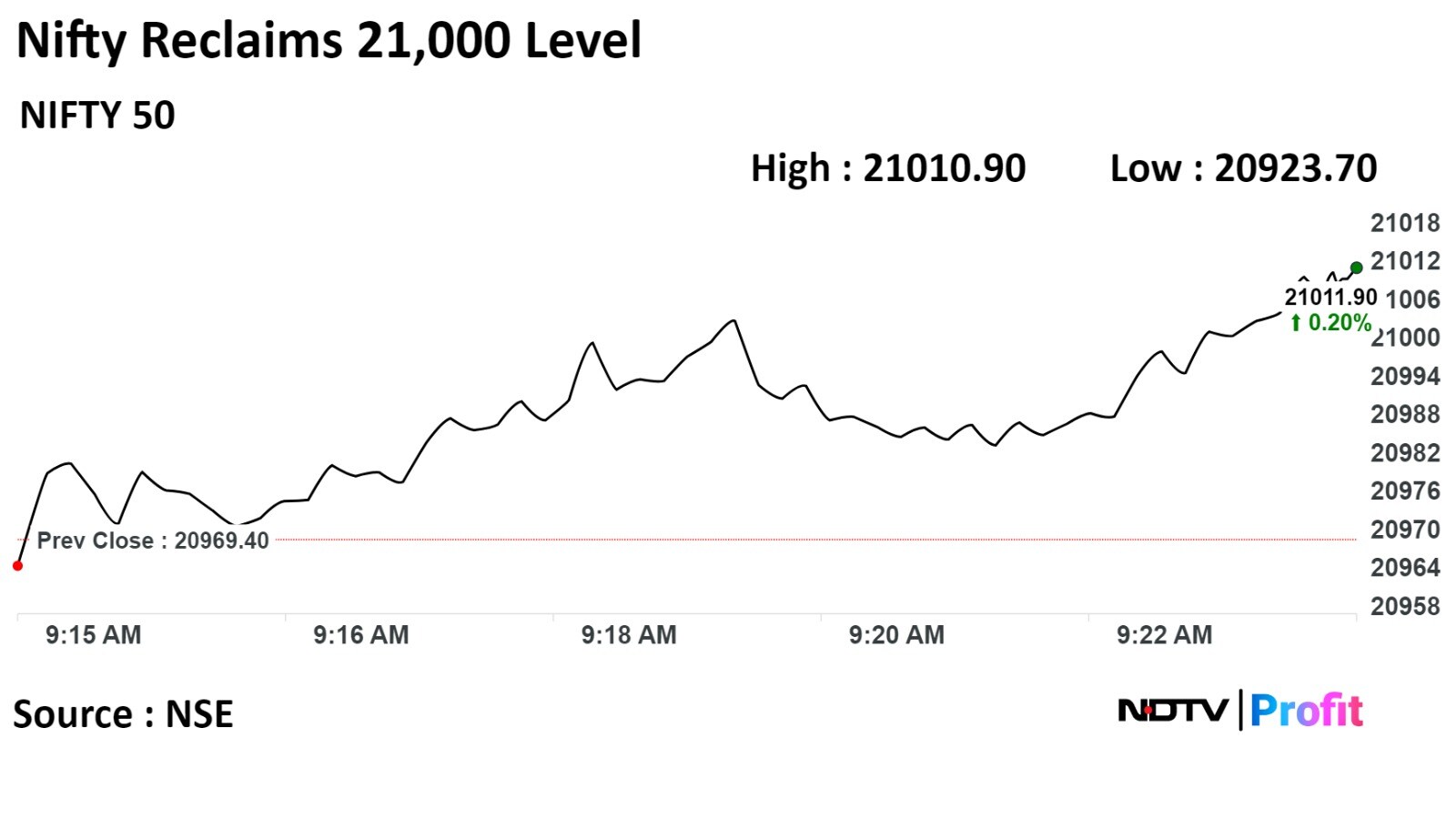

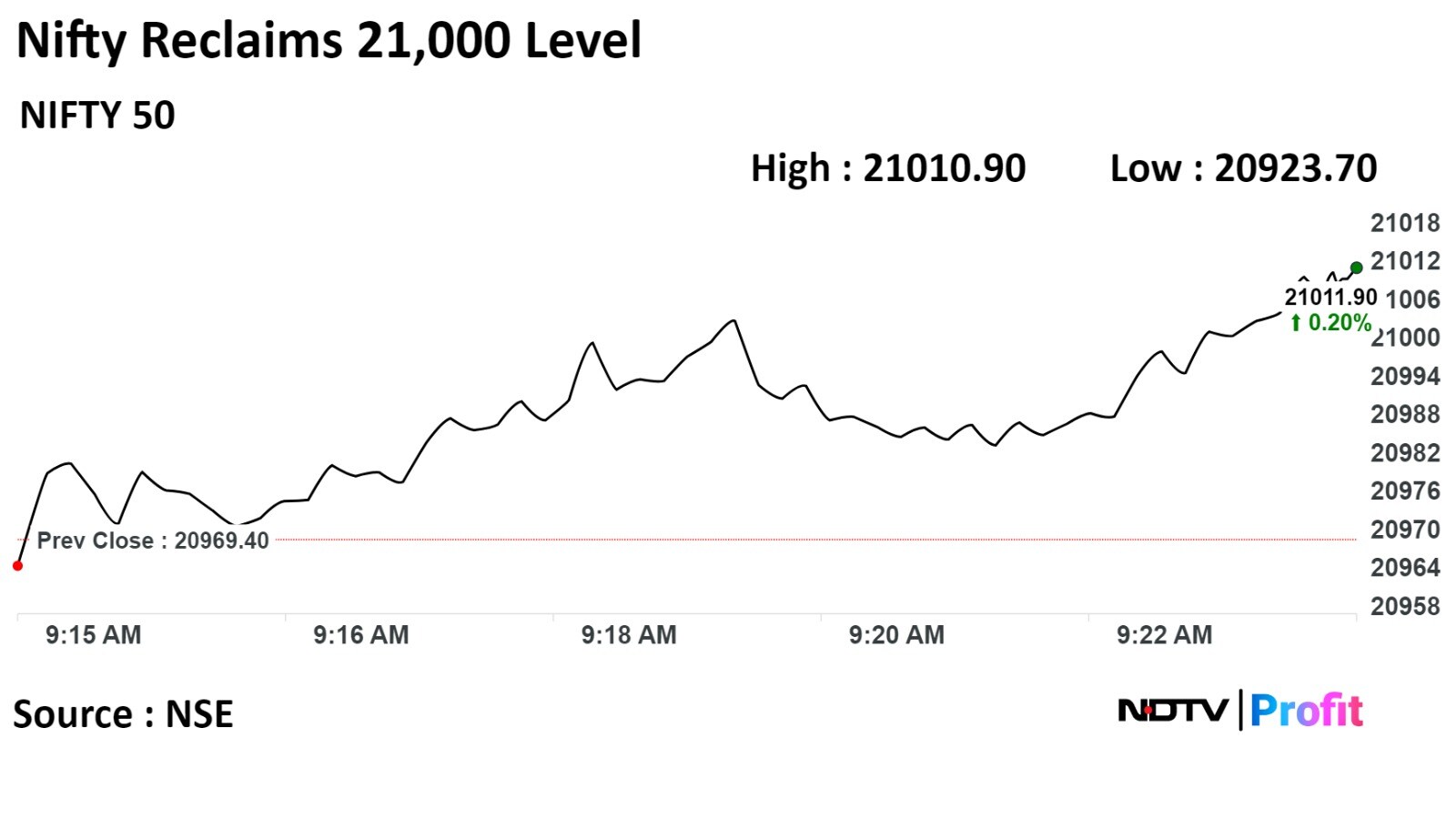

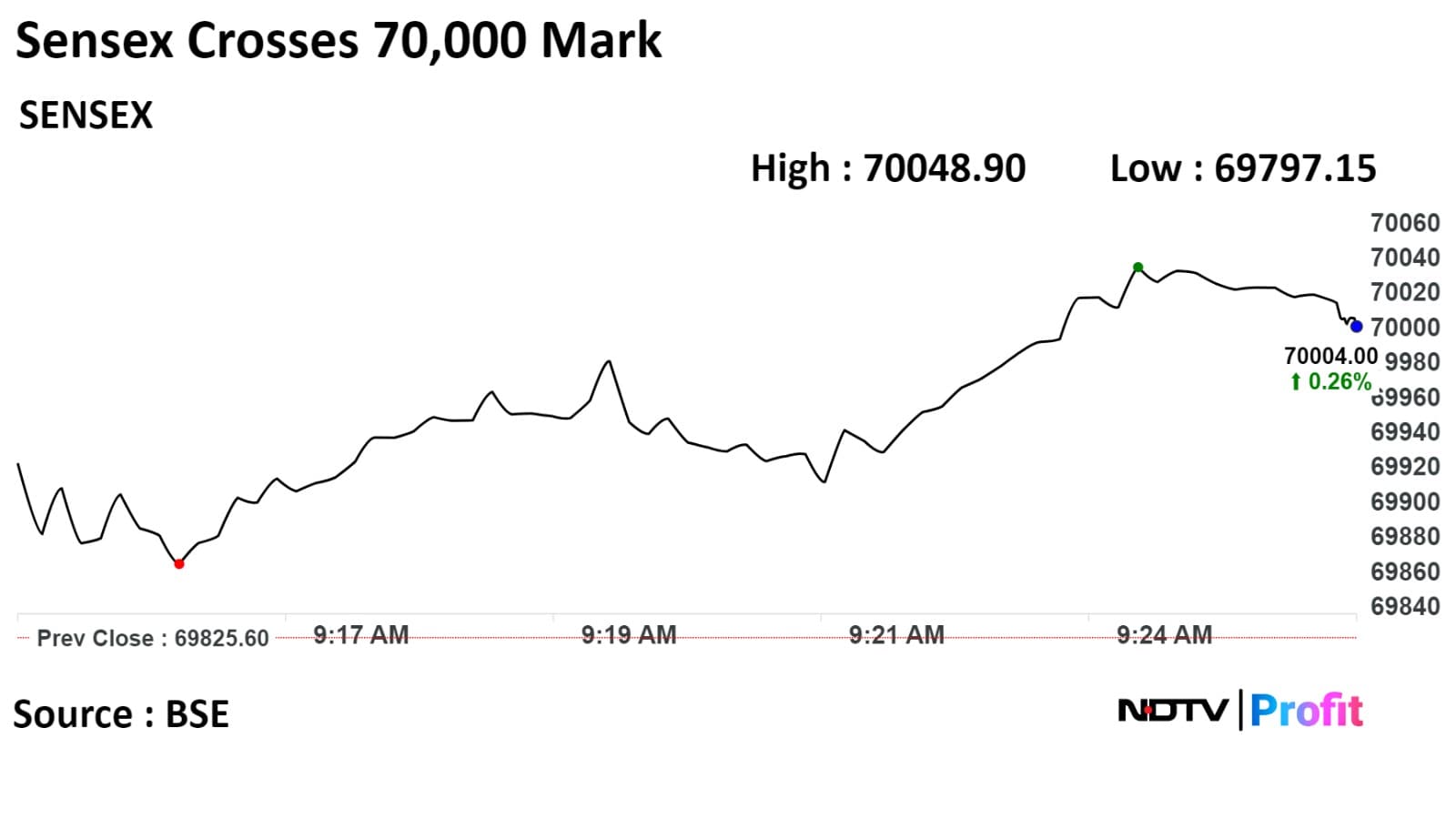

Intraday, the Nifty 50 reclaimed the 21,000 level and the Sensex crossed 70,000 for the first time.

Both the indices closed at their record high levels. The Nifty ended higher by 27.70 points or 0.13% at 20,997.10 points while the Sensex gained 102.93 points or 0.15% to close at 69,928.53 points.

"Favorable corporate earnings cycle, stable policy environment and potential FPI flows could support markets in the medium term," said George Thomas, fund manager of equity at Quantum Mutual Fund.

"Investors should exercise caution in select pockets where stock performance have exceeded the earnings growth by a wide margin. Considering the favorable environment, investors are advised to stay invested in equities in line with their long-term asset allocation plan. A disciplined value fund would be an ideal choice at this point due to its favorable valuation relative to the broader markets and potentially ‘higher for longer’ global interest rate scenario," he added.

Benchmark indices closed higher in the second consecutive session after they had broken their seven-day gaining streak on Thursday.

Intraday, the Nifty 50 reclaimed the 21,000 level and the Sensex crossed 70,000 for the first time.

Both the indices closed at their record high levels. The Nifty ended higher by 27.70 points or 0.13% at 20,997.10 points while the Sensex gained 102.93 points or 0.15% to close at 69,928.53 points.

"Favorable corporate earnings cycle, stable policy environment and potential FPI flows could support markets in the medium term," said George Thomas, fund manager of equity at Quantum Mutual Fund.

"Investors should exercise caution in select pockets where stock performance have exceeded the earnings growth by a wide margin. Considering the favorable environment, investors are advised to stay invested in equities in line with their long-term asset allocation plan. A disciplined value fund would be an ideal choice at this point due to its favorable valuation relative to the broader markets and potentially ‘higher for longer’ global interest rate scenario," he added.

Benchmark indices closed higher in the second consecutive session after they had broken their seven-day gaining streak on Thursday.

Intraday, the Nifty 50 reclaimed the 21,000 level and the Sensex crossed 70,000 for the first time.

Both the indices closed at their record high levels. The Nifty ended higher by 27.70 points or 0.13% at 20,997.10 points while the Sensex gained 102.93 points or 0.15% to close at 69,928.53 points.

"Favorable corporate earnings cycle, stable policy environment and potential FPI flows could support markets in the medium term," said George Thomas, fund manager of equity at Quantum Mutual Fund.

"Investors should exercise caution in select pockets where stock performance have exceeded the earnings growth by a wide margin. Considering the favorable environment, investors are advised to stay invested in equities in line with their long-term asset allocation plan. A disciplined value fund would be an ideal choice at this point due to its favorable valuation relative to the broader markets and potentially ‘higher for longer’ global interest rate scenario," he added.

Benchmark indices closed higher in the second consecutive session after they had broken their seven-day gaining streak on Thursday.

Intraday, the Nifty 50 reclaimed the 21,000 level and the Sensex crossed 70,000 for the first time.

Both the indices closed at their record high levels. The Nifty ended higher by 27.70 points or 0.13% at 20,997.10 points while the Sensex gained 102.93 points or 0.15% to close at 69,928.53 points.

"Favorable corporate earnings cycle, stable policy environment and potential FPI flows could support markets in the medium term," said George Thomas, fund manager of equity at Quantum Mutual Fund.

"Investors should exercise caution in select pockets where stock performance have exceeded the earnings growth by a wide margin. Considering the favorable environment, investors are advised to stay invested in equities in line with their long-term asset allocation plan. A disciplined value fund would be an ideal choice at this point due to its favorable valuation relative to the broader markets and potentially ‘higher for longer’ global interest rate scenario," he added.

Benchmark indices closed higher in the second consecutive session after they had broken their seven-day gaining streak on Thursday.

Intraday, the Nifty 50 reclaimed the 21,000 level and the Sensex crossed 70,000 for the first time.

Both the indices closed at their record high levels. The Nifty ended higher by 27.70 points or 0.13% at 20,997.10 points while the Sensex gained 102.93 points or 0.15% to close at 69,928.53 points.

"Favorable corporate earnings cycle, stable policy environment and potential FPI flows could support markets in the medium term," said George Thomas, fund manager of equity at Quantum Mutual Fund.

"Investors should exercise caution in select pockets where stock performance have exceeded the earnings growth by a wide margin. Considering the favorable environment, investors are advised to stay invested in equities in line with their long-term asset allocation plan. A disciplined value fund would be an ideal choice at this point due to its favorable valuation relative to the broader markets and potentially ‘higher for longer’ global interest rate scenario," he added.

Benchmark indices closed higher in the second consecutive session after they had broken their seven-day gaining streak on Thursday.

Intraday, the Nifty 50 reclaimed the 21,000 level and the Sensex crossed 70,000 for the first time.

Both the indices closed at their record high levels. The Nifty ended higher by 27.70 points or 0.13% at 20,997.10 points while the Sensex gained 102.93 points or 0.15% to close at 69,928.53 points.

"Favorable corporate earnings cycle, stable policy environment and potential FPI flows could support markets in the medium term," said George Thomas, fund manager of equity at Quantum Mutual Fund.

"Investors should exercise caution in select pockets where stock performance have exceeded the earnings growth by a wide margin. Considering the favorable environment, investors are advised to stay invested in equities in line with their long-term asset allocation plan. A disciplined value fund would be an ideal choice at this point due to its favorable valuation relative to the broader markets and potentially ‘higher for longer’ global interest rate scenario," he added.

Benchmark indices closed higher in the second consecutive session after they had broken their seven-day gaining streak on Thursday.

Intraday, the Nifty 50 reclaimed the 21,000 level and the Sensex crossed 70,000 for the first time.

Both the indices closed at their record high levels. The Nifty ended higher by 27.70 points or 0.13% at 20,997.10 points while the Sensex gained 102.93 points or 0.15% to close at 69,928.53 points.

"Favorable corporate earnings cycle, stable policy environment and potential FPI flows could support markets in the medium term," said George Thomas, fund manager of equity at Quantum Mutual Fund.

"Investors should exercise caution in select pockets where stock performance have exceeded the earnings growth by a wide margin. Considering the favorable environment, investors are advised to stay invested in equities in line with their long-term asset allocation plan. A disciplined value fund would be an ideal choice at this point due to its favorable valuation relative to the broader markets and potentially ‘higher for longer’ global interest rate scenario," he added.

Benchmark indices closed higher in the second consecutive session after they had broken their seven-day gaining streak on Thursday.

Intraday, the Nifty 50 reclaimed the 21,000 level and the Sensex crossed 70,000 for the first time.

Both the indices closed at their record high levels. The Nifty ended higher by 27.70 points or 0.13% at 20,997.10 points while the Sensex gained 102.93 points or 0.15% to close at 69,928.53 points.

"Favorable corporate earnings cycle, stable policy environment and potential FPI flows could support markets in the medium term," said George Thomas, fund manager of equity at Quantum Mutual Fund.

"Investors should exercise caution in select pockets where stock performance have exceeded the earnings growth by a wide margin. Considering the favorable environment, investors are advised to stay invested in equities in line with their long-term asset allocation plan. A disciplined value fund would be an ideal choice at this point due to its favorable valuation relative to the broader markets and potentially ‘higher for longer’ global interest rate scenario," he added.

Shares of ITC Ltd., ICICI Bank Ltd., UltraTech Cement Ltd., Tech Mahindra Ltd., and Hindalco Industries Ltd. led the gains.

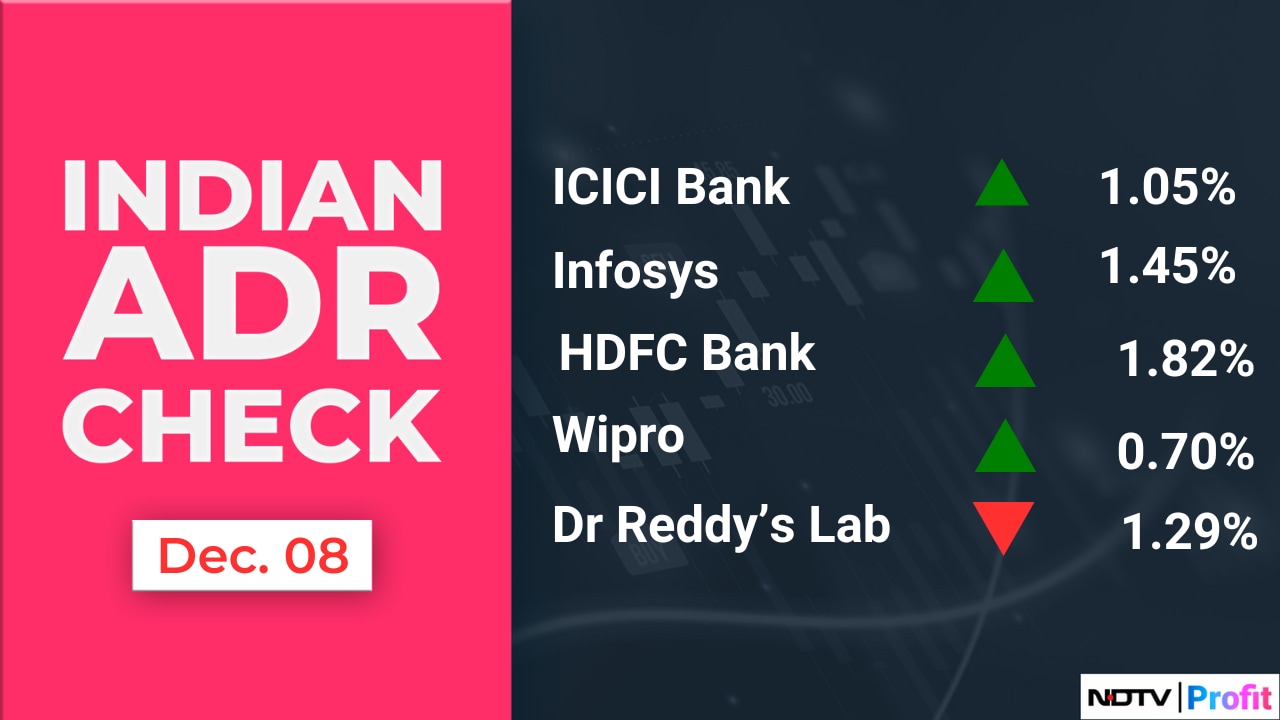

Meanwhile, those of Axis Bank Ltd., Dr. Reddy's Laboratories Ltd., Hindustan Unilever Ltd., Mahindra & Mahindra Ltd., and HDFC Bank Ltd., capped the upside.

Most sectoral indices gained. Nifty Pharma closed 0.9% lower, Nifty Oil & Gas ended lower by 0.2%, and Nifty Financial Services closed flat.

Nifty Metal, Nifty Media, and Nifty PSU Bank closed more than 1% higher.

The broader markets outperformed, with the BSE Midcap being 0.91% lower and the SmallCap Index declining 0.71%.

Two out of the 20 sectors compiled by the BSE fell, while eighteen advanced. BSE Healthcare and BSE Oil & Gas were the only sectoral indices that fell.

The market breadth was skewed in favour of buyers. As many as 2,392 stocks declined, 1,467 advanced and 176 remained unchanged.

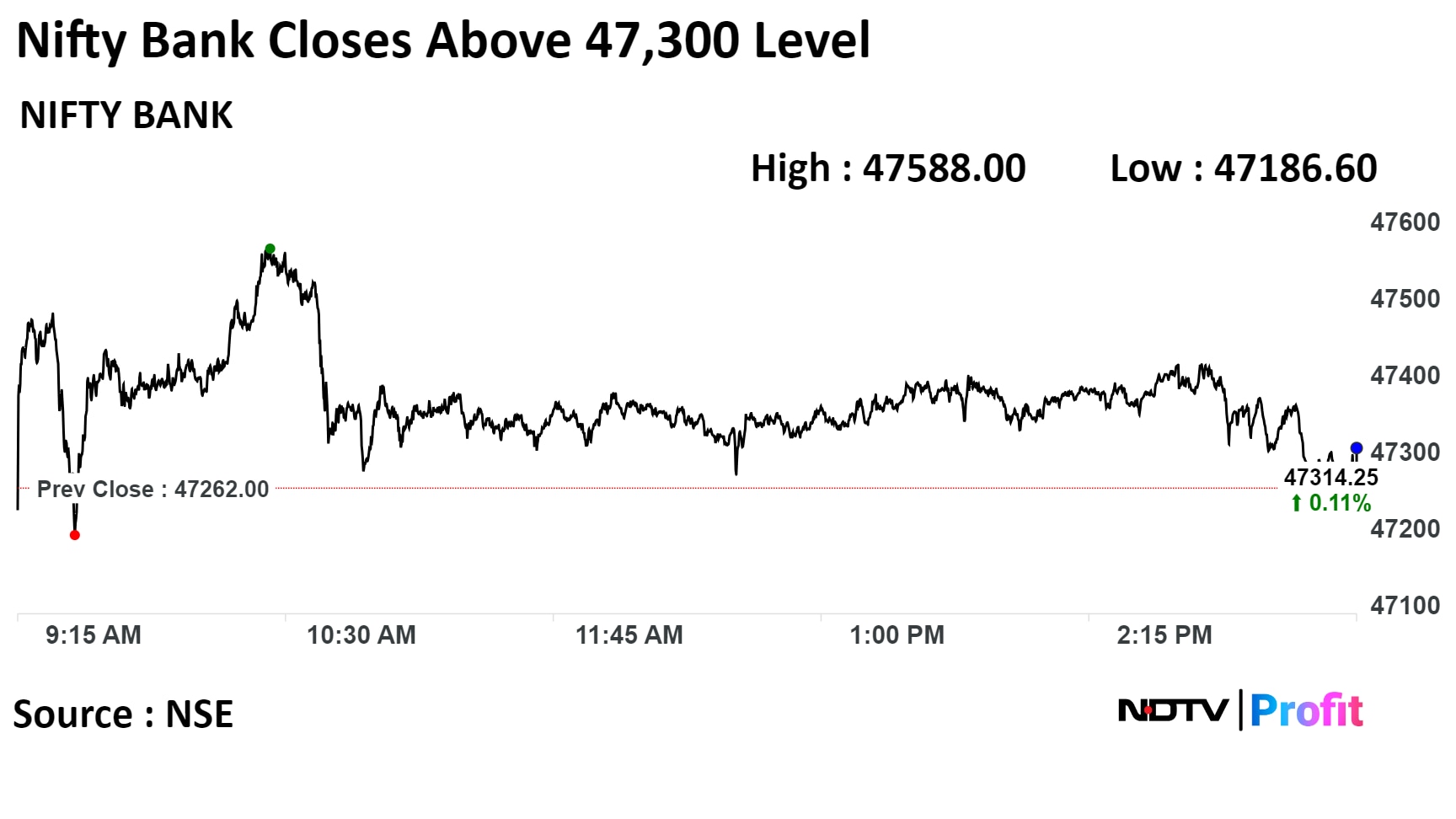

Shares of Tube Investments of India Ltd. rose over 6% on Monday on hope the new mandate from the government for air-conditioned cabins for trucks may increase its sales prospects.

Ministry of Road, Transport, and Highways has issued a notification directing all N2 and N3 category trucks, produced from Oct. 1, 2025, need to have factory-fitted air conditioned cabin for drivers.

Tube Investments of India Ltd. is an engineering company which produces steel tubes, strips, automotive, and industrial chains.

Shares of Tube Investments of India Ltd. rose over 6% on Monday on hope the new mandate from the government for air-conditioned cabins for trucks may increase its sales prospects.

Ministry of Road, Transport, and Highways has issued a notification directing all N2 and N3 category trucks, produced from Oct. 1, 2025, need to have factory-fitted air conditioned cabin for drivers.

Tube Investments of India Ltd. is an engineering company which produces steel tubes, strips, automotive, and industrial chains.

The scrip rose as much as 6.65% to Rs 3,812 apiece, the highest level since Nov 22. It was trading 6.65% higher at Rs 3,812 apiece, as of 02:52 p.m. This compares to a 0.15%des advance in the NSE Nifty 50 Index.

It has risen 32.49% on a year-to-date basis. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 66.55.

Out of five analysts tracking the company, three maintain a 'buy' rating, one recommends a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 10.6%.

"The partnership with Nestle India Limited, a renowned leader in the food and beverage industry, is expected to bring synergies that will benefit both companies and contribute to the growth of the food sector," an exchange filing by Shri Bajrang Alliance said.

Following the news, shares of the company jumped to hit their lifetime high.

Top Gainers

Century Plyboards up 6.05% at Rs 728.4

Karur Vyasa Bank up 5.67% at Rs 163.3

Ashoka Buildcon up 5.55% at Rs 149.25

Cartrade Tech Ltd up 5.9% at Rs 774.95

Bajaj Hindustan Sugar up 5.2% at Rs 28.30

Top Losers

Brightcom Group down 3.01% at Rs 21.0

Varroc Engineering down 2.67% at Rs 523.7

Ami Organics down 2.67% at Rs 1083.3

Global Health down 2.65% at Rs 910.0

Network18 Media& Investments down 2.8% at Rs 85.1

The benchmark indices gave up its gains from early trade on Monday morning and were trading marginally higher during midday.

The S&P BSE Sensex crossed 70,000 mark for the first time shortly after opening, while the NSE Nifty 50 reclaimed 21,000 mark before it slipped below.

As of 11:49 a.m., the Sensex was trading 80 points or 0.11% higher at 69,911.32, while the Nifty was 21.05 points or 0.1% up at 20,991.

"Nifty 50 scaled a new high at 21,006, witnessed minor pullback to fill the gap levels and again moved higher above the opening levels of the day," Vikas Jain, senior research analyst at Reliance Securities, said. "The immediate support levels will be at 20,700 being the double bottoms after a sharp breakout on the first trading day of the previous week followed by 20,500 levels."

"On the higher side, the next band of resistance would be in the range of 21,300–21,500 levels being the weekly pivot resistance," Jain said.

The benchmark indices gave up its gains from early trade on Monday morning and were trading marginally higher during midday.

The S&P BSE Sensex crossed 70,000 mark for the first time shortly after opening, while the NSE Nifty 50 reclaimed 21,000 mark before it slipped below.

As of 11:49 a.m., the Sensex was trading 80 points or 0.11% higher at 69,911.32, while the Nifty was 21.05 points or 0.1% up at 20,991.

"Nifty 50 scaled a new high at 21,006, witnessed minor pullback to fill the gap levels and again moved higher above the opening levels of the day," Vikas Jain, senior research analyst at Reliance Securities, said. "The immediate support levels will be at 20,700 being the double bottoms after a sharp breakout on the first trading day of the previous week followed by 20,500 levels."

"On the higher side, the next band of resistance would be in the range of 21,300–21,500 levels being the weekly pivot resistance," Jain said.

The benchmark indices gave up its gains from early trade on Monday morning and were trading marginally higher during midday.

The S&P BSE Sensex crossed 70,000 mark for the first time shortly after opening, while the NSE Nifty 50 reclaimed 21,000 mark before it slipped below.

As of 11:49 a.m., the Sensex was trading 80 points or 0.11% higher at 69,911.32, while the Nifty was 21.05 points or 0.1% up at 20,991.

"Nifty 50 scaled a new high at 21,006, witnessed minor pullback to fill the gap levels and again moved higher above the opening levels of the day," Vikas Jain, senior research analyst at Reliance Securities, said. "The immediate support levels will be at 20,700 being the double bottoms after a sharp breakout on the first trading day of the previous week followed by 20,500 levels."

"On the higher side, the next band of resistance would be in the range of 21,300–21,500 levels being the weekly pivot resistance," Jain said.

The benchmark indices gave up its gains from early trade on Monday morning and were trading marginally higher during midday.

The S&P BSE Sensex crossed 70,000 mark for the first time shortly after opening, while the NSE Nifty 50 reclaimed 21,000 mark before it slipped below.

As of 11:49 a.m., the Sensex was trading 80 points or 0.11% higher at 69,911.32, while the Nifty was 21.05 points or 0.1% up at 20,991.

"Nifty 50 scaled a new high at 21,006, witnessed minor pullback to fill the gap levels and again moved higher above the opening levels of the day," Vikas Jain, senior research analyst at Reliance Securities, said. "The immediate support levels will be at 20,700 being the double bottoms after a sharp breakout on the first trading day of the previous week followed by 20,500 levels."

"On the higher side, the next band of resistance would be in the range of 21,300–21,500 levels being the weekly pivot resistance," Jain said.

The benchmark indices gave up its gains from early trade on Monday morning and were trading marginally higher during midday.

The S&P BSE Sensex crossed 70,000 mark for the first time shortly after opening, while the NSE Nifty 50 reclaimed 21,000 mark before it slipped below.

As of 11:49 a.m., the Sensex was trading 80 points or 0.11% higher at 69,911.32, while the Nifty was 21.05 points or 0.1% up at 20,991.

"Nifty 50 scaled a new high at 21,006, witnessed minor pullback to fill the gap levels and again moved higher above the opening levels of the day," Vikas Jain, senior research analyst at Reliance Securities, said. "The immediate support levels will be at 20,700 being the double bottoms after a sharp breakout on the first trading day of the previous week followed by 20,500 levels."

"On the higher side, the next band of resistance would be in the range of 21,300–21,500 levels being the weekly pivot resistance," Jain said.

The benchmark indices gave up its gains from early trade on Monday morning and were trading marginally higher during midday.

The S&P BSE Sensex crossed 70,000 mark for the first time shortly after opening, while the NSE Nifty 50 reclaimed 21,000 mark before it slipped below.

As of 11:49 a.m., the Sensex was trading 80 points or 0.11% higher at 69,911.32, while the Nifty was 21.05 points or 0.1% up at 20,991.

"Nifty 50 scaled a new high at 21,006, witnessed minor pullback to fill the gap levels and again moved higher above the opening levels of the day," Vikas Jain, senior research analyst at Reliance Securities, said. "The immediate support levels will be at 20,700 being the double bottoms after a sharp breakout on the first trading day of the previous week followed by 20,500 levels."

"On the higher side, the next band of resistance would be in the range of 21,300–21,500 levels being the weekly pivot resistance," Jain said.

The benchmark indices gave up its gains from early trade on Monday morning and were trading marginally higher during midday.

The S&P BSE Sensex crossed 70,000 mark for the first time shortly after opening, while the NSE Nifty 50 reclaimed 21,000 mark before it slipped below.

As of 11:49 a.m., the Sensex was trading 80 points or 0.11% higher at 69,911.32, while the Nifty was 21.05 points or 0.1% up at 20,991.

"Nifty 50 scaled a new high at 21,006, witnessed minor pullback to fill the gap levels and again moved higher above the opening levels of the day," Vikas Jain, senior research analyst at Reliance Securities, said. "The immediate support levels will be at 20,700 being the double bottoms after a sharp breakout on the first trading day of the previous week followed by 20,500 levels."

"On the higher side, the next band of resistance would be in the range of 21,300–21,500 levels being the weekly pivot resistance," Jain said.

The benchmark indices gave up its gains from early trade on Monday morning and were trading marginally higher during midday.

The S&P BSE Sensex crossed 70,000 mark for the first time shortly after opening, while the NSE Nifty 50 reclaimed 21,000 mark before it slipped below.

As of 11:49 a.m., the Sensex was trading 80 points or 0.11% higher at 69,911.32, while the Nifty was 21.05 points or 0.1% up at 20,991.

"Nifty 50 scaled a new high at 21,006, witnessed minor pullback to fill the gap levels and again moved higher above the opening levels of the day," Vikas Jain, senior research analyst at Reliance Securities, said. "The immediate support levels will be at 20,700 being the double bottoms after a sharp breakout on the first trading day of the previous week followed by 20,500 levels."

"On the higher side, the next band of resistance would be in the range of 21,300–21,500 levels being the weekly pivot resistance," Jain said.

ITC Ltd., Tech Mahindra Ltd., ICICI Bank Ltd., Adani Enterprises Ltd. and UltraTech Cement Ltd. were leading the gains.

Axis Bank Ltd., Dr Reddy's Laboratories Ltd., Bharti Airtel Ltd., Hindalco Industries Ltd. and Hindustan Unilever Ltd. were weighing on the indices.

Eleven out of the 12 sectors advanced, with the Nifty FMCG gaining the most among sectoral indices. Pharma is the only sector to decline.

The broader market outperformed, with the BSE Sensex MidCap gaining 0.59% and SmallCap rising 0.64%.

Nineteen out of the 20 sectors compiled by the BSE advanced, with Services and Commodity rising the most.

The market breadth was skewed in the favour of the buyers. As many as 2,333 stocks advanced, 1,341 declined and 185 remained unchanged on the BSE.

10 lakh shares changed hands in a large trade

0.02% equity changed hands at Rs 354.45 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Wockhardt Ltd. completes phase 3 pneumonia study of WCK 4873, named as Nafithromycin.

The 3-day treatment with Nafithromycin results in clinical cure for 96.7% of patients.

Source: Exchange Filing

10 lakh shares changed hands in a large trade

0.03% equity changed hands at Rs 1,121.55 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Temporary shutdown of the company's Nashik plant for yearly stock taking.

Source: Exchange Filing

Intellect Design Arena Ltd. has entered in to a pact with Indian Bank for its eMACH.ai cash management system.

Source: Exchange Filing

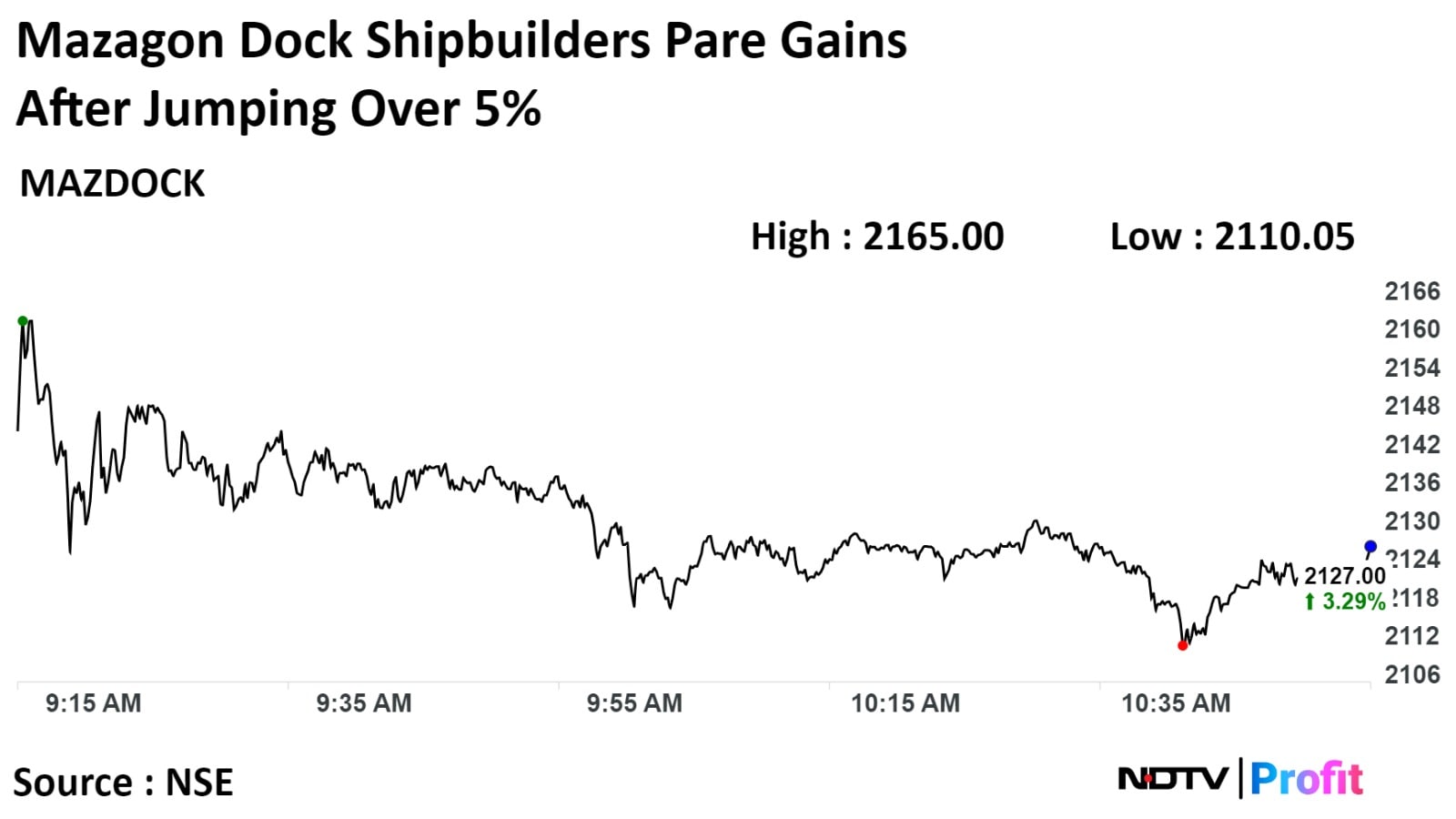

Shares of Mazagon Dock Shipbuilders Ltd. advance over 5% on Monday after the company received an order worth Rs 1,145 crore from ONGC for laying approximately 44.4 km of subsea pipelines in 19 segments.

Time period by which the order is to be executed is May 15, 2024, according to the exchange filing on Friday.

Shares of Mazagon Dock Shipbuilders Ltd. advance over 5% on Monday after the company received an order worth Rs 1,145 crore from ONGC for laying approximately 44.4 km of subsea pipelines in 19 segments.

Time period by which the order is to be executed is May 15, 2024, according to the exchange filing on Friday.

Mazagon Dock Shipbuilders' stock rose as much as 5.22% during the day to Rs 2,166.90 apiece on the NSE. It was trading 3.17 % higher at Rs 2,124.55 apiece compared to a 0.02% advance in the benchmark Nifty 50 as of 10.48 a.m.

It has risen 167.04% on a year-to-date basis. Total traded volume so far in the day stood at 3.2 times its 30-day average.

Of the four analysts tracking the company, two maintain a 'buy', one recommend a 'hold,' and one suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 6.5%

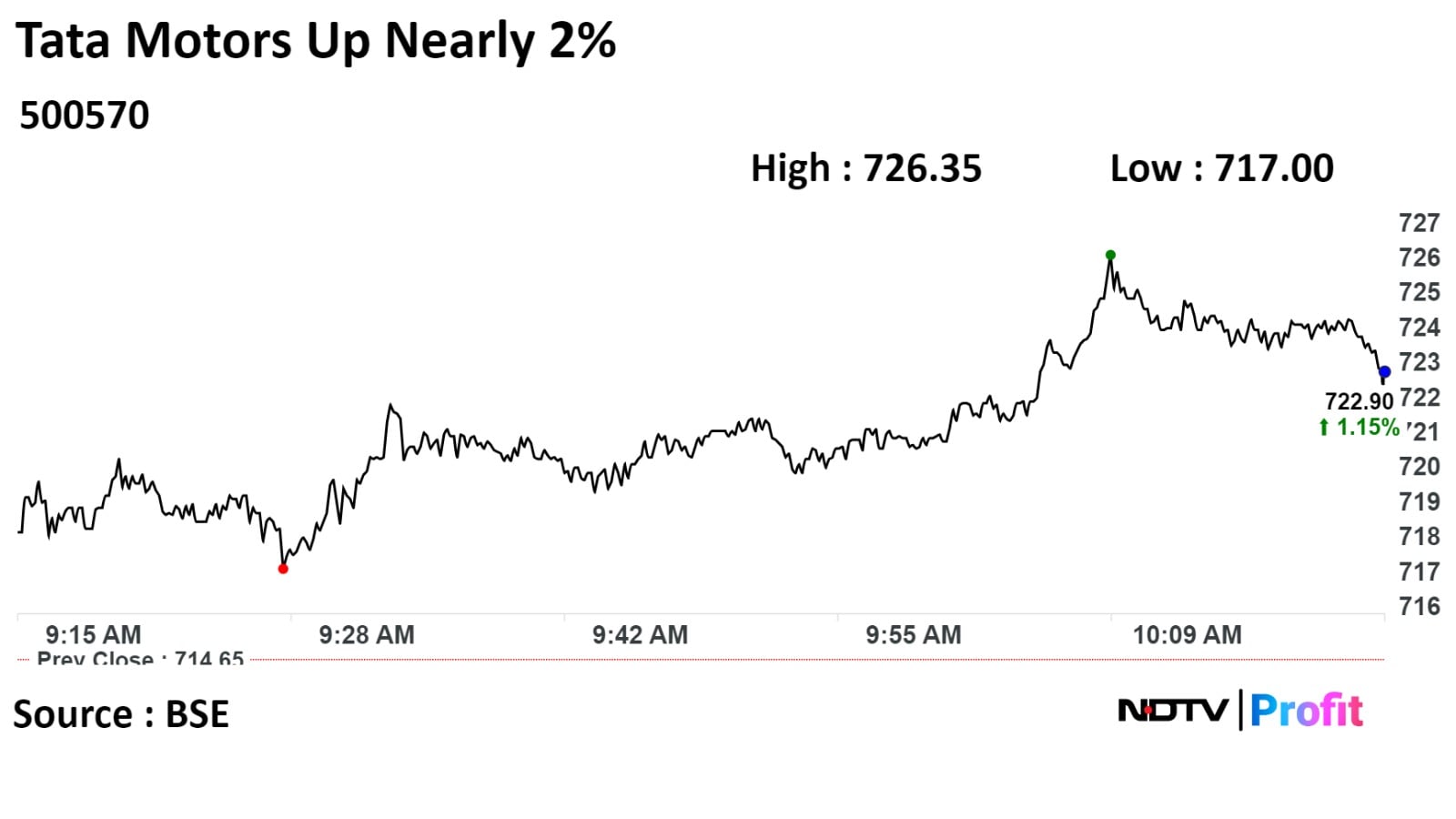

Tata Motors Ltd rose nearly 2% on Monday after it announced that it will hike prices of its commercial vehicles by 3% from January in an exchange filing.

The price hike will be applicable across the entire range of commercial vehicles. The carmaker said in an exchange filing, the price rise is likely to offset the residual impact of the past input costs.

Moreover, the Ministry of Road, Transportation, and Highways issued a notification directing all N2 and N3 category trucks, produced from Oct. 1, 2025, need to have factory-fitted air conditioned cabin for drivers. This will result in increase in production costs.

Tata Motors Ltd rose nearly 2% on Monday after it announced that it will hike prices of its commercial vehicles by 3% from January in an exchange filing.

The price hike will be applicable across the entire range of commercial vehicles. The carmaker said in an exchange filing, the price rise is likely to offset the residual impact of the past input costs.

Moreover, the Ministry of Road, Transportation, and Highways issued a notification directing all N2 and N3 category trucks, produced from Oct. 1, 2025, need to have factory-fitted air conditioned cabin for drivers. This will result in increase in production costs.

The scrip rose as much as 1.67% to Rs 726.50 apiece, the highest level since Dec 8. It was trading 1.35% higher at Rs 724.20 apiece, as of 10:17 a.m. This compares to a 0.16% advance in the NSE Nifty 50 Index.

It has risen 86.57% on a year-to-date basis. The relative strength index was at 71.36, which implied the stock is overbought.

Out of 35 analysts tracking the company, 28 maintain a 'buy' rating, three recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.4%.

32 lakh shares changed hands in a large trade

1.5% equity changed hands at Rs 95.75 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Century Plyboards Ltd at 7.55 times of its 30 day average

Strides Pharma Science Ltd at 7.29 times of its 30 day average

Nrb Bearings Ltd at 4.99 times of its 30 day average

Chalet Hotels Ltd at 4.94 times of its 30 day average

Jammu & Kashmir Bank Ltd at 3.69 times of its 30 day average

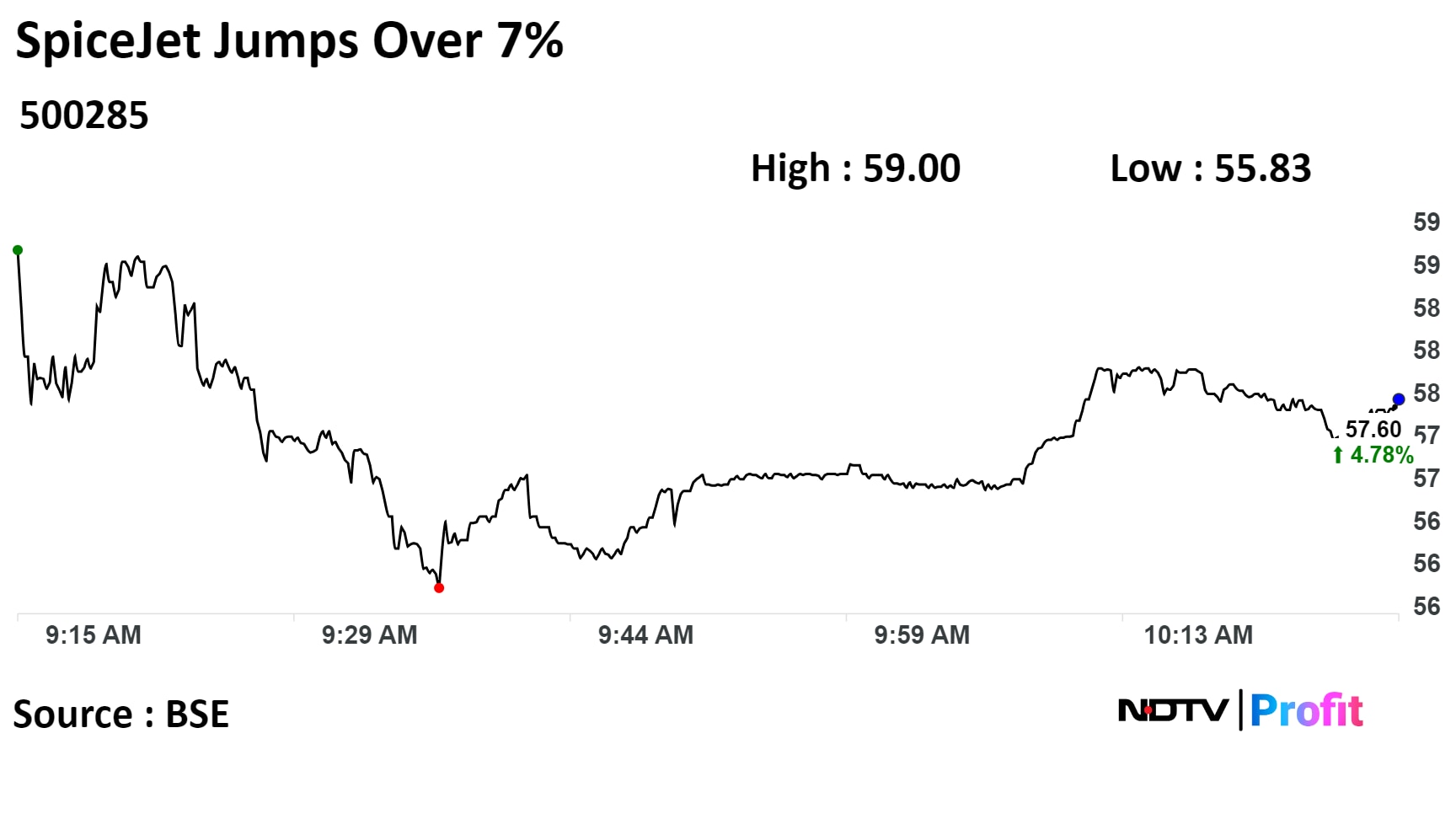

SpiceJet Ltd.'s share jumped over 7% on Monday after the airline announced it will soon be listing its securities on the National Stock Exchange.

SpiceJet had 12.2 lakh shares change hands in a pre-market large trade, according to the Bloomberg data. Buyers and sellers were not known immediately.

SpiceJet Ltd.'s share jumped over 7% on Monday after the airline announced it will soon be listing its securities on the National Stock Exchange.

SpiceJet had 12.2 lakh shares change hands in a pre-market large trade, according to the Bloomberg data. Buyers and sellers were not known immediately.

Shares of the company rose as much as 7.33%, a lifetime high, before paring gains to trade to Rs 59 apiece, its lifetime high. It pared gains to trade 4.24% higher at Rs 57.30 apiece, as of 10:25 a.m. This compares to a 0.31% advance in the Sensex.

It has risen 48.62% on a year-to-date basis. Total traded volume so far in the day stood at 6.7 times its 30-day average. The relative strength index was at 77, indicating stock may be overbought.

Out of 4 analysts tracking the company, one maintain a 'buy' rating and three suggest 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 30.7%

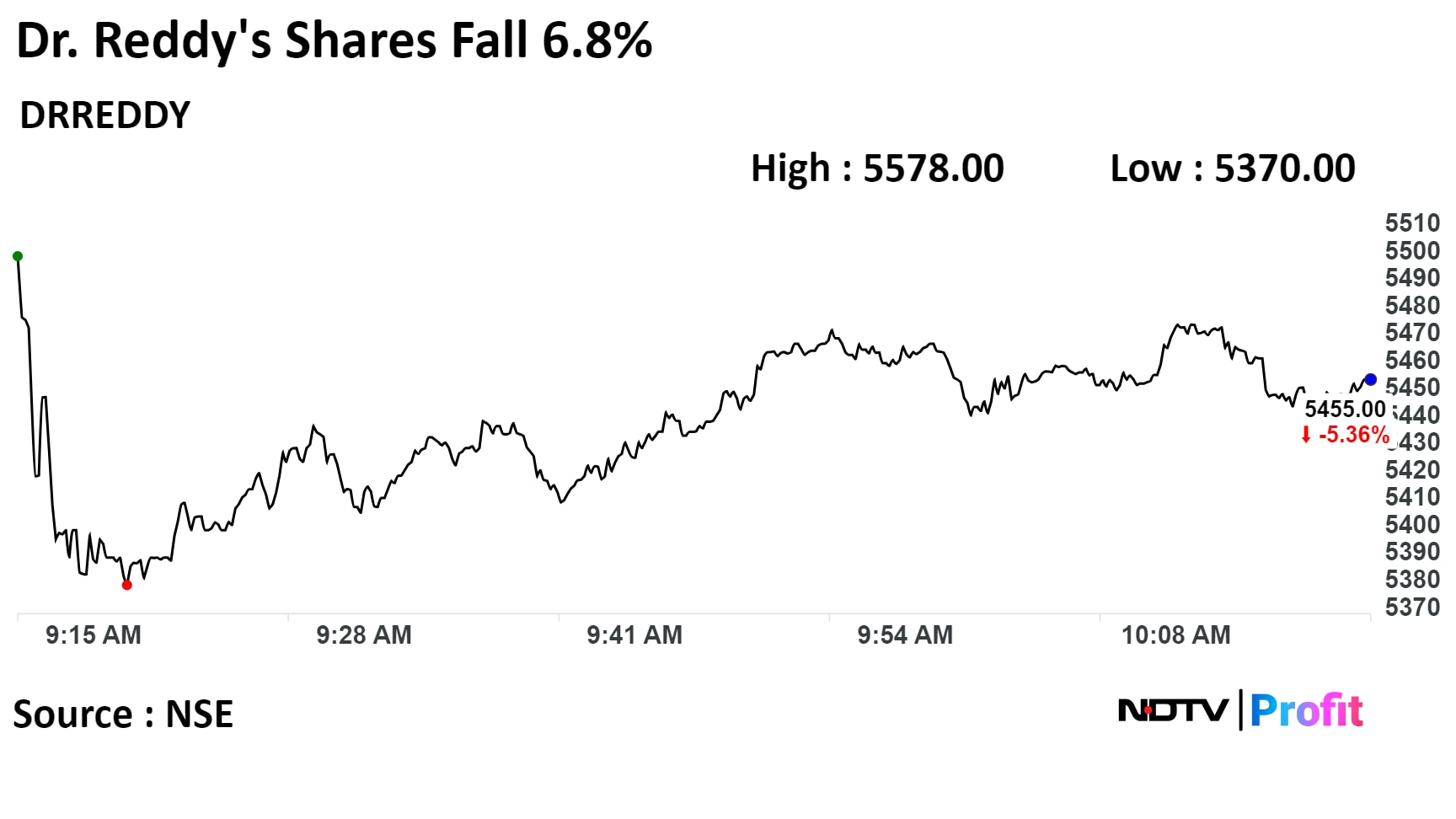

Shares of Dr. Reddy's Laboratories Ltd fell today after the company on Friday said that the US Food and Drug Administration issued a Form 483 with three observations for its R&D centre in Bachupally, Hyderabad.

An exchange filing by the company said that the inspection was conducted from Dec 4 - Dec 8.

Shares of Dr. Reddy's Laboratories Ltd fell today after the company on Friday said that the US Food and Drug Administration issued a Form 483 with three observations for its R&D centre in Bachupally, Hyderabad.

An exchange filing by the company said that the inspection was conducted from Dec 4 - Dec 8.

The scrip fell as much as 6.8% to Rs 5,370 apiece. This compares to a 0.2% advance in the NSE Nifty 50 Index.

It has risen 28.61% on a year-to-date basis. Total traded volume so far in the day stood at 9.3 times its 30-day average. The relative strength index was at 38.7.

Out of 40 analysts tracking the company, 19 maintain a 'buy' rating, 11 recommend a 'hold,' and 10 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.8%.

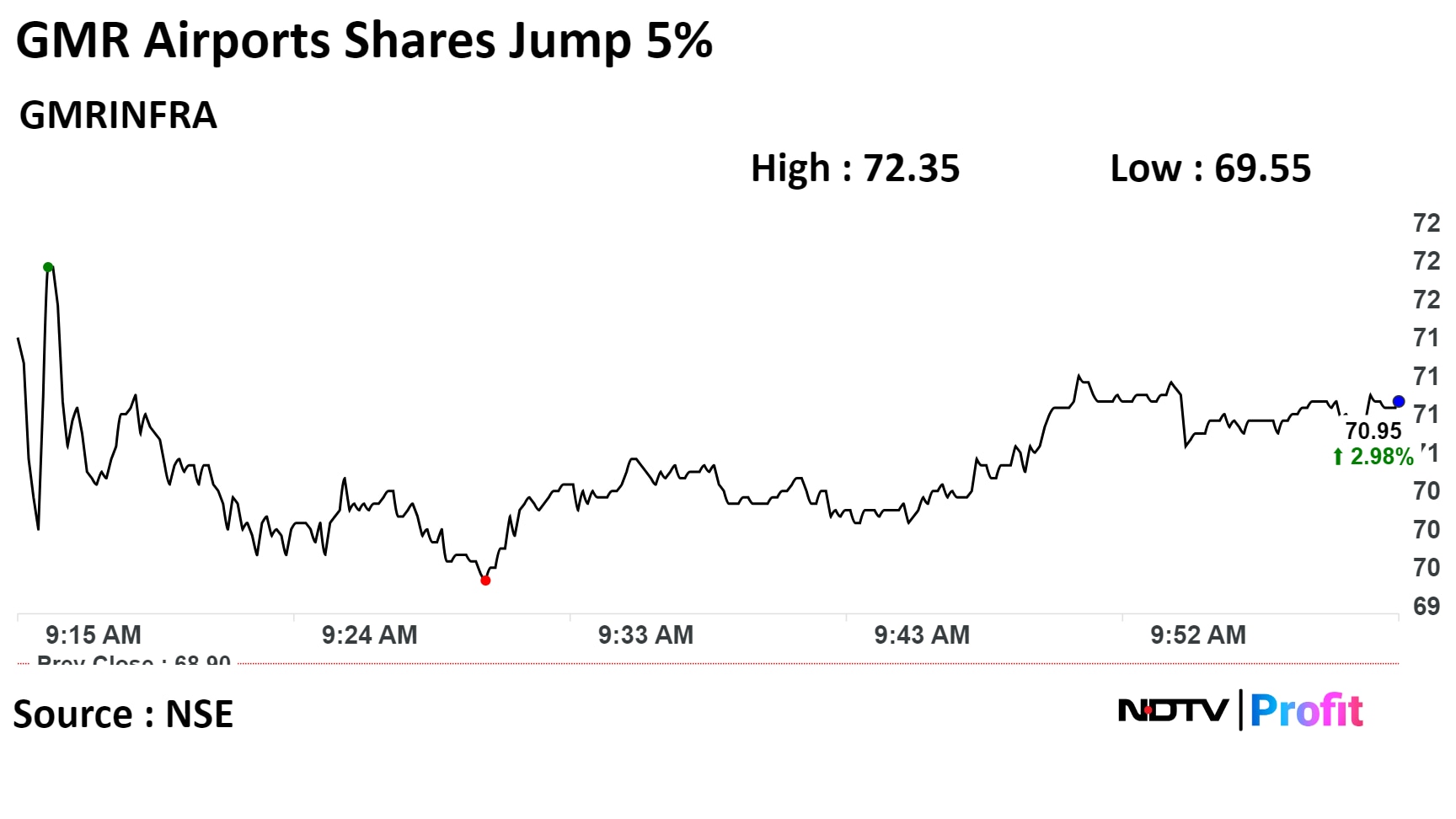

Shares of GMR Airports Infrastructure Ltd. hit a lifetime high on Monday after Rajiv Jain-backed GQG Partners bought a 4.7% stake in the company for Rs 1,671 crore, following divestment by two key investors.

The U.S.-based investment firm through two funds—GQG Partners Emerging Markets Equity Fund and Goldman Sachs-GQG Partners International Opportunities Fund—bought 28.28 crore shares in the airport operator, according to bulk deal data available on BSE.

U.K.-based ASN Investments Ltd. exited GMR Airports by offloading its entire 7.27% stake for Rs 2,555 crore. The shares were sold at Rs 58.21 apiece. Varanium India Opportunity Ltd. also divested its entire 2.3% shareholding for Rs 812.7 crore.

Shares of GMR Airports Infrastructure Ltd. hit a lifetime high on Monday after Rajiv Jain-backed GQG Partners bought a 4.7% stake in the company for Rs 1,671 crore, following divestment by two key investors.

The U.S.-based investment firm through two funds—GQG Partners Emerging Markets Equity Fund and Goldman Sachs-GQG Partners International Opportunities Fund—bought 28.28 crore shares in the airport operator, according to bulk deal data available on BSE.

U.K.-based ASN Investments Ltd. exited GMR Airports by offloading its entire 7.27% stake for Rs 2,555 crore. The shares were sold at Rs 58.21 apiece. Varanium India Opportunity Ltd. also divested its entire 2.3% shareholding for Rs 812.7 crore.

The scrip rose as much as 5% to Rs 72.35 apiece, its lifetime high. It pared gains to trade 2.7% higher at Rs 70.75 apiece, as of 10:05 a.m. This compares to a 0.11% advance in the NSE Nifty 50 Index.

It has risen 78.49% on a year-to-date basis. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 82.02.

Out of 2 analysts tracking the company, 1 maintain a 'buy' rating and 1 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 16.9%.

Corforge Ltd launched Quasar Responsible AI solution. The AI solution is a comprehensive solution which ensures the AI sticks to ethical standards, fairness, transparency, and regulatory compliances. The Quasar Responsible AI solution tackles biases in datasheets, models, identifies potential risks and compliance issues.

Source: Exchange Filing

Shares of Subros Ltd. surged nearly 18% in early trade as the company said in an exchange filing, it has secured an order worth Rs 25 crore from Indian railways.

Subros has gotten an order from Indian Railways for supply and commissioning of coach roof mounted, and air-conditioners. This is in line with the company's aim to expand business in railway electric mobility segment.

The company is already a supplier of rail driver cabin air conditioner to the Indian Railways, according to an exchange filing.

Shares of Subros Ltd. surged nearly 18% in early trade as the company said in an exchange filing, it has secured an order worth Rs 25 crore from Indian railways.

Subros has gotten an order from Indian Railways for supply and commissioning of coach roof mounted, and air-conditioners. This is in line with the company's aim to expand business in railway electric mobility segment.

The company is already a supplier of rail driver cabin air conditioner to the Indian Railways, according to an exchange filing.

The scrip rose to a high of 17.91% to Rs 531 apiece, the highest level since its exchange on Jul 2, 1997. It pared gains to trade 13.47% higher at Rs 511 apiece, as of 09:44 a.m. This compares to a 0.05 advance in the NSE Nifty

50 Index.It has risen 70.63% on a year-to-date basis. Total traded volume so far in the day stood at 44 times its 30-day average. The relative strength index was at 72.39, which implied the stock is overbought.

Out of four analysts tracking the company, three maintain a 'buy' rating, one recommends a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 93.7%.

NTPC Ltd., Tata Motors Ltd., and Mahindra & Mahindra Ltd. lifted Sensex to 70,000 mark.

The Nifty 50 index reclaimed the 21,000 mark after opening flat and the Sensex rose to hit hit a fresh lifetime high on Monday.

At pre-open, the S&P BSE Sensex Index was up 106.30 points, or 0.15%, at 69,931.90 while the NSE Nifty 50 was fell 4.10 points or 0.02% at 20,965.30.

"Despite market fluctuations, the Nifty remains the standout bullish performer," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

"Analysis suggests that the recent FOMO-driven activity in the Nifty is poised to sustain positive momentum on Dalal Street, fueled by factors such as BJP's success, a decline in WTI Oil prices, and optimism about the Federal Reserve's monetary policy," he added.

The Nifty 50 index reclaimed the 21,000 mark after opening flat and the Sensex rose to hit hit a fresh lifetime high on Monday.

At pre-open, the S&P BSE Sensex Index was up 106.30 points, or 0.15%, at 69,931.90 while the NSE Nifty 50 was fell 4.10 points or 0.02% at 20,965.30.

"Despite market fluctuations, the Nifty remains the standout bullish performer," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

"Analysis suggests that the recent FOMO-driven activity in the Nifty is poised to sustain positive momentum on Dalal Street, fueled by factors such as BJP's success, a decline in WTI Oil prices, and optimism about the Federal Reserve's monetary policy," he added.

The Nifty 50 index reclaimed the 21,000 mark after opening flat and the Sensex rose to hit hit a fresh lifetime high on Monday.

At pre-open, the S&P BSE Sensex Index was up 106.30 points, or 0.15%, at 69,931.90 while the NSE Nifty 50 was fell 4.10 points or 0.02% at 20,965.30.

"Despite market fluctuations, the Nifty remains the standout bullish performer," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

"Analysis suggests that the recent FOMO-driven activity in the Nifty is poised to sustain positive momentum on Dalal Street, fueled by factors such as BJP's success, a decline in WTI Oil prices, and optimism about the Federal Reserve's monetary policy," he added.

The Nifty 50 index reclaimed the 21,000 mark after opening flat and the Sensex rose to hit hit a fresh lifetime high on Monday.

At pre-open, the S&P BSE Sensex Index was up 106.30 points, or 0.15%, at 69,931.90 while the NSE Nifty 50 was fell 4.10 points or 0.02% at 20,965.30.

"Despite market fluctuations, the Nifty remains the standout bullish performer," said Prashanth Tapse, senior vice president of research at Mehta Equities Ltd.

"Analysis suggests that the recent FOMO-driven activity in the Nifty is poised to sustain positive momentum on Dalal Street, fueled by factors such as BJP's success, a decline in WTI Oil prices, and optimism about the Federal Reserve's monetary policy," he added.

Shares of HDFC Bank Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., ITC Ltd., and Kotak Mahindra Bank Ltd., contributed the most to the gains.

Meanwhile, those of Dr. Reddy's Laboratories Ltd., Asian Paints Ltd., Mahindra & Mahindra Ltd., Sun Pharmaceutical Industries Ltd., limited the gains.

Among sectoral indices, all rose except Nifty Pharma, Nifty Auto, and Nifty FMCG.

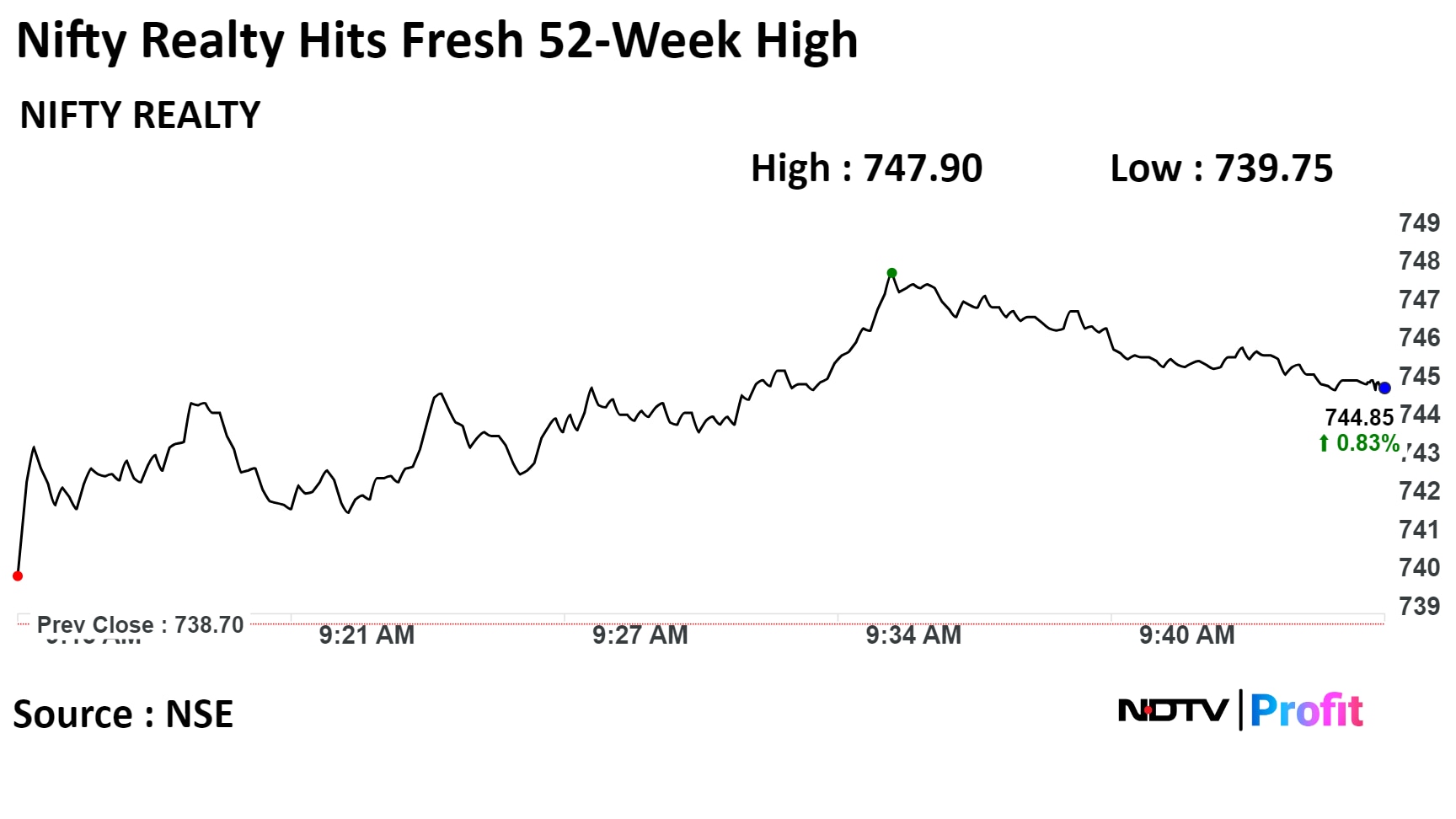

Two out of the 20 sectors compiled by BSE Ltd. fell, while eighteen advanced. Realty rose the most.

The market breadth was skewed in favour of the buyers. About 2,269 stocks rose, 785 declined, and 142 remained unchanged on the BSE.

At pre-open, the S&P BSE Sensex Index was up 106.30 points, or 0.15%, at 69,931.90 while the NSE Nifty 50 was fell 4.10 points or 0.02% at 20,965.30.

10 lakh shares or 0.4% equity changed hands in a pre-market large trade.

Buyers and sellers not known immediately.

Source: Bloomberg

Nomura said Medplus’ generic medicine launch to become earning-accretive from mid-term, and volume gains in sales from this segment will nullify the impact of sales loss from private labels.

Nomura maintained a ‘buy’ rating and increased the target price of Medplus Health Services Ltd. to Rs 974 in December from Rs 952 in November.

Equity inflows remained high in Nov. at Rs 17,700 crore vs. Rs 22,300 crore in October which is positive for 33 months in a row, said the brokerage.

Cash position for equity funds fell to lowest level in two years at 4.9% as of end October. Most inflows seen in small-cap, mid-cap funds at Rs 3,700 crore and Rs 2,700 crore, respectively.

Morgan Stanley said social Mobilisation Institutional Development funds account for one-fourth of the mutual fund equity AUM (ex-ETFs).

Kansai Nerolac Paints Ltd. is focused on expanding its portfolio by continuing to grow in its core-economy and popular-price segments, while improving its presence in the premium segment with differentiated products under the ‘Paint+’ sub-brand, Morgan Stanley has said.

"So far, 11 new products with differentiated features have been launched and premium product revenue salience has increased by 150 basis points", the research firm said in a Dec. 10 note.

The paint company is focusing on emerging segments like construction chemicals and wood finishes. The addressable market for construction chemicals is more than $1 billion, accounting for 10–11% of the total paints market, and has consistently been growing by double digits, the company said in the analyst meeting.

Maintains 'Buy' rating with target price of Rs 6,580

Management confidence of achieving 13-16% FY24 growth guidance

Executable order book provides strong visibility

Targets 150-300bps margin improvement over next 3-4 years

Plans to scale 4 new verticals

To invest to expand presence in the US West coast

U.S. Dollar index at 104.01.

10-year bond yield at 4.24%

Brent crude up 0.40% at $76.14 per barrel

Nymex crude up 0.32% at $71.46 per barrel

GIFT Nifty was 2.5 points or 0.01% down at 21,074.50 as of 8 a.m.

Bitcoin was down 3.34% at $42,339.

Nifty December futures are up 0.21% to 21,075 at a premium of 105.6 points.

Nifty December futures open interest down 3.2%.

Nifty Bank December futures are up by 0.96% to 47,499.80 at a premium of 237.8 points.

Nifty Bank December futures open interest up by 5.6%.

Nifty Options Dec. 13 Expiry: Maximum call open interest at 21,000 and maximum put open interest at 20,000.

Bank Nifty Options Dec. 13 Expiry: Maximum call open interest at 49,000 and maximum put open interest at 47,000.

Securities in ban period: Balrampur Chini Mills, Delta Corp., Hindustan Copper, Indiabulls Housing Finance, National Aluminium, Steel Authority of India, Zee Entertainment.

Nifty December futures are up 0.21% to 21,075 at a premium of 105.6 points.

Nifty December futures open interest down 3.2%.

Nifty Bank December futures are up by 0.96% to 47,499.80 at a premium of 237.8 points.

Nifty Bank December futures open interest up by 5.6%.

Nifty Options Dec. 13 Expiry: Maximum call open interest at 21,000 and maximum put open interest at 20,000.

Bank Nifty Options Dec. 13 Expiry: Maximum call open interest at 49,000 and maximum put open interest at 47,000.

Securities in ban period: Balrampur Chini Mills, Delta Corp., Hindustan Copper, Indiabulls Housing Finance, National Aluminium, Steel Authority of India, Zee Entertainment.

Price band revised from 20% to 10%: Adani Power, Spencer's Retail.

Move into a short-term ASM framework: Adani Energy Solutions, Adani Green Energy, New Delhi Television, TV18 Broadcast.

Move out of short-term ASM framework: Insecticides (India), Swan Energy.

Jindal Steel and Power: Promoter group Siddeshwari Tradex released a pledge of 9.6 lakh shares on Dec. 5 and created a pledge of 5.9 lakh shares on Dec. 5.

Choice International: Promoter group NS Technical Consultancy bought 4 lakh shares on Dec. 6.

Ultramarine & Pigments: Promoter group Deepa Ajay sold 15,033 shares between Dec. 7 and 8.

Arman Financial Services: Promoter group Amit R Manakiwala sold 400 shares on Dec. 6.

Goldiam International: Rashesh Bhansali sold 10 lakh shares or 0.91% stake at Rs 180 apiece.

Neuland Lab: Ramamohan Rao Davuluri sold 4 lakh shares (3.11%) at Rs 5,012.45 apiece.

Pricol: Phi Capital Solutions LLP sold 30.03 lakh shares (2.46%) at Rs 333.16 apiece and Goldman Sachs India bought 28.94 lakh shares (2.37%) at Rs 333 apiece.

Cantabil: BofA Securities Europe Sa bought 4.67 lakh shares (2.86%) at Rs 263 apiece.

Five-Star: Matrix Partners India Investment Holdings II LLC sold 46.84 lakh shares (1.6%), Peak XV Partners Investments V sold 45.66 lakh shares (1.56%), and TPG Asia VII SF PTE sold 89.06 lakh shares (3.04%) at 730 apiece.

Mahindra Logistics: Goldman Sachs India Equity Portfolio sold 5.92 lakh shares (0.82%) at Rs 376.19 apiece.

Spencer Retail: Santosh Industries Ltd. bought 8 lakh shares (0.88%) at Rs 107.32 apiece and Monet Securities Pvt. bought 4.82 lakh shares (0.53%) at Rs 113.74 apiece.

Zomato: SoftBank-affiliated SVF Growth (Singapore) Pte. has cut a 1.07% stake in food aggregator Zomato for Rs 1,127 crore. SVF Growth offloaded 9.35 crore shares at Rs 120.5 apiece. Societe Generale bought a 0.24% stake, Edelweiss Mutual Fund purchased a 0.09% stake, and Morgan Stanley Asia Singapore Pte. bought a 0.09% stake at Rs 120.5 apiece, among other buyers.

Mazagon Dock Shipbuilders: The company received an order worth Rs 1,145 crore from ONGC for laying approximately 44.4 km of subsea pipelines in 19 segments.

GMR Airports Infrastructure: Two key investors in the company have divested their stake, while the Rajiv Jain-backed GQG Partners has picked up a 4.7% stake for Rs 1,671 crore.

Bank of India: The company’s QIP worth of Rs 4,500 crore was oversubscribed by 4.11 times. The company received 104 bids, aggregating to 18,483.30 crore.

REC: The company signed a €200-million loan agreement with the German Bank KfW in New Delhi. This is the company's sixth line of credit under Indo-German Development Cooperation.

JSW Steel: The company secured a coveted position in the DJSI World Index and the DJSI Index for Emerging Markets.

Adani Enterprises: The company acquired the remaining 51% stake in Quintillion Business Media. Post-acquisition, Quintillion Business Media becomes a wholly owned subsidiary of the company.

Ramco Cements: Kolimigundla clinker plant capacity increased to 3.15 MTPA from 2.5 MTPA.

IDFC First Bank: Cloverdell Investment reduced its stake in the company to 2.25% from 4.04%.

Dr Reddy's Laboratories: The US FDA issued Form 483 with three observations in its inspection from Dec. 4 to Dec. 8.

HCL Tech: The leading global technology company expands its footprint in Romania with a new global delivery centre.

Cipla: The company received the FDA approval for ANDA for Vasopressin.

Lemon Tree Hotels: The company signed a licence pact for an 80-room hotel in Karnataka.

Lloyds Metals and Energy: The company approved the expansion of iron ore mining capacity up to 55 MTPA, the establishment of 45 MTPA BHQ beneficiation plants, the establishment of 3 MTPA integrated steel plants and the enhancement of 4 MTPA pellet plants to 8 MTPA pellet plants. The company's board approved the issue of 6.35 crore shares by way of a rights issue for Rs 99.9 crore.

Apollo Tyres: The Supreme Court has dismissed the appeal filed by SEBI and has directed SEBI to refund the entire penalty amount of Rs 65 lakh imposed for the alleged violation of certain provisions of the Buy Back Regulations.

Max Healthcare: The company’s unit will acquire a 100% stake in Starlit Medical Centre for 125 crores.

Vinati Organics: The company’s commercial production of Ortho Secondary Butyl Phenol and Di-Secondary Butyl Phenol has commenced at the company facility.

Imagicaaworld Entertainment: The company signed an MoU with the Uttarakhand government to set up an entertainment park.

Shoppers Stop: The company and the Good Glamm Group are looking to collaborate on creating disruptive omni-channel experiences.

Blue Dart: The board approved the purchase of two leased aircraft from the Netherlands' DLH Aviation for Rs 40 crore.

Ireda: The company launches a retail division with an enhanced emphasis on providing loans to borrowers in the PM-KUSUM scheme, rooftop solar, and other business-to-consumer sectors.

S.P. Apparels: The company purchased the entire or partial shares of Young Brand Apparel Pvt., which is a subsidiary of Bannari Amman Spinning Mills.

Religare: The company completes the acquisition of a 100% equity stake in MIC Insurance Web Aggregator Pvt. Post-acquisition, MIC has become a wholly owned subsidiary of the company.

Tata Motors: The carmaker said it will hike commercial vehicle prices up to 3% from January.

The Ministry of Road, Transport and Highways has issued a notification directing all N2 and N3-category truck, produced from Oct 1, 2025, need to have factory-fitted air-conditioned cabin for drivers. The move is expected to increase production costs.

Ashok Leyland: The Ministry of Road, Transport and Highways has issued a notification directing all N2 and N3-category truck, produced from Oct 1, 2025, need to have factory-fitted air-conditioned cabin for drivers. The move is expected to increase production costs.

The December futures contract of the GIFT Nifty index opened flat on Monday, hinting at a muted opening for benchmarks.

As of 8 am. GIFT Nifty was down 2.5 points or 0.01% at 21,074.50.

Asian markets opened mostly higher today ahead of a week that includes key US inflation data and the Federal Reserve’s final rate decision of the year.

Indices in Japan gained more than 1%, Australia's S&P/ASX 200 traded 0.3% higher and South Korea's Kospi was flat. Meanwhile, those in mainland China and Hong Kong fell.

Treasury yields surged as traders pared expectations for the Federal Reserve to ease monetary policy aggressively next year after a better-than-forecast jobs report, Bloomberg reported.

The S&P 500 Index and Nasdaq 100 advanced 0.41% and 0.45%, respectively, on Dec. 8. The Dow Jones Industrial Average rose by 0.36%.

Brent crude traded 0.40% higher at $76.14 a barrel. Gold fell 0.1% to $2,002.46 an ounce.

Indian benchmark indices rose for six straight weeks, logging the best weekly gains in nearly three years.

The NSE Nifty 50 index ended at a record high after hitting the 21,000 mark for the first time on Friday. The NSE Nifty 50 ended 68.25 points, or 0.33% higher, at 20,969.40, while the S&P BSE Sensex closed 303.91 points, or 0.44% higher, at 69,825.60.

Overseas investors in Indian equities turned net buyers on Friday after two consecutive selling sessions. Foreign portfolio investors mopped up stocks worth Rs 3,632.3 crore, while domestic institutional investors offloaded stocks worth Rs 434 crore, according to provisional data from the National Stock Exchange.

The Indian rupee weakened 3 paise to close at Rs 83.39 against the greenback on Friday.

The December futures contract of the GIFT Nifty index opened flat on Monday, hinting at a muted opening for benchmarks.

As of 8 am. GIFT Nifty was down 2.5 points or 0.01% at 21,074.50.

Asian markets opened mostly higher today ahead of a week that includes key US inflation data and the Federal Reserve’s final rate decision of the year.

Indices in Japan gained more than 1%, Australia's S&P/ASX 200 traded 0.3% higher and South Korea's Kospi was flat. Meanwhile, those in mainland China and Hong Kong fell.

Treasury yields surged as traders pared expectations for the Federal Reserve to ease monetary policy aggressively next year after a better-than-forecast jobs report, Bloomberg reported.

The S&P 500 Index and Nasdaq 100 advanced 0.41% and 0.45%, respectively, on Dec. 8. The Dow Jones Industrial Average rose by 0.36%.

Brent crude traded 0.40% higher at $76.14 a barrel. Gold fell 0.1% to $2,002.46 an ounce.

Indian benchmark indices rose for six straight weeks, logging the best weekly gains in nearly three years.

The NSE Nifty 50 index ended at a record high after hitting the 21,000 mark for the first time on Friday. The NSE Nifty 50 ended 68.25 points, or 0.33% higher, at 20,969.40, while the S&P BSE Sensex closed 303.91 points, or 0.44% higher, at 69,825.60.

Overseas investors in Indian equities turned net buyers on Friday after two consecutive selling sessions. Foreign portfolio investors mopped up stocks worth Rs 3,632.3 crore, while domestic institutional investors offloaded stocks worth Rs 434 crore, according to provisional data from the National Stock Exchange.

The Indian rupee weakened 3 paise to close at Rs 83.39 against the greenback on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.