Overseas investors remain net buyers of Indian equities on Wednesday.

Foreign portfolio investors bought stocks worth Rs 2,766.75 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net buyers for the fourth day and mopped up equities worth Rs 2,149.88 crore, the NSE data showed.

Foreign institutions have been net sellers of Rs 18066 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

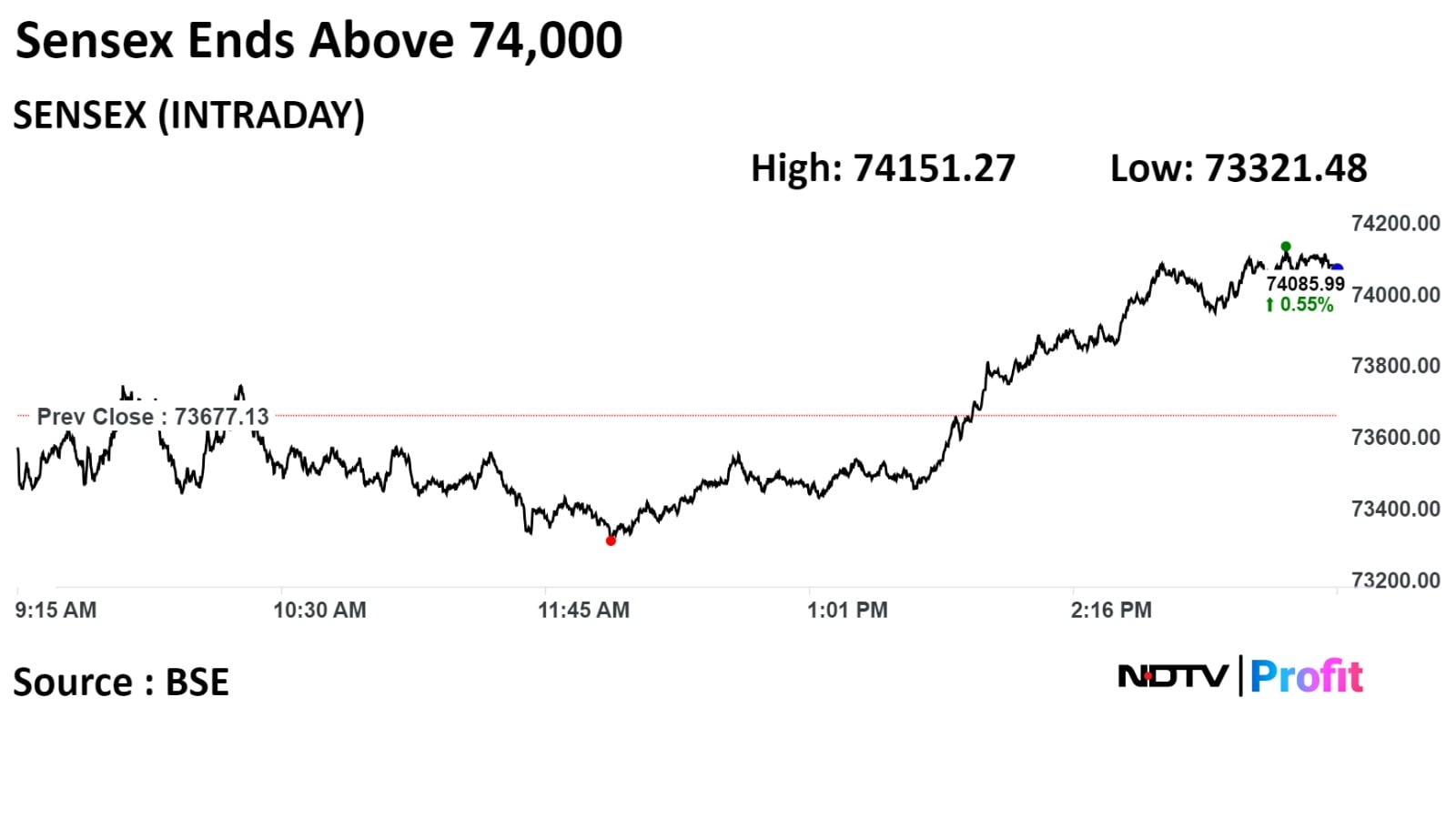

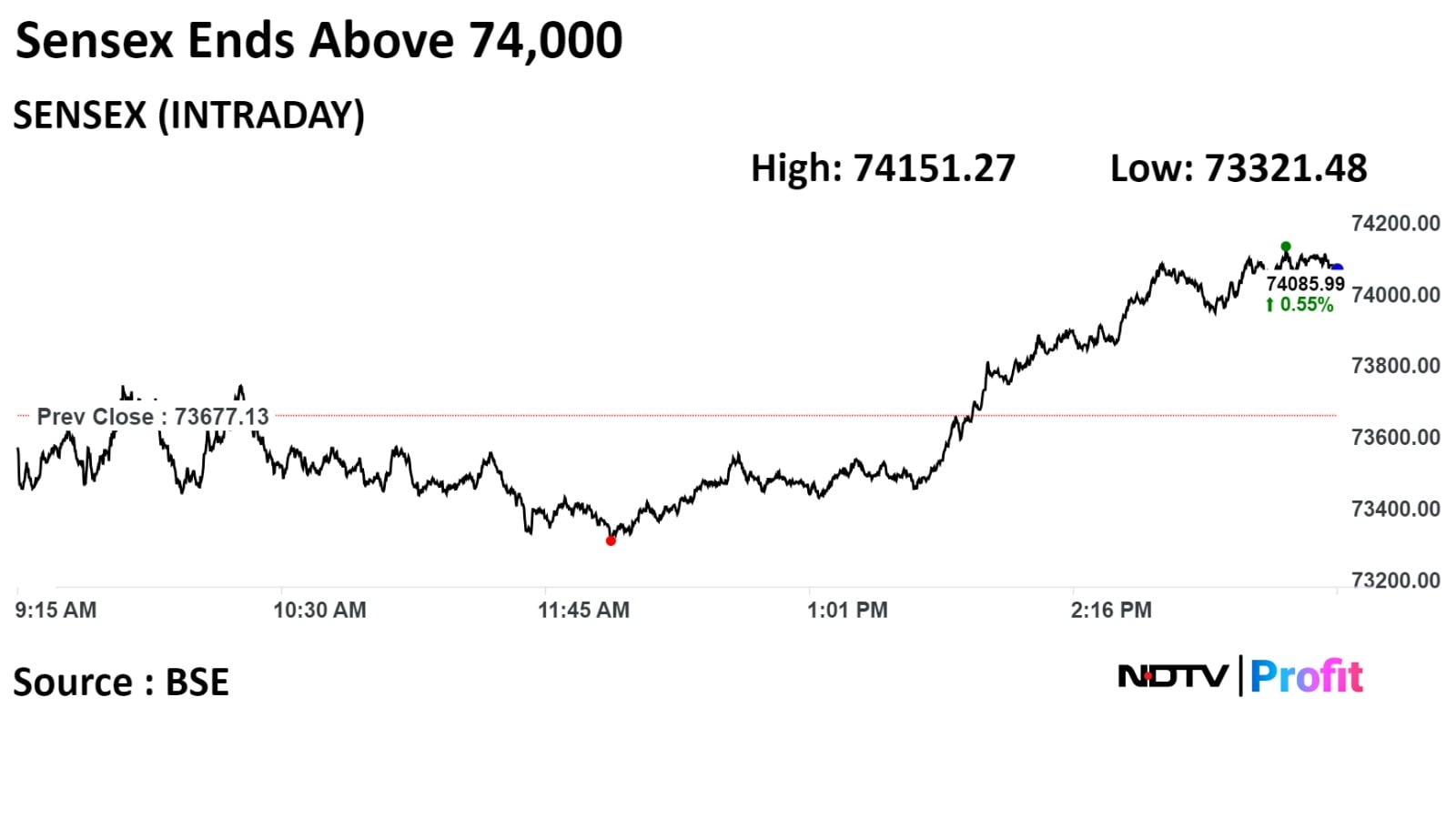

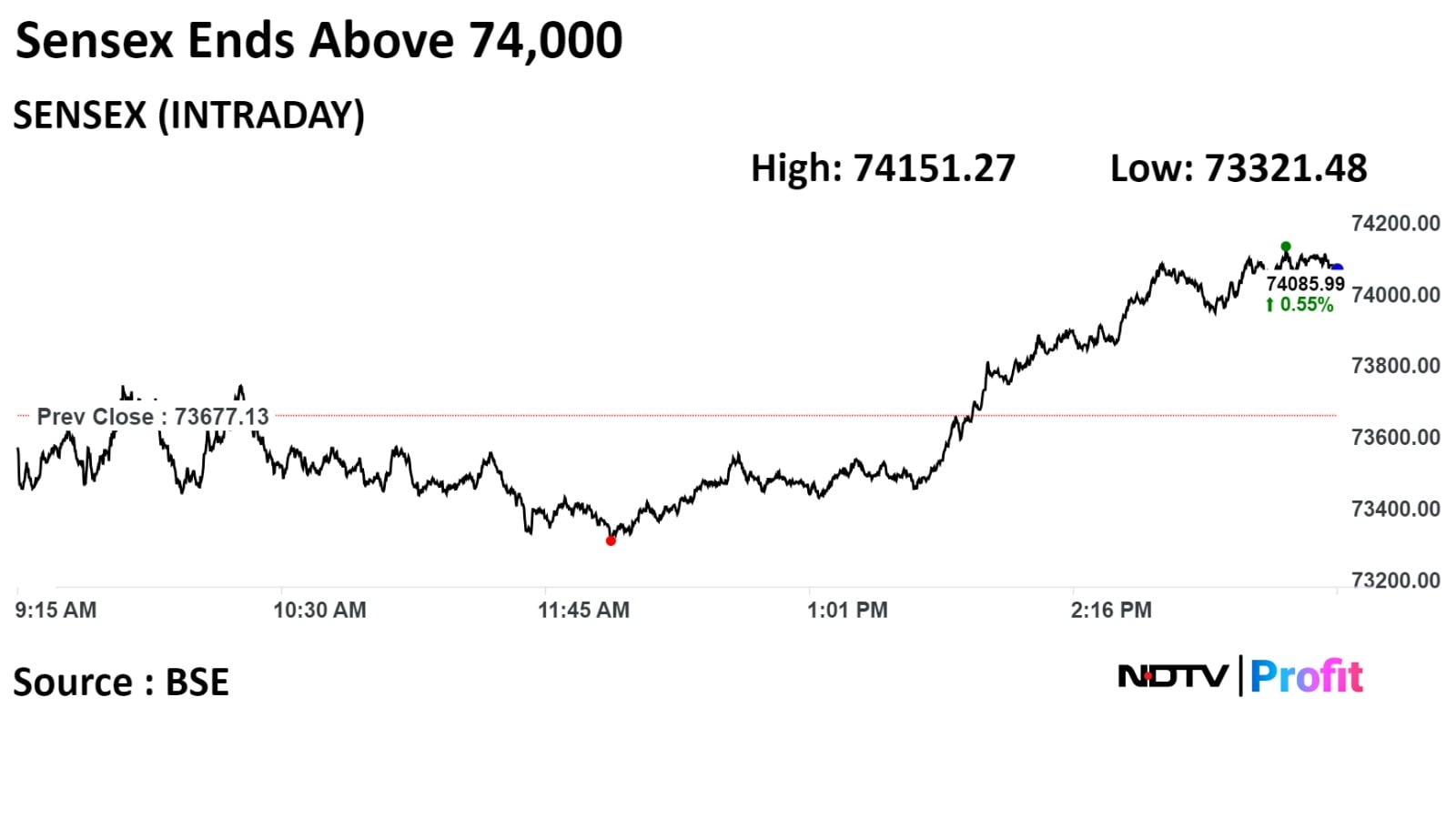

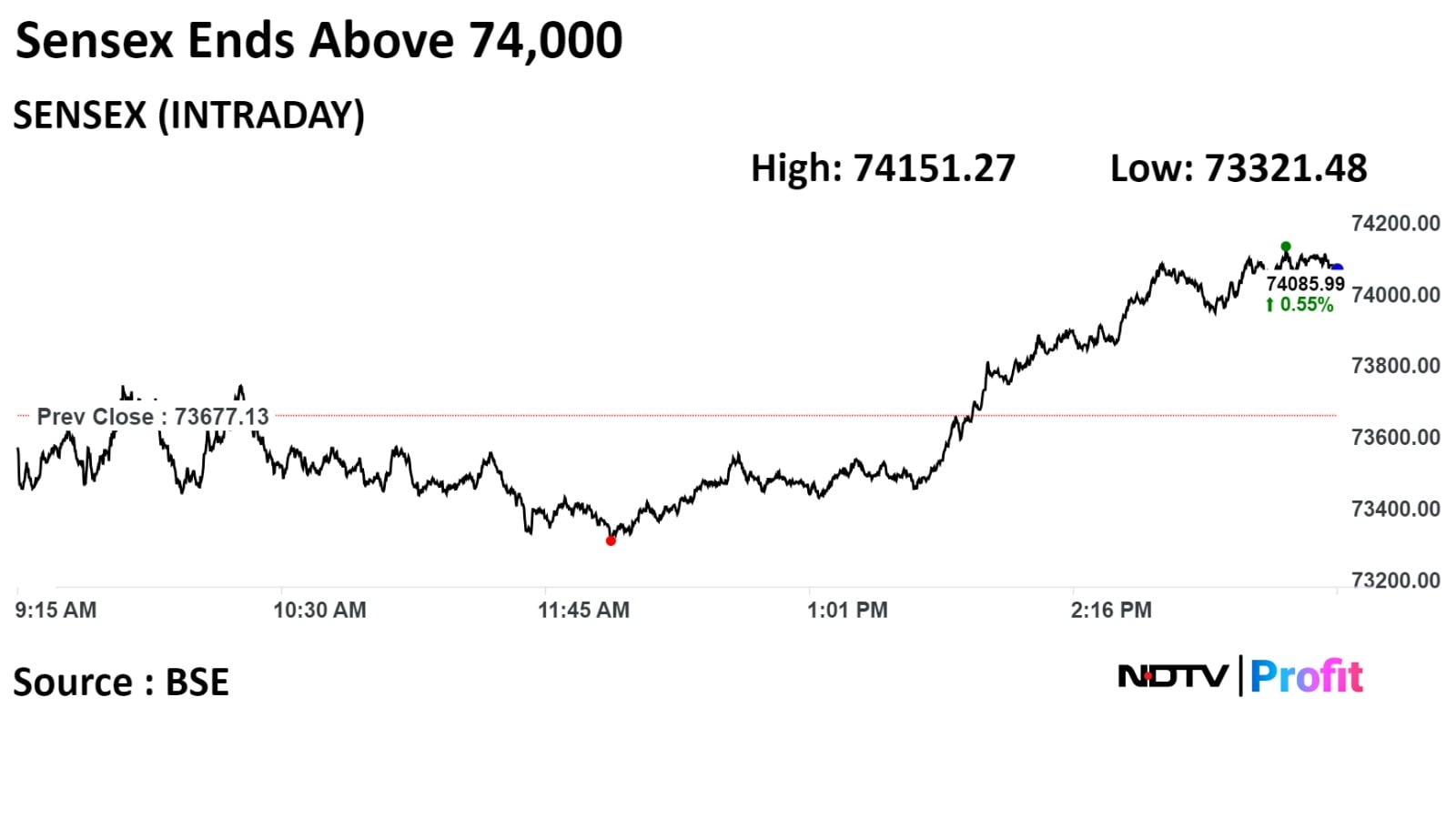

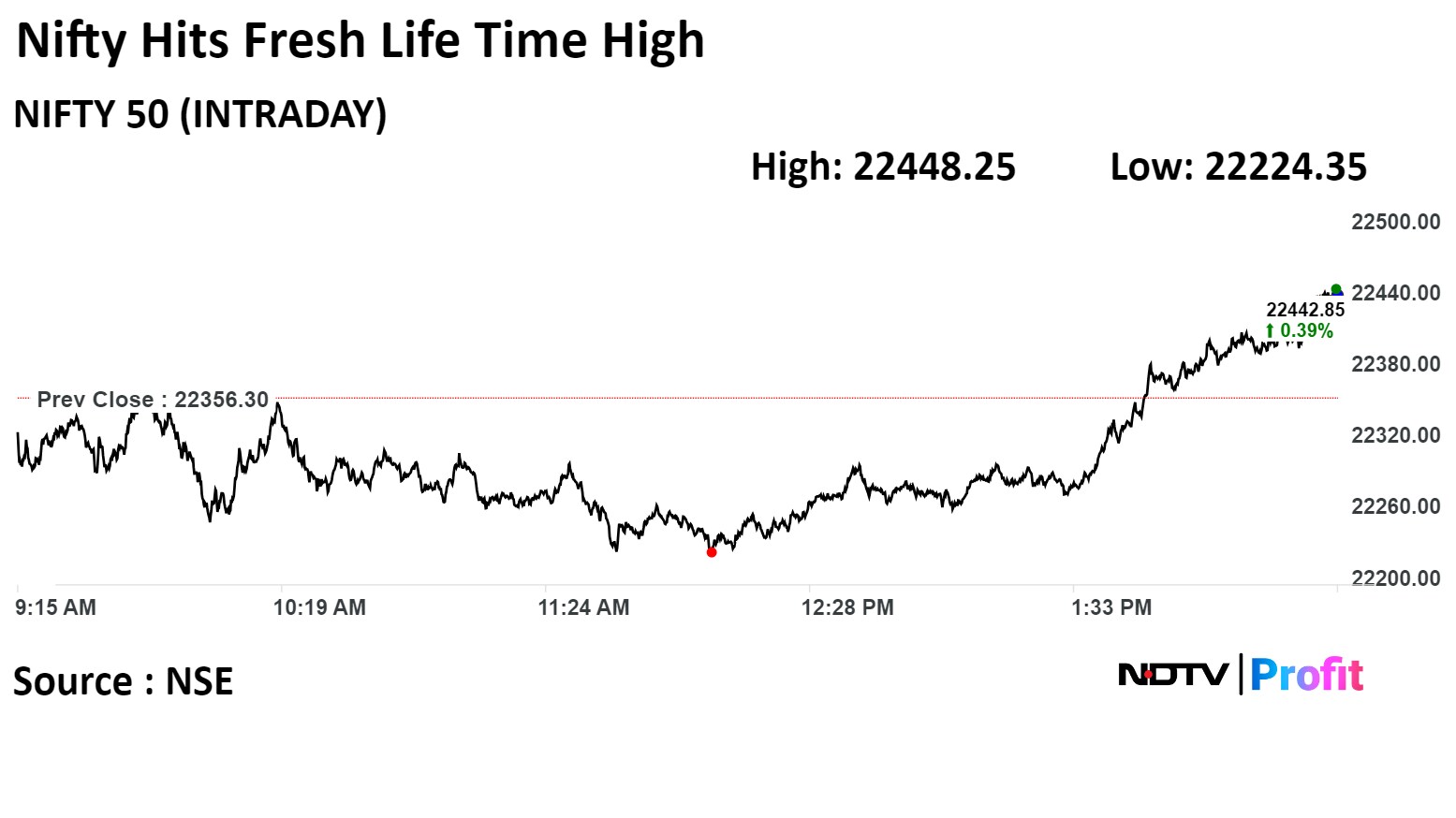

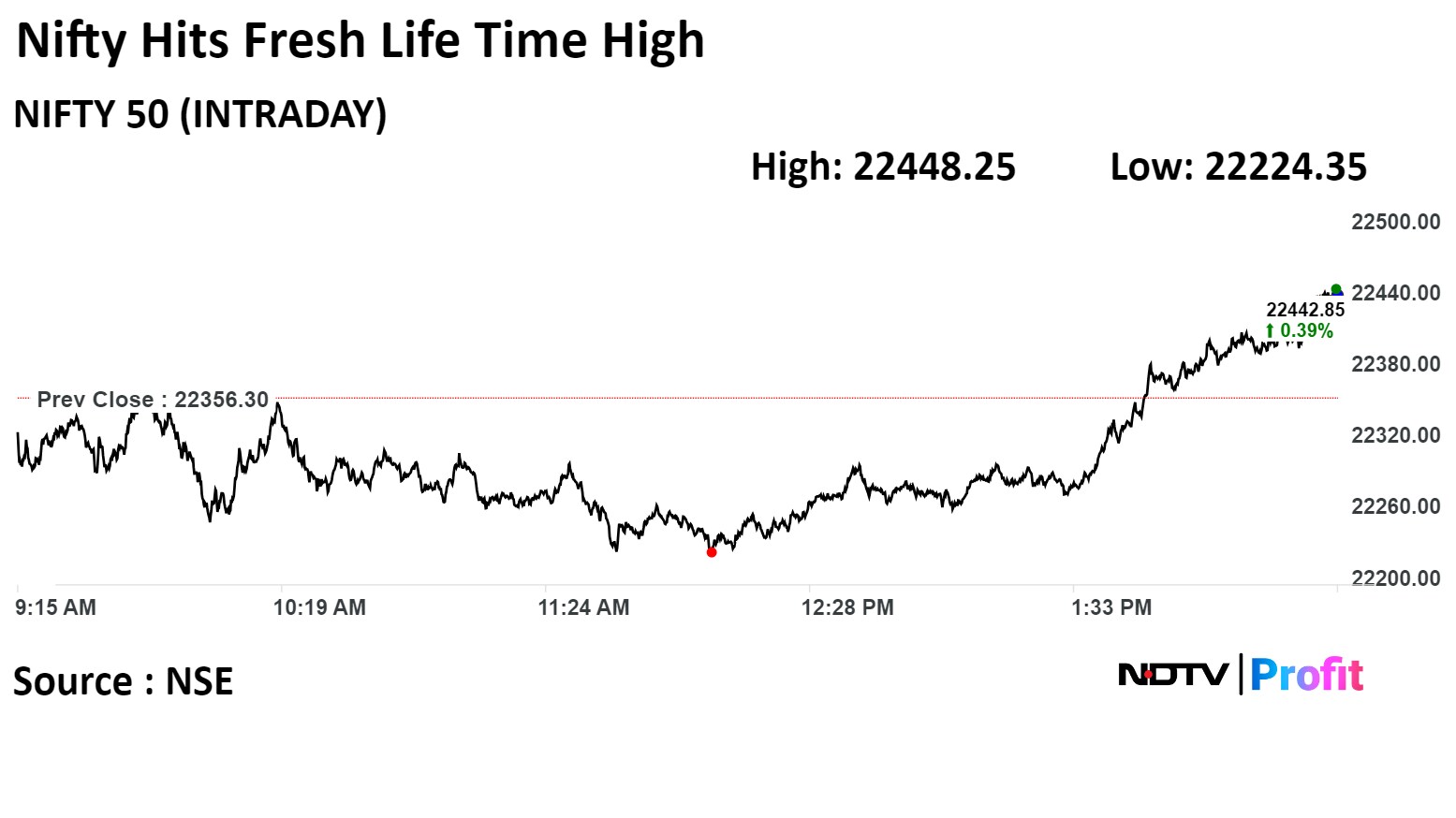

The NSE Nifty 50 closed 117.75 points, or 0.53%, higher at 22,474.05, and the S&P BSE Sensex gained 408.86 points, or 0.55%, to end at 74,085.99.

The local currency strengthened by 7 paise to close at 82.83 against the U.S. Dollar.

It closed at 82.90 on Tuesday.

Source: Bloomberg

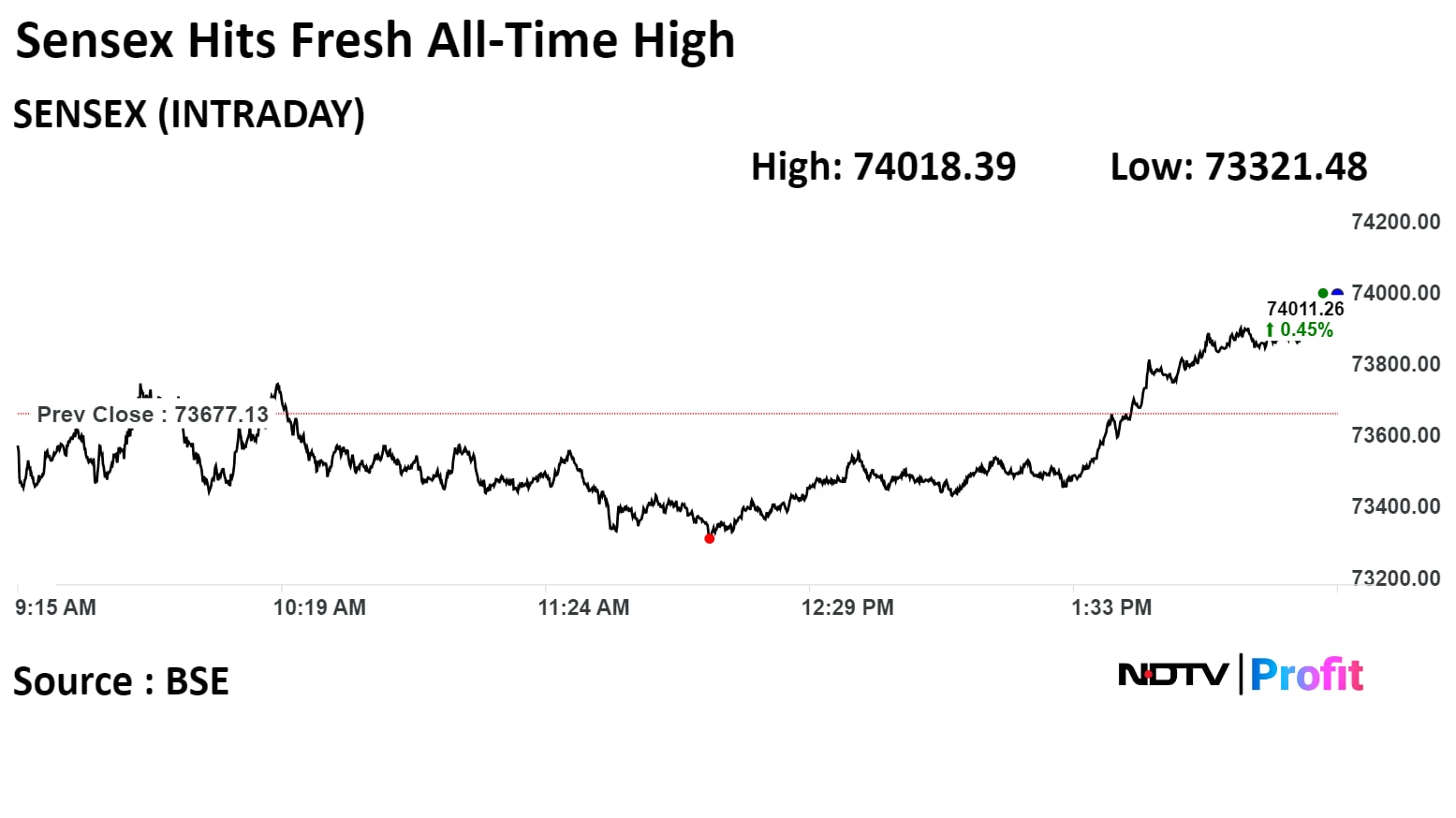

India's benchmark indices rebounded from one-day fall to resume its rally, and settled at record closing high as ICICI Bank Ltd., Axis Bank Ltd. gained.

The NSE Nifty 50 settled 117.75 points or 0.53% higher at 22,474.05, and the S&P BSE Sensex 408.86 points or 0.55% up at 74,085.99.

During the last leg of the trade, the NSE Nifty rose 0.63% to record high of 22,497.20, and the S&P BSE Sensex rose 0.64% to record high 74,151.27.

"Global markets witnessed mixed signals ahead of the US Fed Chair's testimony to Congress. While it's widely expected that the Fed Chair may downplay the urgency for rate hikes, the possibility of hints regarding a potential rate cut trajectory cannot be dismissed, said Vinod Nair, head of research, Geojit Financial Services.

Investors are banking on recent FOMC minutes, suggesting the policy rate may have peaked and higher rates could hinder growth. The domestic market exhibited a smart recovery in the second half, reversing initial losses as buying picked up in large-cap stocks. Nevertheless, the broader index continued to underperform with probit booking in Mid and Small caps reflecting worries about stretched valuations, Nair added.

India's benchmark indices rebounded from one-day fall to resume its rally, and settled at record closing high as ICICI Bank Ltd., Axis Bank Ltd. gained.

The NSE Nifty 50 settled 117.75 points or 0.53% higher at 22,474.05, and the S&P BSE Sensex 408.86 points or 0.55% up at 74,085.99.

During the last leg of the trade, the NSE Nifty rose 0.63% to record high of 22,497.20, and the S&P BSE Sensex rose 0.64% to record high 74,151.27.

"Global markets witnessed mixed signals ahead of the US Fed Chair's testimony to Congress. While it's widely expected that the Fed Chair may downplay the urgency for rate hikes, the possibility of hints regarding a potential rate cut trajectory cannot be dismissed, said Vinod Nair, head of research, Geojit Financial Services.

Investors are banking on recent FOMC minutes, suggesting the policy rate may have peaked and higher rates could hinder growth. The domestic market exhibited a smart recovery in the second half, reversing initial losses as buying picked up in large-cap stocks. Nevertheless, the broader index continued to underperform with probit booking in Mid and Small caps reflecting worries about stretched valuations, Nair added.

India's benchmark indices rebounded from one-day fall to resume its rally, and settled at record closing high as ICICI Bank Ltd., Axis Bank Ltd. gained.

The NSE Nifty 50 settled 117.75 points or 0.53% higher at 22,474.05, and the S&P BSE Sensex 408.86 points or 0.55% up at 74,085.99.

During the last leg of the trade, the NSE Nifty rose 0.63% to record high of 22,497.20, and the S&P BSE Sensex rose 0.64% to record high 74,151.27.

"Global markets witnessed mixed signals ahead of the US Fed Chair's testimony to Congress. While it's widely expected that the Fed Chair may downplay the urgency for rate hikes, the possibility of hints regarding a potential rate cut trajectory cannot be dismissed, said Vinod Nair, head of research, Geojit Financial Services.

Investors are banking on recent FOMC minutes, suggesting the policy rate may have peaked and higher rates could hinder growth. The domestic market exhibited a smart recovery in the second half, reversing initial losses as buying picked up in large-cap stocks. Nevertheless, the broader index continued to underperform with probit booking in Mid and Small caps reflecting worries about stretched valuations, Nair added.

India's benchmark indices rebounded from one-day fall to resume its rally, and settled at record closing high as ICICI Bank Ltd., Axis Bank Ltd. gained.

The NSE Nifty 50 settled 117.75 points or 0.53% higher at 22,474.05, and the S&P BSE Sensex 408.86 points or 0.55% up at 74,085.99.

During the last leg of the trade, the NSE Nifty rose 0.63% to record high of 22,497.20, and the S&P BSE Sensex rose 0.64% to record high 74,151.27.

"Global markets witnessed mixed signals ahead of the US Fed Chair's testimony to Congress. While it's widely expected that the Fed Chair may downplay the urgency for rate hikes, the possibility of hints regarding a potential rate cut trajectory cannot be dismissed, said Vinod Nair, head of research, Geojit Financial Services.

Investors are banking on recent FOMC minutes, suggesting the policy rate may have peaked and higher rates could hinder growth. The domestic market exhibited a smart recovery in the second half, reversing initial losses as buying picked up in large-cap stocks. Nevertheless, the broader index continued to underperform with probit booking in Mid and Small caps reflecting worries about stretched valuations, Nair added.

India's benchmark indices rebounded from one-day fall to resume its rally, and settled at record closing high as ICICI Bank Ltd., Axis Bank Ltd. gained.

The NSE Nifty 50 settled 117.75 points or 0.53% higher at 22,474.05, and the S&P BSE Sensex 408.86 points or 0.55% up at 74,085.99.

During the last leg of the trade, the NSE Nifty rose 0.63% to record high of 22,497.20, and the S&P BSE Sensex rose 0.64% to record high 74,151.27.

"Global markets witnessed mixed signals ahead of the US Fed Chair's testimony to Congress. While it's widely expected that the Fed Chair may downplay the urgency for rate hikes, the possibility of hints regarding a potential rate cut trajectory cannot be dismissed, said Vinod Nair, head of research, Geojit Financial Services.

Investors are banking on recent FOMC minutes, suggesting the policy rate may have peaked and higher rates could hinder growth. The domestic market exhibited a smart recovery in the second half, reversing initial losses as buying picked up in large-cap stocks. Nevertheless, the broader index continued to underperform with probit booking in Mid and Small caps reflecting worries about stretched valuations, Nair added.

India's benchmark indices rebounded from one-day fall to resume its rally, and settled at record closing high as ICICI Bank Ltd., Axis Bank Ltd. gained.

The NSE Nifty 50 settled 117.75 points or 0.53% higher at 22,474.05, and the S&P BSE Sensex 408.86 points or 0.55% up at 74,085.99.

During the last leg of the trade, the NSE Nifty rose 0.63% to record high of 22,497.20, and the S&P BSE Sensex rose 0.64% to record high 74,151.27.

"Global markets witnessed mixed signals ahead of the US Fed Chair's testimony to Congress. While it's widely expected that the Fed Chair may downplay the urgency for rate hikes, the possibility of hints regarding a potential rate cut trajectory cannot be dismissed, said Vinod Nair, head of research, Geojit Financial Services.

Investors are banking on recent FOMC minutes, suggesting the policy rate may have peaked and higher rates could hinder growth. The domestic market exhibited a smart recovery in the second half, reversing initial losses as buying picked up in large-cap stocks. Nevertheless, the broader index continued to underperform with probit booking in Mid and Small caps reflecting worries about stretched valuations, Nair added.

India's benchmark indices rebounded from one-day fall to resume its rally, and settled at record closing high as ICICI Bank Ltd., Axis Bank Ltd. gained.

The NSE Nifty 50 settled 117.75 points or 0.53% higher at 22,474.05, and the S&P BSE Sensex 408.86 points or 0.55% up at 74,085.99.

During the last leg of the trade, the NSE Nifty rose 0.63% to record high of 22,497.20, and the S&P BSE Sensex rose 0.64% to record high 74,151.27.

"Global markets witnessed mixed signals ahead of the US Fed Chair's testimony to Congress. While it's widely expected that the Fed Chair may downplay the urgency for rate hikes, the possibility of hints regarding a potential rate cut trajectory cannot be dismissed, said Vinod Nair, head of research, Geojit Financial Services.

Investors are banking on recent FOMC minutes, suggesting the policy rate may have peaked and higher rates could hinder growth. The domestic market exhibited a smart recovery in the second half, reversing initial losses as buying picked up in large-cap stocks. Nevertheless, the broader index continued to underperform with probit booking in Mid and Small caps reflecting worries about stretched valuations, Nair added.

India's benchmark indices rebounded from one-day fall to resume its rally, and settled at record closing high as ICICI Bank Ltd., Axis Bank Ltd. gained.

The NSE Nifty 50 settled 117.75 points or 0.53% higher at 22,474.05, and the S&P BSE Sensex 408.86 points or 0.55% up at 74,085.99.

During the last leg of the trade, the NSE Nifty rose 0.63% to record high of 22,497.20, and the S&P BSE Sensex rose 0.64% to record high 74,151.27.

"Global markets witnessed mixed signals ahead of the US Fed Chair's testimony to Congress. While it's widely expected that the Fed Chair may downplay the urgency for rate hikes, the possibility of hints regarding a potential rate cut trajectory cannot be dismissed, said Vinod Nair, head of research, Geojit Financial Services.

Investors are banking on recent FOMC minutes, suggesting the policy rate may have peaked and higher rates could hinder growth. The domestic market exhibited a smart recovery in the second half, reversing initial losses as buying picked up in large-cap stocks. Nevertheless, the broader index continued to underperform with probit booking in Mid and Small caps reflecting worries about stretched valuations, Nair added.

Kotak Mahindra Bank Ltd., Axis Bank Ltd., Bharti Airtel Ltd., ICICI Bank Ltd., and Tata Consultancy Services Ltd added positively to the benchmark's rally.

NTPC Ltd., UltraTech Cement Ltd., Adani Enterprises Ltd., Oil and Natural Gas Corp of India Ltd., and Maruti Suzuki Ltd capped gains to the benchmark index.

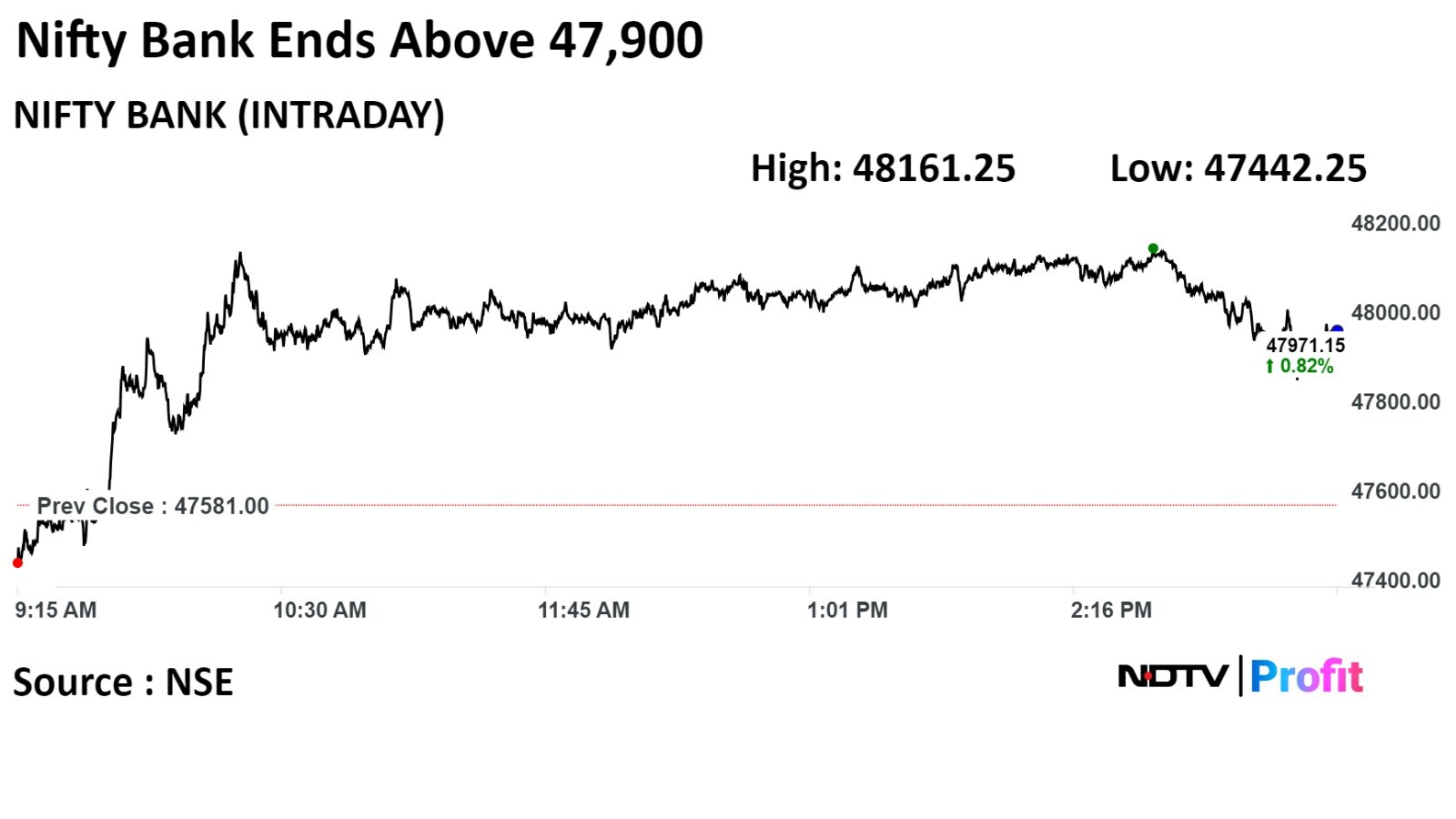

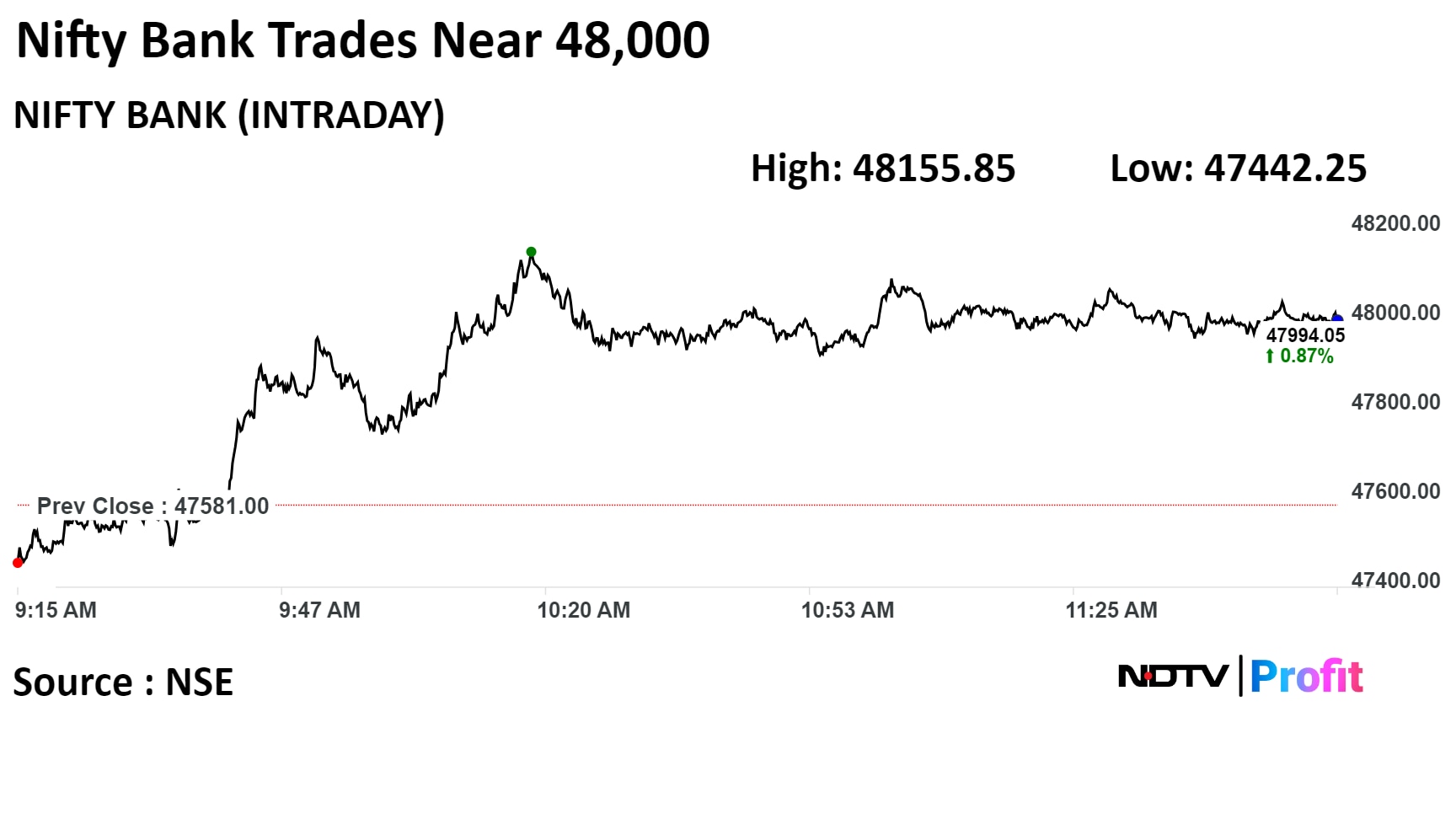

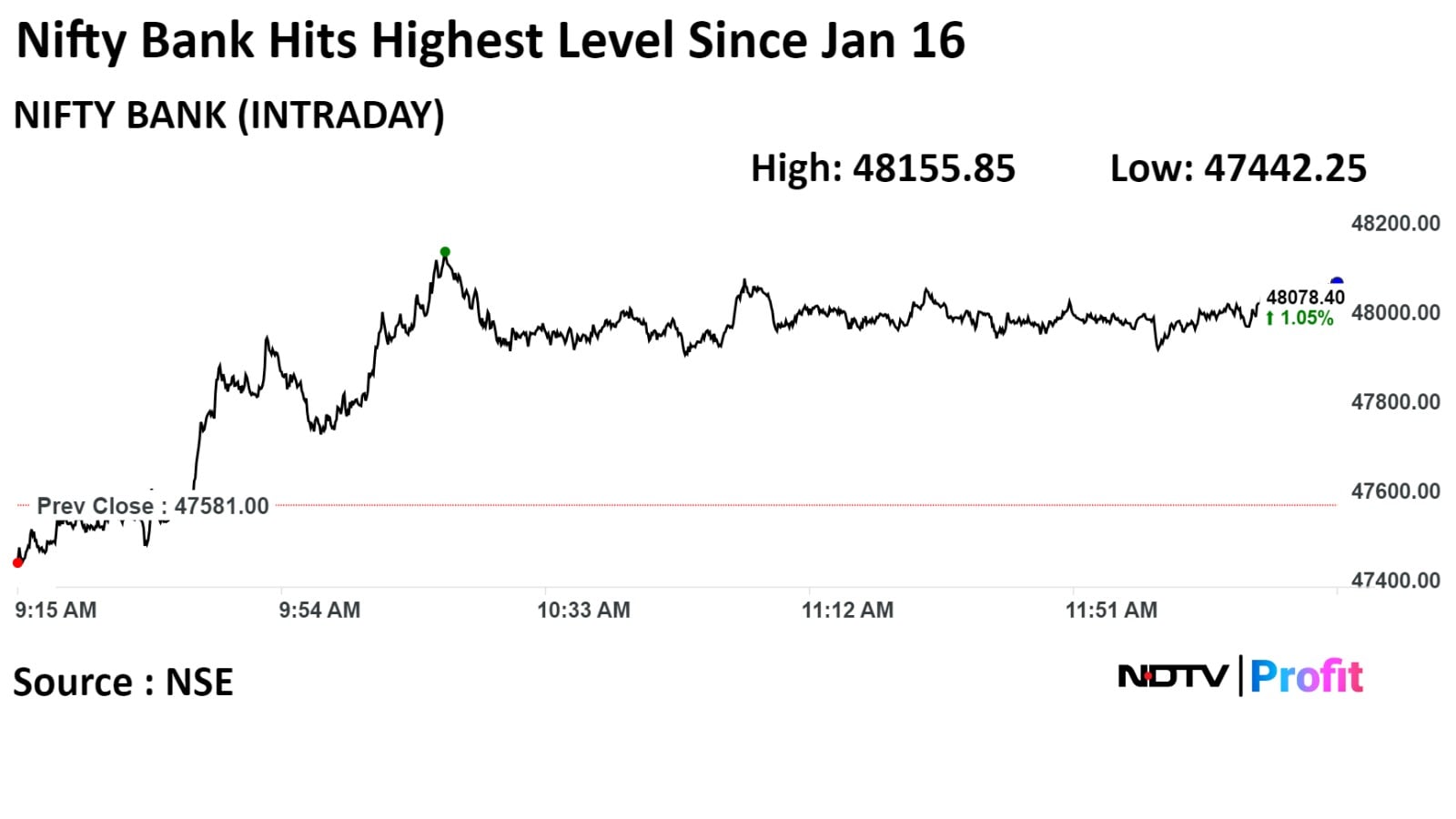

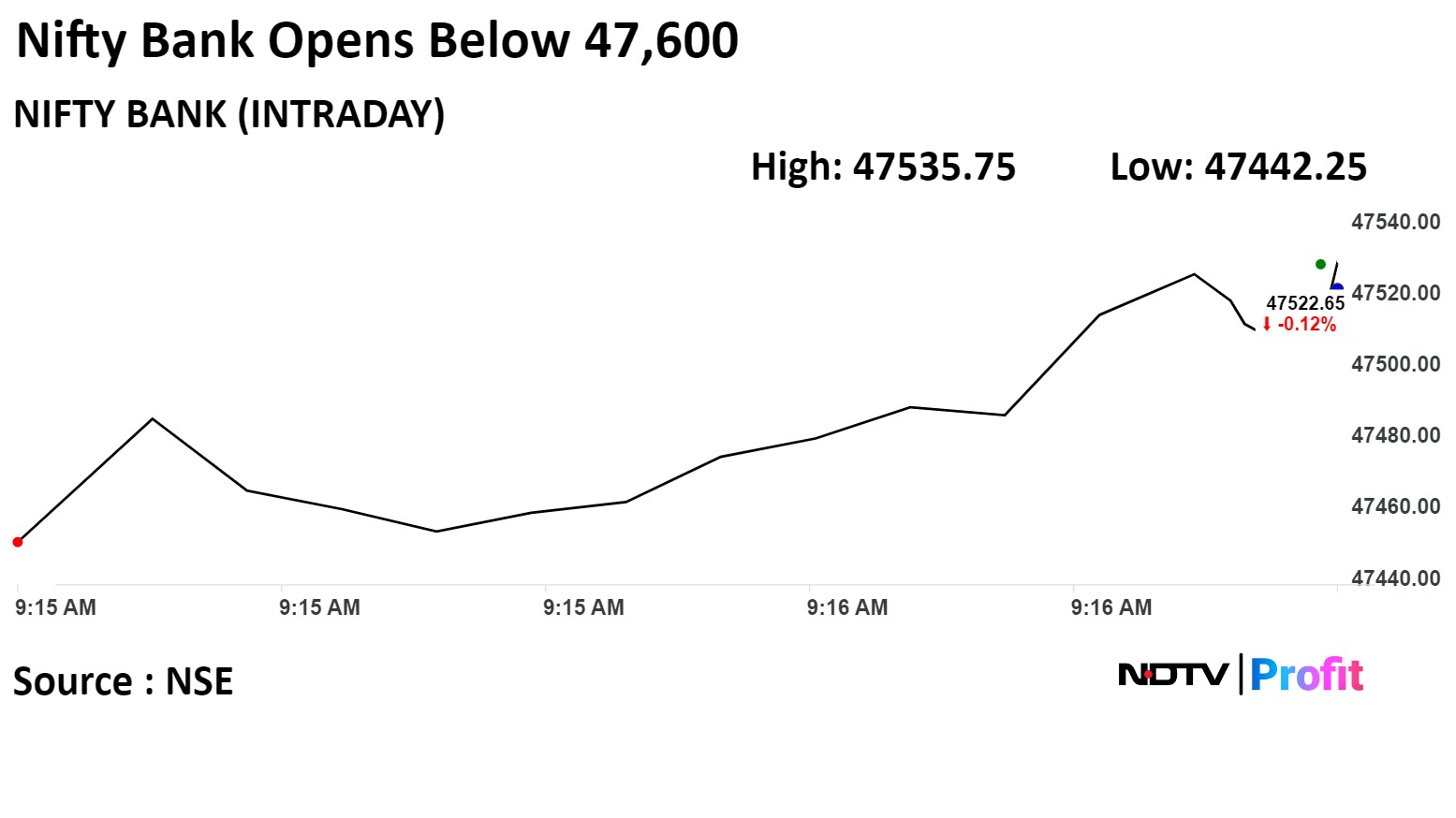

On NSE, six sectors advanced, and six declined. The Nifty Bank index performed best among its peers with 0.82% gain, while the Nifty Media index declined the most.

Broader markets underperformed. The S&P BSE Midcap ended 0.65% lower, and the S&P BSE Smallcap settled 1.91% lower.

On BSE, twelve sectors declined and eight ended higher. The S&P BSE Services declined the most.

Market breadth was skewed in favour of sellers. Around 2,969 stocks fell, 891 rose, and 81 stocks remained unchanged on BSE.

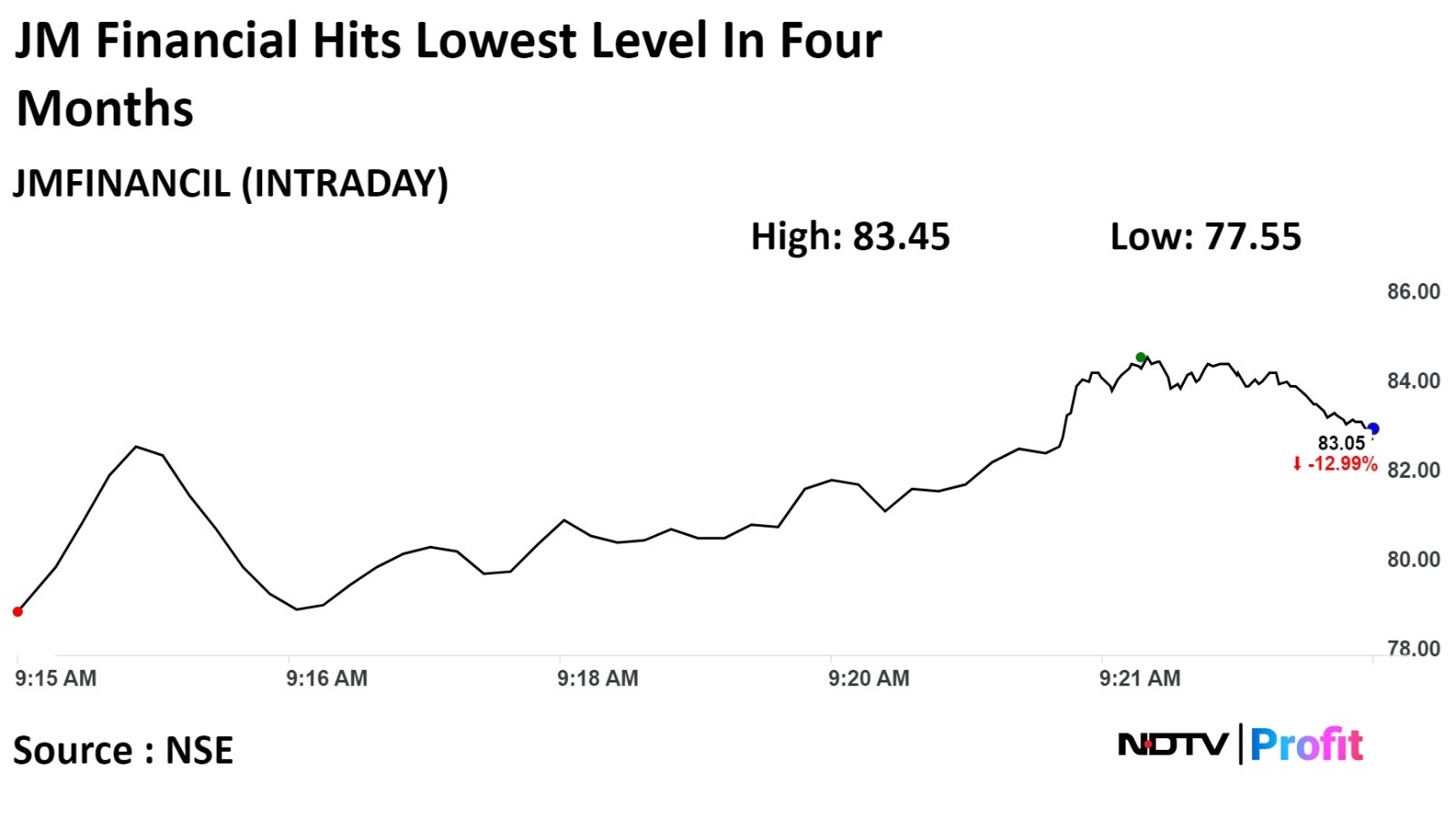

Company's net total income from IPO financing stands at Rs 7 crore for 9MFY24

IPO financing business constitutes 1.5% of the net total income

Alert: RBI barred JM Financial Products from financing against shares and debentures

Source: Exchange filing

Growth in terms of equity opportunity in India has been immense.

Technology shifting the world fasten than people think

Markets way ahead of themselves on rate cuts.

This is a golden age for fixed income.

Source: Rick Rieder, CIO, global fixed income, BlackRock at India Global Forum, Mumbai, 2024

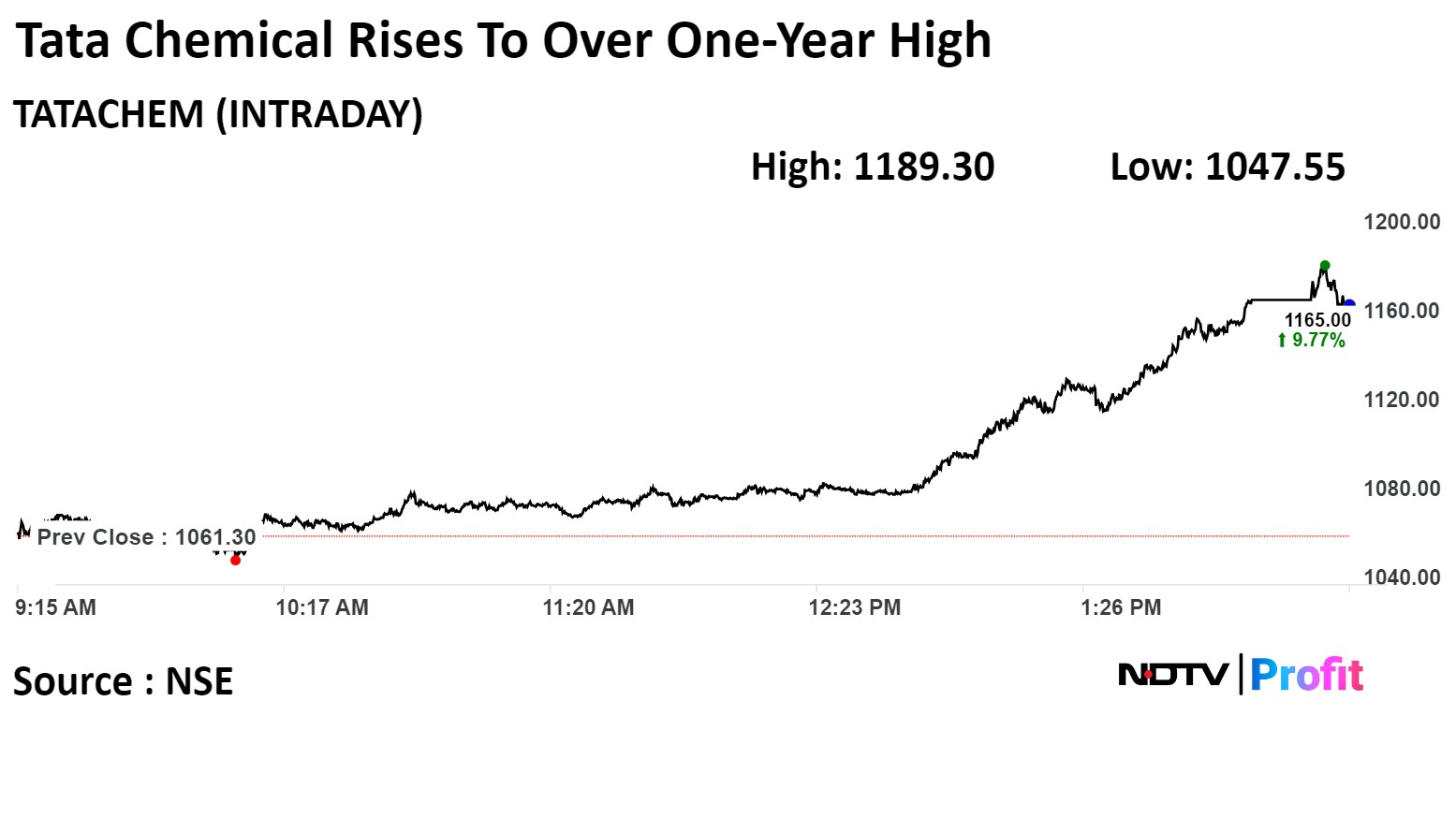

Tata Chemicals Ltd jumped over 12% while extending rally for fifth consecutive session. It rose 12.06% to Rs 1,189.30, the highest level since October, 2022.

The scrip was trading 9.87% higher at Rs 1,166.00 as of 2:51 p.m., which compares to 0.44% advance in the NSE Nifty 50 index.

Tata Chemicals Ltd has risen 16.36% in 12 months. Total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 78.93, which implied the stock is overbought.

Out of eight analysts tracking the company, one maintain a 'buy' rating, three recommend a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies downside of 27.4%.

Tata Chemicals Ltd jumped over 12% while extending rally for fifth consecutive session. It rose 12.06% to Rs 1,189.30, the highest level since October, 2022.

The scrip was trading 9.87% higher at Rs 1,166.00 as of 2:51 p.m., which compares to 0.44% advance in the NSE Nifty 50 index.

Tata Chemicals Ltd has risen 16.36% in 12 months. Total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 78.93, which implied the stock is overbought.

Out of eight analysts tracking the company, one maintain a 'buy' rating, three recommend a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies downside of 27.4%.

Tata Steel Ltd had 10.4 lakh shares or 0.01% equity changed hands in a large trade.

Buyers and sellers are not known immediately.

Source: Bloomberg

Tara Chand InfraLogistics Solution has received 4.5 years contract worth Rs 110 crore from SAIL.

Source: Exchange Filing

Atul Auto has invested Rs 20 crore in unit by subscription in equity share capital on right basis.

Its total investment made in unit now stands at Rs 30 crore, stake in unit at 80%.

Source: Exchange Filing

KPI Green gets new orders aggregating to 9.40 MW for executing solar power projects.

The company's unit to undertake 5 MW capacity; Arm to undertake 4.40 MW capacity.

Projects scheduled to be completed in FY25 in various tranches.

Source: Exchange Filing

Unit signs power purchase agreement with Gujarat Urja Vikas Nigam for 600 MW solar power project in Gujarat.

Source: Exchange Filing

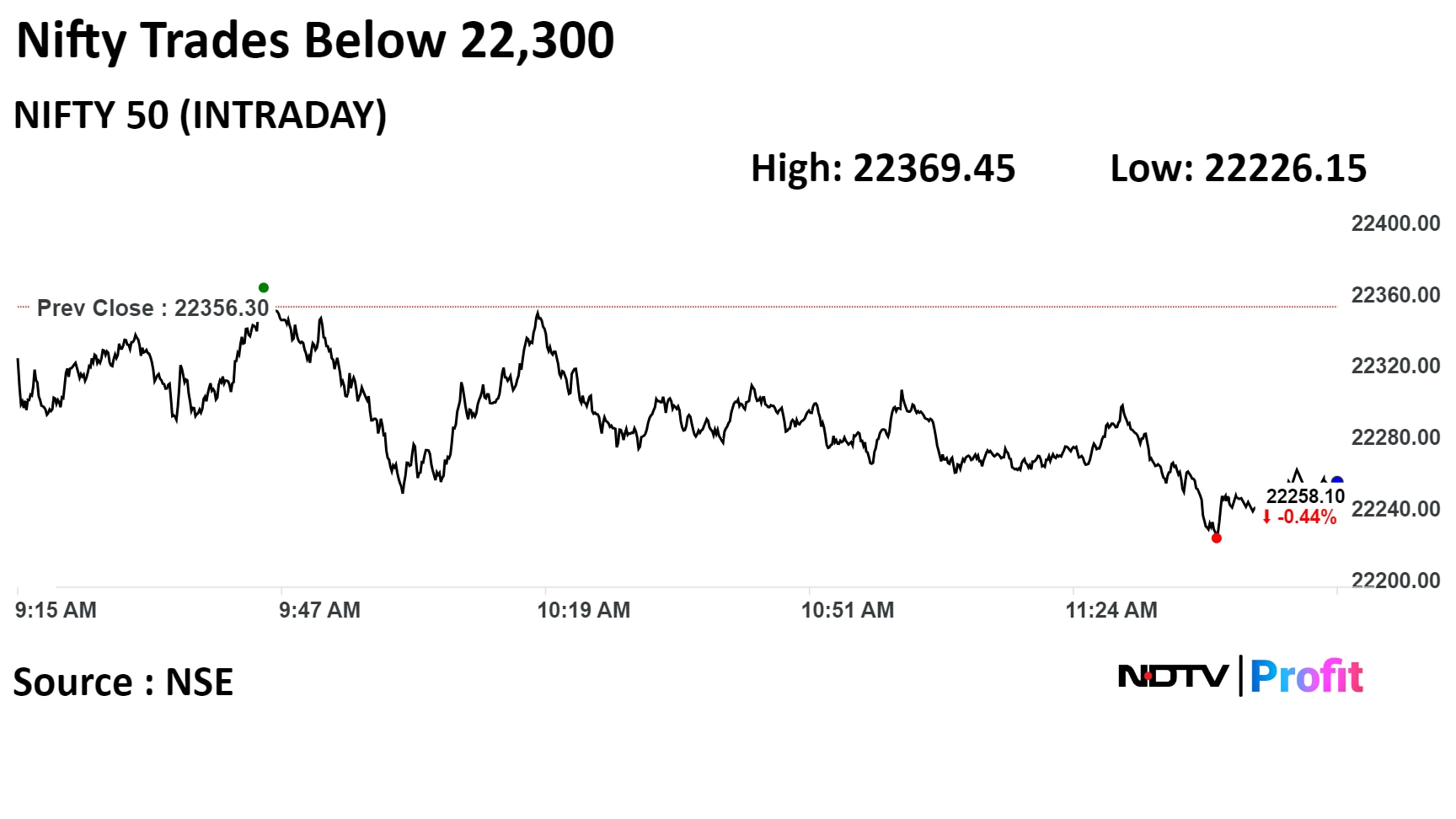

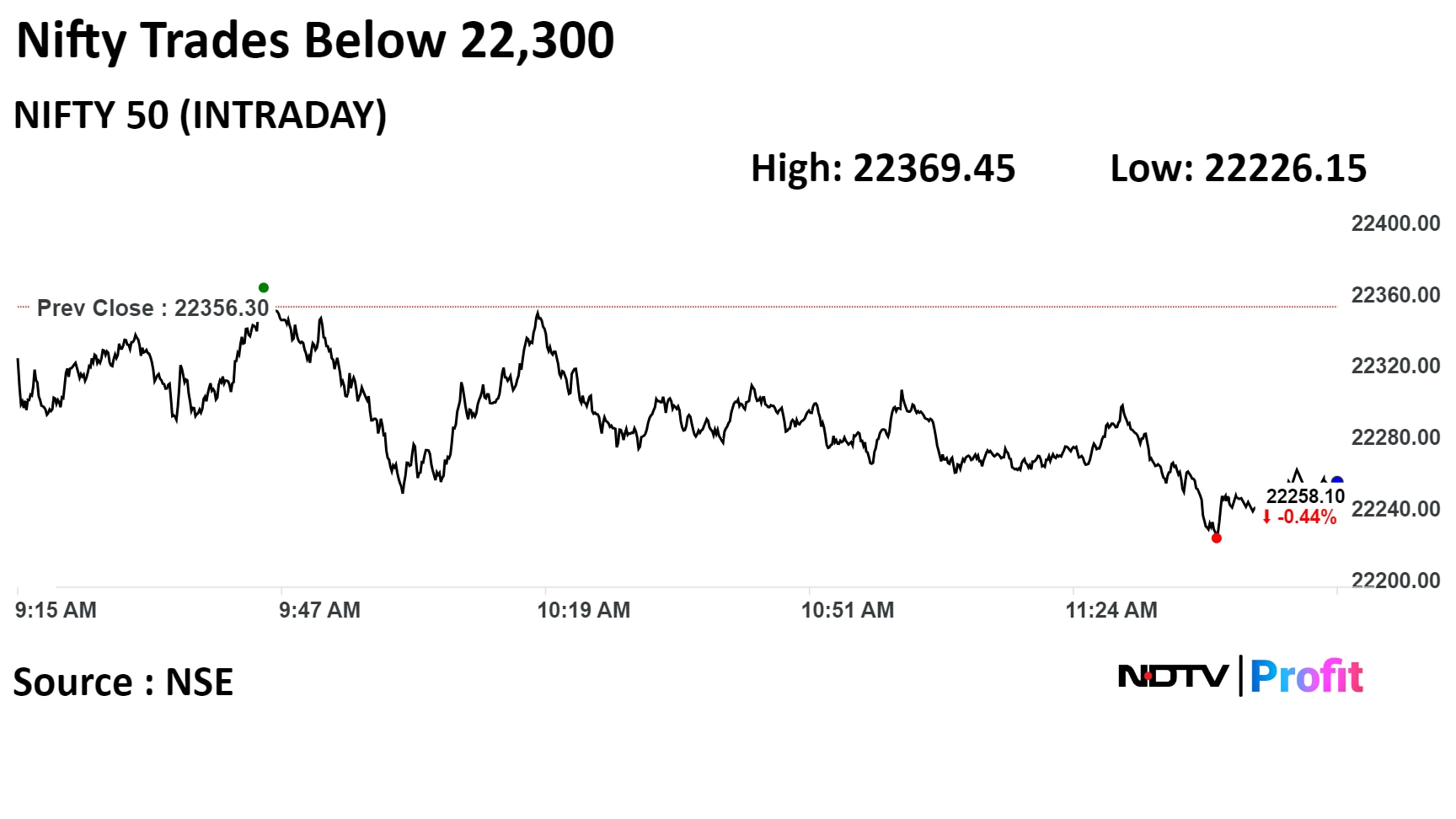

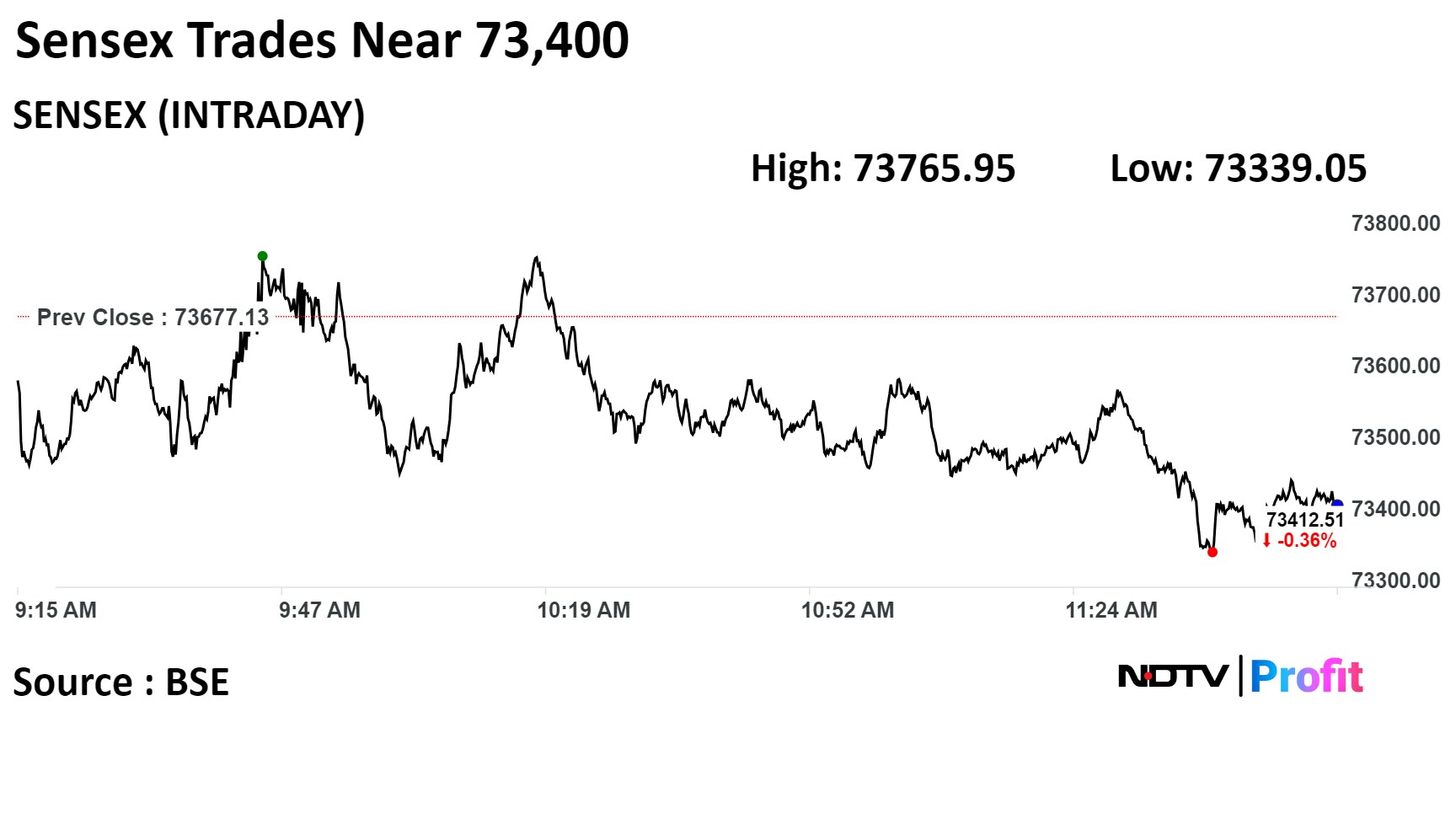

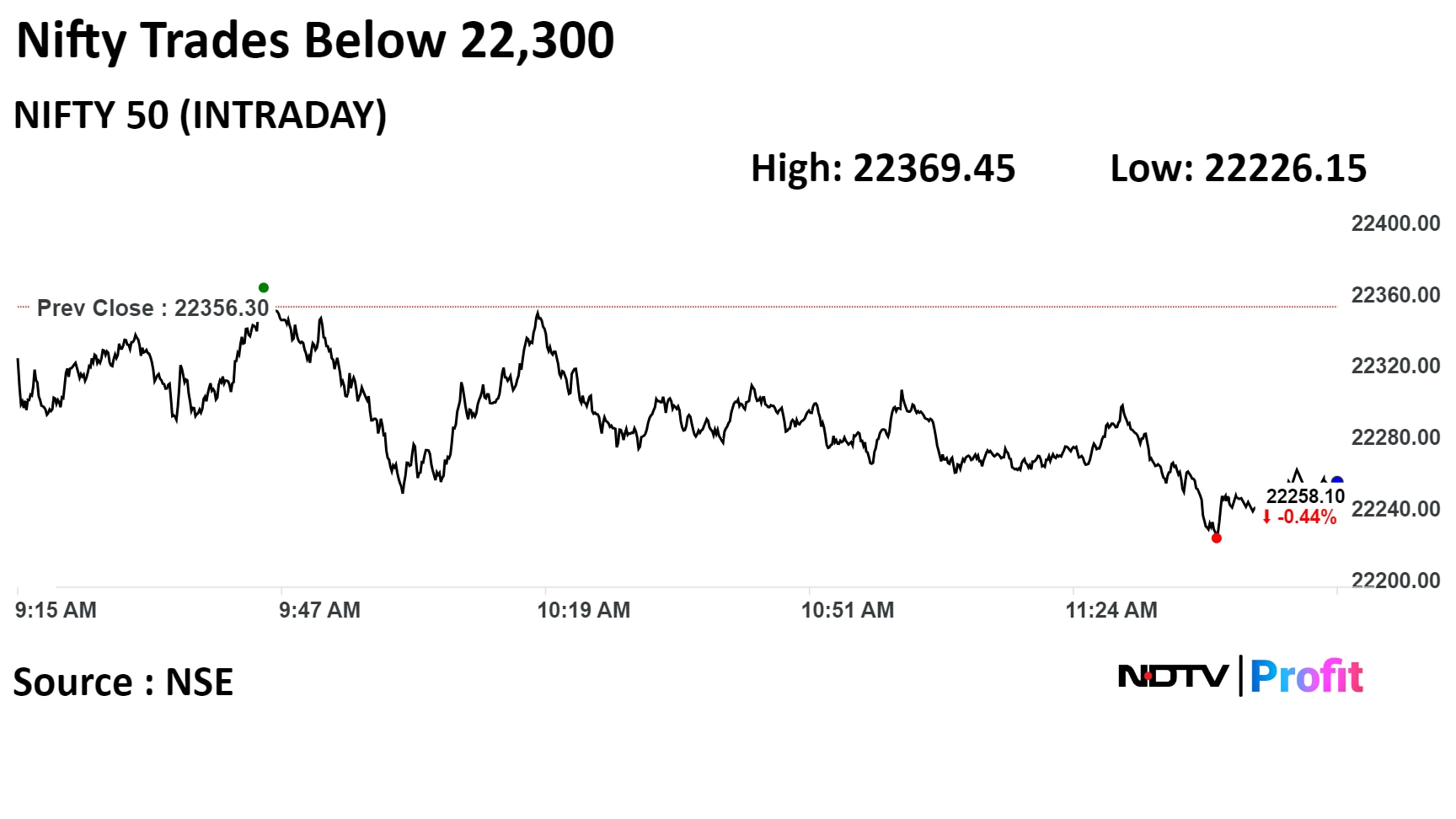

India's benchmark stock indices were trading near day's lows through midday in a volatile session on Wednesday, as investors await U.S. Fed Chair Jerome Powell's semi-annual testimony before the Congress.

Powell will testify on how the central bank plans on proceeding with the monetary policy this year. He is expected to reiterate the lack of urgency to cut rates at his testimony, Bloomberg reported.

As of 11:59 a.m., the NSE Nifty 50 was trading 108.05 points, or 0.48%, lower at 22,248.25 and the S&P BSE Sensex was down 286.67 points, or 0.39%, at 73,390.46.

The trend of the indices is pretty uncertain before the big event tonight, according to Aditya Agarwala, head of research and investments at Invest4edu.

"There has been a significant increase in open interest of Bank Nifty futures, suggesting that post today's event, there could be big move on either side," he said.

India's benchmark stock indices were trading near day's lows through midday in a volatile session on Wednesday, as investors await U.S. Fed Chair Jerome Powell's semi-annual testimony before the Congress.

Powell will testify on how the central bank plans on proceeding with the monetary policy this year. He is expected to reiterate the lack of urgency to cut rates at his testimony, Bloomberg reported.

As of 11:59 a.m., the NSE Nifty 50 was trading 108.05 points, or 0.48%, lower at 22,248.25 and the S&P BSE Sensex was down 286.67 points, or 0.39%, at 73,390.46.

The trend of the indices is pretty uncertain before the big event tonight, according to Aditya Agarwala, head of research and investments at Invest4edu.

"There has been a significant increase in open interest of Bank Nifty futures, suggesting that post today's event, there could be big move on either side," he said.

India's benchmark stock indices were trading near day's lows through midday in a volatile session on Wednesday, as investors await U.S. Fed Chair Jerome Powell's semi-annual testimony before the Congress.

Powell will testify on how the central bank plans on proceeding with the monetary policy this year. He is expected to reiterate the lack of urgency to cut rates at his testimony, Bloomberg reported.

As of 11:59 a.m., the NSE Nifty 50 was trading 108.05 points, or 0.48%, lower at 22,248.25 and the S&P BSE Sensex was down 286.67 points, or 0.39%, at 73,390.46.

The trend of the indices is pretty uncertain before the big event tonight, according to Aditya Agarwala, head of research and investments at Invest4edu.

"There has been a significant increase in open interest of Bank Nifty futures, suggesting that post today's event, there could be big move on either side," he said.

India's benchmark stock indices were trading near day's lows through midday in a volatile session on Wednesday, as investors await U.S. Fed Chair Jerome Powell's semi-annual testimony before the Congress.

Powell will testify on how the central bank plans on proceeding with the monetary policy this year. He is expected to reiterate the lack of urgency to cut rates at his testimony, Bloomberg reported.

As of 11:59 a.m., the NSE Nifty 50 was trading 108.05 points, or 0.48%, lower at 22,248.25 and the S&P BSE Sensex was down 286.67 points, or 0.39%, at 73,390.46.

The trend of the indices is pretty uncertain before the big event tonight, according to Aditya Agarwala, head of research and investments at Invest4edu.

"There has been a significant increase in open interest of Bank Nifty futures, suggesting that post today's event, there could be big move on either side," he said.

India's benchmark stock indices were trading near day's lows through midday in a volatile session on Wednesday, as investors await U.S. Fed Chair Jerome Powell's semi-annual testimony before the Congress.

Powell will testify on how the central bank plans on proceeding with the monetary policy this year. He is expected to reiterate the lack of urgency to cut rates at his testimony, Bloomberg reported.

As of 11:59 a.m., the NSE Nifty 50 was trading 108.05 points, or 0.48%, lower at 22,248.25 and the S&P BSE Sensex was down 286.67 points, or 0.39%, at 73,390.46.

The trend of the indices is pretty uncertain before the big event tonight, according to Aditya Agarwala, head of research and investments at Invest4edu.

"There has been a significant increase in open interest of Bank Nifty futures, suggesting that post today's event, there could be big move on either side," he said.

India's benchmark stock indices were trading near day's lows through midday in a volatile session on Wednesday, as investors await U.S. Fed Chair Jerome Powell's semi-annual testimony before the Congress.

Powell will testify on how the central bank plans on proceeding with the monetary policy this year. He is expected to reiterate the lack of urgency to cut rates at his testimony, Bloomberg reported.

As of 11:59 a.m., the NSE Nifty 50 was trading 108.05 points, or 0.48%, lower at 22,248.25 and the S&P BSE Sensex was down 286.67 points, or 0.39%, at 73,390.46.

The trend of the indices is pretty uncertain before the big event tonight, according to Aditya Agarwala, head of research and investments at Invest4edu.

"There has been a significant increase in open interest of Bank Nifty futures, suggesting that post today's event, there could be big move on either side," he said.

India's benchmark stock indices were trading near day's lows through midday in a volatile session on Wednesday, as investors await U.S. Fed Chair Jerome Powell's semi-annual testimony before the Congress.

Powell will testify on how the central bank plans on proceeding with the monetary policy this year. He is expected to reiterate the lack of urgency to cut rates at his testimony, Bloomberg reported.

As of 11:59 a.m., the NSE Nifty 50 was trading 108.05 points, or 0.48%, lower at 22,248.25 and the S&P BSE Sensex was down 286.67 points, or 0.39%, at 73,390.46.

The trend of the indices is pretty uncertain before the big event tonight, according to Aditya Agarwala, head of research and investments at Invest4edu.

"There has been a significant increase in open interest of Bank Nifty futures, suggesting that post today's event, there could be big move on either side," he said.

India's benchmark stock indices were trading near day's lows through midday in a volatile session on Wednesday, as investors await U.S. Fed Chair Jerome Powell's semi-annual testimony before the Congress.

Powell will testify on how the central bank plans on proceeding with the monetary policy this year. He is expected to reiterate the lack of urgency to cut rates at his testimony, Bloomberg reported.

As of 11:59 a.m., the NSE Nifty 50 was trading 108.05 points, or 0.48%, lower at 22,248.25 and the S&P BSE Sensex was down 286.67 points, or 0.39%, at 73,390.46.

The trend of the indices is pretty uncertain before the big event tonight, according to Aditya Agarwala, head of research and investments at Invest4edu.

"There has been a significant increase in open interest of Bank Nifty futures, suggesting that post today's event, there could be big move on either side," he said.

Reliance Industries Ltd.,

Shares of Axis Bank Ltd., Bajaj Auto Ltd., Kotak Mahindra Bank Ltd., HDFC Bank Ltd., and ICICI Bank Ltd. were positively contributing to the Nifty.

Whereas, Infosys Ltd., ITC Ltd., NTPC Ltd., Tata Consultancy Services Ltd. and Reliance Industries Ltd. were weighing on the index.

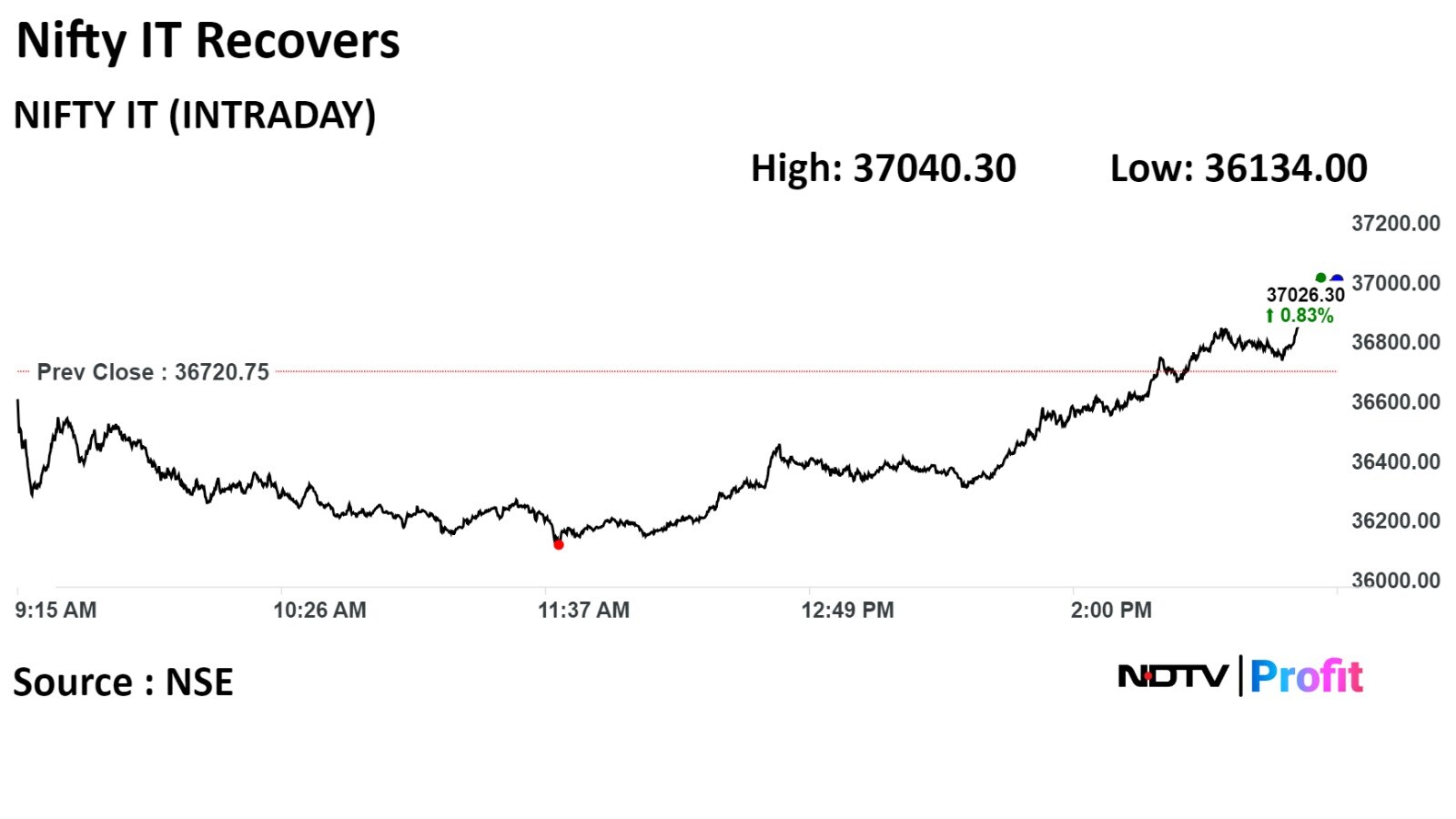

Except Nifty Bank and Nifty Financial Services, all sectoral indices fell. Nifty Media fell the most.

Broader markets underperformed, with the S&P BSE Midcap falling 1.98% and the S&P BSE Smallcap declining 2.87% through midday trade on Wednesday.

Only S&P BSE Bankex gained of the 20 sectoral indices on the BSE. S&P BSE Services gained nearly 3%.

Market breadth was skewed in the favour of the sellers. Around 3,146 stocks fell, 585 rose, and 100 stocks remained unchanged on BSE.

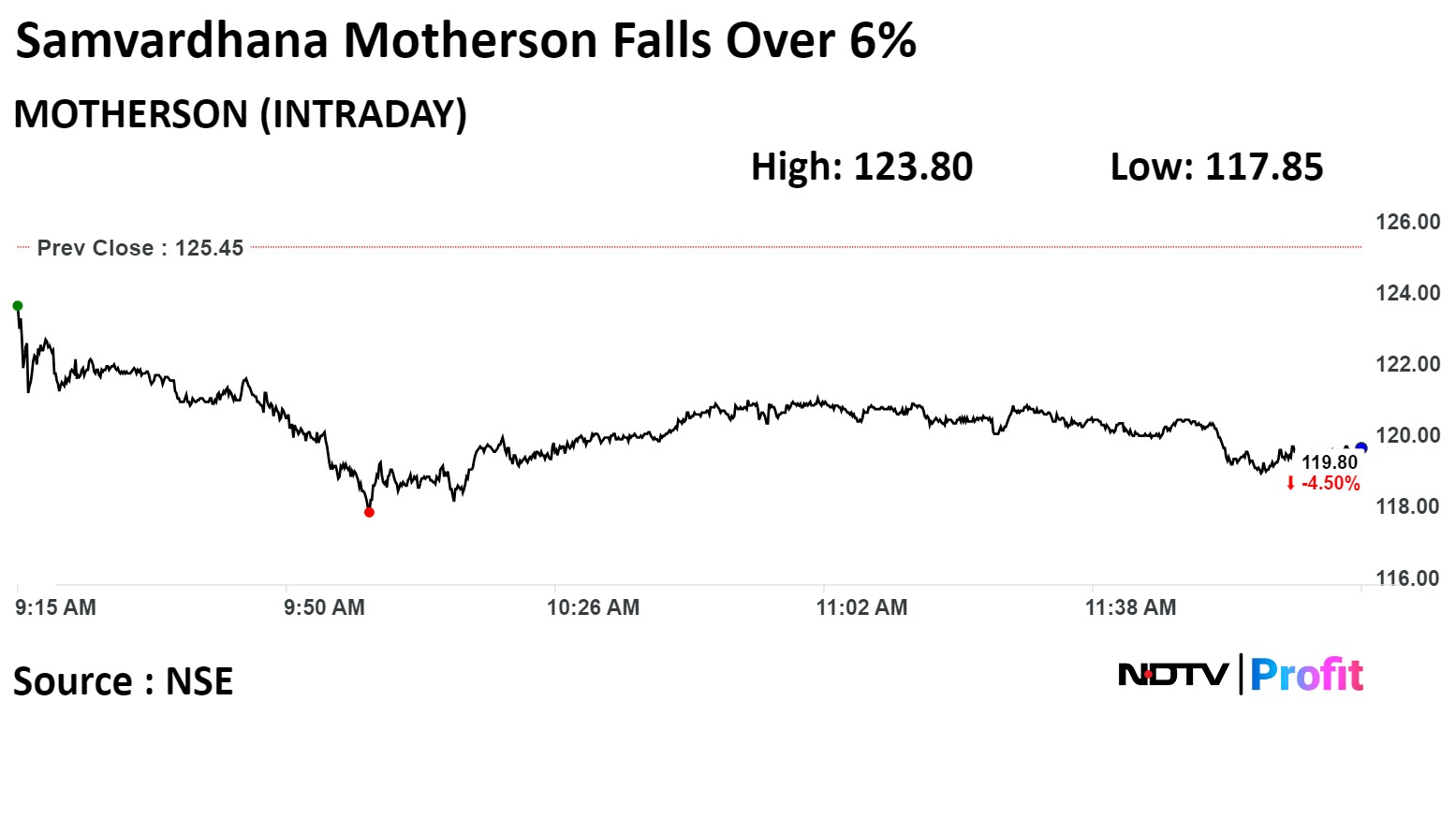

Samvardhana Motherson fell over 6% on Wednesday after its 4.7% equity changed hands in large trades.

The company's 32.2 crore shares changed hands in 14 large trades. Buyers and sellers are not known immediately, Bloomberg reported.

Samvardhana Motherson International Ltd fell as much as 6.06% to Rs 117.85 apiece, the lowest level since March 1.

It was trading 4.50% lower at Rs 119.80 apiece, as of 12:16 p.m. This compares to a 0.49% decline in the NSE Nifty 50 Index.It has declined 43.99% in 12 months. Total traded volume so far in the day stood at 60 times its 30-day average. The relative strength index was at 57.93.

Out of 22 analysts tracking the company, 21 maintain a 'buy' rating, and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.5%.

Samvardhana Motherson fell over 6% on Wednesday after its 4.7% equity changed hands in large trades.

The company's 32.2 crore shares changed hands in 14 large trades. Buyers and sellers are not known immediately, Bloomberg reported.

Samvardhana Motherson International Ltd fell as much as 6.06% to Rs 117.85 apiece, the lowest level since March 1.

It was trading 4.50% lower at Rs 119.80 apiece, as of 12:16 p.m. This compares to a 0.49% decline in the NSE Nifty 50 Index.It has declined 43.99% in 12 months. Total traded volume so far in the day stood at 60 times its 30-day average. The relative strength index was at 57.93.

Out of 22 analysts tracking the company, 21 maintain a 'buy' rating, and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.5%.

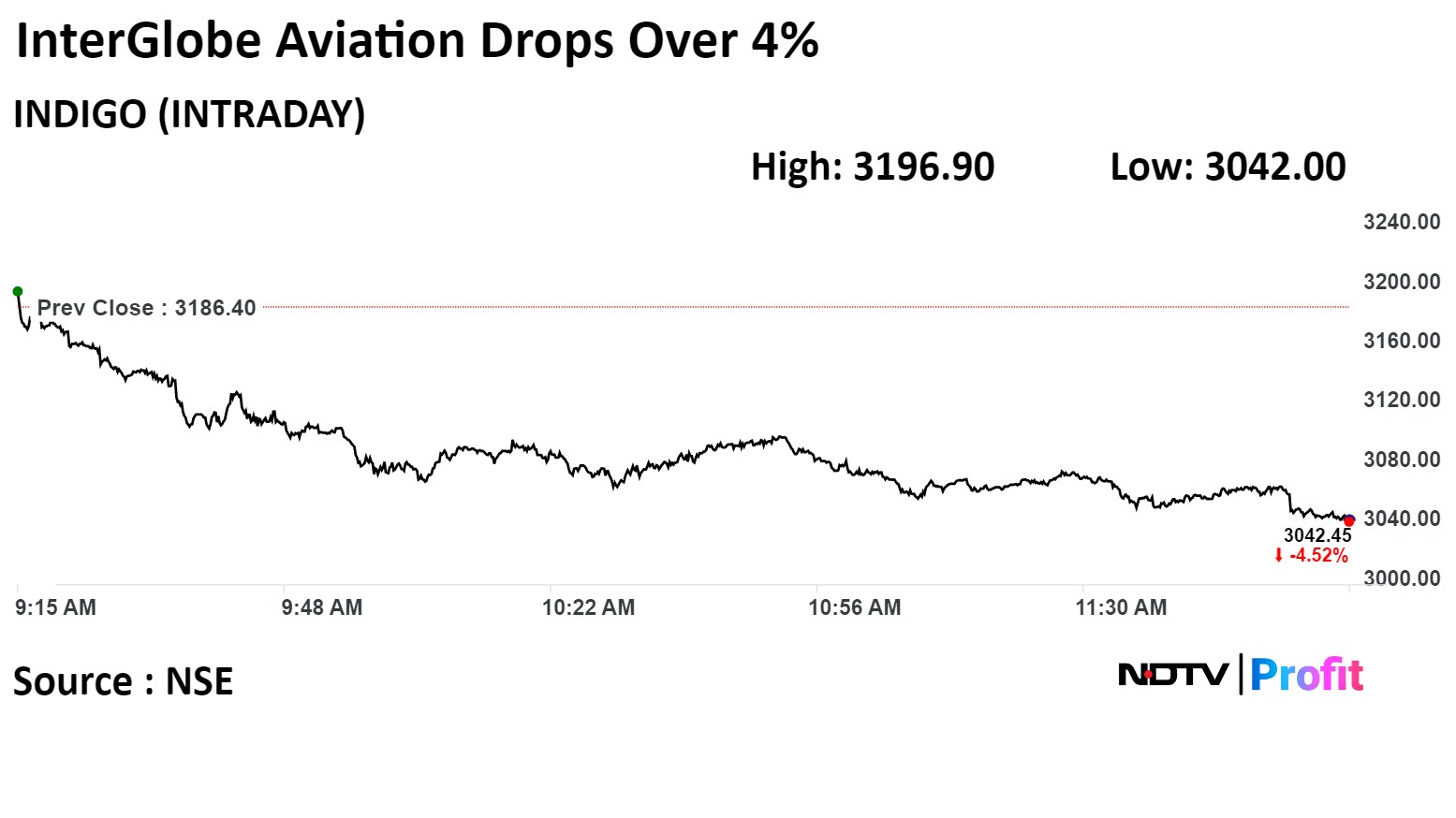

InterGlobe Aviation Ltd fell as much as 4.43% to Rs 3,045.15 apiece, the lowest level since Feb 19. It was trading 4.31% lower at Rs 3,049.00 apiece, as of 12:01 p.m. This compares to a 0.48% decline in the NSE Nifty 50 Index.

It has risen 64.30% in 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 43.79.

Out of 22 analysts tracking the company, 17 maintain a 'buy' rating, two recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.1%.

InterGlobe Aviation Ltd fell as much as 4.43% to Rs 3,045.15 apiece, the lowest level since Feb 19. It was trading 4.31% lower at Rs 3,049.00 apiece, as of 12:01 p.m. This compares to a 0.48% decline in the NSE Nifty 50 Index.

It has risen 64.30% in 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 43.79.

Out of 22 analysts tracking the company, 17 maintain a 'buy' rating, two recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.1%.

Samvardhana Motherson International at 28.83x its 30 day average

Mahanagar Gas at 14.61x its 30 day average

JM Financial at 11.41x its 30 day average

IIFL Finance at 10.95x its 30 day average

Indraprastha Gas at 3.89x its 30 day average

L&T Finance Holdings at 3.8x its 30 day average

BofA maintained 'Buy' on Makemytrip and Indigo

Expect MMYT to benefit from lower competition, better demand in high margin hotels

Increase MMYT EPS estimates by 3-6%

Indigo to benefit from its orderbook and low cost structure

Sees India tourism as a multi-year theme

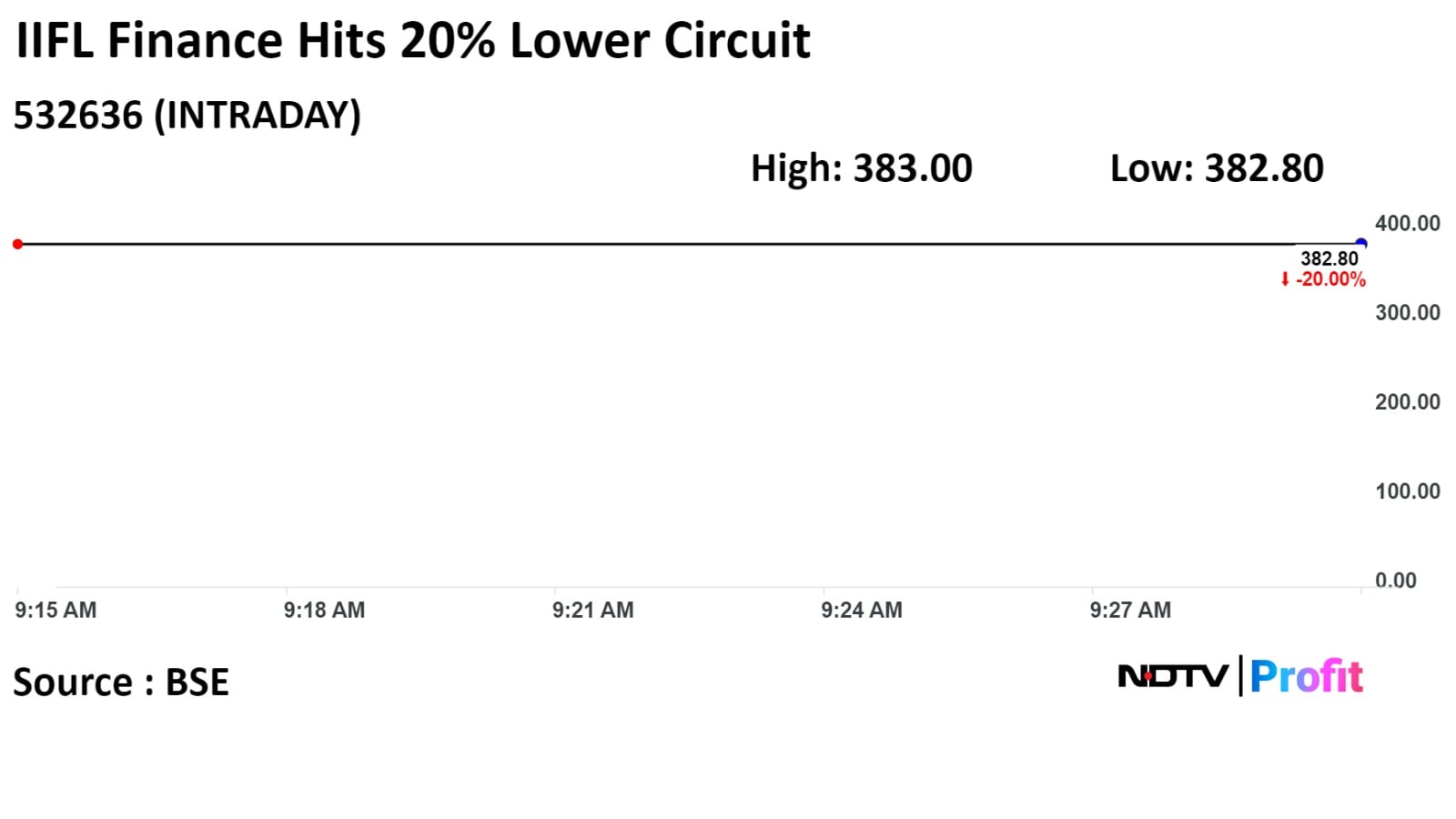

Fairfax India Holdings Corp to invest up to $200 million in IIFL Finance Ltd for liquidity support.

Fairfax India committed to providing liquidity support to the company amidst recent RBI embargo.

Fairfax India says it has 'full trust and confidence' in IIFL Finance Ltd.'s management led by Nirmal Jain and R Venkataraman.

Source: Exchange filing

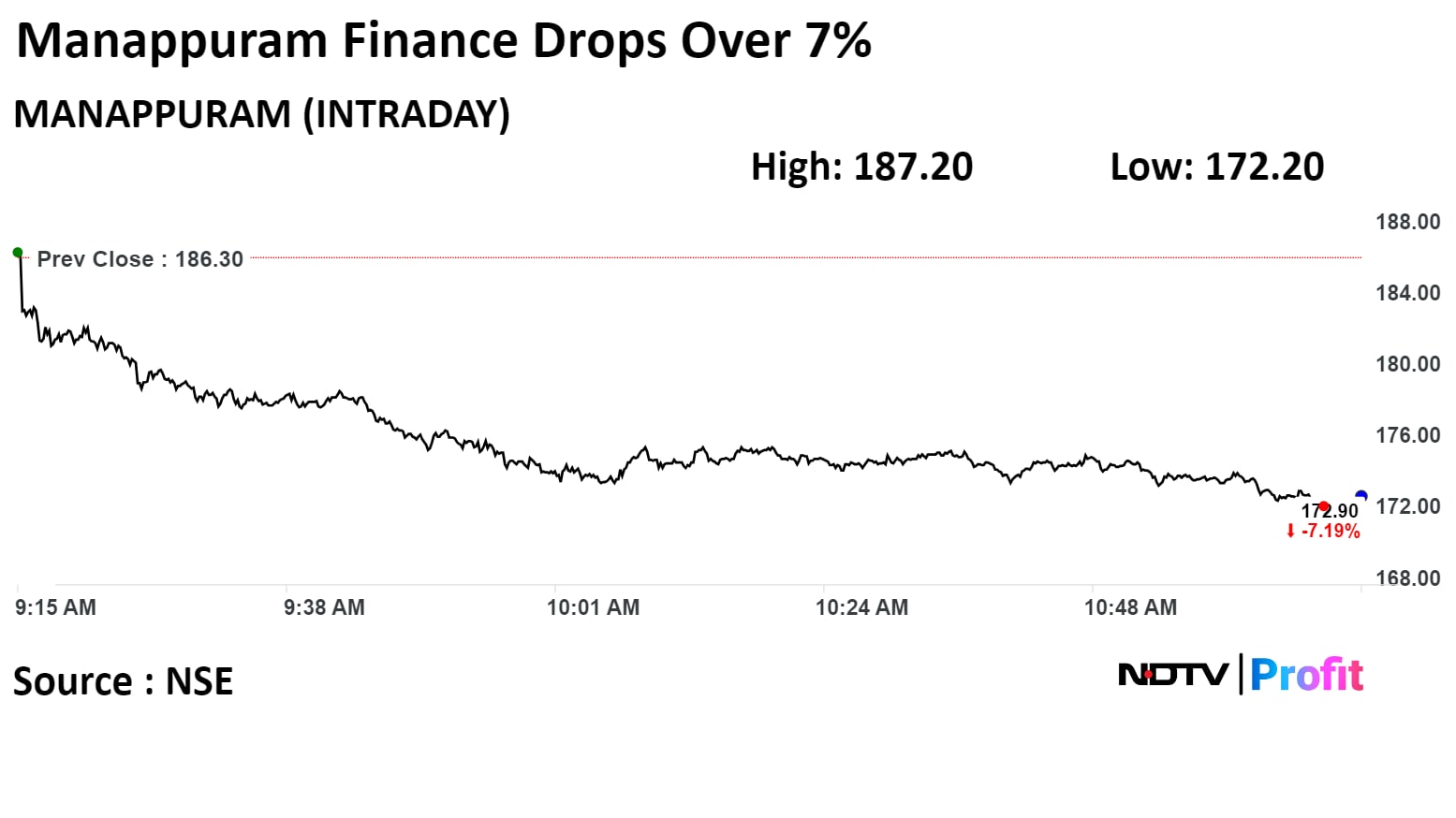

On NSE, Manappuram Finance Ltd dropped over 7.57% to Rs 172.20, and reversed gains from Tuesday. It was trading 7.30% lower at Rs 172.70, compared to 0.40% decline on NSE Nifty 50 index.

It logged 56.43% gain in 12 months. Total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 43.86.

Out of 18 analysts tracking the company, 15 maintain a 'buy' rating, one recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 24.0%.

On NSE, Manappuram Finance Ltd dropped over 7.57% to Rs 172.20, and reversed gains from Tuesday. It was trading 7.30% lower at Rs 172.70, compared to 0.40% decline on NSE Nifty 50 index.

It logged 56.43% gain in 12 months. Total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 43.86.

Out of 18 analysts tracking the company, 15 maintain a 'buy' rating, one recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 24.0%.

Ajmera Realty & Infra India Ltd has secured a structured deal worth Rs 500 crore from Standard Chartered & ICICI Bank for Mumbai project

Of the total deal amount, Rs 200 crore to be utilised for partial prepayment of GCP loan availed from HDFC Bank.

Source: Exchange filing

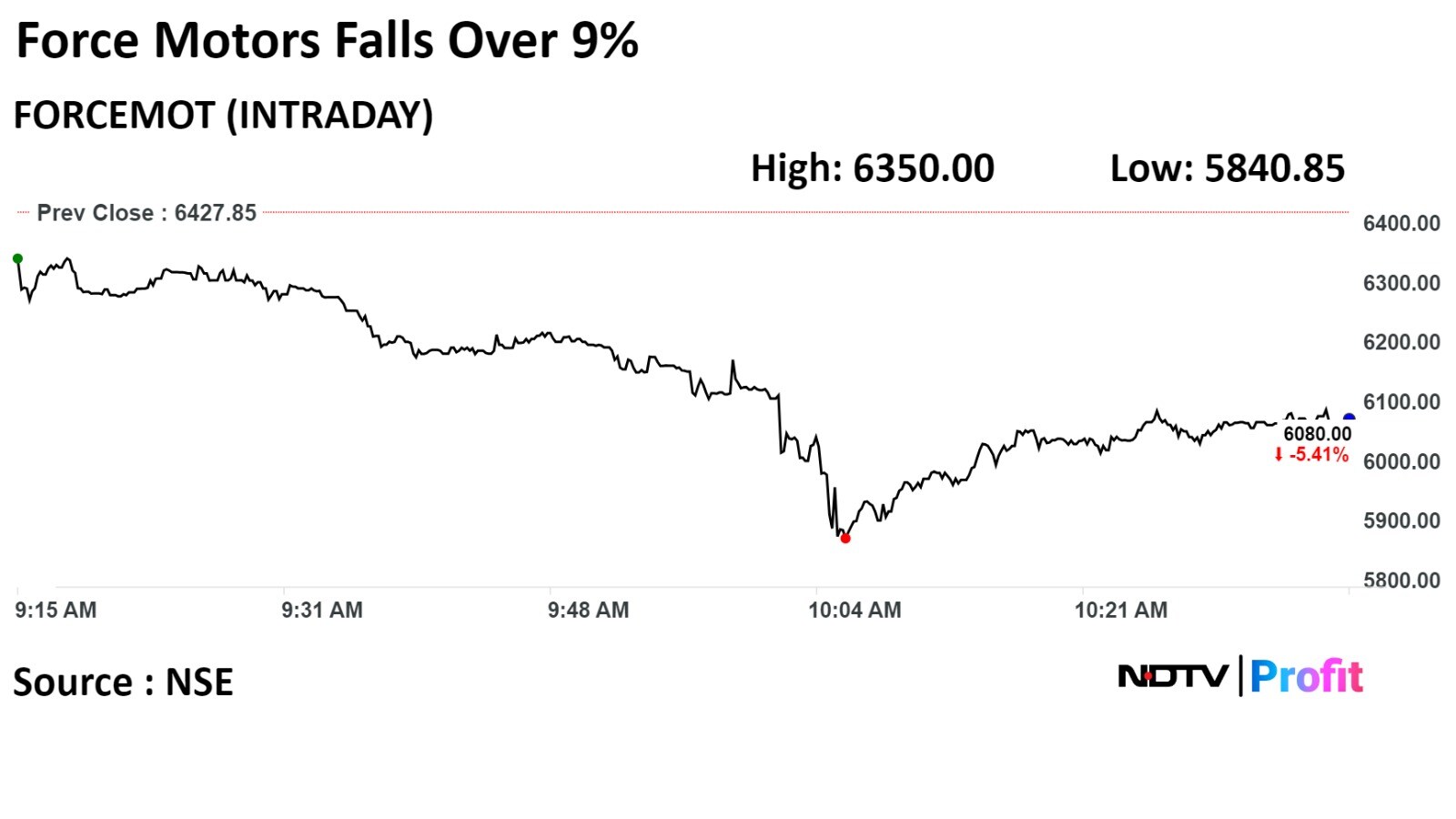

The scrip fell as much as 9.13% to Rs 5,840.85 apiece, the lowest level since Feb 26. It pared losses to trade 5.26% lower at Rs 6,080.65 apiece, as of 10:41 p.m.This compares to a 0.3% decline in the NSE Nifty 50 Index.

It has fallen 422.42% in the last twelve months. Total traded volume so far in the day stood at 3.6 times its 30-day average. The relative strength index was at 62.42.

The scrip fell as much as 9.13% to Rs 5,840.85 apiece, the lowest level since Feb 26. It pared losses to trade 5.26% lower at Rs 6,080.65 apiece, as of 10:41 p.m.This compares to a 0.3% decline in the NSE Nifty 50 Index.

It has fallen 422.42% in the last twelve months. Total traded volume so far in the day stood at 3.6 times its 30-day average. The relative strength index was at 62.42.

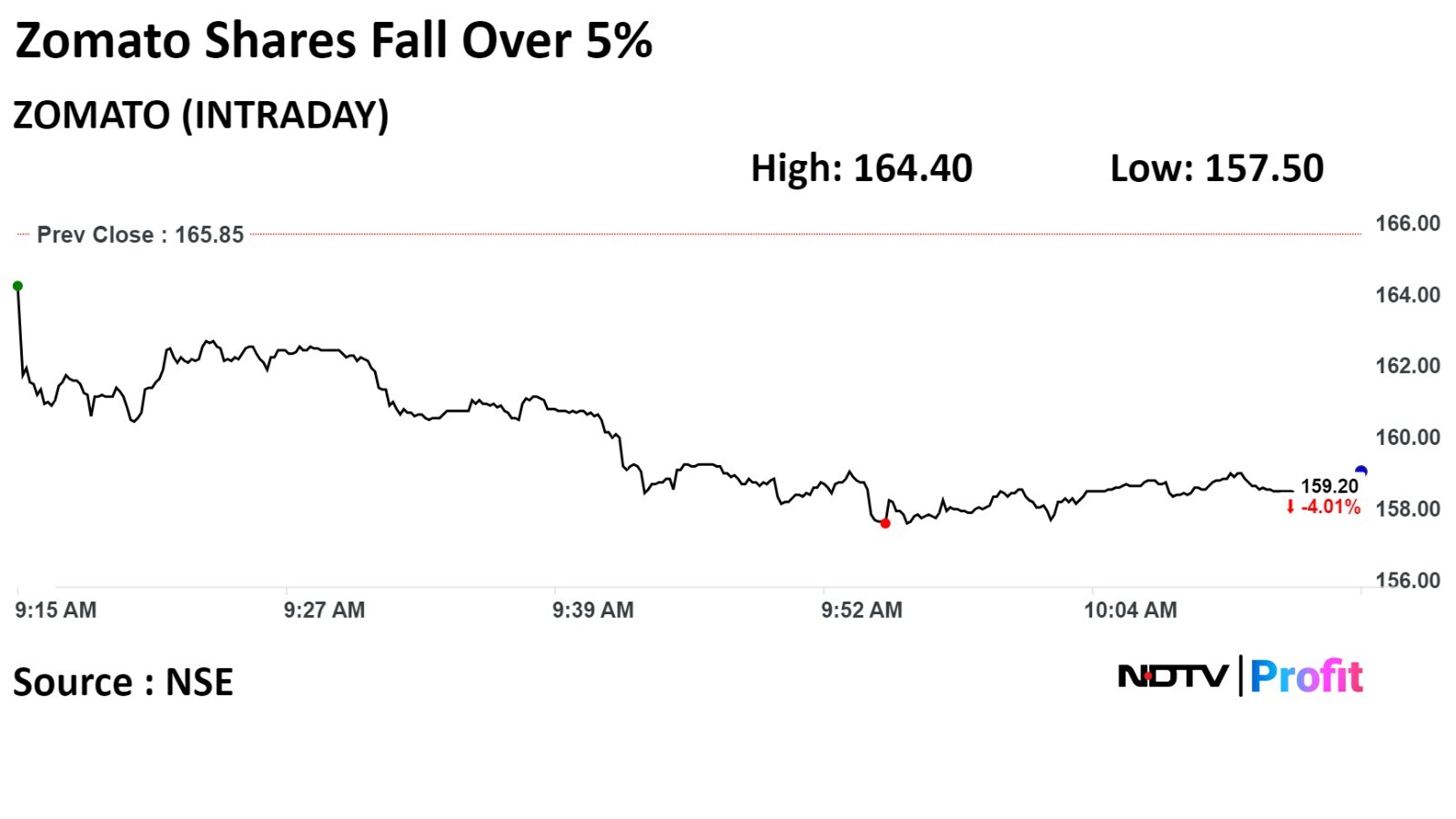

Shares of Zomato Ltd. fell 5% after over 2% equity changed hands in multiple large trades on Wednesday.

At least 19.1 lakh shares or 2.2% equity changed hands in nine large trades at Rs 162.8 apiece, according to Bloomberg. The buyers and sellers were not known immediately.

According to media reports, China's Ant Group's arm Antfin Singapore Holdings Pte will sell 2% stake in the company. As of December 2023, Antfin Singapore held a 6.32% stake in the food and grocery delivery platform.

Zomato's stock fell as much as 5.03% during the day to Rs 157.50 apiece on the NSE. It was trading 4.04% lower at Rs 159.15 per share, compared to a 0.18% advance in the benchmark Nifty 50 as of 10:14 a.m.

The share price has risen 195% in the last 12 months. The total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 54.4.

Twenty-four out of the 28 analysts tracking Zomato have a 'buy' rating on the stock and four suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 6.4%.

Shares of Zomato Ltd. fell 5% after over 2% equity changed hands in multiple large trades on Wednesday.

At least 19.1 lakh shares or 2.2% equity changed hands in nine large trades at Rs 162.8 apiece, according to Bloomberg. The buyers and sellers were not known immediately.

According to media reports, China's Ant Group's arm Antfin Singapore Holdings Pte will sell 2% stake in the company. As of December 2023, Antfin Singapore held a 6.32% stake in the food and grocery delivery platform.

Zomato's stock fell as much as 5.03% during the day to Rs 157.50 apiece on the NSE. It was trading 4.04% lower at Rs 159.15 per share, compared to a 0.18% advance in the benchmark Nifty 50 as of 10:14 a.m.

The share price has risen 195% in the last 12 months. The total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 54.4.

Twenty-four out of the 28 analysts tracking Zomato have a 'buy' rating on the stock and four suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 6.4%.

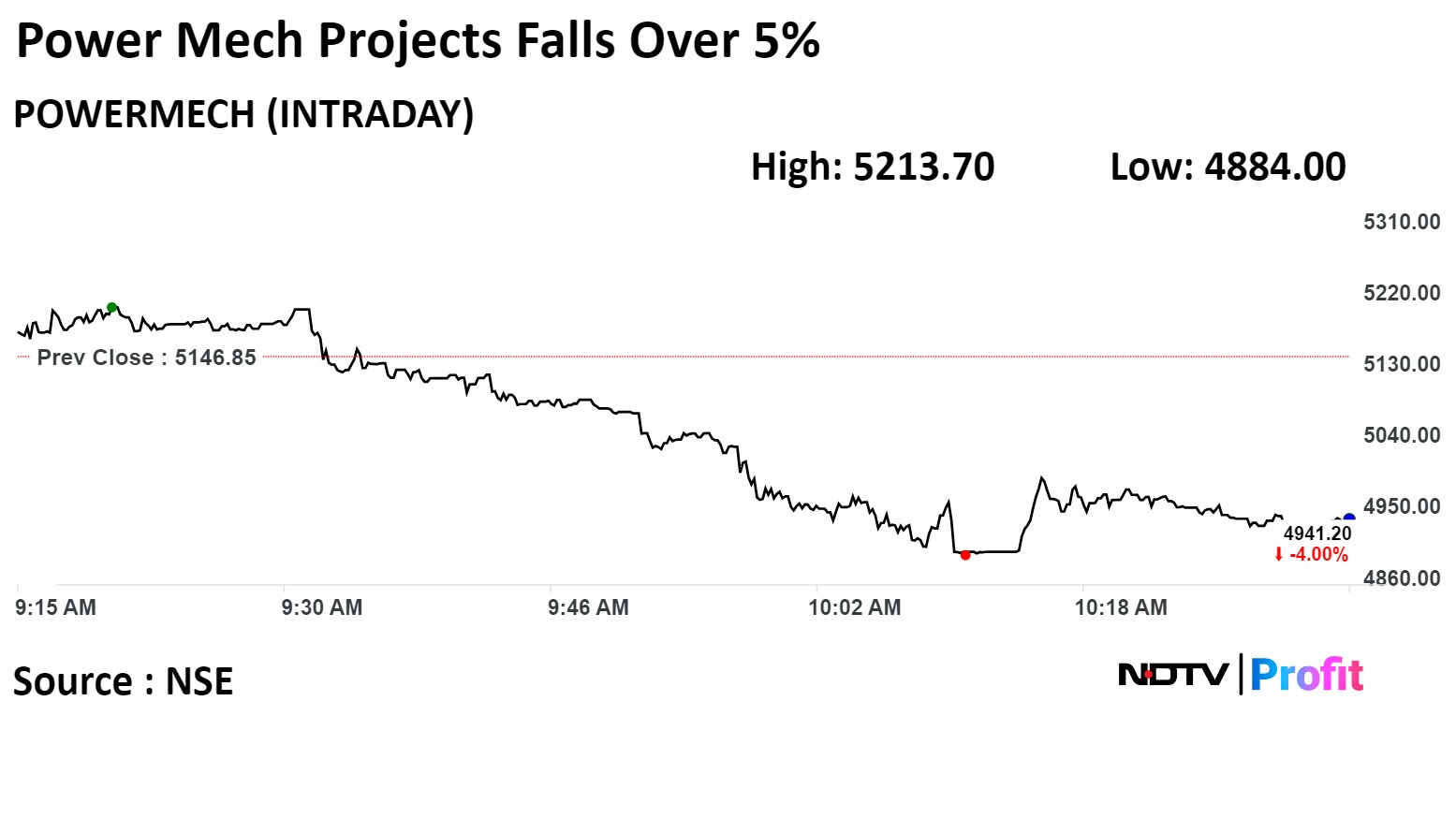

Power Mech Projects Ltd fell as much as 5.71% to Rs 4,853.10 apiece, the lowest level since Jan 24. It was trading 5.44% lower at Rs 4,879 apiece, as of 10:37 a.m. This compares to a 0.29% decline in the NSE Nifty 50 Index.

It has risen 104.04% in 12 months. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 37.95.

One analyst tracking the company maintained a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.04%.

Power Mech Projects Ltd fell as much as 5.71% to Rs 4,853.10 apiece, the lowest level since Jan 24. It was trading 5.44% lower at Rs 4,879 apiece, as of 10:37 a.m. This compares to a 0.29% decline in the NSE Nifty 50 Index.

It has risen 104.04% in 12 months. Total traded volume so far in the day stood at 2.5 times its 30-day average. The relative strength index was at 37.95.

One analyst tracking the company maintained a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.04%.

The Nifty IT index fell 1.21% to 36,276.05, to the lowest level since Jan 31, as losses in Coforge Ltd., Mphasis Ltd.

The Nifty IT index fell 1.21% to 36,276.05, to the lowest level since Jan 31, as losses in Coforge Ltd., Mphasis Ltd.

Most large banks who have multi-network arrangements should not face any disruptions.

Banks will have to assess need for multiple networks for each co-branded product

RBI's move may be aimed at ensuring business continuity.

Source: People in the know to NDTV Profit

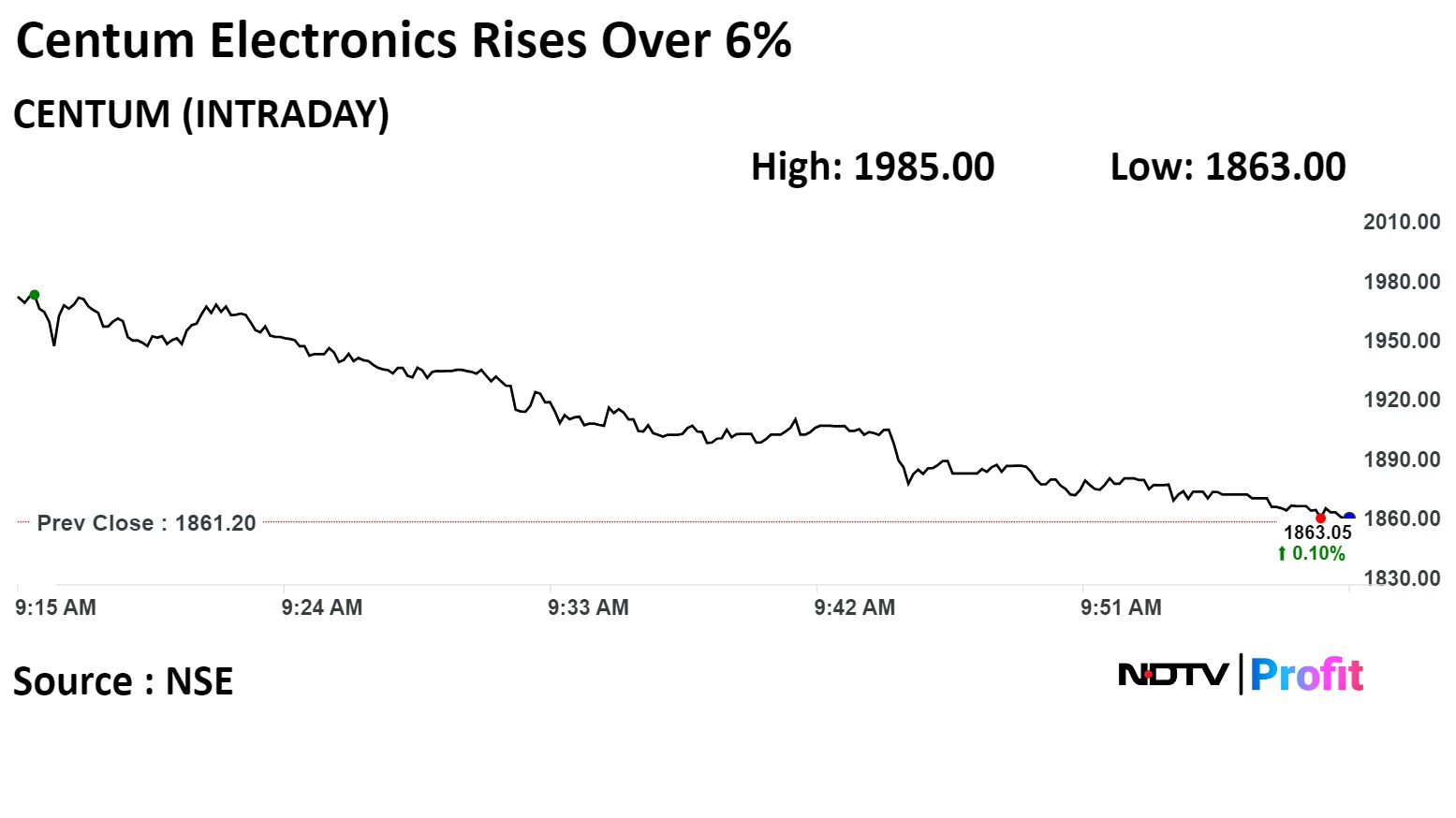

Shares of Centum Electronics Ltd. rose over 6% to one-week high on Wednesday after it secured an order worth Rs 187 crore from Defence Research and Development Organisation.

The company has received the order for realisation of space-based EW Payloads, which will be executed in over 16 months, according to an exchange filing.

Shares of the company rose as much as 6.65% to Rs 1,985.00 apiece, the highest level since Feb 27. It pared gains to trade 0.82% higher at Rs 1,876.45 apiece as of 9:55 a.m. This compares to a 0.20% decline in the NSE Nifty 50 Index.

The stock has risen 219.70% in past 12 months. Total traded volume so far in the day stood at 5.6 times its 30-day average. The relative strength index was at 60.80.

One analyst maintained a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.1%.

Shares of Centum Electronics Ltd. rose over 6% to one-week high on Wednesday after it secured an order worth Rs 187 crore from Defence Research and Development Organisation.

The company has received the order for realisation of space-based EW Payloads, which will be executed in over 16 months, according to an exchange filing.

Shares of the company rose as much as 6.65% to Rs 1,985.00 apiece, the highest level since Feb 27. It pared gains to trade 0.82% higher at Rs 1,876.45 apiece as of 9:55 a.m. This compares to a 0.20% decline in the NSE Nifty 50 Index.

The stock has risen 219.70% in past 12 months. Total traded volume so far in the day stood at 5.6 times its 30-day average. The relative strength index was at 60.80.

One analyst maintained a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.1%.

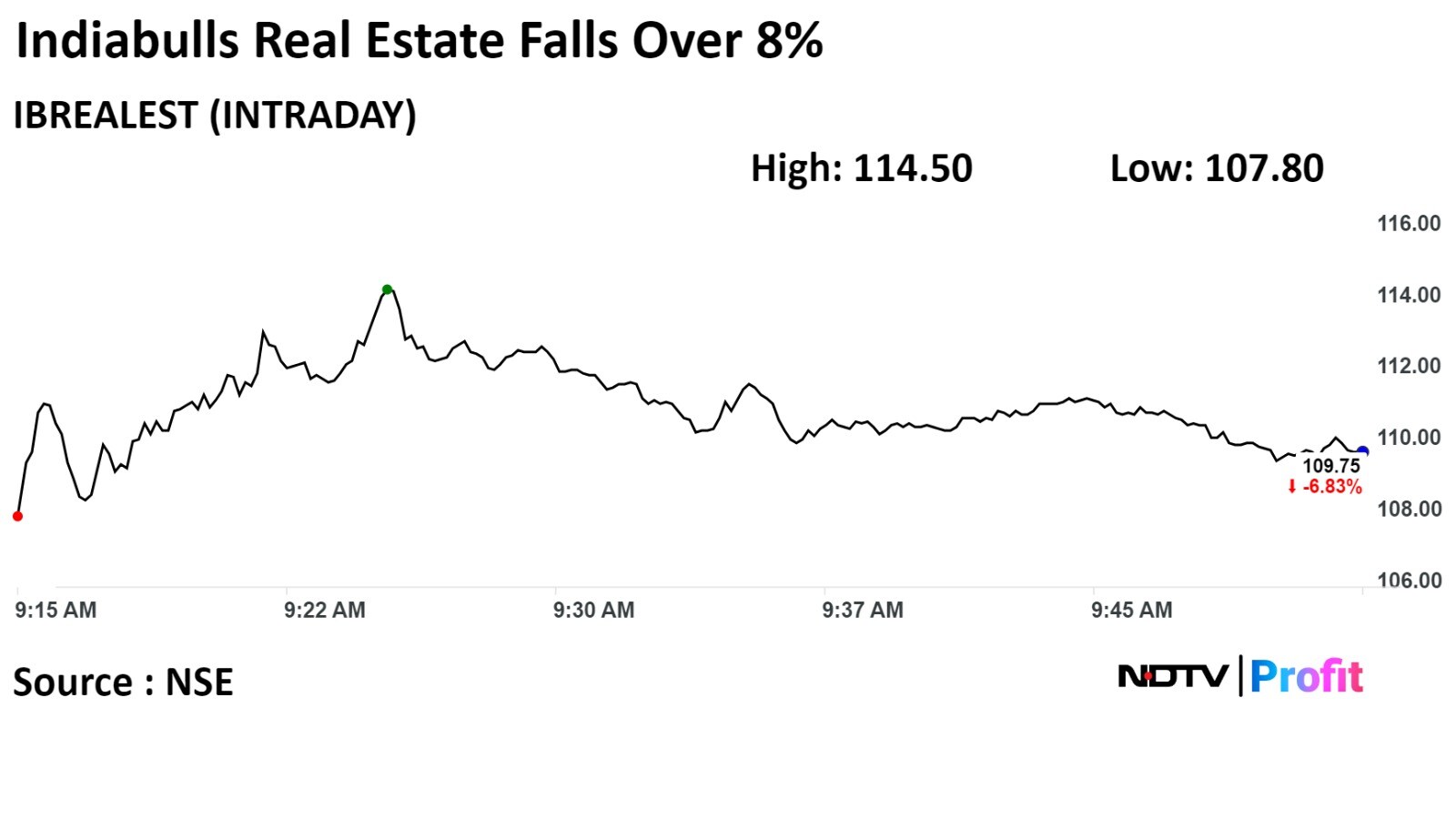

Shares of Indiabulls Real Estate fell after the company informed the exhchanges that it along with its subsidiary Indiabulls Industrial Infrastructure Ltd. has been directed by Maharashtra Industrial Development Corporation to vacate the land area admeasuring 512.068 hectors.

The scrip fell as much as 8.96% to Rs 107.25 apiece, the lowest level since Feb 6. It pared gains to trade 8.57% lower at Rs 107.70 apiece, as of 10:00 a.m. This compares to a 0.6% decline in the NSE Nifty 50 Index.

It has risen 120.25% in the last twelve months. Total traded volume so far in the day stood at 0.55 times its 30-day average. The relative strength index was at 42.24.

Shares of Indiabulls Real Estate fell after the company informed the exhchanges that it along with its subsidiary Indiabulls Industrial Infrastructure Ltd. has been directed by Maharashtra Industrial Development Corporation to vacate the land area admeasuring 512.068 hectors.

The scrip fell as much as 8.96% to Rs 107.25 apiece, the lowest level since Feb 6. It pared gains to trade 8.57% lower at Rs 107.70 apiece, as of 10:00 a.m. This compares to a 0.6% decline in the NSE Nifty 50 Index.

It has risen 120.25% in the last twelve months. Total traded volume so far in the day stood at 0.55 times its 30-day average. The relative strength index was at 42.24.

The restrictions placed by the regulator on IIFL Finance Ltd.'s gold loan disbursement could impact the company's earnings and lower the co-lending income, according to Jefferies.

Reserve Bank of India's restriction on disbursing gold loans due to material supervisory concerns should dent earnings due to rapid unwinding of profitable gold loan book, and lower co-lending income, the brokerage said in a note on Feb. 05.

Jefferies has downgraded the gold loan provider to 'hold' with a target price of Rs 435 apiece

The restrictions placed by the regulator on IIFL Finance Ltd.'s gold loan disbursement could impact the company's earnings and lower the co-lending income, according to Jefferies.

Reserve Bank of India's restriction on disbursing gold loans due to material supervisory concerns should dent earnings due to rapid unwinding of profitable gold loan book, and lower co-lending income, the brokerage said in a note on Feb. 05.

Jefferies has downgraded the gold loan provider to 'hold' with a target price of Rs 435 apiece

JM Financial Products Ltd declined nearly 19% on Wednesday after the Reserve Bank of India barred it from lending against shares, debentures with immediate effect.

This incudes lending against initial public offer of shares as well as against subscriptions to debentures. The regulator has observed serious deficiencies in loans sanctioned for IPO financing, and as well as to non-convertible debentures, according to a release by RBI.

JM Financial Group said there is no material deficiencies in the loan sanctioning process, and reaffirm there's no governance issues as well, a spokesperson said to NDTV Profit. The company also said it has not violated any applicable rule.

JM Financial Products Ltd declined nearly 19% on Wednesday after the Reserve Bank of India barred it from lending against shares, debentures with immediate effect.

This incudes lending against initial public offer of shares as well as against subscriptions to debentures. The regulator has observed serious deficiencies in loans sanctioned for IPO financing, and as well as to non-convertible debentures, according to a release by RBI.

JM Financial Group said there is no material deficiencies in the loan sanctioning process, and reaffirm there's no governance issues as well, a spokesperson said to NDTV Profit. The company also said it has not violated any applicable rule.

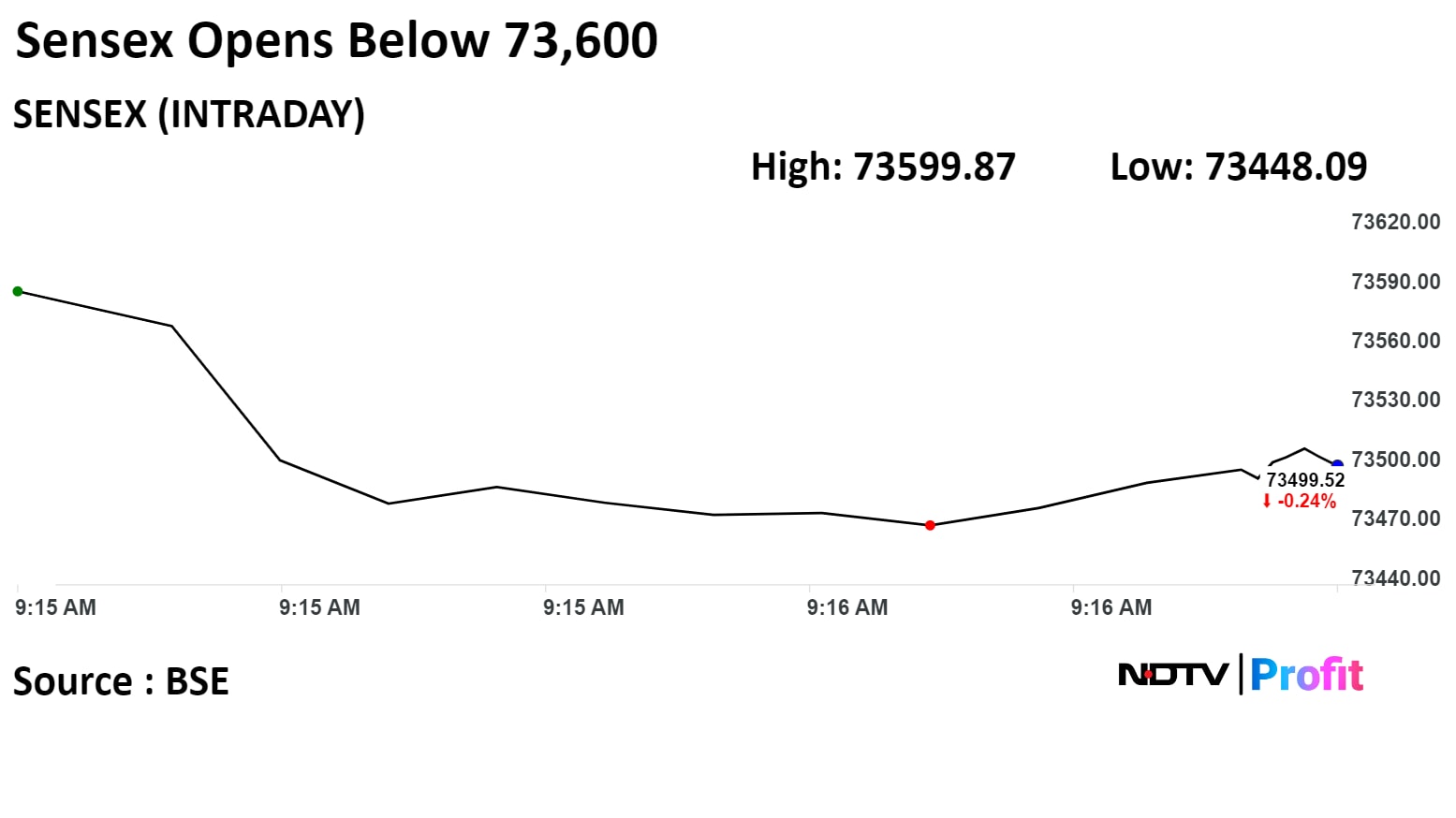

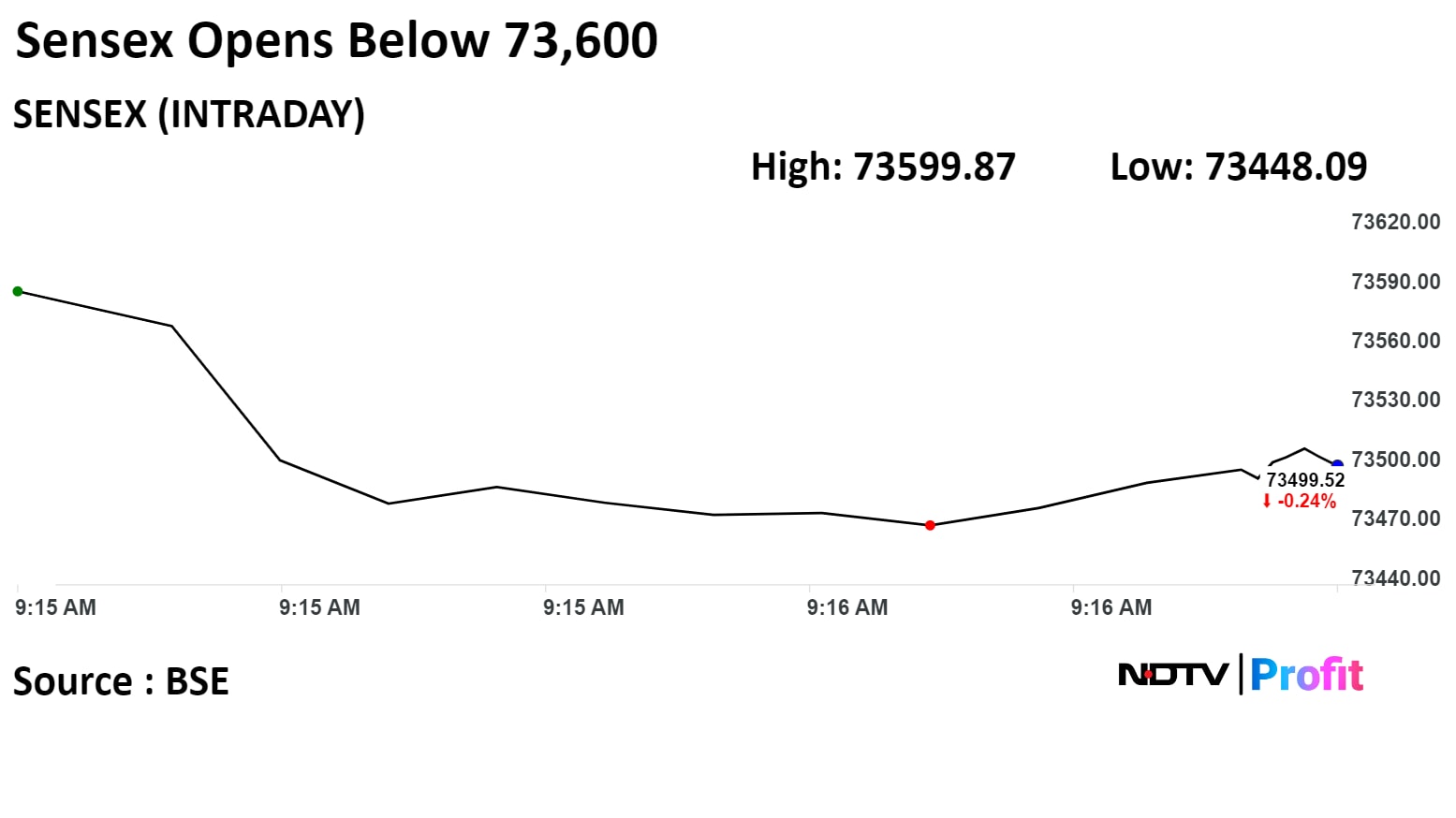

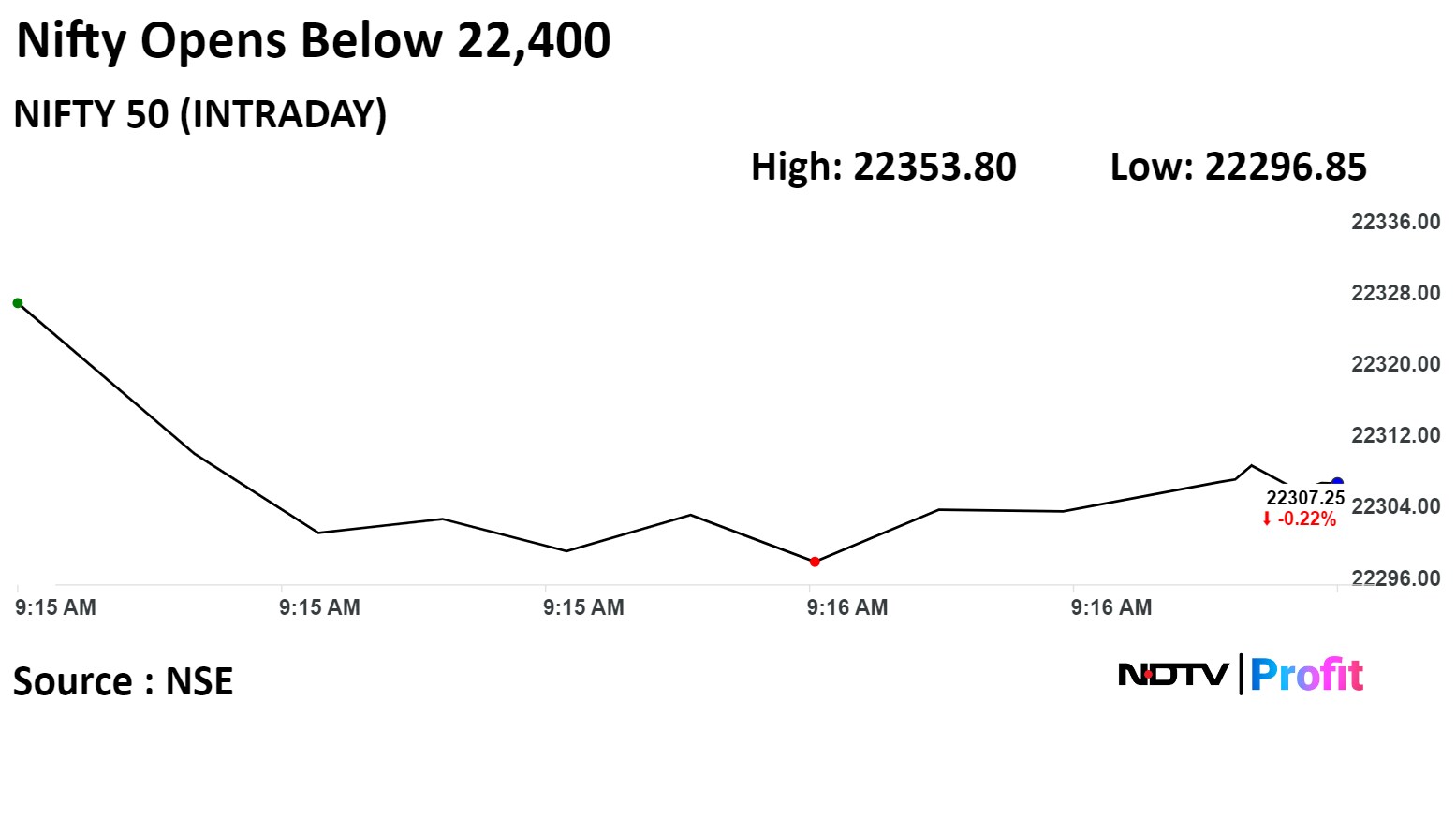

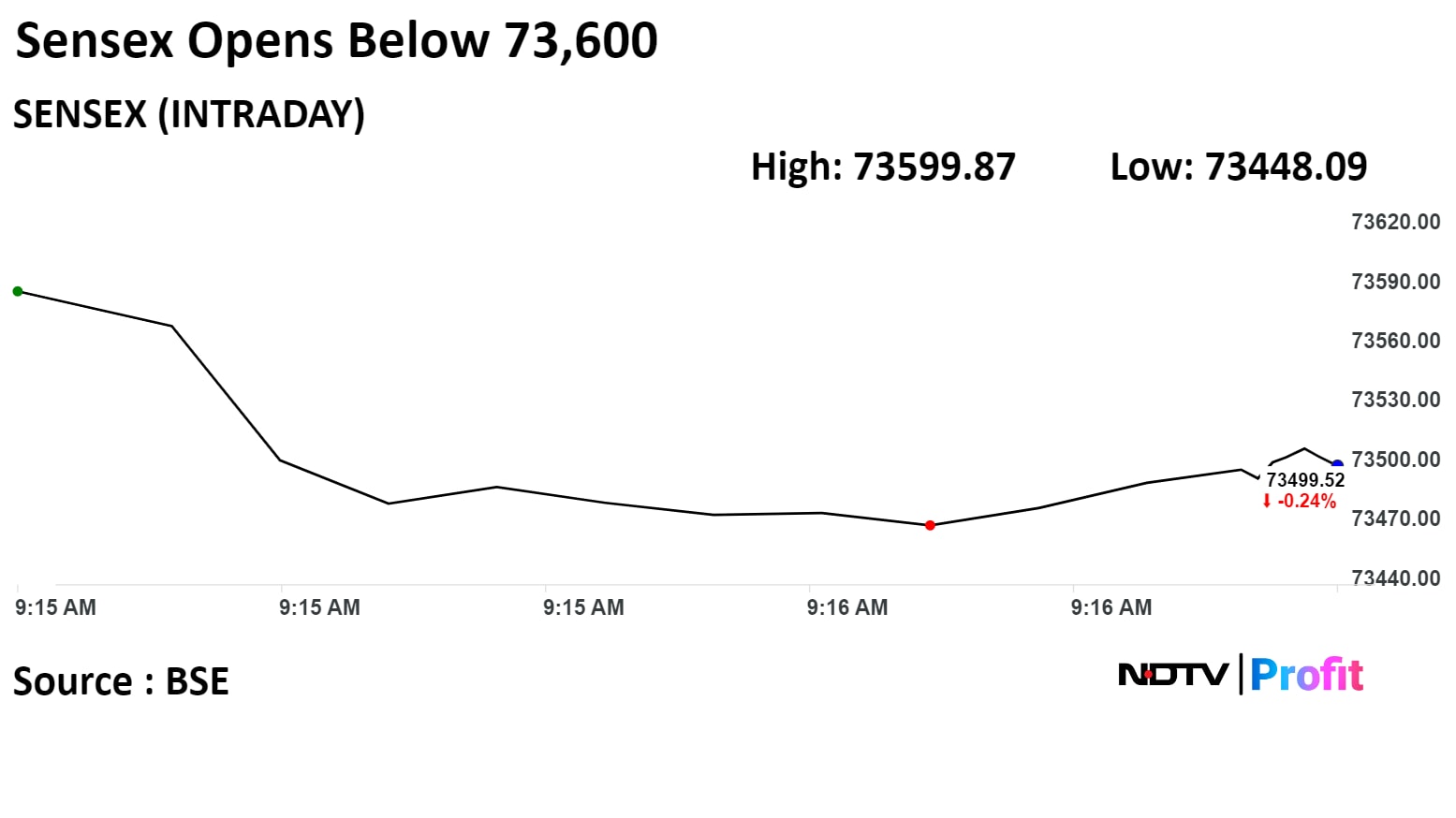

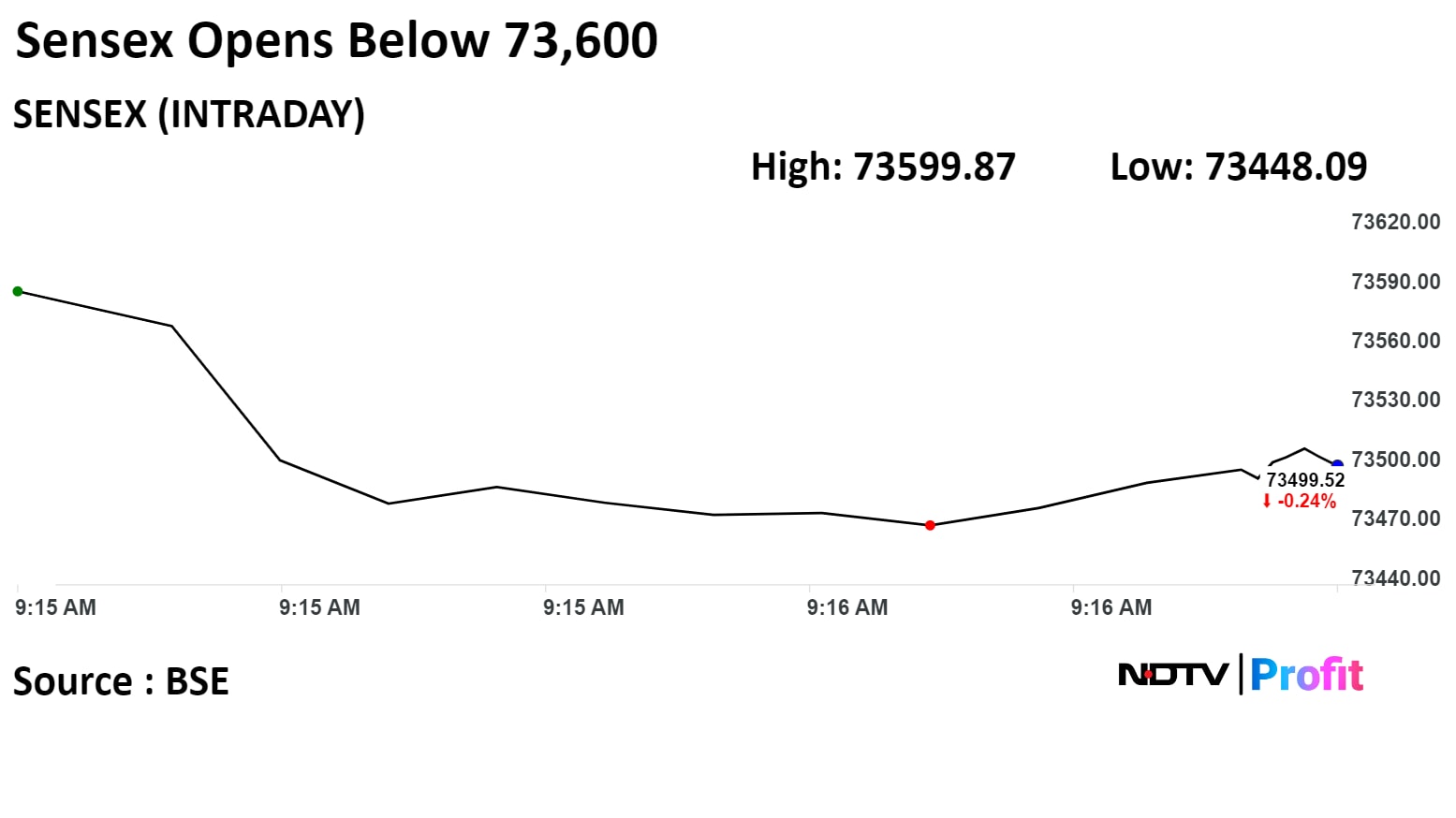

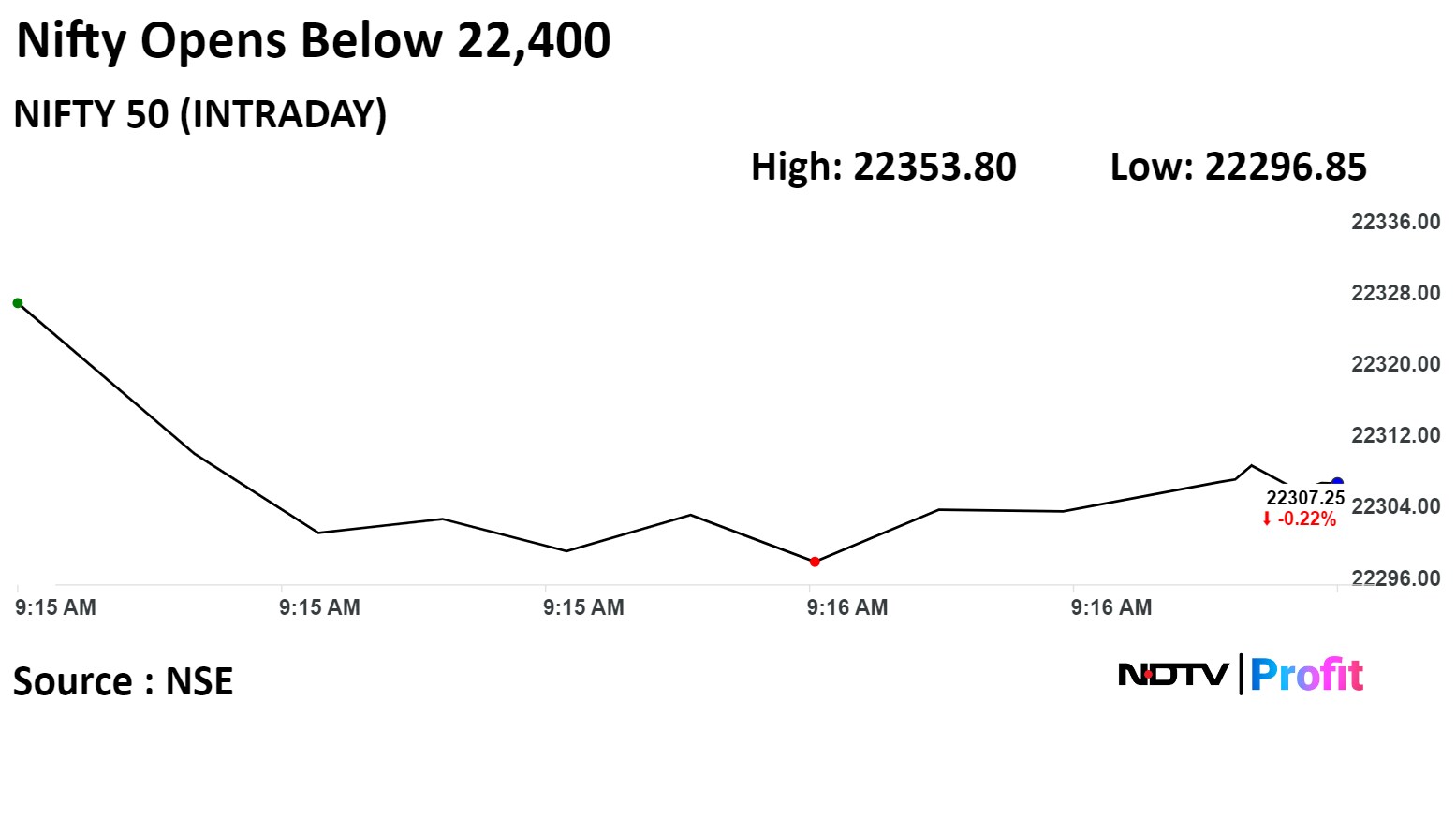

India's benchmark indices extended losses at opening on Wednesday as Infosys Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd dragged.

As of 09:19 a.m. the NSE Nifty 50 was trading 50.65 points or 0.23% lower at 22,305.65, and the S&P BSE Sensex was 181.98 points or 0.25% down at 73,495.16.

"Now, 22,200 and 22,100/73,200-72,900 would act as an important support zone for traders. Above 22,450/74,000, the market may move to 22,500-22,600/74,200-74,500. On the other hand, the market may extend the correction below 22,150," said Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices extended losses at opening on Wednesday as Infosys Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd dragged.

As of 09:19 a.m. the NSE Nifty 50 was trading 50.65 points or 0.23% lower at 22,305.65, and the S&P BSE Sensex was 181.98 points or 0.25% down at 73,495.16.

"Now, 22,200 and 22,100/73,200-72,900 would act as an important support zone for traders. Above 22,450/74,000, the market may move to 22,500-22,600/74,200-74,500. On the other hand, the market may extend the correction below 22,150," said Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices extended losses at opening on Wednesday as Infosys Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd dragged.

As of 09:19 a.m. the NSE Nifty 50 was trading 50.65 points or 0.23% lower at 22,305.65, and the S&P BSE Sensex was 181.98 points or 0.25% down at 73,495.16.

"Now, 22,200 and 22,100/73,200-72,900 would act as an important support zone for traders. Above 22,450/74,000, the market may move to 22,500-22,600/74,200-74,500. On the other hand, the market may extend the correction below 22,150," said Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices extended losses at opening on Wednesday as Infosys Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd dragged.

As of 09:19 a.m. the NSE Nifty 50 was trading 50.65 points or 0.23% lower at 22,305.65, and the S&P BSE Sensex was 181.98 points or 0.25% down at 73,495.16.

"Now, 22,200 and 22,100/73,200-72,900 would act as an important support zone for traders. Above 22,450/74,000, the market may move to 22,500-22,600/74,200-74,500. On the other hand, the market may extend the correction below 22,150," said Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices extended losses at opening on Wednesday as Infosys Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd dragged.

As of 09:19 a.m. the NSE Nifty 50 was trading 50.65 points or 0.23% lower at 22,305.65, and the S&P BSE Sensex was 181.98 points or 0.25% down at 73,495.16.

"Now, 22,200 and 22,100/73,200-72,900 would act as an important support zone for traders. Above 22,450/74,000, the market may move to 22,500-22,600/74,200-74,500. On the other hand, the market may extend the correction below 22,150," said Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices extended losses at opening on Wednesday as Infosys Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd dragged.

As of 09:19 a.m. the NSE Nifty 50 was trading 50.65 points or 0.23% lower at 22,305.65, and the S&P BSE Sensex was 181.98 points or 0.25% down at 73,495.16.

"Now, 22,200 and 22,100/73,200-72,900 would act as an important support zone for traders. Above 22,450/74,000, the market may move to 22,500-22,600/74,200-74,500. On the other hand, the market may extend the correction below 22,150," said Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices extended losses at opening on Wednesday as Infosys Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd dragged.

As of 09:19 a.m. the NSE Nifty 50 was trading 50.65 points or 0.23% lower at 22,305.65, and the S&P BSE Sensex was 181.98 points or 0.25% down at 73,495.16.

"Now, 22,200 and 22,100/73,200-72,900 would act as an important support zone for traders. Above 22,450/74,000, the market may move to 22,500-22,600/74,200-74,500. On the other hand, the market may extend the correction below 22,150," said Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices extended losses at opening on Wednesday as Infosys Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd dragged.

As of 09:19 a.m. the NSE Nifty 50 was trading 50.65 points or 0.23% lower at 22,305.65, and the S&P BSE Sensex was 181.98 points or 0.25% down at 73,495.16.

"Now, 22,200 and 22,100/73,200-72,900 would act as an important support zone for traders. Above 22,450/74,000, the market may move to 22,500-22,600/74,200-74,500. On the other hand, the market may extend the correction below 22,150," said Shrikant Chouhan, head equity research, Kotak Securities.

HDFC Bank Ltd., Infosys Ltd., Tata Consultancy Services Ltd., ICICI Bank and Ltd., HCL Technologies Ltd. weighed on the benchmark index.

Reliance Industries Ltd., Kotak Mahindra Bank Ltd., Larsen & Toubro Ltd., Bajaj Auto Ltd., and UltraTech Cement Ltd added positively to the index.

On NSE, 11 sectors out of 12 declined. The Nifty IT index was top loser among sectoral indices, and the Nifty Metal index was the top gainer.

Broader markets were also trading lower. The S&P BSE Midcap index declined 0.01%, and the S&P BSE Smallcap index was 0.5% lower.

On BSE, 17 out of 20 sectors declined, and three advanced. The S&P BSE Telecommunication index declined the most. The S&P BSE Auto index rose the most.

Market breadth was skewed in favour of sellers. Around 1,743 stocks declined, 1,108 stocks rose, and 103 remained unchanged on BSE.

At pre-open, the NSE Nifty 50 was trading 28.80 points or 0.13% lower at 22,327.50, and the S&P BSE Sensex 89.43 points or 0.12% lower at 73,587.70.

The local currency opened flat at 82.90 against the U.S. Dollar.

Source: Bloomberg

The yield on the 10-year bond opened flat at 7.05%.

Source: Bloomberg

U.S. Dollar Index at 103.88

U.S. 10-year bond yield at 4.16%

Brent crude down 0.16% at $81.91 per barrel

Nymex crude down 0.12% at $78.06 per barrel

GIFT Nifty was trading flat at 22,427 as of 8:11 a.m.

Bitcoin was up 0.20% at $63,456.82

Citi Research maintained 'buy' on Aavas Financiers Ltd, and opened 90-day upside catalyst watch with a Price target of Rs 1,830.

Expects increasing disbursements to support 23% AUM growth in FY24.

Increased PLR by 25 basis points with effect from March 24 to arrest downward trajectory in spreads.

Sees promoter stake sale overhang behind for near-medium term

Expects AUM growth at higher end of 20-25% with more expansion across states

Sees valuations at its historical lows, given recent underperformance

Note: PLR stands for Prime Lending Rate

Citi Research downgraded Mahanagar Gas to 'sell' on regulatory risk on margins and cut price target by 5% to Rs 1,405 apiece.

Recent oil minister statements translate to potential drastic steps to ensure consumers benefit.

Fear any drastic steps by government could renew concerns on exclusivity and margins.

Mahanagar Gas' margins are more susceptible given premium it enjoys.

Potential positive medium-term to be opening new areas.

Open 90 day negative catalyst watch.

Citi Research maintained a 'buy' on UltraTech Cement.

Management Meet Takeaways:

ULTC top pick in cement space, company continues to remain attractive

Estimates 12% volume CAGR through FY23-26

Sees Ebitda per tonne expansion, continued growth visibility

Company expects Indian cement demand to grow 8-9% in FY24 and FY25

Urban real estate demand to be strong over next 4-5 years

Pace of demand to outpace ULTC supply, resulting in improved utilization

Management indicated soft cement pricing.

G R Infraprojects Ltd.'s promoters is to sell up to 5% stake via open market between March 7 and April 7.

Promoters will sell stakes to comply with MPS requirements.

Source: Exchange filing

Tata Technologies Ltd. has appointed S Sukanya appointed as chief operating officer effective March 6.

Source: Exchange filing

Nifty March futures down by 0.27% to 22,433.25 at a premium of 76.95 points.

Nifty March futures open interest down by 4%.

Nifty Bank March futures up by 0.45% to 47,909.05 at a premium of 328.05 points.

Nifty Bank March futures open interest up by 9.23.

Nifty Options March 7 Expiry: Maximum call open interest at 23,000 and maximum put open interest at 22,200.

Bank Nifty Options March 6 Expiry: Maximum call open interest at 49,000 and maximum put open interest at 46,000.

Securities in ban period: Zee Entertainment Enterprises.

Nifty March futures down by 0.27% to 22,433.25 at a premium of 76.95 points.

Nifty March futures open interest down by 4%.

Nifty Bank March futures up by 0.45% to 47,909.05 at a premium of 328.05 points.

Nifty Bank March futures open interest up by 9.23.

Nifty Options March 7 Expiry: Maximum call open interest at 23,000 and maximum put open interest at 22,200.

Bank Nifty Options March 6 Expiry: Maximum call open interest at 49,000 and maximum put open interest at 46,000.

Securities in ban period: Zee Entertainment Enterprises.

Ex/record dividend: DCM Shriram, Marico.

Moved into short-term ASM framework: Dishman Carbogen Amcis.

Moved out short-term ASM framework: Yasho Industries.

Safari Industries: To meet analysts and investors on March 8.

Jubilant Pharmova: To meet analysts and investors on March 12.

Cyient DLM: To meet analysts and investors on March 14.

Kotak Mahindra Bank: To meet analysts and investors on March 11 and 12.

Welspun Corp: To meet analysts and investors on March. 18.

Krsnaa Diagnostics: To meet analysts and investors on March 7.

Welspun Corp: To meet analysts and investors on March. 28.

Infosys: To meet analysts and investors on March 13.

Usha Martin: Promoter Peterhouse Investments sold 2.5 lakh shares on March 5.

ADF Foods: Promoter Krish Bhavesh Thakkar bought 30,000 shares between March 1 and 2.

TD Power Systems: BNP Paribas Arbitrage sold 46 lakh shares (2.94%), and Vittoria Fund-Oc,Lp bought 46 lakh shares (2.94%) at Rs 320.5 apiece.

Aavas Financiers: Lake District Holdings sold 58.39 lakh shares (7.38%), Partners Group sold 41.57 lakh shares (5.25%), SBI Mutual Fund bought 63 lakh shares (7.96%), and Amansa Holdings bought 23.59 lakh shares (2.98%) at Rs 1370 apiece.

R K Swamy: The public issue was subscribed to 6.01 times on day 2. The bids were led by non-institutional investors (9.71 times), retail investors (18.31 times), and institutional investors (0.37 times).

JG Chemicals: The public issue was subscribed to 2.47 times on day 1. The bids were led by non-institutional investors (2.9 times), retail investors (3.64 times), and institutional investors (0.02 times).

Gopal Snacks: The company will offer its shares for bidding on Wednesday. The price band is set from Rs 381 to Rs 401 per share. The Rs 650 crore IPO is completely an offer-for-sale issue. The company has raised Rs 194 crore from anchor investors.

JM Financial: The Reserve Bank of India directed the company to stop any form of financing against shares and debentures with immediate effect. This includes the sanction and disbursal of loans against the initial public offer of shares as well as against subscriptions to debentures.

JSW Energy: The company’s step-down unit signed a battery energy storage purchase agreement with Solar Energy Corp. for 250 MW/500 MWh of battery energy storage systems. The company has signed an agreement for the first project out of the total awarded project capacity of 500 MW/1,000 MWh.

NHPC: The company started work on Jalaun Ultra Renewable Energy Power Park in Uttar Pradesh. The company’s unit is to invest Rs 800 crore in a 1,200 MW renewable power park to be constructed in 24 months and generate 2,400 MU of electricity every year.

Wipro: The company acquired a 27% stake in B2B sales platform SDVerse LLC for $5.85 million in cash. The transaction will be completed before the end of March. General Motors, Magna, and Wipro have teamed up to develop SDVerse LLC.

Aditya Birla Fashion: Caladium Investment exercised the right to convert all 6.6 crore warrants into equity shares.

IRCTC: The company signed a deal with Swiggy to provide pre-ordered meals via IRCTC e-Catering Services.

Sanghvi Movers: The board approved the incorporation of a wholly owned unit.

Sonata Software: The company will open a delivery centre in Poland to address the growing demands from its global clients.

Force Motors: The company produced 2,987 vehicle units for the month of February and sold 2,366 units domestically.

ONGC: The board approved an additional investment of Rs 99 crore in unit ONGC Green.

Indian Hotels: The company invested Rs 35 crore in its unit through the right issue.

Bharat Forge: The company had made an investment of Rs 179.9 crore in its unit, Bharat Forge Global Holding.

Havells India: The company plans to add kitchen appliances to its portfolio, outsource the entire range of products, and serve the domestic market.

Bank of India: The bank invests Rs 60.35 crore in the National Asset Reconstruction Co. under preferential share issuance. The bank stake in NARCL will remain at 9% after the allotment of new shares.

Indiabulls Real Estate: The company believes MIDC's order to vacate a 512.1-hectare plot in Nashik SEZ in a month is unlawful and is evaluating legal options to defend itself.

REC: The board will meet on March 16 to consider an interim dividend.

Bharti Airtel: The telco approved the allotment of 56.8 lakh shares to FCCB holders at a conversion rate of Rs 518 per share.

CESC: The company’s unit, Crescent Power, acquired a 100% stake in Purvah Green Power.

Centum Electronics: The company received an order worth Rs 187 crore from DRDO for the realisation of space-based EW payloads.

Share indices in the Asia-Pacific region fell during early trade on Wednesday, following overnight losses on Wall Street driven by index-heavy tech giant companies.

The Nikkei 225 was trading 0.24% down at 40,003, and the S&P ASX 200 was 0.29% down at 7,702.10 as of 7:16 a.m.

U.S. stocks came under pressure as a trio of tech heavyweights slid, with traders wading through mixed economic data in the run-up to Jerome Powell’s testimony to Congress, according to Bloomberg.

The S&P 500 Index and Nasdaq composite fell by 1.02% and 1.65%, respectively, as of Tuesday. The Dow Jones Industrial Average settled 1.04% lower.

Brent crude was trading 0.92% lower at $82.04 a barrel. Gold was lower by 0.06% at $2,126.80 an ounce.

The GIFT Nifty was trading flat at 22,427 as of 8:11 a.m.

India's benchmark stock indices ended lower on Tuesday, snapping four days of gains, weighed by losses in Infosys Ltd. and Bajaj Finance Ltd.

The NSE Nifty 50 settled 49.3 points, or 0.22%, lower at 22,356.3, and the S&P BSE Sensex declined 195.16 points, or 0.26%, to end at 73,677.13.

Overseas investors became net buyers of Indian equities on Tuesday. Foreign portfolio investors bought stocks worth Rs 574 crore; domestic institutional investors remained net buyers for the third day and mopped up equities worth Rs 1,835 crore, the NSE data showed.

The Indian rupee closed flat at 82.89 against the U.S. dollar.

Share indices in the Asia-Pacific region fell during early trade on Wednesday, following overnight losses on Wall Street driven by index-heavy tech giant companies.

The Nikkei 225 was trading 0.24% down at 40,003, and the S&P ASX 200 was 0.29% down at 7,702.10 as of 7:16 a.m.

U.S. stocks came under pressure as a trio of tech heavyweights slid, with traders wading through mixed economic data in the run-up to Jerome Powell’s testimony to Congress, according to Bloomberg.

The S&P 500 Index and Nasdaq composite fell by 1.02% and 1.65%, respectively, as of Tuesday. The Dow Jones Industrial Average settled 1.04% lower.

Brent crude was trading 0.92% lower at $82.04 a barrel. Gold was lower by 0.06% at $2,126.80 an ounce.

The GIFT Nifty was trading flat at 22,427 as of 8:11 a.m.

India's benchmark stock indices ended lower on Tuesday, snapping four days of gains, weighed by losses in Infosys Ltd. and Bajaj Finance Ltd.

The NSE Nifty 50 settled 49.3 points, or 0.22%, lower at 22,356.3, and the S&P BSE Sensex declined 195.16 points, or 0.26%, to end at 73,677.13.

Overseas investors became net buyers of Indian equities on Tuesday. Foreign portfolio investors bought stocks worth Rs 574 crore; domestic institutional investors remained net buyers for the third day and mopped up equities worth Rs 1,835 crore, the NSE data showed.

The Indian rupee closed flat at 82.89 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.