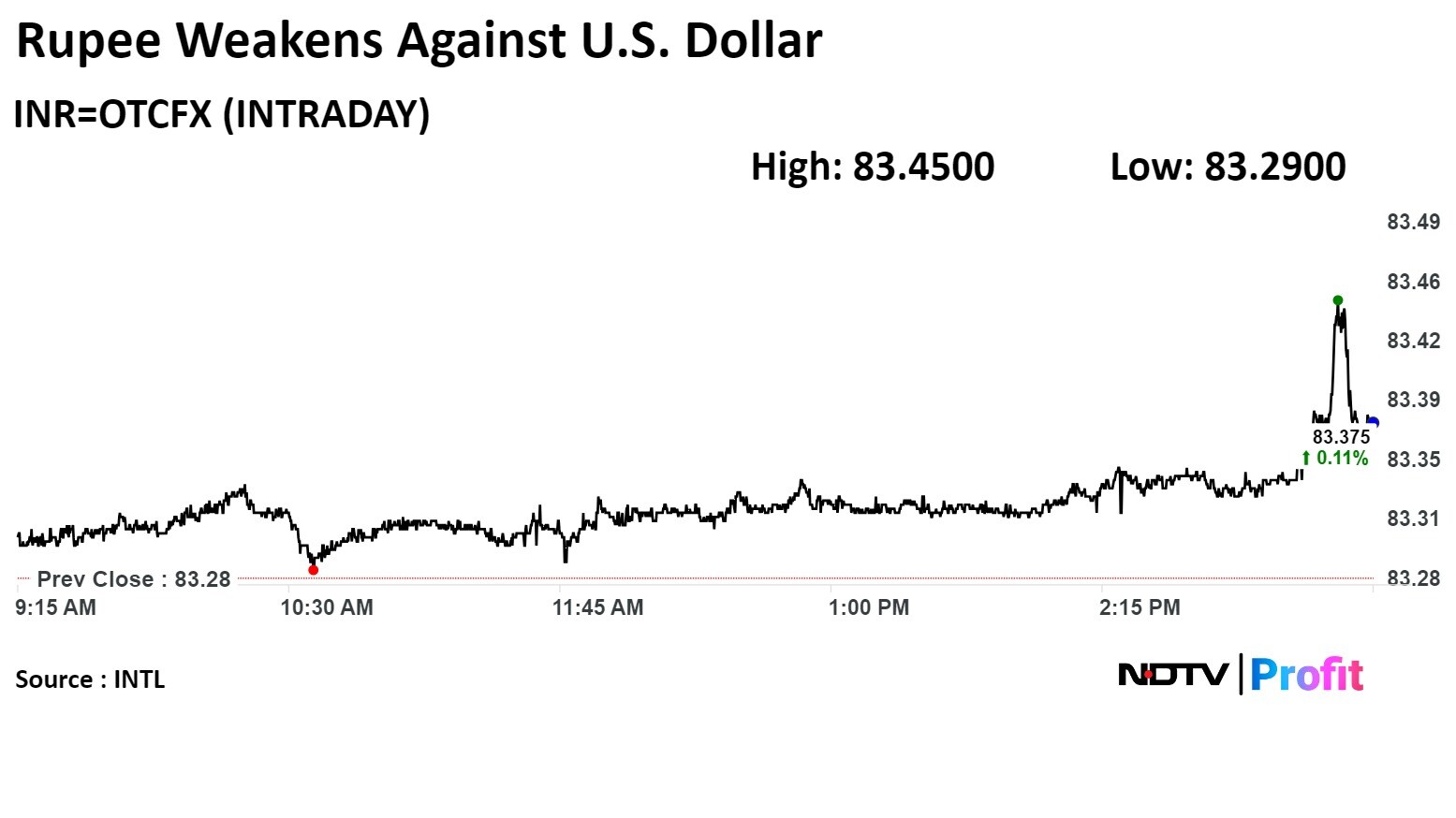

The local currency weakened by 9 paise to close at 83.38 against the U.S. Dollar.

It closed at 83.29 a dollar on Tuesday.

Source: Bloomberg

The local currency weakened by 9 paise to close at 83.38 against the U.S. Dollar.

It closed at 83.29 a dollar on Tuesday.

Source: Bloomberg

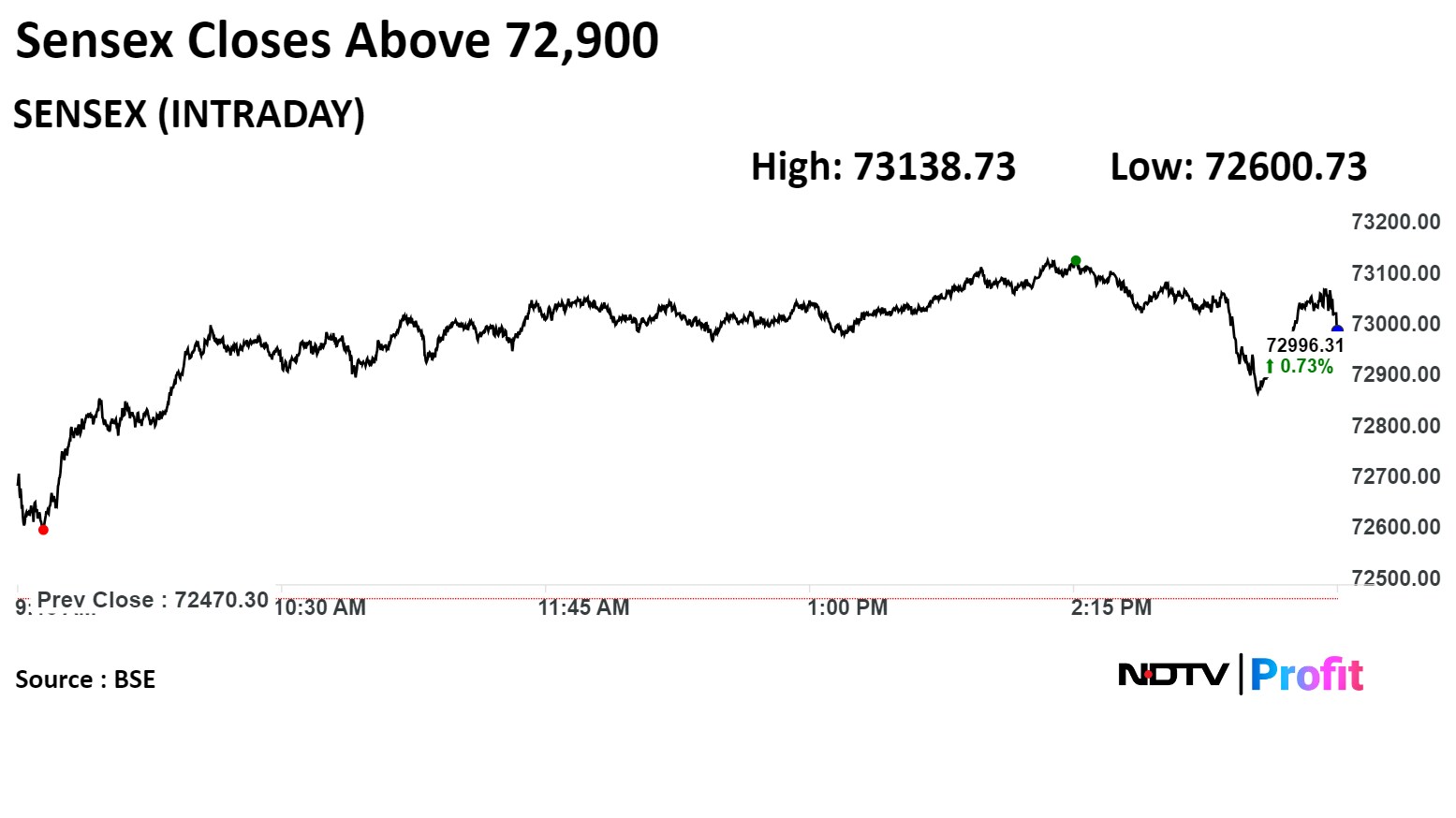

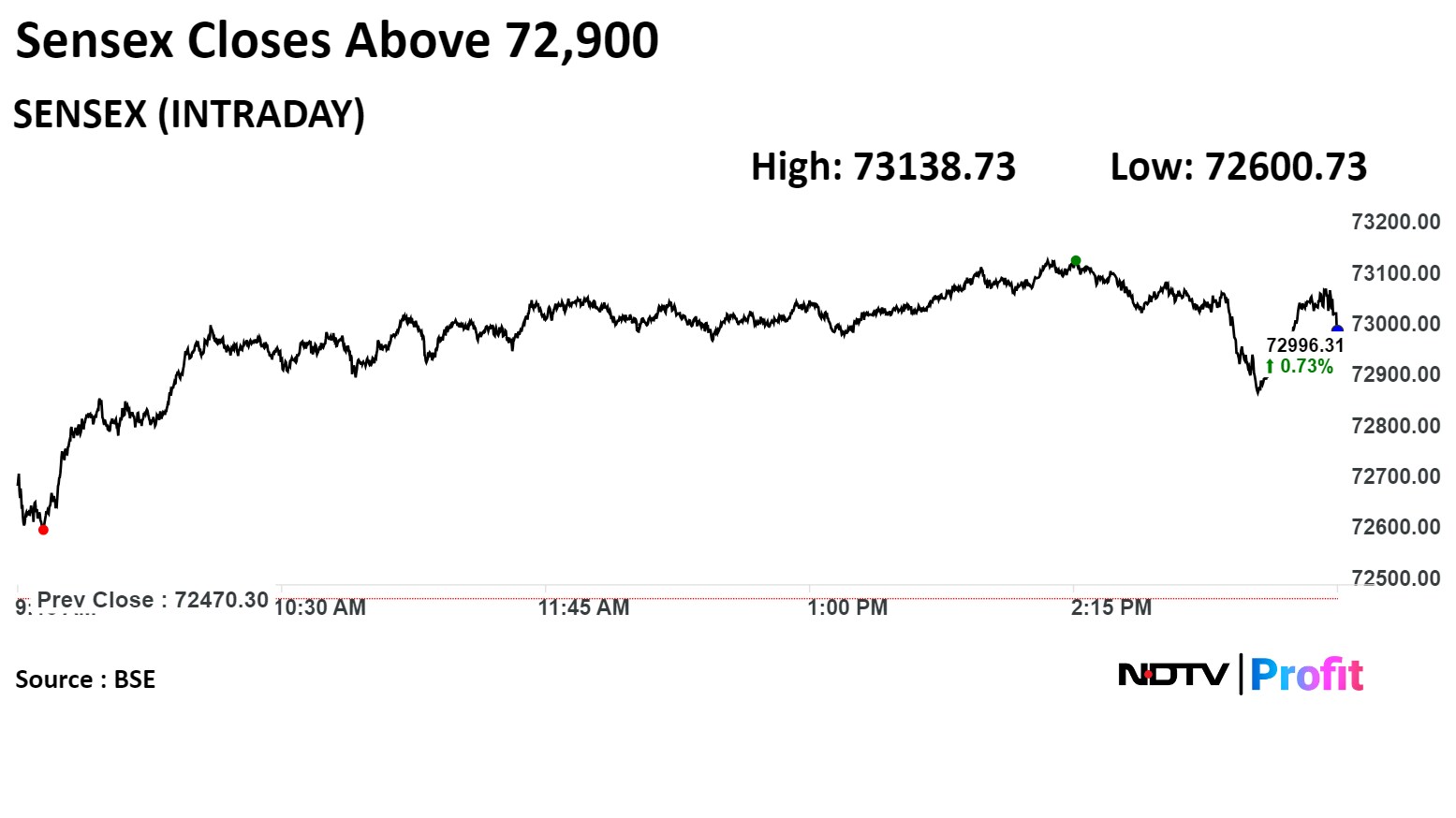

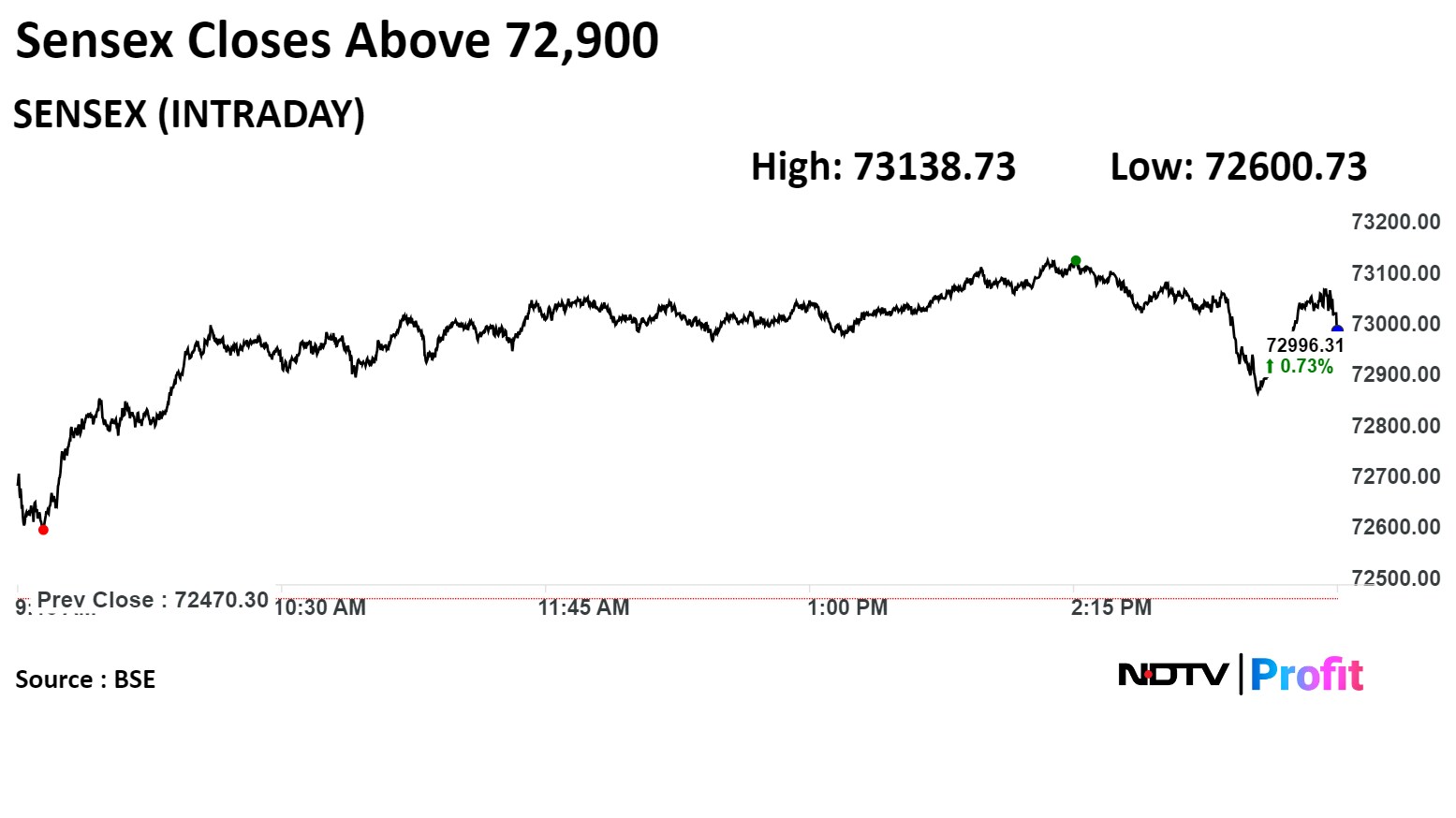

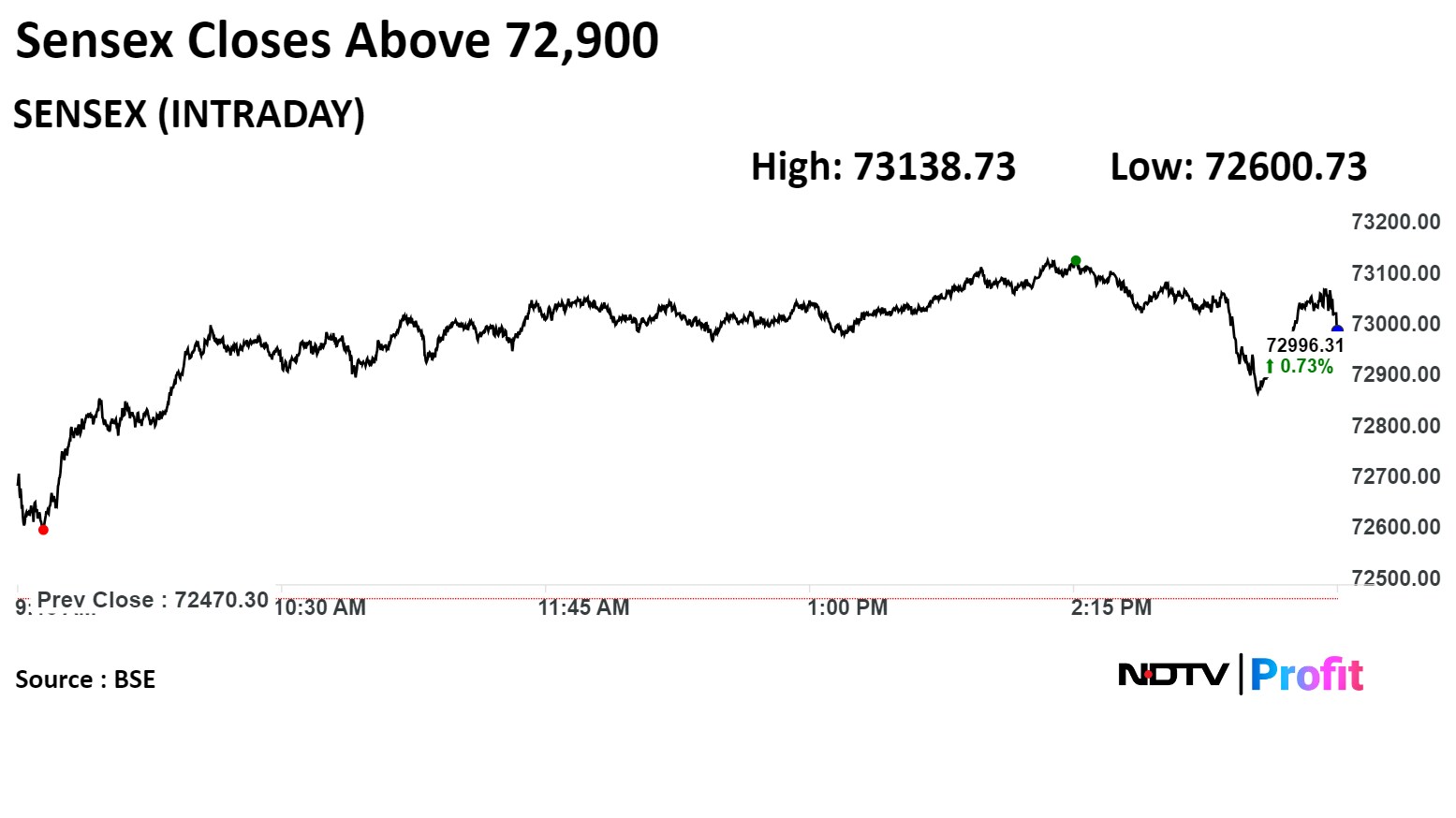

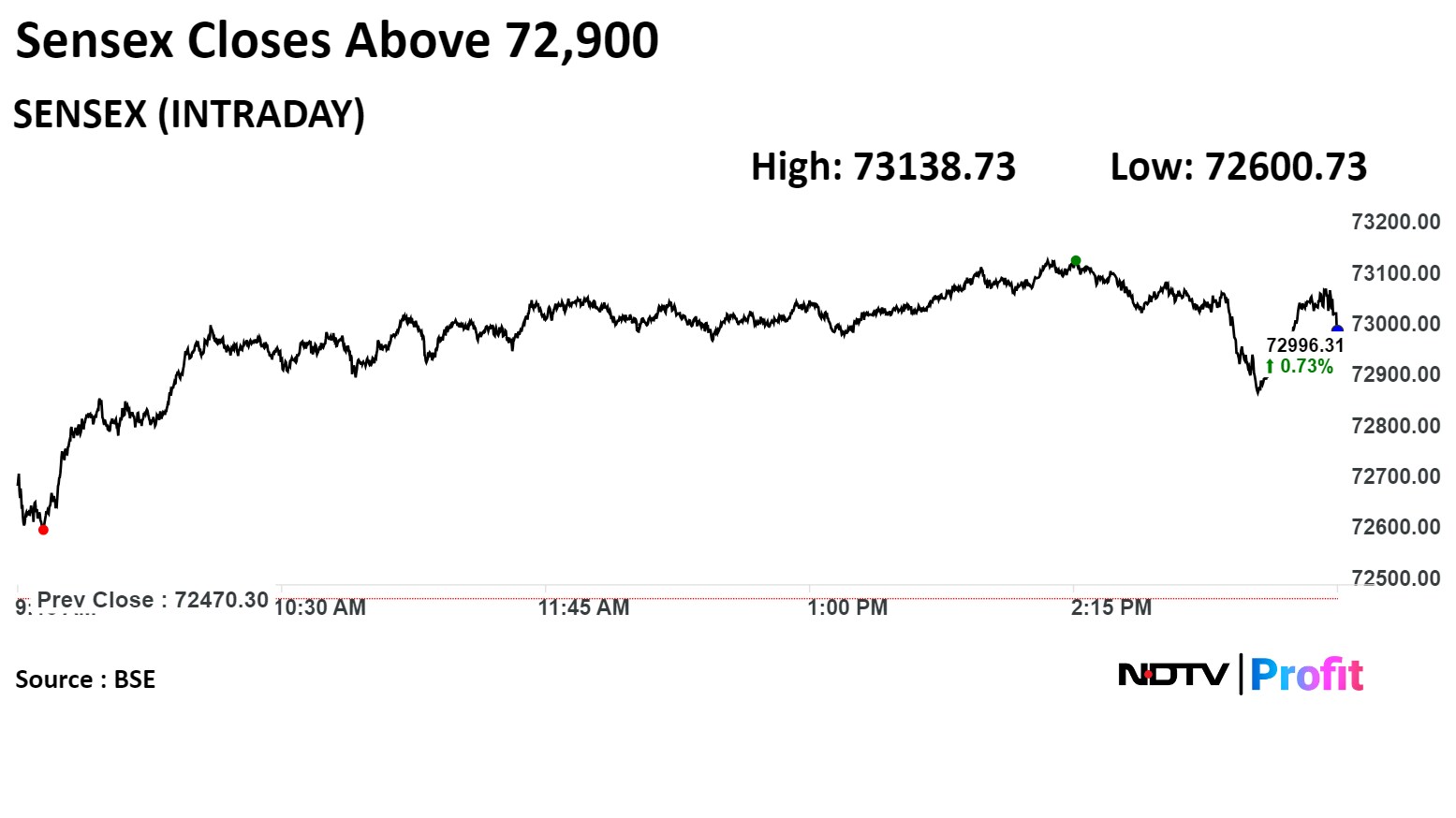

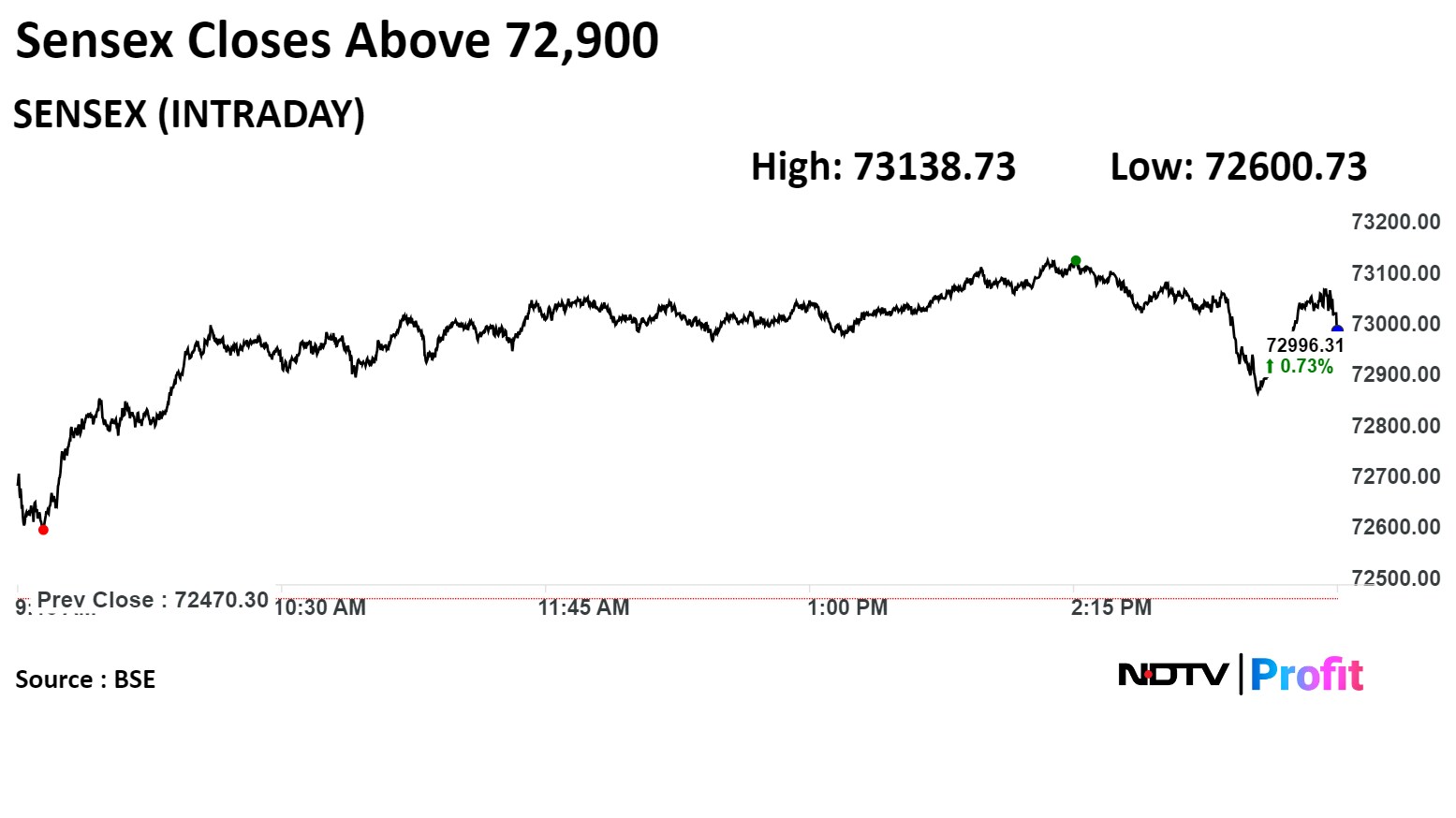

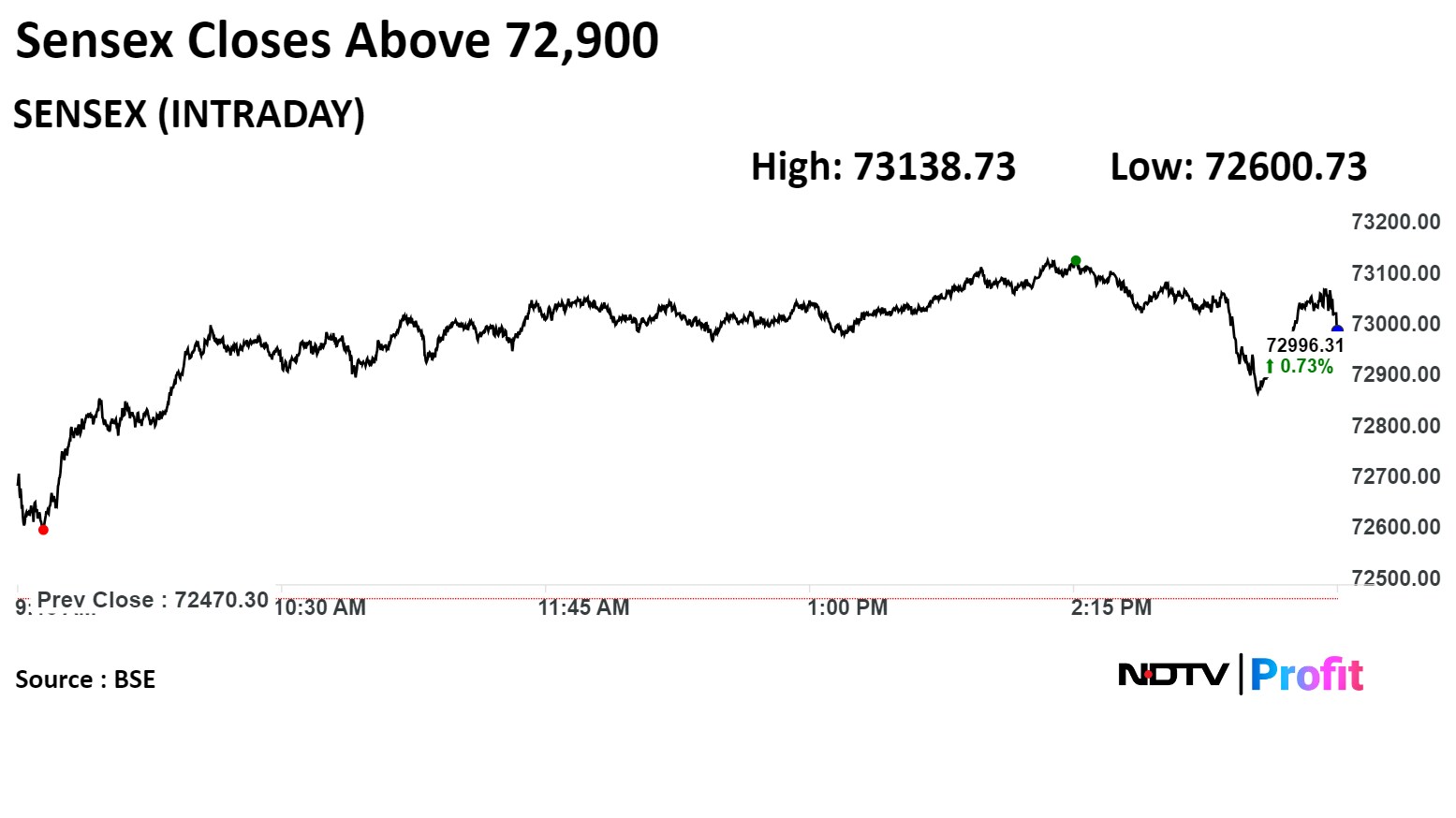

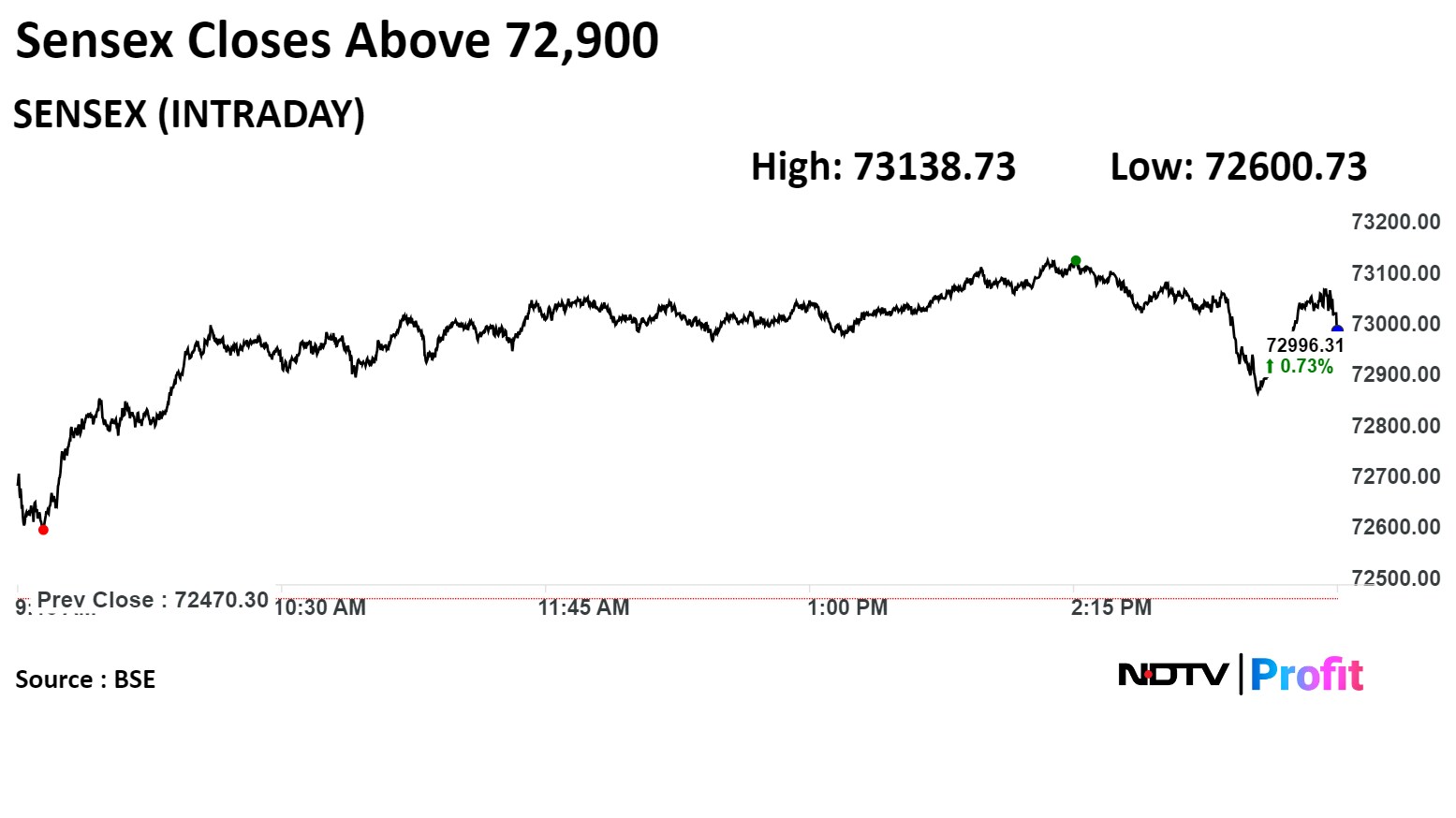

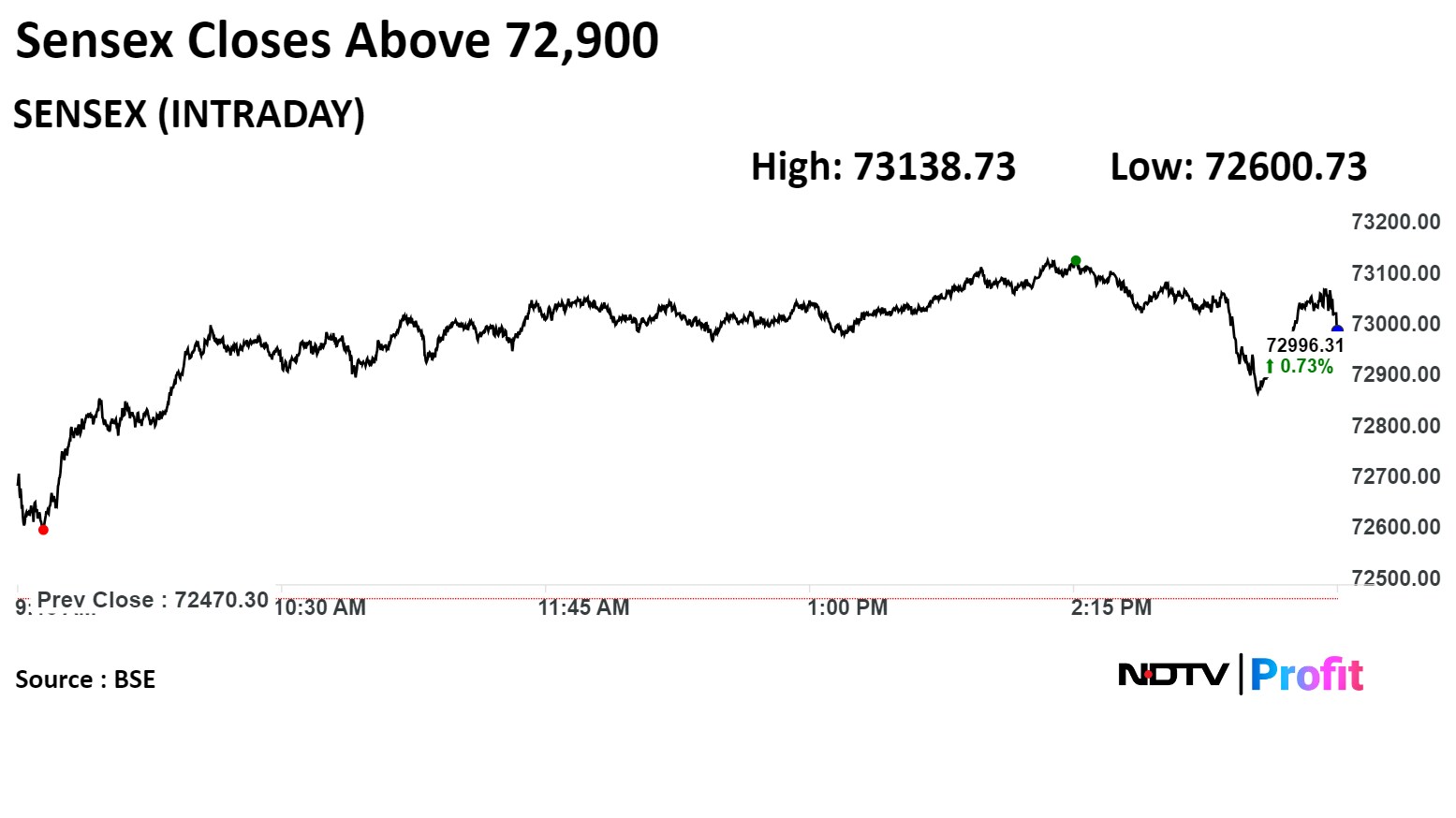

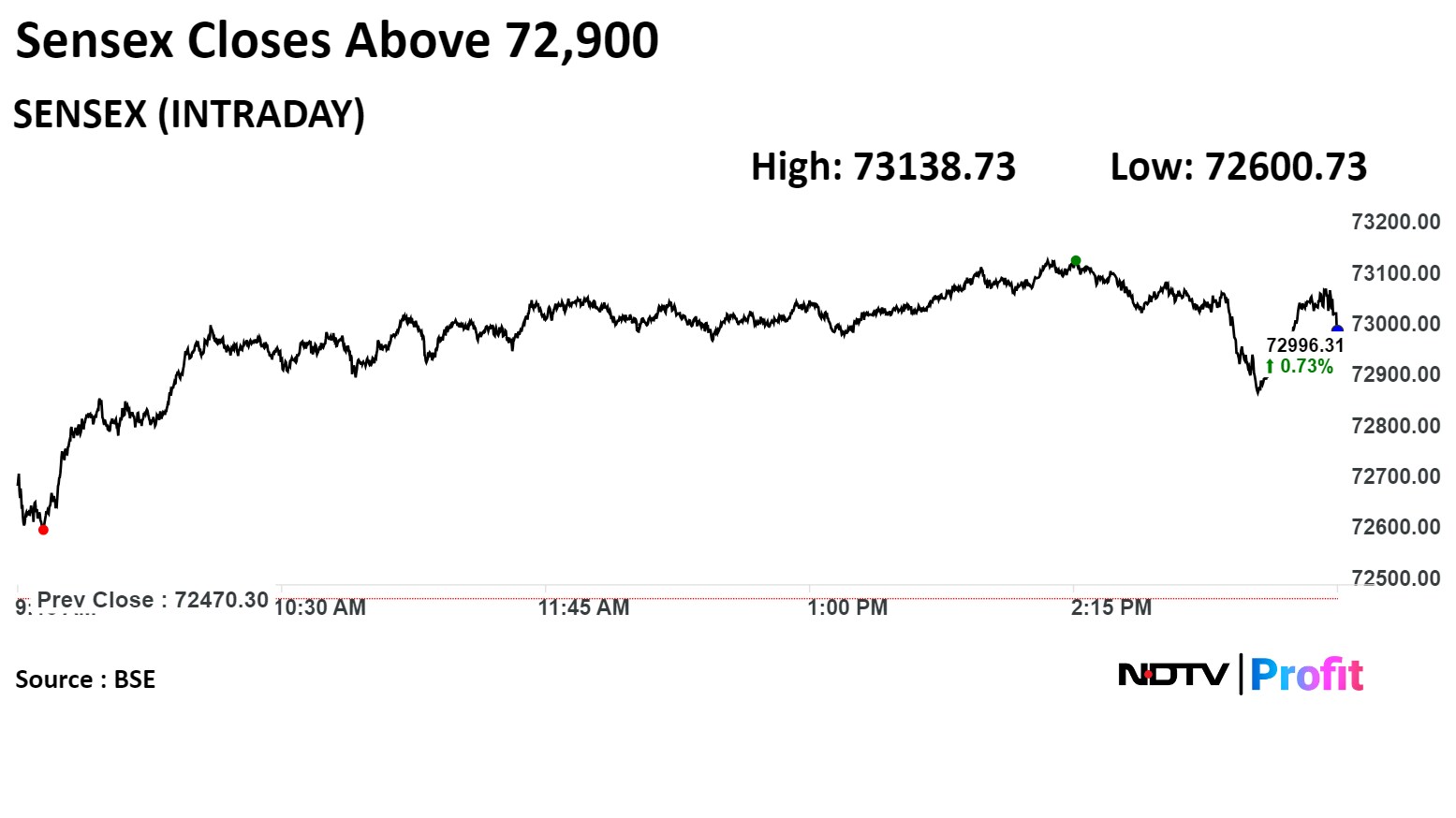

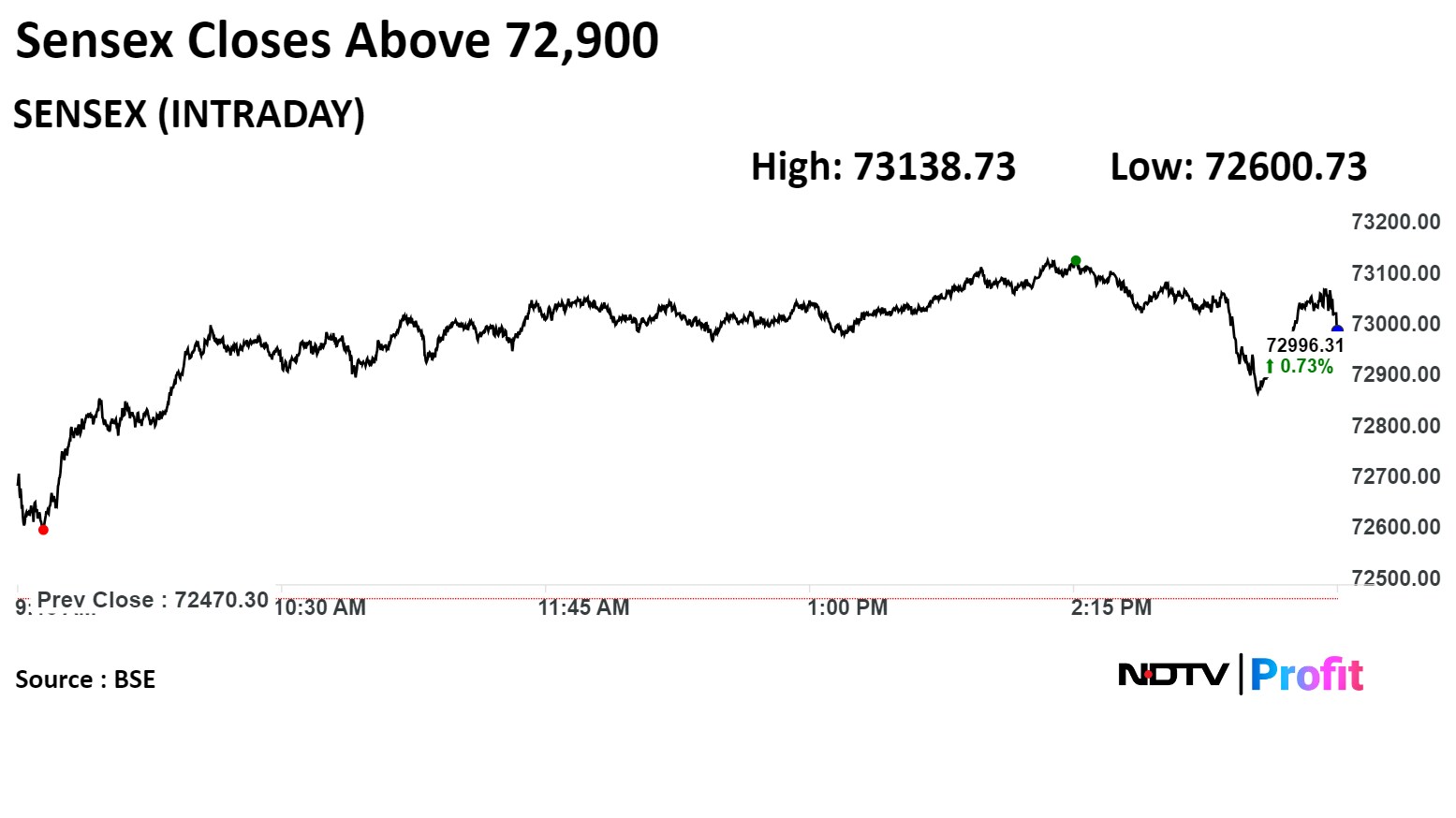

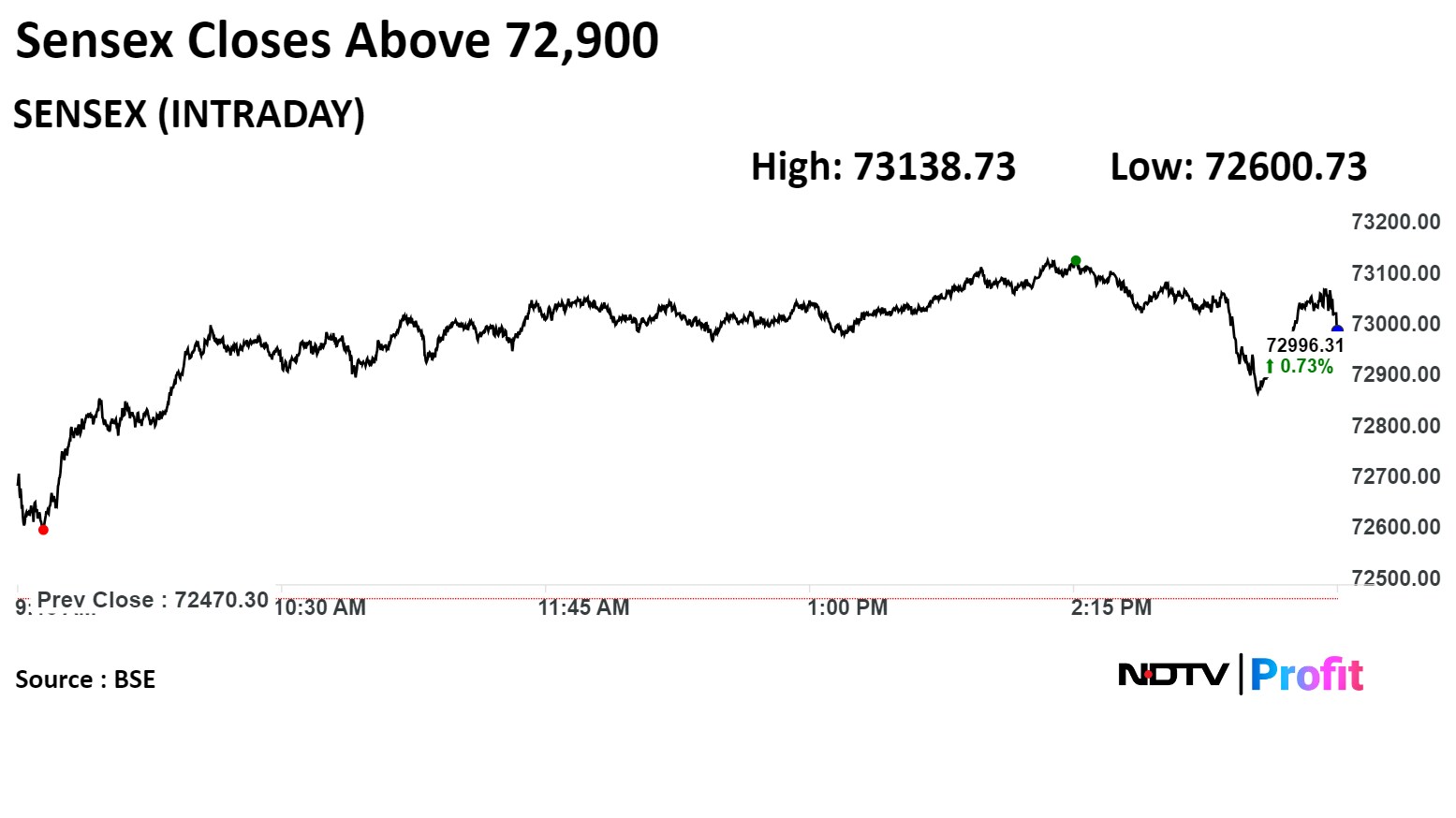

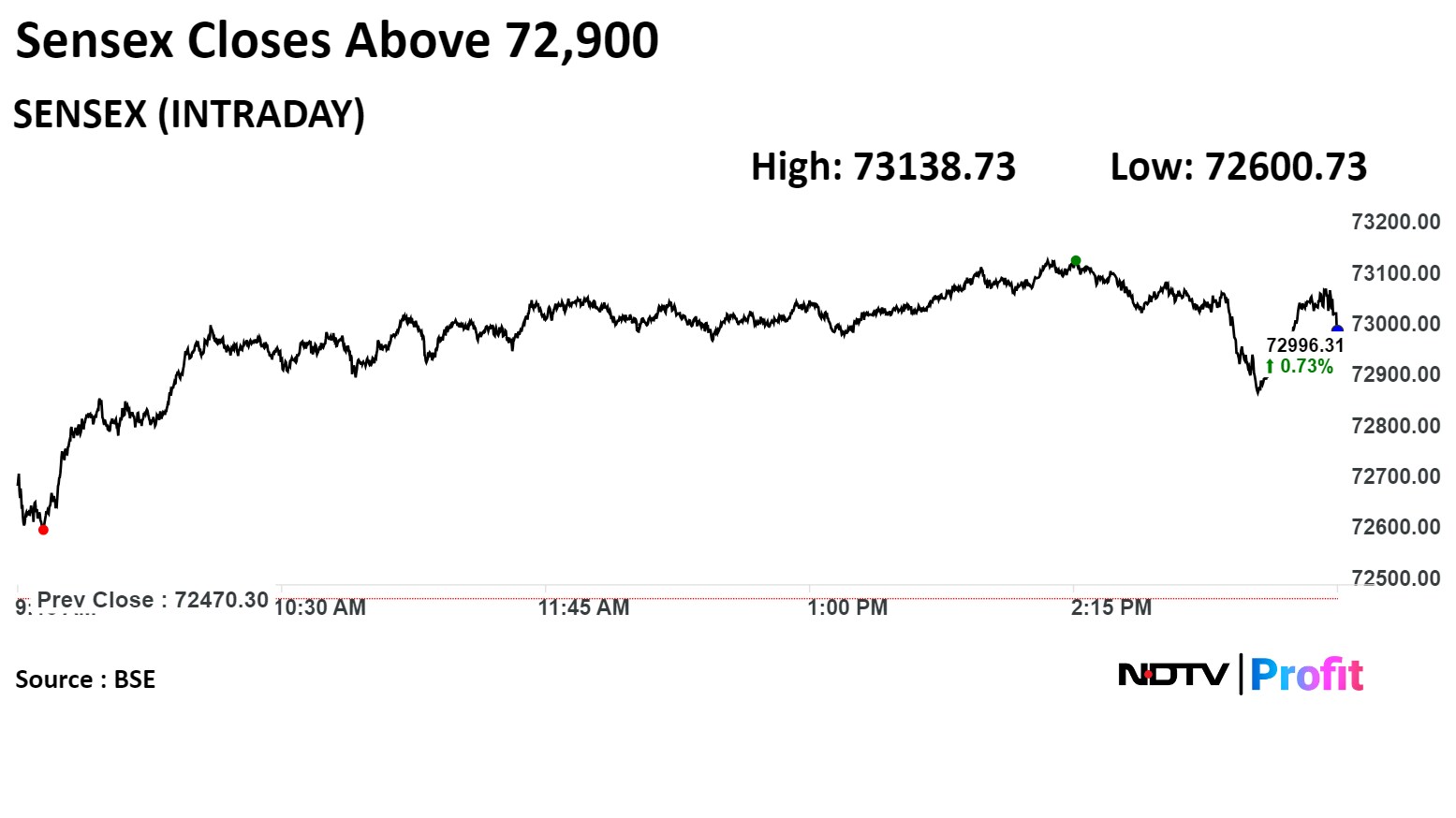

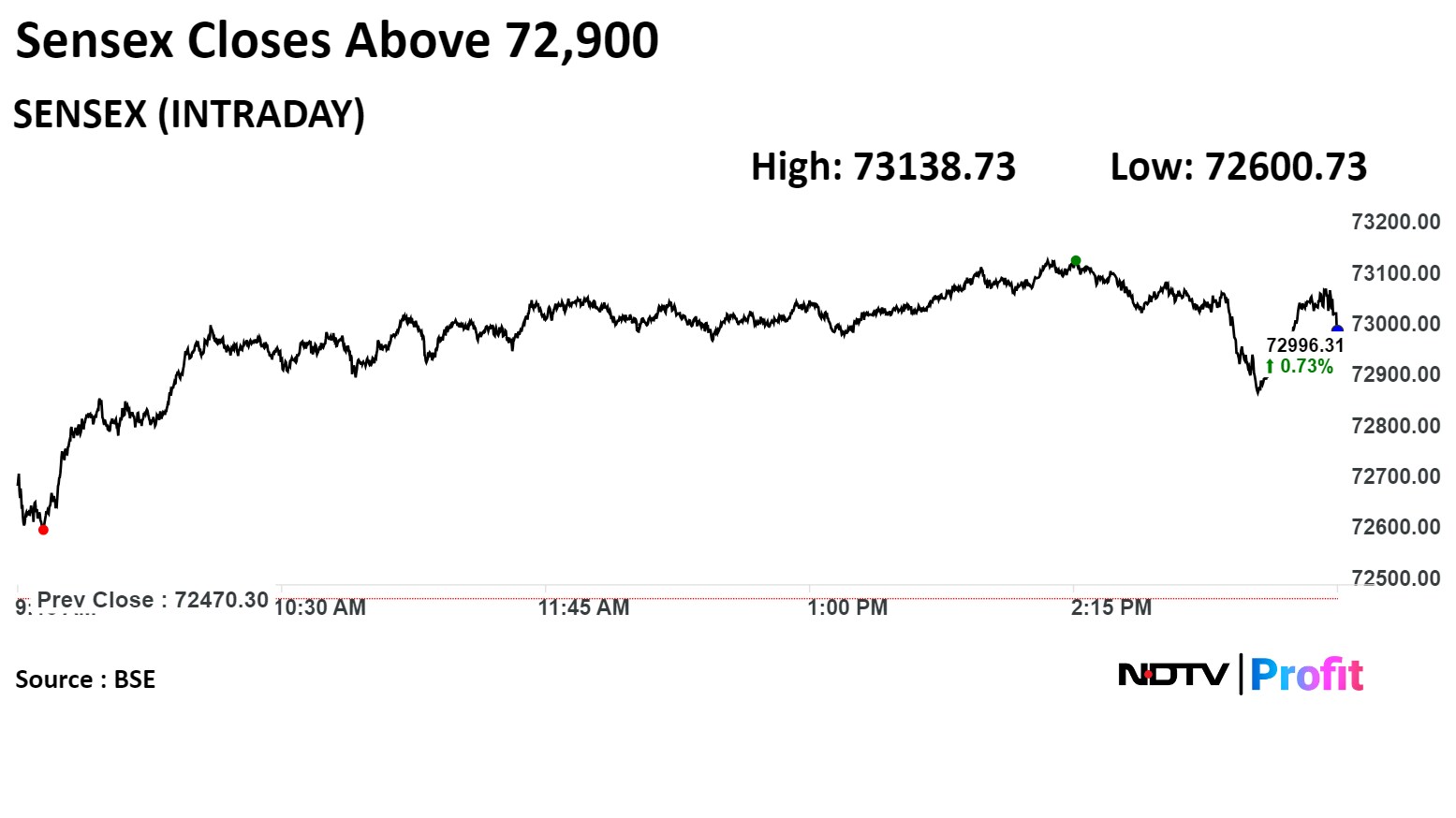

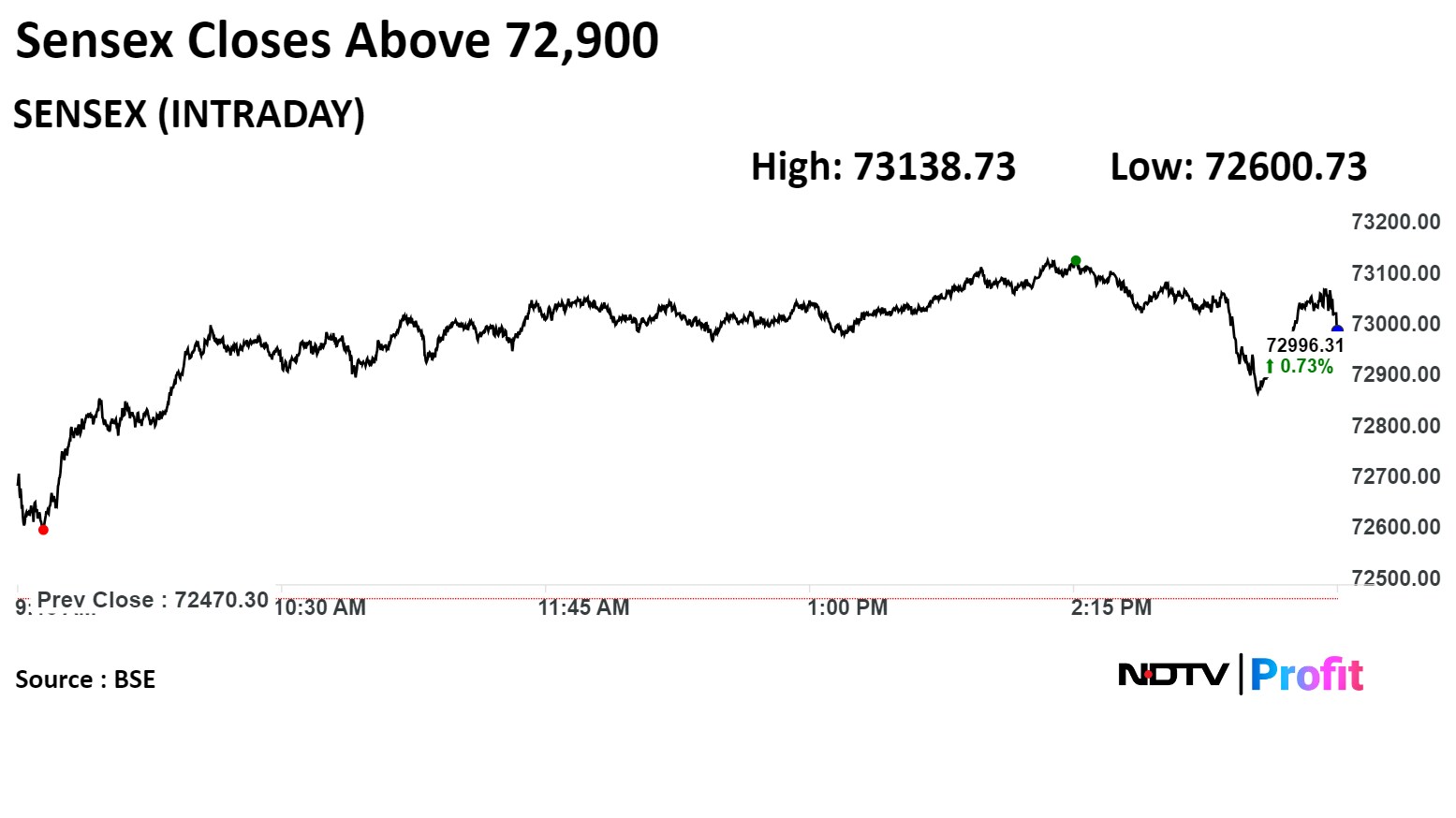

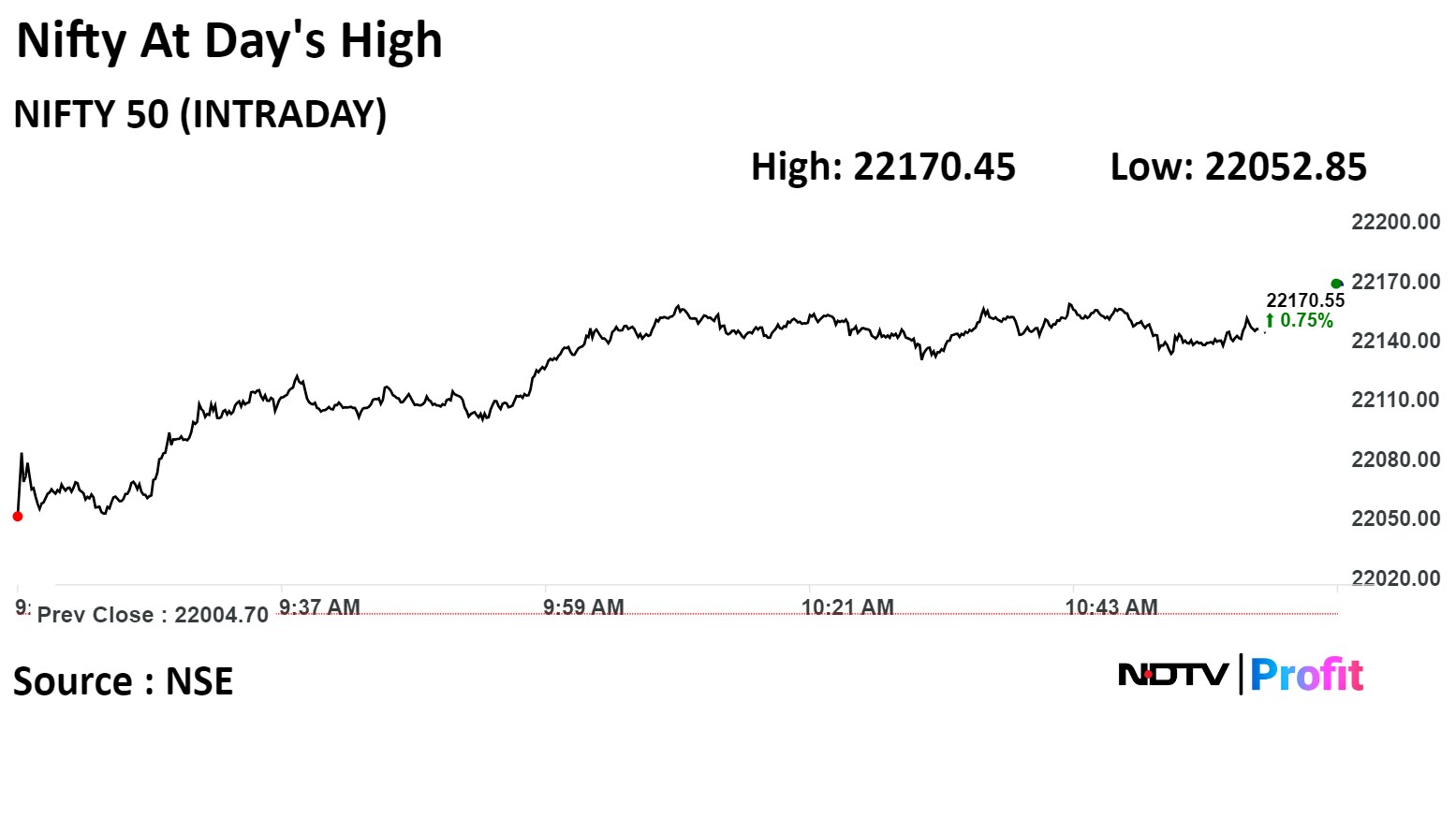

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

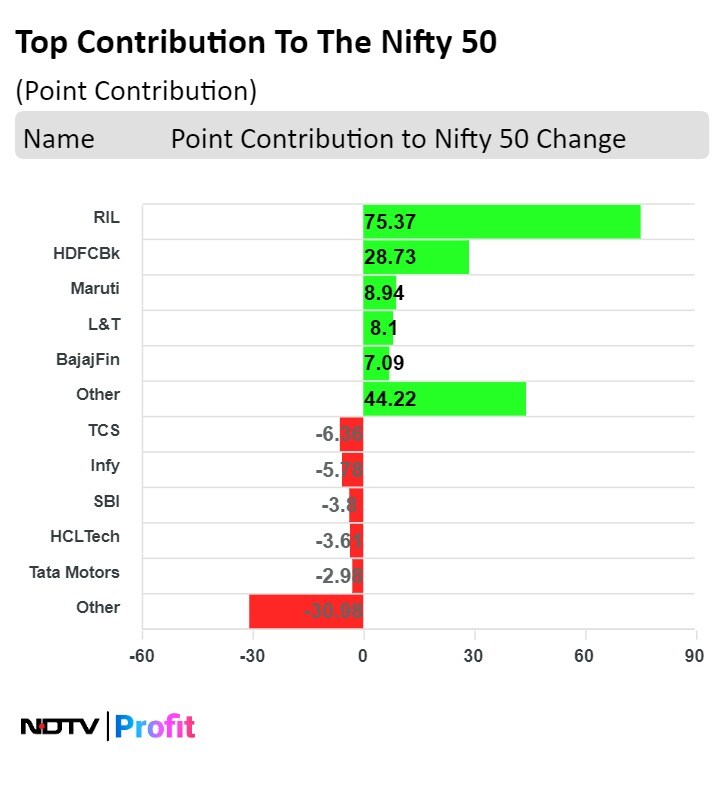

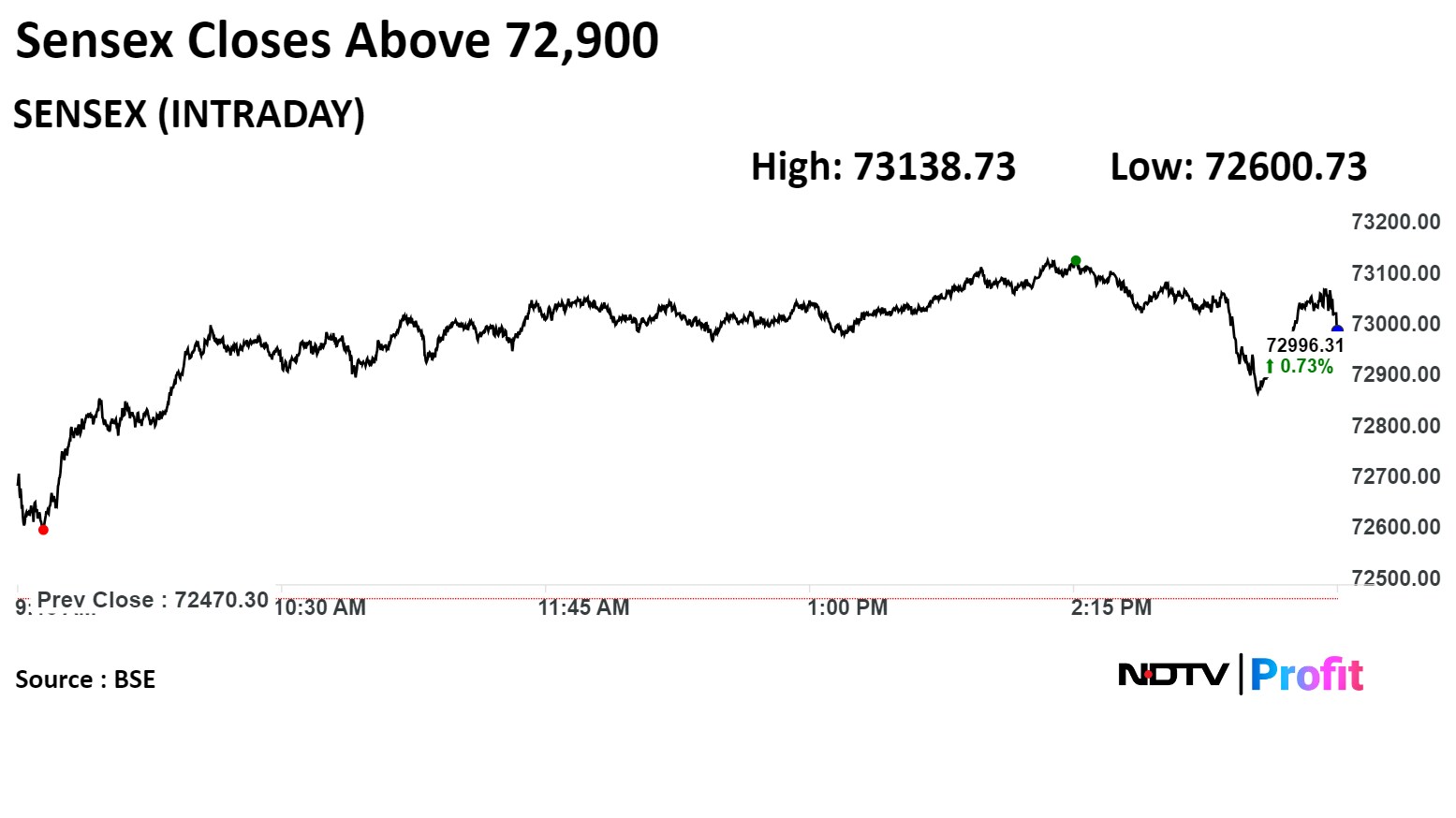

Reliance Industries Ltd., HDFC Bank Ltd., Maruti Suzuki India Ltd., Larsen & Toubro Ltd. and Bajaj Finance Ltd. assisted the upward movement of the index.

Tata Motors Ltd., HCL Technologies Ltd., State Bank of India, Infosys Ltd., and Tata Consultancy Services Ltd. capped gains in the index.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

Reliance Industries Ltd., HDFC Bank Ltd., Maruti Suzuki India Ltd., Larsen & Toubro Ltd. and Bajaj Finance Ltd. assisted the upward movement of the index.

Tata Motors Ltd., HCL Technologies Ltd., State Bank of India, Infosys Ltd., and Tata Consultancy Services Ltd. capped gains in the index.

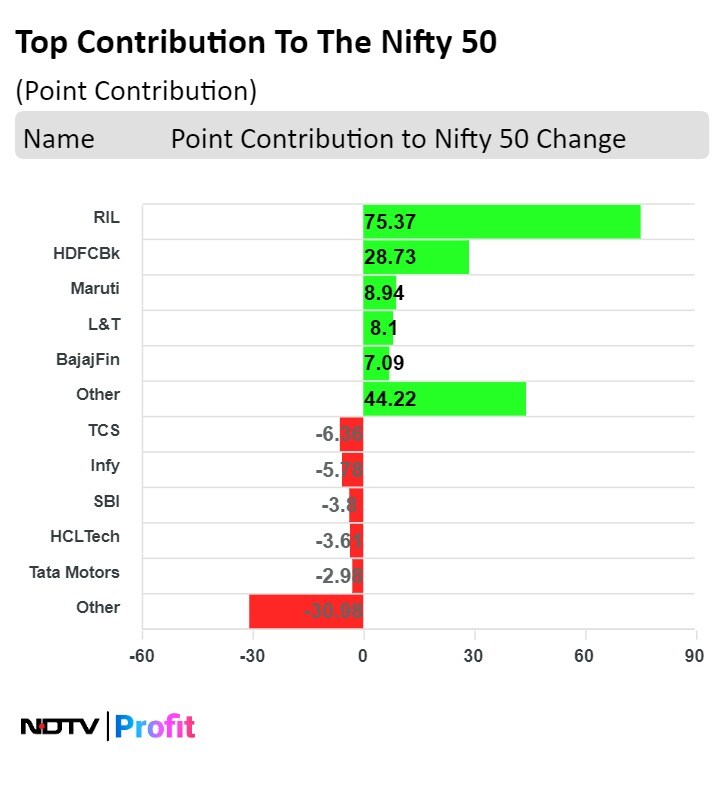

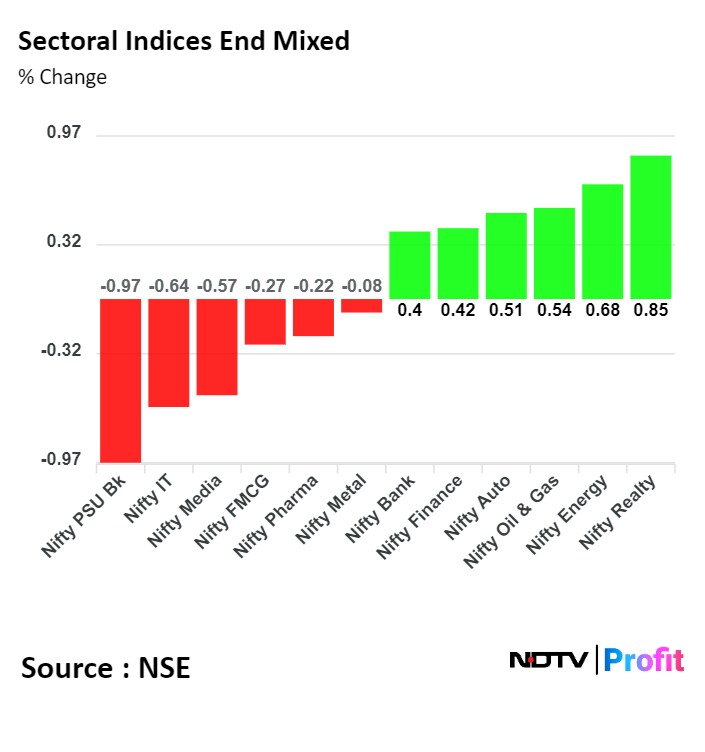

On NSE, six sectors advanced, and six sectors declined. The NSE Nifty Realty was the top performing sectors, while the NSE Nifty PSU Bank fell the most.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

Reliance Industries Ltd., HDFC Bank Ltd., Maruti Suzuki India Ltd., Larsen & Toubro Ltd. and Bajaj Finance Ltd. assisted the upward movement of the index.

Tata Motors Ltd., HCL Technologies Ltd., State Bank of India, Infosys Ltd., and Tata Consultancy Services Ltd. capped gains in the index.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

India's benchmark indices recouped losses to continue their rally, tracking recovery in heavyweight in Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 settled 143.25 points or 0.65% higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points or 0.73% up at 72,996.31.

Intraday, the NSE Nifty 50 scaled a high of 22,193.60, and the S&P BSE Sensex rose to a high 73,138.73.

"We are of the view that, the market texture is bullish but in the near future 20 day Simple Moving Day Average or 22,170/73,100 would act as a key resistance for the bulls. Above which, the market could move up till 22,300-22,350/73,400-73,500. On the flip side, below 22080/72800 the sentiment could change. Below which the market could retest the level of 50 day SMA or 21,950-21,900/72,500-72,400," Shrikant Chouhan, head equity research, Kotak Securities.

Reliance Industries Ltd., HDFC Bank Ltd., Maruti Suzuki India Ltd., Larsen & Toubro Ltd. and Bajaj Finance Ltd. assisted the upward movement of the index.

Tata Motors Ltd., HCL Technologies Ltd., State Bank of India, Infosys Ltd., and Tata Consultancy Services Ltd. capped gains in the index.

On NSE, six sectors advanced, and six sectors declined. The NSE Nifty Realty was the top performing sectors, while the NSE Nifty PSU Bank fell the most.

Broader markets ended on a mixed note. The S&P BSE Midcap ended flat, and the S&P BSE Smallcap ended 0.70% higher.

On BSE, six sectors declined, and 14 sectors advanced. The S&P BSE TECK index fell the most among sectoral indices. The S&P BSE Services was the best performing sector.

Market breadth was skewed in favour of sellers. Around 2,308 stocks declined, around 1,531 stocks advanced, and 110 remained unchanged on BSE.

Chalet Hotels Ltd. has opened QIP for raising up to Rs 2,000 crore.

It sets floor price at Rs 780.76 per share.

Source: Exchange filing

Welspun Corp Ltd.'s unit to invest Rs 2,355 crore is to set up manufacturing units in Telangana, Odisha, Madhya Pradesh, J&K.

Investment for manufacturing plastic pipes and water storage with total capacity of 2 lakh metric ton.

Source: Exchange Filing

Vodafone Idea Ltd. launched new entertainment app with more than13+ OTT platforms, 400 TV channels.

New entertainment app priced at Rs 202 for prepaid users and Rs 199 for postpaid users.

Source: Press Release

Zaggle Prepaid Ocean Services Ltd. has signed a pact with Riya Travel & Tours for travel and expense management solutions.

Source: Exchange Filing

Tata Motors Ltd.'s electric mobility unit has partnered with HPCL to set up EV charging stations at the fuel retailer’s petrol pumps across India.

Tata Motors and HPCL has signed a MoU for EV charging infra.

This tie-up to leverage HPCL’s fuel stations across India.

The tie-up is to explore a new payment system for EV charging via co-branded RFID card.

HPCL aims to install 5,000 EV charging stations by Dec 2024 from 3,000-odd at present.

Tata Motors is the biggest electric carmaker with 68% market share

HPCL has 21,500 fuel stations across India.

Source: Company statement

IPCA Laboratories Ltd. has signed a tech transfer pact with Omexa Formulary to develop anti-cancer biosimilar for global markets

Source: Exchange Filing

Lupin Ltd. received an income tax demand worth Rs 477.3 crore for AY22.

Source: Exchange Filing

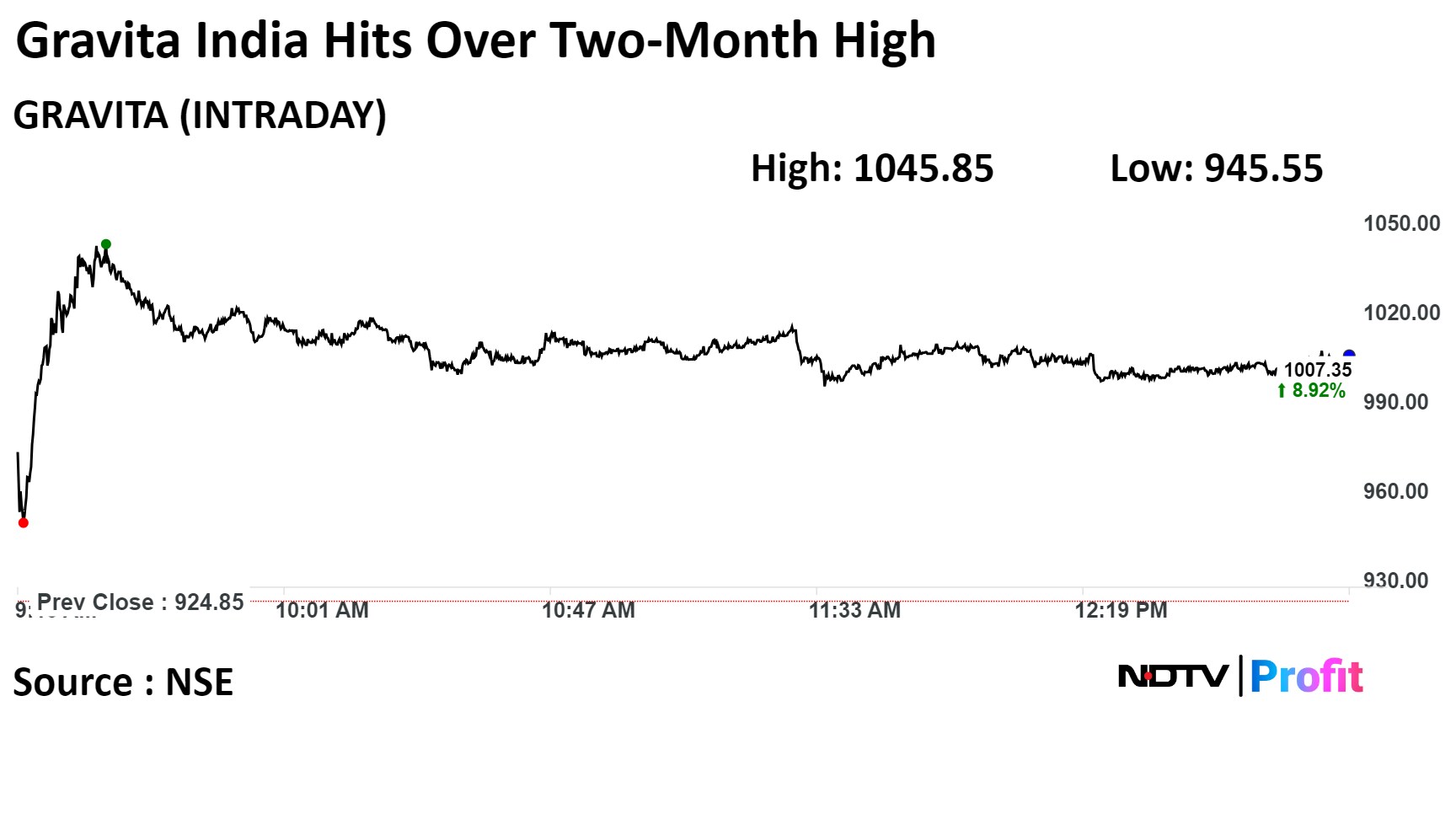

Gravita India's stock jumped to hit an over two month-high today as industry tailwinds and inferior competition drove Kotak Institutional Equities to initiate coverage on the stock with a 'buy' rating.

The brokerage's fair value of Rs. 1,200 implies an upside of 29.75% from Tuesday's closing price.

Gravita India's stock jumped to hit an over two month-high today as industry tailwinds and inferior competition drove Kotak Institutional Equities to initiate coverage on the stock with a 'buy' rating.

The brokerage's fair value of Rs. 1,200 implies an upside of 29.75% from Tuesday's closing price.

The scrip rose as much as 13.08% to Rs 1,045.85 apiece, the highest level since Jan 17. It pared gains to trade 8.9% higher at Rs 1,005.90 apiece, as of 1:09 p.m. This compares to a 0.7% advance in the NSE Nifty 50 Index.

It has risen 107.37% on a year-to-date basis. Total traded volume so far in the day stood at 7.47 times its 30-day average. The relative strength index was at 65.79.

Three analysts tracking the company have a 'buy' rating for the stock according to Bloomberg data. The average 12-month consensus price target implies an upside of 36%.

Zee Entertainment Enterprises Ltd. had its 1.8% equities change hands in five bunch trades.

Source: Bloomberg

Tata Steel Ltd. has approved allotment of NCDs aggregating to Rs 2,700 crore.

Source: Exchange Filing

Shatki Pumps India Ltd. raised Rs 200 crore via QIP.

QIBs include LIC Mutual Fund and SBI Mutual Fund.

Source: Exchange filing

Usha Martin Ltd. appointed Abhijit Paul as CFO effective May 1.

The company accepted resignation of CFO Anirban Sanyal effective April 30.

Source: Exchange Filing

Rites Ltd. opened a branch office in Abu Dhabi, UAE.

Source: Exchange Filing

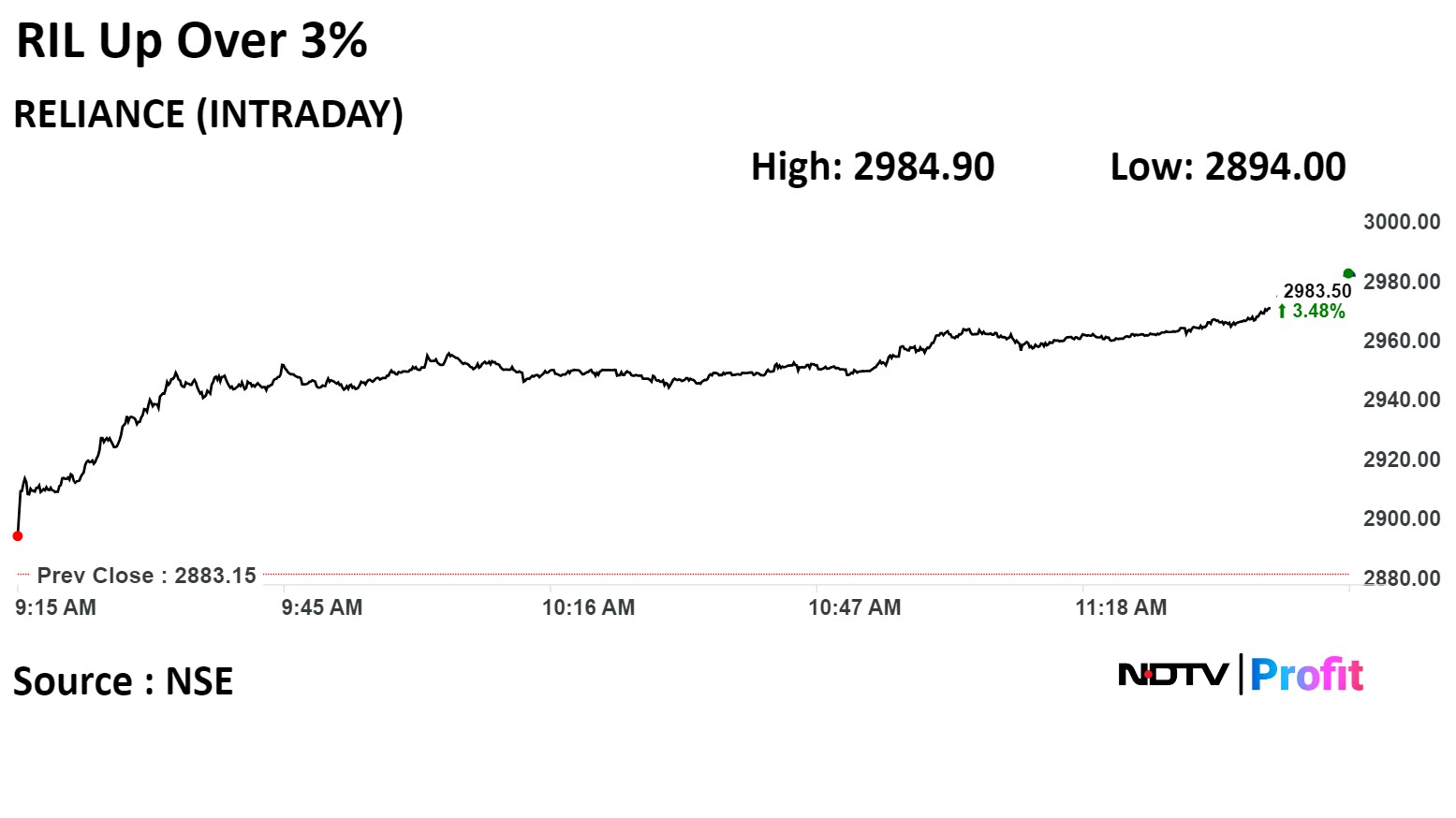

Reliance Industries Ltd. rose as much as 3.53% to Rs 2,984.90 apiece, the highest level since March 7. It was trading 3.39% higher at Rs 2,980.80 apiece, as of 11:52 a.m. This compares to a 0.79% advance in the NSE Nifty 50 Index.

It has risen 46.23% in 12 months. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 58.95.

Out of 35 analysts tracking the company, 29 maintain a 'buy' rating, four recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.1%.

Reliance Industries Ltd. rose as much as 3.53% to Rs 2,984.90 apiece, the highest level since March 7. It was trading 3.39% higher at Rs 2,980.80 apiece, as of 11:52 a.m. This compares to a 0.79% advance in the NSE Nifty 50 Index.

It has risen 46.23% in 12 months. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 58.95.

Out of 35 analysts tracking the company, 29 maintain a 'buy' rating, four recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.1%.

Adani Group stocks added as much as Rs 32,753.14 crore in investor wealth, taking their total market capitalisation to Rs 15.92 lakh crore during the day.

At 11:27 p.m., the shares added Rs 18,059 crore to investor wealth at a market capitalisation of Rs 15.77 lakh crore.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

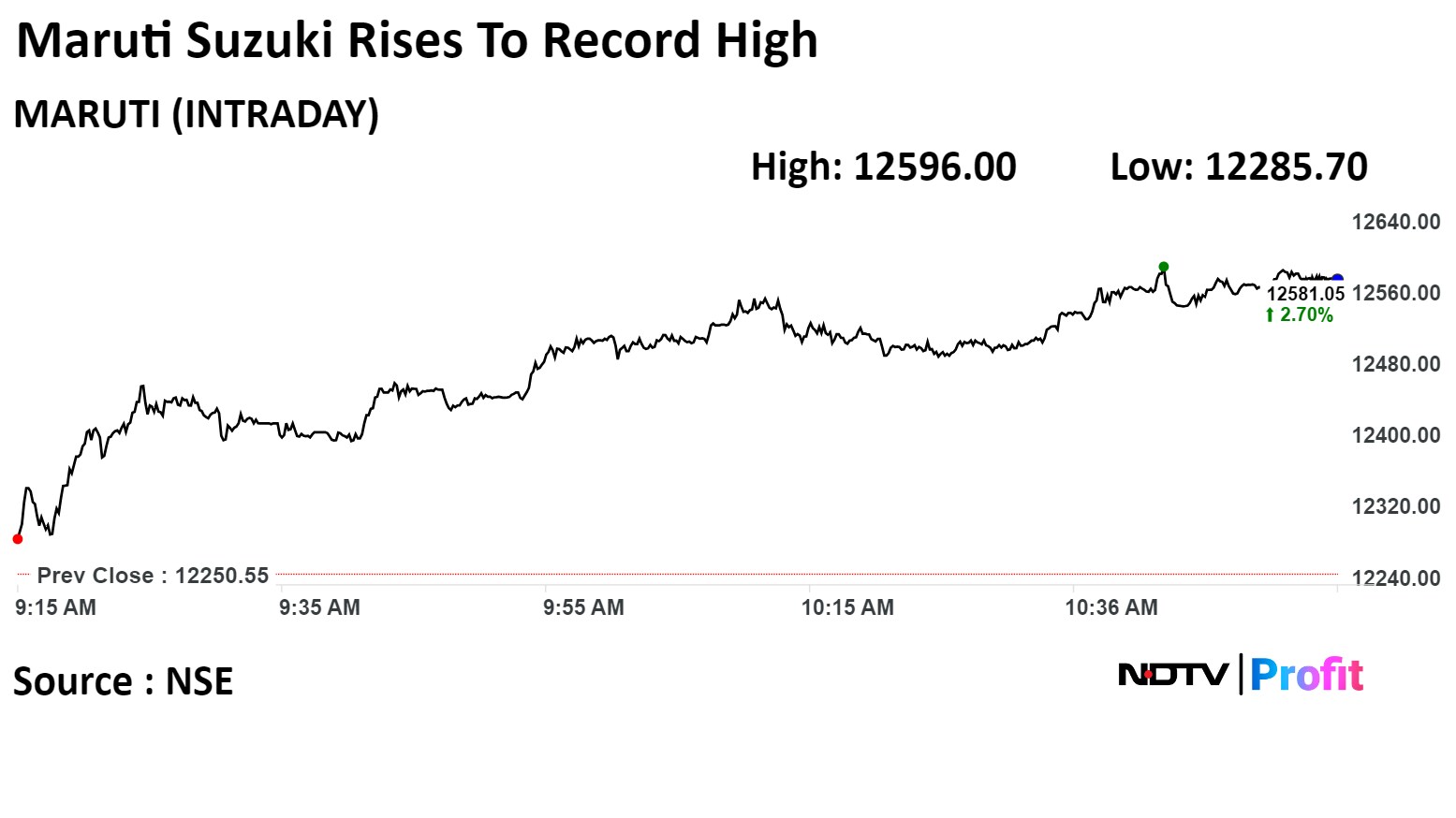

Maruti Suzuki India Ltd. rose 2.82% to Rs 12,596.00, the highest level since its listing on Jul 9, 2003. It was trading 2.69% up at Rs 12,580.15 as of 11:01 a.m., as compared to 0.68% advance in the NSE Nifty 50 index.

The scrip has risen 52.34% in 12 months. Total traded volume so far in the day stood at 2.3 times its 30-day average. The relative strength index was at 75.38, which implied the stock is overbought.

Out of 50 analysts tracking the company, 41 maintain a 'buy' rating, six recommend a 'hold', and three suggest 'Sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 3.7%.

Maruti Suzuki India Ltd. rose 2.82% to Rs 12,596.00, the highest level since its listing on Jul 9, 2003. It was trading 2.69% up at Rs 12,580.15 as of 11:01 a.m., as compared to 0.68% advance in the NSE Nifty 50 index.

The scrip has risen 52.34% in 12 months. Total traded volume so far in the day stood at 2.3 times its 30-day average. The relative strength index was at 75.38, which implied the stock is overbought.

Out of 50 analysts tracking the company, 41 maintain a 'buy' rating, six recommend a 'hold', and three suggest 'Sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 3.7%.

Caplin Point Laboratories Ltd.'s unit commenced operation of Oncology facility near Chennai.

Investment commitment for facility stands at Rs 150 crore.

Source: Exchange Filing

Larsen & Toubro Ltd. received orders in the range of Rs 2,500-5,000 crore for buildings & factories business in domestic and international markets.

Source: Exchange Filing

Shriram Value Services raised stake in Shriram Finance Co. Ltd. to 5.53% from 3.46%.

Shriram Value Services bought 2.07% stake in the company from promoter Shriram Ownership Trust.

Source: Exchange Filing.

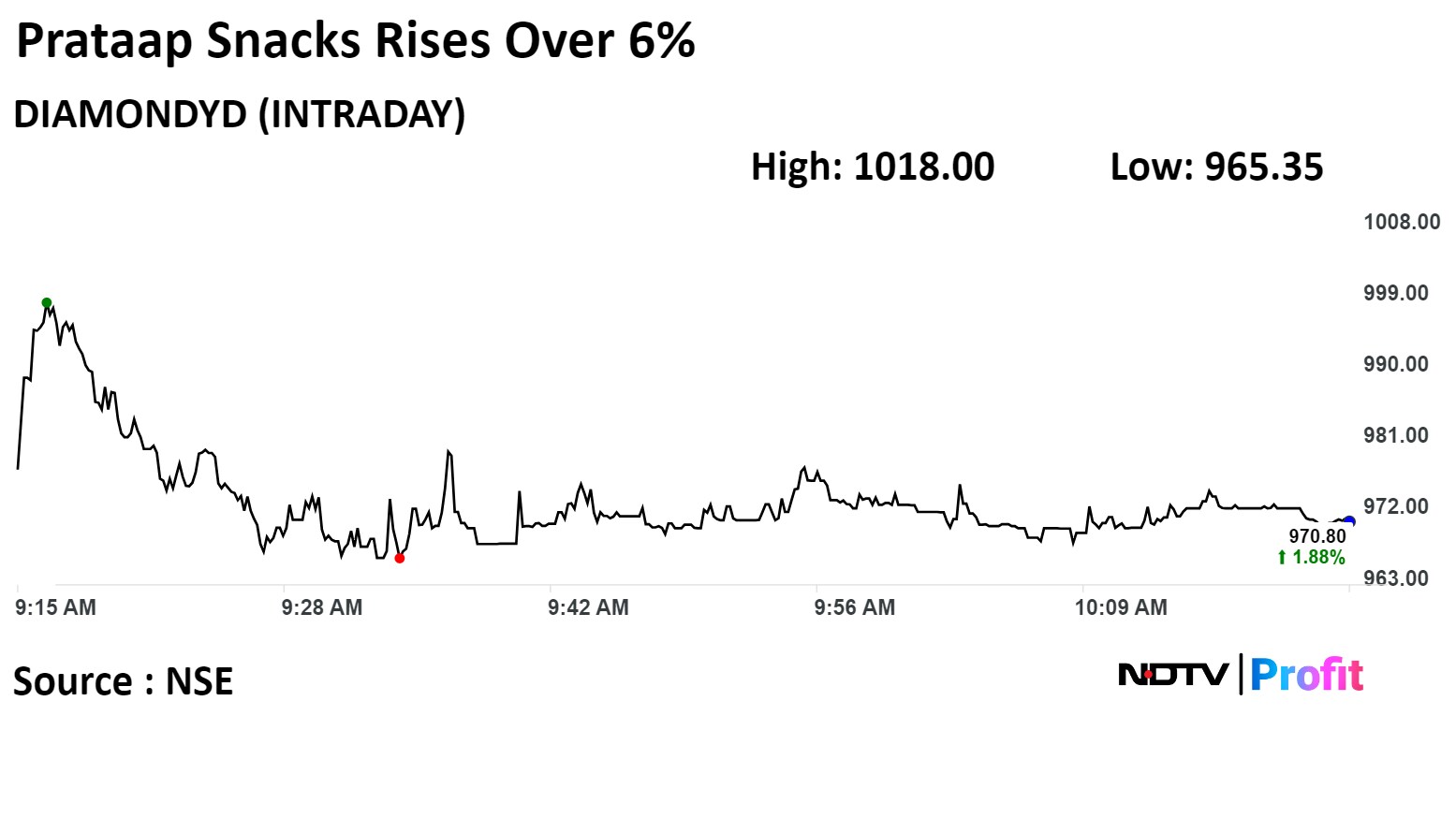

Prataap Snacks Ltd. rose 6.84% to Rs 1,018.00, the highest level since March 12 on NSE. It pared gains to trade 1.96% higher at Rs 971.50 as of 10:26 a.m. This compares to 0.64% advance in the NSE Nifty 50 index.

The popular yellow diamond crisp maker has started commercial production unit at Samba in Jammu & Kashmir.

The unit with a capacity of 10,000 metric ton intends to produce namkeen snacks, fried namkeen pellets, and other namkeen snacks including popcorn, the company said in an exchange filing.

It has risen 42.95% in 12 months. Total traded volume so far in the day stood at 1.1 times its 30-day average. The relative strength index was at 37.41.

Out of three analysts tracking the company, two maintain a 'buy' rating, one recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 19.9%.

Prataap Snacks Ltd. rose 6.84% to Rs 1,018.00, the highest level since March 12 on NSE. It pared gains to trade 1.96% higher at Rs 971.50 as of 10:26 a.m. This compares to 0.64% advance in the NSE Nifty 50 index.

The popular yellow diamond crisp maker has started commercial production unit at Samba in Jammu & Kashmir.

The unit with a capacity of 10,000 metric ton intends to produce namkeen snacks, fried namkeen pellets, and other namkeen snacks including popcorn, the company said in an exchange filing.

It has risen 42.95% in 12 months. Total traded volume so far in the day stood at 1.1 times its 30-day average. The relative strength index was at 37.41.

Out of three analysts tracking the company, two maintain a 'buy' rating, one recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 19.9%.

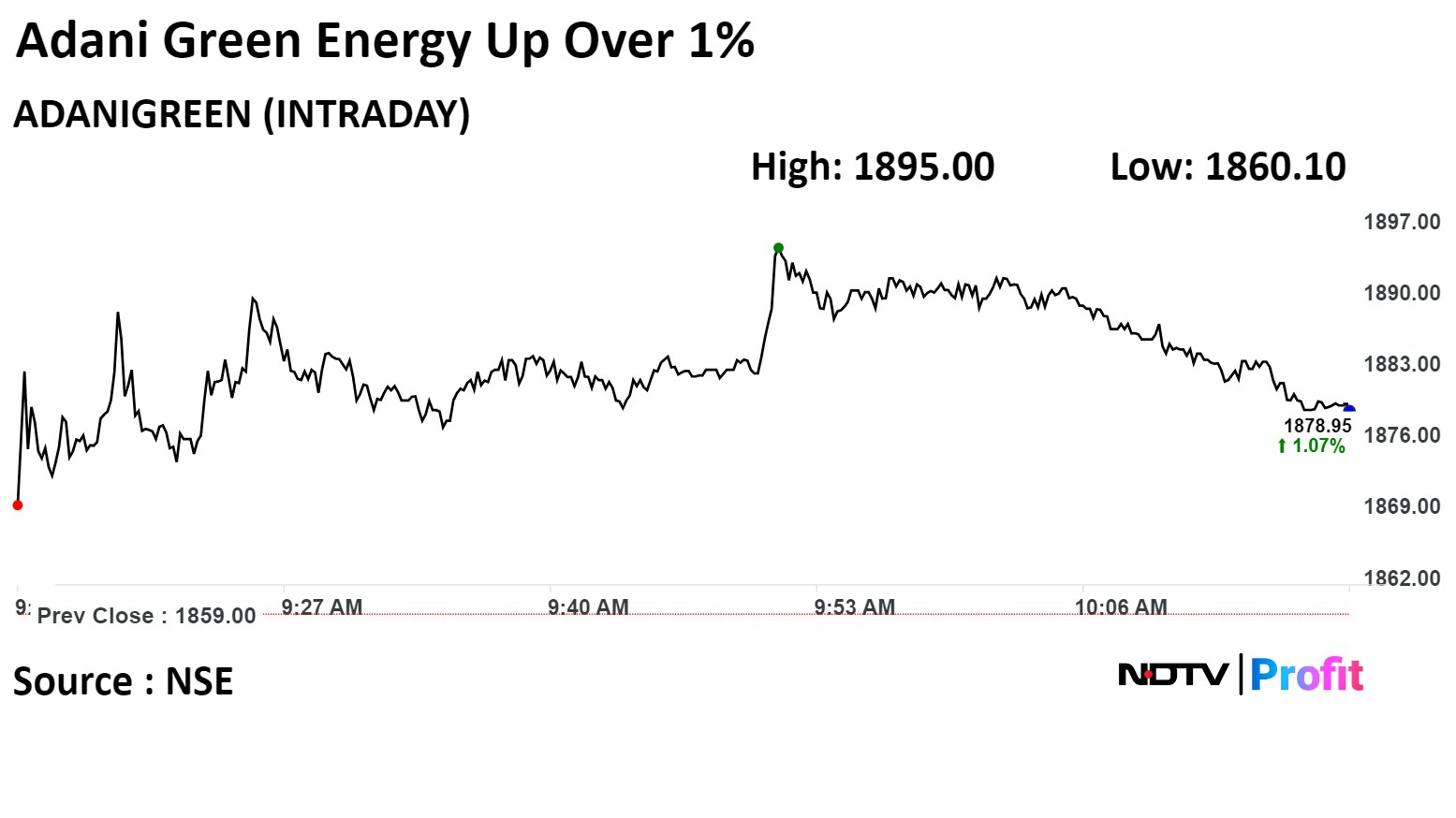

Adani Green Energy Ltd. had operationalised 180 MW solar power plant in Rajasthan.

Rajasthan plant has 25-year power purchase agreement with Solar Energy Corporation of India Ltd.

Rajasthan plant to produce 540 million units of electricity annually.

Source: Exchange Filing

Adani Green Energy Ltd. had operationalised 180 MW solar power plant in Rajasthan.

Rajasthan plant has 25-year power purchase agreement with Solar Energy Corporation of India Ltd.

Rajasthan plant to produce 540 million units of electricity annually.

Source: Exchange Filing

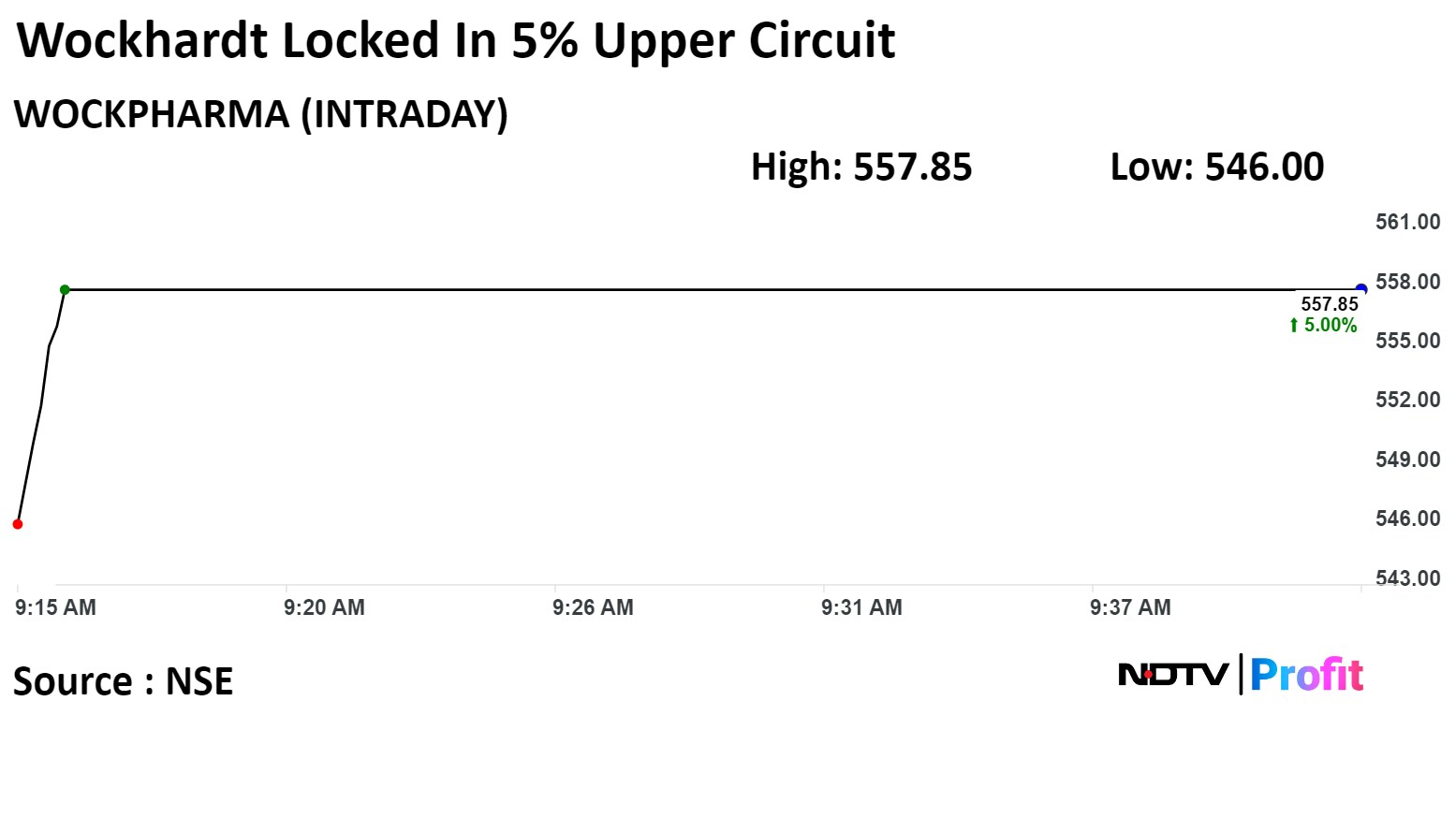

Wockhardt Ltd hit a 5.0% upper circuit and rose to Rs 557.85 apiece, the highest level since March 21. It remained locked in 5% upper circuit, as of 09:53 a.m. This compares to a 0.46% advance in the NSE Nifty 50 Index.

The company has raised Rs 480 crore through Qualified Institutional Placement from March 20 to March 26, the company said in the exchange filing.

It has risen 268.95% in 12 months. Total traded volume so far in the day stood at 0.4 times its 30-day average. The relative strength index was at 54.94.

Wockhardt Ltd hit a 5.0% upper circuit and rose to Rs 557.85 apiece, the highest level since March 21. It remained locked in 5% upper circuit, as of 09:53 a.m. This compares to a 0.46% advance in the NSE Nifty 50 Index.

The company has raised Rs 480 crore through Qualified Institutional Placement from March 20 to March 26, the company said in the exchange filing.

It has risen 268.95% in 12 months. Total traded volume so far in the day stood at 0.4 times its 30-day average. The relative strength index was at 54.94.

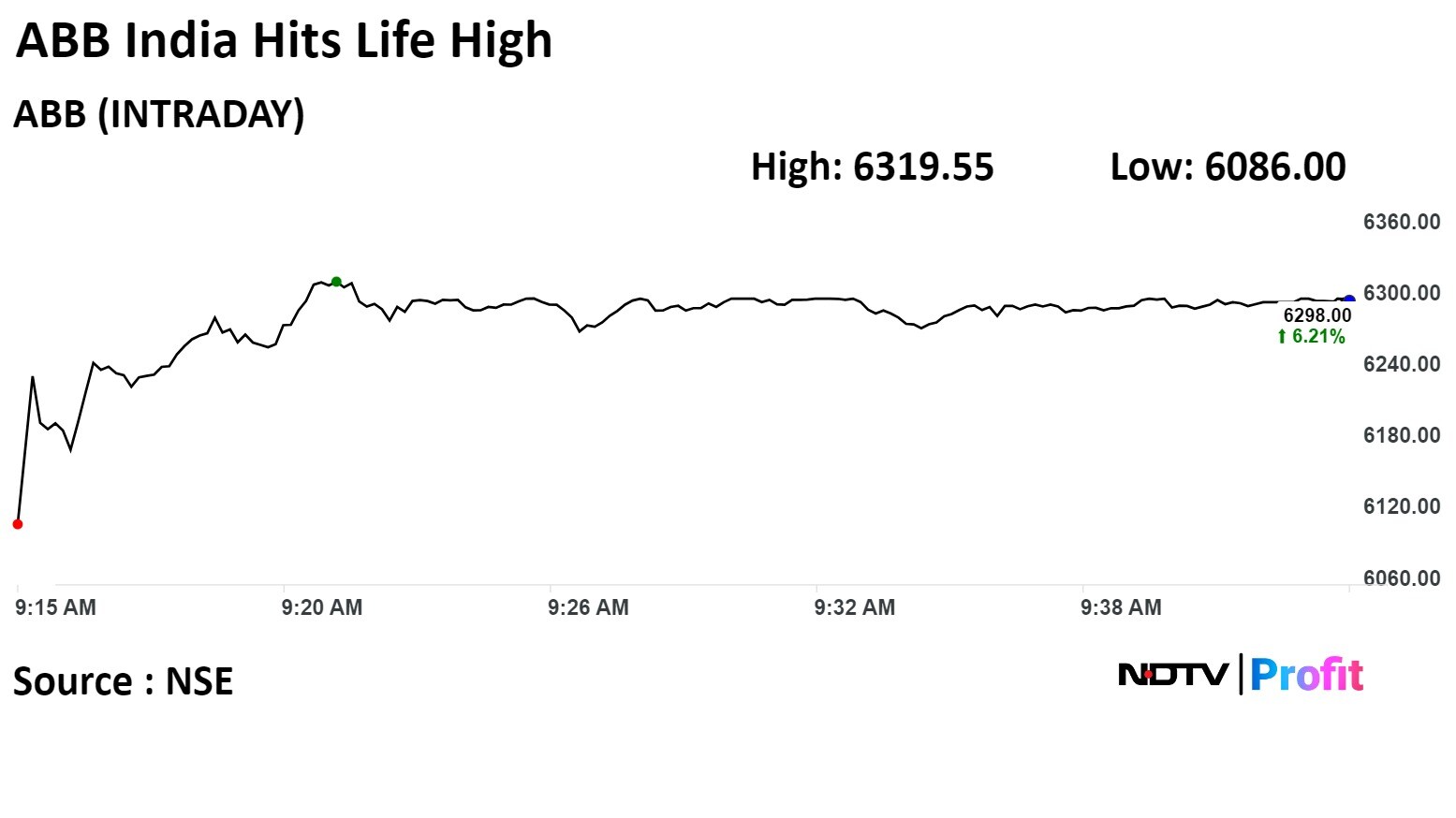

ABB India Ltd. rose 6.57% to Rs 6,319.55. It is trading 6.09% higher at Rs 6,219, compared to 0.44% advance on NSE Nifty 50 index.

UBS has maintained 'Buy' rating on ABB India Ltd., and raised the price target to Rs 7,550 from Rs 5,380 earlier. This implied an upside potential of 26%.

UBS expects margin improvement, which enhance the premium valuation.

The scrip has risen 89.28% in 12 months. Total traded volume so far in the day stood at 4.8 times its 30-day average. The relative strength index was at 76, indicating that stock may be overbought.

Out of 29 analysts tracking the company, 15 maintain a 'buy' rating, eight recommend a 'hold,' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside 16%.

ABB India Ltd. rose 6.57% to Rs 6,319.55. It is trading 6.09% higher at Rs 6,219, compared to 0.44% advance on NSE Nifty 50 index.

UBS has maintained 'Buy' rating on ABB India Ltd., and raised the price target to Rs 7,550 from Rs 5,380 earlier. This implied an upside potential of 26%.

UBS expects margin improvement, which enhance the premium valuation.

The scrip has risen 89.28% in 12 months. Total traded volume so far in the day stood at 4.8 times its 30-day average. The relative strength index was at 76, indicating that stock may be overbought.

Out of 29 analysts tracking the company, 15 maintain a 'buy' rating, eight recommend a 'hold,' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside 16%.

Central Depository Services India Ltd. has 77.2 lakh shares or 7.4% equity changed hands in a large trade, reported Bloomberg.

Buyers and sellers are not known immediately.

Central Depository Services India Ltd. has 77.2 lakh shares or 7.4% equity changed hands in a large trade, reported Bloomberg.

Buyers and sellers are not known immediately.

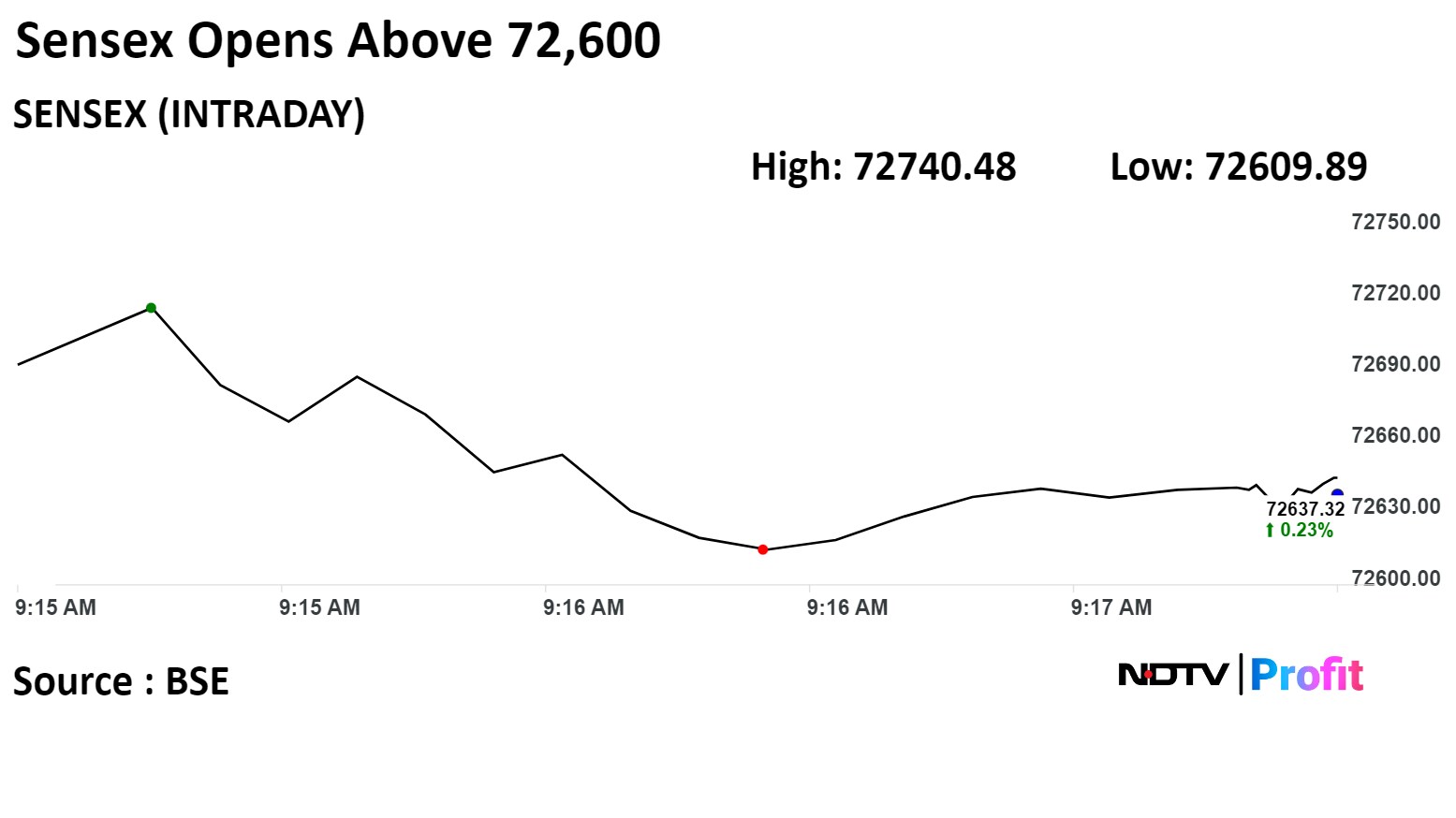

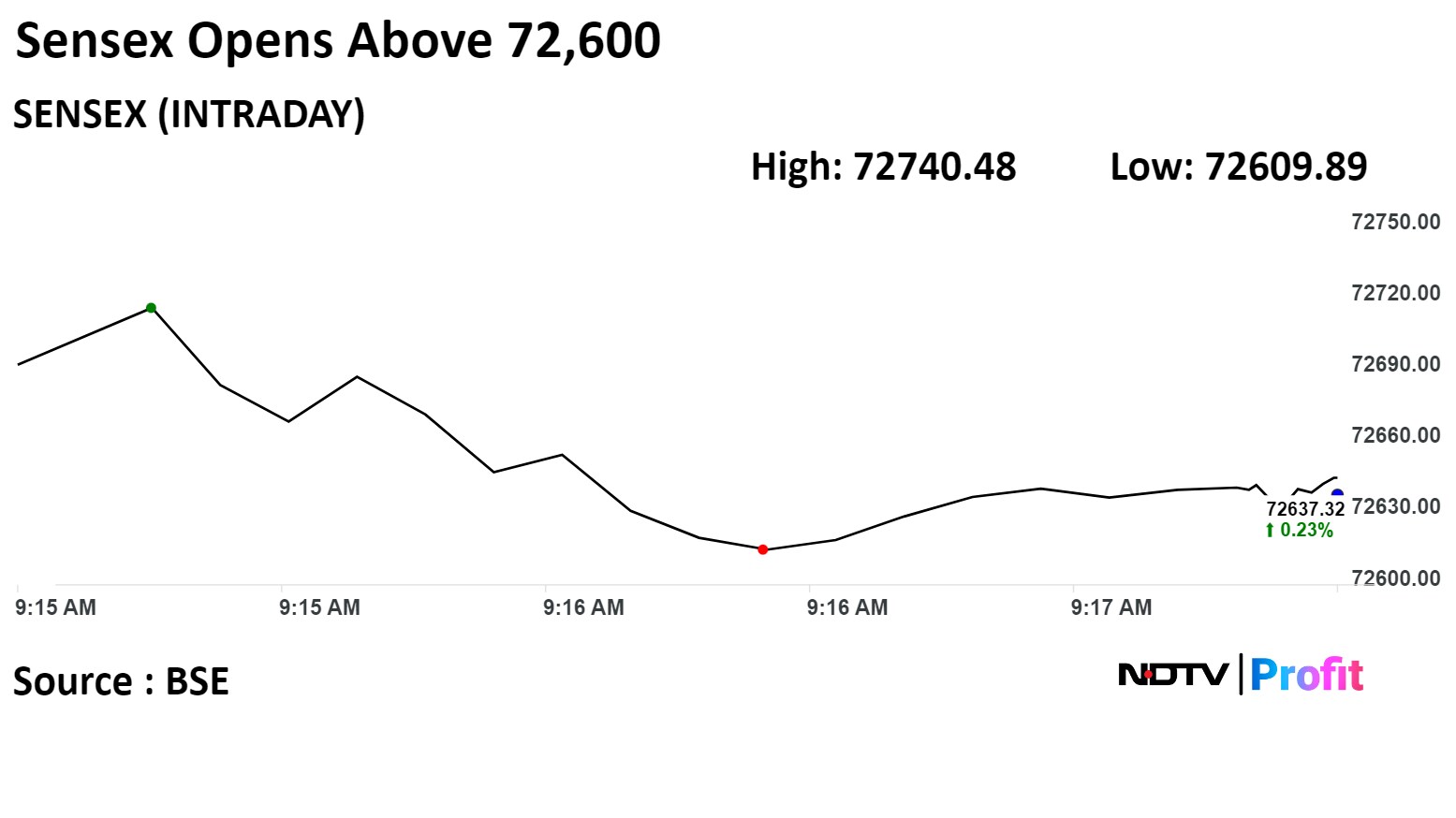

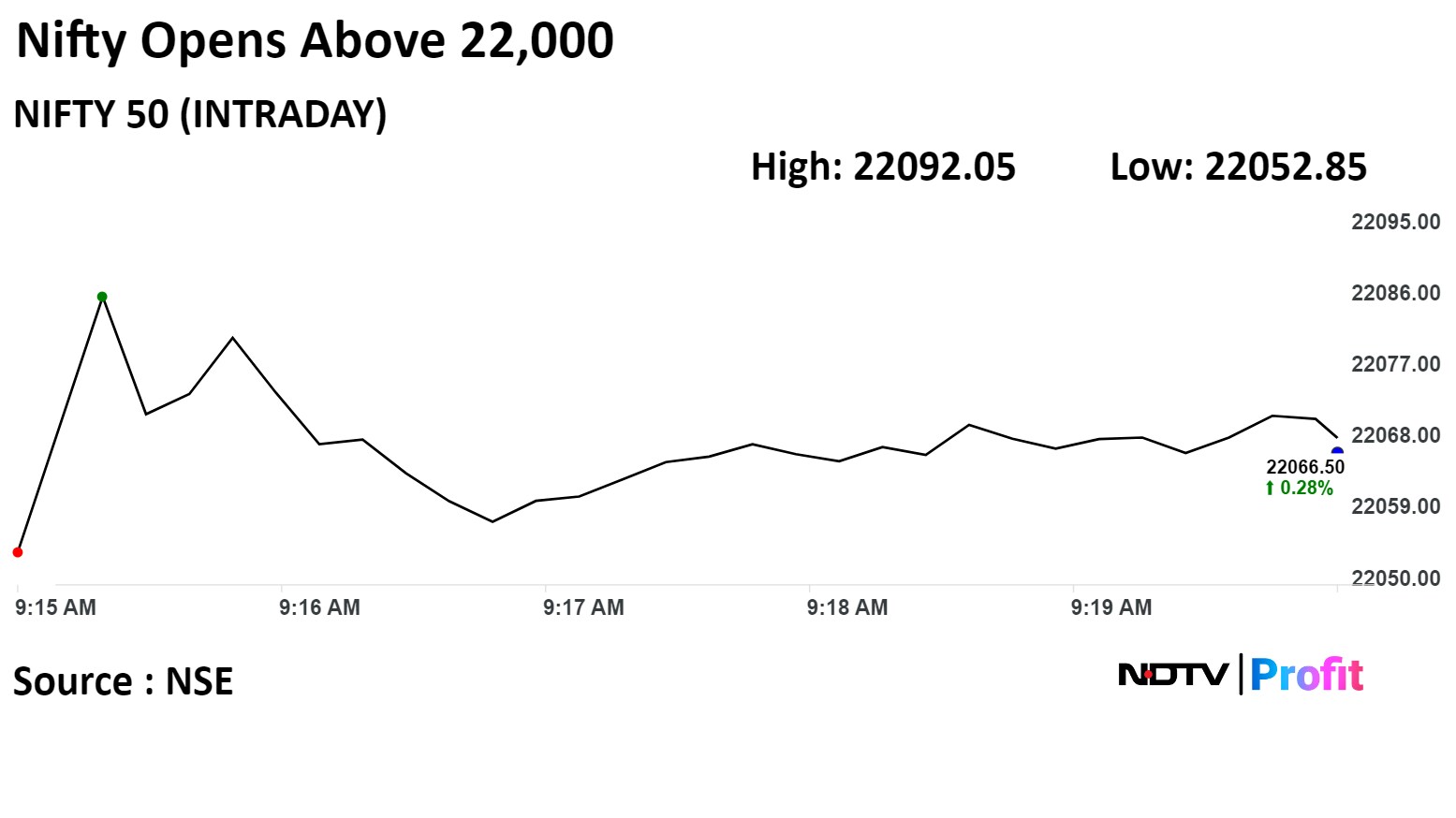

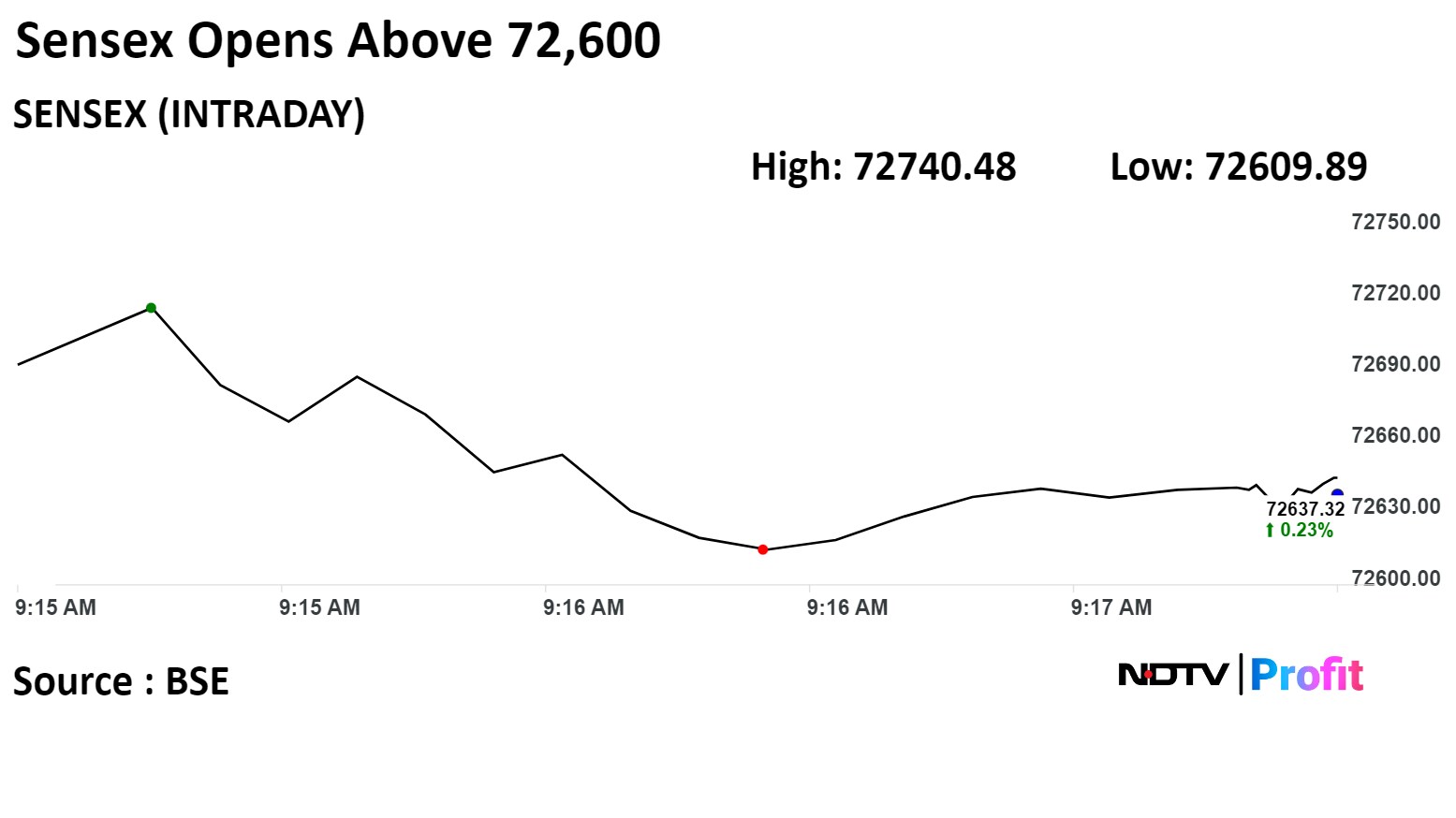

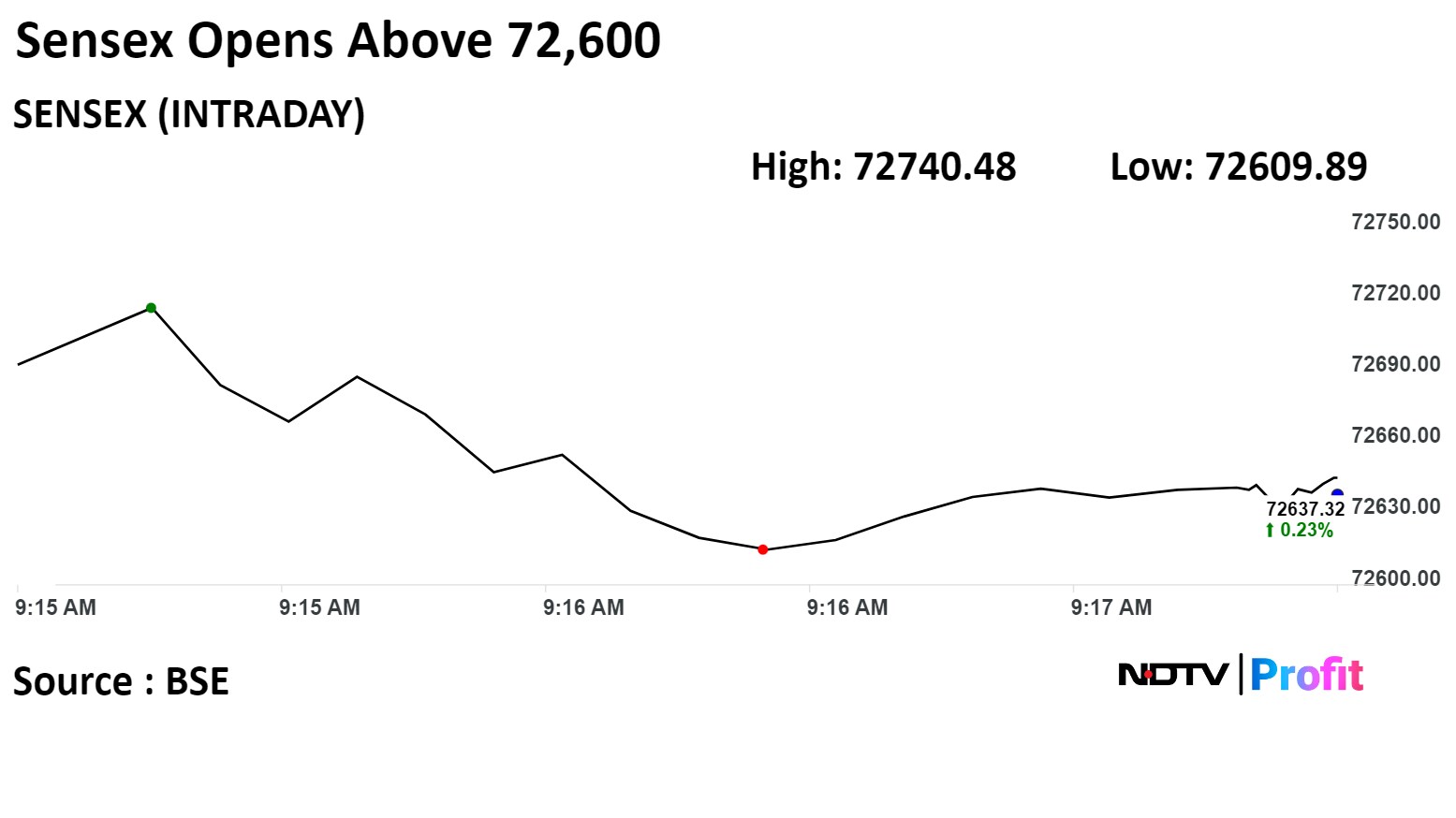

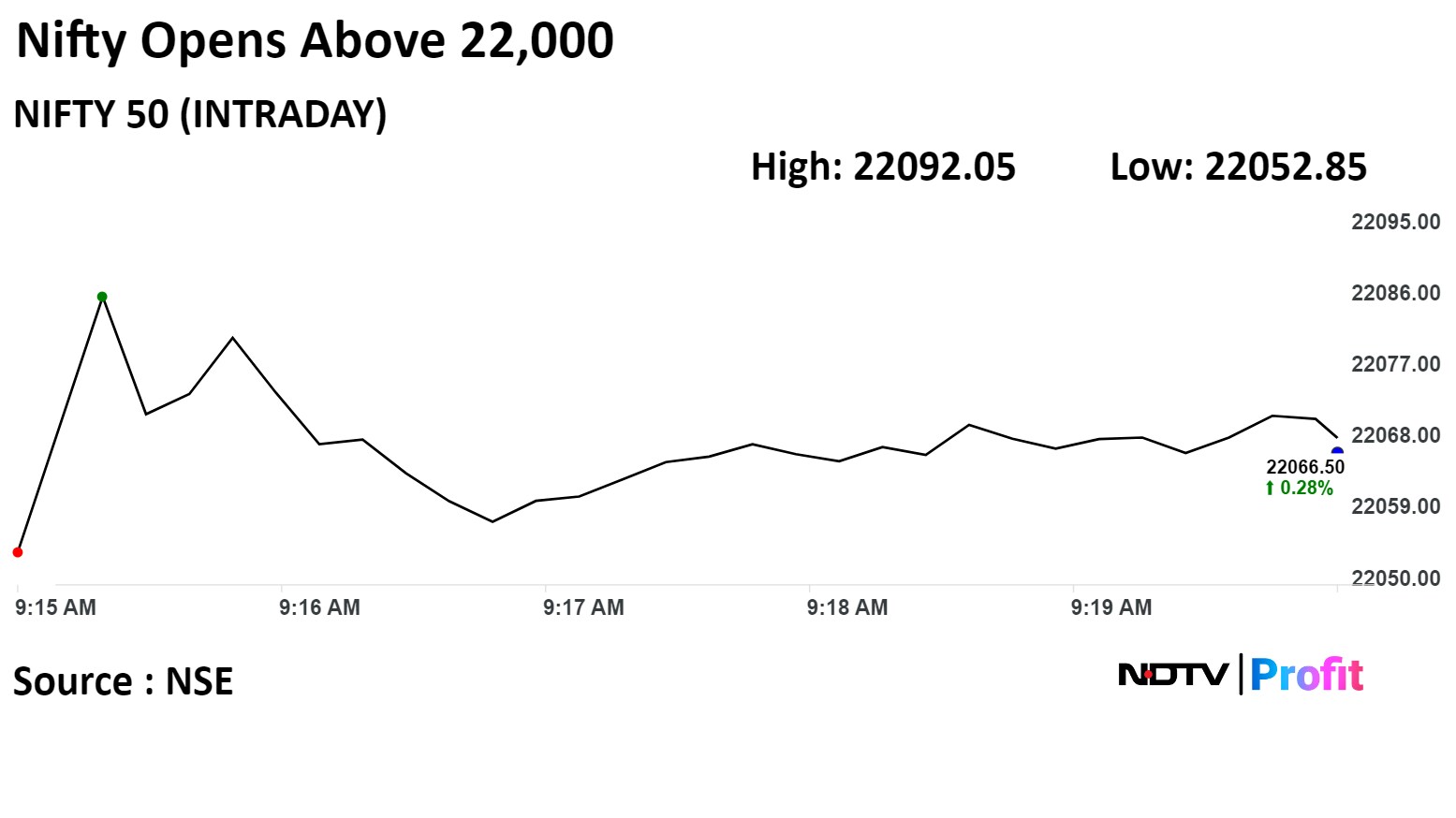

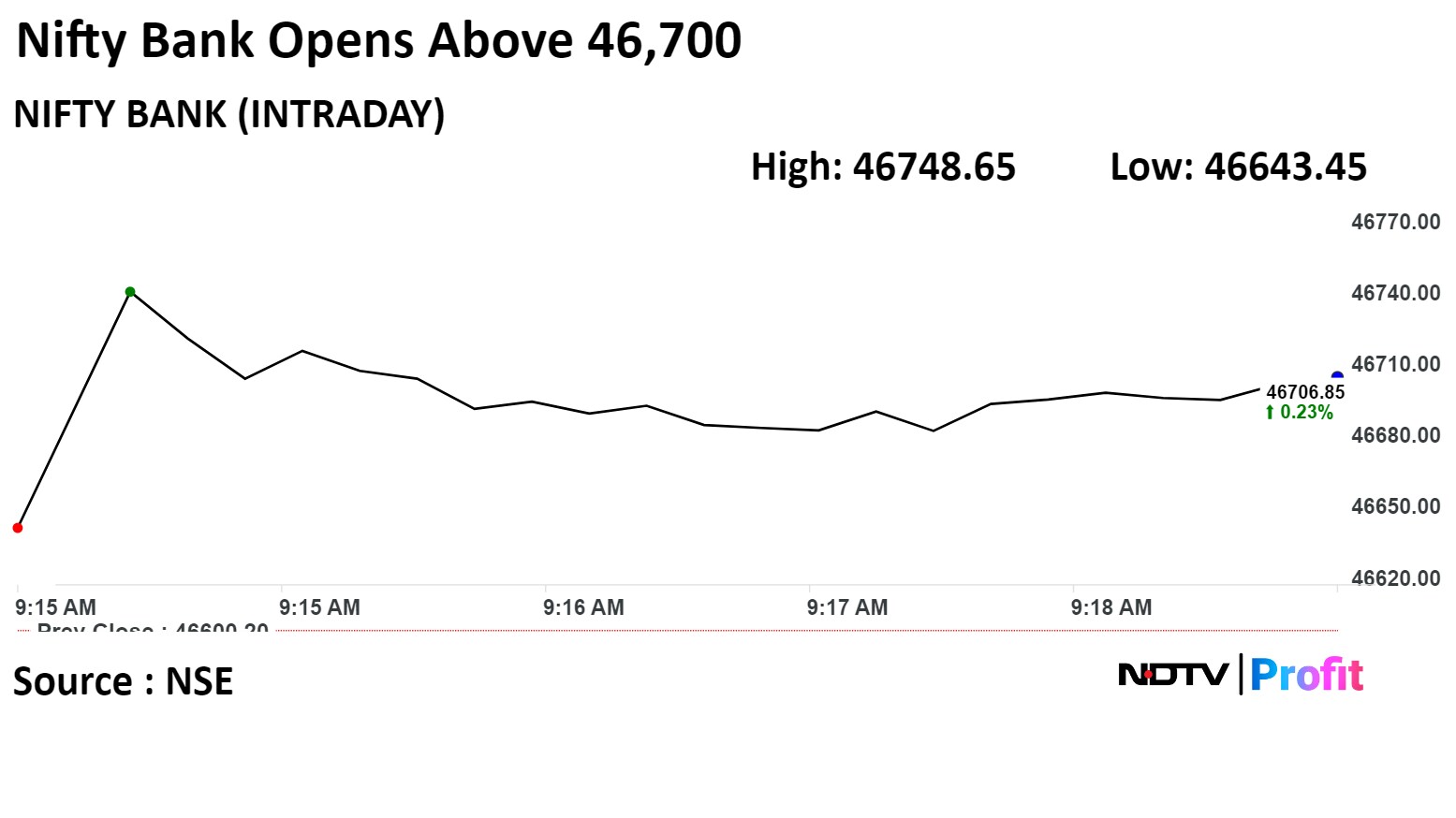

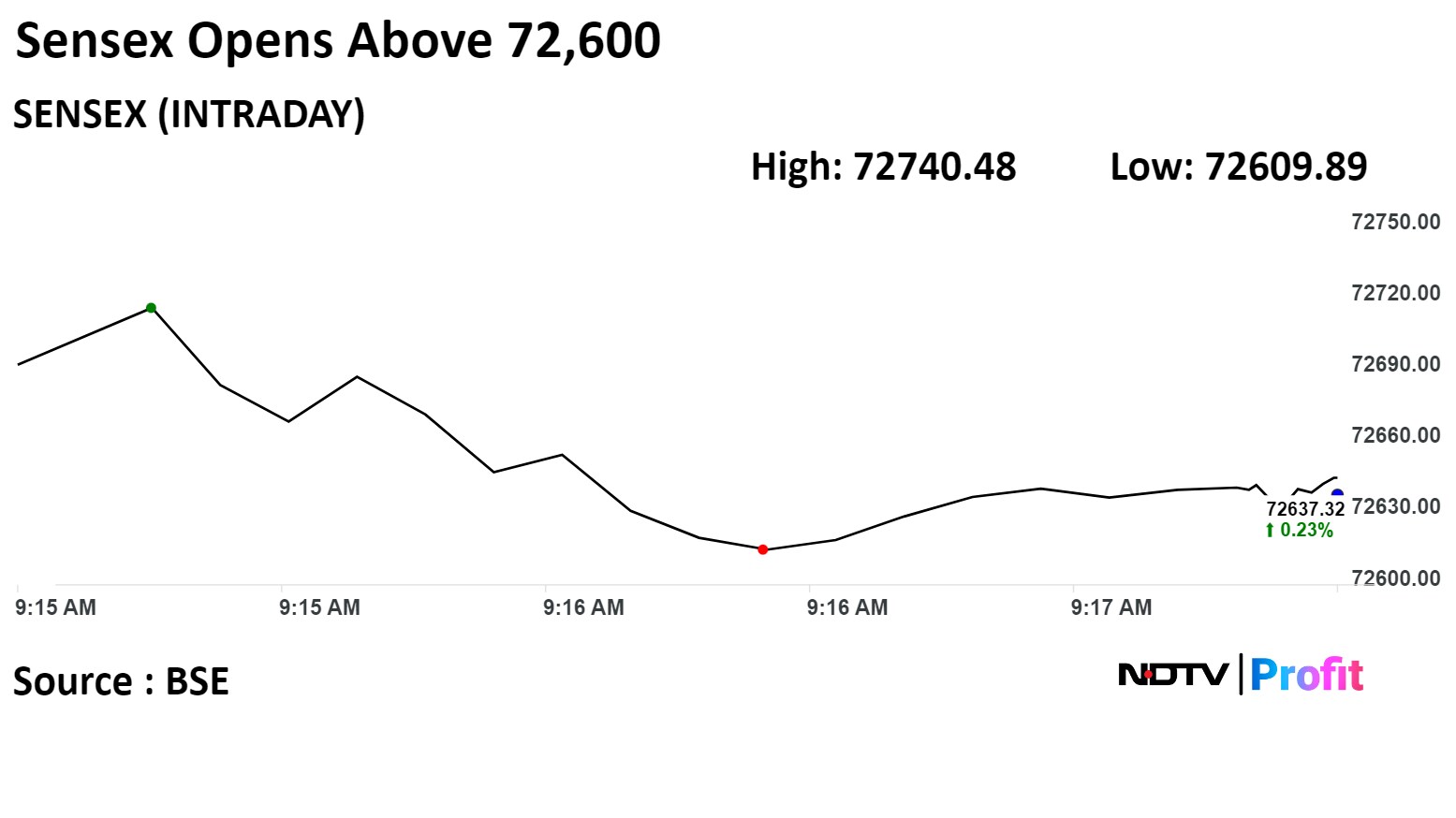

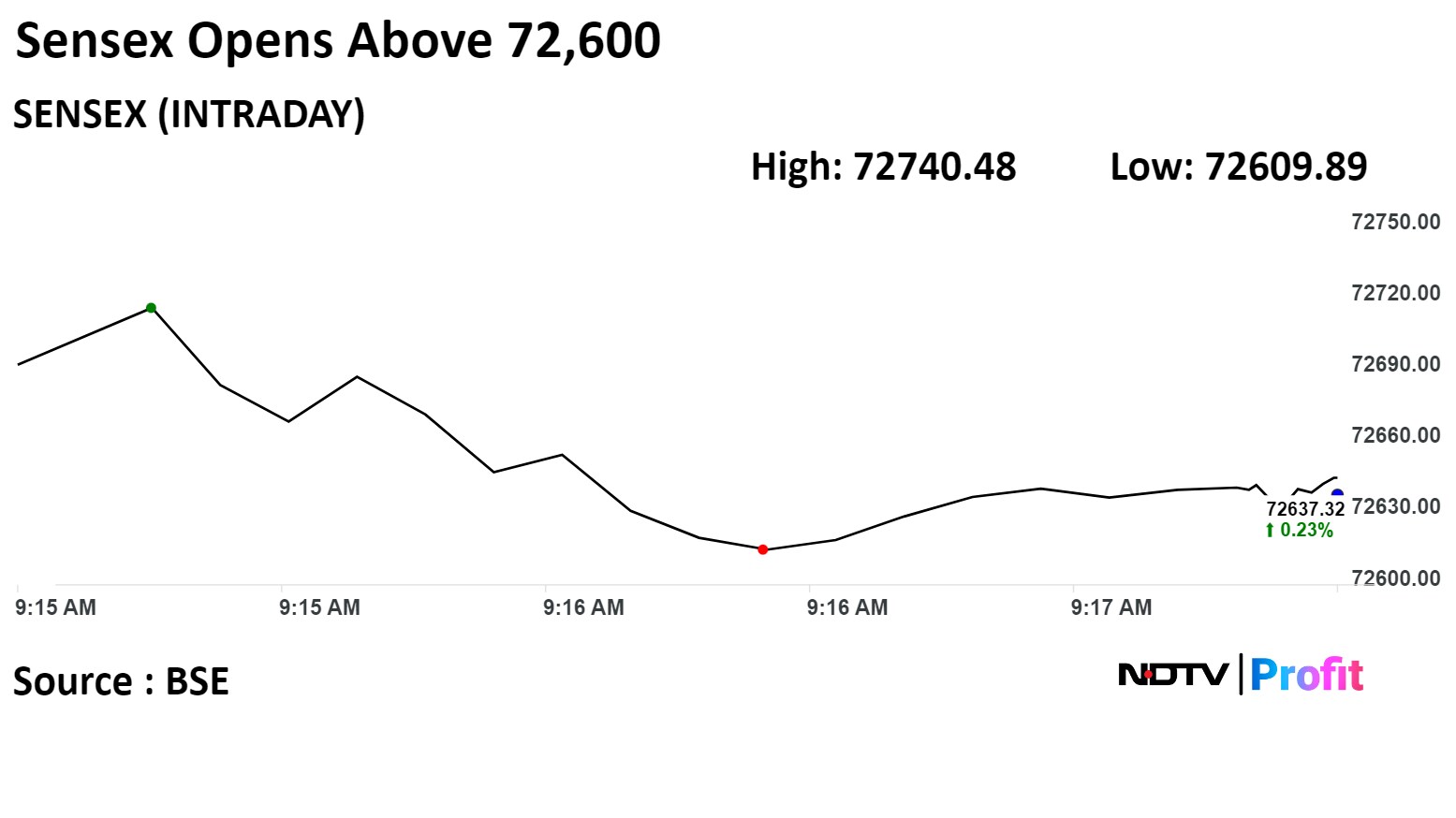

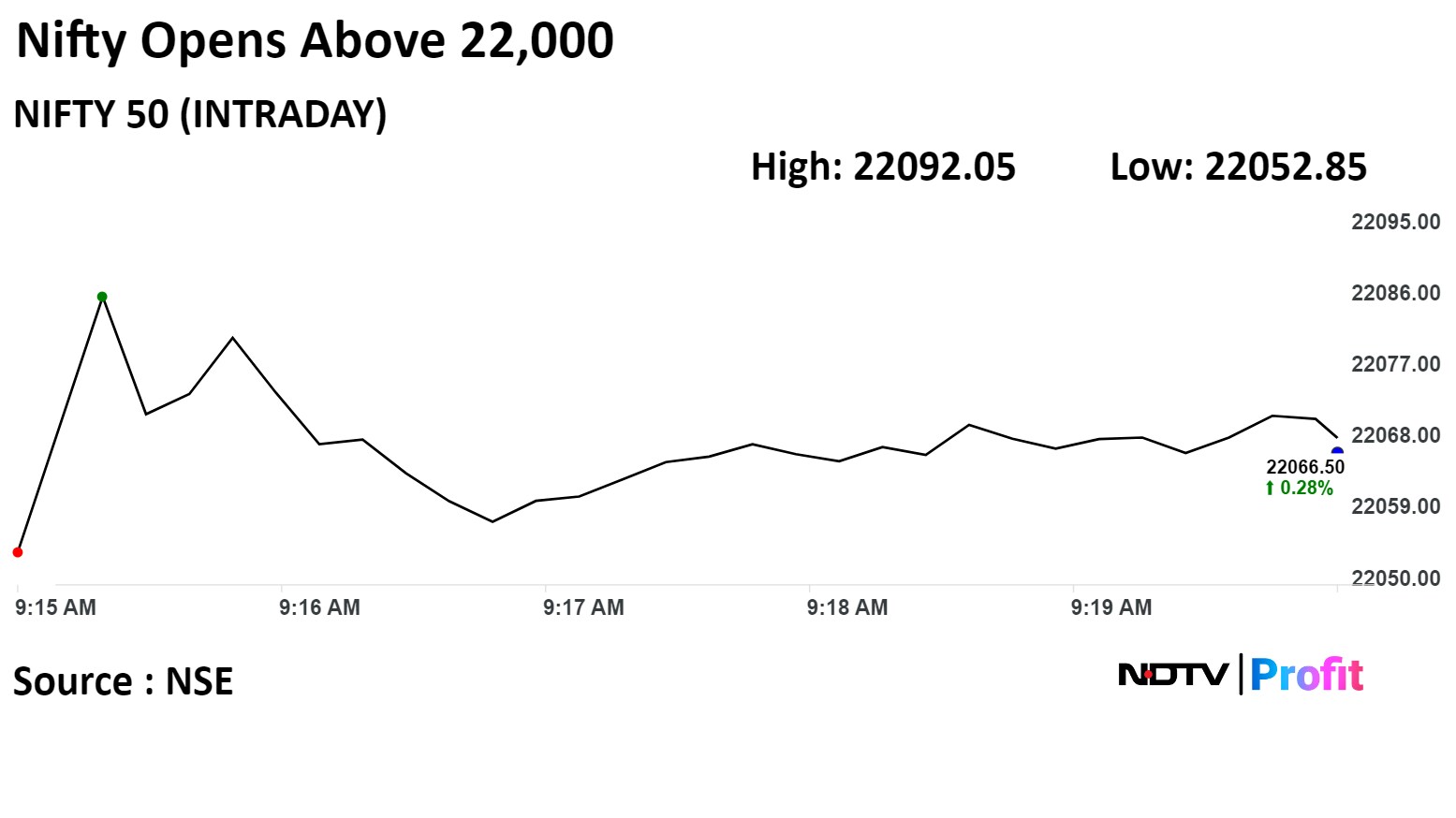

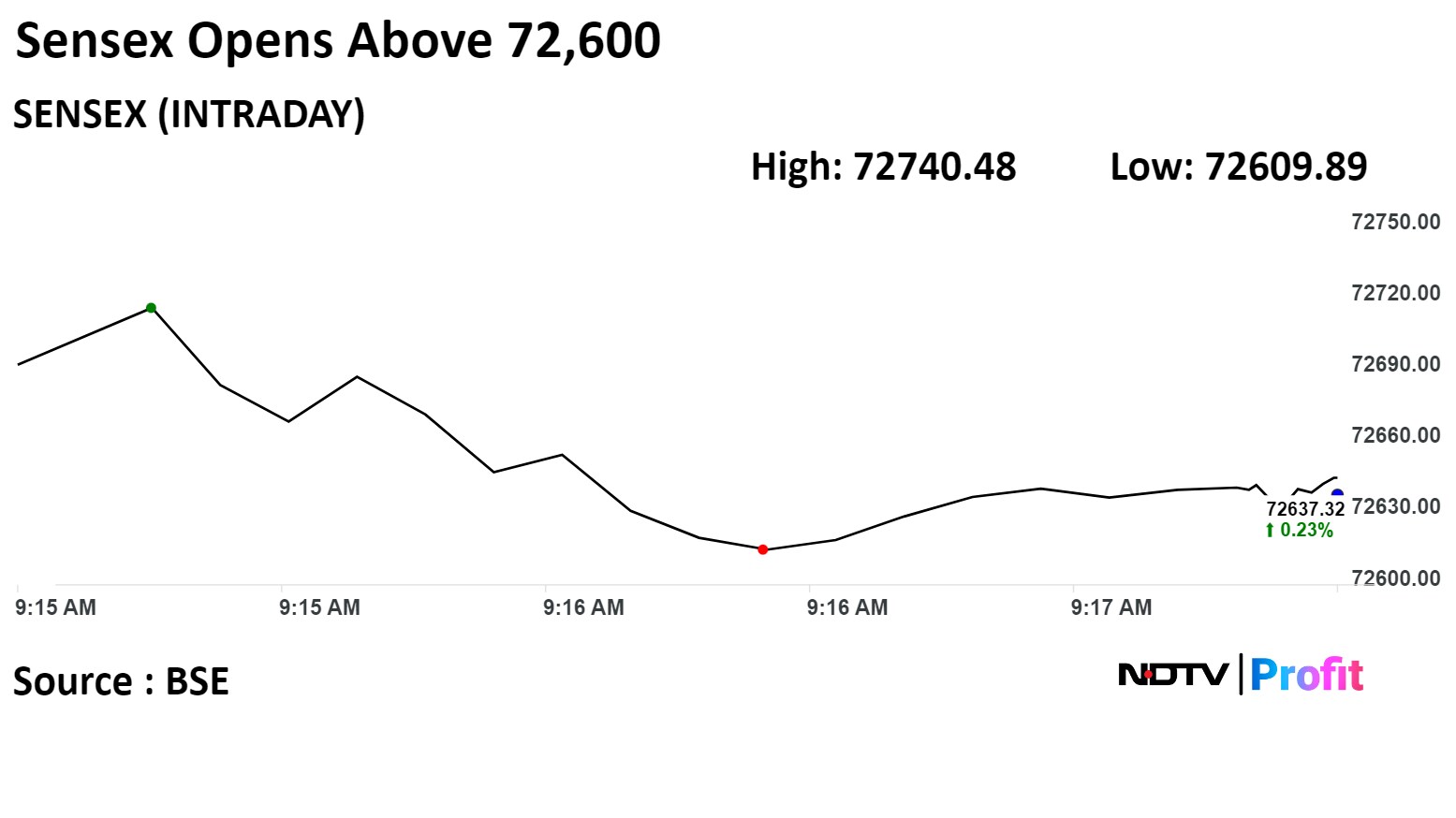

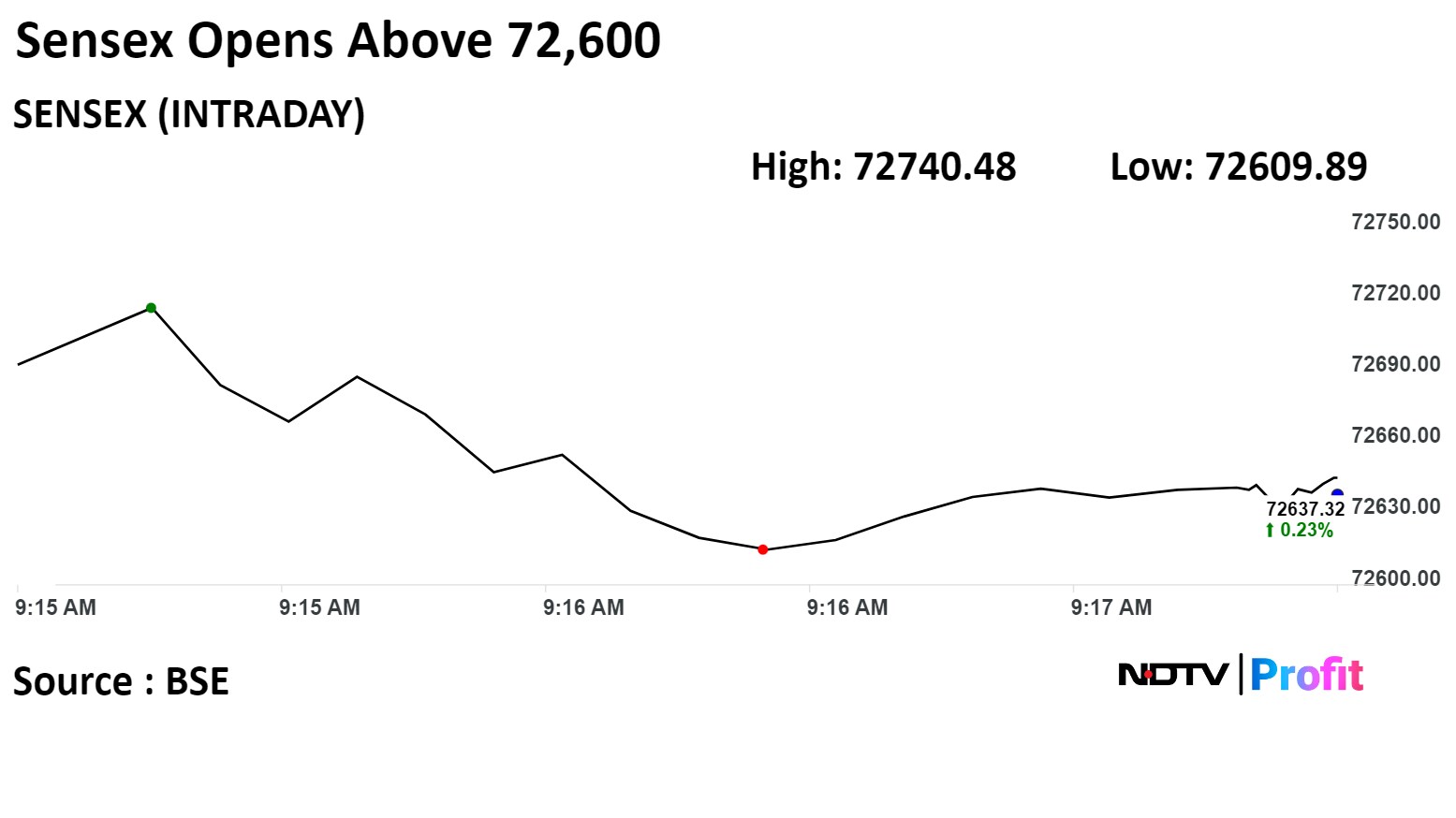

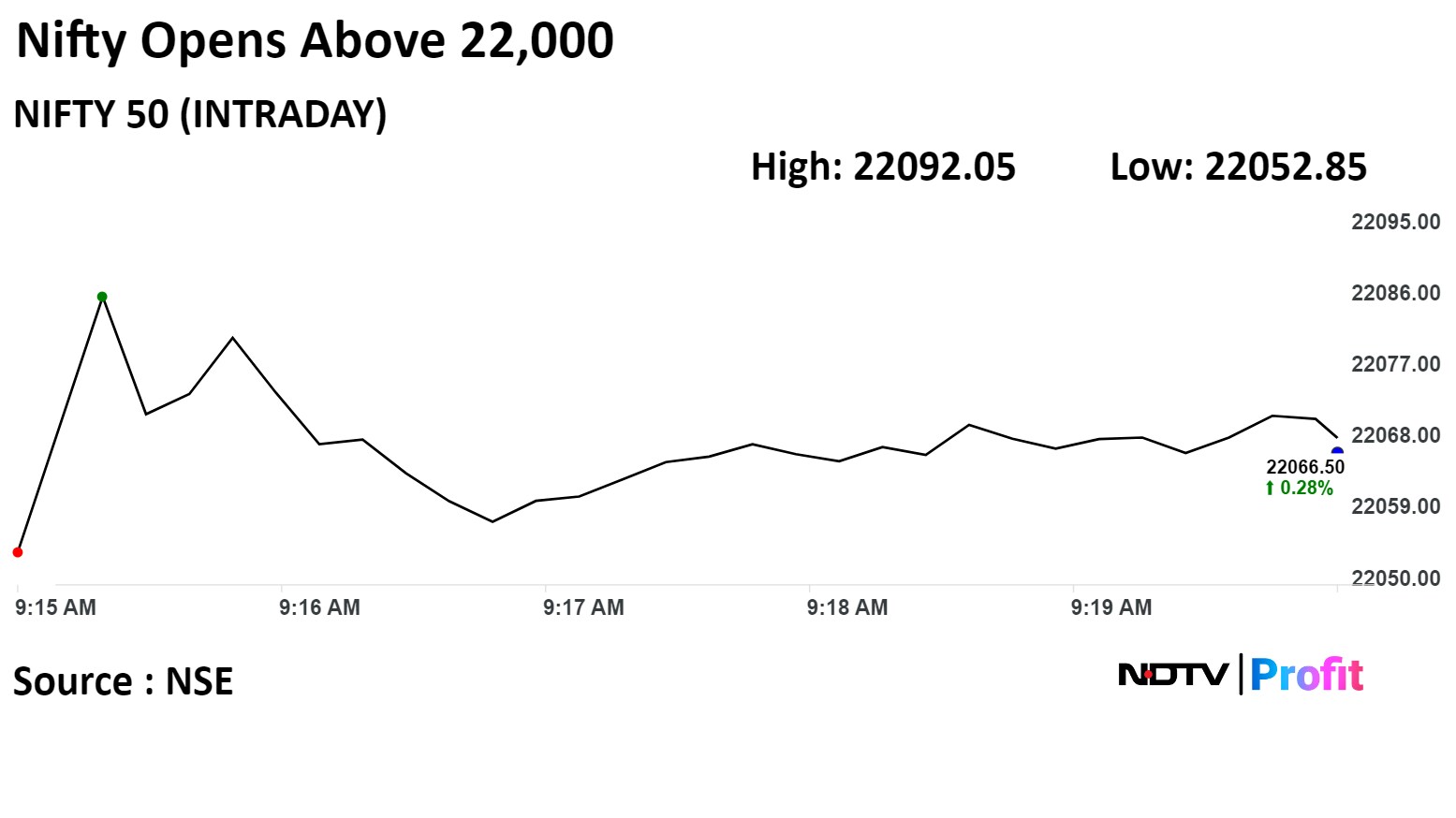

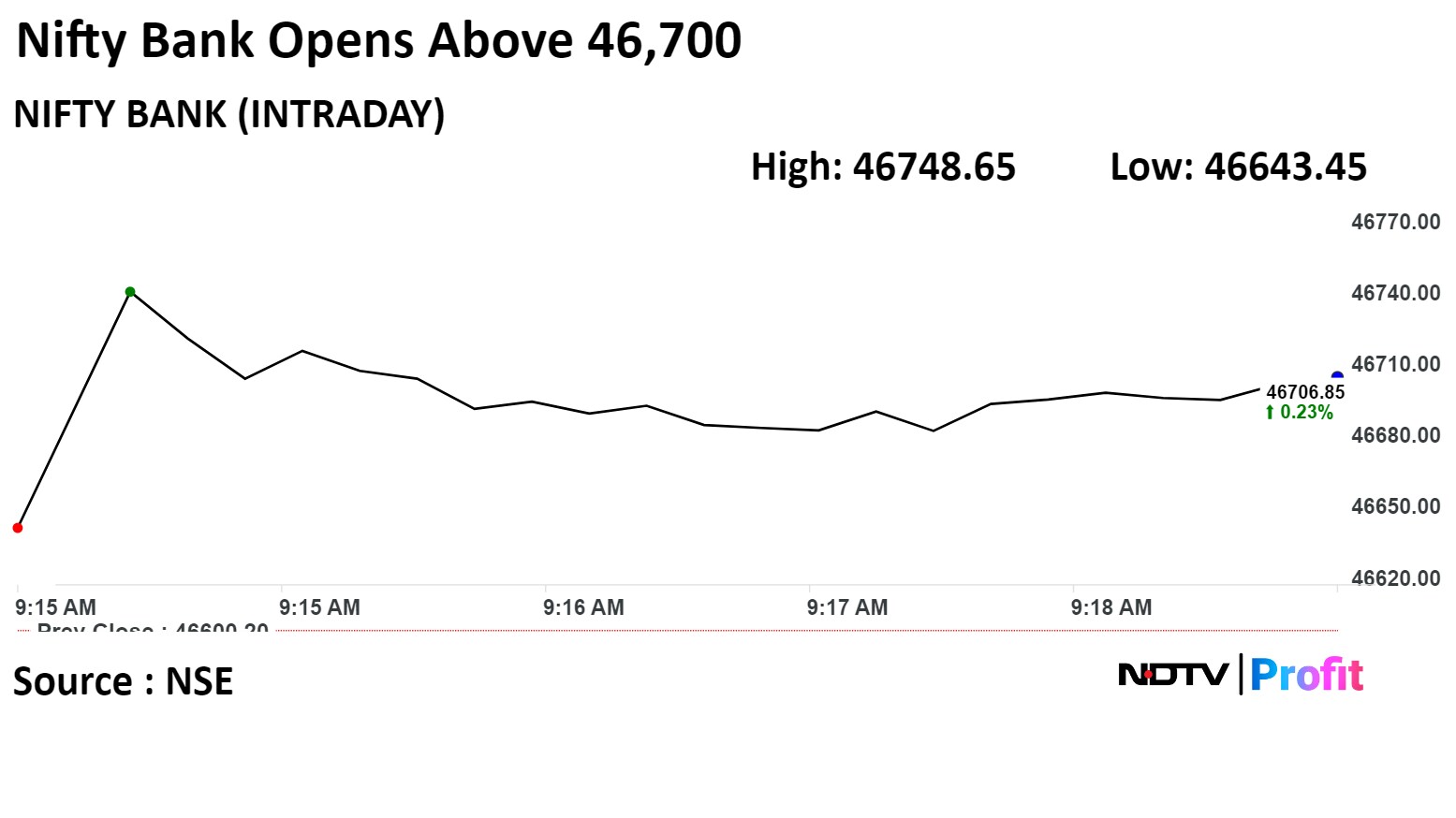

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

"On the hourly chart, it appears that the Index is forming an inverted head and shoulder formation where a level of 22,200 will be considered as a breakout point (neckline), and in that case, the target is 22,640," said Aditya Gaggar, director, Progressive Shares.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

"On the hourly chart, it appears that the Index is forming an inverted head and shoulder formation where a level of 22,200 will be considered as a breakout point (neckline), and in that case, the target is 22,640," said Aditya Gaggar, director, Progressive Shares.

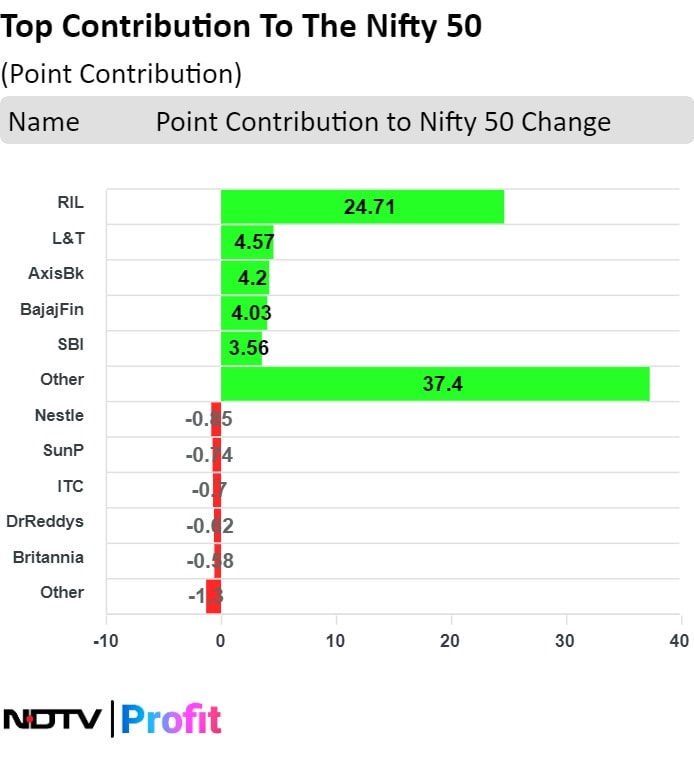

Reliance Industries Ltd., Larsen & Toubro Ltd., Axis Bank Ltd., Bajaj Finance Ltd., and State Bank of India added to the benchmark index.

Britannia Industries Ltd., Dr Reddy's Laboratories Ltd., ITC Ltd., Sun Pharmaceutical Industries Ltd., and Nestle India Ltd. limited gains to the index.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

"On the hourly chart, it appears that the Index is forming an inverted head and shoulder formation where a level of 22,200 will be considered as a breakout point (neckline), and in that case, the target is 22,640," said Aditya Gaggar, director, Progressive Shares.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

India's benchmark indices recouped losses to open higher on Wednesday, lead by gains in Larsen & Toubro Ltd., Reliance Industries Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 57.60 points or 0.26% higher at 22,062.30, and the S&P BSE Sensex 162.92 points or 0.22% higher at 72,633.22.

The Nifty 50 has reversed its previous day gains and crossover of 22,200 will give an upward breakout on the higher side to test the highs, said Vikas Jain, senior research analyst at Reliance Securities.

The inside range candle will give an either side breakout from the current range and 21,900 would act as trend reversal level. The hourly RSI is moving upwards and crossover of the averages would give a swift up move along with the broader markets momentum, Jain added.

"On the hourly chart, it appears that the Index is forming an inverted head and shoulder formation where a level of 22,200 will be considered as a breakout point (neckline), and in that case, the target is 22,640," said Aditya Gaggar, director, Progressive Shares.

Reliance Industries Ltd., Larsen & Toubro Ltd., Axis Bank Ltd., Bajaj Finance Ltd., and State Bank of India added to the benchmark index.

Britannia Industries Ltd., Dr Reddy's Laboratories Ltd., ITC Ltd., Sun Pharmaceutical Industries Ltd., and Nestle India Ltd. limited gains to the index.

On NSE, 11 sectors advanced, and one declined. The NSE Nifty Media index rose the most among peers to become the top performer. The NSE Nifty FMCG was the worst performing sector.

Broader markets outperformed benchmark indices. The S&P BSE Midcap was 0.63% higher, and the S&P BSE Smallcap was 0.88% up.

On BSE, all sectors advanced with the S&P BSE Oil & Gas sector rose over 1% to become the top performing sector among peers.

Market breadth was skewed in favour of buyers. Around 2,048 stocks advanced, 818 stocks declined, and 118 stocks remained unchanged on BSE.

At pre-open, the NSE Nifty 50 was 49.80 points or 0.23% higher at 22,054.50, and the S&P BSE Sensex was 0.31% or 221.86 points higher at 72,692.16.

The yield on the 10-year bond opened flat at 7.09%.

Source: Bloomberg

The local currency weakened by 4 paise to open at 83.33 against the U.S. Dollar.

It closed at 83.29 a dollar on Tuesday.

Source: Bloomberg

UPL is in process of completing formalities for rights issue.

Clarifies after receiving queries from investors regarding proposed rights issue aggregating up to Rs 4,200 crore.

Source: Exchange Filing

U.S. Dollar Index at 104.32

U.S. 10-year bond yield at 4.23%

Brent crude down 0.64% at $85.70 per barrel

Nymex crude down 0.60% at $81.13 per barrel

GIFT Nifty down 41.5 points 0.19% at 22,172.50 as of 8:24 a.m.

Bitcoin was up 0.91% at $70,461.25

Opens 90-day downside catalyst watch

Expects disappointing e-auction price trends in Q4

E-auction premium to FSA prices at 39% in Feb'24, lowest since July'21

Expect e-auction volume at 70mt in FY25.

Expects 10% change in e-auction volumes to impact EPS by 2.3%

Key risks: lower volumes on weak power demand

OMCs to benefit from, shift in government stance towards PSUs

Valuations remain undemanding, at discounts to historical values

Margin outlook favourable in refining and marketing

Integrated margins to sustain above historical averages over FY25-26

OMCs may return to dynamic fuel pricing under the next government.

Key risks: Political uncertainty, oil price spike.

The brokerage raised the price target to Rs 7,550 apiece from Rs 5,380 apiece earlier, implying an upside of 26%.

Electrification and motion will drive growth and margins.

Believe ABB is best play on infrastructure scale-up in voltage electrification.

Expects significant scope to ramp up voltage electrification portfolio where it trails Schneider and SIEM.

Assume better growth in export orders with premium product mix & operating leverage.

Expect improvement in margins, which should support premium valuation

Expects cash return on cash invested to expand by 270 bps to 12% in FY27

Expect capex to fall sequentially

Expect 17% Ebitda CAGR over FY24-27

RIL investments in next 3 years to be less capex heavy, higher in returns with short gestation period

The Indian rupee closed stronger on Tuesday after the dollar index came off from an over one-month high.

The Indian rupee closed stronger on Tuesday after the dollar index came off from an over one-month high.

Nifty March futures down by 0.32% to 22,088.55 at a premium of 83.85 points.

Nifty March futures open interest down by 22%.

Nifty Bank March futures down by 0.43% to 46,717.55 at a premium of 117.35 points.

Nifty Bank March futures open interest down by 21.6%.

Nifty Options March 28 Expiry: Maximum Call open interest at 22,500 and Maximum Put open interest at 22,000.

Bank Nifty Options March 27 Expiry: Maximum Call Open Interest at 47,000 and Maximum Put open interest at 46,000.

Securities in ban period: SAIL.

Narayana Hrudalaya: To meet investors on March 29.

Shyam Metalics and Energy: To meet investors on March 27.

Blue Dart: To meet investors on March 29.

Torrent Power: To meet investors on April 1 and 3.

Pidilite industries: To meet analysts and investors on March 29.

R R Kable: To meet investors on March 27.

Pidilite Industries: Promoter Maithili Parekh sold 18.6 lakh shares on March 22.

Sapphire Foods India: Promoter Sagista Realty Advisors sold 34,037 shares on March 22.

V.S.T. Tillers Tractors: Promoter Arun Vellore Surendra bought 5,000 shares.

Gokul Agro Resources: Promoter Ritika Infracon bought 14.2 lakh shares on March 22.

Bharat Wire Ropes: Promoter Gyanshankar Investment & Trading bought 40,000 shares on March 19.

Jubilant FoodWorks: Promoter Jubilant Consumer created a pledge for 11.58 crore shares on March 22.

Mankind Pharma: Beige sold 1.16 crore shares (2.9%) at Rs 2122.51 apiece.

Rishabh Instruments: Ashika Global Securities bought 2.16 lakh shares (0.56%) at Rs 420.08 apiece and Yaduka Financial Services sold 2.16 lakh shares (0.56%) at Rs 420.07 apiece.

Spacenet Enterprises India: Suvi Rubber sold 29.83 lakh shares (0.56%) at Rs 25.9 apiece.

Rama Steel Tubes: Sajm Global Impex sold 25 lakh shares (0.49%) at Rs 13.34 apiece, Hemali Pathik Thakkar sold 25 lakh shares (0.49%) at Rs 13.18 apiece, Sajm Global Impex bought 25 lakh shares (0.49%) at Rs 12.87 apiece and Hemali Pathik Thakkar bought 25 lakh shares (0.49%) at Rs 12.85 apiece.

SRM Contractors: The Rs 130.2-crore issue was subscribed 3.56 times on its first day. The bids were led by non-institutional investors (6.26 times), retail investors (3.54 times), and institutional investors (1.57 times).

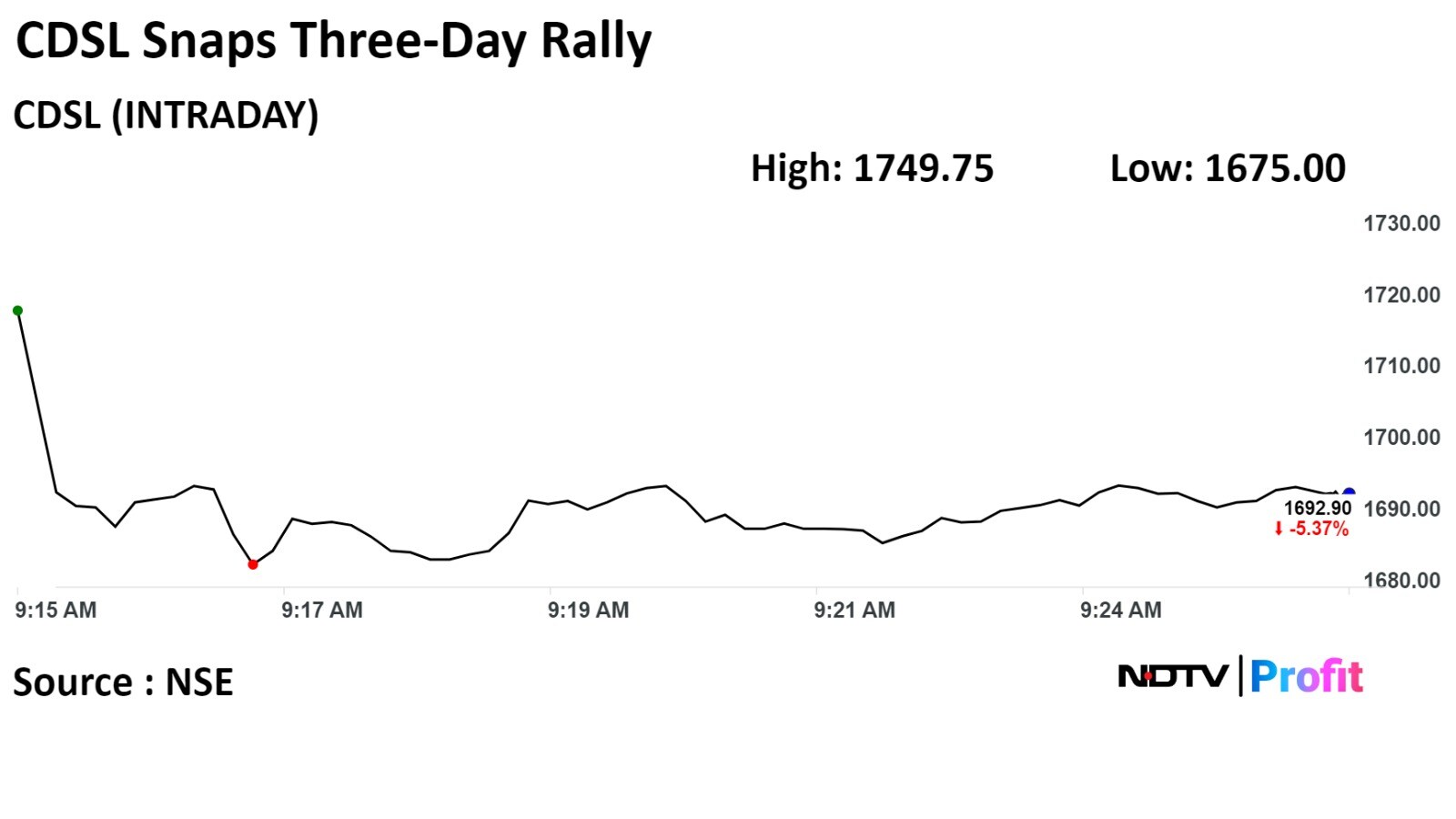

CDSL: Standard Chartered plans to sell the entire stake of 7.18% via block deal. The floor price is set at Rs 1,672 per equity share.

Wipro: The company has transferred its entire shareholding by Wipro Holdings (UK) in Wipro Gulf LLC to Wipro IT Services UK Societas.

Titan: TCL Watches Switzerland AG ceased to be a wholly owned subsidiary after liquidation.

Sanofi India and Cipla: The two companies announced an exclusive distribution partnership to expand the reach of the CNS (Central Nervous System) portfolio in India. Cipla will distribute Sanofi India’s six CNS products.

Avenue Supermarts: The DMart owner opened three new stores at Karimnagar (Telangana), Narsingi, Hyderabad (Telangana) and Sachin, Surat (Gujarat). The total number of stores as of today stands at 357.

Piramal Enterprises: The company has invested Rs 2,000 crore in unit Piramal Capital & Housing Finance by way of subscription to rights issue.

IDFC: The company received an NCLT order to seek shareholders' approval on May 17 regarding the scheme of amalgamation of IDFC Financial Holding into and with IDFC and IDFC with IDFC First Bank.

Power Grid Corp.: The company successfully commissioned a capacity expansion project in the southern region.

Angel One: The company has set a floor price of Rs 2,555.01 apiece for its QIP.

Indian Hotels: The company infused $6.5 million as equity in its Netherlands-based wholly-owned arm, IHOCO BV.

APL Apollo Tubes: The company has completed the acquisition of 53.57% share capital and voting rights in KML on March 26, 2024, making it a subsidiary.

Matrimony.com: The board reappointed Murugavel Janakiraman as Managing Director until March 31, 2026.

IIFL Finance: The NBF appointed Arun Kumar Purwar as chairman and an additional non-independent non-executive director effective April 1.

Pratap Snacks: Commercial production at its newly set-up unit situated at Khewat commenced.

Prism Johnson: The company will consider fundraising via bonds on March 29.

Wockhardt: The company raised Rs 480 crore via QIP at an issue price of Rs 517 apiece.

Shyam Metalics and Energy: The company's JV obtained a letter of intent for the grant of a composite licence for the Surjagad-1 iron ore block on an area of 1526 hectares in Maharashtra.

Lumax Industries: The company will invest Rs 5 crore in its European unit.

Praveg: Operations at Praveg’s Safari Velavadar Resort, located near Blackbuck National Park in Gujarat, started.

Crompton Greaves Consumer Electricals: HDFC Mutual Fund increased its shareholding to 9.46% as of March 22.

Bharat Dynamics: HDFC Mutual Fund increased its shareholding to 3.02% as of March 22.

Markets in the Asia-Pacific region rose during early trade on Tuesday, with China's industrial profit data in focus.

The Nikkei 225 was trading 0.62% higher at 40,650.37, and the S&P ASX 200 was 0.36% higher at 7,808.00 as of 6:29 a.m.

U.S. stocks gave up gains during the last hours of the trade, sending the S&P 500 and Dow Jones Industrial Average to their third straight decline, as investors await the Personal Consumption Expenditure data, due to be released on Friday. The Federal Reserve's preferred inflation gauge will provide fresh cues about the central bank's rate trajectory going forward.

The S&P 500 and Dow Jones Industrial Average fell 0.28% and 0.08%, respectively, on Tuesday. The Nasdaq Composite declined 0.42%.

Brent crude was trading down 0.53%, while gold was down 0.06%.

The GIFT Nifty was trading 23 points or 0.1% lower at 22,044.50 as of 8:24 a.m.

India's benchmark equity indices snapped their three-day rally and ended lower on Tuesday as losses in heavyweights weighed, while broader indices ended higher.

The Nifty lost 75.90 points, or 0.34%, to close at 22,020.85, while the Sensex ended down 357.98 points, or 0.49%, at 72,473.96.

Overseas investors turned net buyers on Tuesday after three days of selling. Foreign portfolio investors mopped up stocks worth Rs 10.1 crore, while domestic institutional investors remained net buyers for the sixth day and mopped up equities worth Rs 5,024.4 crore, the NSE data showed.

The Indian rupee strengthened by 14 paise to close at 83.29 against the U.S. dollar.

Markets in the Asia-Pacific region rose during early trade on Tuesday, with China's industrial profit data in focus.

The Nikkei 225 was trading 0.62% higher at 40,650.37, and the S&P ASX 200 was 0.36% higher at 7,808.00 as of 6:29 a.m.

U.S. stocks gave up gains during the last hours of the trade, sending the S&P 500 and Dow Jones Industrial Average to their third straight decline, as investors await the Personal Consumption Expenditure data, due to be released on Friday. The Federal Reserve's preferred inflation gauge will provide fresh cues about the central bank's rate trajectory going forward.

The S&P 500 and Dow Jones Industrial Average fell 0.28% and 0.08%, respectively, on Tuesday. The Nasdaq Composite declined 0.42%.

Brent crude was trading down 0.53%, while gold was down 0.06%.

The GIFT Nifty was trading 23 points or 0.1% lower at 22,044.50 as of 8:24 a.m.

India's benchmark equity indices snapped their three-day rally and ended lower on Tuesday as losses in heavyweights weighed, while broader indices ended higher.

The Nifty lost 75.90 points, or 0.34%, to close at 22,020.85, while the Sensex ended down 357.98 points, or 0.49%, at 72,473.96.

Overseas investors turned net buyers on Tuesday after three days of selling. Foreign portfolio investors mopped up stocks worth Rs 10.1 crore, while domestic institutional investors remained net buyers for the sixth day and mopped up equities worth Rs 5,024.4 crore, the NSE data showed.

The Indian rupee strengthened by 14 paise to close at 83.29 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.