Overseas investors turned net sellers of Indian equities on Wednesday.

Foreign portfolio investors offloaded stocks worth Rs 2,599.2 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained buyers and mopped up equities worth Rs 2,667.5 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 1,7463 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

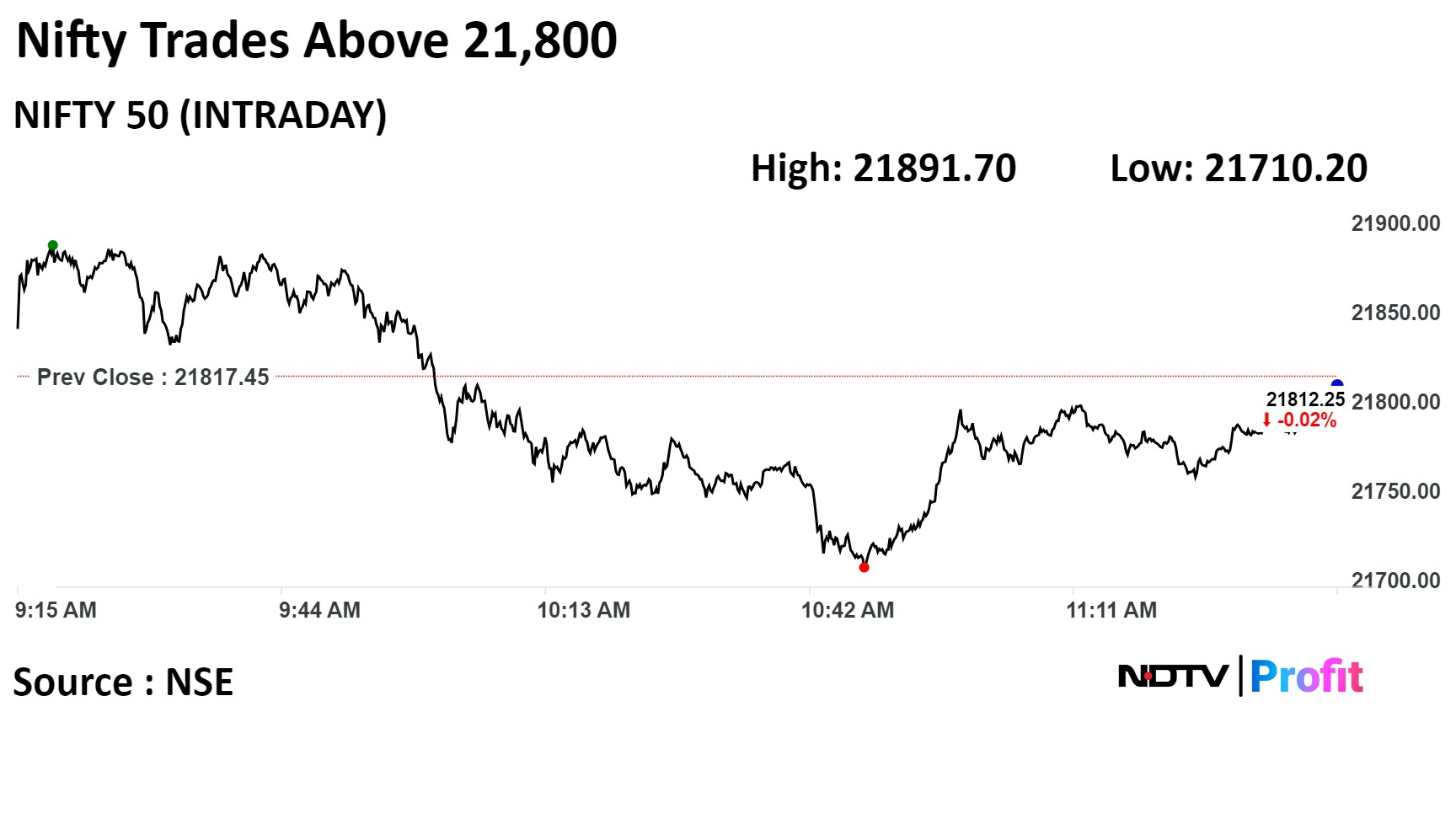

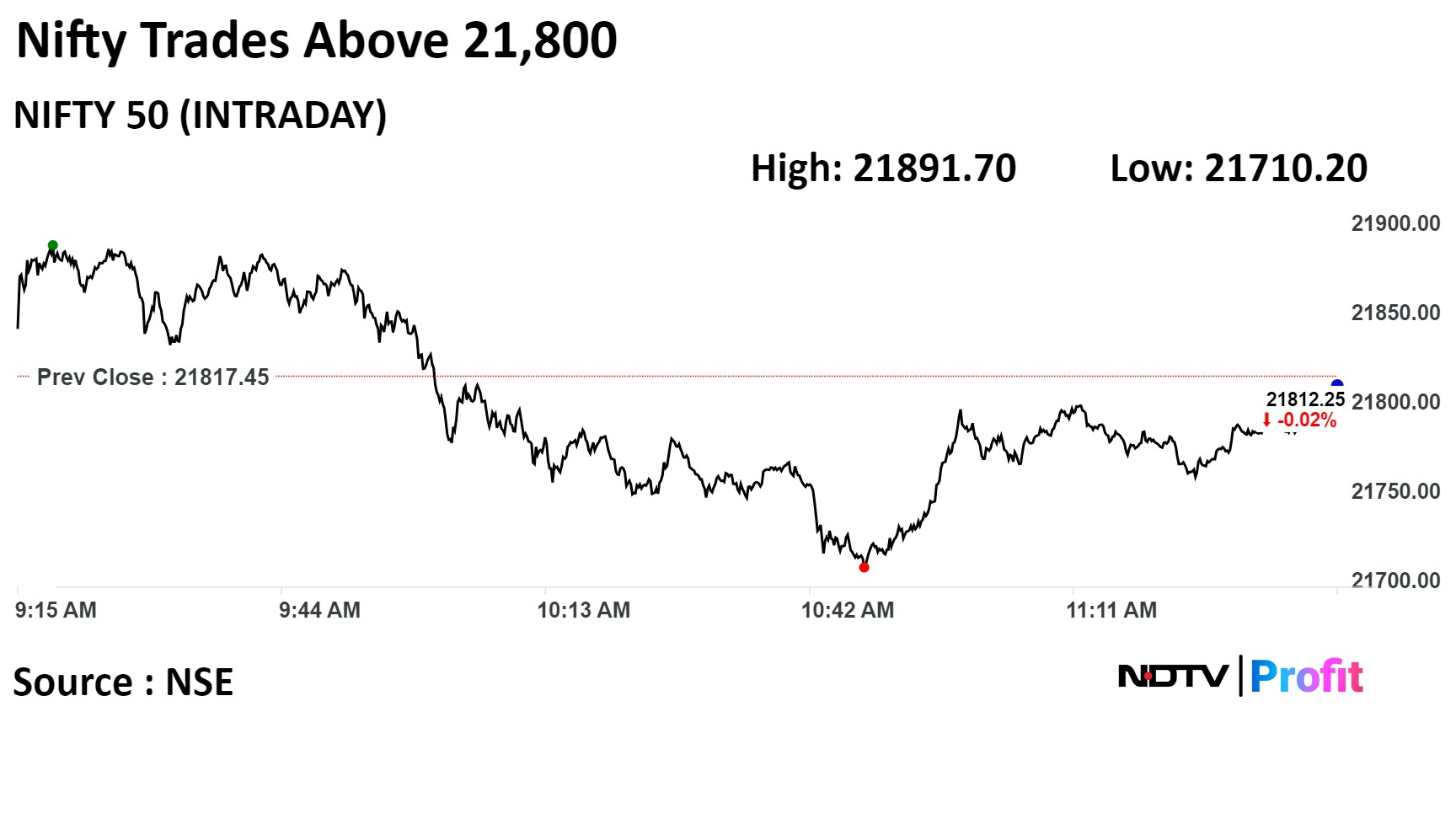

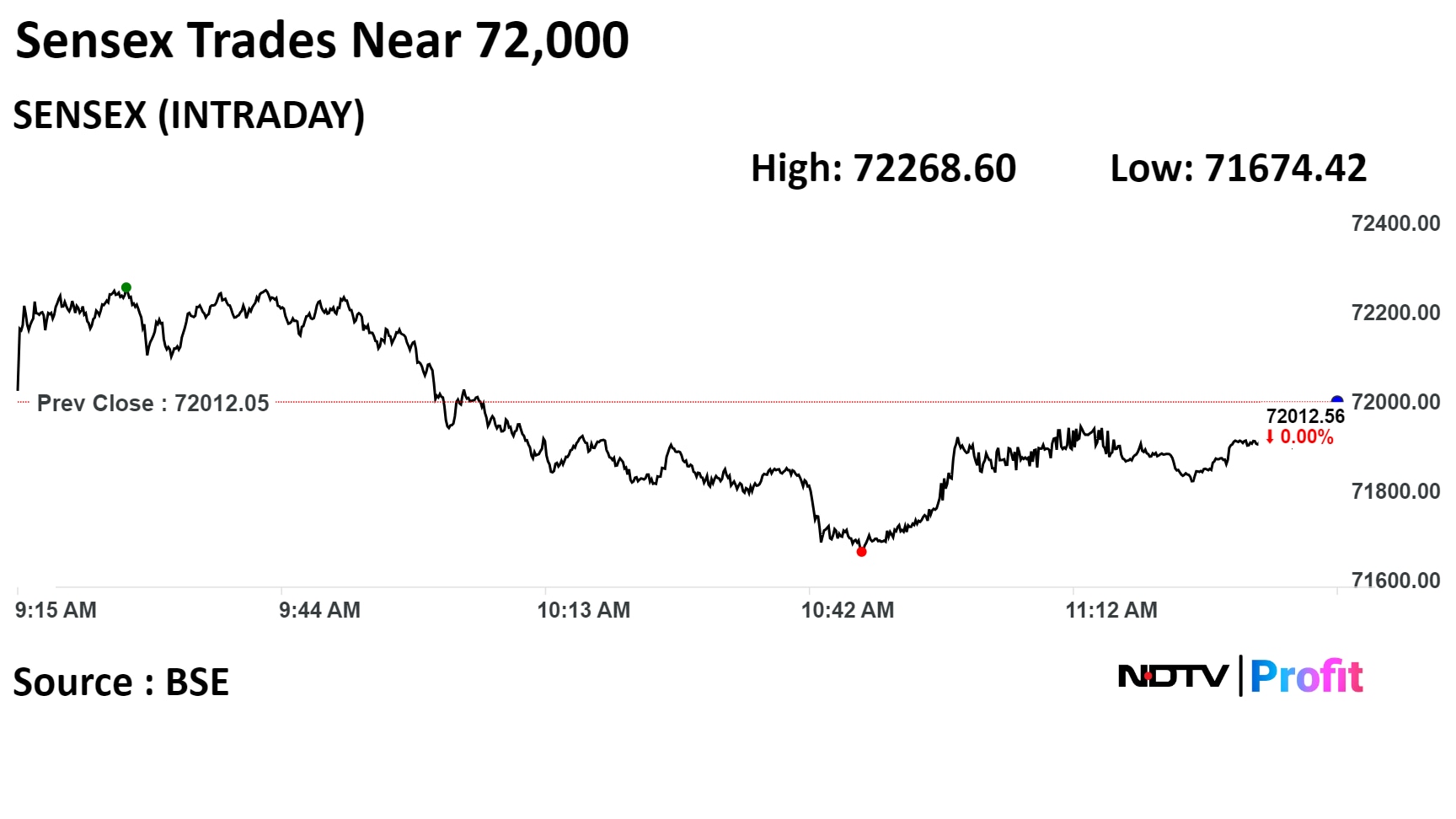

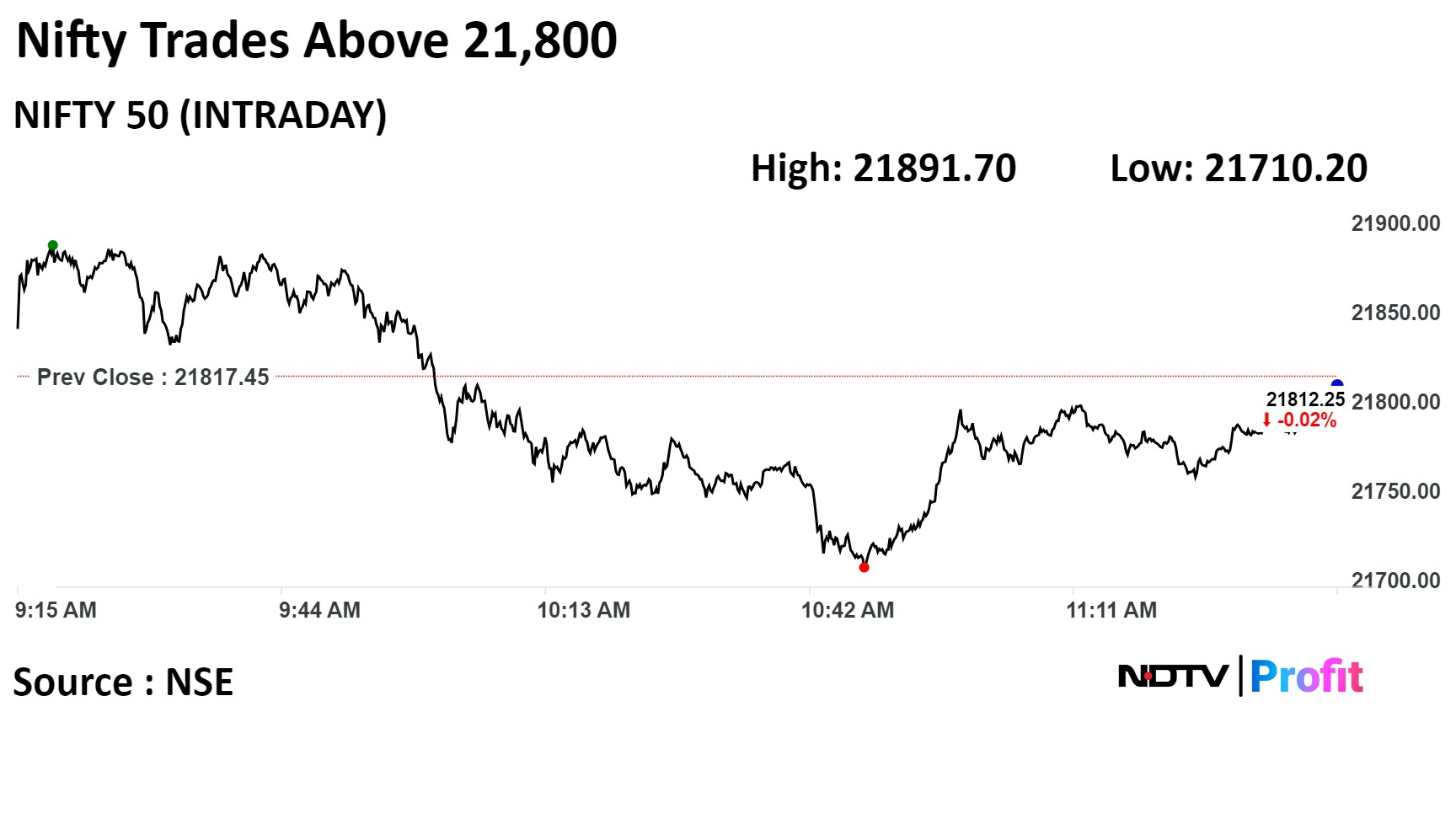

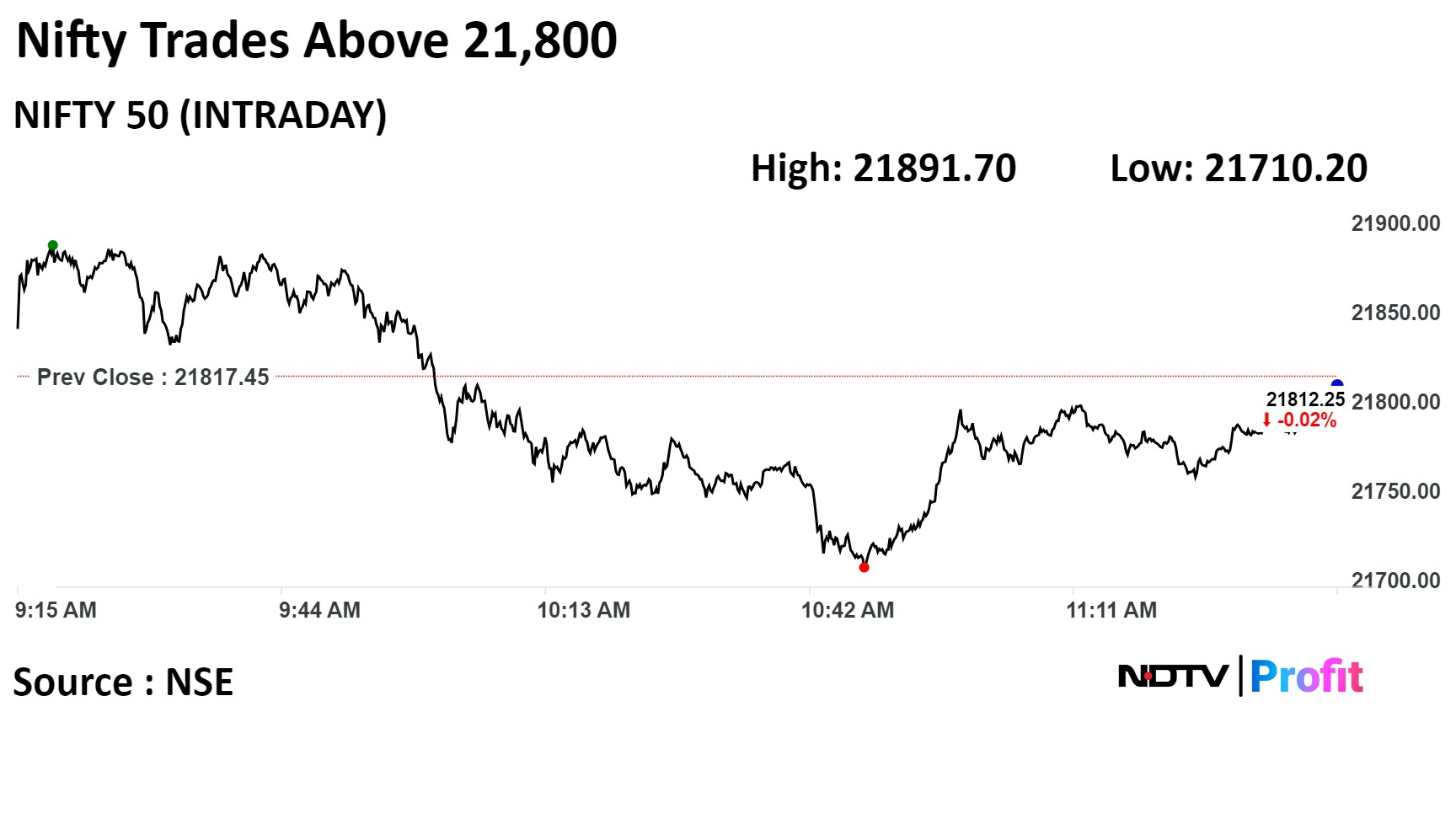

The NSE Nifty 50 settled 21.65 points, or 0.10% higher at 21,839.10, and the S&P BSE Sensex ended 89.64 points, or 0.12% higher at 72,101.69.

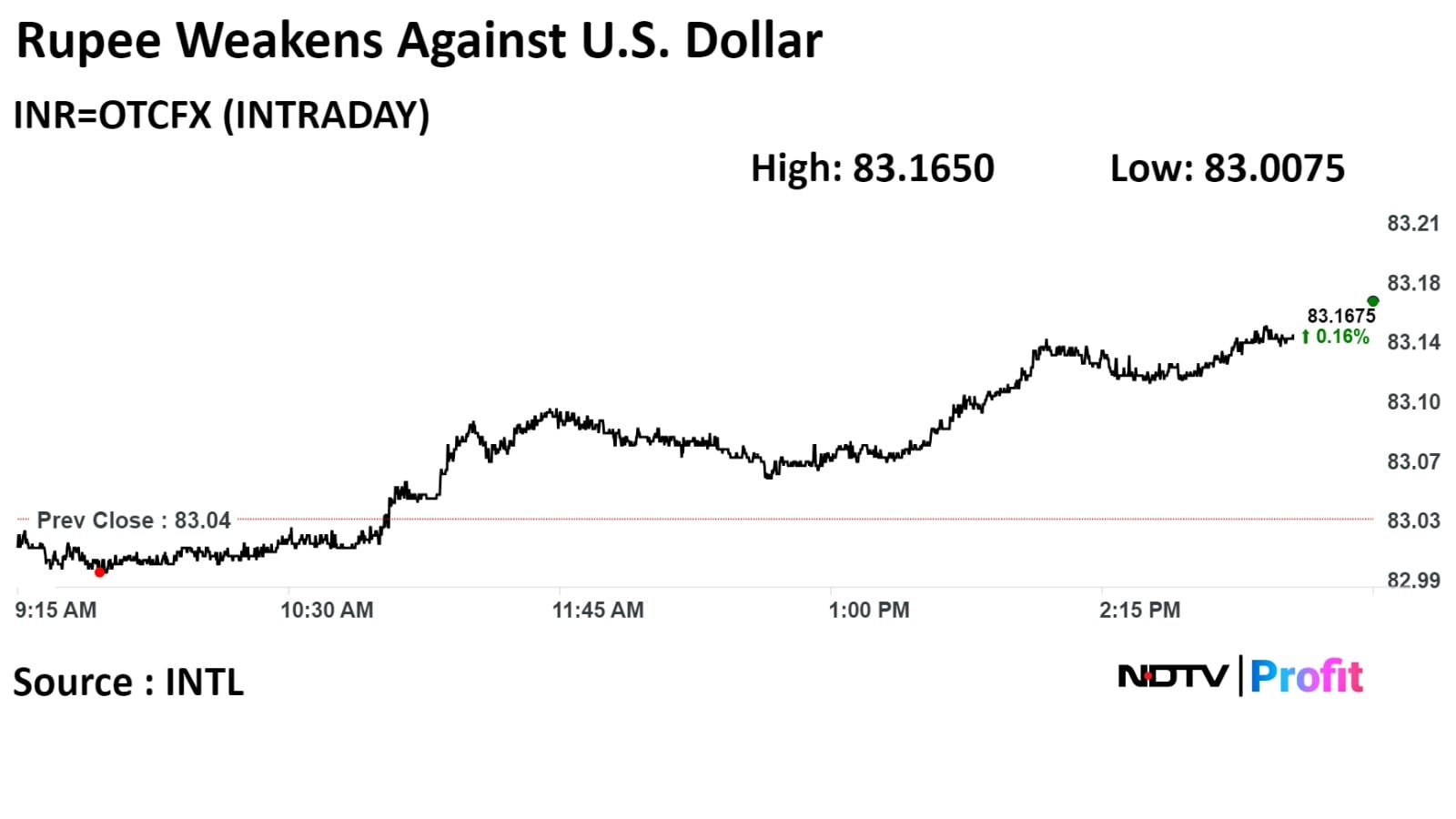

The local currency weakened by 13 paise to close at 83.17 against the U.S. Dollar, marking the lowest level in near one-month.

It closed at 83.04 a dollar on Tuesday.

Source: Bloomberg

The local currency weakened by 13 paise to close at 83.17 against the U.S. Dollar, marking the lowest level in near one-month.

It closed at 83.04 a dollar on Tuesday.

Source: Bloomberg

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

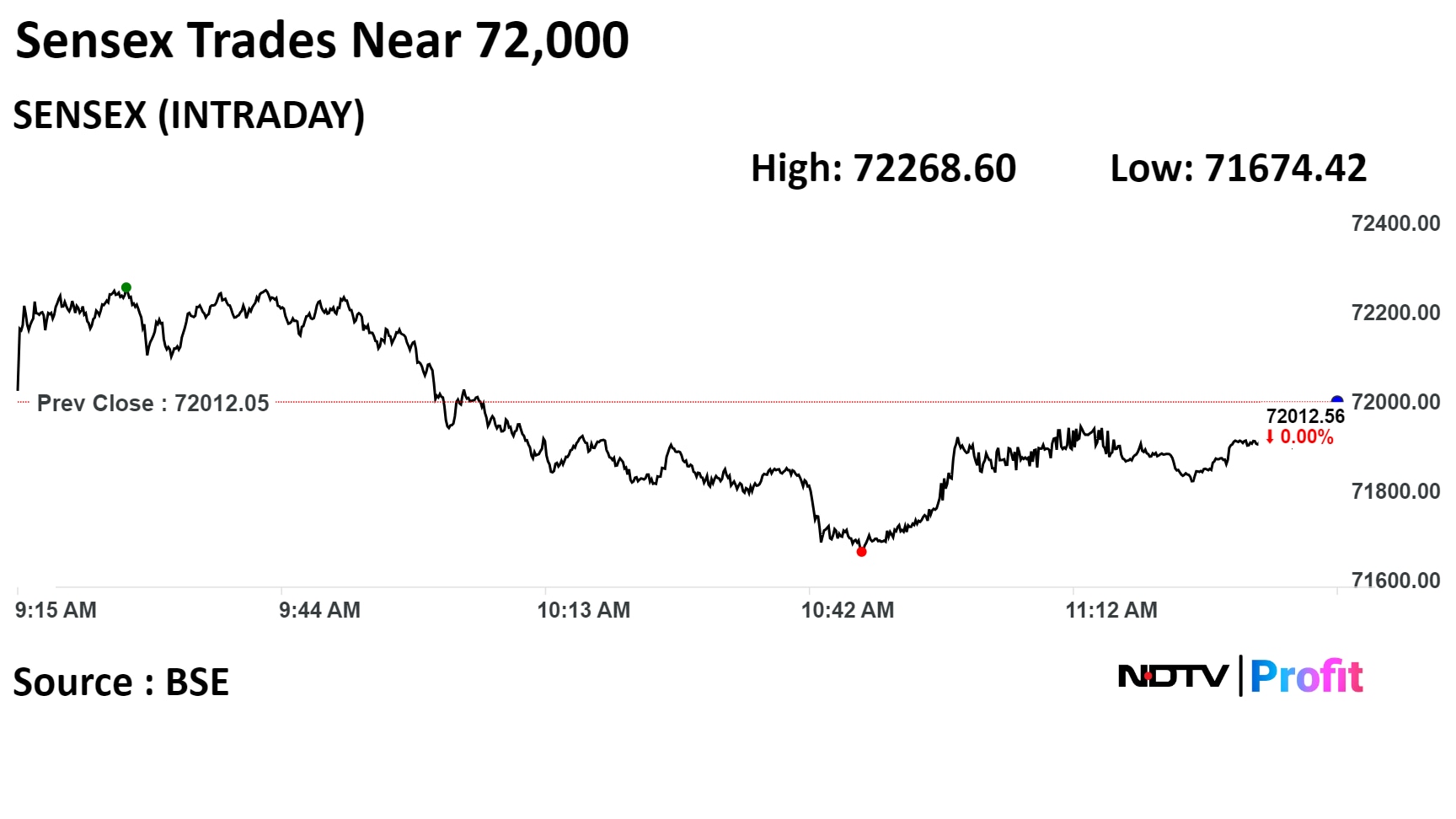

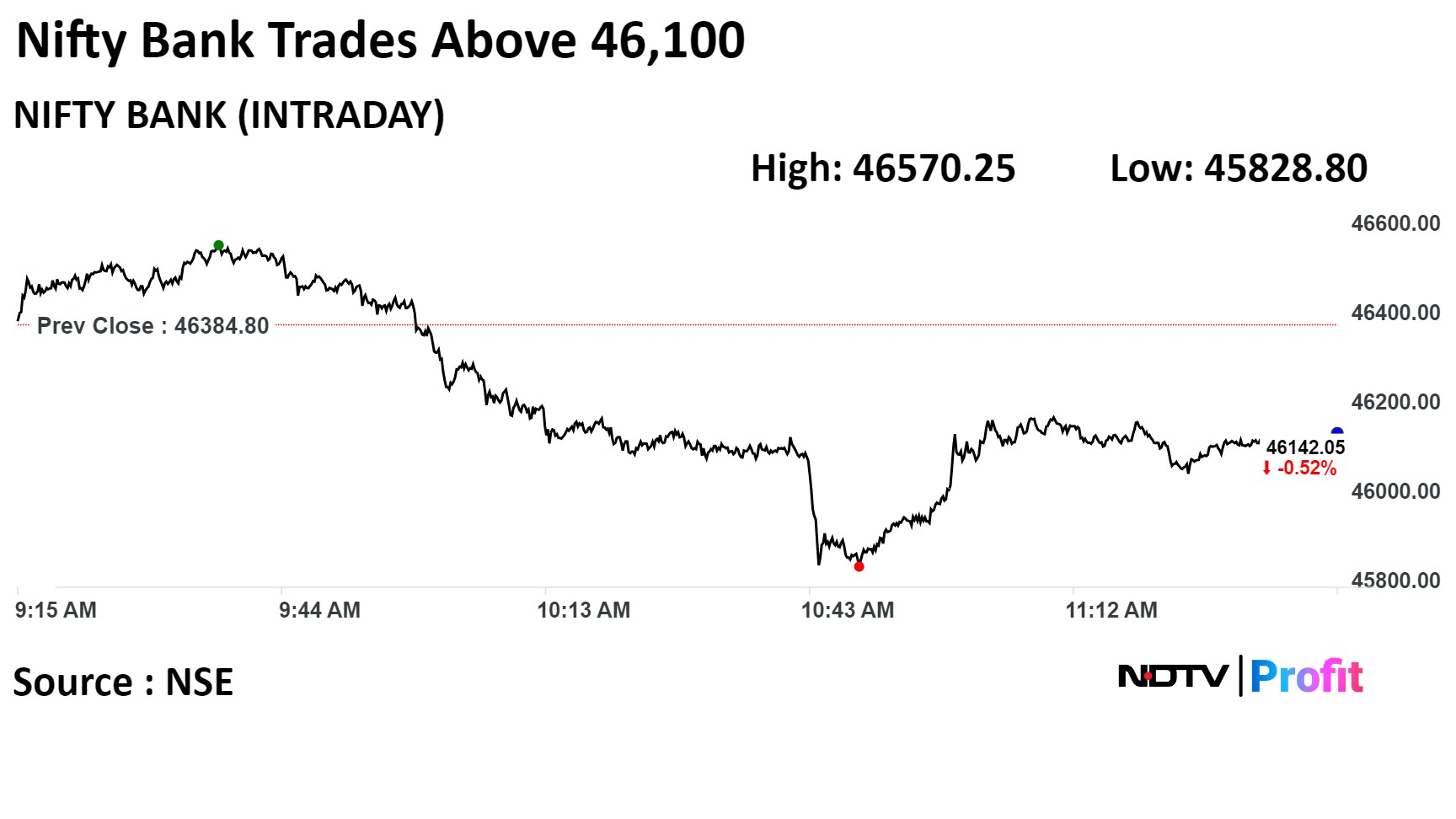

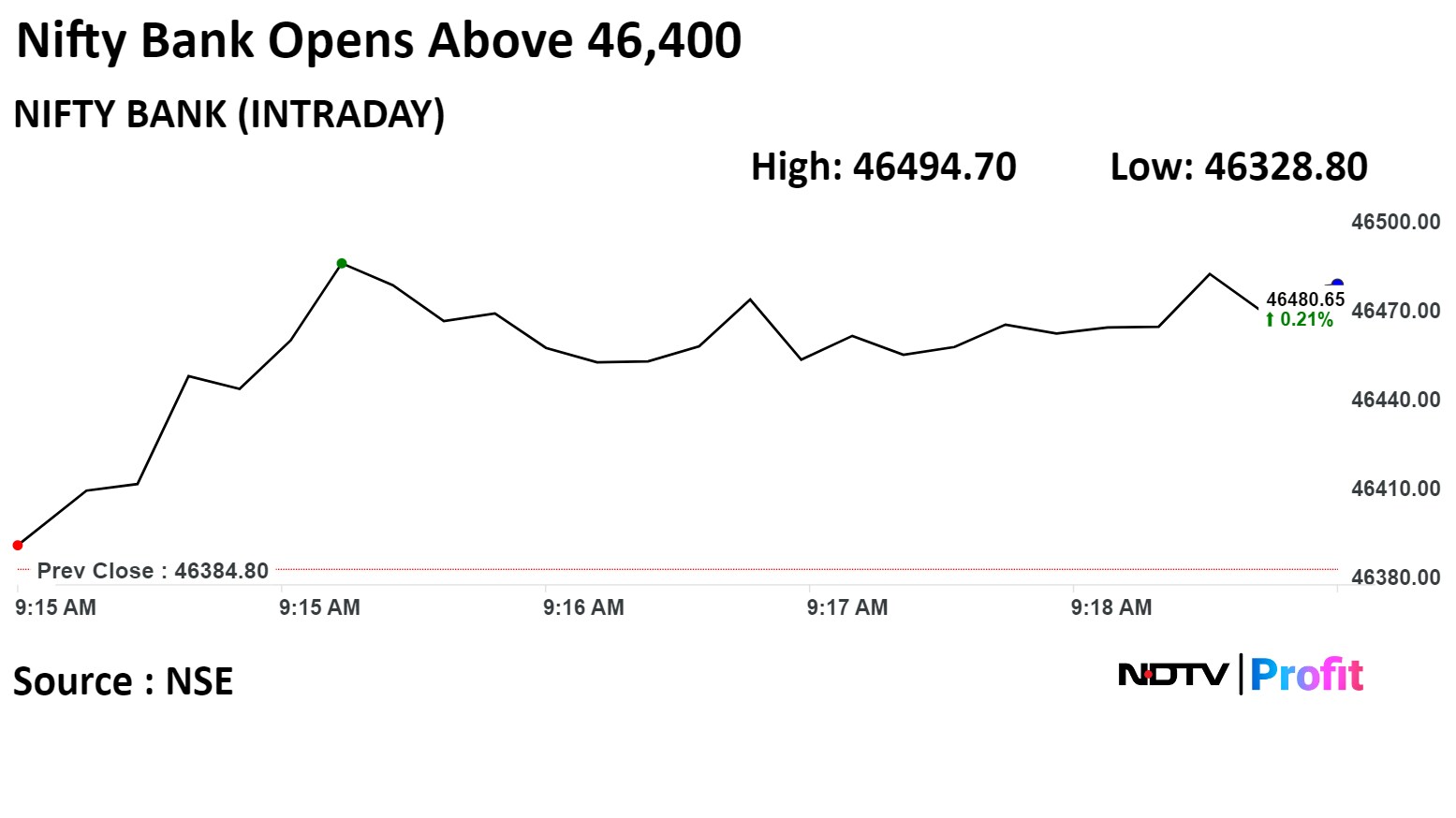

The Nifty Bank index extended losses for nine day and ended Wednesday's session lower in contrast to the benchmark indices, dragged by HDFC Bank Ltd., Axis Bank Ltd.

The index has recorded worst losing streak in over 20 years.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

The Nifty Bank index extended losses for nine day and ended Wednesday's session lower in contrast to the benchmark indices, dragged by HDFC Bank Ltd., Axis Bank Ltd.

The index has recorded worst losing streak in over 20 years.

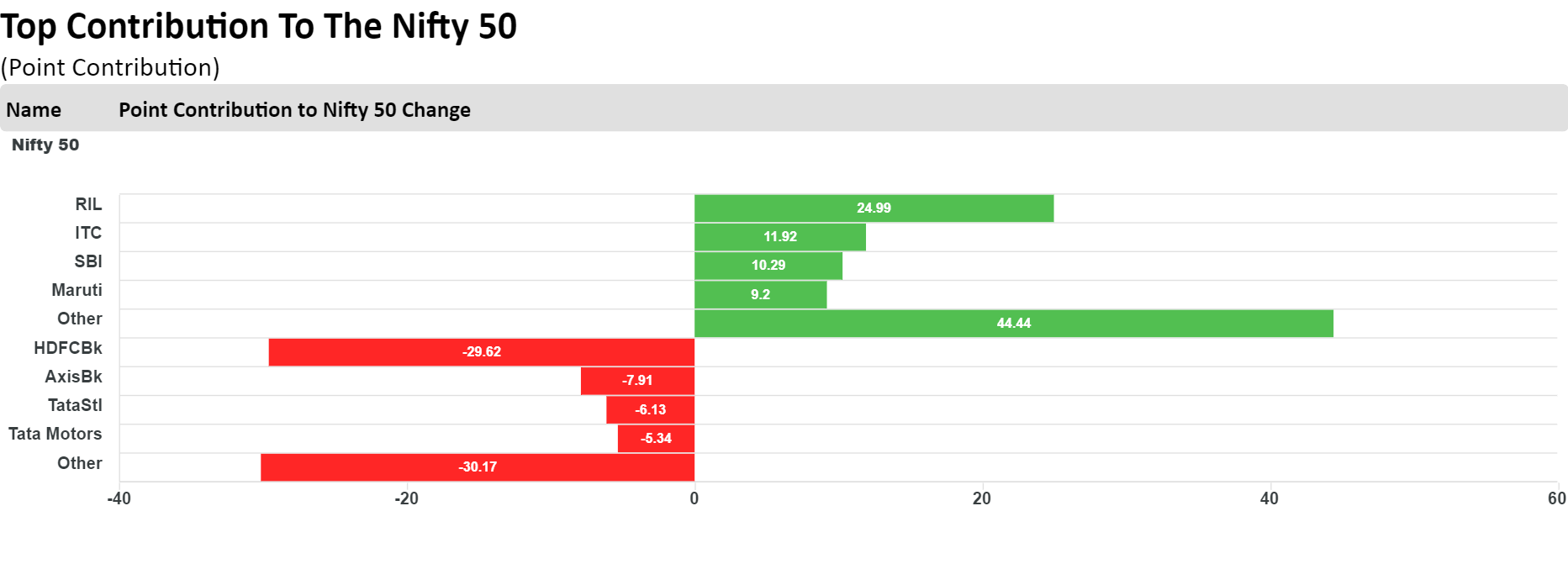

Reliance Industries Ltd., ITC Ltd., State Bank of India, Maruti Suzuki India Ltd., and Power Grid Corp of India added positively to the benchmark indices.

HDFC Bank Ltd., Axis Bank Ltd., Tata Steel Ltd., Tata Motors Ltd., and Hindustan Unilever Ltd. limited gains to the index.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

The Nifty Bank index extended losses for nine day and ended Wednesday's session lower in contrast to the benchmark indices, dragged by HDFC Bank Ltd., Axis Bank Ltd.

The index has recorded worst losing streak in over 20 years.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

India's benchmark indices recovered losses to end higher on Wednesday, lead by gains in shares of Reliance Industries Ltd., ITC Ltd., and State Bank of India.

The NSE Nifty 50 settled 21.65 points or 0.099% higher 21,839.10, and the S&P BSE Sensex ended 89.64 points or 0.12% up at 72,101.69.

Now, market participants shift their focus on the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

The NSE Nifty 50 rose 0.52% to 21,930.90, and the S&P BSE Sensex rose 0.54% to 72,406.67 during the day.

The U.S. central bank is expected to stand pat in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for fresh cues on rate trajectory moving ahead.

The Fed fund future traders are expecting 99% chance of benchmark federal fund rates to remain unchanged at current 5.25-5.55% in Fed's March monetary policy meeting, according to CME FedWatch Tool.

Due to profit booking at higher levels it trimmed some gains and in the second half of the day and finally close near 21,850/72,100 level, said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"We are of the view that, as long as it is trading below 21950/72500 the weak sentiment is likely to continue. Below which, the market could retest the level of 21700- 21650/71700-71500. On the other side, above 21950/72500 the sentiment could change. Above 21950/72500, the chances of hitting 22050-22100/72800-73000 would turn bright," he said.

The Nifty Bank index extended losses for nine day and ended Wednesday's session lower in contrast to the benchmark indices, dragged by HDFC Bank Ltd., Axis Bank Ltd.

The index has recorded worst losing streak in over 20 years.

Reliance Industries Ltd., ITC Ltd., State Bank of India, Maruti Suzuki India Ltd., and Power Grid Corp of India added positively to the benchmark indices.

HDFC Bank Ltd., Axis Bank Ltd., Tata Steel Ltd., Tata Motors Ltd., and Hindustan Unilever Ltd. limited gains to the index.

On NSE, six sectors out of 12 ended higher and six ended lower. The Nifty Oil & Gas sector was the top performing sector, and the Nifty Metal was the top loser.

Broader markets underperformed. The S&P BSE Midcap index ended 0.05% higher, and the S&P BSE Smallcap fell 0.14%.

On BSE, 13 sectors ended higher and seven closed with losses. S&P BSE Energy and S&P BSE Oil & Gas rose the most.

Market breadth was skewed in favour of sellers. Around 2,188 stocks declined, 1,605 stocks rose, and 110 stocks remained unchanged on BSE

The scrip rose as much as 5.54% to Rs 166.70 piece, the highest level since March 6. It has risen 224.71% on a year-to-date basis. Total traded volume in the day stood at 0.8% times its 30-day average. The relative strength index was at 59.79.

The scrip rose as much as 5.54% to Rs 166.70 piece, the highest level since March 6. It has risen 224.71% on a year-to-date basis. Total traded volume in the day stood at 0.8% times its 30-day average. The relative strength index was at 59.79.

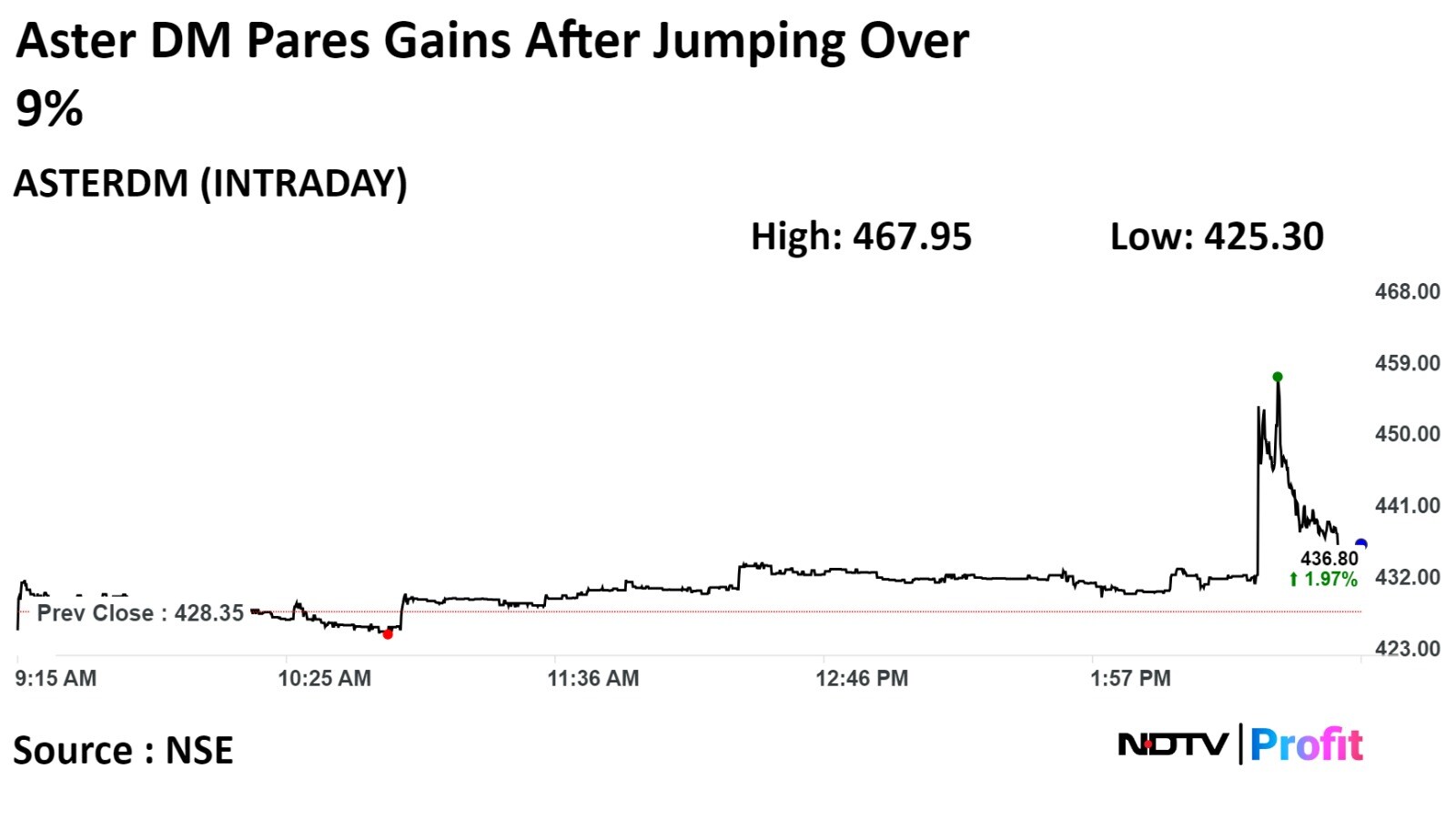

Separation of India and GCC business is nearing completion, said Aster DM Healthcare.

Fajr Capital-led consortium gets key approvals from Saudi Arabia’s General Authority for Competition for the separation.

Source: Exchange filing

Separation of India and GCC business is nearing completion, said Aster DM Healthcare.

Fajr Capital-led consortium gets key approvals from Saudi Arabia’s General Authority for Competition for the separation.

Source: Exchange filing

Anup Engineering Ltd.'s board approved issue of bonus equity shares in the ratio of 1:1.

Source: Exchange Filing

Housing & Urban Development Development Corp board approved interim dividend of Rs 1.5 per share.

The company's board approved fundraise of up to Rs 40,000 crore via bonds or debentures during FY25.

Board approved increase in overall borrowing limit to `1.5 lk cr from `1 lk cr previously.

Source: Exchange Filing

JSW-led Indian entities to hold 51% in JSW MG Motor India Pvt. Ltd., management says.

JSW Group to hold 35% stake in JSW MG Motor

Indian financial investors to hold 8%, dealers 3% and employees 5%

Rs 5,000 crore will be the total investment at the outset

Management refuses to comment on valuation of JV

Investment aimed at augmenting production

JSW Steel currently provides only a small amount of steel to MG Motor cars in India right now, JSW Group’s Parth Jindal says.

More group synergies likely in terms of exports from JSW’s ports, charging from energy unit

Synergies aimed at reducing final cost of electric vehicles

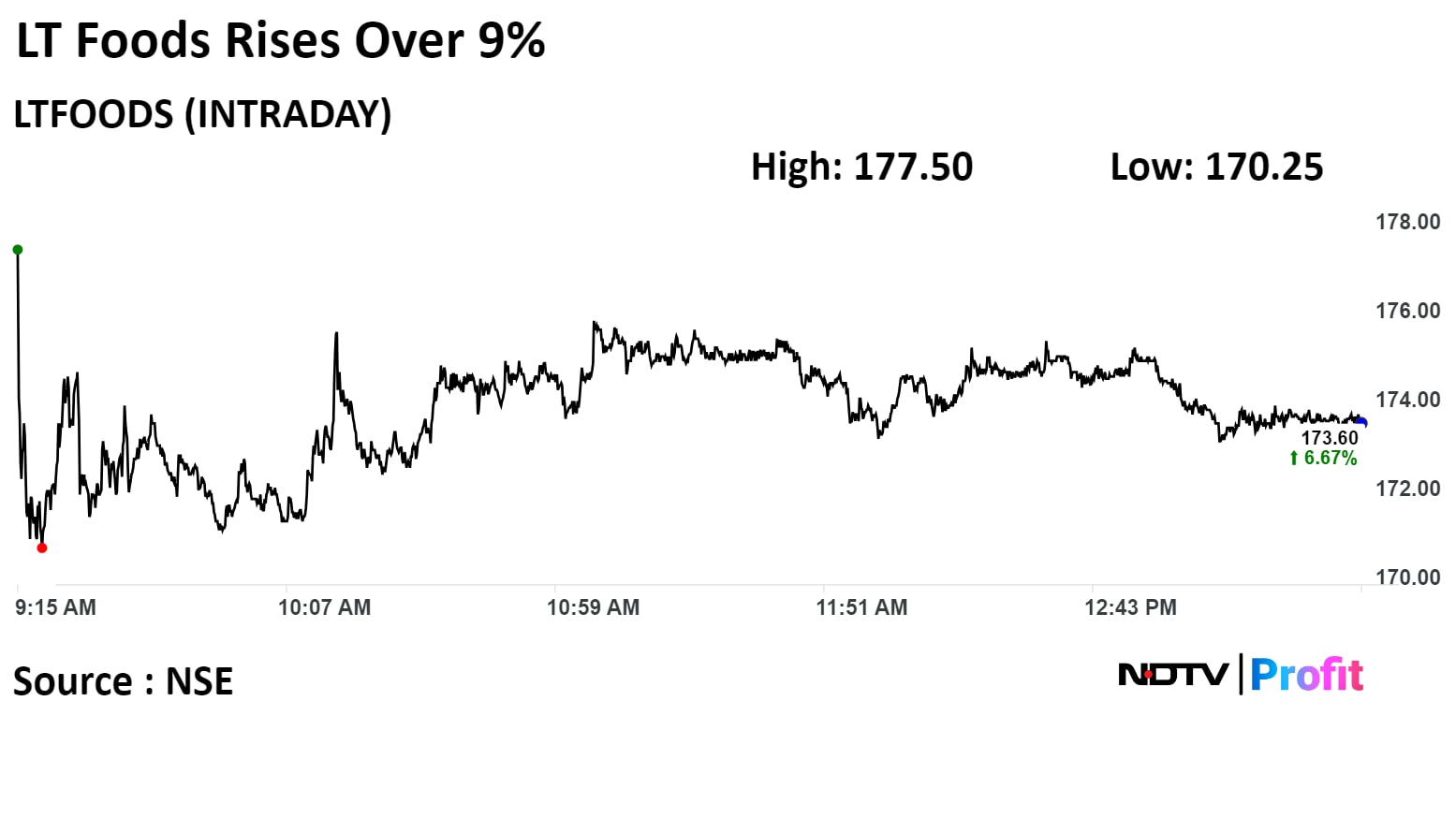

LT Foods Ltd. rose as much as 9.06% to Rs 177.50 apiece, the highest level since March 13. It was trading 6.70% higher at Rs 173.65 apiece, as of 1:36 p.m. This compares to a 0.29% advance in the NSE Nifty 50 Index.

It has risen 78.37% in 12 months. Total traded volume so far in the day stood at 16 times its 30-day average. The relative strength index was at 46.89.

One analyst maintains a 'buy' rating, according to Bloomberg data.

LT Foods Ltd. rose as much as 9.06% to Rs 177.50 apiece, the highest level since March 13. It was trading 6.70% higher at Rs 173.65 apiece, as of 1:36 p.m. This compares to a 0.29% advance in the NSE Nifty 50 Index.

It has risen 78.37% in 12 months. Total traded volume so far in the day stood at 16 times its 30-day average. The relative strength index was at 46.89.

One analyst maintains a 'buy' rating, according to Bloomberg data.

CG Power & Industrial Solutions Ltd. rose as much as 7.30% to Rs 513.95 apiece, the highest level since its listing on Jul 2, 1997. It was trading 5.31% higher at Rs 504.45 apiece, as of 1:14 p.m. This compares to a 0.42% advance in the NSE Nifty 50 Index.

It has risen 76.19% in 12 months. Total traded volume so far in the day stood at 4.3 times its 30-day average. The relative strength index was at 69.85.

Out of eight analysts tracking the company, five maintain a 'buy' rating, and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 11.4%.

CG Power & Industrial Solutions Ltd. rose as much as 7.30% to Rs 513.95 apiece, the highest level since its listing on Jul 2, 1997. It was trading 5.31% higher at Rs 504.45 apiece, as of 1:14 p.m. This compares to a 0.42% advance in the NSE Nifty 50 Index.

It has risen 76.19% in 12 months. Total traded volume so far in the day stood at 4.3 times its 30-day average. The relative strength index was at 69.85.

Out of eight analysts tracking the company, five maintain a 'buy' rating, and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 11.4%.

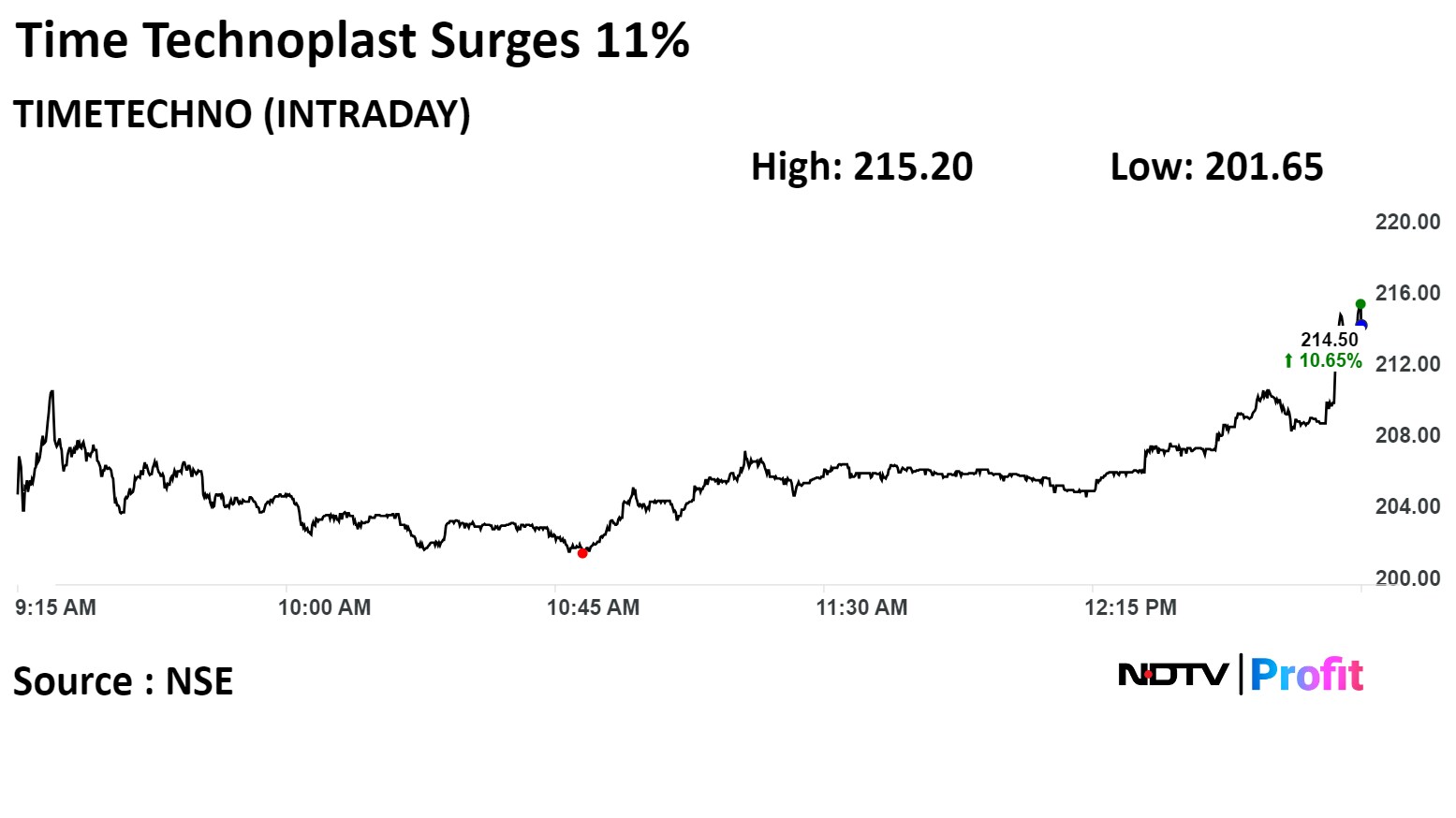

Time Technoplast rose as much as 11.01% to Rs 215.20 apiece, the highest level since March 11. It was trading 10.21% higher at Rs 213.65 apiece, as of 1:02 p.m. This compares to a 0.24% advance in the NSE Nifty 50 Index.

It has risen 192.67% in 12 months. Total traded volume so far in the day stood at 1.0 times its 30-day average. The relative strength index was at 53.90.

Time Technoplast rose as much as 11.01% to Rs 215.20 apiece, the highest level since March 11. It was trading 10.21% higher at Rs 213.65 apiece, as of 1:02 p.m. This compares to a 0.24% advance in the NSE Nifty 50 Index.

It has risen 192.67% in 12 months. Total traded volume so far in the day stood at 1.0 times its 30-day average. The relative strength index was at 53.90.

Kotak Mahindra Bank Ltd. has received the Reserve Bank of India's nod for redesignation of KVS Manian as Joint MD effective March 19.

The lender received RBI's nod for redesignation of Shanti Ekambaram Deputy MD effective March 19.

Source: Exchange filing

India's benchmark stock indices were trading little changed amid volatility through midday on Wednesday ahead of the U.S. Fed rate decision later in the day.

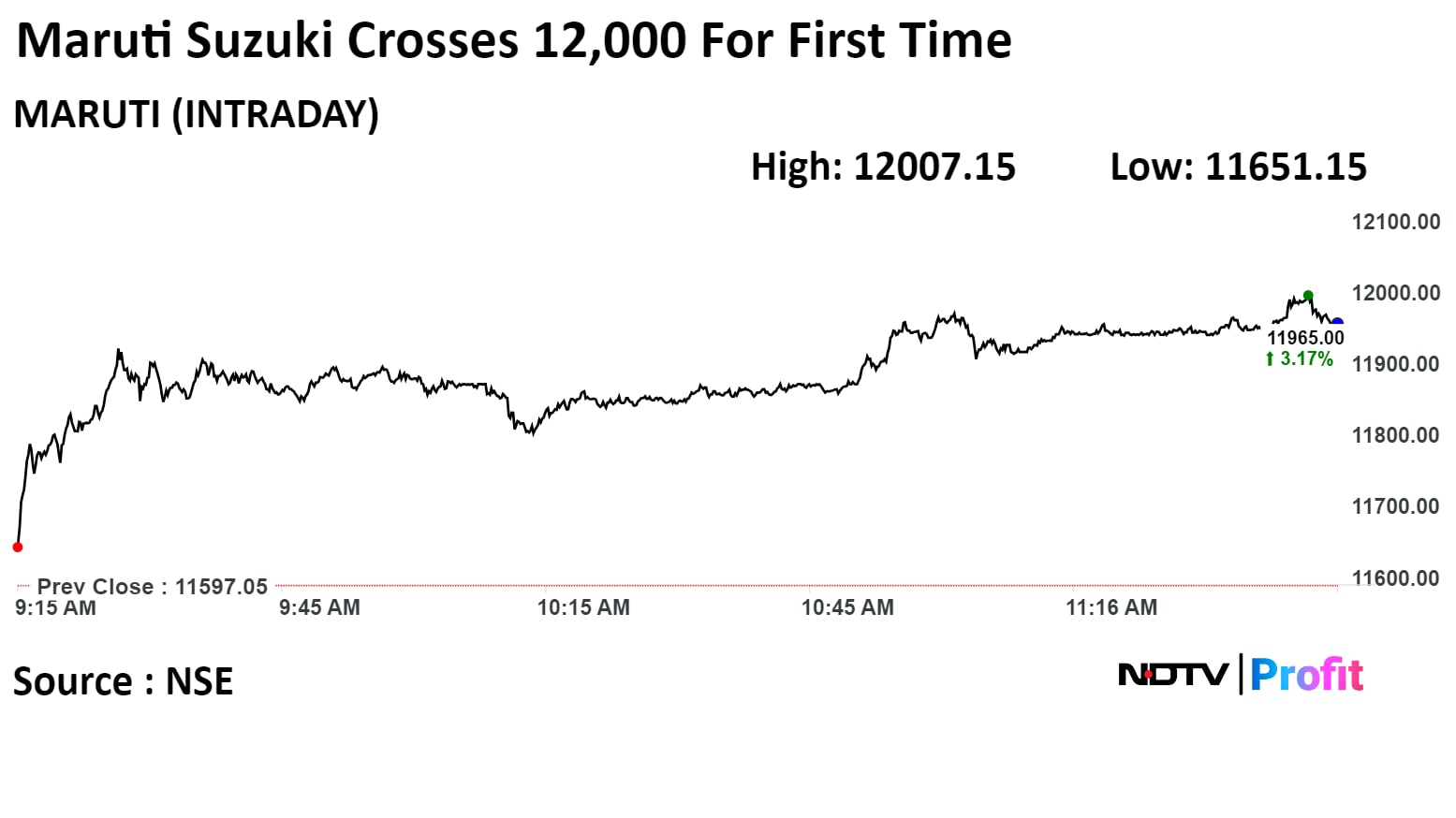

Gains in Reliance Industries Ltd. and Maruti Suzuki India Ltd. contributed the most to the indices.

At 11:51 a.m., the Nifty traded 28.85 points, or 0.13%, higher at 21,846.30, while the Sensex gained 113.45 points, or 0.16%, to trade at 72,125.49.

"Markets are trying to consolidate with a downward bias," Aditya Agarwala, head of research and investments at Invest4edu, told NDTV Profit.

Index heavyweights including HDFC Bank, Kotak Mahindra Bank, Axis Bank, and ICICI Bank are doing pretty well, but SBI is creating pressure on Nifty Bank in the last five-seven sessions, he said.

"The short buildup in HDFC Bank has been weared off, and other components (of Nifty Bank) are poised fully well," he said. He expects a rally of 1,000–2,000 points, awaiting a good trigger.

"The Nifty may catch up soon," he added.

India's benchmark stock indices were trading little changed amid volatility through midday on Wednesday ahead of the U.S. Fed rate decision later in the day.

Gains in Reliance Industries Ltd. and Maruti Suzuki India Ltd. contributed the most to the indices.

At 11:51 a.m., the Nifty traded 28.85 points, or 0.13%, higher at 21,846.30, while the Sensex gained 113.45 points, or 0.16%, to trade at 72,125.49.

"Markets are trying to consolidate with a downward bias," Aditya Agarwala, head of research and investments at Invest4edu, told NDTV Profit.

Index heavyweights including HDFC Bank, Kotak Mahindra Bank, Axis Bank, and ICICI Bank are doing pretty well, but SBI is creating pressure on Nifty Bank in the last five-seven sessions, he said.

"The short buildup in HDFC Bank has been weared off, and other components (of Nifty Bank) are poised fully well," he said. He expects a rally of 1,000–2,000 points, awaiting a good trigger.

"The Nifty may catch up soon," he added.

India's benchmark stock indices were trading little changed amid volatility through midday on Wednesday ahead of the U.S. Fed rate decision later in the day.

Gains in Reliance Industries Ltd. and Maruti Suzuki India Ltd. contributed the most to the indices.

At 11:51 a.m., the Nifty traded 28.85 points, or 0.13%, higher at 21,846.30, while the Sensex gained 113.45 points, or 0.16%, to trade at 72,125.49.

"Markets are trying to consolidate with a downward bias," Aditya Agarwala, head of research and investments at Invest4edu, told NDTV Profit.

Index heavyweights including HDFC Bank, Kotak Mahindra Bank, Axis Bank, and ICICI Bank are doing pretty well, but SBI is creating pressure on Nifty Bank in the last five-seven sessions, he said.

"The short buildup in HDFC Bank has been weared off, and other components (of Nifty Bank) are poised fully well," he said. He expects a rally of 1,000–2,000 points, awaiting a good trigger.

"The Nifty may catch up soon," he added.

India's benchmark stock indices were trading little changed amid volatility through midday on Wednesday ahead of the U.S. Fed rate decision later in the day.

Gains in Reliance Industries Ltd. and Maruti Suzuki India Ltd. contributed the most to the indices.

At 11:51 a.m., the Nifty traded 28.85 points, or 0.13%, higher at 21,846.30, while the Sensex gained 113.45 points, or 0.16%, to trade at 72,125.49.

"Markets are trying to consolidate with a downward bias," Aditya Agarwala, head of research and investments at Invest4edu, told NDTV Profit.

Index heavyweights including HDFC Bank, Kotak Mahindra Bank, Axis Bank, and ICICI Bank are doing pretty well, but SBI is creating pressure on Nifty Bank in the last five-seven sessions, he said.

"The short buildup in HDFC Bank has been weared off, and other components (of Nifty Bank) are poised fully well," he said. He expects a rally of 1,000–2,000 points, awaiting a good trigger.

"The Nifty may catch up soon," he added.

India's benchmark stock indices were trading little changed amid volatility through midday on Wednesday ahead of the U.S. Fed rate decision later in the day.

Gains in Reliance Industries Ltd. and Maruti Suzuki India Ltd. contributed the most to the indices.

At 11:51 a.m., the Nifty traded 28.85 points, or 0.13%, higher at 21,846.30, while the Sensex gained 113.45 points, or 0.16%, to trade at 72,125.49.

"Markets are trying to consolidate with a downward bias," Aditya Agarwala, head of research and investments at Invest4edu, told NDTV Profit.

Index heavyweights including HDFC Bank, Kotak Mahindra Bank, Axis Bank, and ICICI Bank are doing pretty well, but SBI is creating pressure on Nifty Bank in the last five-seven sessions, he said.

"The short buildup in HDFC Bank has been weared off, and other components (of Nifty Bank) are poised fully well," he said. He expects a rally of 1,000–2,000 points, awaiting a good trigger.

"The Nifty may catch up soon," he added.

India's benchmark stock indices were trading little changed amid volatility through midday on Wednesday ahead of the U.S. Fed rate decision later in the day.

Gains in Reliance Industries Ltd. and Maruti Suzuki India Ltd. contributed the most to the indices.

At 11:51 a.m., the Nifty traded 28.85 points, or 0.13%, higher at 21,846.30, while the Sensex gained 113.45 points, or 0.16%, to trade at 72,125.49.

"Markets are trying to consolidate with a downward bias," Aditya Agarwala, head of research and investments at Invest4edu, told NDTV Profit.

Index heavyweights including HDFC Bank, Kotak Mahindra Bank, Axis Bank, and ICICI Bank are doing pretty well, but SBI is creating pressure on Nifty Bank in the last five-seven sessions, he said.

"The short buildup in HDFC Bank has been weared off, and other components (of Nifty Bank) are poised fully well," he said. He expects a rally of 1,000–2,000 points, awaiting a good trigger.

"The Nifty may catch up soon," he added.

India's benchmark stock indices were trading little changed amid volatility through midday on Wednesday ahead of the U.S. Fed rate decision later in the day.

Gains in Reliance Industries Ltd. and Maruti Suzuki India Ltd. contributed the most to the indices.

At 11:51 a.m., the Nifty traded 28.85 points, or 0.13%, higher at 21,846.30, while the Sensex gained 113.45 points, or 0.16%, to trade at 72,125.49.

"Markets are trying to consolidate with a downward bias," Aditya Agarwala, head of research and investments at Invest4edu, told NDTV Profit.

Index heavyweights including HDFC Bank, Kotak Mahindra Bank, Axis Bank, and ICICI Bank are doing pretty well, but SBI is creating pressure on Nifty Bank in the last five-seven sessions, he said.

"The short buildup in HDFC Bank has been weared off, and other components (of Nifty Bank) are poised fully well," he said. He expects a rally of 1,000–2,000 points, awaiting a good trigger.

"The Nifty may catch up soon," he added.

India's benchmark stock indices were trading little changed amid volatility through midday on Wednesday ahead of the U.S. Fed rate decision later in the day.

Gains in Reliance Industries Ltd. and Maruti Suzuki India Ltd. contributed the most to the indices.

At 11:51 a.m., the Nifty traded 28.85 points, or 0.13%, higher at 21,846.30, while the Sensex gained 113.45 points, or 0.16%, to trade at 72,125.49.

"Markets are trying to consolidate with a downward bias," Aditya Agarwala, head of research and investments at Invest4edu, told NDTV Profit.

Index heavyweights including HDFC Bank, Kotak Mahindra Bank, Axis Bank, and ICICI Bank are doing pretty well, but SBI is creating pressure on Nifty Bank in the last five-seven sessions, he said.

"The short buildup in HDFC Bank has been weared off, and other components (of Nifty Bank) are poised fully well," he said. He expects a rally of 1,000–2,000 points, awaiting a good trigger.

"The Nifty may catch up soon," he added.

Shares of Reliance Industries Ltd., Maruti Suzuki Ltd., Tata Consultancy Services Ltd., Eicher Motors Ltd., and Bajaj Finance Ltd. were contributing the most to Nifty 50.

While those of HDFC Bank Ltd., ICICI Bank Ltd., Tata Motors Ltd., Axis Bank Ltd., and Tata Steel Ltd. were weighing on the index.

Most sectoral indices fell with Nifty Metal and Nifty PSU Bank falling over 1% whereas Nifty Oil & Gas and Nifty IT gained.

Broader markets underperformed their larger peers, with the S&P BSE Midcap falling 0.25% and the S&P BSE Smallcap declining 0.32% through midday on Wednesday.

On BSE, eight indices rose while 12 declined. The S&P BSE Metal fell the most.

Market breadth was skewed in favour of the sellers. Around 2,220 stocks declined, 1,350 stocks rose, and 128 stocks remained unchanged on BSE.

Carysil Ltd has approved raising up to Rs 150 crore via QIP.

Source: Exchange Filing

Tata Consultancy Services Ltd. launched innovation hub 'Pace Port' in London.

Source: Exchange Filing

JSW-MG aims to sell one million EVs by 2030, capturing one-third of the market.

India to move from 4 million cars to 10 million cars over next 10 years.

Source: Press Event

Maruti Suzuki India Ltd. rose 3.54% to Rs 12,007.15, the highest level since its listing on Jul 9, 2023. It was trading 3.09% higher at Rs 11,954.90 as of 11:52 a.m., as compared to 0.12% advance on the NSE Nifty 50 index.

It has gained 45.47% in 12 months. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 67.98.

Out of 49 analysts tracking the company, 40 maintain a 'buy' rating, six recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.1%.

Maruti Suzuki India Ltd. rose 3.54% to Rs 12,007.15, the highest level since its listing on Jul 9, 2023. It was trading 3.09% higher at Rs 11,954.90 as of 11:52 a.m., as compared to 0.12% advance on the NSE Nifty 50 index.

It has gained 45.47% in 12 months. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 67.98.

Out of 49 analysts tracking the company, 40 maintain a 'buy' rating, six recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.1%.

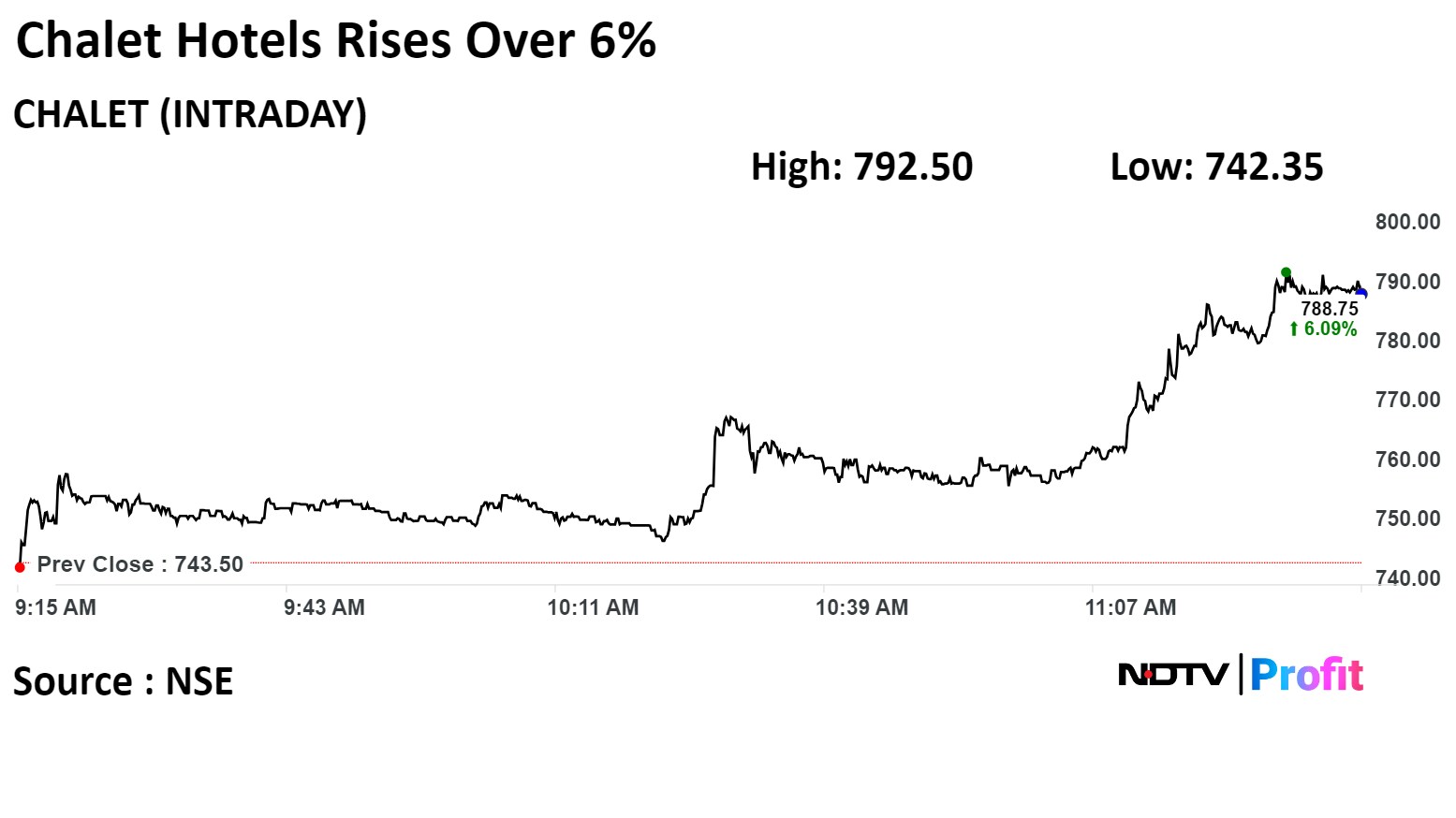

Chalet Hotels Ltd. rose as much as 6.59% to Rs 792.50 apiece, the highest level since March 6. It was trading 5.86% higher at Rs 787.05 apiece, as of 11:57 a.m. This compares to a 0.13% advance in the NSE Nifty 50 Index.

It has risen 115.54% in 12 months. Total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 54.97.

Out of 13 analysts tracking the company, 11 maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.9%.

Chalet Hotels Ltd. rose as much as 6.59% to Rs 792.50 apiece, the highest level since March 6. It was trading 5.86% higher at Rs 787.05 apiece, as of 11:57 a.m. This compares to a 0.13% advance in the NSE Nifty 50 Index.

It has risen 115.54% in 12 months. Total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 54.97.

Out of 13 analysts tracking the company, 11 maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.9%.

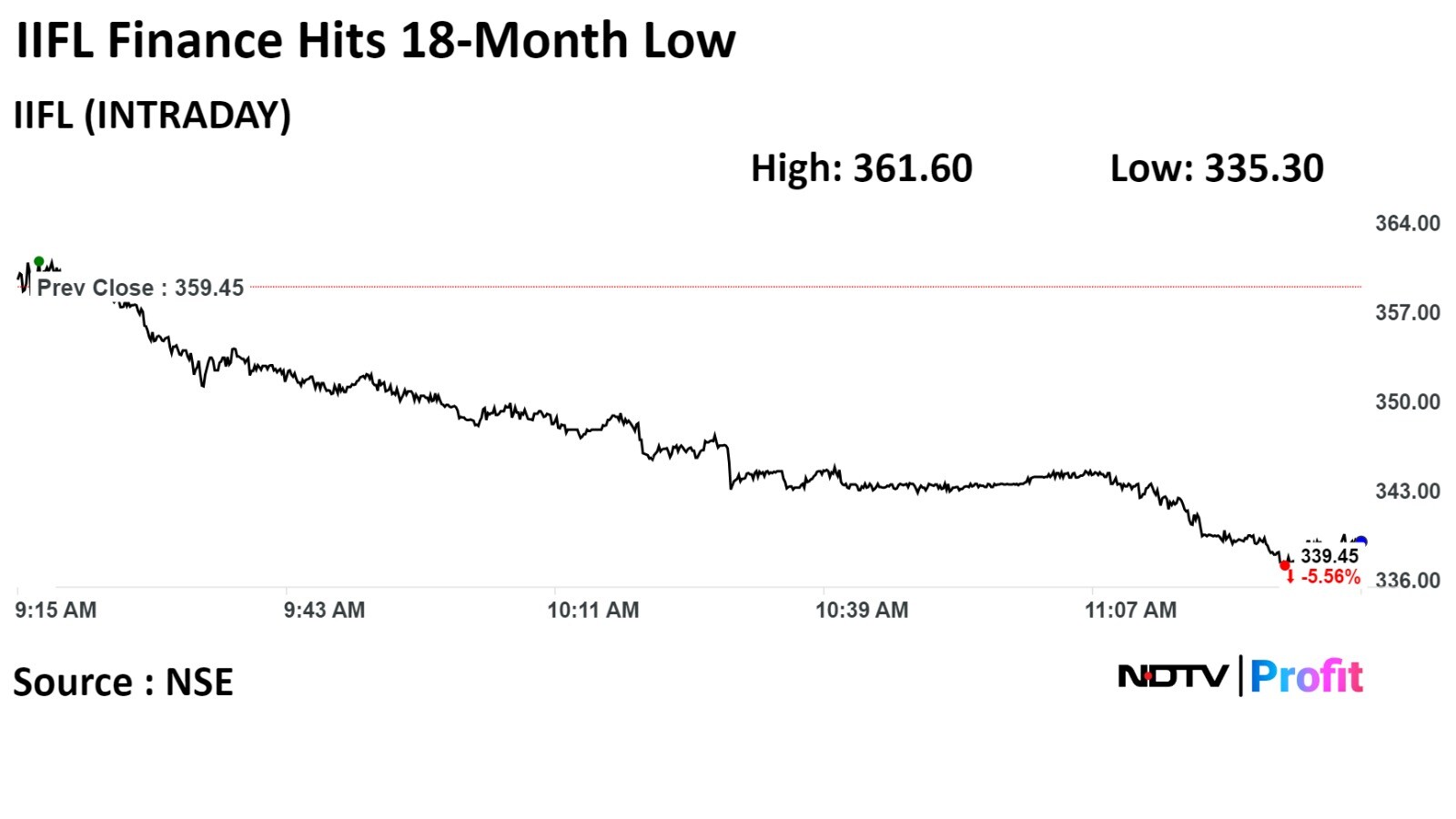

IIFL Finance Ltd. fell as much as 6.72% to Rs 335.30 apiece, the lowest level since Sep 12, 2022. It was trading 5.48% lower at Rs 339.75 apiece, as of 12:04 p.m. This compares to a 0.12% advance in the NSE Nifty 50 Index.

It has declined 20.31% in 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 22.07, which implied the stock is oversold.

Out of seven analysts tracking the company, five maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 92.2%.

IIFL Finance Ltd. fell as much as 6.72% to Rs 335.30 apiece, the lowest level since Sep 12, 2022. It was trading 5.48% lower at Rs 339.75 apiece, as of 12:04 p.m. This compares to a 0.12% advance in the NSE Nifty 50 Index.

It has declined 20.31% in 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 22.07, which implied the stock is oversold.

Out of seven analysts tracking the company, five maintain a 'buy' rating, one recommend a 'hold,' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 92.2%.

Rama Steel Tubes Ltd. reduced bank loans limits by Rs 116 crore.

Source: Exchange Filing

Hindustan Unilever Ltd. declined 1.19% to Rs 2,240.00, the lowest level since Jul 1, 2022. It was trading 0.66% down at Rs 2,252 as of 11:23 a.m., which compares to decline 0.23% decline in the NSE Nifty 50 index.

The scrip has been falling for three consecutive session.

It has declined 10.40% in 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 25.23, which implied the stock is oversold.

Out of 43 analysts tracking the company, 20 maintain a 'buy' rating, 16 recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.60%.

Hindustan Unilever Ltd. declined 1.19% to Rs 2,240.00, the lowest level since Jul 1, 2022. It was trading 0.66% down at Rs 2,252 as of 11:23 a.m., which compares to decline 0.23% decline in the NSE Nifty 50 index.

The scrip has been falling for three consecutive session.

It has declined 10.40% in 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 25.23, which implied the stock is oversold.

Out of 43 analysts tracking the company, 20 maintain a 'buy' rating, 16 recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.60%.

Lt Foods at 6.7x its 30 day average up 8%

Metro Brands at 4.87x its 30 day average up 8%

Sapphire Foods India at 4.5x its 30 day averageup 1%

DB Realty at 3.3x its 30 day average down 0.3%

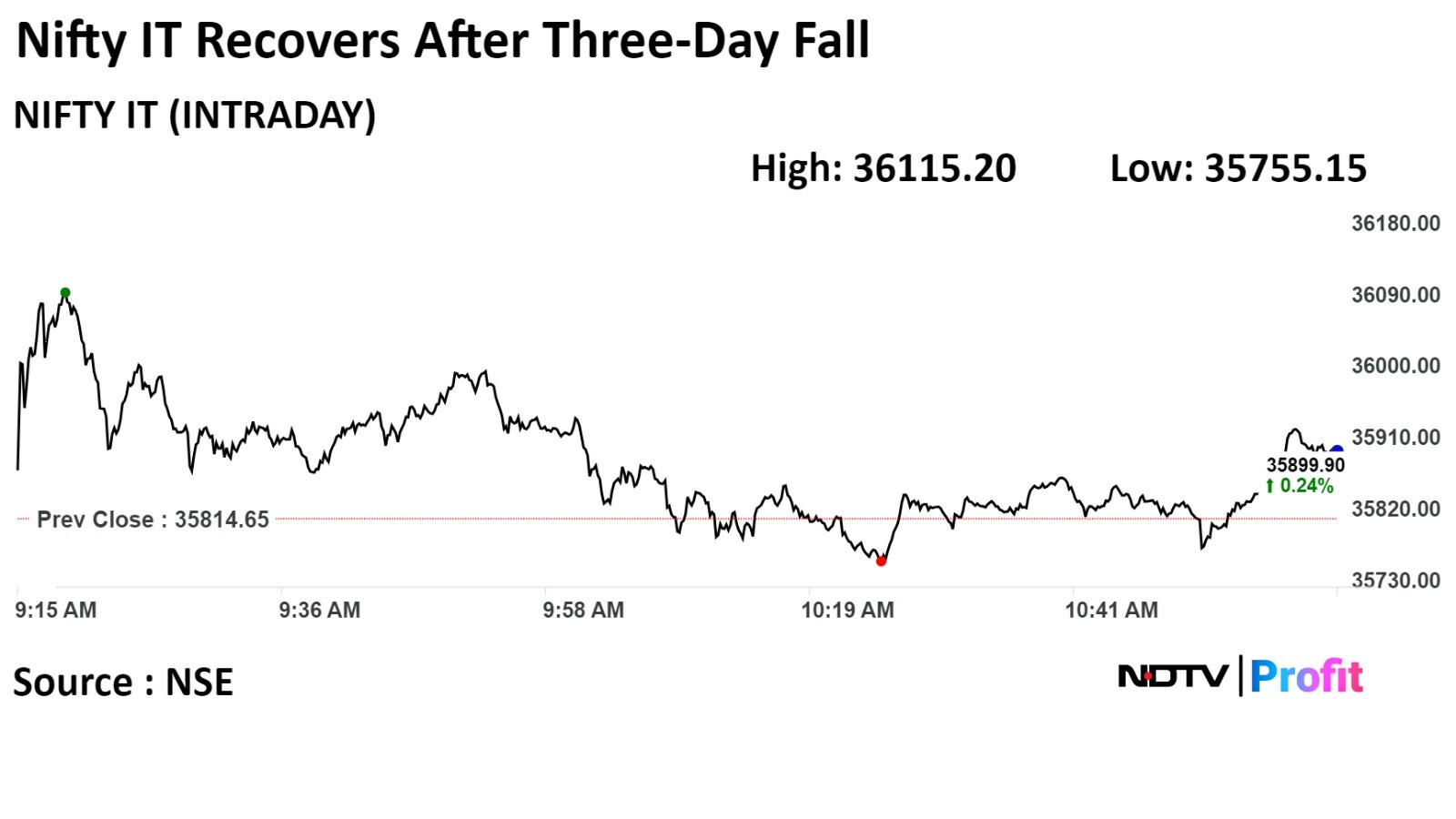

The Nifty index recovered from losses recorded in past three session on Wednesday, tracking gains in Tata Consultancy Services Ltd., Infosys Ltd., and Persistent Systems Ltd.

The index was trading 0.11% or 44.70 points higher at 35,858.60 as of 11:09 a.m.

The Nifty index recovered from losses recorded in past three session on Wednesday, tracking gains in Tata Consultancy Services Ltd., Infosys Ltd., and Persistent Systems Ltd.

The index was trading 0.11% or 44.70 points higher at 35,858.60 as of 11:09 a.m.

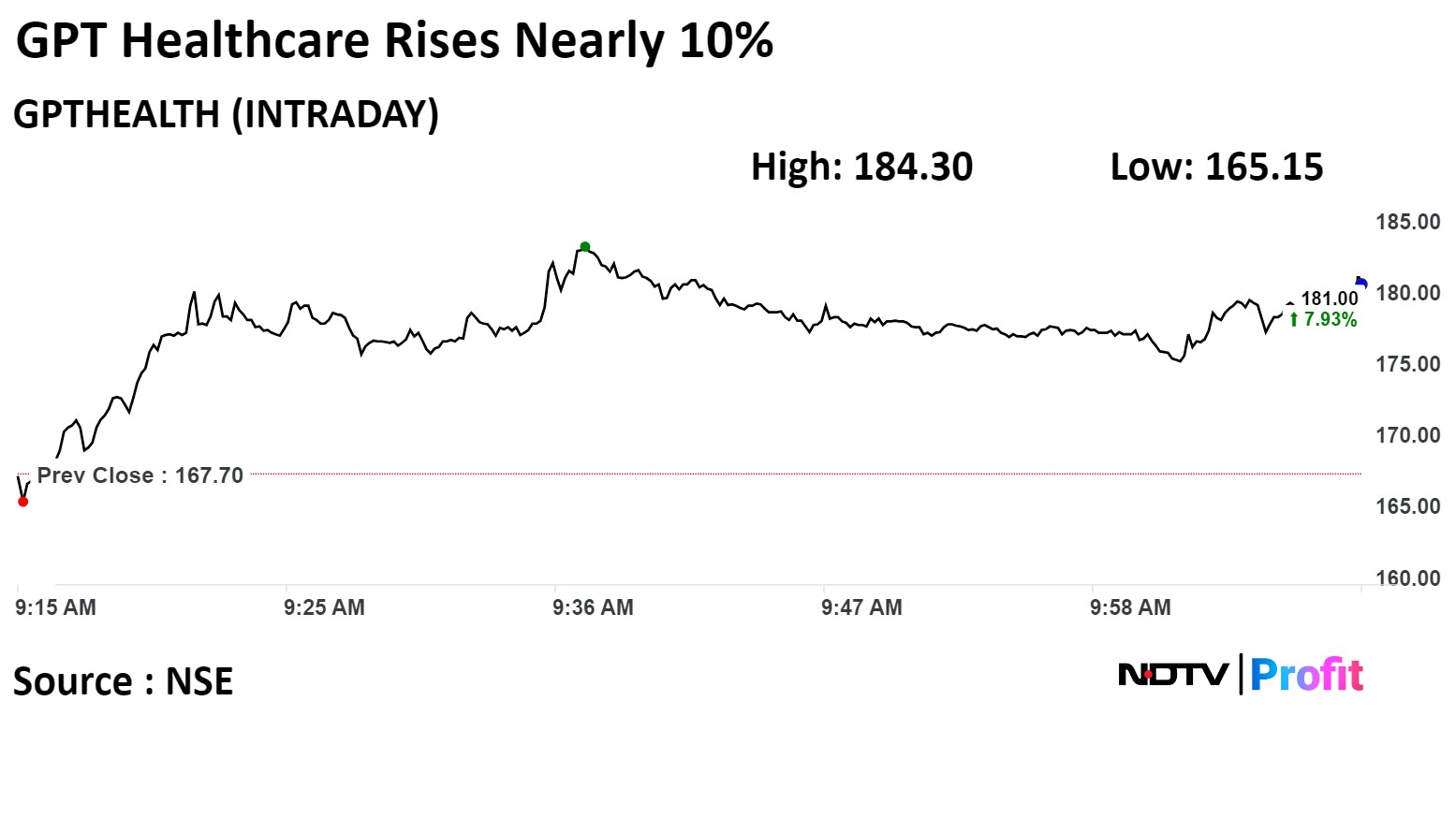

Shares of GPT Healthcare Ltd. surged nearly 10% to a two-week high on Wednesday, after its profit jumped in the third quarter.

Net profit of the newly listed company rose 37.4% year-on-year to Rs 11.5 crore in the quarter ended December 2023, according to an exchange filing.

Shares of GPT Healthcare Ltd. surged nearly 10% to a two-week high on Wednesday, after its profit jumped in the third quarter.

Net profit of the newly listed company rose 37.4% year-on-year to Rs 11.5 crore in the quarter ended December 2023, according to an exchange filing.

Ontario Teachers' Pension Plan completed third investment worth about Rs 1,820 crore in National Highways Infra Trust.

Total investment in National Highways Infra Trust stands at about Rs 3,680 crore.

Alert: National Highways Infra Trust is an InvIT sponsored by NHAI.

Source: Press release

Ramky Infrastructure Ltd. received two orders worth Rs 217 crore from Greater Chennai Corp.

Source: Exchange filing

Hindustan Unilever Ltd. will closely assess the global initiatives of Unilever

The ice cream business has an inherently different business model compared to the rest of Unilever's business.

Ice creams contributed to 3% of HUL Revenue in FY23.

HUL has cost savings program in HUL called Symphony.

The company generates gross savings of 6% of turnover.

HUL will assimilate best practices to take Symphony to its next phase.

"We will discuss this with the HUL Board and Unilever management in the coming months"

Source: HUL spokesperson

Jupiter Wagons Ltd. has approved acquisition of Bonatrans India Private for Rs 271 crore.

The acquisition is to be completed within 30 days.

Bonatrans India manufactures components of rolling stocks such as wheels, axles & wheel Sets.

Source: Exchange filing

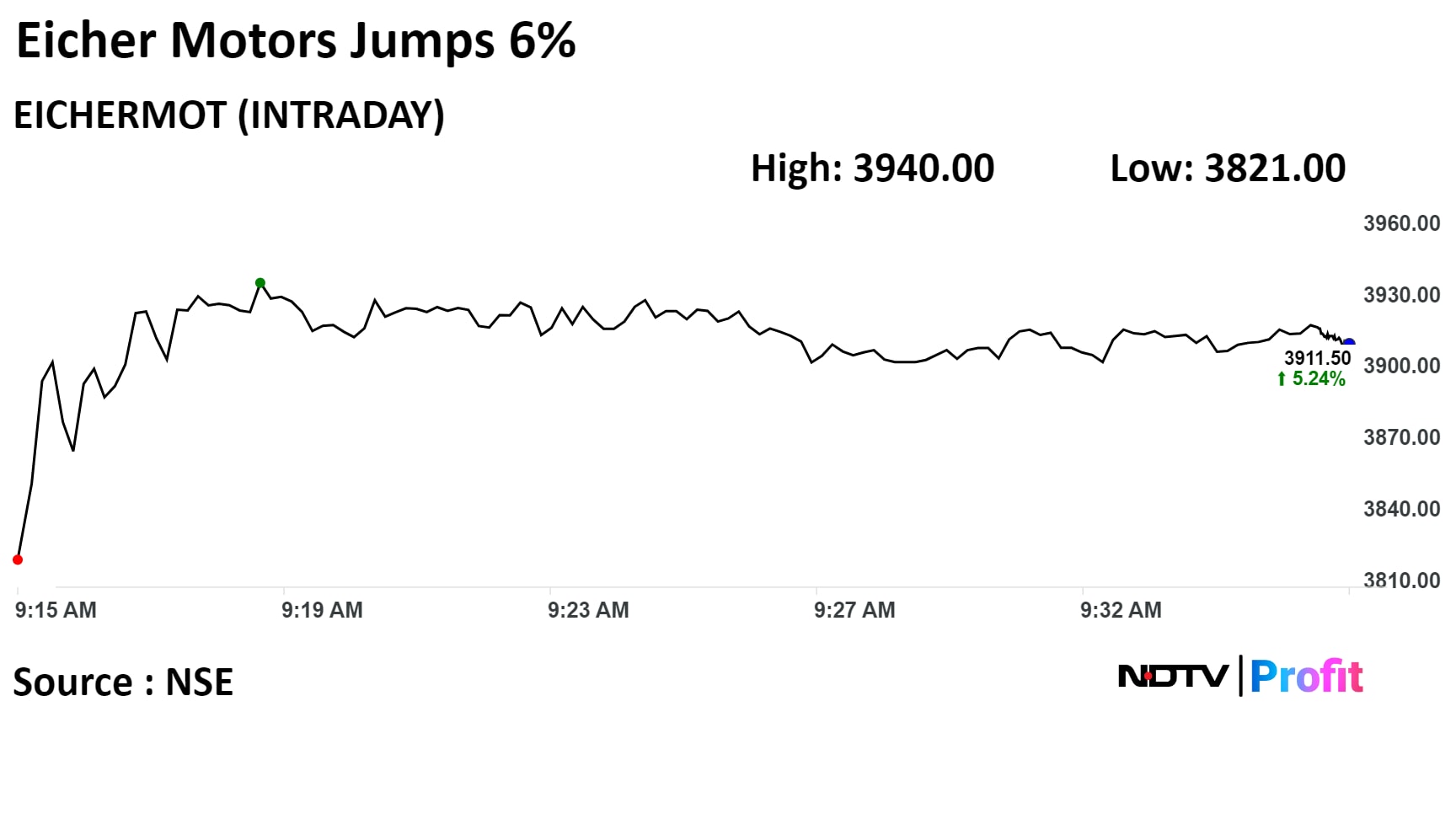

On the NSE, Eicher's stock rose as much as 6% during the day to Rs 3,940 apiece, the highest since Feb. 28. It was trading 5.04% higher at Rs 3,904 per share, compared to a 0.09% advance in the benchmark Nifty 50 as of 9:32 a.m.

The share price has risen 32.75% in the last 12 months. The total traded volume so far in the day stood at 24 times its 30-day average. The relative strength index was at 57.3.

Nineteen out of the 41 analysts tracking the company have a 'buy' rating on the stock, 11 recommend 'hold' and as many suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3.4%.

On the NSE, Eicher's stock rose as much as 6% during the day to Rs 3,940 apiece, the highest since Feb. 28. It was trading 5.04% higher at Rs 3,904 per share, compared to a 0.09% advance in the benchmark Nifty 50 as of 9:32 a.m.

The share price has risen 32.75% in the last 12 months. The total traded volume so far in the day stood at 24 times its 30-day average. The relative strength index was at 57.3.

Nineteen out of the 41 analysts tracking the company have a 'buy' rating on the stock, 11 recommend 'hold' and as many suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3.4%.

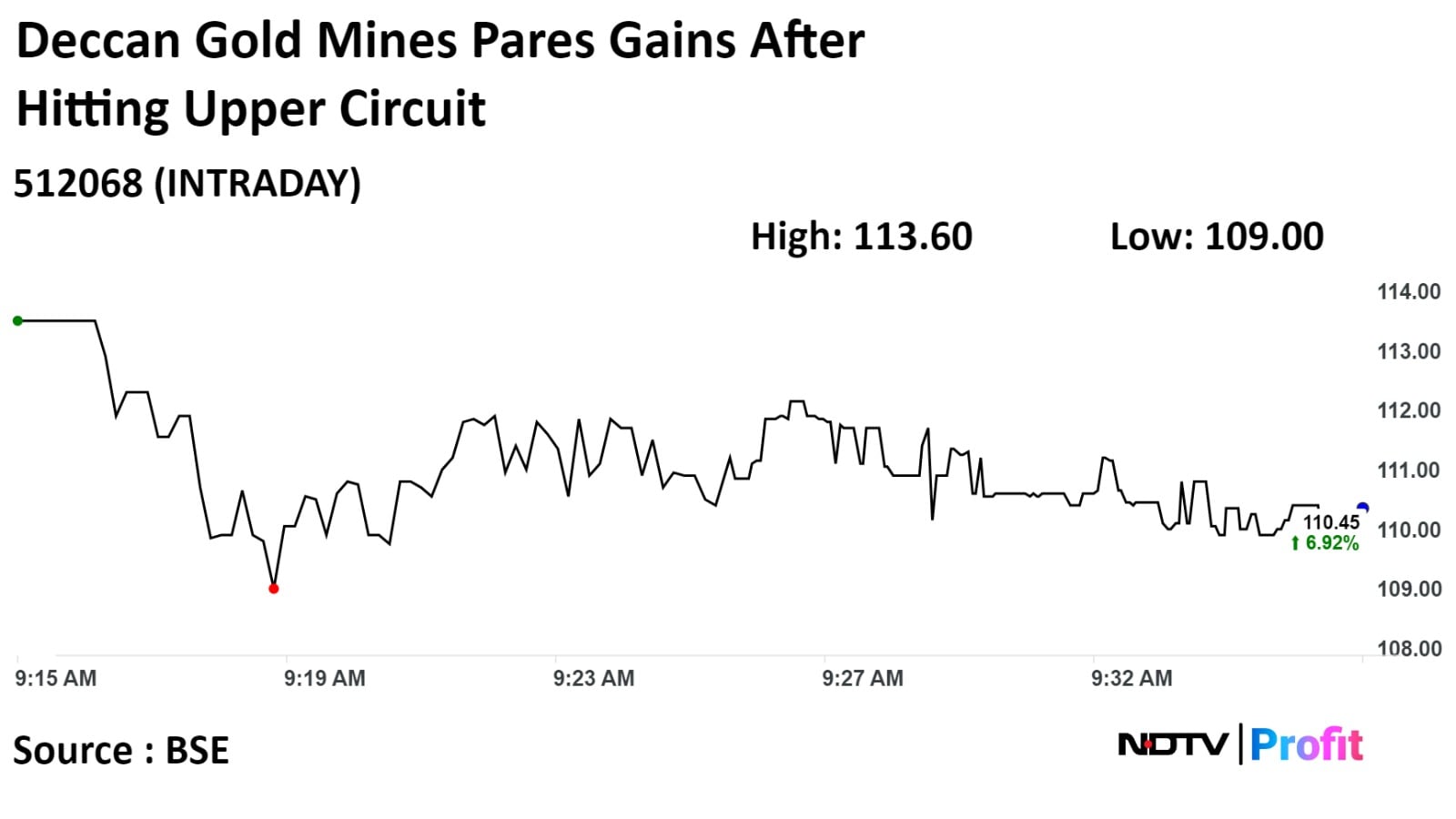

Shares of Deccan Gold Mines hit their upper circuit limit of 10% after discovering gold and lithium reserves in Tanzania.

In an exchange filing, the company said that it has found high grade quartz veins, up to a maximum of 8.52 g/t Gold grade are in the PL block 11524 in the Nzega - Tabora Greenstone belt.

Moreover, a prospecting license for lithium and associated metals covering an area of 100.49 sq.km has been recommended in favour of Deccan Gold Tanzania Pvt Ltd and grant order is awaited.

Shares of Deccan Gold Mines hit their upper circuit limit of 10% after discovering gold and lithium reserves in Tanzania.

In an exchange filing, the company said that it has found high grade quartz veins, up to a maximum of 8.52 g/t Gold grade are in the PL block 11524 in the Nzega - Tabora Greenstone belt.

Moreover, a prospecting license for lithium and associated metals covering an area of 100.49 sq.km has been recommended in favour of Deccan Gold Tanzania Pvt Ltd and grant order is awaited.

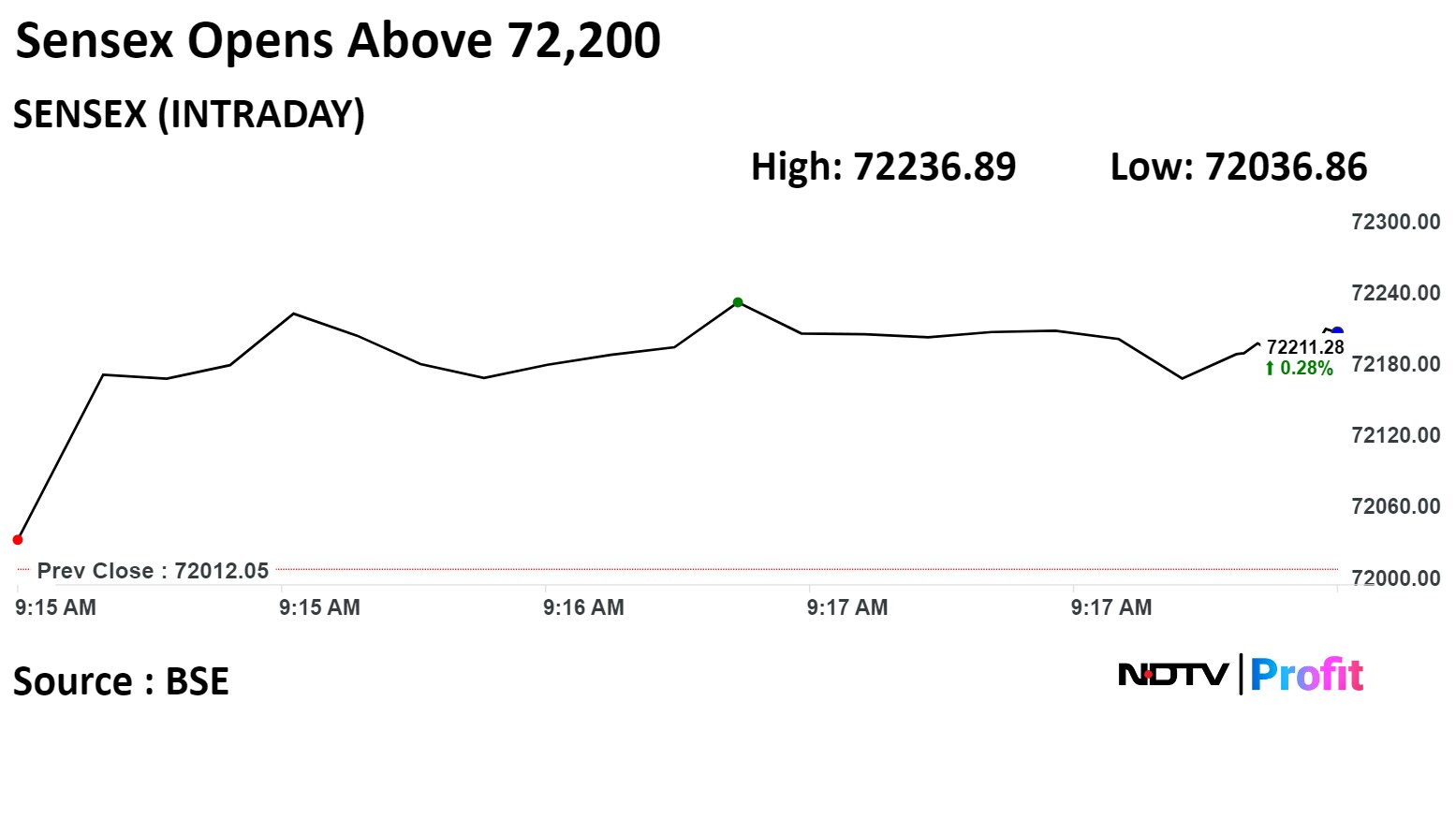

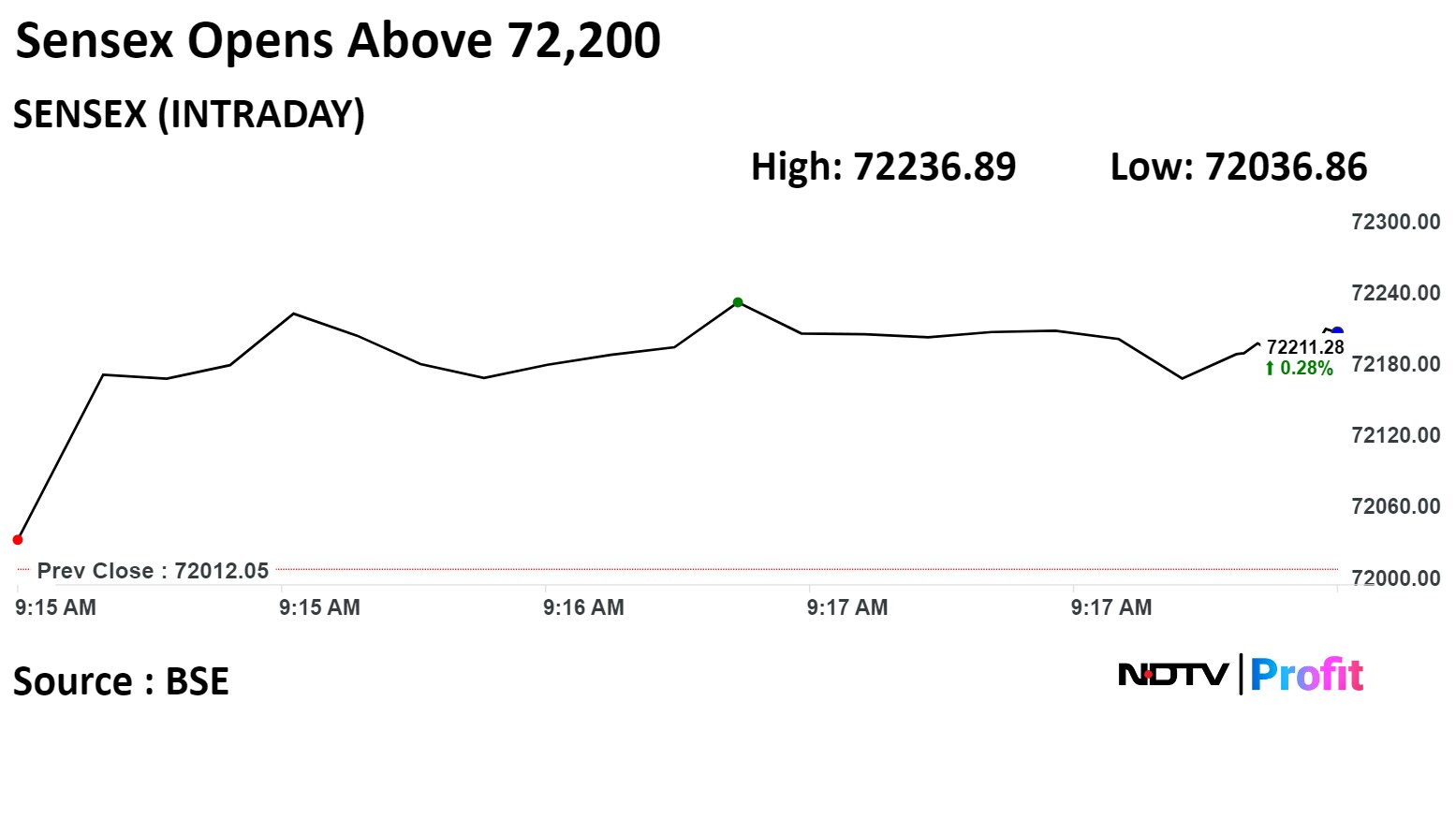

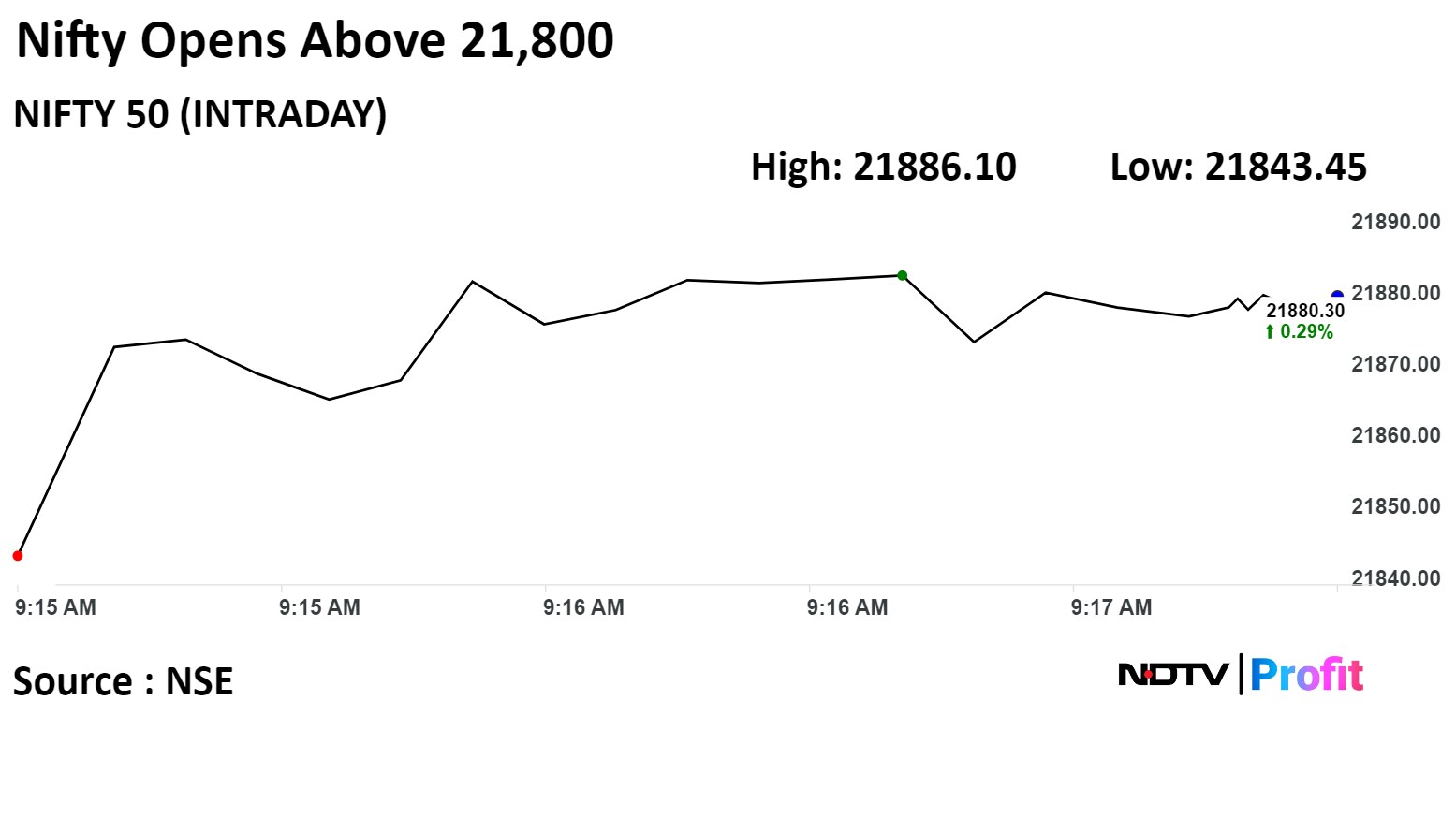

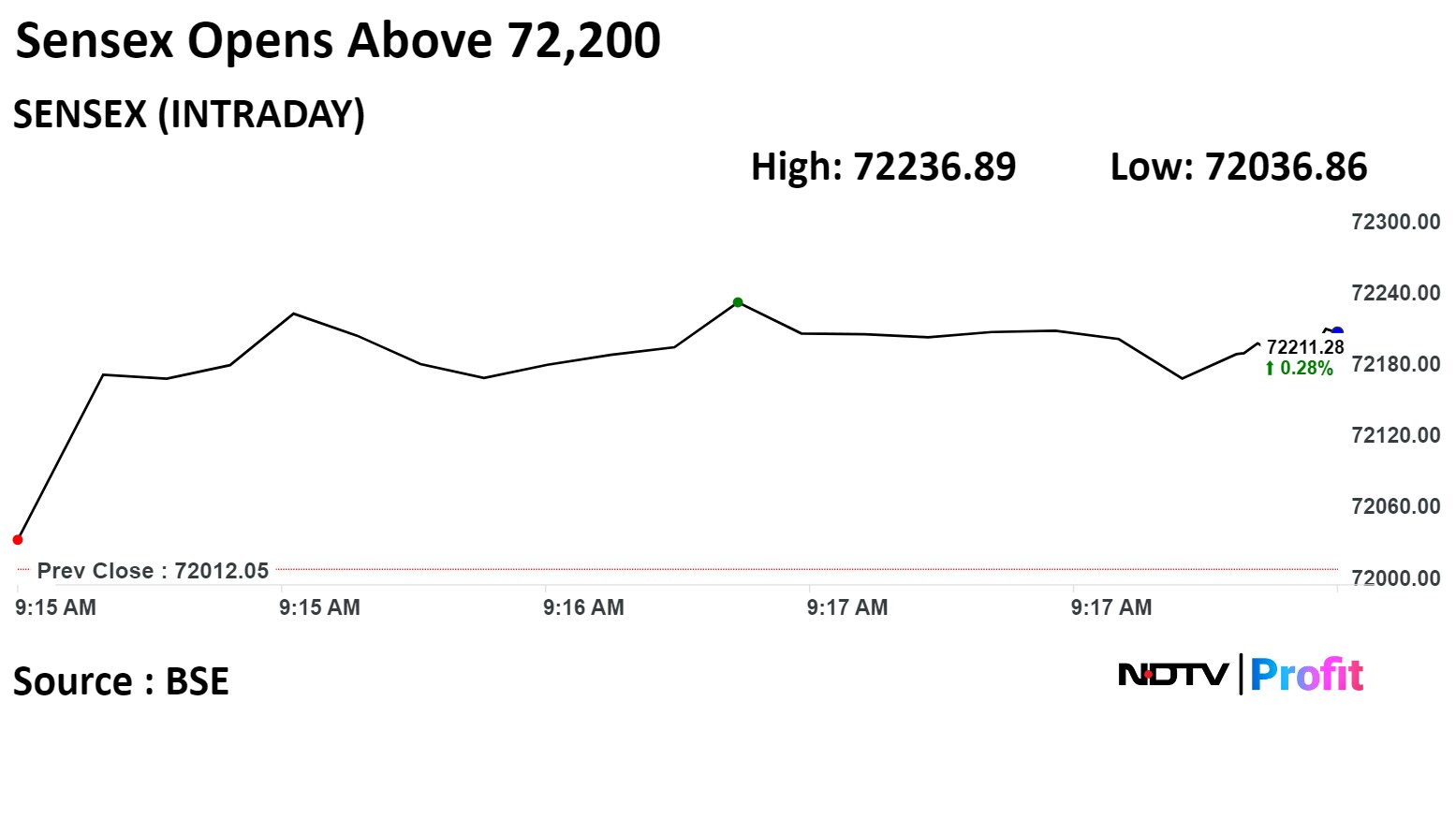

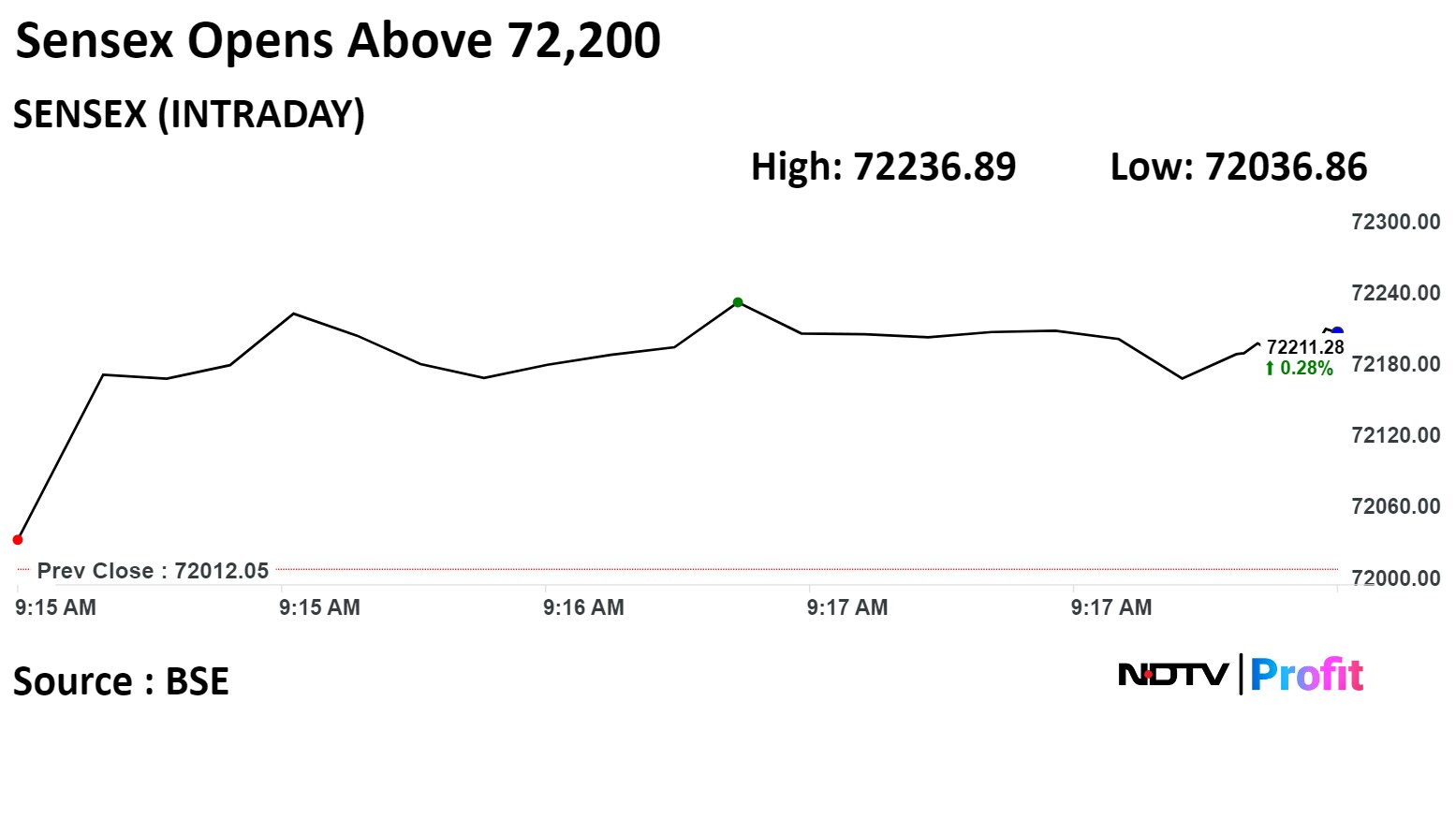

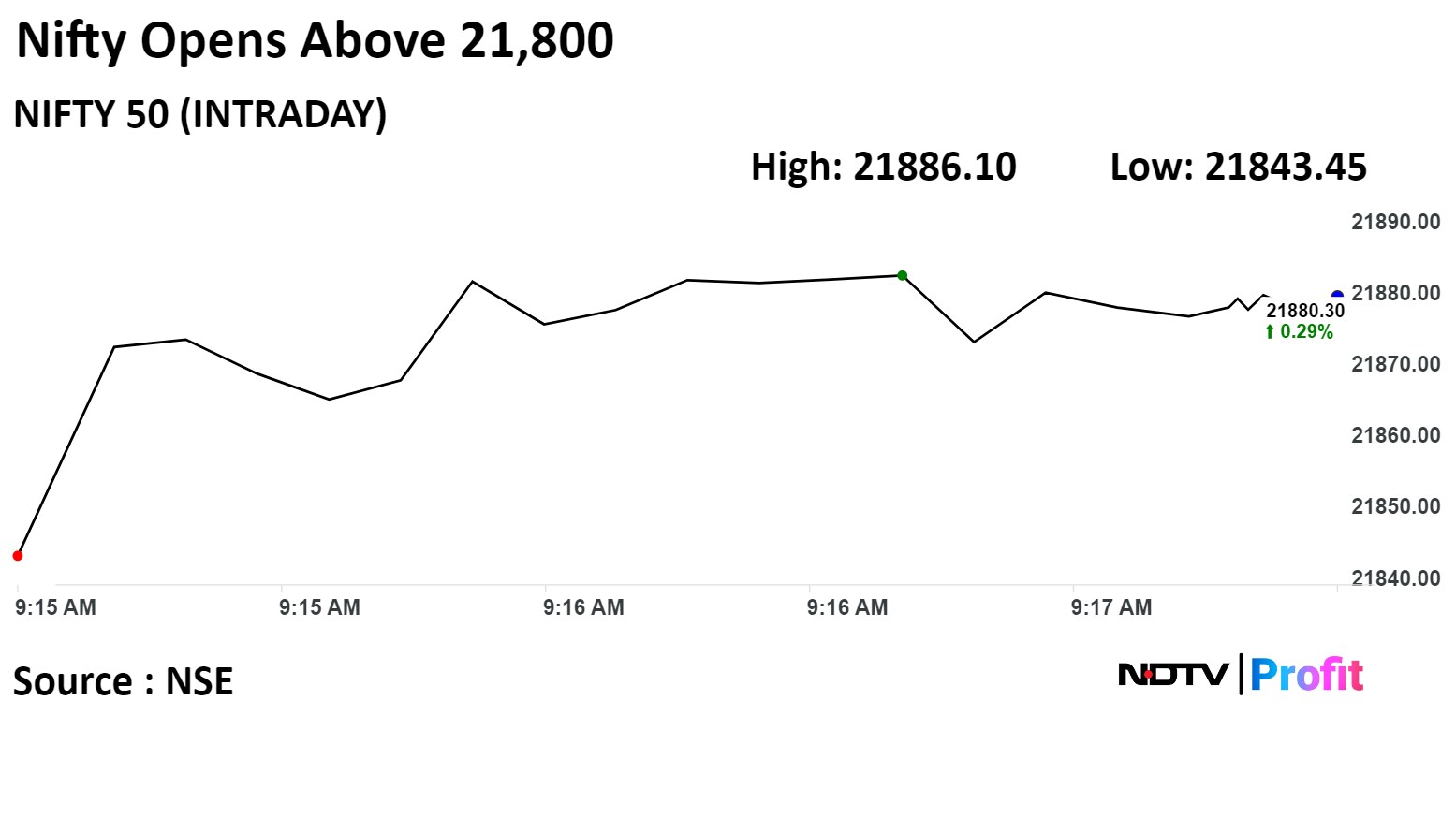

India's benchmark indices recovered losses at open, tracking gains in Asian peers, and on Wall Street as investors keenly wait for the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

Eicher Motors Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. added to the gains in the benchmark indices.

As of 09:22 a.m., the NSE Nifty 50 index was trading 65.00 points or 0.30% higher at 21,882.45, and the S&P BSE Sensex was trading 191.49 points or 0.27% higher at 72,203.54.

The U.S. central bank is expected to maintain the pause in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for cues on rate trajectory moving ahead.

The Fed fund future traders are betting 99% chance of rates to remain unchanged at current 5.25-5.55% level in Fed's March monetary policy meeting, according to CME FedWatch Tool.

India's benchmark indices recovered losses at open, tracking gains in Asian peers, and on Wall Street as investors keenly wait for the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

Eicher Motors Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. added to the gains in the benchmark indices.

As of 09:22 a.m., the NSE Nifty 50 index was trading 65.00 points or 0.30% higher at 21,882.45, and the S&P BSE Sensex was trading 191.49 points or 0.27% higher at 72,203.54.

The U.S. central bank is expected to maintain the pause in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for cues on rate trajectory moving ahead.

The Fed fund future traders are betting 99% chance of rates to remain unchanged at current 5.25-5.55% level in Fed's March monetary policy meeting, according to CME FedWatch Tool.

India's benchmark indices recovered losses at open, tracking gains in Asian peers, and on Wall Street as investors keenly wait for the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

Eicher Motors Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. added to the gains in the benchmark indices.

As of 09:22 a.m., the NSE Nifty 50 index was trading 65.00 points or 0.30% higher at 21,882.45, and the S&P BSE Sensex was trading 191.49 points or 0.27% higher at 72,203.54.

The U.S. central bank is expected to maintain the pause in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for cues on rate trajectory moving ahead.

The Fed fund future traders are betting 99% chance of rates to remain unchanged at current 5.25-5.55% level in Fed's March monetary policy meeting, according to CME FedWatch Tool.

India's benchmark indices recovered losses at open, tracking gains in Asian peers, and on Wall Street as investors keenly wait for the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

Eicher Motors Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. added to the gains in the benchmark indices.

As of 09:22 a.m., the NSE Nifty 50 index was trading 65.00 points or 0.30% higher at 21,882.45, and the S&P BSE Sensex was trading 191.49 points or 0.27% higher at 72,203.54.

The U.S. central bank is expected to maintain the pause in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for cues on rate trajectory moving ahead.

The Fed fund future traders are betting 99% chance of rates to remain unchanged at current 5.25-5.55% level in Fed's March monetary policy meeting, according to CME FedWatch Tool.

"The Indian market did not participate in the rally in the last few sessions after the market regulator SEBI and AMF have directed fund houses to provide additional disclosures for small and mid-cap funds from this month," said Vikas Jain, senior research analyst at Reliance Securities.

As a result, traders were booking profit at a higher level and skip the higher market volatility. Recent fall is a good buying opportunity for a longer term perspective in the strong fundamental stocks. Realty, financial, auto, IT and PSUs stocks are looking attractive on account of favourable risk reward ratio, Jain said.

India's benchmark indices recovered losses at open, tracking gains in Asian peers, and on Wall Street as investors keenly wait for the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

Eicher Motors Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. added to the gains in the benchmark indices.

As of 09:22 a.m., the NSE Nifty 50 index was trading 65.00 points or 0.30% higher at 21,882.45, and the S&P BSE Sensex was trading 191.49 points or 0.27% higher at 72,203.54.

The U.S. central bank is expected to maintain the pause in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for cues on rate trajectory moving ahead.

The Fed fund future traders are betting 99% chance of rates to remain unchanged at current 5.25-5.55% level in Fed's March monetary policy meeting, according to CME FedWatch Tool.

India's benchmark indices recovered losses at open, tracking gains in Asian peers, and on Wall Street as investors keenly wait for the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

Eicher Motors Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. added to the gains in the benchmark indices.

As of 09:22 a.m., the NSE Nifty 50 index was trading 65.00 points or 0.30% higher at 21,882.45, and the S&P BSE Sensex was trading 191.49 points or 0.27% higher at 72,203.54.

The U.S. central bank is expected to maintain the pause in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for cues on rate trajectory moving ahead.

The Fed fund future traders are betting 99% chance of rates to remain unchanged at current 5.25-5.55% level in Fed's March monetary policy meeting, according to CME FedWatch Tool.

India's benchmark indices recovered losses at open, tracking gains in Asian peers, and on Wall Street as investors keenly wait for the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

Eicher Motors Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. added to the gains in the benchmark indices.

As of 09:22 a.m., the NSE Nifty 50 index was trading 65.00 points or 0.30% higher at 21,882.45, and the S&P BSE Sensex was trading 191.49 points or 0.27% higher at 72,203.54.

The U.S. central bank is expected to maintain the pause in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for cues on rate trajectory moving ahead.

The Fed fund future traders are betting 99% chance of rates to remain unchanged at current 5.25-5.55% level in Fed's March monetary policy meeting, according to CME FedWatch Tool.

India's benchmark indices recovered losses at open, tracking gains in Asian peers, and on Wall Street as investors keenly wait for the outcome of the U.S. Federal Reserve's monetary policy meeting, due to be published later today.

Eicher Motors Ltd., Infosys Ltd., and Tata Consultancy Services Ltd. added to the gains in the benchmark indices.

As of 09:22 a.m., the NSE Nifty 50 index was trading 65.00 points or 0.30% higher at 21,882.45, and the S&P BSE Sensex was trading 191.49 points or 0.27% higher at 72,203.54.

The U.S. central bank is expected to maintain the pause in the monetary policy meeting this week. However, market participants will closely monitor Chair Jerome Powell's remarks, and dot plots for cues on rate trajectory moving ahead.

The Fed fund future traders are betting 99% chance of rates to remain unchanged at current 5.25-5.55% level in Fed's March monetary policy meeting, according to CME FedWatch Tool.

"The Indian market did not participate in the rally in the last few sessions after the market regulator SEBI and AMF have directed fund houses to provide additional disclosures for small and mid-cap funds from this month," said Vikas Jain, senior research analyst at Reliance Securities.

As a result, traders were booking profit at a higher level and skip the higher market volatility. Recent fall is a good buying opportunity for a longer term perspective in the strong fundamental stocks. Realty, financial, auto, IT and PSUs stocks are looking attractive on account of favourable risk reward ratio, Jain said.

Infosys Ltd., Eicher Motors Ltd., Tata Consultancy Services Ltd., Maruti Suzuki India Ltd., and Axis Bank Ltd. added positively to the benchmark indices.

ICICI Bank Ltd., Hindustan Unilever Ltd., Reliance Industries Ltd., Asian Paints Ltd., and HDFC Bank Ltd. limited gains in the benchmark indices.

On NSE, all sectoral indices were trading in positive with the Nifty Auto index emerging as the top leader.

Broader markets underperformed benchmark indices. The S&P BSE Midcap index was 0.02% down, and the S&P BSE Smallcap was 0.11% down.

On BSE, 13 sectors advanced out of 20, and seven declined. The S&P BSE Auto index rose the most among sectoral indices, and the S&P BSE Metal index fell the most.

Market breadth was skewed in favour of the buyers. Around 1,675 stocks rose, 1,175 stocks declined, and 118 stocks remained unchanged on BSE.

At pre-open, the NSE Nifty 50 was trading 26.45 points or 0.12% higher at 21,843.90, and the S&P BSE Sensex was trading 24.81points or 0.034% higher at 72,036.86.

L&T Technology Services Ltd. will train 1,000 engineers in 3 years on Nvidia's gen-AI software NeMo.

Source: Exchange filing

The yield on the 10-year bond opened flat at 7.10%.

Source: Bloomberg

The local currency strengthened by 4 paise to open at 83 against the U.S. Dollar.

It closed at 83.04 a dollar on Tuesday.

Source: Bloomberg

Oriana Power Ltd. received an order worth Rs 14.9 crore for 3 MWp project from Mormugao Port Authority in Goa.

Source: Exchange filing

UBS upgraded Eicher Motors Ltd.'s rating from 'Neutral' to 'Buy' with a target price of Rs 5,000 from earlier Rs 4,300.

RE's upcoming 450cc platform launch to address competition and growth concerns.

Rival launches have not been able to ramp up volume meaningfully.

Replacement demand remains ripe.

Competition has not breached RE's qualitative/emotive edge

Exports to deliver strong double-digit growth in medium term

Forecast an 18% EBITDA CAGR in FY24-26, 11% ahead of consensus in PAT by FY26

Trading at a 17% discount to peers compared to 47% premium (last five years average).

Zomato Ltd. has decided to remove the on-ground segregation of vegetarian fleet using the colour green.

All riders, including regular and vegetarian fleet, will wear the colour red.

Same-colour uniforms will ensure that delivery partners are not incorrectly associated with non-veg food.

Same uniform will ensure that delivery partners are not targeted by RWAs during 'special days'.

Source: Deepindar Goyal on X

Update on our pure veg fleet —

— Deepinder Goyal (@deepigoyal) March 20, 2024

While we are going to continue to have a fleet for vegetarians, we have decided to remove the on-ground segregation of this fleet on the ground using the colour green. All our riders — both our regular fleet, and our fleet for vegetarians, will…

JP Morgan initiates on Cyient with an Outperform; TP: 2600

Diversified portfolio with a wider addressable market to tap

Ciyent's 80% of portfolio seeing strong demand led by Aero, Telecom (wireline) & sustainability

Strong margin execution that has bridged gap with its peers

Re-rating potential: inexpensive valuations (20x FY26E PE vs peers 35x)

U.S. Dollar Index at 103.88

U.S. 10-year bond yield at 4.29%

Brent crude down 0.22% at $87.19 per barrel

Nymex crude down 0.35% at $83.18 per barrel

GIFT Nifty up 45 points or 0.21% at 21,944.00 as of 8:16 a.m.

Bitcoin was down 2.62% at $62,076.24

Nuvama retains 'buy' on Dabur with target price of Rs 680 apiece.

Focus on premiumisation and scaling up existing categories to new adjacencies

Boost profits via price hikes (6.1% in 9MFY24)

Target of 20%-plus Ebitda margin and 8–10% A&P spends

Targeting direct reach of 1.6 million outlets (existing 1.4 million) in near term

Sustainability of rural business remains key

expect Q4FY24 volumes to rise by a mid-single digit with margin expansion

Bernstein rates Bajaj Auto an 'outperform' with a revised target price of Rs 9,400 apiece.

Increased near-term and long-term estimates for Bajaj Auto.

Key levers: improvement in exports, pick up in domestic volumes.

Revised the long-term revenue/ Ebitda growth estimates by 1-2%

Value ascribed to the EV business is $1.6bn.

Expect EV venture to have 12% market share in E-scoters by FY30.

JP Morgan initiates coverage of Tata Tech with an 'underperform' and sets target price at Rs 800 apiece.

While ER&D remains a star sector.

The company has high client concentration with limited evidence in scaling non-anchor clients.

Expects low earnings CAGR of 16% over FY24-26E vs peer avg of 18%

Believe valuations are excessive at 53x 1-year forward P/E

Target price for HPCL/IOCL/BPCL raise to Rs 570/195/735

Believes overhang on marketing margins has passed

Believe OMCs will be allowed to revert to daily prices post elections

Factor marketing margins of Rs 3 per liter

Healthy refining outlook over CY24/25

Favorable demand-supply, global inventory levels to support refining segment

Expect refining margins of $9 per barrel

Nifty March futures down by 1.14% to 21,886.5 at a premium of 69.05 points.

Nifty March futures open interest down by 6%.

Nifty Bank March futures up by 0.67% to 46,449.05 at a premium of 64.25 points.

Nifty Bank March futures open interest up by 0.65%.

Nifty Options March 21 Expiry: Maximum Call open interest at 22,000 and Maximum Put open interest at 21,000.

Bank Nifty Options March 20 Expiry: Maximum Call Open Interest at 47,000 and Maximum Put open interest at 45,000.

Securities in ban period: Balrampur Chini Mills, Bharat Heavy Electricals, Biocon, Hindustan Copper, Indus Tower, Piramal Enterprise, RBL Bank, Sail, and Zee Entertainment Enterprise.

The Indian rupee weakened by 13 paise to close at 83.04 against the U.S. Dollar

Price band revised from 10% to 5%: Sanghi Industries,

Price band revised from 5% to 20%: Platinum Industries.

Ex/record bonus issue: Advani Hotels and Resorts, Paisalo Digital

Ex/record buyback: Dwarikesh Sugar Industries.

Moved out into short-term ASM framework: Saurashtra Cement,

Moved out short-term ASM framework: Jupiter Lifeline Hospitals, Tata Chemicals.

Crompton Greaves and Consumer Electric: To meet analysts and investors on March 22 and 26.

Tilaknagar Industries: To meet analysts and investors on March 22.

Adani Ports: To meet analysts and investors on March 26 and 27.

GE Power India: To meet analysts and investors on April 4.

UltraTech Cement: To meet analysts and investors on March 20.

Man Infraconstruction: To meet analysts and investors on March 22.

Mangalore Chemical and Fertilizers: Promoter Zuari Agro Chemicals created a pledge of 3.5 lakh shares on March 15.

Gokul Agro Resources: Promoter Ritika Infracon bought 1.09 lakh shares on March 18.

Bharat Wire Ropes: Promoter Gyanshankar bought 2.86 lakh shares on March 13.

Star Cement: Promoter Prem Kumar Bhajanka acquired 24,801 shares on March 15.

LT Foods: Abakkus Asset Manager LLP bought 33.93 lakh shares (0.97%) at Rs 162.04 apiece.

Rama Steel Tubes: SKSE Securities bought 62.06 lakh shares (1.22%) at Rs 15.1 apiece, while Share India Securities sold 26.28 lakh shares (0.51%) at Rs 15.15 apiece.

Star Health and Allied Services: ICICI Prudential Mutual Fund bought 35.74 lakh shares (0.61%) at Rs 540 apiece.

Tata Consultancy Services: The U.S.-based Central Bank selected TCS BaNCS to update core technology infra.

UltraTech Cement: The composite scheme of arrangement between Kesoram Industries and UltraTech Cement has been successfully completed, marking a significant milestone for both companies.

Aditya Birla Capital: Promoter to exercise a green shoe option for shares of Aditya Birla Sun Life AMC.

GPT Healthcare: The company's revenue rose 4% YoY to Rs 96.6 crore, and net profit rose 37.4% YoY to Rs 11.5 crore for Q3 FY24.

KIOCL: The company installed four vertical pressure filters in the pellet plant unit at Mangalore, with the capacity of each filter at 100 tn/hr.

Shakti Pumps: The board approved the QIP of up to Rs 200 crore at a floor price of Rs 1,272.09 per share.

Matrimony.com: The board approved the re-appointment of Murugavel Janakiraman as managing director for three years, effective April 1.

Care Ratings: The board approved the incorporation of a wholly owned subsidiary in GIFT City, Gujarat.

Patanjali Foods: The company issued clarification that the Supreme Court order relates to ads for ayurvedic products and medicines from Patanjali Ayurved and has no bearing on the company.

Rushil Decor: The company incorporated the unit Rushil Modala Ply for the manufacturing and sale of plywood and allied products.

Aurobindo Pharma: The company received USFDA approval for Mometasone Furoate Monohydrate nasal spray.

Apollo Hospital: The company redesignated Madhu Sasidhar as President and CEO, Hospitals Division, effective April 1.

Narayan Hrudayalaya: The company approved an allotment of 30,000 NCDs worth Rs 300 crore on a private placement basis.

NBCC: The company’s subsidiary, HSCC (India), has secured a Rs 14 crore work order for lab equipment procurement for the Himachal Pharma Testing Lab.

Deccan Gold Mines: Unit Deccan Gold Tanzania has discovered gold and lithium reserves in Tanzania, a significant step towards the company's strategy to diversify into critical minerals.

IFCI: The company has approved a preferential issue of equity shares worth Rs 500 crore to the government for FY24.

Persistent System: The company acquired a 100% shareholding of Persistent Systems U.K. from Aepona Group.

Samvardhana Motherson International: The company has announced the acquisition of an 81% stake in the Yachiyo 4W business and 100% equity capital in Yachiyo India manufacturing.

Indiabulls Housing: The board approved offering a circular for foreign currency-denominated bonds.

SKF India: The company appointed Mukund Vasudevan as President, Industrial Region, India and Southeast Asia.

Stocks in the Asia-Pacific region powered ahead, mirroring the gains made in the U.S. market, which gears up for the latest monetary policy decision from the Federal Reserve.

The Kospi was trading 1.05% higher at 2,684.6, and the S&P ASX 200 was trading 0.12% higher at 7,712.5 as of 6:28 a.m.

A rebound in U.S. tech stocks helped the S&P 500 touch a new record high. The S&P 500 index and Nasdaq 100 rose by 0.56% and 0.39%, respectively, as of Tuesday.

The yield on the 10-year U.S. bond was trading at 4.29%, and Bitcoin was above the 63,000 level. Brent crude was trading beyond $87 a barrel, whereas WTI crude was above the $83 mark.

At 8:16 a.m., the GIFT Nifty, an early indicator of the Nifty 50 Index’s performance in India, was 45 points or 0.21% higher at 21,944.00.

India's benchmark stock indices fell to their lowest level in over a month on Tuesday, dragged by losses in the shares of IT companies.

The Nifty closed 238.25 points, or 1.08%, lower at 21,817.45—the lowest level since Feb. 13—while the Sensex fell 736.37 points, or 1.01%, to end at 72,012.05—the lowest since Feb. 14.

Overseas investors became net buyers of Indian equities on Tuesday.

Foreign portfolio investors bought stocks worth Rs 1,421.5 crore, and domestic institutional investors remained net buyers for the third day and mopped up equities worth Rs 7,449.5 crore, the NSE data showed. This comes on a day when 2.02 crore shares of Tata Consultancy Services Ltd. changed hands in five large trades.

The Indian rupee weakened by 13 paise to close at Rs 83.04 against the U.S. dollar.

Stocks in the Asia-Pacific region powered ahead, mirroring the gains made in the U.S. market, which gears up for the latest monetary policy decision from the Federal Reserve.

The Kospi was trading 1.05% higher at 2,684.6, and the S&P ASX 200 was trading 0.12% higher at 7,712.5 as of 6:28 a.m.

A rebound in U.S. tech stocks helped the S&P 500 touch a new record high. The S&P 500 index and Nasdaq 100 rose by 0.56% and 0.39%, respectively, as of Tuesday.

The yield on the 10-year U.S. bond was trading at 4.29%, and Bitcoin was above the 63,000 level. Brent crude was trading beyond $87 a barrel, whereas WTI crude was above the $83 mark.

At 8:16 a.m., the GIFT Nifty, an early indicator of the Nifty 50 Index’s performance in India, was 45 points or 0.21% higher at 21,944.00.

India's benchmark stock indices fell to their lowest level in over a month on Tuesday, dragged by losses in the shares of IT companies.

The Nifty closed 238.25 points, or 1.08%, lower at 21,817.45—the lowest level since Feb. 13—while the Sensex fell 736.37 points, or 1.01%, to end at 72,012.05—the lowest since Feb. 14.

Overseas investors became net buyers of Indian equities on Tuesday.

Foreign portfolio investors bought stocks worth Rs 1,421.5 crore, and domestic institutional investors remained net buyers for the third day and mopped up equities worth Rs 7,449.5 crore, the NSE data showed. This comes on a day when 2.02 crore shares of Tata Consultancy Services Ltd. changed hands in five large trades.

The Indian rupee weakened by 13 paise to close at Rs 83.04 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.