Overseas investors turned net sellers of Indian equities on Monday.

Foreign portfolio investors sold stocks worth Rs 2,051.09 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors turned buyers and mopped up equities worth Rs 2,260.88 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 17278 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

The NSE Nifty 50 closed 32.35 points, or 0.15%, higher at 22,055.70, and the S&P BSE Sensex ended 104.99 points, or 0.14%, up at 72,748.42.

The yield on the 10-year bond closed 3 bps higher at 7.09%.

Source: Bloomberg

The local currency weakened by two paise to close at 82.91 against the U.S. Dollar.

It closed at 82.89 a dollar on Friday.

Source: Bloomberg

The local currency weakened by two paise to close at 82.91 against the U.S. Dollar.

It closed at 82.89 a dollar on Friday.

Source: Bloomberg

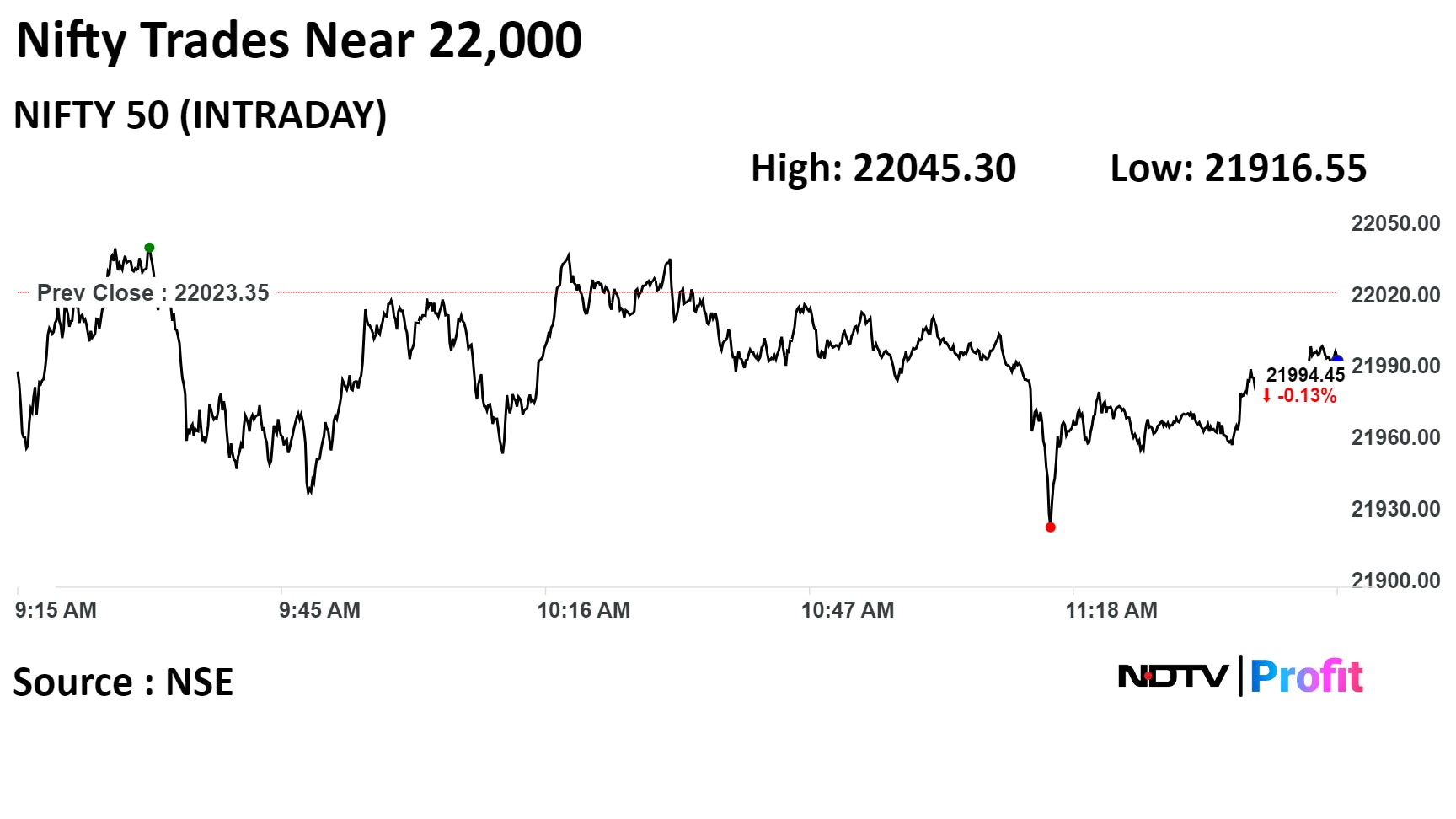

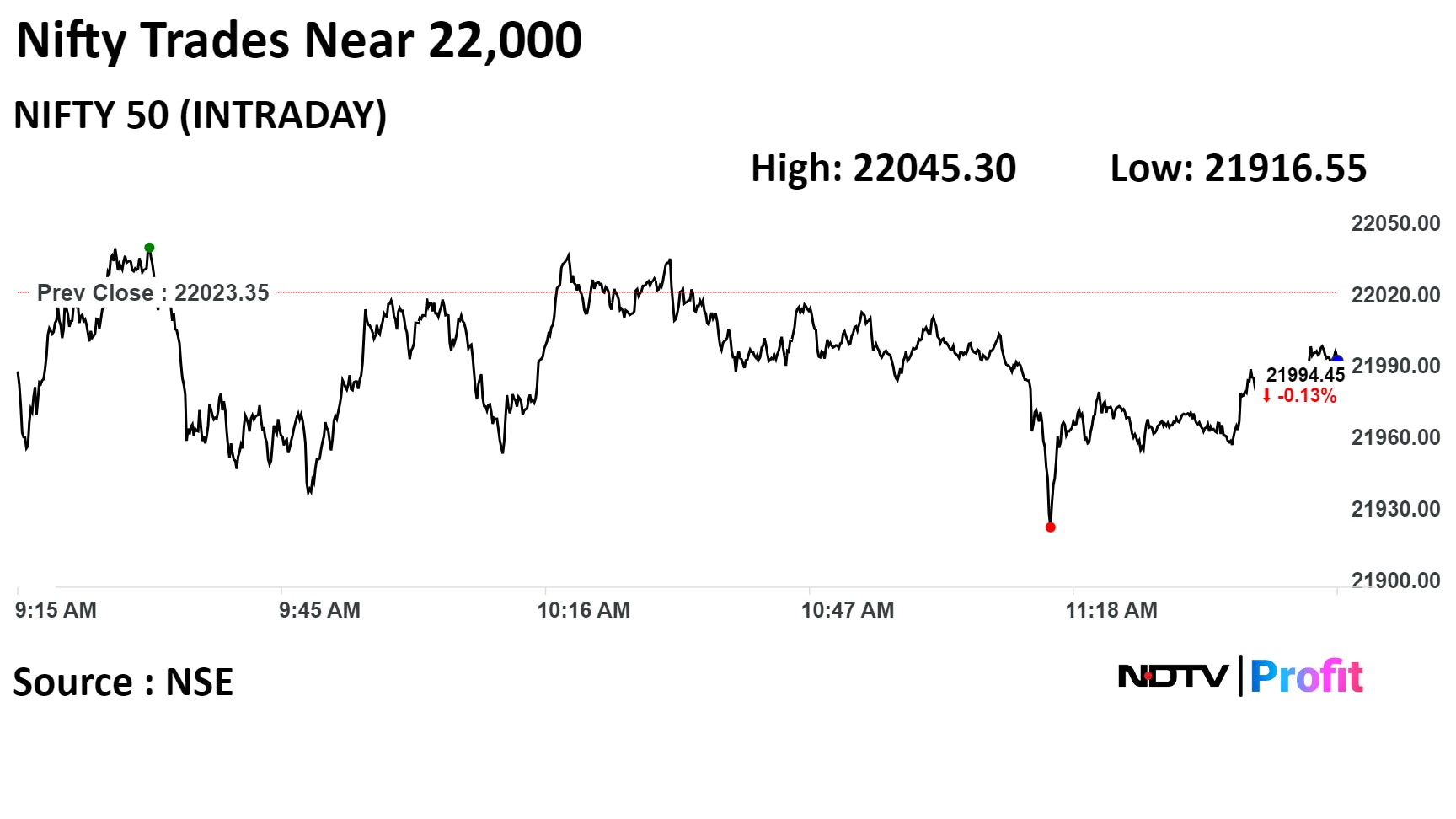

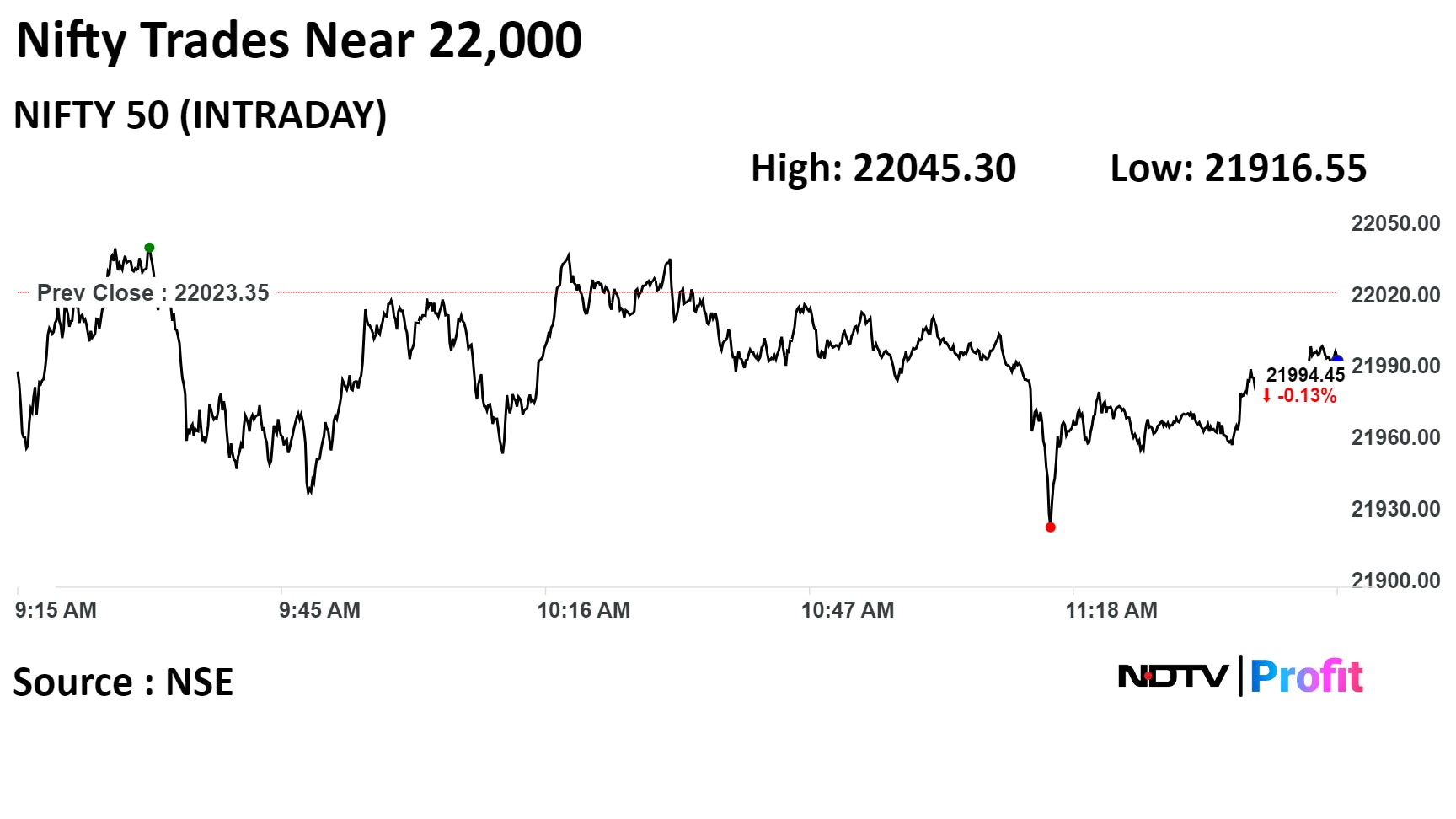

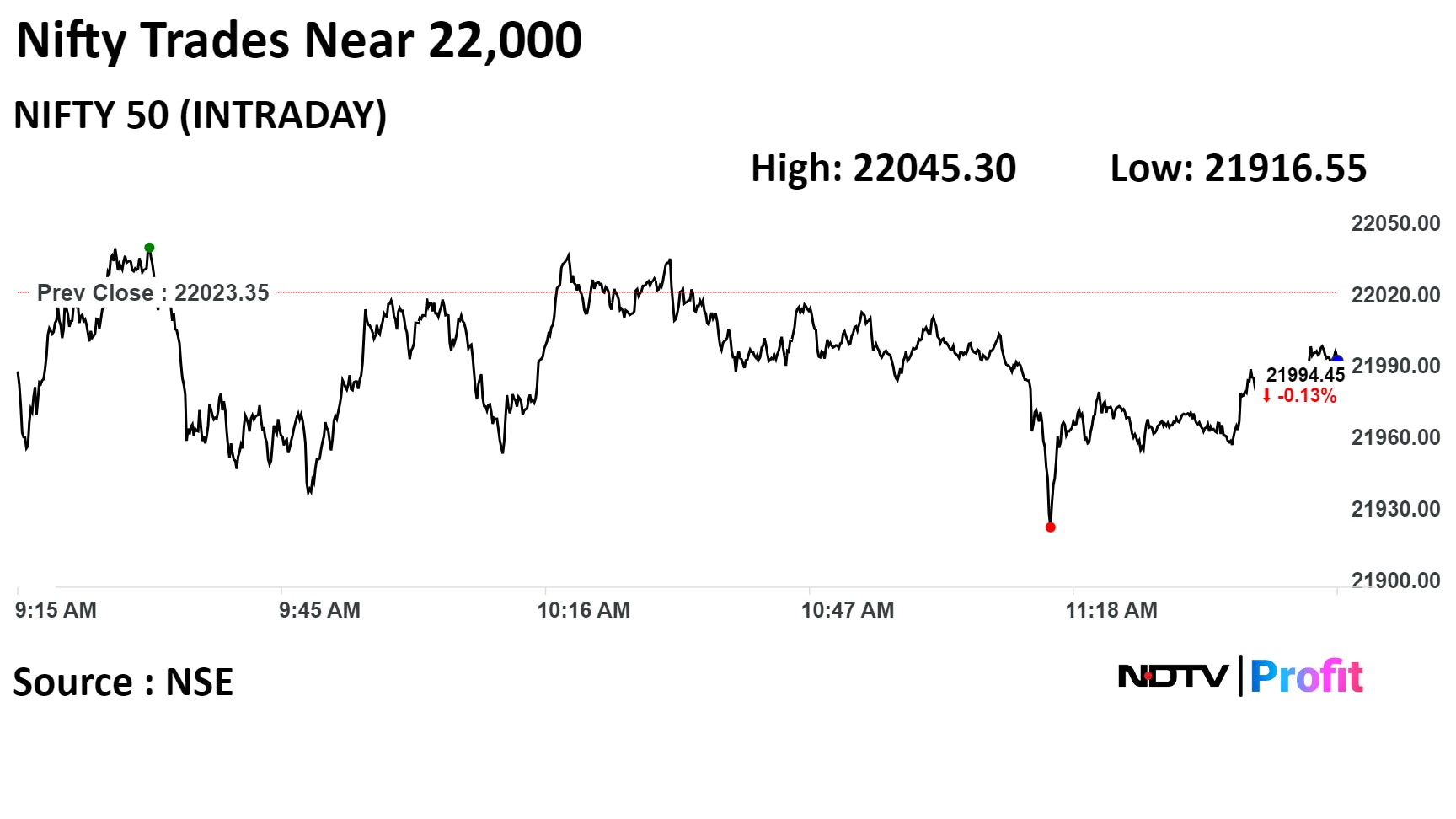

India's benchmark indices rebounded from one-day fall to end the first session of the week higher, tracking gains in Tata Steel Ltd., Reliance Industries Ltd., and Mahindra & Mahindra Ltd.

The NSE Nifty 50 settled 32.35 points or 0.15% higher at 22,055.70, and the S&P BSE Sensex settled 104.99 points or 0.14% higher at 72,748.42.

Intraday, the NSE Nifty 50 index fell 0.48% to 21,916.55, and the S&P BSE Sensex fell 0.45% to 72,314.16.

India's benchmark indices rebounded from one-day fall to end the first session of the week higher, tracking gains in Tata Steel Ltd., Reliance Industries Ltd., and Mahindra & Mahindra Ltd.

The NSE Nifty 50 settled 32.35 points or 0.15% higher at 22,055.70, and the S&P BSE Sensex settled 104.99 points or 0.14% higher at 72,748.42.

Intraday, the NSE Nifty 50 index fell 0.48% to 21,916.55, and the S&P BSE Sensex fell 0.45% to 72,314.16.

India's benchmark indices rebounded from one-day fall to end the first session of the week higher, tracking gains in Tata Steel Ltd., Reliance Industries Ltd., and Mahindra & Mahindra Ltd.

The NSE Nifty 50 settled 32.35 points or 0.15% higher at 22,055.70, and the S&P BSE Sensex settled 104.99 points or 0.14% higher at 72,748.42.

Intraday, the NSE Nifty 50 index fell 0.48% to 21,916.55, and the S&P BSE Sensex fell 0.45% to 72,314.16.

India's benchmark indices rebounded from one-day fall to end the first session of the week higher, tracking gains in Tata Steel Ltd., Reliance Industries Ltd., and Mahindra & Mahindra Ltd.

The NSE Nifty 50 settled 32.35 points or 0.15% higher at 22,055.70, and the S&P BSE Sensex settled 104.99 points or 0.14% higher at 72,748.42.

Intraday, the NSE Nifty 50 index fell 0.48% to 21,916.55, and the S&P BSE Sensex fell 0.45% to 72,314.16.

"The morning trade was dominated by the bears and the Index almost tested its strong support of 21,900 followed by a swift recovery under the leadership of Metal, Auto, and selected heavyweights which helped the Index reclaim 22,000," Progressive Shares Director Aditya Gaggar said.

After the initial fall in the morning trade, Mid and Small-cap segments remained rangebound and underperformed the NSE Nifty 50 index. The reading for the Index will remain the same i.e. breakout on either side giving a proper direction: higher side 22,200 and lower side 21,900.

India's benchmark indices rebounded from one-day fall to end the first session of the week higher, tracking gains in Tata Steel Ltd., Reliance Industries Ltd., and Mahindra & Mahindra Ltd.

The NSE Nifty 50 settled 32.35 points or 0.15% higher at 22,055.70, and the S&P BSE Sensex settled 104.99 points or 0.14% higher at 72,748.42.

Intraday, the NSE Nifty 50 index fell 0.48% to 21,916.55, and the S&P BSE Sensex fell 0.45% to 72,314.16.

India's benchmark indices rebounded from one-day fall to end the first session of the week higher, tracking gains in Tata Steel Ltd., Reliance Industries Ltd., and Mahindra & Mahindra Ltd.

The NSE Nifty 50 settled 32.35 points or 0.15% higher at 22,055.70, and the S&P BSE Sensex settled 104.99 points or 0.14% higher at 72,748.42.

Intraday, the NSE Nifty 50 index fell 0.48% to 21,916.55, and the S&P BSE Sensex fell 0.45% to 72,314.16.

India's benchmark indices rebounded from one-day fall to end the first session of the week higher, tracking gains in Tata Steel Ltd., Reliance Industries Ltd., and Mahindra & Mahindra Ltd.

The NSE Nifty 50 settled 32.35 points or 0.15% higher at 22,055.70, and the S&P BSE Sensex settled 104.99 points or 0.14% higher at 72,748.42.

Intraday, the NSE Nifty 50 index fell 0.48% to 21,916.55, and the S&P BSE Sensex fell 0.45% to 72,314.16.

India's benchmark indices rebounded from one-day fall to end the first session of the week higher, tracking gains in Tata Steel Ltd., Reliance Industries Ltd., and Mahindra & Mahindra Ltd.

The NSE Nifty 50 settled 32.35 points or 0.15% higher at 22,055.70, and the S&P BSE Sensex settled 104.99 points or 0.14% higher at 72,748.42.

Intraday, the NSE Nifty 50 index fell 0.48% to 21,916.55, and the S&P BSE Sensex fell 0.45% to 72,314.16.

"The morning trade was dominated by the bears and the Index almost tested its strong support of 21,900 followed by a swift recovery under the leadership of Metal, Auto, and selected heavyweights which helped the Index reclaim 22,000," Progressive Shares Director Aditya Gaggar said.

After the initial fall in the morning trade, Mid and Small-cap segments remained rangebound and underperformed the NSE Nifty 50 index. The reading for the Index will remain the same i.e. breakout on either side giving a proper direction: higher side 22,200 and lower side 21,900.

Reliance Industries Ltd., Tata Steel Ltd., Tata Motors Ltd., Mahindra & Mahindra Ltd., and Axis Bank added positively to the index.

Infosys Ltd., Tata Consultancy Services Ltd., HDFC Bank Ltd., Hindustan Unilever Ltd., and Titan Co. Ltd. limited gains in the index.

On NSE, eight sectors out of 12 advanced, four declined. The Nifty Metal index gained over 2%, tracking gains in Tata Steel Ltd., and was the top performer among sectoral indices.

The Nifty IT index fell over 1% to become the worst performer.

Broader markets underperformed. The S&P BSE Midcap ended flat, and the S&P BSE Smallcap ended 0.07% lower.

On BSE, six sectors declined, and fourteen advanced. The S&P BSE Metal rose the most.

Market breadth was skewed in favour of buyers. Around 2, 008 stocks advanced, 1,929 stocks fell, and 119 stocks remained unchanged on BSE.

Dilip Buildcon Ltd. received a LoA for project worth Rs 413 crore from Madhya Pradesh Water Resource Department.

Source: Exchange Filing

Poonawalla Fincorp Ltd. has Appointed Arvind Kapil as MD and CEO for 5 years with effect from June 24.

Arvind Kapil currently serves as HDFC Bank’s Group Head overseeing mortgage banking business.

Source: Exchange filing

Rites Ltd. received an order worth Rs 67.5 crore order for quality inspection of 18 trades of toolkits.

Source: Exchange Filing

Servotech Power Systems Ltd. will build 20 EV charging stations for Nashik Municipal Corporation.

Source: Exchange Filing

Jindal Drilling & Industries Ltd is to buy jack-up rig from Discovery Drilling for $75 million.

Source: Exchange Filing

Godawari Power & Ispat Ltd.'s board has approved merger of wholly-owned arm Godawari Energy with the company.

Source: Exchange Filing

Strong product-market fit is driving 'J Curve' for quick commerce

Does not see an immediate concern since moats with QC players are for real

E-comm incumbents must be worried on protecting their turf from foray by BigBasket and Flipkart

QC now offers a wide product assortment and has gone way beyond grocery

45% of the e-comm GMV is from metro & tier 1, a key focus for QC

Blinkit and Zepto have seen a steady rise, outpacing e-comm peers

There also has been concerted efforts from incumbents to reduce delivery timelines

Slotted delivery players would however take time to adjust to ‘on demand’ dynamics

Basket expansion by QC players may also bring portfolio complexity

India's benchmark indices were trading marginally lower amid volatility, tracking losses in the Wall Street.

However, Nifty is set to breach 22,000 by late trade on Monday, helped by shares of Tata Steel Ltd. and Mahindra & Mahindra Ltd. that gained the most.

At 11:56 a.m., the Nifty 50 was trading 32.35 points or 0.15% lower at 21,991.00,, and the Sensex fell 86.94 points or 0.12% to trade at 72,556.49.

Foreign institutional investors can ideally follow a sitting out strategy, according to Shilpa Rout, derivatives lead analyst at Prabhudas Lilladher. "FII's long-short ratio is constant, and they are net long at 38–40%, which also means that they are not aggressively bearish or bullish," she told NDTV Profit.

The Nifty 50 is at a very crucial support at 22,000, if that gets breached, 21,800–21,500 can be seen coming in very swiftly, according to Rout. However, if the index manages to remain above 22,000, it will face hurdles at 22,300–22,500, she said

India's benchmark indices were trading marginally lower amid volatility, tracking losses in the Wall Street.

However, Nifty is set to breach 22,000 by late trade on Monday, helped by shares of Tata Steel Ltd. and Mahindra & Mahindra Ltd. that gained the most.

At 11:56 a.m., the Nifty 50 was trading 32.35 points or 0.15% lower at 21,991.00,, and the Sensex fell 86.94 points or 0.12% to trade at 72,556.49.

Foreign institutional investors can ideally follow a sitting out strategy, according to Shilpa Rout, derivatives lead analyst at Prabhudas Lilladher. "FII's long-short ratio is constant, and they are net long at 38–40%, which also means that they are not aggressively bearish or bullish," she told NDTV Profit.

The Nifty 50 is at a very crucial support at 22,000, if that gets breached, 21,800–21,500 can be seen coming in very swiftly, according to Rout. However, if the index manages to remain above 22,000, it will face hurdles at 22,300–22,500, she said

India's benchmark indices were trading marginally lower amid volatility, tracking losses in the Wall Street.

However, Nifty is set to breach 22,000 by late trade on Monday, helped by shares of Tata Steel Ltd. and Mahindra & Mahindra Ltd. that gained the most.

At 11:56 a.m., the Nifty 50 was trading 32.35 points or 0.15% lower at 21,991.00,, and the Sensex fell 86.94 points or 0.12% to trade at 72,556.49.

Foreign institutional investors can ideally follow a sitting out strategy, according to Shilpa Rout, derivatives lead analyst at Prabhudas Lilladher. "FII's long-short ratio is constant, and they are net long at 38–40%, which also means that they are not aggressively bearish or bullish," she told NDTV Profit.

The Nifty 50 is at a very crucial support at 22,000, if that gets breached, 21,800–21,500 can be seen coming in very swiftly, according to Rout. However, if the index manages to remain above 22,000, it will face hurdles at 22,300–22,500, she said

India's benchmark indices were trading marginally lower amid volatility, tracking losses in the Wall Street.

However, Nifty is set to breach 22,000 by late trade on Monday, helped by shares of Tata Steel Ltd. and Mahindra & Mahindra Ltd. that gained the most.

At 11:56 a.m., the Nifty 50 was trading 32.35 points or 0.15% lower at 21,991.00,, and the Sensex fell 86.94 points or 0.12% to trade at 72,556.49.

Foreign institutional investors can ideally follow a sitting out strategy, according to Shilpa Rout, derivatives lead analyst at Prabhudas Lilladher. "FII's long-short ratio is constant, and they are net long at 38–40%, which also means that they are not aggressively bearish or bullish," she told NDTV Profit.

The Nifty 50 is at a very crucial support at 22,000, if that gets breached, 21,800–21,500 can be seen coming in very swiftly, according to Rout. However, if the index manages to remain above 22,000, it will face hurdles at 22,300–22,500, she said

India's benchmark indices were trading marginally lower amid volatility, tracking losses in the Wall Street.

However, Nifty is set to breach 22,000 by late trade on Monday, helped by shares of Tata Steel Ltd. and Mahindra & Mahindra Ltd. that gained the most.

At 11:56 a.m., the Nifty 50 was trading 32.35 points or 0.15% lower at 21,991.00,, and the Sensex fell 86.94 points or 0.12% to trade at 72,556.49.

Foreign institutional investors can ideally follow a sitting out strategy, according to Shilpa Rout, derivatives lead analyst at Prabhudas Lilladher. "FII's long-short ratio is constant, and they are net long at 38–40%, which also means that they are not aggressively bearish or bullish," she told NDTV Profit.

The Nifty 50 is at a very crucial support at 22,000, if that gets breached, 21,800–21,500 can be seen coming in very swiftly, according to Rout. However, if the index manages to remain above 22,000, it will face hurdles at 22,300–22,500, she said

India's benchmark indices were trading marginally lower amid volatility, tracking losses in the Wall Street.

However, Nifty is set to breach 22,000 by late trade on Monday, helped by shares of Tata Steel Ltd. and Mahindra & Mahindra Ltd. that gained the most.

At 11:56 a.m., the Nifty 50 was trading 32.35 points or 0.15% lower at 21,991.00,, and the Sensex fell 86.94 points or 0.12% to trade at 72,556.49.

Foreign institutional investors can ideally follow a sitting out strategy, according to Shilpa Rout, derivatives lead analyst at Prabhudas Lilladher. "FII's long-short ratio is constant, and they are net long at 38–40%, which also means that they are not aggressively bearish or bullish," she told NDTV Profit.

The Nifty 50 is at a very crucial support at 22,000, if that gets breached, 21,800–21,500 can be seen coming in very swiftly, according to Rout. However, if the index manages to remain above 22,000, it will face hurdles at 22,300–22,500, she said

India's benchmark indices were trading marginally lower amid volatility, tracking losses in the Wall Street.

However, Nifty is set to breach 22,000 by late trade on Monday, helped by shares of Tata Steel Ltd. and Mahindra & Mahindra Ltd. that gained the most.

At 11:56 a.m., the Nifty 50 was trading 32.35 points or 0.15% lower at 21,991.00,, and the Sensex fell 86.94 points or 0.12% to trade at 72,556.49.

Foreign institutional investors can ideally follow a sitting out strategy, according to Shilpa Rout, derivatives lead analyst at Prabhudas Lilladher. "FII's long-short ratio is constant, and they are net long at 38–40%, which also means that they are not aggressively bearish or bullish," she told NDTV Profit.

The Nifty 50 is at a very crucial support at 22,000, if that gets breached, 21,800–21,500 can be seen coming in very swiftly, according to Rout. However, if the index manages to remain above 22,000, it will face hurdles at 22,300–22,500, she said

India's benchmark indices were trading marginally lower amid volatility, tracking losses in the Wall Street.

However, Nifty is set to breach 22,000 by late trade on Monday, helped by shares of Tata Steel Ltd. and Mahindra & Mahindra Ltd. that gained the most.

At 11:56 a.m., the Nifty 50 was trading 32.35 points or 0.15% lower at 21,991.00,, and the Sensex fell 86.94 points or 0.12% to trade at 72,556.49.

Foreign institutional investors can ideally follow a sitting out strategy, according to Shilpa Rout, derivatives lead analyst at Prabhudas Lilladher. "FII's long-short ratio is constant, and they are net long at 38–40%, which also means that they are not aggressively bearish or bullish," she told NDTV Profit.

The Nifty 50 is at a very crucial support at 22,000, if that gets breached, 21,800–21,500 can be seen coming in very swiftly, according to Rout. However, if the index manages to remain above 22,000, it will face hurdles at 22,300–22,500, she said

Shares of Tata Steel Ltd., Mahindra & Mahindra Ltd., Tata Motors Ltd., Reliance Industries Ltd., and Bharti Airtel Ltd. were contributing the most to the Nifty.

While, those of ICICI Bank Ltd., HDFC Bank Ltd., Infosys Ltd., Titan Co. Ltd., and Adani Ports & Special Economic Zone Ltd. weighed on the index.

Sectoral indices were mixed. Nifty Realty gained the most followed by Nifty Media. Nifty Realty and Nifty IT were among the top losers.

Broader markets underperform their larger peers, with the S&P BSE Midcap falling 0.16% and the S&P BSE Smallcap trading 0.29% lower through midday trade on Monday.

On BSE, seven sectors declined and 13 advanced. The S&P BSE Metal rose the most sectoral indices.

Market breadth was skewed in favour of the sellers. Around 1,934 stocks declined, 1,792 stocks rose, and 145 stocks remained unchanged on BSE.

Sona Comstar achieved production milestone of 400 million differential gears and 6 million differential assemblies.

Sona’s global market share of differential gears is up to 8.1% in 2023 from 5.0% in 2020.

Sona’s India market share in differential gears is at 60-90% across categories.

Sona serves seven of the Top 10 global carmakers, four of the Top 10 EV makers.

Source: Exchange filing

Shriram Finance Ltd.'s promoter Shriram Value Services will acquire up to 2.09% stake in co from another promoter via block deals on or after March 22.

Source: Exchange Filing

TransIndia Real Estate Ltd. appointed Ram Walase as CEO effective immediately.

Source: Exchange Filing

Baazar Style Retail filed for IPO having fresh issue of up to Rs 185 crore.

The IPO to have OFS of up to 1.6 crore shares.

Rekha Jhunjhunwala, Intensive Softshare to sell stake via IPO.

Axis Capital, JM Financial & Intensive Fiscal Services are the BRLMs.

Source: DRHP

J Kumar Infraprojects Ltd. got order worth Rs 334 crore from NBCC India Ltd.

The order is for development of Hari Nagar Depot in New Delhi.

The order is expected to executed in 24 months.

Source: Exchange Filing

Procter & Gamble Hygiene and Healthcare Ltd. has appointed Kumar Venkatasubramanian as MD for 5 years effective May 1.

Kumar Venkatasubramanian to take over from LV Vaidyanathan, who will resign effective April 30.

Source: Exchange filing

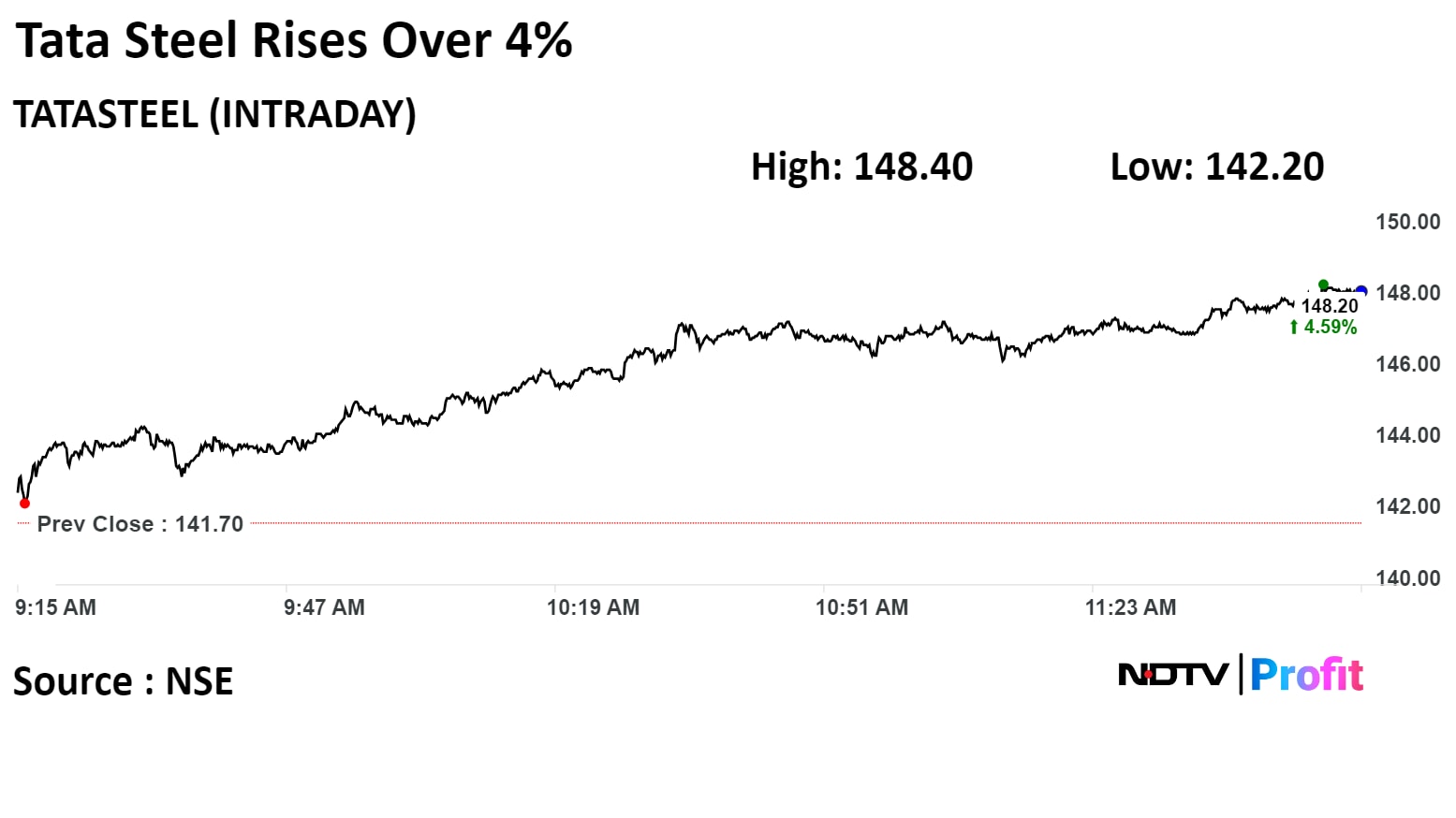

Shares of Tata Steel Ltd. rose 4.73% to Rs. 148.40, the highest level since March 13, following large trades.

Tata Steel Ltd.'s 39.8 lakh shares changed hands in large trades. Buyers and sellers are not known immediately, Bloomberg reported.

The scrip was trading 4.69% higher at Rs. 148.35, as of 12:01 p.m., which compares to 0.17% decline in the NSE Nifty 50 index.

It has risen 41.82% in 12 months. Total traded volume so far in the day stood at 3.5 times its 30-day average. The relative strength index was at 53.68..

Out of 31 analysts tracking the company, 18 maintain a 'buy' rating, six recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.8%.

Shares of Tata Steel Ltd. rose 4.73% to Rs. 148.40, the highest level since March 13, following large trades.

Tata Steel Ltd.'s 39.8 lakh shares changed hands in large trades. Buyers and sellers are not known immediately, Bloomberg reported.

The scrip was trading 4.69% higher at Rs. 148.35, as of 12:01 p.m., which compares to 0.17% decline in the NSE Nifty 50 index.

It has risen 41.82% in 12 months. Total traded volume so far in the day stood at 3.5 times its 30-day average. The relative strength index was at 53.68..

Out of 31 analysts tracking the company, 18 maintain a 'buy' rating, six recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.8%.

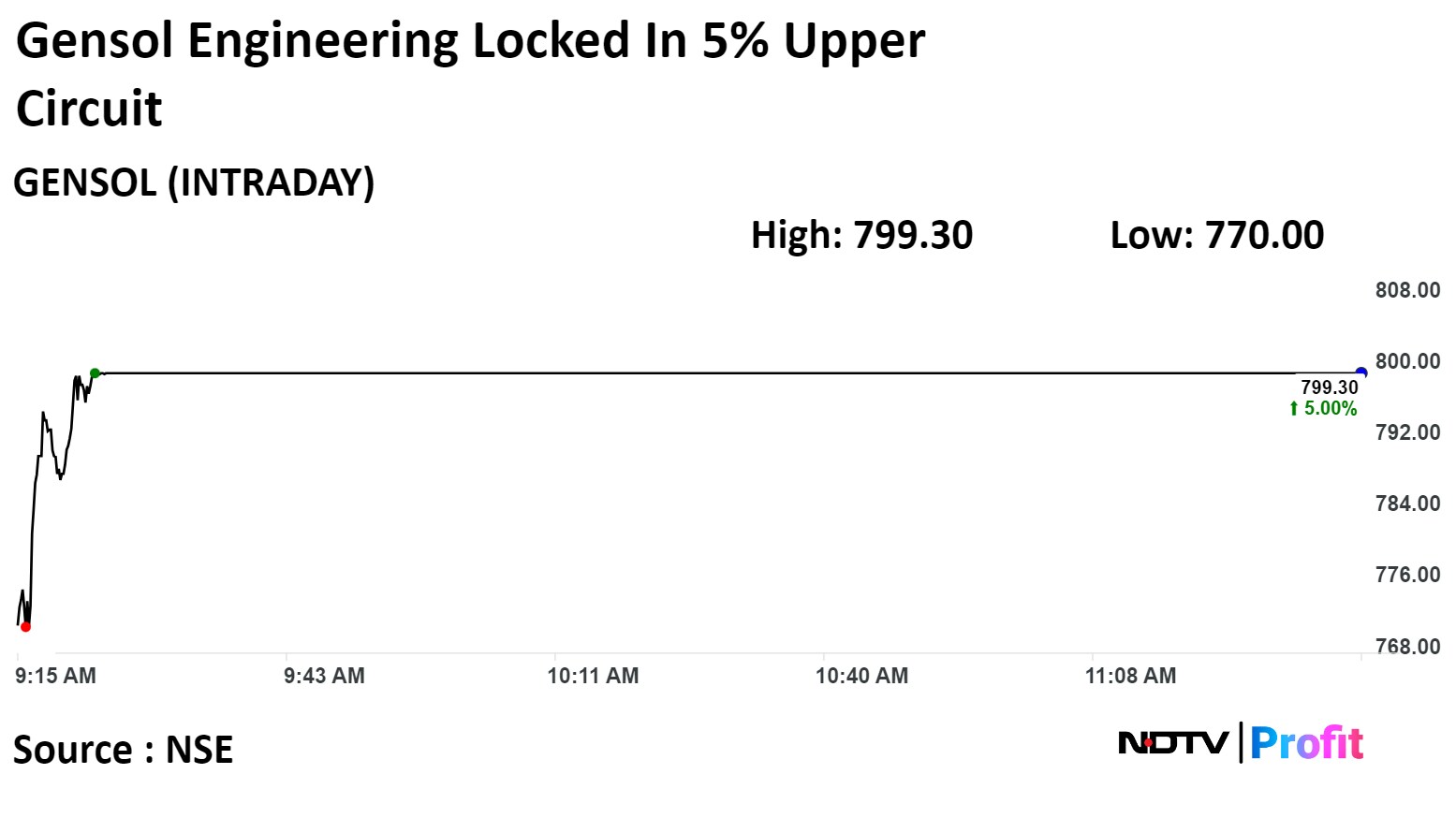

Gensol Engineering Ltd.'s shares were locked in 5% upper circuit on NSE as it concluded 160 MW ground-mounted solar project in Gujarat.

The company has completed the ground-mounted solar project worth Rs 128 crore for Continuum Green Energy in Bhavnagar, Gujarat, according to an exchange filing.

Gensol Engineering Ltd.'s shares were locked in 5% upper circuit on NSE as it concluded 160 MW ground-mounted solar project in Gujarat.

The company has completed the ground-mounted solar project worth Rs 128 crore for Continuum Green Energy in Bhavnagar, Gujarat, according to an exchange filing.

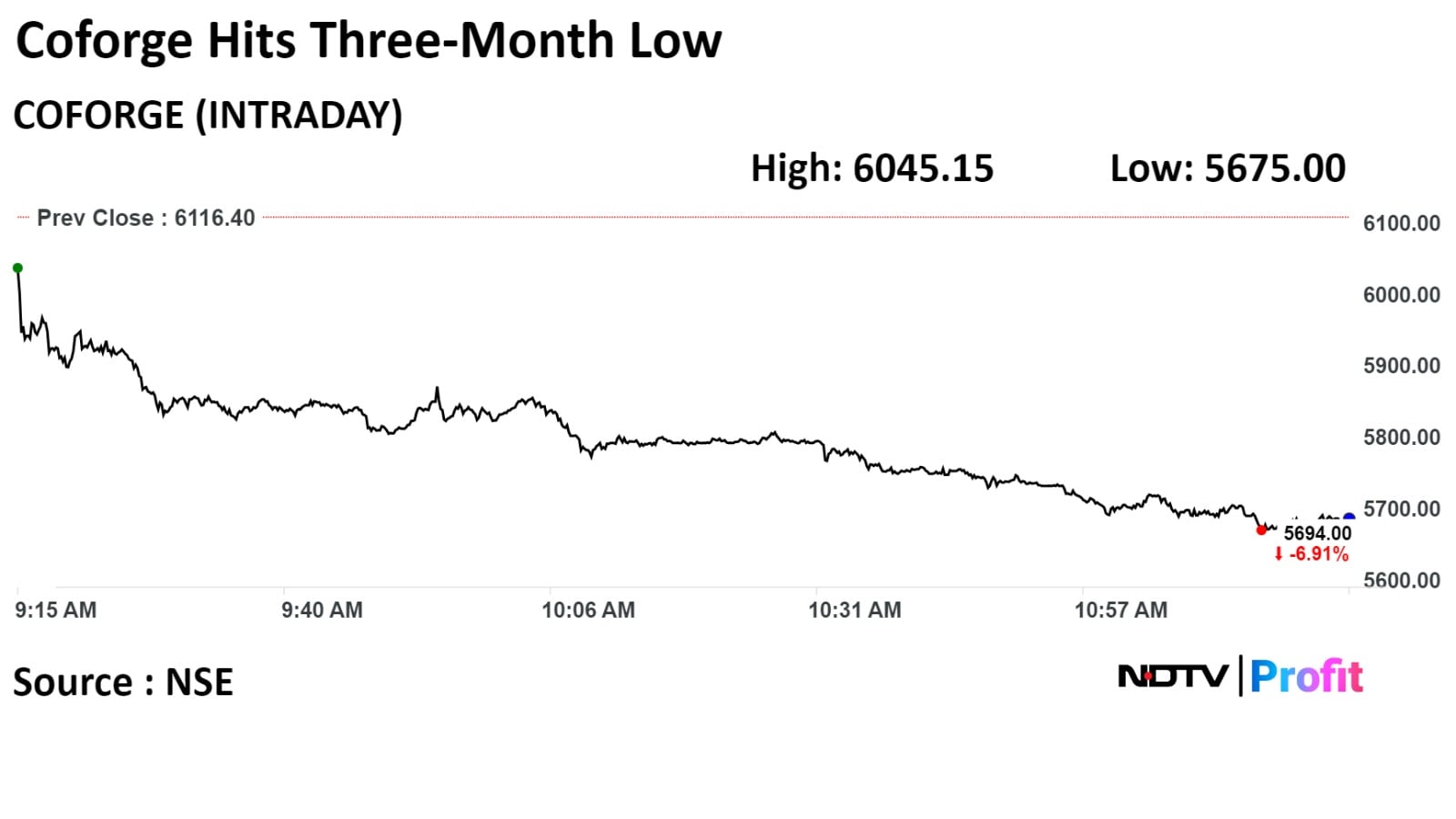

Shares of Coforge Ltd. fell again after a one-day recovery to hit its lowest level in three months.

Shares of Coforge Ltd. fell again after a one-day recovery to hit its lowest level in three months.

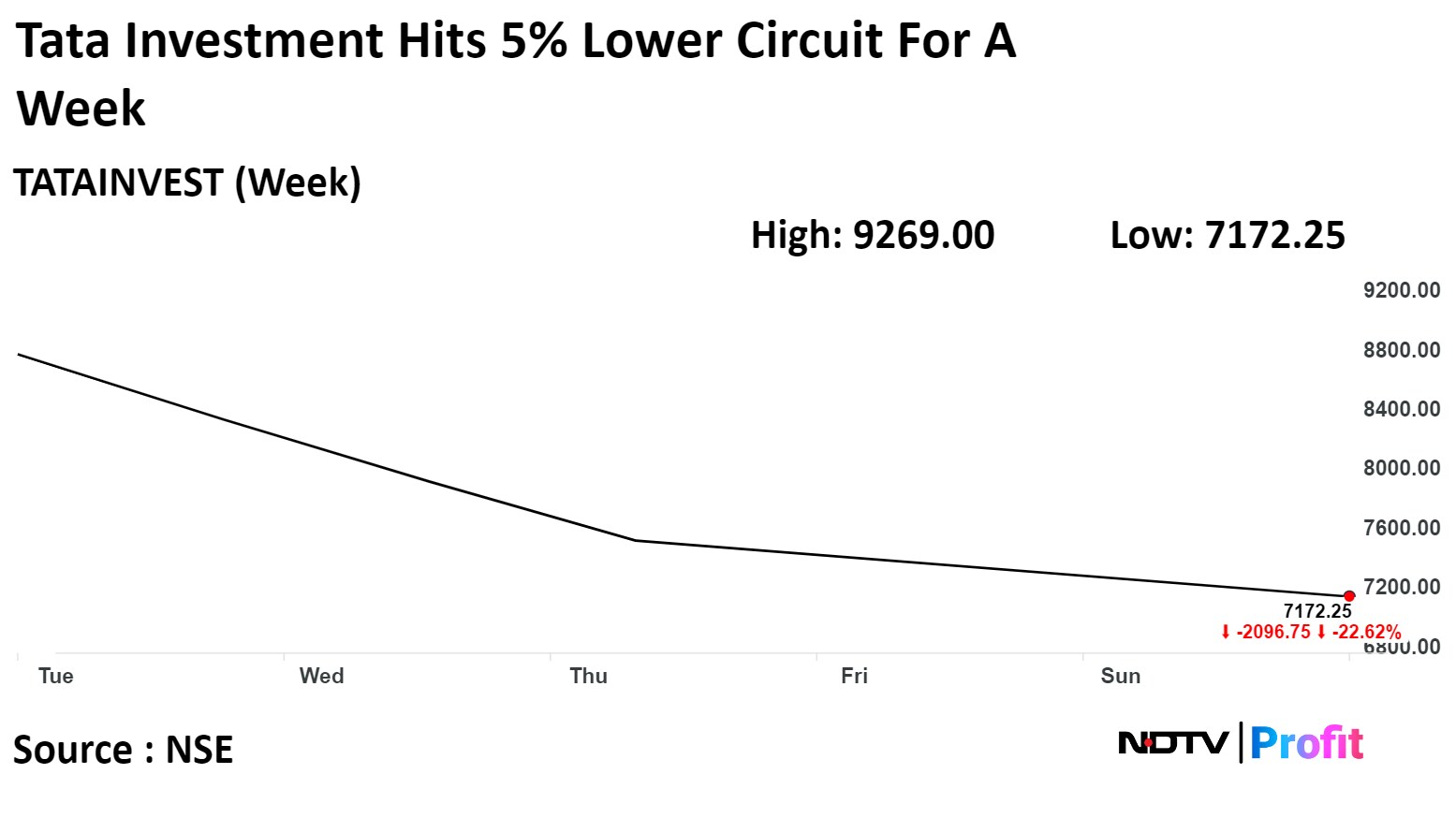

Tata Investment Corp. Ltd. hit a 5% lower circuit and fell to Rs 7,172.25 apiece, the lowest level since Feb 29. It remained locked in the 5% lower circuit for seven sessions in a row.

As of 11:14 a.m. it continued to remain locked in the 5% lower circuit, which compared to a 0.47% decline in the NSE Nifty 50 Index.

It has risen 270.80% in 12 months. Total traded volume so far in the day stood at 0.80 times its 30-day average. The relative strength index was at 47.81.

Tata Investment Corp. Ltd. hit a 5% lower circuit and fell to Rs 7,172.25 apiece, the lowest level since Feb 29. It remained locked in the 5% lower circuit for seven sessions in a row.

As of 11:14 a.m. it continued to remain locked in the 5% lower circuit, which compared to a 0.47% decline in the NSE Nifty 50 Index.

It has risen 270.80% in 12 months. Total traded volume so far in the day stood at 0.80 times its 30-day average. The relative strength index was at 47.81.

Star Health & Allied Insurance Corp. Ltd. offers dollar-denominated insurance via GIFT City branch.

Star Health & Allied Insurance Corp Ltd. is to start GIFT City operations by the end of March 2024.

Source: Exchange filing

Lupin Ltd. has appointed Christoph Funke as chief technical operations officer, effective March 18.

Source: Exchange filing

Apple Inc is in talks with Google LLC to let its Gemini power iPhone AI features.

Source: Bloomberg

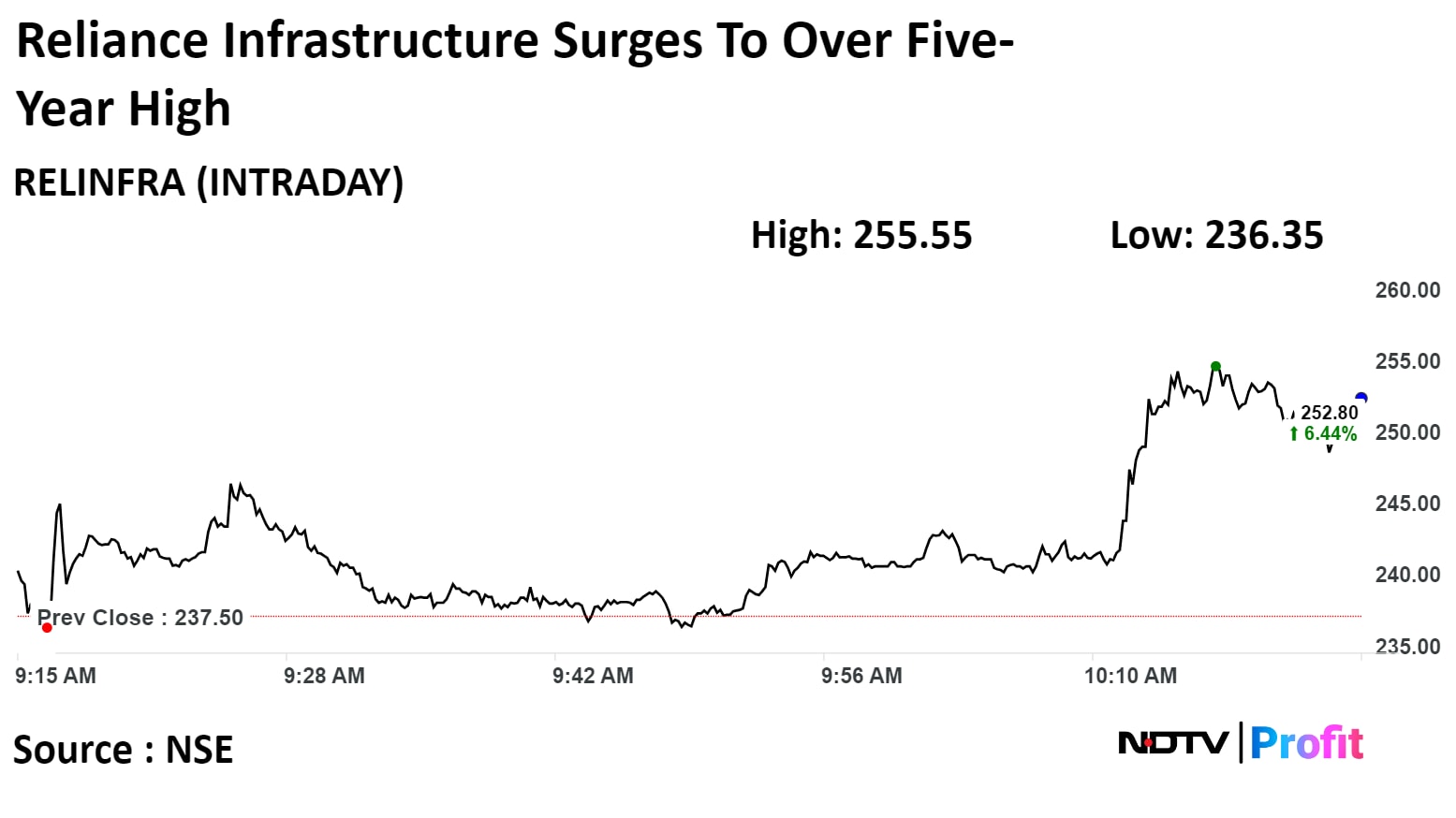

Reliance Infrastructure Ltd rose as much as 8.17% to Rs 256.90 apiece, the highest Feb 4, 2019. It was trading 7.20% higher at Rs 254.60 apiece, as of 10:28 a.m. This compares to a 0.01% advance in the NSE Nifty 50 Index.

It has risen 71.97% in 12 months. Total traded volume so far in the day stood at 4.2 times its 30-day average. The relative strength index was at 61.58.

Reliance Infrastructure Ltd rose as much as 8.17% to Rs 256.90 apiece, the highest Feb 4, 2019. It was trading 7.20% higher at Rs 254.60 apiece, as of 10:28 a.m. This compares to a 0.01% advance in the NSE Nifty 50 Index.

It has risen 71.97% in 12 months. Total traded volume so far in the day stood at 4.2 times its 30-day average. The relative strength index was at 61.58.

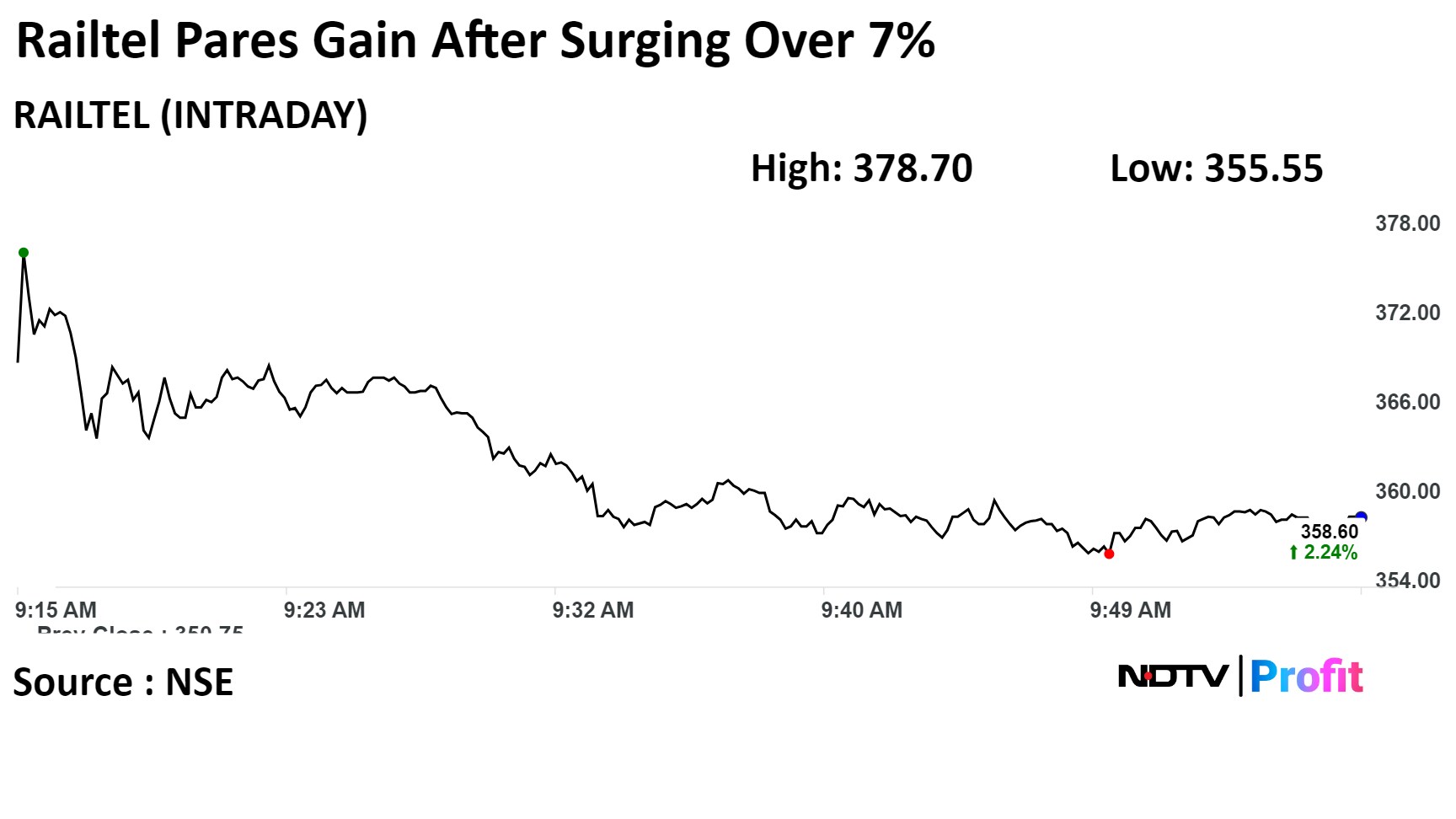

Shares of Railtel Corp. surged nearly 8% in early trade on Monday after the company bagged multiple projects worth Rs 482.5 crore.

The company received a work order worth Rs 130 crore from the Bihar Education Project Council on Saturday, according to an exchange filing.

The company through a bid process, was selected for execution and maintenance of this project across the health units of BMC in Mumbai for Rs 351.95 crore.

Railtel Corp's stock rose as much as 7.97% during the day to Rs 378.7 apiece on the NSE. It was trading 1.8% higher at Rs 357.3 apiece, compared to a 0.17% decline in the benchmark Nifty 50 as of 9:53 a.m.

It has risen 249% in the last 12 months. The total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 42.

One out of the three analysts tracking the company have a 'buy' rating on the stock and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 253%.

Shares of Railtel Corp. surged nearly 8% in early trade on Monday after the company bagged multiple projects worth Rs 482.5 crore.

The company received a work order worth Rs 130 crore from the Bihar Education Project Council on Saturday, according to an exchange filing.

The company through a bid process, was selected for execution and maintenance of this project across the health units of BMC in Mumbai for Rs 351.95 crore.

Railtel Corp's stock rose as much as 7.97% during the day to Rs 378.7 apiece on the NSE. It was trading 1.8% higher at Rs 357.3 apiece, compared to a 0.17% decline in the benchmark Nifty 50 as of 9:53 a.m.

It has risen 249% in the last 12 months. The total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 42.

One out of the three analysts tracking the company have a 'buy' rating on the stock and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 253%.

Shares of Amber Enterprises India Pvt. Ltd rose 5% on NSE as company incorporated wholly owned subsidiary AT Railway Sub Systems.

The company has incorporated the new subsidiary to specialise in manufacturing railway components and sub-systems for the rolling stock industry in India and overseas, the company said in an exchange filing.

Amber Enterprises India Ltd. rose as much as 5.02% to Rs 3,499.95 apiece, the highest level since March 15. It pared gains to trade 2.24% higher at Rs 3,407.25 apiece, as of 09:52 a.m. This compares to a 0.24% decline in the NSE Nifty 50 Index.

It has risen 79.31% in 12 months. Total traded volume so far in the day stood at 5.1 times its 30-day average. The relative strength index was at 34.69.

Out of 25 analysts tracking the company, 12 maintain a 'buy' rating, nine recommend a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.3%.

Shares of Amber Enterprises India Pvt. Ltd rose 5% on NSE as company incorporated wholly owned subsidiary AT Railway Sub Systems.

The company has incorporated the new subsidiary to specialise in manufacturing railway components and sub-systems for the rolling stock industry in India and overseas, the company said in an exchange filing.

Amber Enterprises India Ltd. rose as much as 5.02% to Rs 3,499.95 apiece, the highest level since March 15. It pared gains to trade 2.24% higher at Rs 3,407.25 apiece, as of 09:52 a.m. This compares to a 0.24% decline in the NSE Nifty 50 Index.

It has risen 79.31% in 12 months. Total traded volume so far in the day stood at 5.1 times its 30-day average. The relative strength index was at 34.69.

Out of 25 analysts tracking the company, 12 maintain a 'buy' rating, nine recommend a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.3%.

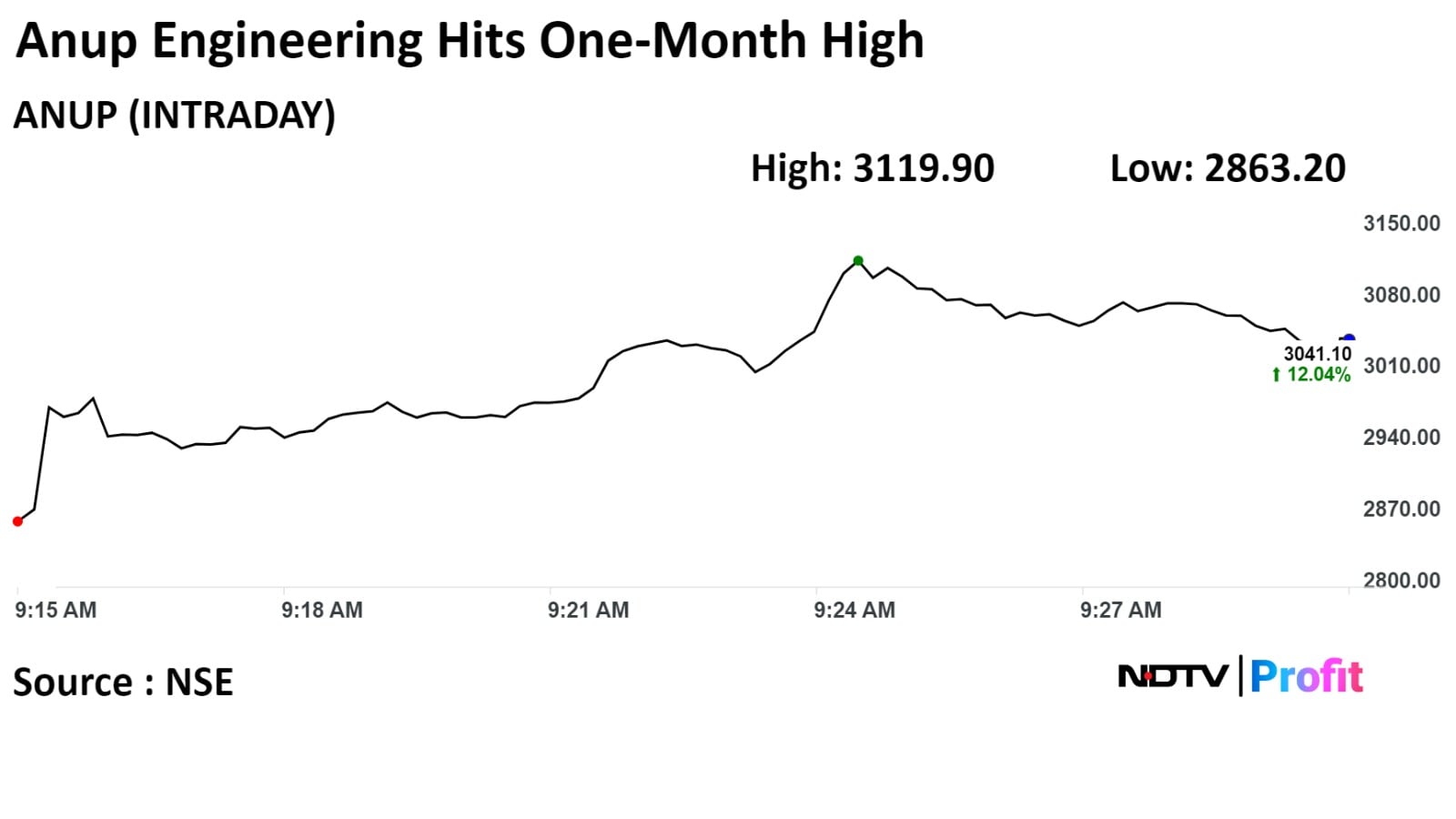

Shares of The Anup Engineering Ltd. jumped to hit a one-month high today as the company plans to acquire Mabel Engineering Pvt. Ltd. to expand its product portfolio, capacity, and geographical spread.

The scrip rose as much as 4.99% to Rs 373.05 piece, the highest level since March 12 and was locked in its upper circuit limit as of 09:56 a.m. This compares to a 0.08% decline in the NSE Nifty 50 Index.

Shares of The Anup Engineering Ltd. jumped to hit a one-month high today as the company plans to acquire Mabel Engineering Pvt. Ltd. to expand its product portfolio, capacity, and geographical spread.

The scrip rose as much as 4.99% to Rs 373.05 piece, the highest level since March 12 and was locked in its upper circuit limit as of 09:56 a.m. This compares to a 0.08% decline in the NSE Nifty 50 Index.

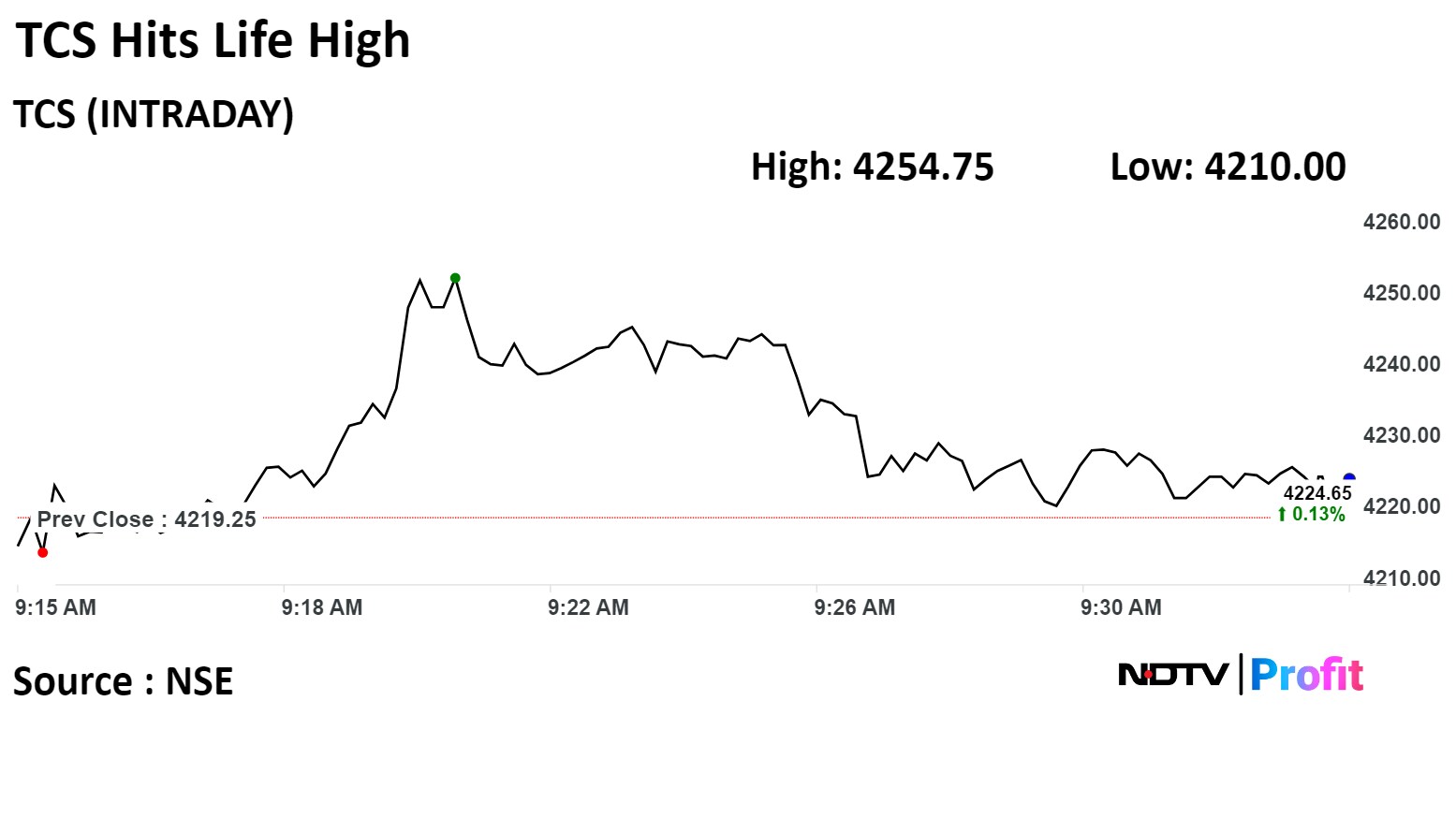

Tata Consultancy Services rose 0.84% to Rs 4,254.75 apiece, the highest level since its listing on Aug 25, 2004. It pared gains to trade 0.04% higher at Rs 4,220 apiece, as of 09:37 a.m. This compares to a 0.25% decline in the NSE Nifty 50 Index.

It has risen 31.72% in 12 months. Total traded volume so far in the day stood at 0.12 times its 30-day average. The relative strength index was at 63.21.

Out of 46 analysts tracking the company, 26 maintain a 'buy' rating, 10 recommend a 'hold,' and 10 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 4.1%.

Tata Consultancy Services rose 0.84% to Rs 4,254.75 apiece, the highest level since its listing on Aug 25, 2004. It pared gains to trade 0.04% higher at Rs 4,220 apiece, as of 09:37 a.m. This compares to a 0.25% decline in the NSE Nifty 50 Index.

It has risen 31.72% in 12 months. Total traded volume so far in the day stood at 0.12 times its 30-day average. The relative strength index was at 63.21.

Out of 46 analysts tracking the company, 26 maintain a 'buy' rating, 10 recommend a 'hold,' and 10 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 4.1%.

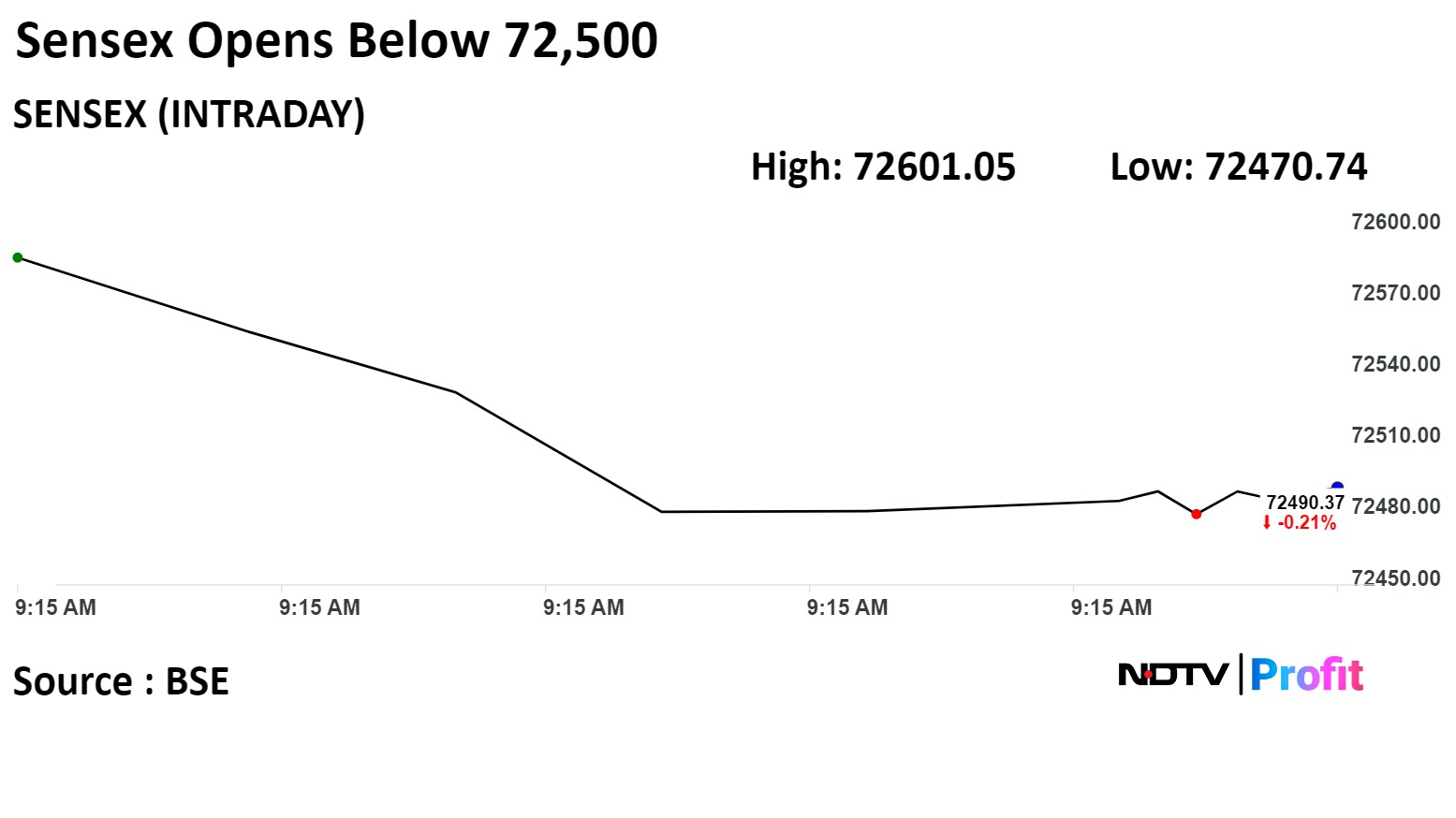

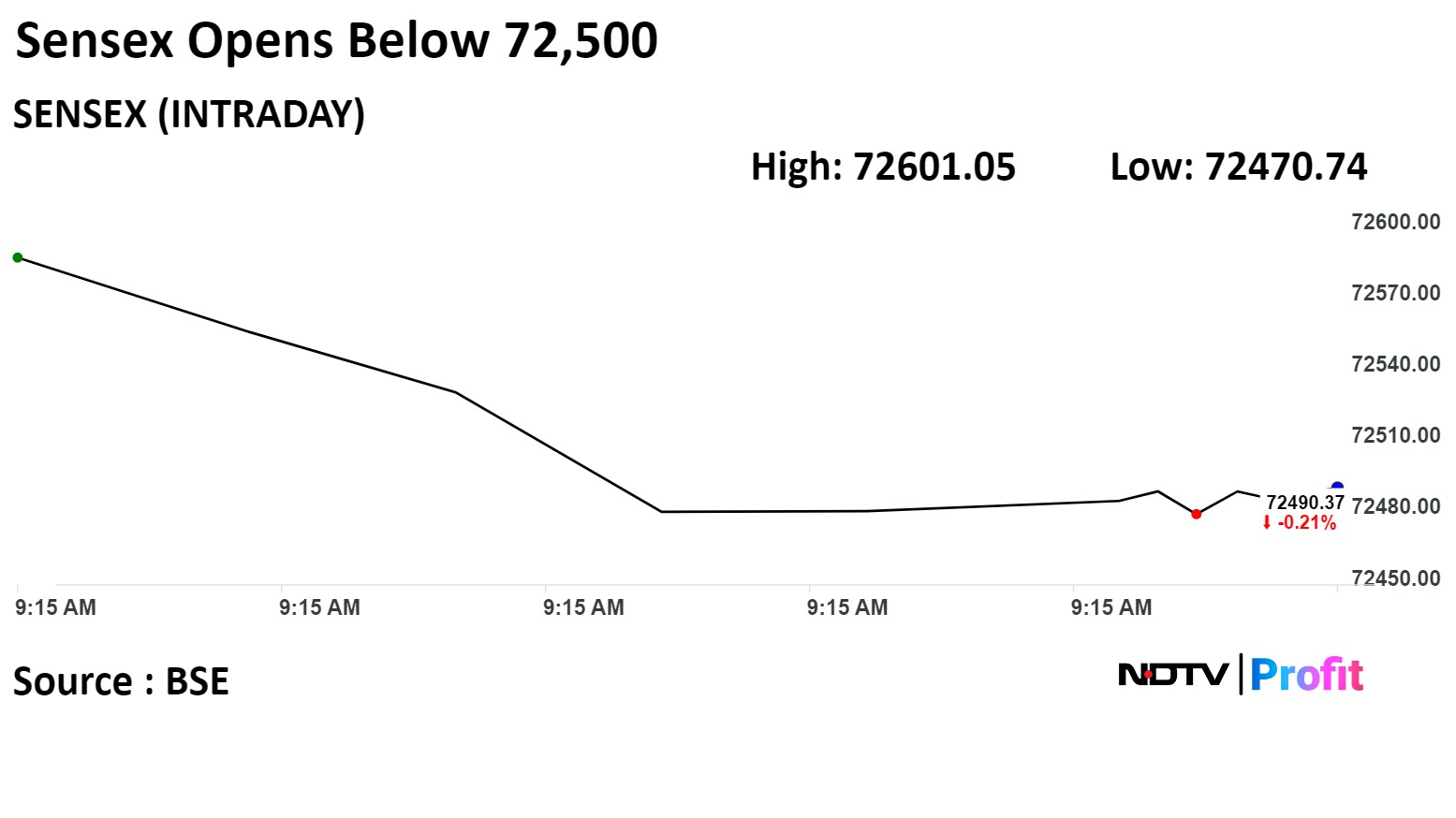

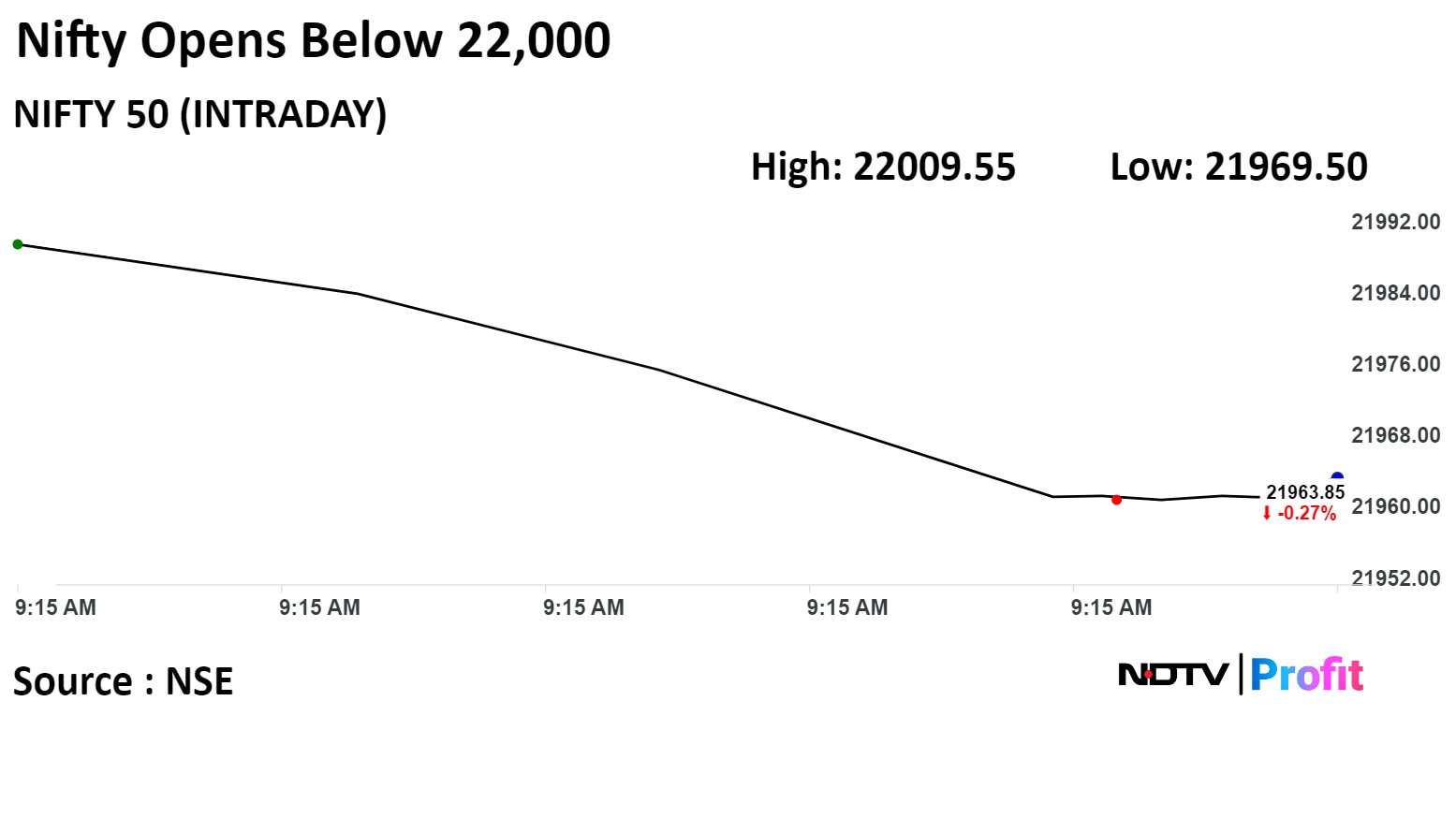

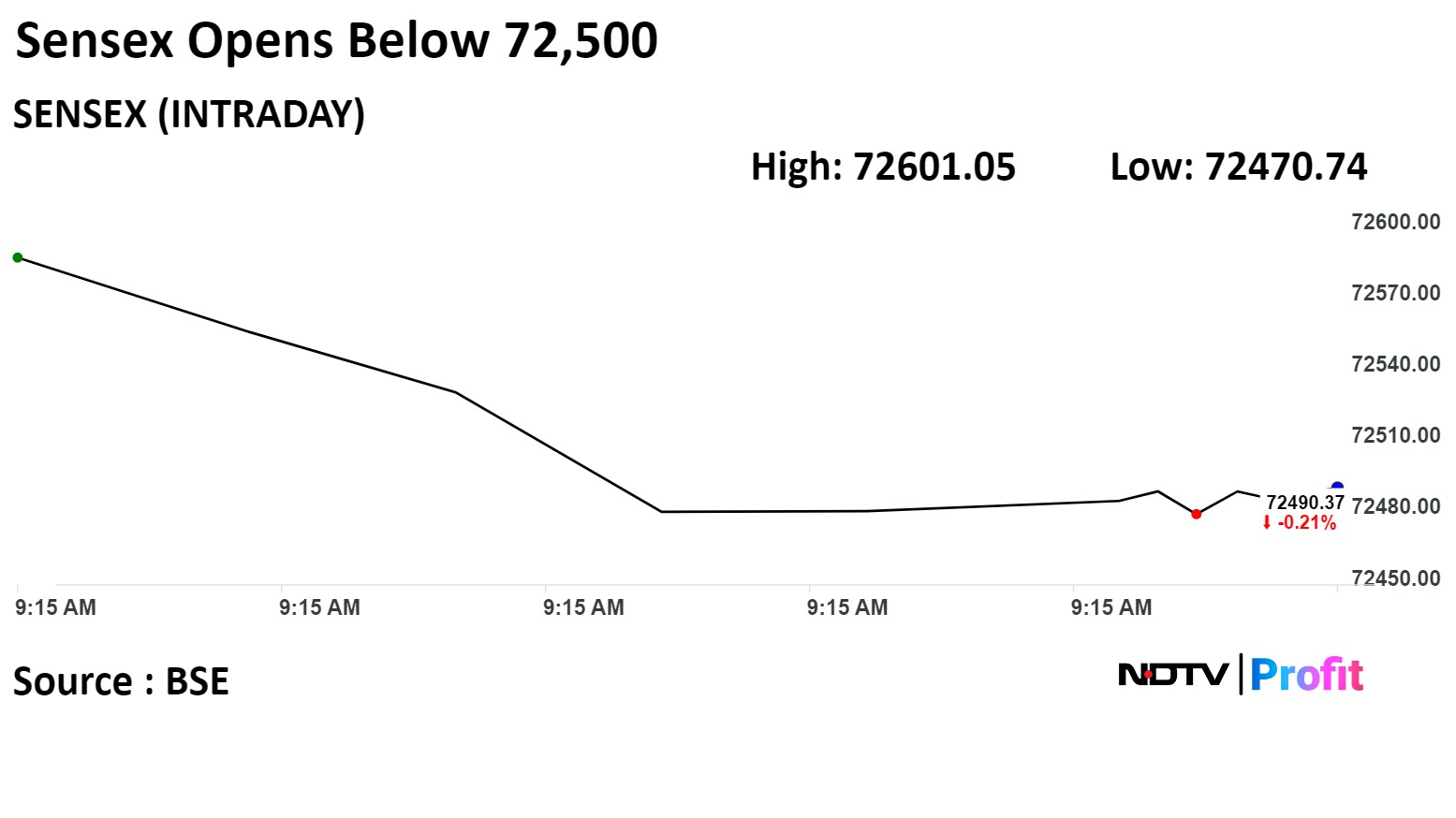

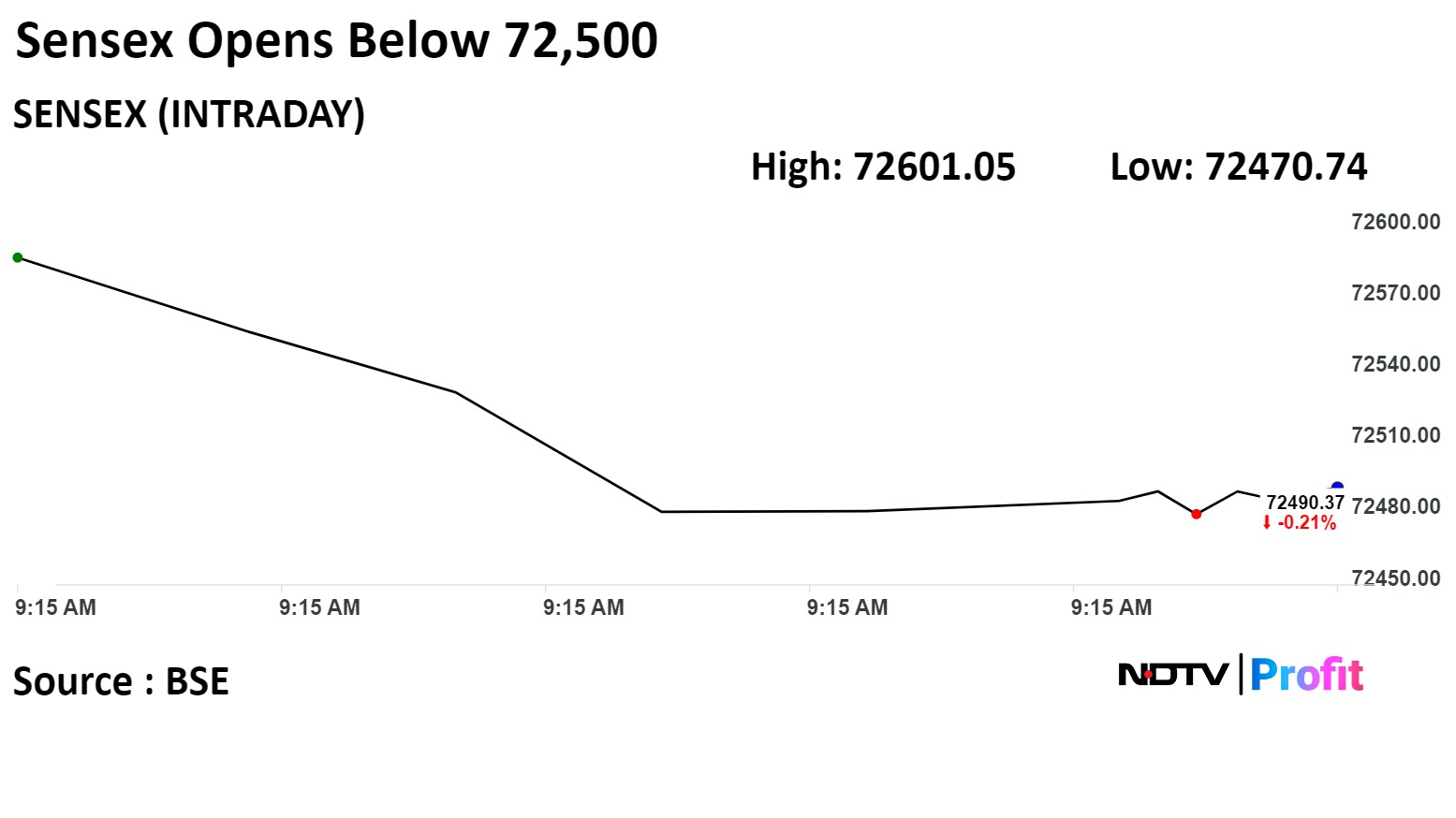

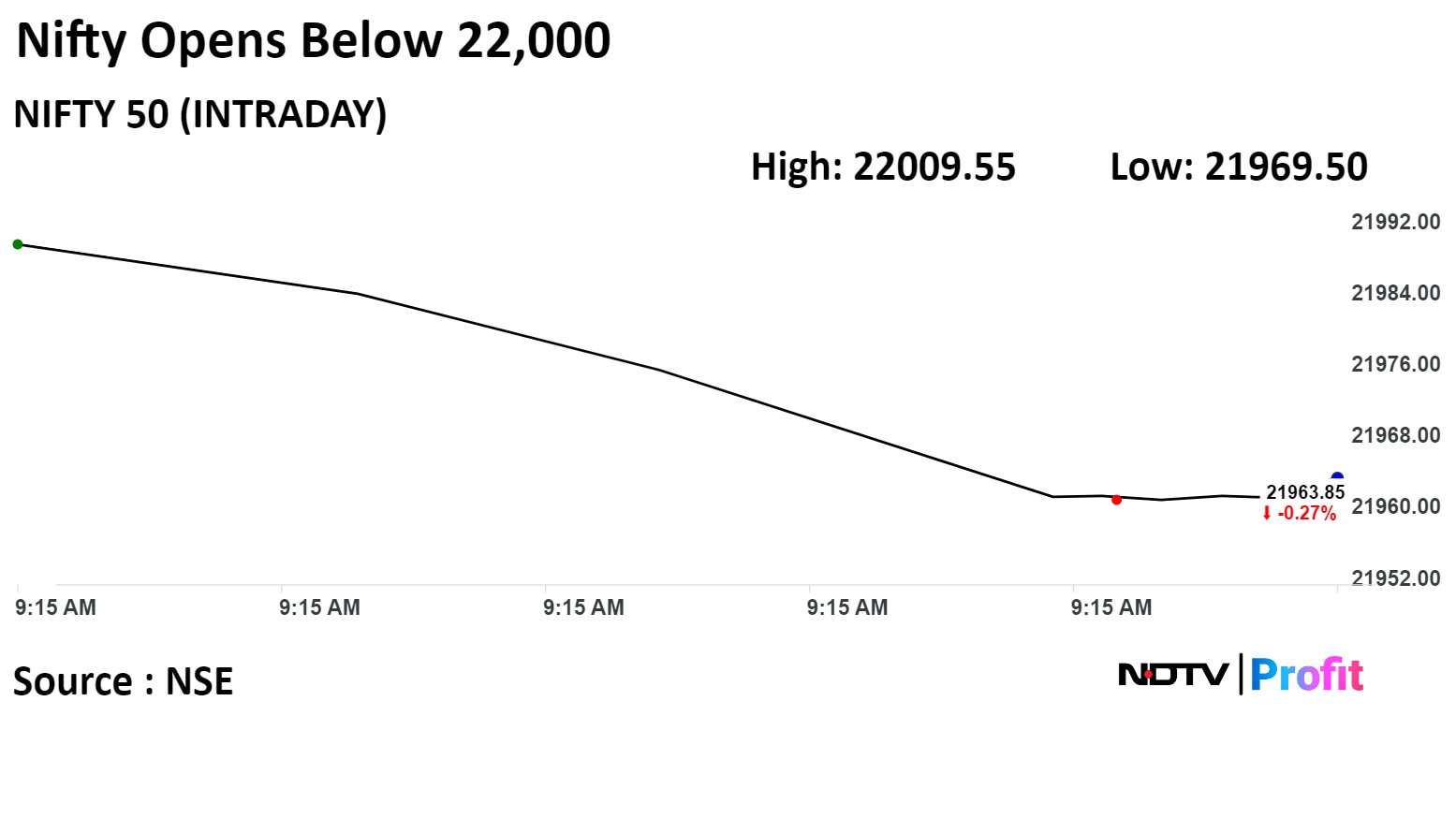

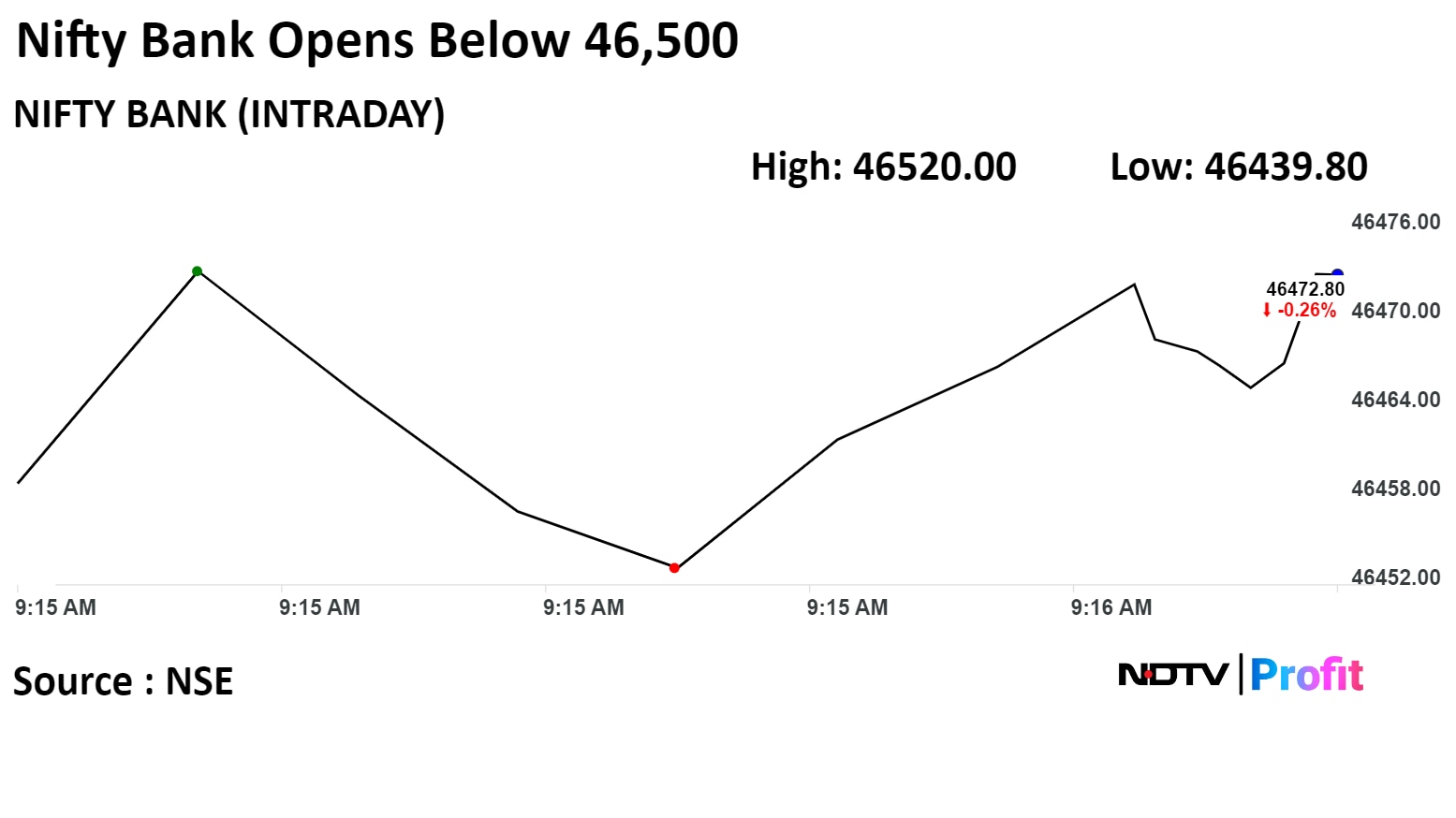

India's benchmark indices opened lower extending losses from last session as losses in shares of ICICI Bank Ltd., ITC Ltd., and Bharti Airtel Ltd. weighed.

As of 09:18 a.m., the NSE Nifty was trading 16.65 points or 0.076% lower at 22,006.70, and the S&P BSE Sensex was trading 453.85 points or 0.62% higher at 72,643.43.

"On the weekly chart, the Index has made a bearish engulfing candlestick pattern at record levels which indicates a probability of a trend reversal and a breakdown of 21,900 will confirm the same. In that case, the ongoing correction may extend to 21,530 while on the flip side, zone of 22,200-22,250 will be considered as a strong hurdle," said Aditya Gaggar, director, Progressive Shares

India's benchmark indices opened lower extending losses from last session as losses in shares of ICICI Bank Ltd., ITC Ltd., and Bharti Airtel Ltd. weighed.

As of 09:18 a.m., the NSE Nifty was trading 16.65 points or 0.076% lower at 22,006.70, and the S&P BSE Sensex was trading 453.85 points or 0.62% higher at 72,643.43.

"On the weekly chart, the Index has made a bearish engulfing candlestick pattern at record levels which indicates a probability of a trend reversal and a breakdown of 21,900 will confirm the same. In that case, the ongoing correction may extend to 21,530 while on the flip side, zone of 22,200-22,250 will be considered as a strong hurdle," said Aditya Gaggar, director, Progressive Shares

India's benchmark indices opened lower extending losses from last session as losses in shares of ICICI Bank Ltd., ITC Ltd., and Bharti Airtel Ltd. weighed.

As of 09:18 a.m., the NSE Nifty was trading 16.65 points or 0.076% lower at 22,006.70, and the S&P BSE Sensex was trading 453.85 points or 0.62% higher at 72,643.43.

"On the weekly chart, the Index has made a bearish engulfing candlestick pattern at record levels which indicates a probability of a trend reversal and a breakdown of 21,900 will confirm the same. In that case, the ongoing correction may extend to 21,530 while on the flip side, zone of 22,200-22,250 will be considered as a strong hurdle," said Aditya Gaggar, director, Progressive Shares

India's benchmark indices opened lower extending losses from last session as losses in shares of ICICI Bank Ltd., ITC Ltd., and Bharti Airtel Ltd. weighed.

As of 09:18 a.m., the NSE Nifty was trading 16.65 points or 0.076% lower at 22,006.70, and the S&P BSE Sensex was trading 453.85 points or 0.62% higher at 72,643.43.

"On the weekly chart, the Index has made a bearish engulfing candlestick pattern at record levels which indicates a probability of a trend reversal and a breakdown of 21,900 will confirm the same. In that case, the ongoing correction may extend to 21,530 while on the flip side, zone of 22,200-22,250 will be considered as a strong hurdle," said Aditya Gaggar, director, Progressive Shares

India's benchmark indices opened lower extending losses from last session as losses in shares of ICICI Bank Ltd., ITC Ltd., and Bharti Airtel Ltd. weighed.

As of 09:18 a.m., the NSE Nifty was trading 16.65 points or 0.076% lower at 22,006.70, and the S&P BSE Sensex was trading 453.85 points or 0.62% higher at 72,643.43.

"On the weekly chart, the Index has made a bearish engulfing candlestick pattern at record levels which indicates a probability of a trend reversal and a breakdown of 21,900 will confirm the same. In that case, the ongoing correction may extend to 21,530 while on the flip side, zone of 22,200-22,250 will be considered as a strong hurdle," said Aditya Gaggar, director, Progressive Shares

India's benchmark indices opened lower extending losses from last session as losses in shares of ICICI Bank Ltd., ITC Ltd., and Bharti Airtel Ltd. weighed.

As of 09:18 a.m., the NSE Nifty was trading 16.65 points or 0.076% lower at 22,006.70, and the S&P BSE Sensex was trading 453.85 points or 0.62% higher at 72,643.43.

"On the weekly chart, the Index has made a bearish engulfing candlestick pattern at record levels which indicates a probability of a trend reversal and a breakdown of 21,900 will confirm the same. In that case, the ongoing correction may extend to 21,530 while on the flip side, zone of 22,200-22,250 will be considered as a strong hurdle," said Aditya Gaggar, director, Progressive Shares

India's benchmark indices opened lower extending losses from last session as losses in shares of ICICI Bank Ltd., ITC Ltd., and Bharti Airtel Ltd. weighed.

As of 09:18 a.m., the NSE Nifty was trading 16.65 points or 0.076% lower at 22,006.70, and the S&P BSE Sensex was trading 453.85 points or 0.62% higher at 72,643.43.

"On the weekly chart, the Index has made a bearish engulfing candlestick pattern at record levels which indicates a probability of a trend reversal and a breakdown of 21,900 will confirm the same. In that case, the ongoing correction may extend to 21,530 while on the flip side, zone of 22,200-22,250 will be considered as a strong hurdle," said Aditya Gaggar, director, Progressive Shares

India's benchmark indices opened lower extending losses from last session as losses in shares of ICICI Bank Ltd., ITC Ltd., and Bharti Airtel Ltd. weighed.

As of 09:18 a.m., the NSE Nifty was trading 16.65 points or 0.076% lower at 22,006.70, and the S&P BSE Sensex was trading 453.85 points or 0.62% higher at 72,643.43.

"On the weekly chart, the Index has made a bearish engulfing candlestick pattern at record levels which indicates a probability of a trend reversal and a breakdown of 21,900 will confirm the same. In that case, the ongoing correction may extend to 21,530 while on the flip side, zone of 22,200-22,250 will be considered as a strong hurdle," said Aditya Gaggar, director, Progressive Shares

ICICI Bank Ltd., Adani Ports & Special Economic Zone Ltd., Adani Enterprises Ltd., and Infosys Ltd. weighed on the benchmark index.

Reliance Industries Ltd., Mahindra & Mahindra Ltd., NTPC Ltd., Tata Steel Ltd., Coal India Ltd., and HDFC Bank Ltd. limited losses in the benchmark index.

On NSE, nine sectors out of 12 were trading in negative, one was trading flat, and two were trading in positive. The Nifty Media index rose the most among sectoral indices, and the Nifty IT index fell the most among sectoral indices.

Broader markets outperformed benchmark indices. The S&P BSE Midcap index rose 0.29%, and the S&P BSE Smallcap rose 0.67%.

On BSE, 17 sectors rose, and three declined, The S&P BSE Industrials rose the most among sectoral indices.

Market breadth was skewed in favour of buyers. Around 2,074 stocks rose, 845 stocks declined, and 140 remained unchanged on BSE.

At pre-open, the NSE Nifty 50 was 33.25 points or 0.15% lower at 21,990.10, while the S&P BSE Sensex was trading 453.85 points or 0.62% lower at 72,643.43.

The local currency strengthened by 4 paise to open at 82.85 against the U.S. Dollar.

It closed at 82.89 a dollar on Friday.

Source: Bloomberg

The yield on the 10-year bond opened flat at 7.07%.

Source: Bloomberg

The brokerage retained a 'Buy’ on NTPC with a target price Rs 367.

CERC has released its final tariff norms for the period 2024–29.

Granular changes benefitting thermal; positive for NTPC, negative for PGCIL.

No change in ROEs for thermal, 0.5% cut for new transmission.

O&M cost recovery hike, benefits NTPC by Rs 5 billion and 12 billion versus draft/older norms.

Arbitration tribunal passes consent award relating to arbitration proceedings between Vizhinjam Port and Kerala Government.

Kerala Government extends completion date for Vizhinjam Port to December 3, 2024, from December 3, 2019.

Concession Agreement extended by 5 years until Dec 3, 2060.

Source: Exchange filing

U.S. Dollar Index at 103.49

U.S. 10-year bond yield at 4.30%

Brent crude up 0.02% at $85.36 per barrel

Nymex crude up 0.10% at $81.12 per barrel

GIFT Nifty was up 35.5 points or 0.16% at 22,084.00 as of 8:24 a.m.

Bitcoin was down 1.53% at $67,228.94

Rating upgrade on similar EBITDA/t and volume growth expectations as ULTC

Firm expects double digit volume growth in FY24 and FY25

Expect Q4 volumes to be slightly higher sequentially

Estimate FY25/26 EBITDA/t at Rs1,320/Rs1,350

Low Duties for foreign cos that commit to set up plant

Volume/ Value Caps limit near term impact

Opens up India as a progressive export base; brings advanced tech

Increases competition in premium EV segment for M&M & MG

Positive for PV Suppliers; Sona, Uno Minda & Motherson Group key beneficiers

No direct impact on domestic 2W OEMs

Potential impact on 4W OEMs to depend on global OEM interest

Possible Tesla entry to cause worry for mainly Tata Motors

Vinfast entry could be a fit in price sensitive Indian market

Any launch by global OEM priced at/ below Rs 20 lakh to garner consumer interest

Traditional players have been slow to address the opportunity

Challenge has been the lack of tech know-how and supply chain

India is price-sensitive market, over 70% of vehicles sold below $15K

Demand for vehicles costing more than $30K is less than 3% of the market

Tesla's entry (assuming) a negative for incumbents (Maruti, M&M, Tata, and Hyundai)

No immediate stock price impact because not an immediate challenge; price points high initially

Supply chain partners like Sona Comstar to benefit if India becomes hub for export

Higher subsidies boosted EV Sales from 0.4% in FY21 to 5% in H2FY23

They believe 2W demand continues to shift towards EV at gradual pace

Share of EVs in 2W sales rebound at 4-6% over 2 years

Estimate E2W Price rise of Rs 7-12K

Maximum incentives to 333,000 units; similar to November-February registrations

Start of PLI can help cushion reduced FAME incentives

Policymakers prefer incentives for manufacturing/ capability vs demand creation

EVs to form 5%/7%/9%/19% over FY24/25/26/30

New EV policy makes competitive landscape tougher for future electric cars by Tata Motors, M&M

Indian OEMs will need to offer an attractive value proposition to premium EV buyers.

New EV policy is likely to result in attractive opportunities for some of the Indian auto part makers.

No risks for the likes of Tata Motors and Mahindra & Mahindra, for the time being.

The Indian rupee closed weaker against the dollar on Friday after U.S. inflation data dashed hopes of a Fed rate cut in the first half of the year.

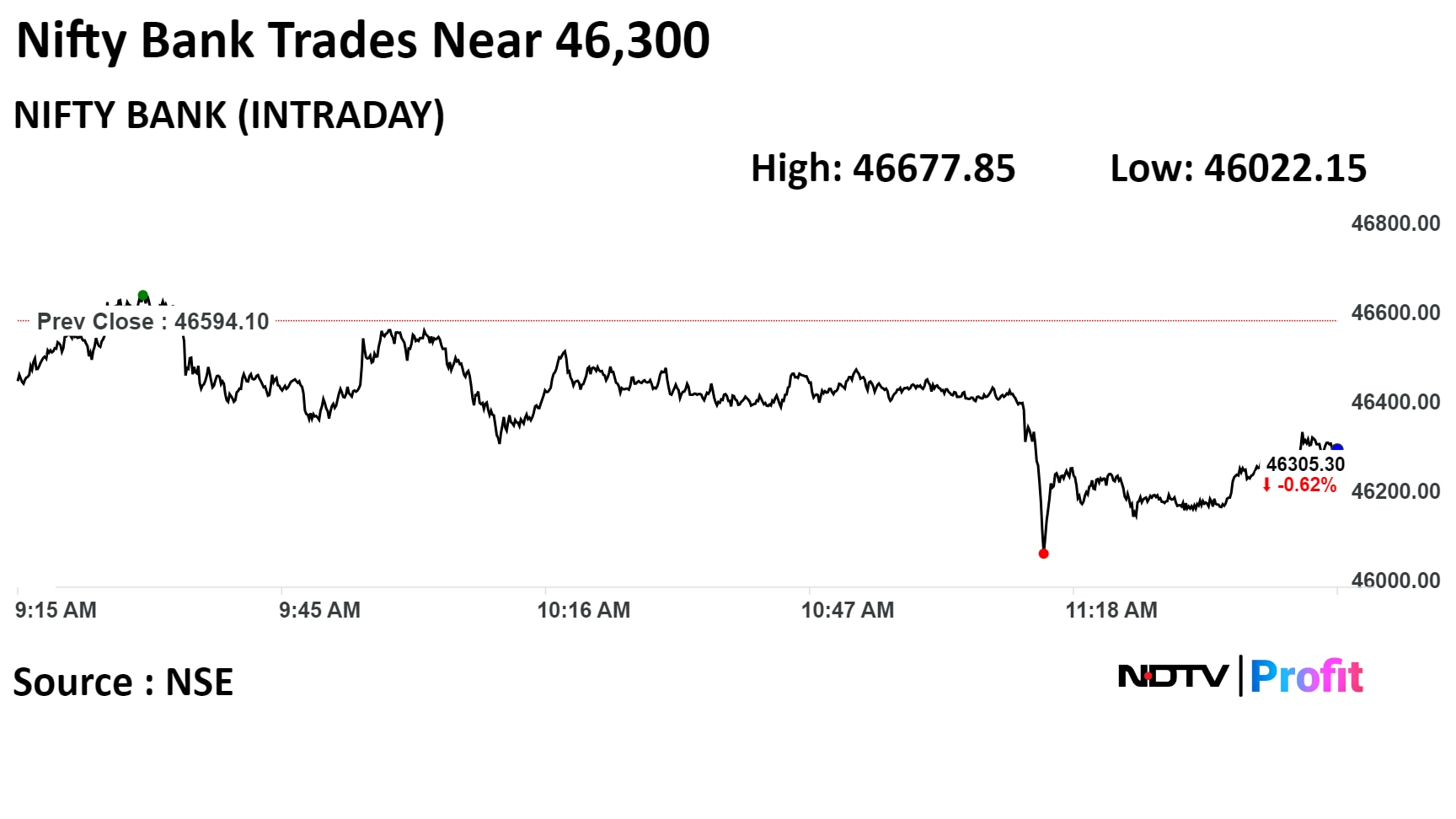

Nifty March futures down by 0.65% to 22,133 at a premium of 109.35 points.

Nifty March futures open interest down by 2.75%.

Nifty Bank March futures down by 0.67% to 46,694.7 at a premium of 100.6 points.

Nifty Bank March futures open interest down by 0.27%.

Nifty Options March 21 Expiry: Maximum call open interest at 23,000 and maximum put open interest at 21,000.

Bank Nifty Options March 20 Expiry: Maximum call open interest at 47,000 and maximum put open interest at 44,000.

Securities in ban period: Aditya Birla Fashion, Bharat Heavy Electricals, Biocon, Hindustan Copper, Manappuram Finance, National Aluminium, Piramal Enterprise, RBL Bank, Sail, Tata Chemical, Zee Entertainment Enterprise.

Capital Small Finance Bank: To meet analysts and investors on March 19.

Parag Milk Foods: To meet analysts and investors on March 26 and 28.

Choice International: To meet analysts and investors on March 20.

Price Band changes from 10% to 5%: D B Realty.

Price Band changes from 10% to 20%: Pearl Global Industries.

Ex/record Dividend: Oil India.

Moved into short-term ASM framework: Rico Auto Industries, Bigbloc Construction, Sindhu Trade Links.

Man Industries: Promoter Man Finance bought 17,000 shares on March 12.

Man Infraconstruction: Promoter Mansi P. Shah bought 2 lakh shares on March 14.

Gokul Agro Resources: Promoter Ritika Infracon bought 1.72 lakh shares on March 14.

Star Cement: Promoter Prem Kumar Bhajanka bought 2.64 lakh shares on March 12.

Asahi India Glass: Promoter Dinesh K. Agarwal created the pledge of 10,000 shares on March 13.

India Cements: Promoter EWS Finance and Investments created a pledge of 19.7 lakh shares between March 13 and 14.

Mangalore Chemicals and Fertilizers: Promoter Zuari Agro Chemicals created a pledge of 75,000 shares on March 13.

GMR Power and Urban Infra: F3 Advisors bought 1.57 crore shares (2.61%) at Rs 42.6 apiece, while Sahastraa Advisors sold 94.27 lakh shares (1.56%) at Rs 42.65 apiece and Setu Securities sold 35.74 lakh shares (0.59%) at Rs 42.42 apiece.

Voltamp Transformers: Norges Bank bought 0.77 lakh shares (0.76%) at Rs 8,201.54.

CMS Info Systems: Norges Bank bought 21.84 lakh shares (1.39%) at Rs 386.33 apiece, while UBS Principal Capital Asia sold 11.54 lakh shares (0.73%) at Rs 385.15 apiece.

Dish TV India: Setu Securities bought 1.17 crore shares (0.64%) at Rs 17.26 apiece.

Electrosteel Cast: Norges Bank bought 41.54 lakh shares (0.69%) at Rs 155.83 apiece.

Gokaldas Exports: Norges Bank bought 3.47 lakh shares (0.57%) at Rs 733.21 apiece, while UBS Principal Capital Asia sold 3.9 lakh shares (0.64%) at Rs 730.92 apiece.

Kopran: Quant Mutual Fund-Quant Small Cap Fund bought 2.5 lakh shares (0.51%) at Rs 255.41 apiece.

South Indian Bank: Norges Bank bought 1.57 crore shares (0.75%) at Rs 29.35 apiece.

Sundaram Finance: UBS Principal Capital Asia sold 6.63 lakh shares (0.59%) at Rs 3,797.03 apiece, Vanguard Emerging Markets bought 8.85 lakh shares (0.79%) at Rs 3,796.45 apiece and Vanguard Total International Stock Index Fund bought 9.12 lakh shares (0.82%) at Rs 3,796.45 apiece.

Krystal Integrated Services: The public issue was subscribed to 0.70 times on day 2. The bids were led by institutional investors (0.57 times), non-institutional investors (1.15 times), and retail investors (0.58 times).

Life Insurance Corp.: The government has approved a 17% overall hike in wages for more than 1.10 lakh employees of the insurance giant.

ITC: The company entered into a share purchase agreement with its arm, Russell Credit, to acquire a 45.36% stake in International Travel House.

Asset Management Companies: Mutual funds reported their stress test results on Friday, following the market regulator's concern about "forth" in the mid- and small-cap space.

Zee Entertainment: The company’s Managing Director and Chief Executive Officer, Punit Goenka, streamlined the company's technology and data vertical.

Gujarat Gas: The company has invited expressions of interest from ceramic customers for the purchase of natural gas.

Hindustan Aeronautics: The company signed a contract worth Rs 2,890 crore with the Ministry of Defence for the mid-life upgrade of 25 Dornier aircraft along with associated equipment for the Indian Navy.

Jindal Stainless: The company supplied stainless steel for India’s first underwater metro line in Kolkata. This landmark project is worth Rs 4,965 crore.

Adani Group Stocks: The Adani group plans to invest over Rs 1.2 lakh crore (about $14 billion) across its portfolio companies that range from ports to energy, airports, commodities, cement and media in financial year starting April 1, according to a PTI report.

Rail Vikas Nigam: The company received a Letter of Acceptance worth Rs 339 crore from Maharashtra Metro Rail for the design and construction of the Pune Metro Rail Project.

Punjab National Bank: The bank, in its EGM, approved raising equity capital of up to Rs 7,500 crore through qualified institutional placements or any other permitted mode or a combination.

Brigade Enterprises: The company announced the launch of BuzzWorks in Bengaluru. BuzzWorks introduces flexible and managed workspace solutions to cater to the evolving needs of modern businesses.

Metro Brands: The company received an NCLT nod to demerge Metro Athleisure from the company.

Housing & Urban Development Corp.: The company will consider fundraising up to Rs 40,000 crore in bonds or debentures on March 20.

Dish TV India: The company appointed Manoj Dobhal as axecutive director, effective Friday.

ICICI Prudential: The company redesignated Sandeep Batra as chairman of the board, effective June 30.

Aditya Birla Fashion: The company received a no-objection observation from NSE and BSE for a merger with TCNS Clothing.

Crompton Greaves: The company received a patent for a linear node tubular lighting system for 20 years.

Lupin: The USFDA inspected the company’s manufacturing facility in Aurangabad from March 6 to March 15, 2024, and closed with the issuance of a Form 483 with one observation.

CSB Bank: The company appointed BK Divakara as executive director for three years, effective Friday.

SJVN: The company received a letter of intent from Gujarat Urja Vikas Nigam for a 200 MW solar project.

Vinati Organics: The Finance Ministry imposed an anti-dumping duty on the import of 'Para-Tertiary Butyl Phenol' for five years.

Star Health and Allied Insurance: The company has been granted registration as an IFSC Insurance Office for setting up a branch office in Gujarat.

KSB: The company received a letter of award of Rs 63.22 crore for a contract for 2500 solar water pumping systems under the PM-Kusum III Scheme.

Omaxe: The company has acquired 34.55% of Secure Properties Pvt.'s equity shares and subscribed to 35% of 'Omaxe be Together Amausi Busport' and 'Omaxe be Together Ayodhya Dham Busport', making them associate companies.

Amber Enterprises: The company announced the incorporation of a wholly owned subsidiary, AT Railway Sub Systems, to specialise in manufacturing railway components and sub-systems for the rolling stock industry in India and overseas.

GTPL Hathway: The company has completed the acquisition of Metro Cast Network India, increasing its holding from 34.34% to 50.10%.

Ashoka Buildcon: The company acquired 4.9 crore shares of GVR Ashoka Chennai ORR from GVR Infra Projects. It will further acquire a total of 9.5 crore shares in GVR Ashoka Chennai ORR.

IRCON International: The company received a Letter of Acceptance for the construction of a twin-tube unidirectional tunnel in Mizoram for Rs 631 crore.

JSW Energy: The company's unit, JSW Neo Energy, received a letter of award from Solar Energy Corp. for an additional 500 MW of wind capacity.

Anup Engineering: The company entered into a pact to acquire a 100% stake in Mabel Engineering.

RailTel Corp: The company received a work order worth Rs 130 crore from the Bihar Education Project Council.

Most markets in the Asia-Pacific region were trading on a mixed note as investors awaited interest rate decisions from the Bank of Japan and the Federal Reserve this week.

The Nikkei 225 was trading 1.65% higher at 39,346.14, and the S&P ASX 200 was trading 0.16% lower at 7,658.20 as of 06:21 a.m.

The Bank of Japan's rate decision is scheduled for Tuesday, while the Federal Reserve is due on Wednesday.

The U.S. stock market fell as tech sold off and a pile of options expiring Friday threatened to trigger sudden price swings, according to Bloomberg.

The S&P 500 dropped to around 5,120, with trading volume that was 20% above the average of the past month. The Nasdaq 100 fell 1%, and the Dow Jones Industrial Average declined 0.5%.

Spot gold was trading flat at $2,156.060 an ounce, while Brent was trading higher at $85.41.

The GIFT Nifty was trading 35.5 points or 0.16% higher at 22,084.00 as of 8:24 a.m.

India's benchmark stock indices snapped a four-week rally and recorded their worst fall in over four months on Friday, dragged by shares of Mahindra & Mahindra and Reliance Industries.

Small-cap and mid-cap indices recovered in the last part of Friday's trade but ended with a weekly loss.

The NSE Nifty 50 ended 150.10 points, or 0.68%, lower at 21,996.55, and the S&P BSE Sensex fell 453.85 points, or 0.62%, to close at 72,643.43.

Overseas investors turned net buyers of Indian equities on Friday after two consecutive sessions of selling.

Foreign portfolio investors mopped up stocks worth Rs 848.6 crore, while domestic institutional investors turned sellers and offloaded equities worth Rs 682.3 crore, the NSE data showed.

The Indian rupee closed weaker against the dollar on Friday after U.S. inflation data dashed hopes of a rate cut in the first half of the year from the Federal Reserve.

Most markets in the Asia-Pacific region were trading on a mixed note as investors awaited interest rate decisions from the Bank of Japan and the Federal Reserve this week.

The Nikkei 225 was trading 1.65% higher at 39,346.14, and the S&P ASX 200 was trading 0.16% lower at 7,658.20 as of 06:21 a.m.

The Bank of Japan's rate decision is scheduled for Tuesday, while the Federal Reserve is due on Wednesday.

The U.S. stock market fell as tech sold off and a pile of options expiring Friday threatened to trigger sudden price swings, according to Bloomberg.

The S&P 500 dropped to around 5,120, with trading volume that was 20% above the average of the past month. The Nasdaq 100 fell 1%, and the Dow Jones Industrial Average declined 0.5%.

Spot gold was trading flat at $2,156.060 an ounce, while Brent was trading higher at $85.41.

The GIFT Nifty was trading 35.5 points or 0.16% higher at 22,084.00 as of 8:24 a.m.

India's benchmark stock indices snapped a four-week rally and recorded their worst fall in over four months on Friday, dragged by shares of Mahindra & Mahindra and Reliance Industries.

Small-cap and mid-cap indices recovered in the last part of Friday's trade but ended with a weekly loss.

The NSE Nifty 50 ended 150.10 points, or 0.68%, lower at 21,996.55, and the S&P BSE Sensex fell 453.85 points, or 0.62%, to close at 72,643.43.

Overseas investors turned net buyers of Indian equities on Friday after two consecutive sessions of selling.

Foreign portfolio investors mopped up stocks worth Rs 848.6 crore, while domestic institutional investors turned sellers and offloaded equities worth Rs 682.3 crore, the NSE data showed.

The Indian rupee closed weaker against the dollar on Friday after U.S. inflation data dashed hopes of a rate cut in the first half of the year from the Federal Reserve.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.