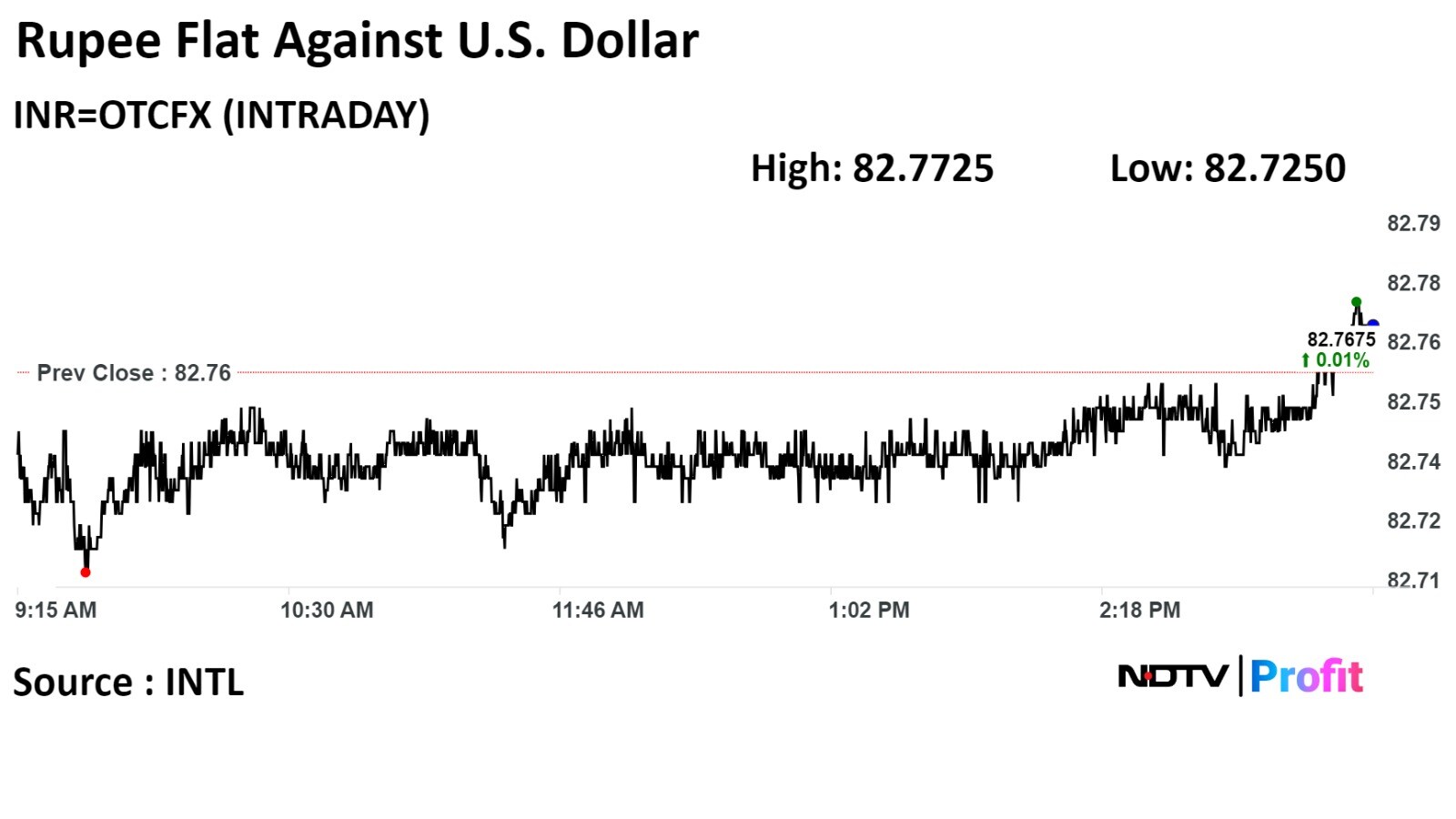

The local currency closed flat at 82.77 against the U.S. Dollar.

Source: Cogencis

The local currency closed flat at 82.77 against the U.S. Dollar.

Source: Cogencis

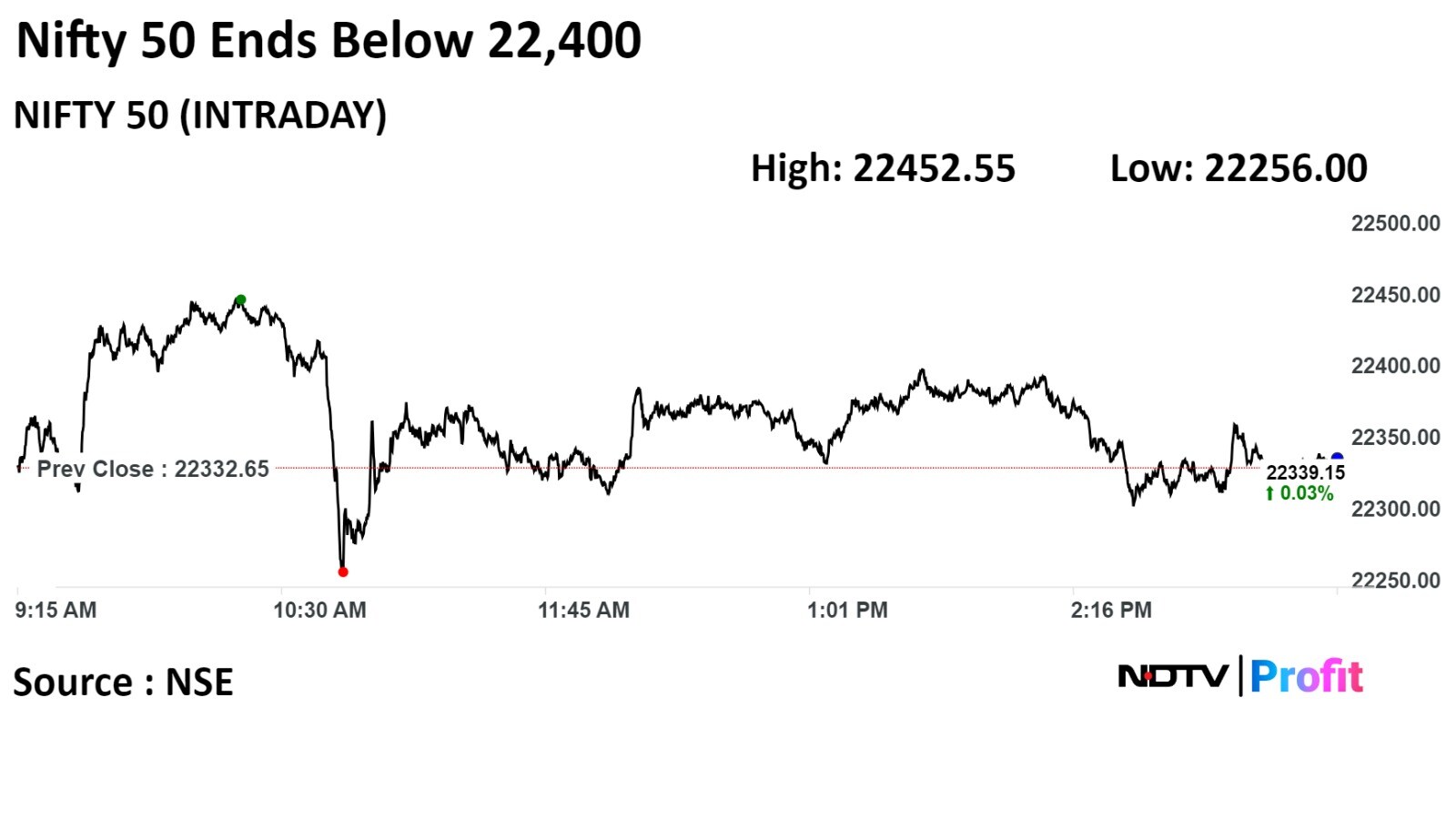

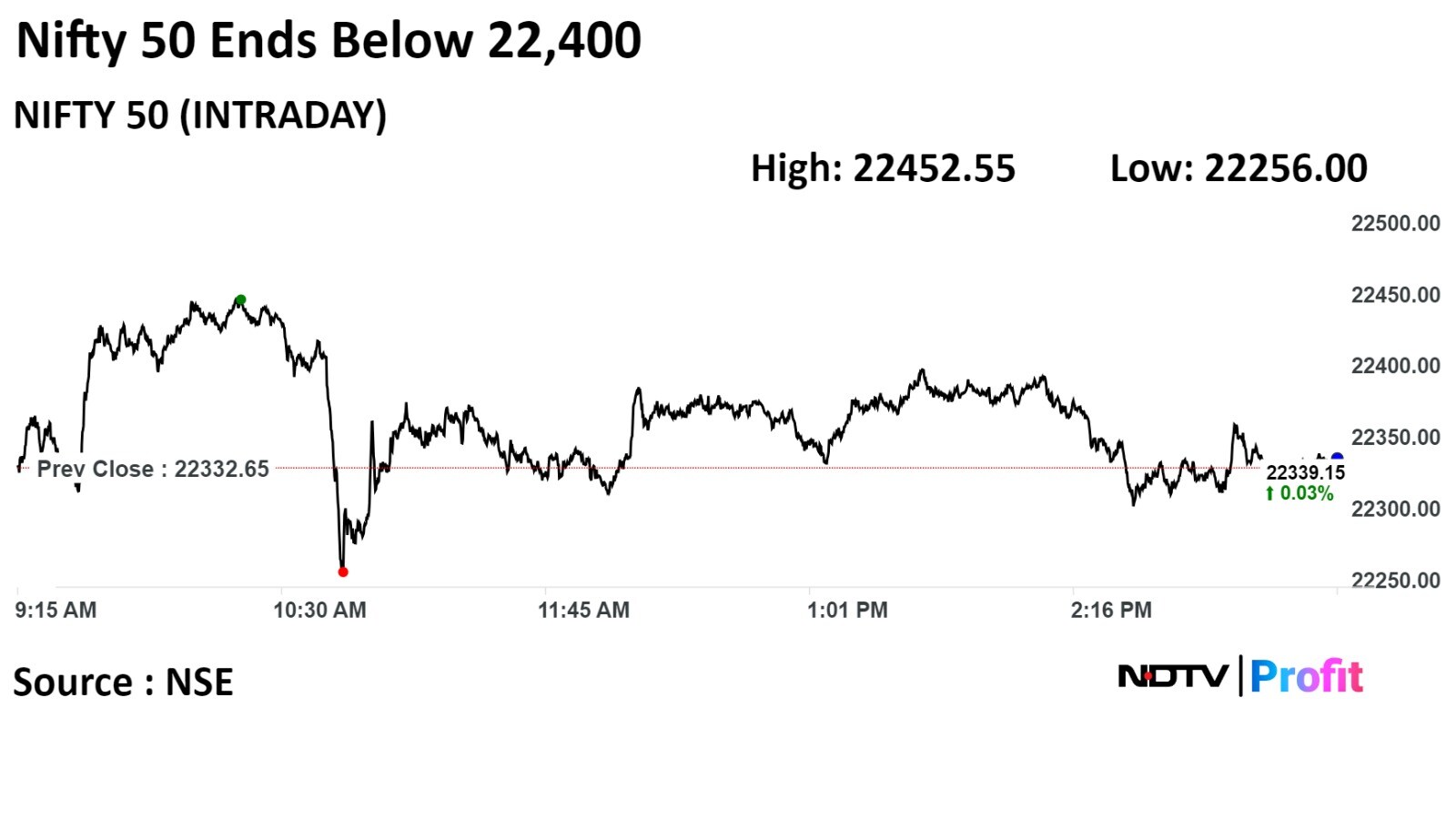

India's benchmark indices ended on a mixed note after concluding a choppy session on Tuesday. Gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd supported, while losses in shares of State Bank of India, ITC Ltd dragged.

Today, the NSE Nifty 50 settled 3.05 points or 0.01% up at 22,335.70, and the S&P BSE Sensex settled 165.32 points or 0.22% higher at 73,667.96.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

India's benchmark indices ended on a mixed note after concluding a choppy session on Tuesday. Gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd supported, while losses in shares of State Bank of India, ITC Ltd dragged.

Today, the NSE Nifty 50 settled 3.05 points or 0.01% up at 22,335.70, and the S&P BSE Sensex settled 165.32 points or 0.22% higher at 73,667.96.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

India's benchmark indices ended on a mixed note after concluding a choppy session on Tuesday. Gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd supported, while losses in shares of State Bank of India, ITC Ltd dragged.

Today, the NSE Nifty 50 settled 3.05 points or 0.01% up at 22,335.70, and the S&P BSE Sensex settled 165.32 points or 0.22% higher at 73,667.96.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

India's benchmark indices ended on a mixed note after concluding a choppy session on Tuesday. Gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd supported, while losses in shares of State Bank of India, ITC Ltd dragged.

Today, the NSE Nifty 50 settled 3.05 points or 0.01% up at 22,335.70, and the S&P BSE Sensex settled 165.32 points or 0.22% higher at 73,667.96.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

"Today, the benchmark indices witnessed range bound activity, the nifty ends 2.5 points lower while the Sensex was up by 165 points. Among Sectors, Reality index lost the most shed 3.7 percent whereas intraday buying were seen in selective IT stocks," said Shrikant Chouhan, head equity research, Kotak Securities.

Technically, after intraday technical bounce back the Nifty/Sensex took the resistance near 22,450/74,000 and corrected sharply. On intraday charts, it is still holding weak texture which indicating weak sentiment is likely to continue in the near future, Chouhan said.

For the day traders now, 22,450/74,000 would act as a key resistance zone. Below the same, the weak texture is likely to continue. Below 22,450/74,000, the market could slip till 22,250-22,200/73,400-73,200. On the flip side, above 22450/74000 the sentiment could change. Above which, the market could bounce back up to 22,500-22,525/74,600-74,700, he added.

India's benchmark indices ended on a mixed note after concluding a choppy session on Tuesday. Gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd supported, while losses in shares of State Bank of India, ITC Ltd dragged.

Today, the NSE Nifty 50 settled 3.05 points or 0.01% up at 22,335.70, and the S&P BSE Sensex settled 165.32 points or 0.22% higher at 73,667.96.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

India's benchmark indices ended on a mixed note after concluding a choppy session on Tuesday. Gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd supported, while losses in shares of State Bank of India, ITC Ltd dragged.

Today, the NSE Nifty 50 settled 3.05 points or 0.01% up at 22,335.70, and the S&P BSE Sensex settled 165.32 points or 0.22% higher at 73,667.96.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

India's benchmark indices ended on a mixed note after concluding a choppy session on Tuesday. Gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd supported, while losses in shares of State Bank of India, ITC Ltd dragged.

Today, the NSE Nifty 50 settled 3.05 points or 0.01% up at 22,335.70, and the S&P BSE Sensex settled 165.32 points or 0.22% higher at 73,667.96.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

India's benchmark indices ended on a mixed note after concluding a choppy session on Tuesday. Gains in shares of HDFC Bank Ltd., Tata Consultancy Services Ltd supported, while losses in shares of State Bank of India, ITC Ltd dragged.

Today, the NSE Nifty 50 settled 3.05 points or 0.01% up at 22,335.70, and the S&P BSE Sensex settled 165.32 points or 0.22% higher at 73,667.96.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

"Today, the benchmark indices witnessed range bound activity, the nifty ends 2.5 points lower while the Sensex was up by 165 points. Among Sectors, Reality index lost the most shed 3.7 percent whereas intraday buying were seen in selective IT stocks," said Shrikant Chouhan, head equity research, Kotak Securities.

Technically, after intraday technical bounce back the Nifty/Sensex took the resistance near 22,450/74,000 and corrected sharply. On intraday charts, it is still holding weak texture which indicating weak sentiment is likely to continue in the near future, Chouhan said.

For the day traders now, 22,450/74,000 would act as a key resistance zone. Below the same, the weak texture is likely to continue. Below 22,450/74,000, the market could slip till 22,250-22,200/73,400-73,200. On the flip side, above 22450/74000 the sentiment could change. Above which, the market could bounce back up to 22,500-22,525/74,600-74,700, he added.

HDFC Bank Ltd., Tata Consultancy Services Ltd., Reliance Industries Ltd., Infosys Ltd., and Bharti Airtel Ltd added positively to the benchmark index.

ITC Ltd., State Bank of India, Larsen & Toubro Ltd., Axis Bank Ltd., and Adani Enterprises Ltd weighed on the benchmark index.

On NSE, 10 sectors out of 12 declined, and two advanced. The NSE Nifty IT index rose the most among peer sectoral indices, while the Nifty Realty index was the top loser.

Broader markets underperformed benchmark indices. The S&P BSE Midcap index declined 1.3%, and the S&P BSE Smallcap index fell 2.11%.

On BSE, 19 sectors out of 20 sectors declined, and one sector advanced. The S&P BSE Realty index fell over 3% to become the top loser among sectoral indices. The S&P BSE TECK index rose the most.

Market breadth was skewed in favour of sellers. Around 3,220 stocks declined, 675 stocks advanced, and 72 remained unchanged on BSE.

Bharat Mobility Global Expo 2025 will be between 17-22 January 2025.

Expo to be be spread over Bharat Mandapam, Yashobhoomi, industrial centre in Greater Noida.

SIAM’s biennial expo to be part of the Bharat mobility expo.

Source: ministry of commerce

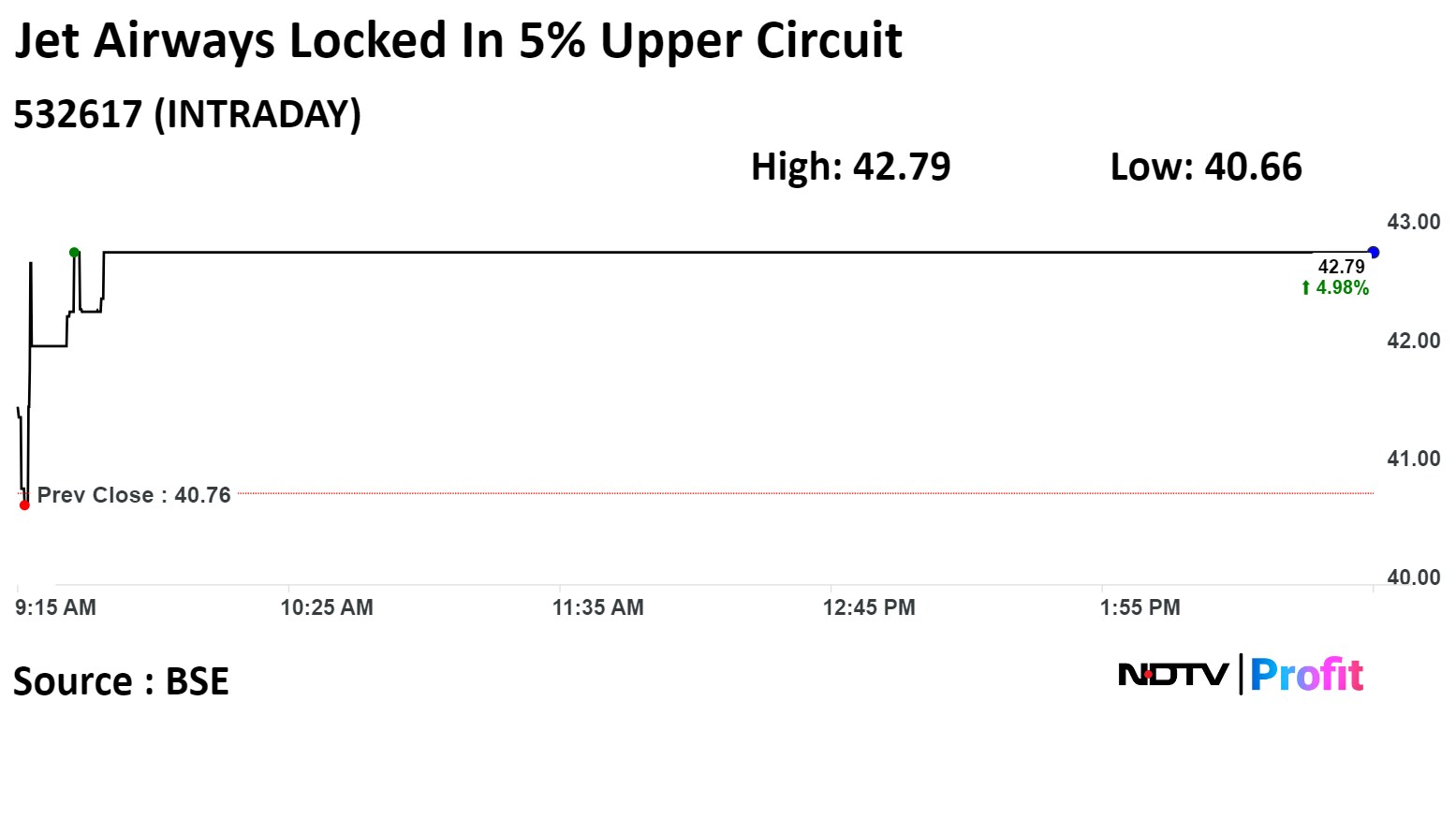

Jet Airways India Ltd hit an upper circuit of 5.00% to Rs 42.79 apiece, the highest level since March 6. It remained locked in the upper circuit as of 3:08 p.m., which compared to the 0.04% advance on NSE Nifty 50 index.

It has declined 37.51% in 12 months. Total traded volume so far in the day stood at 1.4 times its 30-day average. The relative strength index was 28.91, which implied the stock is oversold .

Jet Airways India Ltd hit an upper circuit of 5.00% to Rs 42.79 apiece, the highest level since March 6. It remained locked in the upper circuit as of 3:08 p.m., which compared to the 0.04% advance on NSE Nifty 50 index.

It has declined 37.51% in 12 months. Total traded volume so far in the day stood at 1.4 times its 30-day average. The relative strength index was 28.91, which implied the stock is oversold .

Promoter Ambuja Cements to sell up to 4% stake in co between March 13, 2024, and Feb 6, 2025.

Up to 2% stake to be sold in FY24 and an additional 2% stake will be sold in the next financial year.

Ambuja Cements to sell stake to achieve minimum public shareholding.

Source: Exchange filing

NCLAT approves control transfer of Jet Airways to Jalan Kalrock.

SBI'S appeal has been disposed.

The order dated January 13, 2023, is upheld.

Rs 150 crore to be adjusted in the first tranche of the plan.

All parties directed to implement the plan within 90 days.

Source: NCLAT Proceedings

Lumax Industries Ltd to expand its Chakan plant in Pune at an investment of Rs 152.6 crore.

The project is aimed to cater to new orders received from OEM customers for advance lighting solutions.

Lumax Industries will also set up new manufacturing unit for advance lighting solutions at its Sanand plant.

Source: Exchange filing

India's benchmark stock indices were trading higher through midday on Tuesday, led by gains in index heavyweights HDFC Bank Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd.

As of 12:49 p.m., the NSE Nifty 50 was trading 34.25 points, or 0.15%, higher at 22,366.90, and the S&P BSE Sensex gained 236.95 points, or 0.32%, to 73,739.59.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

"Despite the market reaching all-time highs, sentiments appear to be somewhat subdued. It may be advisable to focus on trading only in high-quality stocks under such circumstances," said Shrey Jain, founder and chief executive officer of SAS Online.

"Yesterday, profit-taking in the Nifty was driven by selling pressure in banking stocks and Reliance," he said. "Regarding options activity, the 22,500 call strike stands out with substantial open interest of around 81 lakh shares, expected to present a significant resistance level initially. Additionally, the 22,300 and 22,400 put strikes also show significant OI, totaling approximately 32 lakh shares."

On the downside, the immediate support level for Nifty 50 is anticipated at around 22,200, Jain said.

India's benchmark stock indices were trading higher through midday on Tuesday, led by gains in index heavyweights HDFC Bank Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd.

As of 12:49 p.m., the NSE Nifty 50 was trading 34.25 points, or 0.15%, higher at 22,366.90, and the S&P BSE Sensex gained 236.95 points, or 0.32%, to 73,739.59.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

"Despite the market reaching all-time highs, sentiments appear to be somewhat subdued. It may be advisable to focus on trading only in high-quality stocks under such circumstances," said Shrey Jain, founder and chief executive officer of SAS Online.

"Yesterday, profit-taking in the Nifty was driven by selling pressure in banking stocks and Reliance," he said. "Regarding options activity, the 22,500 call strike stands out with substantial open interest of around 81 lakh shares, expected to present a significant resistance level initially. Additionally, the 22,300 and 22,400 put strikes also show significant OI, totaling approximately 32 lakh shares."

On the downside, the immediate support level for Nifty 50 is anticipated at around 22,200, Jain said.

India's benchmark stock indices were trading higher through midday on Tuesday, led by gains in index heavyweights HDFC Bank Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd.

As of 12:49 p.m., the NSE Nifty 50 was trading 34.25 points, or 0.15%, higher at 22,366.90, and the S&P BSE Sensex gained 236.95 points, or 0.32%, to 73,739.59.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

"Despite the market reaching all-time highs, sentiments appear to be somewhat subdued. It may be advisable to focus on trading only in high-quality stocks under such circumstances," said Shrey Jain, founder and chief executive officer of SAS Online.

"Yesterday, profit-taking in the Nifty was driven by selling pressure in banking stocks and Reliance," he said. "Regarding options activity, the 22,500 call strike stands out with substantial open interest of around 81 lakh shares, expected to present a significant resistance level initially. Additionally, the 22,300 and 22,400 put strikes also show significant OI, totaling approximately 32 lakh shares."

On the downside, the immediate support level for Nifty 50 is anticipated at around 22,200, Jain said.

India's benchmark stock indices were trading higher through midday on Tuesday, led by gains in index heavyweights HDFC Bank Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd.

As of 12:49 p.m., the NSE Nifty 50 was trading 34.25 points, or 0.15%, higher at 22,366.90, and the S&P BSE Sensex gained 236.95 points, or 0.32%, to 73,739.59.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

"Despite the market reaching all-time highs, sentiments appear to be somewhat subdued. It may be advisable to focus on trading only in high-quality stocks under such circumstances," said Shrey Jain, founder and chief executive officer of SAS Online.

"Yesterday, profit-taking in the Nifty was driven by selling pressure in banking stocks and Reliance," he said. "Regarding options activity, the 22,500 call strike stands out with substantial open interest of around 81 lakh shares, expected to present a significant resistance level initially. Additionally, the 22,300 and 22,400 put strikes also show significant OI, totaling approximately 32 lakh shares."

On the downside, the immediate support level for Nifty 50 is anticipated at around 22,200, Jain said.

India's benchmark stock indices were trading higher through midday on Tuesday, led by gains in index heavyweights HDFC Bank Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd.

As of 12:49 p.m., the NSE Nifty 50 was trading 34.25 points, or 0.15%, higher at 22,366.90, and the S&P BSE Sensex gained 236.95 points, or 0.32%, to 73,739.59.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

"Despite the market reaching all-time highs, sentiments appear to be somewhat subdued. It may be advisable to focus on trading only in high-quality stocks under such circumstances," said Shrey Jain, founder and chief executive officer of SAS Online.

"Yesterday, profit-taking in the Nifty was driven by selling pressure in banking stocks and Reliance," he said. "Regarding options activity, the 22,500 call strike stands out with substantial open interest of around 81 lakh shares, expected to present a significant resistance level initially. Additionally, the 22,300 and 22,400 put strikes also show significant OI, totaling approximately 32 lakh shares."

On the downside, the immediate support level for Nifty 50 is anticipated at around 22,200, Jain said.

India's benchmark stock indices were trading higher through midday on Tuesday, led by gains in index heavyweights HDFC Bank Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd.

As of 12:49 p.m., the NSE Nifty 50 was trading 34.25 points, or 0.15%, higher at 22,366.90, and the S&P BSE Sensex gained 236.95 points, or 0.32%, to 73,739.59.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

"Despite the market reaching all-time highs, sentiments appear to be somewhat subdued. It may be advisable to focus on trading only in high-quality stocks under such circumstances," said Shrey Jain, founder and chief executive officer of SAS Online.

"Yesterday, profit-taking in the Nifty was driven by selling pressure in banking stocks and Reliance," he said. "Regarding options activity, the 22,500 call strike stands out with substantial open interest of around 81 lakh shares, expected to present a significant resistance level initially. Additionally, the 22,300 and 22,400 put strikes also show significant OI, totaling approximately 32 lakh shares."

On the downside, the immediate support level for Nifty 50 is anticipated at around 22,200, Jain said.

India's benchmark stock indices were trading higher through midday on Tuesday, led by gains in index heavyweights HDFC Bank Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd.

As of 12:49 p.m., the NSE Nifty 50 was trading 34.25 points, or 0.15%, higher at 22,366.90, and the S&P BSE Sensex gained 236.95 points, or 0.32%, to 73,739.59.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

"Despite the market reaching all-time highs, sentiments appear to be somewhat subdued. It may be advisable to focus on trading only in high-quality stocks under such circumstances," said Shrey Jain, founder and chief executive officer of SAS Online.

"Yesterday, profit-taking in the Nifty was driven by selling pressure in banking stocks and Reliance," he said. "Regarding options activity, the 22,500 call strike stands out with substantial open interest of around 81 lakh shares, expected to present a significant resistance level initially. Additionally, the 22,300 and 22,400 put strikes also show significant OI, totaling approximately 32 lakh shares."

On the downside, the immediate support level for Nifty 50 is anticipated at around 22,200, Jain said.

India's benchmark stock indices were trading higher through midday on Tuesday, led by gains in index heavyweights HDFC Bank Ltd., Reliance Industries Ltd., and Tata Consultancy Services Ltd.

As of 12:49 p.m., the NSE Nifty 50 was trading 34.25 points, or 0.15%, higher at 22,366.90, and the S&P BSE Sensex gained 236.95 points, or 0.32%, to 73,739.59.

The Nifty rose 0.54% to hit an intraday high of 22,452.55, and the Sensex rose 0.68% to touch a high of 74,004.16 so far today.

"Despite the market reaching all-time highs, sentiments appear to be somewhat subdued. It may be advisable to focus on trading only in high-quality stocks under such circumstances," said Shrey Jain, founder and chief executive officer of SAS Online.

"Yesterday, profit-taking in the Nifty was driven by selling pressure in banking stocks and Reliance," he said. "Regarding options activity, the 22,500 call strike stands out with substantial open interest of around 81 lakh shares, expected to present a significant resistance level initially. Additionally, the 22,300 and 22,400 put strikes also show significant OI, totaling approximately 32 lakh shares."

On the downside, the immediate support level for Nifty 50 is anticipated at around 22,200, Jain said.

Shares of HDFC Bank Ltd., Infosys Ltd., Maruti Suzuki India Ltd., Reliance Industries Ltd. and Tata Consultancy Services Ltd. were positively contributing to the Nifty.

While, Axis Bank Ltd., Cipla Ltd., ITC Ltd., ICICI Bank Ltd. and State Bank of India were weighing on the index.

On NSE, 10 sectors declined with Nifty Realty emerging as the top loser. Two sectoral indices advanced, with the Nifty IT emerging as the top gainer.

Broader markets on BSE underperformed the benchmark indices. The S&P BSE Midcap fell 1.29%, and the S&P BSE Smallcap declined 2.33%.

On BSE, 18 of the 20 sectors declined and only one advanced. The S&P BSE Realty slumped over 3% to become the worst performer among sectoral indices. The S&P BSE Teck was the top gainer among sectoral indices.

Market breadth was skewed in the favour of sellers. Around 3,202 stocks declined, 583 stocks rose, and 103 remained unchanged on BSE.

Mahindra Lifespace Developers Ltd Acquires 9.4 acres land parcel in Whitefield, Bengaluru.

Bengaluru land to have 1.2 million square feet FSI potential, a Gross GDV of Rs 1,700 crore.

Source: Exchange Filing

ION Exchange (India) Ltd received Rs 120 crore order from Saudi Arabia's Maaden for setting up water treatment plant.

Source: Exchange filing

KNR Constructions received a LoA for water supply projects worth Rs 1,163 crore in Telangana.

Source: Exchange filing

Bajaj Electrical has signed a licensing agreement allowing Bajel Projects to use the Bajaj trademark for a period of 3 years.

To charge 1% royalty from Bajel Projects for the revenue generated from the use of the trademark.

Source: Exchange filing

Rail Vikas Nigam Ltd received a LOA worth Rs 193 crore from Rajasthan Rajya Vidyut Prasaran Nigam.

The contract is expected to be executed in 24 months.

Source: Exchange Filing

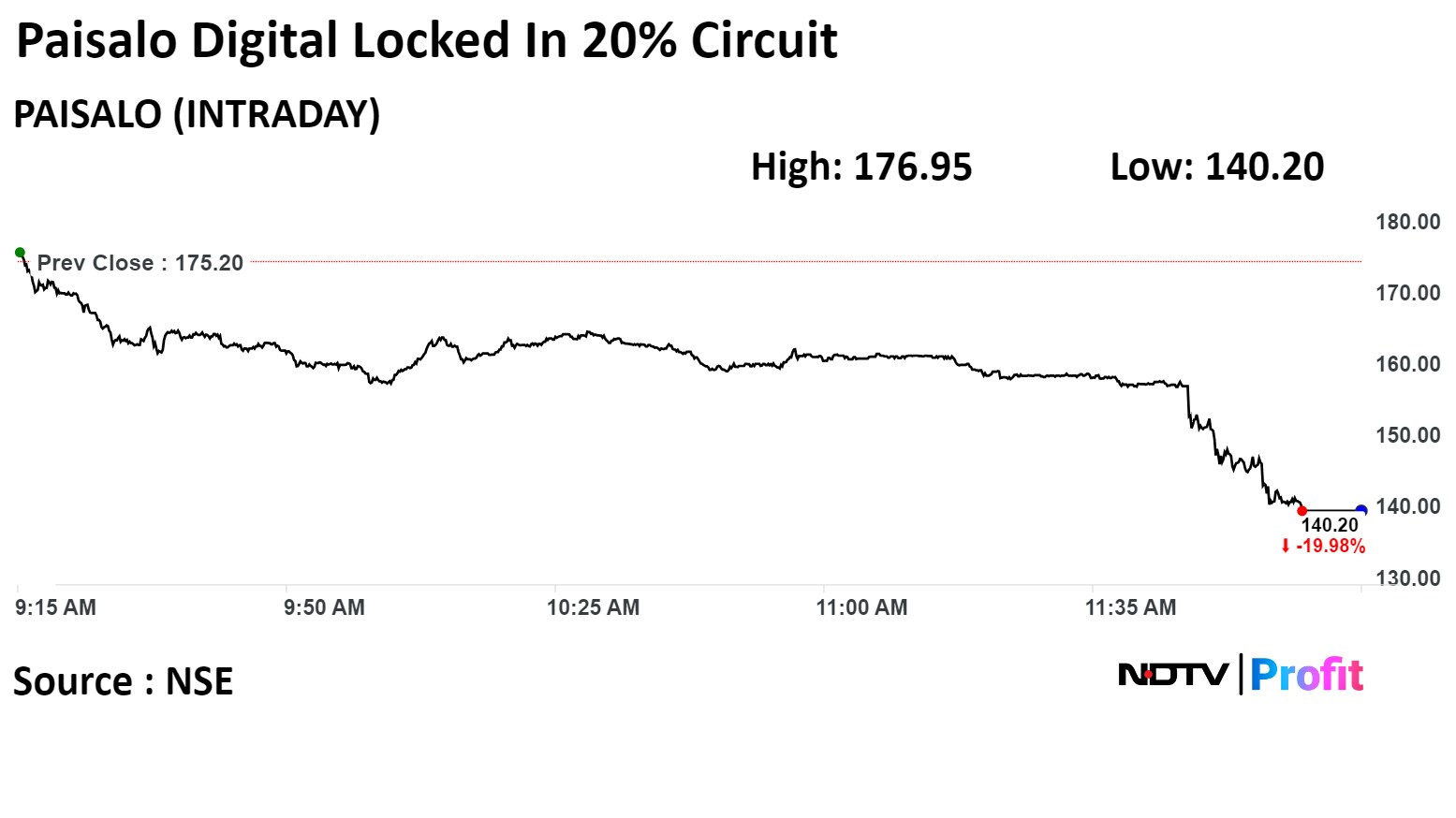

Paisalo Digital Ltd has clarifiesd on reports of HC's order asking regulators to look into companies' lending practices.

The company said there is no order directing any regulator to investigate any unfair lending practices.

Source: Exchange filing

Century Plyboards Ltd has appoints Sumant Wattas as CEO, effective April 1.

Source: Exchange Filing

The Board of Directors has approved to reduce overall transaction charges across cash equity and equity derivatives segments and products by 1%.

The reduction will come into effect April 1, 2024.

The reduction is to have impact of Rs 130 crore per annum on revenue from transaction charges.

Source: NSE Statement

Tata Power's project comprises 100 MW solar PV project and 120 MWh battery energy storage system.

Tata Power Solar commissions solar and battery energy storage project in Chhattisgarh.

Source: Exchange Filing

Vodafone Idea has ‘soft commitment’ of up to $1 billion for equity raise.

Government is unlikely to participate in the fundraise

Mode of fundraise is yet to be decided.

Alert: Vodafone Idea had approved a fund raise of Rs 45,000 crore via equity and debt.

Source: People in the know to NDTV Profit

Accusations involve the company charging a 125% interest rate per annum on loans.

Petitioner submitted: Outstanding amount of Rs. 15,94,31,127/- in May 2019 escalated to Rs. 23,02,88,001/- in June 2019.

Petitioner alleges exorbitant interest rate

SEBI's stance: Doesn't regulate NBFCs' lending practices, emphasizes role as a market regulator, especially in the securities market.

Accusations involve the company charging a 125% interest rate per annum on loans.

Petitioner submitted: Outstanding amount of Rs. 15,94,31,127/- in May 2019 escalated to Rs. 23,02,88,001/- in June 2019.

Petitioner alleges exorbitant interest rate

SEBI's stance: Doesn't regulate NBFCs' lending practices, emphasizes role as a market regulator, especially in the securities market.

On NSE, Paisalo Digital Ltd hit a 19.98% lower circuit and fell to the lowest level Rs 140.20 apiece, the lowest level since Feb 16. It remained locked in 19.98% lower circuit as of 12:18 p.m. This compares to a 0.17% advance in the NSE Nifty 50 Index.

It has risen 141.10% in 12 months. Total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 42.24.

One analyst tracking the company maintained 'Buy' rating on the company, according to Bloomberg data. The average 12-month consensus price target implies an upside 23.4%.

Response to Recent Speculation BAT PLC notes the recent press speculation relating to a potential disposal of part of its shareholding in ITC Ltd. BAT confirms that it is evaluating a possible disposal of a small part of BAT's shareholding in ITC by means of an on-market block trade. There can be no certainty that any such transaction will proceed, nor can there be any certainty as to the terms of any potential transaction. A further announcement will be made if and when appropriate.

The person responsible for arranging for the release of this announcement on behalf of BAT PLC is Caroline Ferland, Group Company Secretary.

Source: Bloomberg

Aurionpro Solutions Ltd got a contract worth Rs 100 crore from SBI for cash-management and transaction banking platform.

Source: Exchange filing

Hero MotoCorp sales up 16.42% YoY at 4,45,095 units

Honda India sales up 82.29% YoY at 4,13,967 units

TVS Motor sales up 20.82% YoY at 2,67,502 units

Bajaj Auto sales up 42.94% YoY at 1,68,727 units

Royal Enfield sales up 5.41% YoY at 67,922 units

Note: Bajaj Auto’s exports make up almost half of its overall sales volumes.

Source: SIAM statement

PV sales up 10.75% at 370,786 units

Two-wheeler sales up 34.62% at 15,20,761 units

Three-wheeler sales up 8.34% at 54,584 units

Source: SIAM statement

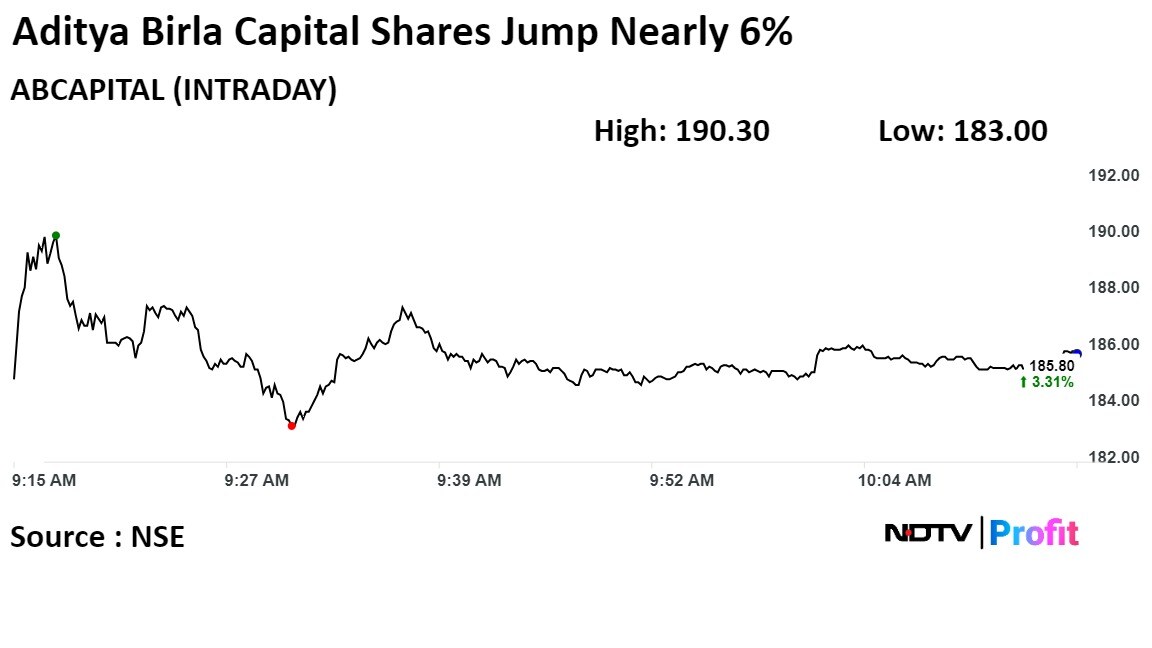

The shares of Aditya Birla Capital Ltd. rose on Tuesday after the board on Monday approved the amalgamation of the wholly owned unit Aditya Birla Finance Ltd.

The scrip rose as much as 5.81% to 190.30 apiece, the highest level since March 6. It pared gains to trade 3.20% higher at Rs 185.60 apiece, as of 10:08 a.m. This compares to a 0.46% advance in the NSE Nifty 50 Index.

It has risen 26.22% in the last 12 months. Total traded volume so far in the day stood at 6.7 times its 30-day average. The relative strength index was at 52.84.

Out of nine analysts tracking the company, eight maintain a 'buy' rating and one recommends a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.5%.

The shares of Aditya Birla Capital Ltd. rose on Tuesday after the board on Monday approved the amalgamation of the wholly owned unit Aditya Birla Finance Ltd.

The scrip rose as much as 5.81% to 190.30 apiece, the highest level since March 6. It pared gains to trade 3.20% higher at Rs 185.60 apiece, as of 10:08 a.m. This compares to a 0.46% advance in the NSE Nifty 50 Index.

It has risen 26.22% in the last 12 months. Total traded volume so far in the day stood at 6.7 times its 30-day average. The relative strength index was at 52.84.

Out of nine analysts tracking the company, eight maintain a 'buy' rating and one recommends a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.5%.

Lists at Rs 250 on NSE vs issue price of Rs 288

Lists at discount of 13.2% to the issue price on NSE

Lists at Rs 252 on BSE vs issue price of Rs 288

Lists at discount of 12.5% to the issue price on BSE

SpiceJet Ltd. fell to over two-month low on BSE on reports that the company's two senior executives have tendered their resignation.

Chief Operating Officer Arun Kashyap and Chief Commercial Officer Shilpa Bhatia have put their papers for resignation, PTI reported, citing sources.

SpiceJet Ltd. fell to over two-month low on BSE on reports that the company's two senior executives have tendered their resignation.

Chief Operating Officer Arun Kashyap and Chief Commercial Officer Shilpa Bhatia have put their papers for resignation, PTI reported, citing sources.

The scrip fell as much as 9.87% to Rs 54.60 apiece, the lowest level since Dec 18. It pared losses to trade 5.45% lower at Rs 57.28 apiece, as of X:X a/p.m. This compares to a 0.40% advance in the NSE Nifty 50 Index.

It has risen 66.28% in 12 months. Total traded volume so far in the day stood at 1.1 times its 30-day average. The relative strength index was at 33.40.

Out of four analysts tracking the company, one maintains a 'buy' rating, three recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies a downside of 15.4%.

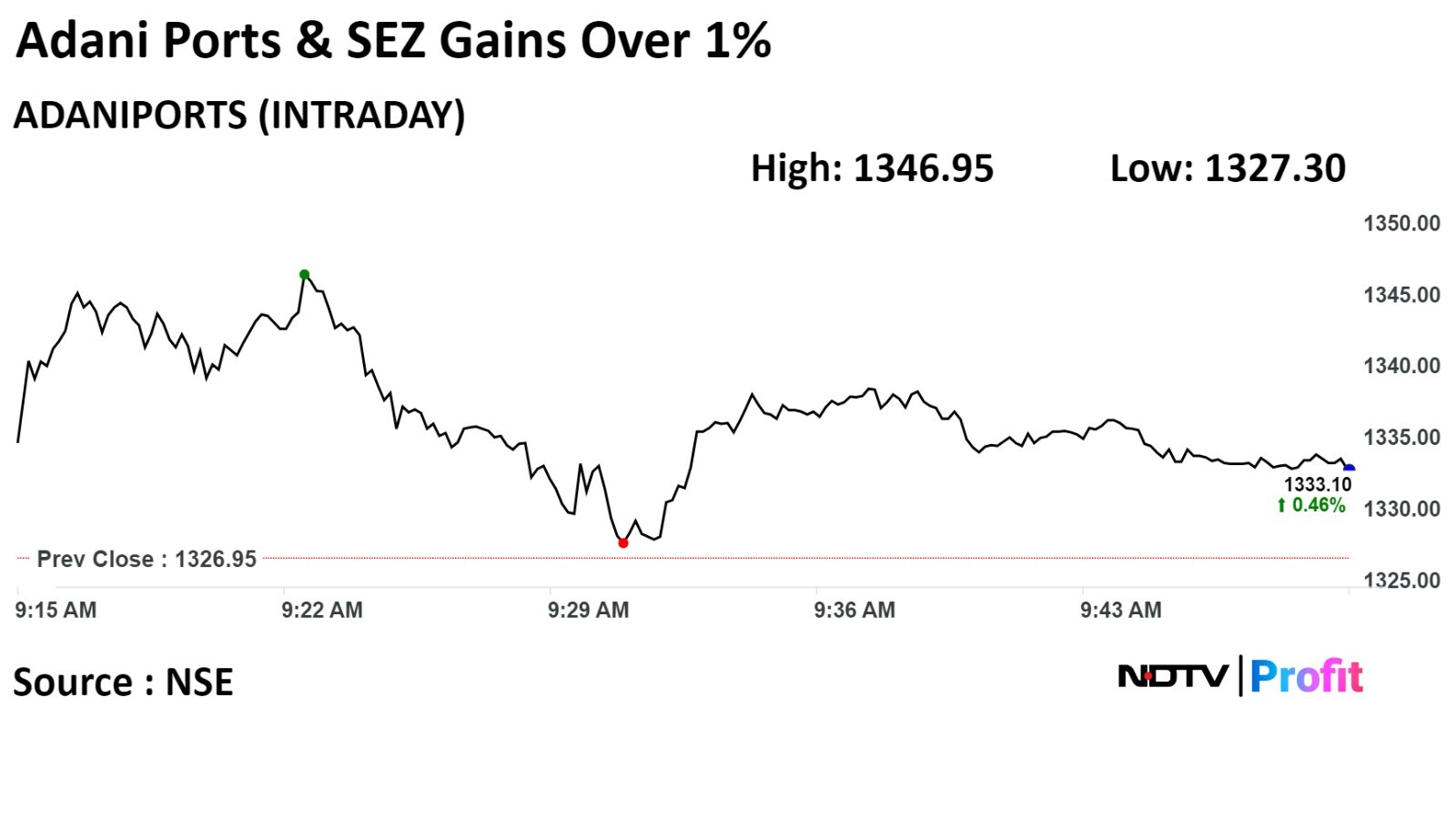

Adani Ports and Special Economic Zone Ltd. is well positioned to surpass revised guidance of FY24 and the company expects acceleration in India’s port cargo volume growth due to substantial improvement in in-land logistics and port capacity, according to brokerages.

The port's company is well positioned to grow reasonably faster than industry due to its presence across both coasts of India, Citi added in a note.

Shares of Adani Ports rose as much as 1.28% to Rs 1,342.35 apiece on the NSE. The stock was trading 0.11% higher at Rs 1,326.95 per share compared to benchmark Nifty 50 which advanced 0.43% at 9:39 a.m.

Of the 21 analysts tracking the company, 19 maintain a 'buy' rating on the stock and two recommend 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3.7%

Adani Ports and Special Economic Zone Ltd. is well positioned to surpass revised guidance of FY24 and the company expects acceleration in India’s port cargo volume growth due to substantial improvement in in-land logistics and port capacity, according to brokerages.

The port's company is well positioned to grow reasonably faster than industry due to its presence across both coasts of India, Citi added in a note.

Shares of Adani Ports rose as much as 1.28% to Rs 1,342.35 apiece on the NSE. The stock was trading 0.11% higher at Rs 1,326.95 per share compared to benchmark Nifty 50 which advanced 0.43% at 9:39 a.m.

Of the 21 analysts tracking the company, 19 maintain a 'buy' rating on the stock and two recommend 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3.7%

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

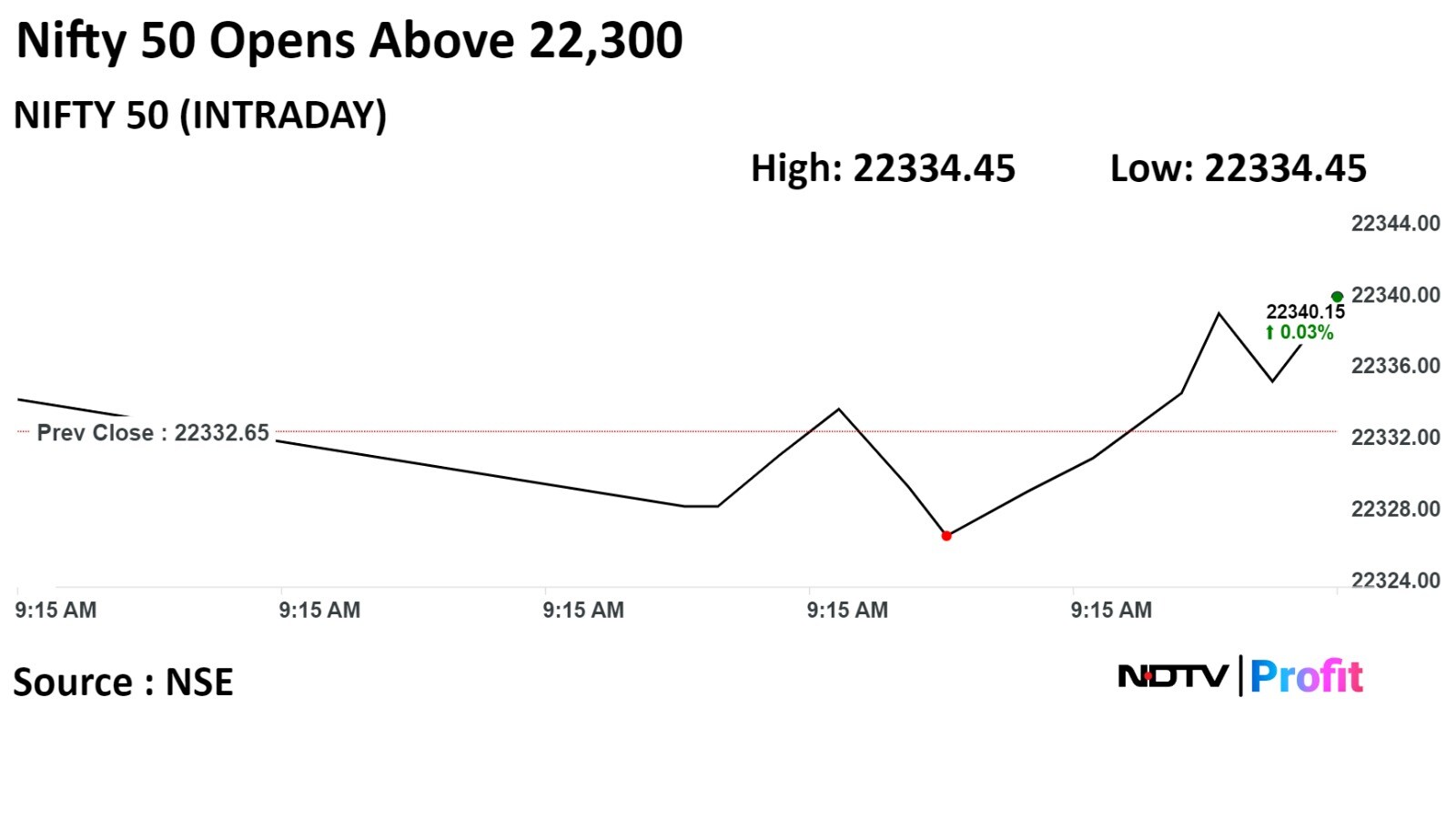

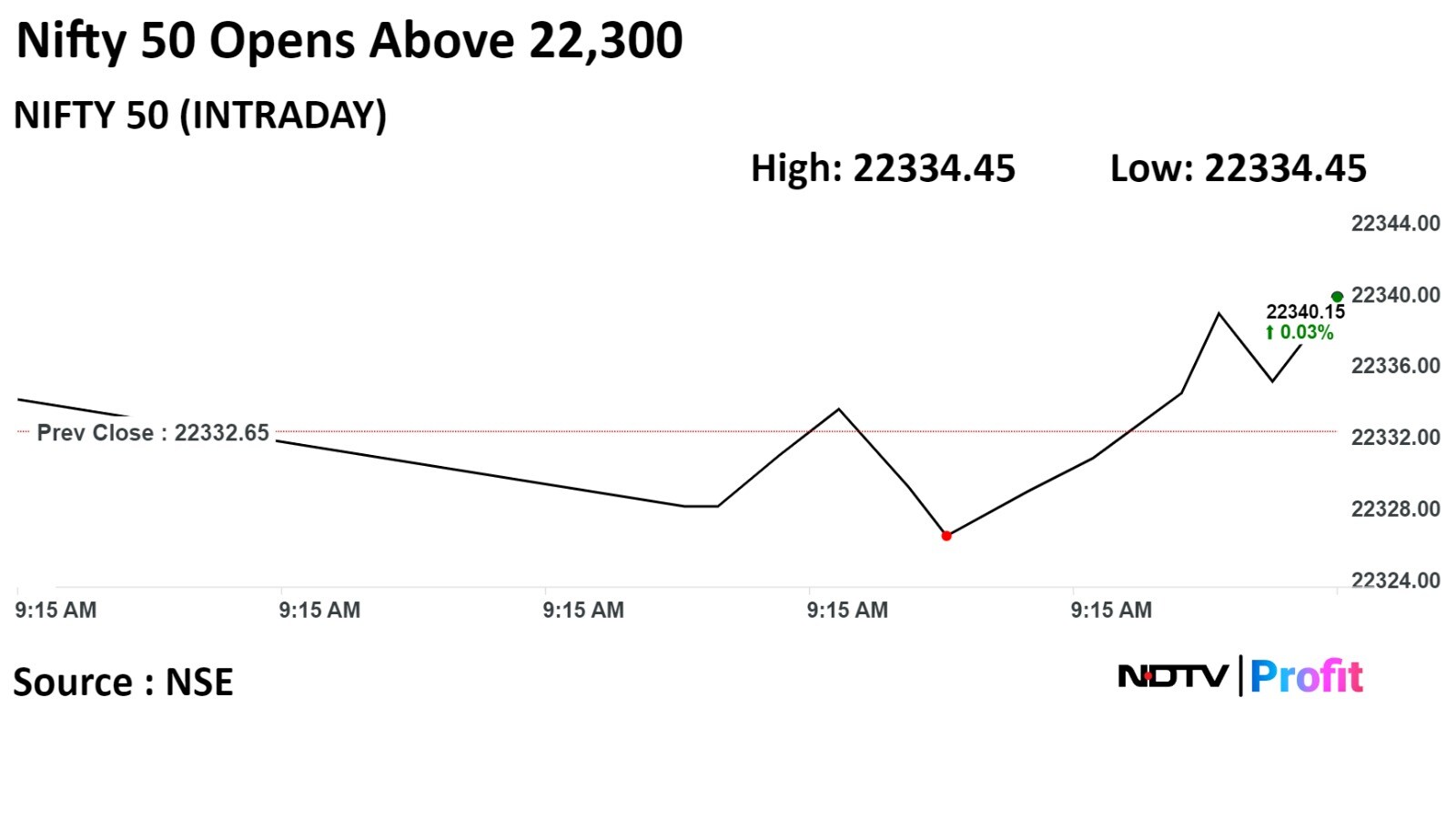

India's benchmark indices opened flat as gains in shares of Reliance Industries Ltd., Infosys Ltd. offset losses in ITC Ltd., and Hindustan Unilever Ltd.

As of 09:18 a.m. the NSE Nifty 50 was trading 26.80 points or 0.12% higher at 22,359.45, and the S&P BSE Sensex was trading 108.50 points or 0.15% higher at 73,611.14.

"The daily chart shows that the coordinates have formed a bearish candlestick, indicating that this temporary weakness is likely to continue. Our view is that as long as the market trades below 22450/73900 it can fall to 22,270-22000/73,200-73,000. On the upside, a technical pullback is possible after dismissing 22,450/73,900. If the market goes above 22450/73900, it may retest 22,500-22,530/74,000-74,200 levels. Contra traders can take long bets near 22,270-22,230/73,100-73,000 with a stop loss at 22,180," said Shrikant Chouhan, head equity, research, Kotak Securities.

India's benchmark indices opened flat as gains in shares of Reliance Industries Ltd., Infosys Ltd. offset losses in ITC Ltd., and Hindustan Unilever Ltd.

As of 09:18 a.m. the NSE Nifty 50 was trading 26.80 points or 0.12% higher at 22,359.45, and the S&P BSE Sensex was trading 108.50 points or 0.15% higher at 73,611.14.

"The daily chart shows that the coordinates have formed a bearish candlestick, indicating that this temporary weakness is likely to continue. Our view is that as long as the market trades below 22450/73900 it can fall to 22,270-22000/73,200-73,000. On the upside, a technical pullback is possible after dismissing 22,450/73,900. If the market goes above 22450/73900, it may retest 22,500-22,530/74,000-74,200 levels. Contra traders can take long bets near 22,270-22,230/73,100-73,000 with a stop loss at 22,180," said Shrikant Chouhan, head equity, research, Kotak Securities.

India's benchmark indices opened flat as gains in shares of Reliance Industries Ltd., Infosys Ltd. offset losses in ITC Ltd., and Hindustan Unilever Ltd.

As of 09:18 a.m. the NSE Nifty 50 was trading 26.80 points or 0.12% higher at 22,359.45, and the S&P BSE Sensex was trading 108.50 points or 0.15% higher at 73,611.14.

"The daily chart shows that the coordinates have formed a bearish candlestick, indicating that this temporary weakness is likely to continue. Our view is that as long as the market trades below 22450/73900 it can fall to 22,270-22000/73,200-73,000. On the upside, a technical pullback is possible after dismissing 22,450/73,900. If the market goes above 22450/73900, it may retest 22,500-22,530/74,000-74,200 levels. Contra traders can take long bets near 22,270-22,230/73,100-73,000 with a stop loss at 22,180," said Shrikant Chouhan, head equity, research, Kotak Securities.

India's benchmark indices opened flat as gains in shares of Reliance Industries Ltd., Infosys Ltd. offset losses in ITC Ltd., and Hindustan Unilever Ltd.

As of 09:18 a.m. the NSE Nifty 50 was trading 26.80 points or 0.12% higher at 22,359.45, and the S&P BSE Sensex was trading 108.50 points or 0.15% higher at 73,611.14.

"The daily chart shows that the coordinates have formed a bearish candlestick, indicating that this temporary weakness is likely to continue. Our view is that as long as the market trades below 22450/73900 it can fall to 22,270-22000/73,200-73,000. On the upside, a technical pullback is possible after dismissing 22,450/73,900. If the market goes above 22450/73900, it may retest 22,500-22,530/74,000-74,200 levels. Contra traders can take long bets near 22,270-22,230/73,100-73,000 with a stop loss at 22,180," said Shrikant Chouhan, head equity, research, Kotak Securities.

Tata Consultancy Services Ltd., Infosys Ltd., Reliance Industries Ltd., HDFC Bank Ltd., and HCL Technologies Ltd. added positively to the benchmark indices.

ITC Ltd., State Bank of India, Hindustan Unilever Ltd., NTPC Ltd., Bajaj Finance Ltd. weighed on the benchmark index.

On NSE, 11 sectors declined, and one advanced. The Nifty IT index rose the most among peers.

The Nifty PSU Bank index declined over 1% dragged by losses in shares of State Bank of India.

Broader markets underperformed benchmark indices. The S&P BSE Midcap index fell 1.12%, and the S&P BSE Smallcap declined 0.74%.

On BSE, 18 sectors out of 20 declined, and two advanced. The S&P BSE Realty index declined the most to become the top loser among sectoral indices. The S&P BSE IT index rose the most among sectoral indices.

Market breadth was skewed in favour of the sellers. Around 2,248 stocks declined, 756 stocks declined, and 98 remained unchanged on BSE.

At pre open, the NSE Nifty 50 was trading 1.80 points or 0.01% higher at 22,334.45, and the BSE Sensex was trading 13.78 points or 0.02% up at 73,516.42.

The yield on the 10-year bond opened flat at 7.02%.

Source: Bloomberg

The local currency strengthened by 4 paise to 82.72 against the U.S. Dollar.

It closed at 82.76 on Monday.

Source: Cogencis

Port cargo volume growth to accelerate on improving in-land logistics.

Believes faster than industry growth with presence across both coasts of India.

Management increased its FY24 cargo guidance to 400mnt vs 370-390 metric tonn.

Sees strong traction in logistics business with 12% market share in container train operations

Remains favourable pick in Infrastructure despite sharp rally.

HSBC Global Research has maintained 'Buy' rating on Adani Ports & Special Economic Zone Ltd with a Price target of Rs 1,560, implying 17.7% upside.

Expect ADSEZ on track to beat 400 million metric tonn target in FY24.

Ebitda forecasts increased by 1-4% for FY24-26E on higher port throughput assumptions

Expect ROIC to rise from 10% in FY23 to 16% in FY26E

Believes ADSEZ as long-term play on India’s trade and infrastructure growth

Expect its diverse and sticky cargo to buffer near term uncertainties

Motilal Oswal retained a 'Buy' on Adani Ports and Special Economic Zone Ltd with a target price of Rs 1,600.

Records highest-ever cargo volume YTD FY24; limited impact of Red Sea crisis on volumes

Building infrastructure for strong future growth in logistics business

Management has recently revised its FY24 cargo volume guidance to 400 MMT from ~380 MMT Increase the target multiple to 17x EV/EBITDA (vs 16x earlier)

Data regarding customers buying electoral bonds ready for submission.

Mapping of data was important as a review process to avoid discrepancies.

Customers can no longer claim anonymity, as disclosure is ordered by Supreme Court.

Source: People In The Know To NDTV Profit

U.S. Dollar Index at 102.79

U.S. 10-year bond yield at 4.10%

Brent crude up 0.26% at $82.42 per barrel

Nymex crude up 0.22% at $78.10 per barrel

GIFT Nifty up 26.5 points, or 0.12%, at 22,450.00 as of 7:37 a.m.

Bitcoin was up 0.26% at $72,303.25

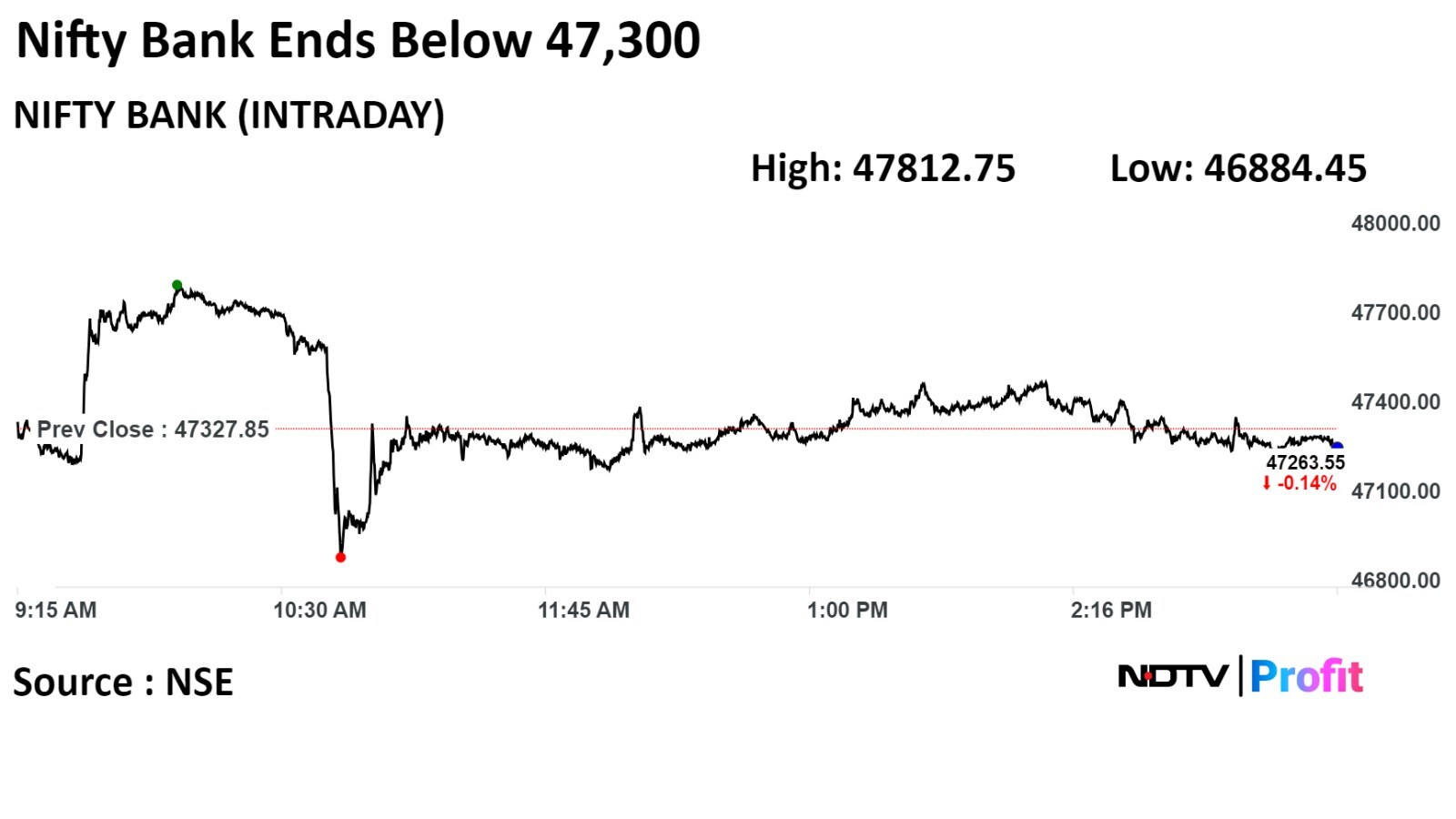

Nifty March futures down by 0.66% to 22,421.35 at a premium of 88.7 points.

Nifty March futures open interest down by 4.3%.

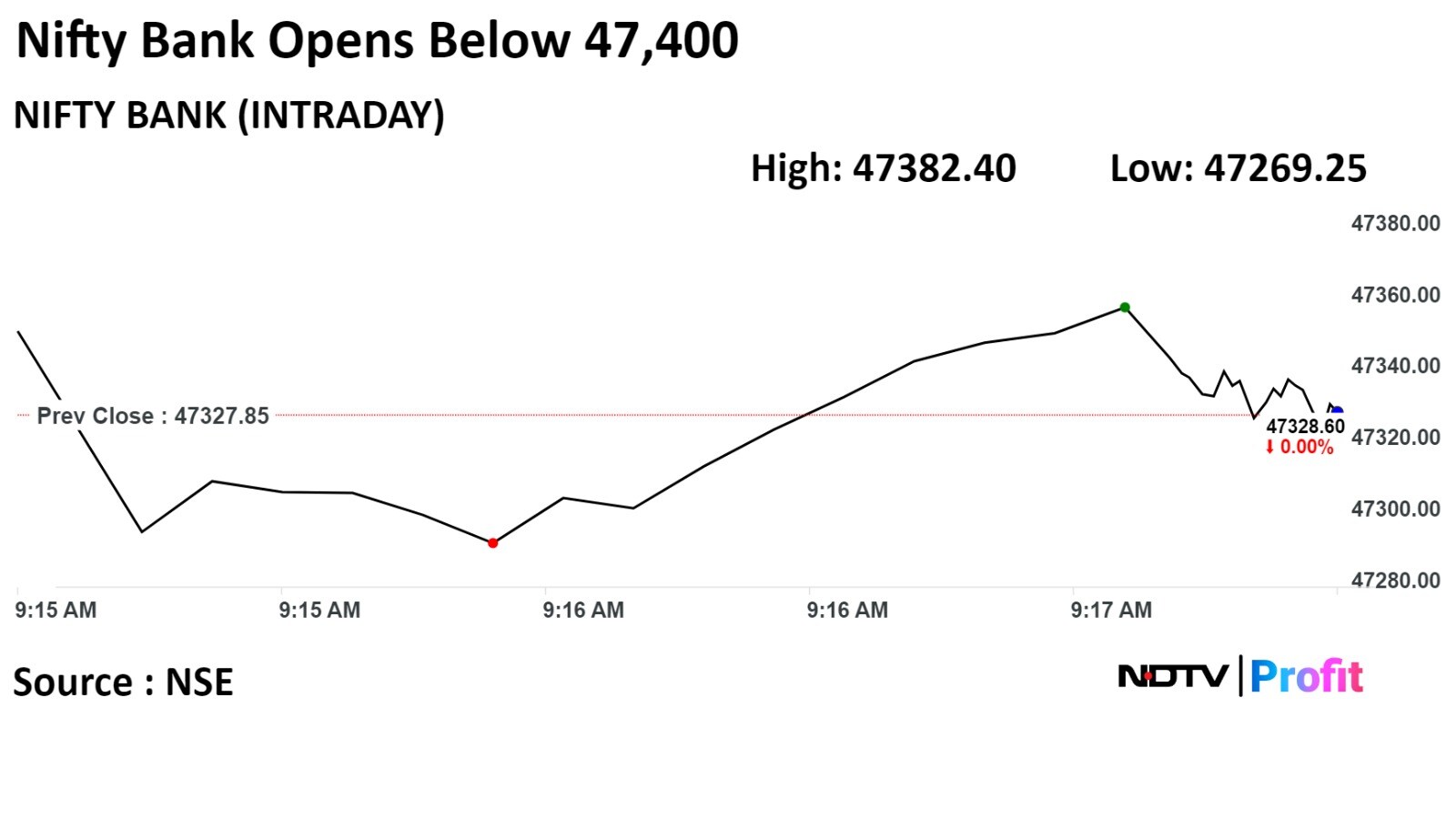

Nifty Bank March futures down by 1.05% to 47,489.85 at a premium of 162 points.

Nifty Bank March futures open interest down by 1.7%.

Nifty Options March 14 Expiry: Maximum call open interest at 23,000 and maximum put open interest at 21,500.

Bank Nifty Options March 13 Expiry: Maximum call open interest at 48,000 and maximum put open interest at 45,500.

Securities in ban period: Aditya Birla Fashion, Hindustan Copper, Manappuram Finance, Mahanagar Gas, Sail, Tata Chemical, and Zee Entertainment Enterprise.

Price band changes from 20% to 10%: Sindhu Trade Links.

Ex/record Rights Issue: IRB Infrastructure Trust.

Moved into short-term ASM framework: Tata Chemicals.

Moved out short-term ASM framework: Inox India, Sanghvi Movers, and Shaily Engineering Plastics.

CarTrade Tech: To meet analysts and investors on March 14.

Navin Fluorine: To meet analysts and investors on March 15.

Yatharth Hospital and Trauma Care Services: To meet analysts and investors on March 12.

Narayan Hrudayalaya: To meet analysts and investors on March 15.

Ashiana Housing: To meet analysts and investors on March 14.

Inox Wind: To meet analysts and investors on March 18.

Rallis India: To meet analysts and investors on March 14.

Shriram Finance: To meet analysts and investors on March 14.

Paisalo Digital: Promoter Equilibrated Venture CFlow, PRI CAF, and Pro FITCCH revoked a pledge of 3.37 lakh shares on March 7.

Deccan Gold Mines: Promoter Rama Mines Mauritius sold 1.05 lakh shares between March 5 and 7.

Usha Martin: Promoter Peterhouse Investments India sold 5 lakh shares on March 11.

Yasho Industries: Promoter Parag Vinod Jhaveri sold 33,393 shares on March 5.

InterGlobe Aviation: Rakesh Gangwal sold 2.25 crore shares (5.82%) at Rs 3.015.88 apiece, while Morgan Stanley Asia (Singapore) Pte. bought 21 lakh shares (0.54%) at Rs 3.015.1 apiece.

Tilaknagar Industries: M and S Bottling Company sold 10 lakh shares (0.52%) at Rs 193.22 apiece.

Dwarkesh Sugar: Goel Anil Kumar sold 14.39 lakh shares (0.76%) at Rs 83.66 apiece.

Gopal Snacks: The public issue was subscribed to 9.02 times on day 3. The bids were led by institutional investors (17.5 times), non-institutional investors (9.5 times), and retail investors (4.01 times).

Popular Vehicles and Services: The company will offer its shares for bidding on Tuesday. The price band is set from Rs 280 to Rs 295 per share. The Rs 601.55 crore IPO is a combination of a fresh issue and an offer for sale. The company has raised Rs 180 crore from anchor investors.

R K Swamy: The company's shares will debut on the stock exchanges on Tuesday at an issue price of Rs 288 apiece. The Rs 423.56-crore IPO was subscribed 25.94 times on its third and final day. Bids were led by institutional investors (34.36 times), retail investors (34.03 times), non-institutional investors (20.58 times), and portion reserved for employees (2.52 times).

Bharat Highways Infrastructure Investment Trust InvIT: The company's shares will debut on the stock exchanges on Tuesday at an issue price of Rs 100 apiece. The Rs 2,500-crore IPO was subscribed 8.01 times on its third and final day. Bids were led by institutional investors (8.92 times) and other investors bid for 6.93 times.

Aditya Birla Capital: The board approved the amalgamation of the wholly owned unit Aditya Birla Finance with the company. The merger is subject to the sanction of the National Company Law Tribunal and other necessary approvals from the Reserve Bank of India and other shareholders.

ITC: British American Tobacco is preparing to kick off a sale of part of its stake in the company as soon as this week, Bloomberg reported. Amidst this, about 12 million equity shares, or 0.09% stake, changed hands in a large trade on Monday. It increased its stake in Sproutlife Foods to 44.74% for Rs 50 crore.

SpiceJet: Chief Operating Officer Arun Kashyap and Chief Commercial Officer Shilpa Bhatia have resigned from the airline, PTI reported.

Rail Vikas Nigam: The company emerged as the lowest bidder from Central Railway for signalling and telecommunication work for the provision of automatic block signalling on Khapri- Sewagram section of Nagpur Division. It also received a construction order worth Rs 339 crore from Maharashtra Metro Rail Corp.

Adani Enterprises: The survey of Dharavi will commence on March 18 from Kamla Raman Nagar to digitally collect data from lakhs of informal tenement residents.

H.G. Infra Engineering: The company received a letter of award worth Rs 862.11 crore from the National Highways Authority of India.

Jupiter Wagons: The company received an order worth Rs 957 crore from the Ministry of Railways to manufacture and supply 2,237 units of BOSM wagons.

Mahindra and Mahindra: The company reported total production at 73,380 units vs. 58,203 units YoY for February.

Pitti Engineering: The company will buy Bagadia Chaitra Industries for an enterprise value of Rs 124.92 crore.

Wipro: The IT major has expanded its partnership with Nutanix to launch a new Nutanix-focused business unit.

Imagicaaworld Entertainment: The company announced its successful bid to establish a landmark concept at the iconic Sabarmati Riverfront in Ahmedabad for Rs 130 crore.

Triveni Engineering and Industries: The company acquired a 25.43% stake in Sir Shadi Lal Enterprises for Rs 35 crore with the objective of expanding its business operations in sugar and alcohol businesses.

IRB Infrastructure Developers: The company’s unit, the IRB Lalitpur tollway, achieves financial closure for the NH-44 project with Rs 3,500 crore in project finance from the lender.

HIL: The board approved a 100% equity acquisition of Crestia Polytech for a total consideration of Rs 160 crore.

Share indices in the Asia-Pacific region were trading on a mixed note as investors refrained from placing fresh bets before the release of the U.S. CPI print for February.

As of 7:39 a.m., the Nikkei 225 was trading 1.08% lower at 38,402.23 as traders' expectations grew that the Bank of Japan would end its negative interest rates next week after the country averted falling into recession. The yen continued its rally against the U.S. dollar for the sixth consecutive session.

The S&P ASX 200 was trading 0.20% higher at 7,719.40 as of 07:38 a.m.

Wall Street traders found little encouragement to keep pushing the stock market higher at the start of a week that will bring the last key inflation figures before the Federal Reserve decision, according to Bloomberg.

The S&P 500 Index and Nasdaq Composite fell by 0.11% and 0.41%, respectively, on Monday. The Dow Jones Industrial Average settled 0.12% up.

Brent crude was trading 0.17% higher at $82.35 a barrel. Gold was 0.08% down at $2,180.92 an ounce.

The GIFT Nifty was trading 26.5 points, or 0.12%, higher at 22,450.00 as of 07:37 a.m.

India's benchmark equity indices snapped a two-session rally and closed lower on Monday due to losses in the shares of HDFC Bank Ltd. and Reliance Industries Ltd. The NSE Nifty 50 ended lower after closing at its lifetime high for the third consecutive session at 22,526.60.

Overseas investors remained net buyers of Indian equities for the fourth consecutive session on Monday. Foreign portfolio investors bought stocks worth Rs 4,213 crore; domestic institutional investors remained net buyers for the fourth straight session and mopped up equities worth Rs 3,238 crore, the NSE data showed.

The Indian rupee strengthened by 2 paise to 82.77 against the U.S. dollar.

Share indices in the Asia-Pacific region were trading on a mixed note as investors refrained from placing fresh bets before the release of the U.S. CPI print for February.

As of 7:39 a.m., the Nikkei 225 was trading 1.08% lower at 38,402.23 as traders' expectations grew that the Bank of Japan would end its negative interest rates next week after the country averted falling into recession. The yen continued its rally against the U.S. dollar for the sixth consecutive session.

The S&P ASX 200 was trading 0.20% higher at 7,719.40 as of 07:38 a.m.

Wall Street traders found little encouragement to keep pushing the stock market higher at the start of a week that will bring the last key inflation figures before the Federal Reserve decision, according to Bloomberg.

The S&P 500 Index and Nasdaq Composite fell by 0.11% and 0.41%, respectively, on Monday. The Dow Jones Industrial Average settled 0.12% up.

Brent crude was trading 0.17% higher at $82.35 a barrel. Gold was 0.08% down at $2,180.92 an ounce.

The GIFT Nifty was trading 26.5 points, or 0.12%, higher at 22,450.00 as of 07:37 a.m.

India's benchmark equity indices snapped a two-session rally and closed lower on Monday due to losses in the shares of HDFC Bank Ltd. and Reliance Industries Ltd. The NSE Nifty 50 ended lower after closing at its lifetime high for the third consecutive session at 22,526.60.

Overseas investors remained net buyers of Indian equities for the fourth consecutive session on Monday. Foreign portfolio investors bought stocks worth Rs 4,213 crore; domestic institutional investors remained net buyers for the fourth straight session and mopped up equities worth Rs 3,238 crore, the NSE data showed.

The Indian rupee strengthened by 2 paise to 82.77 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.