(2).jpeg?downsize=773:435)

Sterlite Technologies Ltd. shares hit a six-month high on Thursday after it rose over 15% on winning a Rs 2,631-crore contract from Bharat Sanchar Nigam Ltd. In addition, the shares were trading at a high volume.

Sterlite Tech, through its global services business, in consortium with Dilip Buildcon Ltd., entered into the agreement with BSNL for a deal value of Rs 2,631 crore.

The project entails design, supply, construction, installation, upgradation, operation, and maintenance of the middle-mile network under BharatNet for the Jammu and Kashmir, and Ladakh Telecom Circles.

It is expected to take place over a period of three years for construction, while the maintenance is for 10 years. It will be at 5.5% per annum of capex for the first five years, and then 6.5% per annum of capex for the next five years of maintenance, according to the filing.

Sterlite Technologies Share Price Rises

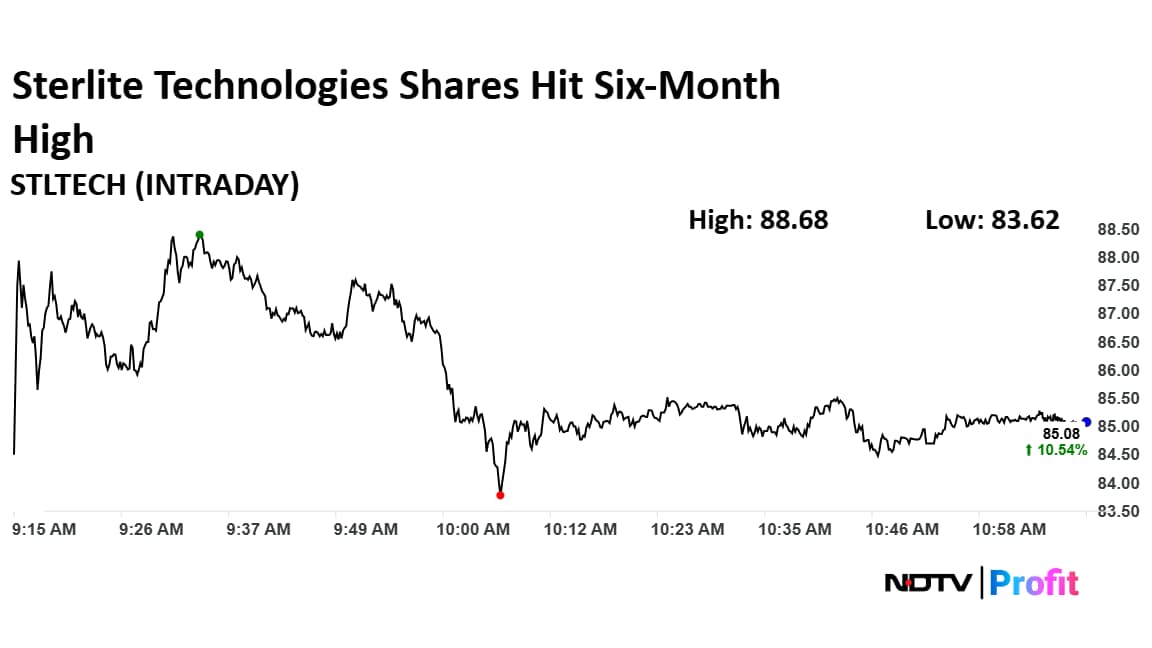

Shares of Sterlite Technologies rose as much as 15.21% to Rs 88.68 apiece, the highest level since Dec. 18. It pared gains to trade 10.87% higher at Rs 85.34 apiece, as of 11:04 a.m. This compares to a 0.35% decline in the NSE Nifty 50.

The stock has fallen 34.69% in the last 12 months and 25.60% year-to-date. Total traded volume so far in the day stood at 44 times its 30-day average. The relative strength index was at 79 indicating it was overbought.

Out of three analysts tracking the company, two maintain a 'buy' rating and one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.