- SpiceJet unlocked $89.5 million liquidity from settlement with Carlyle Aviation Partners

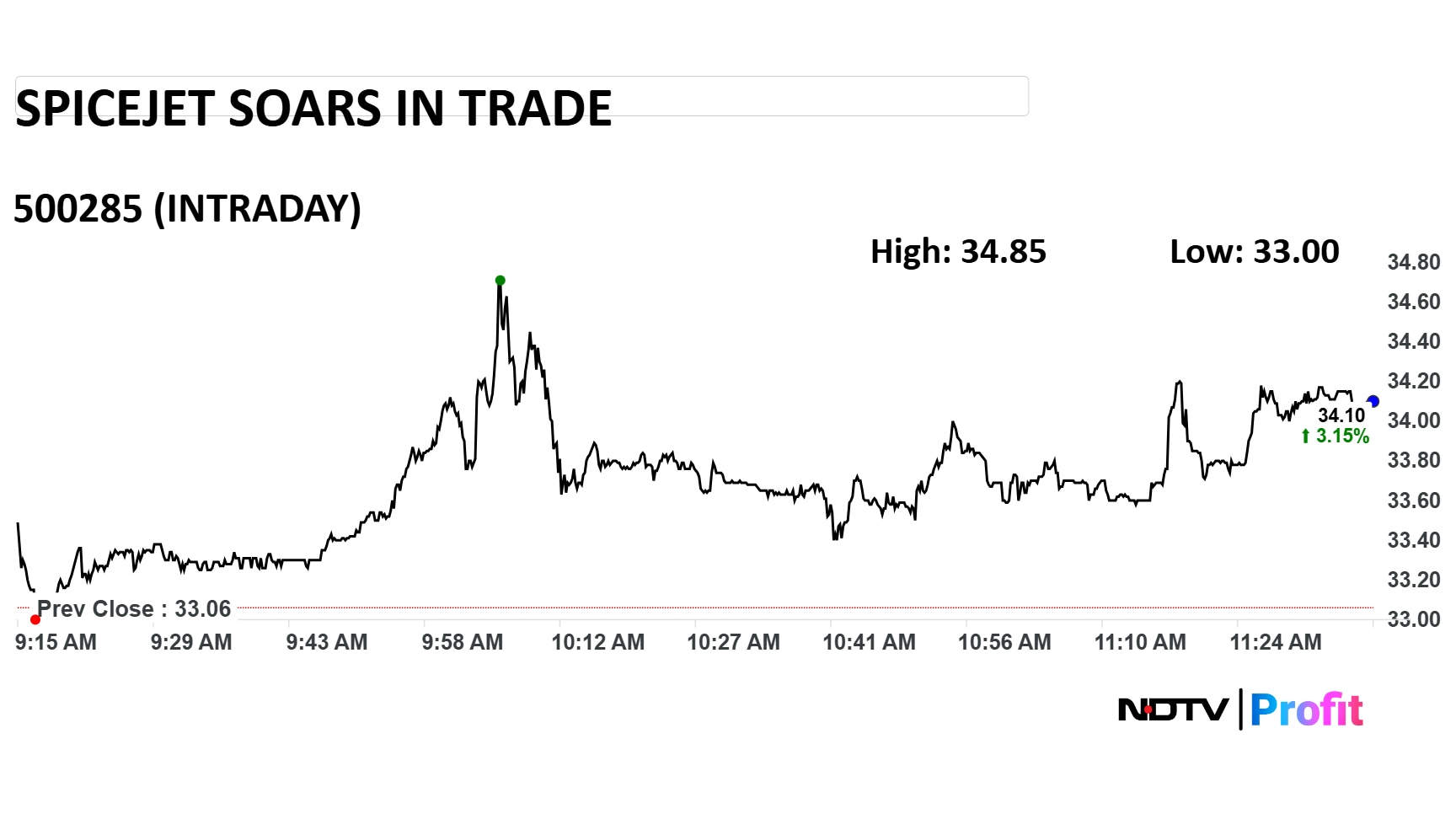

- Shares reached an intraday high of Rs 34.85 amid improving investor sentiment

- Settlement releases $79.6 million for maintenance and $9.9 million to offset lease obligations

SpiceJet Ltd. shares are buzzing in trade on Thursday after the aviation company unlocked fresh $89.5 million liquidity borne from a settlement with Carlyle Aviation Partners earlier this week.

The shares of SpiceJet reached an intraday high of Rs 34.85 following improving investor sentiment. On a year-to-date basis, though, the stock has fallen almost 40%, which goes up to 46% on a year-on-year basis.

For SpiceJet, the settlement agreement with Carlyle Aviation Partners unlocks $79.6 million in cash maintenance reserves for future aircraft and engine maintenance while the additional $9.9 million will be credited to offset lease obligations, the company confirmed in a statement.

The liquidity gained from the settlement will go a long way in helping SpiceJet's book and greatly supporting its ongoing restructuring efforts.

It must be noted that the liquidity boost is a part of an overall settlement, where the lessors will restructure certain lease obligations, amounting to $121.18 million.

Photo: NDTV Profit

This will be done against the issuance of $50 million in equity shares to Carlyle. Interestingly, the contract has a provision which states that should lessors realise proceeds above $50 million from the sale of these shares, the excess amount will be used to offset future lease obligations for SpiceJet.

Ajay Singh, Chairman and Managing Director of SpiceJet, commented on the development, stating, “This agreement marks a significant milestone in our ongoing restructuring and un-grounding efforts. The support extended by Carlyle demonstrates their confidence in SpiceJet's long-term prospects. This transaction meaningfully reduces our liabilities, strengthens our balance sheet, and positions us well for sustainable growth.”

The positive update comes at a time when SpiceJet reported disappointing numbers in the June quarter of the ongoing financial year, where the company registered a net loss of Rs 234 crore.

The stock is currently trading with a relative strength index of 53, which indicates neutral market sentiment.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.