The US stock market was on track to finish flat for the week as oil prices surged and traders sought safety in bonds after Israel attacked Iran's capital following an escalation of tensions over the country's rapidly advancing nuclear program.

The S&P 500 Index was down 0.8% on Friday, coming off session lows premarket as traders weighed the potential impact on financial markets. The Nasdaq 100 Index dropped 1.1% as high-flying technology shares lost momentum. A basket tracking the Magnificent Seven stocks including Alphabet Inc. and Amazon.com Inc. declined 1%. Meanwhile, Nvidia Corp., Tesla Inc., Meta Platforms Inc. and Apple Inc. all fell.

“Tensions are high, but the stock market is trying to assess if there will be a lasting impact,” Yung-Yu Ma, chief investment strategist at PNC Asset Management Group, said by phone. “These types of geopolitical events are often reversed in a matter of days or weeks as long as the economic impact globally isn't significant or lasting. So traders are trying to figure out whether any ongoing military actions will result in major disruptions to oil supply.”

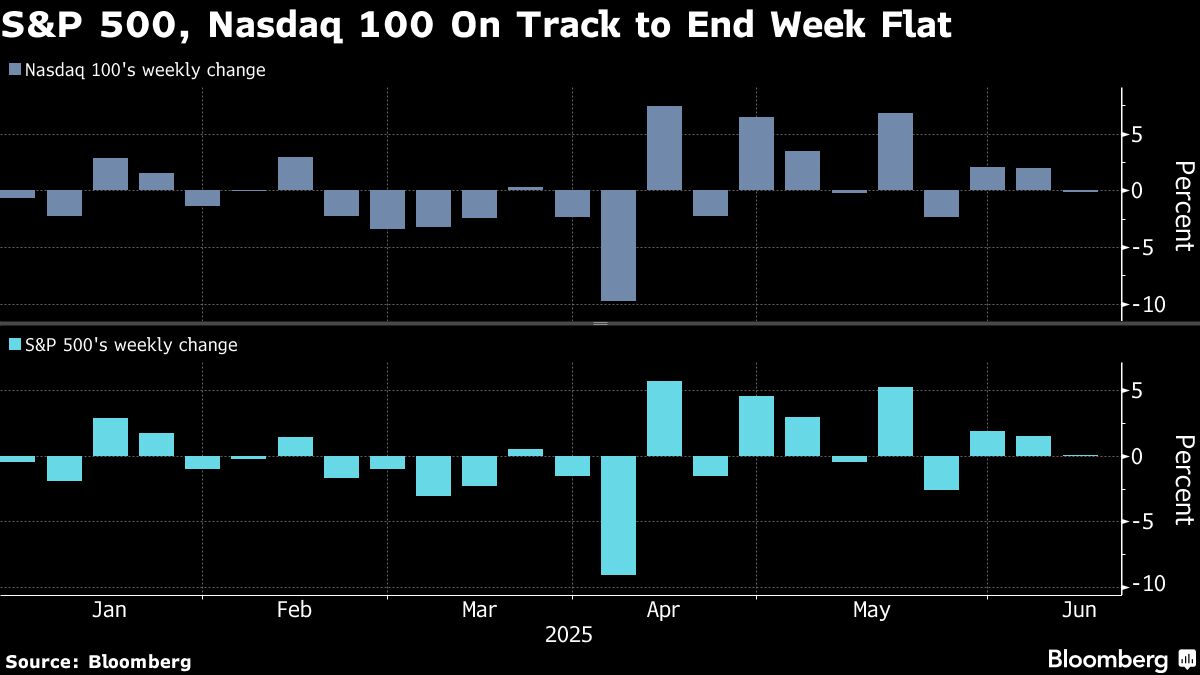

For the week, the S&P 500 was up just 0.1%, while the Nasdaq 100 was on track to slip 0.1%.

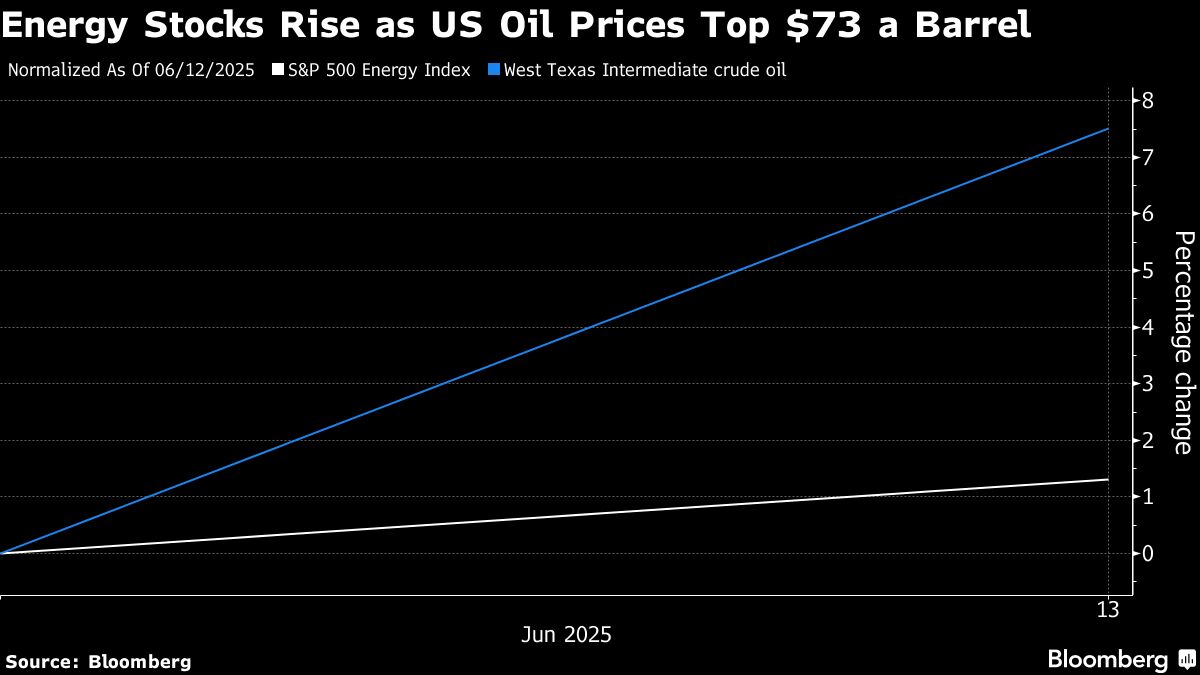

Shares of energy companies rallied as crude prices soared as much as 13%, sending oil majors like Exxon Mobil Corp. and Chevron Corp. sharply higher, while defense stocks Rtx Corp. and Lockheed Martin Corp. rose. Airline shares from Delta Air Lines Inc. to American Airlines Group Inc. respectively slid 4% and 4.7% following Israel's attacks. Travel stocks like Royal Caribbean Cruises Ltd., Carnival Corp. and Norwegian Cruise Line also fell.

Major US stock indexes slumped after the escalations in the Middle East, with the oil-producing region adding to uncertainty for financial markets. Israel said it struck around 100 targets across Iranian cities Friday morning, using 200 planes. The attacks, which Israel said will likely continue over the coming days, caused oil prices to spike before trimming some gains. Investors snapped up haven assets such as gold and US Treasuries.

US President Donald Trump urged Iran to accept a nuclear deal to avoid further attacks. Wall Street's so-called chief fear gauge, the Cboe Volatility Index, or VIX, which reflects the 30-day implied volatility of the index based on options values, jumped to 20, approaching its highest since late May.

Traders sold the riskiest parts of the stock market, with the small-capitalization Russell 2000 Index falling 1.4%. A Goldman Sachs basket of unprofitable tech companies, which includes firms like Roku Inc. and Peloton Interactive Inc., slid 1.1%.

The jolt in turbulence upends a listless stretch for US stocks. Before Friday, the S&P 500 hadn't seen a move exceeding 0.6% in either direction for 11 of the past 12 sessions through Thursday — the longest such stretch since early December, according to data compiled by Bloomberg.

If the gains in oil prices prove to be persistent, that threatens to keep inflation stubbornly high, adding to the pressures the Federal Reserve and other global central banks are facing as they grapple with the impact of Trump's trade wars. Fears that the attack may spiral into a wider conflict sent stocks falling around the world, with investors rushing into to assets perceived as less risky. Gold rose 1.2% while the dollar pared back some of its earlier gains.

The Fed has been reluctant to cut interest rates this year after reducing them in latter part of 2024 as policymakers wait to see how much Trump's tariffs will hurt the US economy and raise inflation.

That said, some money managers believe Friday's turbulence will be short-lived. “This certainly raises uncertainty for investors, but this likely won't sway the Fed because the attack didn't target oil facilities, and that means the price of oil, and thereby inflation, won't be impacted over the long-term,” Thomas Martin, senior portfolio manager at Globalt Investments, said by phone.

Traders on Friday looked beyond the University of Michigan's preliminary consumer survey for June, which showed sentiment rising to 60.5 points, above all estimates and up from 52.2 in May.

Elsewhere, United States Steel Corp. dropped 3.6% after Nikkei reported that Nippon Steel's planned takeover of the US company may not proceed if the Japanese company doesn't get sufficient freedom of management. RH shares jumped 14.8% after the furniture company swung to a profit in its latest quarter despite threats from tariffs.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.