South Korean assets tumbled after the country's president declared martial law amid a deepening rift between the ruling party and its main opposition, a surprise move that sparked investor concern over political instability and the potential for unrest.

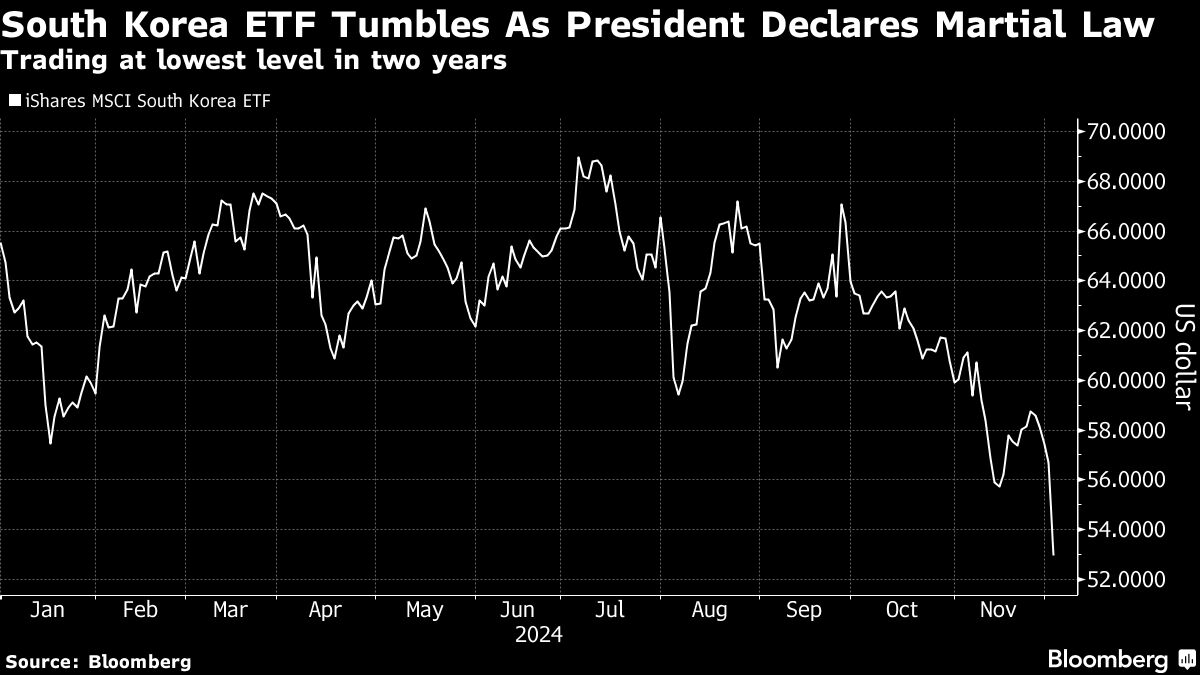

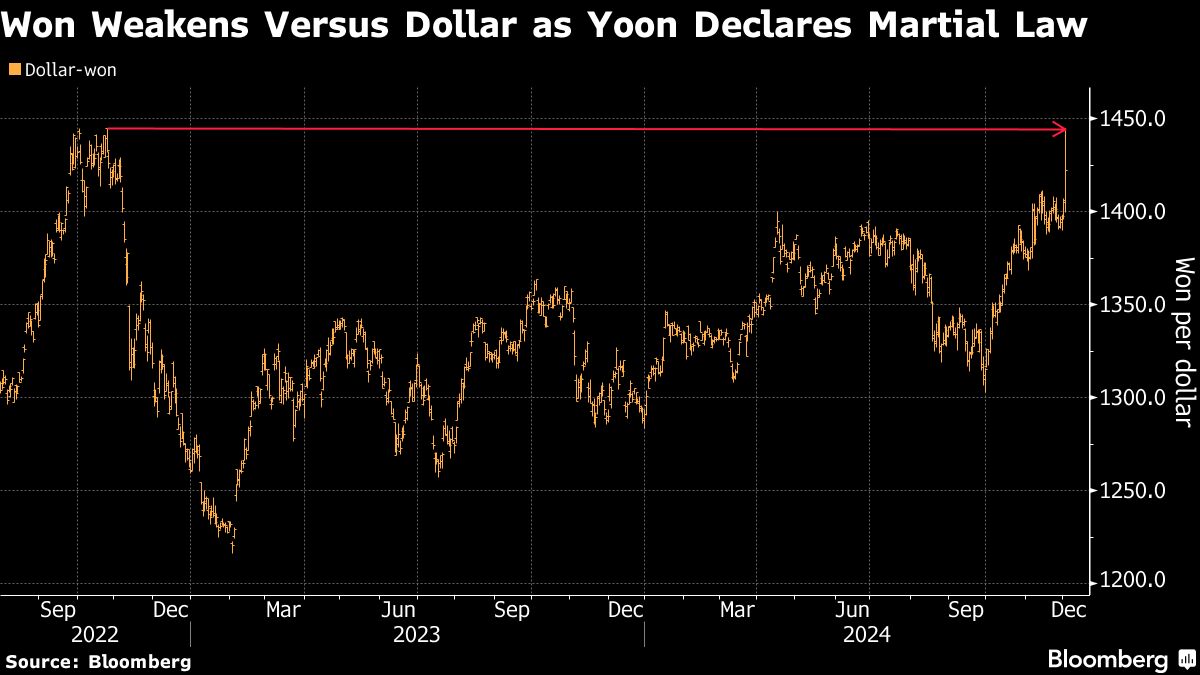

The iShares MSCI South Korea ETF sank as much as 7.1% in US trading as of 11 a.m. New York time, its worst intraday drop since Aug. 5, while London-listed shares of Samsung Electronics lost as much as 7.5%. The onshore Korean won weakened as much as 2.9% to 1444.65 per dollar, leading losses among currency markets amid thin trading during the New York session.

Korean shares and the won regained some lost ground after South Korean authorities vowed to provide “unlimited liquidity” to markets as needed, and lawmakers voted to request lifting the shock measure.

President Yoon Suk Yeol said the surprise decision — the first imposition of martial law in South Korea in more than 40 years — was made to protect freedom and constitutional order, and that it will not have an impact on South Korea's foreign policy. He added that it would also help remove supporters of North Korea.

“The domestic uncertainty adds to the external pressures in recent weeks as the market is starting to price in the rise of higher US tariffs under the new Trump administration,” said Aroop Chatterjee, a strategist at Wells Fargo in New York.

Other South Korean ADRs also declined. E-commerce company Coupang Inc. fell as much as 9.8% in US trading, alongside losses in steel processor Posco Holdings Inc. and KB Financial Group Inc. The Korea Exchange, the nation's main stock bourse, said Wednesday trading is under review.

The onshore won pared some of its losses to trade at 1,421.85 per dollar as of 11:25 a.m. in New York. Still the currency remains the worst performer in Asia this year, weakening by more than 9%.

“Martial law feels like a bit of overkill,” said Mark McCormick, global head of FX and EM strategy at TD Securities in Toronto. “Seems like the goal is deflection, reflecting low approval ratings and a fair amount of scandals. Policymakers like to keep a grip on KRW, so I would expect some of the volatility to settle down after today's big move.”

Tuesday's is the first overnight shock for the won, which began trading extended hours in July amid authorities' broad push to get its stocks and bonds included in more global indexes. Previously, trading in the currency was halted at 3:30 p.m. local time.

The central bank's dovish policy stance is another drag on the won, after policymakers unexpectedly cut interest rates by a quarter point to 3%, according to Elias Haddad, a strategist at Brown Brothers Harriman in New York. Still, the nation's current-account surplus cushions the currency, he said.

The declaration of martial law will likely compound an already protectionist zeitgeist, according to Joe Gilbert, a portfolio manager at Integrity Asset Management, adding that he believes “a viable off ramp exists to ameliorate the situation with the Korean parliament.”

In the meantime, Gilbert said he's watching semiconductor stocks, which he says may be winners in the short term if there is any disruption to chip production with the South Korean behemoth Samsung.

South Korean financial authorities said they will use all possible measures to stabilize markets, according to a statement from the authorities. The finance minister, central bank governor and financial regulators met on Tuesday and said they'll announce details on the market's plan on Wednesday.

While the surprise move to impose martial law jolted markets in South Korea, it hasn't had as much of an impact elsewhere, particularly the US, at least for now.

“We are not seeing any impact on US stocks, as we know that the US tends to export volatility instead of importing it,” said David Wagner, portfolio manager at Aptus Capital Advisors. “It's unlikely that this type of information will derail the animal spirits that have been rising in the post-election domestic market.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.