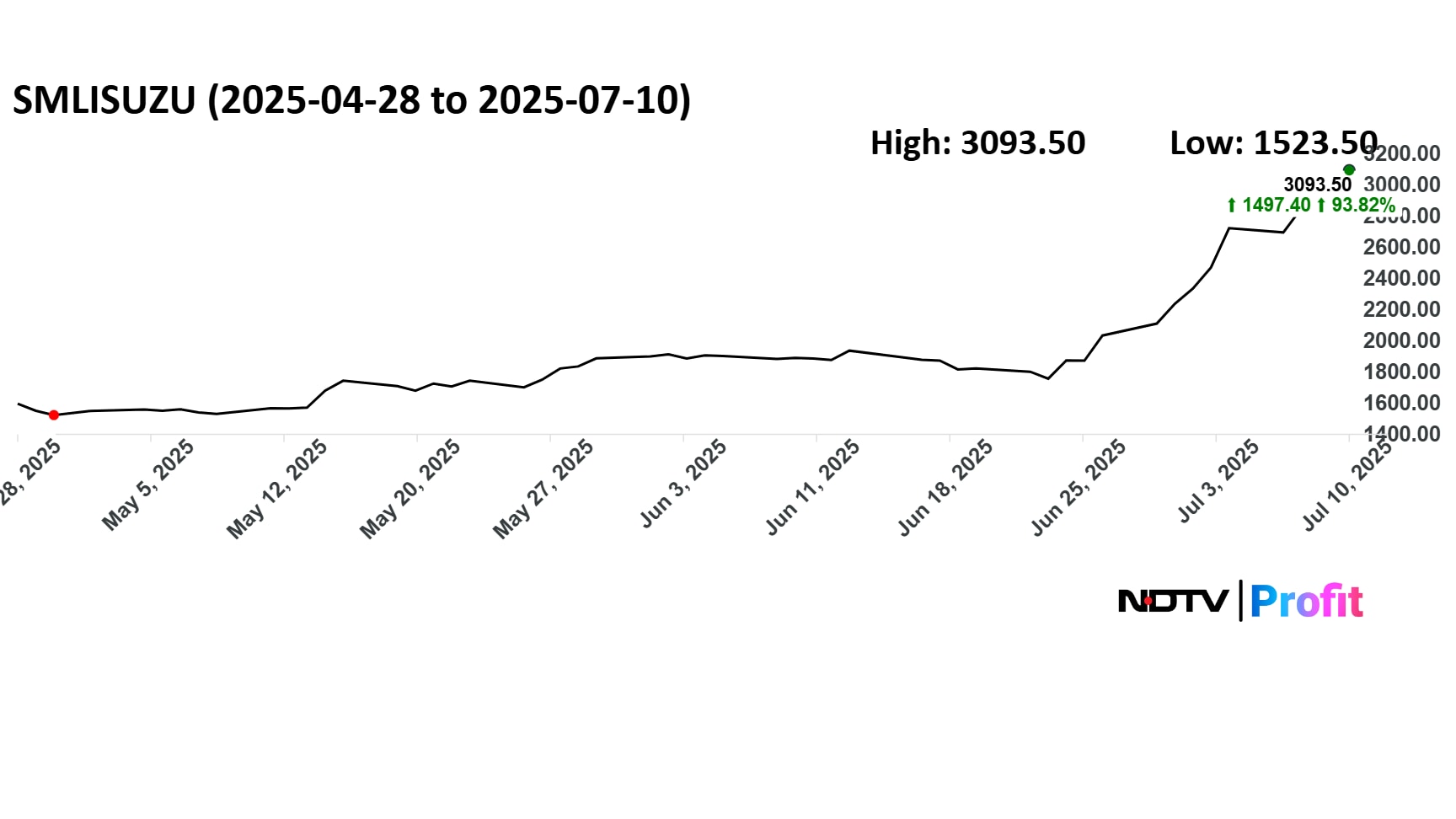

SML Isuzu Ltd. has attracted interest among investors after Mahindra & Mahindra Ltd. announced it will acquire the firm over two months ago. The share price has run up 93% since April 28.

The stock traded at Rs 1,596 apiece on that day. On Thursday, the scrip closed at Rs 3,082.9.

M&M will pick up a 43.96% stake or 63,62,306 shares held by Japanese promoter Sumitomo Corp. and a 15% stake or 21,70,747 shares from Isuzu Motors Ltd. at Rs 650 per share. That pegs the valuation of the 58.96% stake purchases at Rs 554.63 crore.

Separately, the Scorpio maker will float an open offer to acquire a 26% stake, equivalent to 37,62,628 shares, at Rs 1,554.6 apiece to comply with market regulations.

As of July 10, the share price traded at nearly twice the open offer price and 3.7 times the acquisition price.

SML Isuzu share price has run up 93% since April 28.

What Has Changed For SML Isuzu?

The news flow has been positive in the last three months.

SML Isuzu on May 30 reported 13% revenue growth in the fourth quarter of fiscal 2025 to Rs 771 crore. The operating margin increased from 10.77% to 11.95%.

In the June quarter, sales increased 12% with the cargo vehicles segment growing 46%. The quarterly financial results will be released on July 22.

Besides earnings and business updates, during this period, the Competition Commission of India approved Mahindra's acquisition plan.

What Is M&M's Plan With SML Isuzu?

M&M sells pick-up trucks between 2-3.5 tonnes, while SML Isuzu largely operates in the 6.5-9.5 tonnes space. The acquisition will double M&M's market share in the category to 6%.

The company plans to increase this to 10-12% by fiscal 2031 and more than 20% by financial year 2036.

“This acquisition is aligned with our capital allocation strategy for investing in high-potential growth areas which have a strong right to win and have demonstrated operational excellence," M&M Chief Executive Officer Anish Shah said in April.

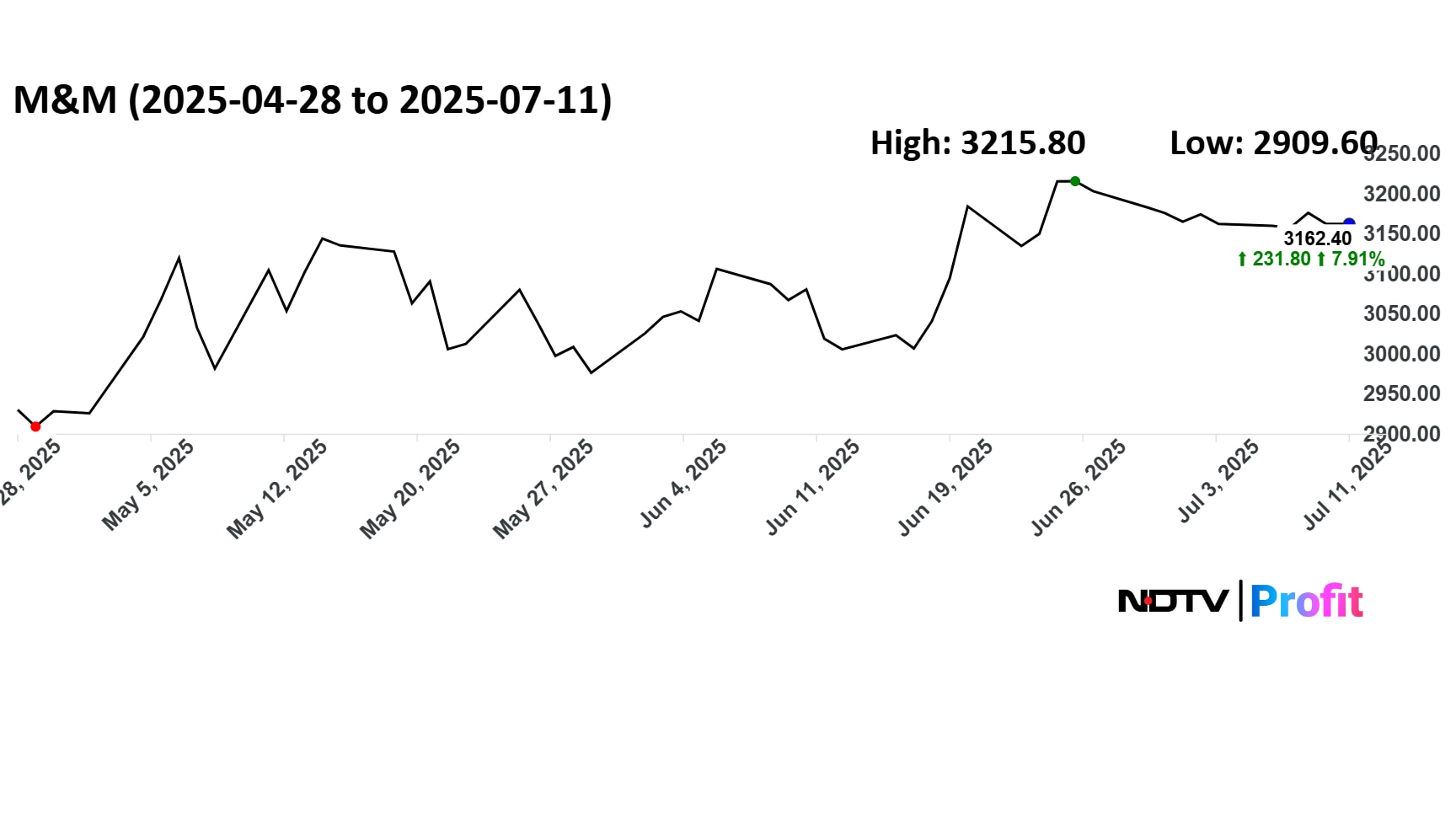

Mahindra share price has risen nearly 8% since the SML Isuzu acquisition announcement.

Will M&M Revise Open Offer Price?

There is no compulsion for M&M to revise its open offer price for SML Isuzu public shareholders. If the current market price continues to remain above the open offer price, it could prompt many public shareholders not to float their shares in the tender.

At the offer rate, M&M will spend less on the acquisition compared to its market value. Mahindra was spending 2.4 times more than what it paid promoters, to acquire 26% from the public.

As of March, the company had over 28,000 retail investors.

Notably, Flipkart Co-founder Sachin Bansal owns 19.4%. No mutual funds, insurance companies, FIIs or any other large domestic institutions owned a stake.

Mahindra has not yet disclosed the date for the start of the open offer for SML Isuzu shareholders to participate in the tender.

The stock currently trades at 49 times the 12-month forward price-to-earnings compared to the two-year average PE of 31 times.

Therefore, retail minority shareholders should be cautious.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.