How An India-Based Supplier To John Deere Is Outpacing The Auto Ancillary Rally

John Deere contributes about 2.7% of SJS Enterprises’ revenue, according to data available on Bloomberg.

The auto ancillary sector has gained momentum in recent months, supported by premiumisation across vehicle segments and diversification. Volume growth across categories, with commercial vehicles joining the recovery, has driven this trend. Exports are also emerging as a growth lever, adding earnings beyond the domestic market.

While engines, chassis and mechanical components dominate attention in auto ancillaries, the visual identity segment receives less focus. The Indian decorative aesthetics industry grew at a compound annual growth rate of 20% during FY21–FY26E, reflecting the growing role of aesthetics in product differentiation. SJS Enterprises operates in this segment.

SJS Enterprises, an India-based auto ancillary supplier, counts John Deere among its global customers. The US-based maker of agricultural and construction equipment contributes about 2.7% of SJS’s revenue, according to data available on Bloomberg.

Multi-Sector Presence

SJS manufactures products that enhance visual appeal and brand identity across end products. The company operates across 14 product categories, including decals, body graphics, dials, domes, 3D lux badges, overlays, aluminium badges and chrome-plated products.

Unlike auto ancillary companies that depend largely on automotive demand, SJS has a diversified revenue mix. It supplies two-wheelers and passenger vehicles, along with consumer appliances, medical devices and farm equipment. This diversification helps manage demand cycles.

Automotive Drives Growth

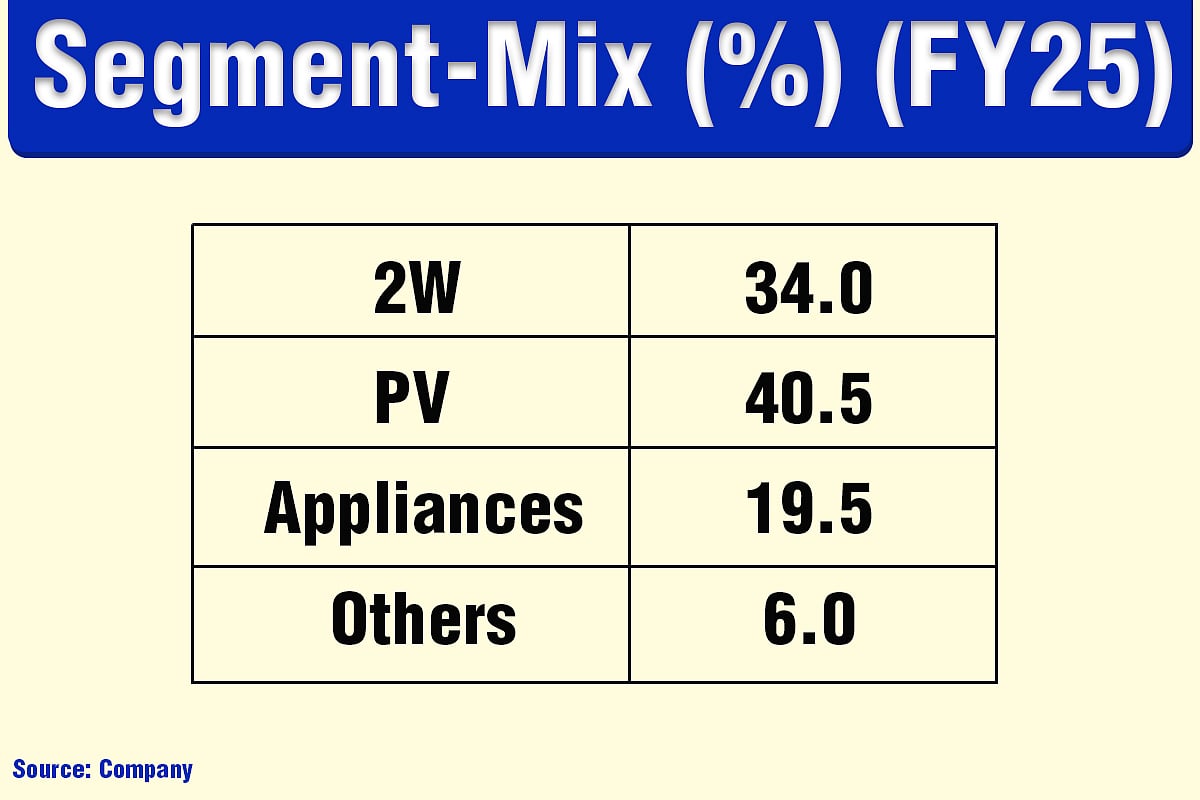

Automotive remains the main revenue contributor, accounting for 74.5% of FY25 revenue of Rs 760 crore. Passenger vehicles contributed 40.5%, while two-wheelers accounted for 34%. Consumer appliances contributed 19.5%, and other segments 6%.

This mix has helped SJS deliver higher growth than the industry for 24 consecutive quarters.

(Segment mix)

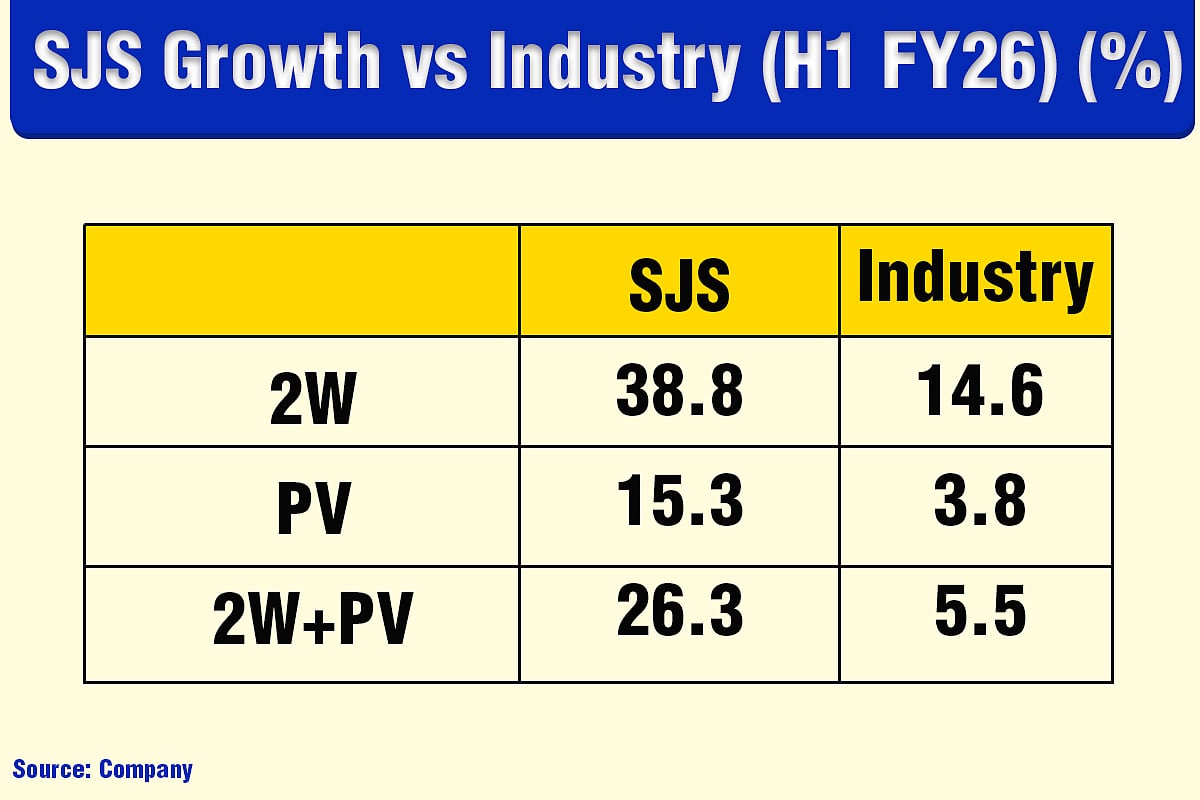

Ahead Of Industry

In FY25, SJS’s automotive sales rose 29.5% year-on-year, compared with industry volume growth of 9.5% in two-wheelers and passenger vehicles. In H1 FY26, automotive sales increased 26.3%, while industry growth stood at 5.5%.

This performance is supported by long-standing client relationships, with an average tenure of around 20 years among the top 10 customers.

SJS supplies two-wheeler makers including TVS, Hero MotoCorp, Honda, Bajaj, Royal Enfield and Ather. Passenger vehicle clients include Mahindra & Mahindra, Tata Motors, Maruti Suzuki, Kia, Hyundai and MG Motor. Recent additions include Stellantis, Orafol USA, River and Azad India.

The company plans to grow faster by expanding higher-value products in line with industry trends.

Kit Value Expansion

SJS is transitioning customers from legacy parts to higher-value solutions to increase kit value, or the value supplied per vehicle. It aims to raise passenger vehicle kit value from Rs 3,500–5,000 by four to six times through products such as aluminium badges, dual-tone wheel caps, IML interiors and touchscreen cover glass.

In-mould electronics is a key part of this strategy. SJS strengthened this capability through the acquisition of Walter Pack India in July 2023. Revenue from the unit rose 1.5 times and accounted for 51.7% of FY25 revenue.

The technology enables embedded touch controls in interior surfaces, replacing mechanical buttons. It is used in automotive interiors and appliances such as washing machines and refrigerators.

SJS also plans to lift two-wheeler kit value of Rs 300–500 by 1.5 to two times through illuminated logos and touchscreens. In consumer appliances, it plans to raise kit value of Rs 50–150 by three to four times using IMD and IML overlays and printed electronics. The company is also expanding into North America, Europe and Southeast Asia.

Exports Expand Value

This expansion is supported by new contracts and customers. SJS has secured export orders from Stellantis for plants in North America, Latin America and Europe. It has also added Orafol USA, River, Whirlpool and Azad to its client list.

The company aims to increase exports to 15% of revenue by FY28 from 7.5% in FY25.

SJS has partnered with BOE Varitronix to manufacture automotive display solutions for the Indian passenger vehicle market. The partnership covers assembly and optical bonding and is expected to contribute to volumes from FY28.

The company is also developing smart surfaces that combine aesthetic finishes with electronic functions for automotive dashboards and medical devices.

Capacity Expansion

SJS is building a greenfield chrome plating and painting facility with an investment of Rs 100 crore. The plant was scheduled for commissioning in early Q3 FY26.

The company is also setting up a plant for optical cover glass and displays to meet demand for digital cabins. It is investing Rs 45 crore to expand capacity for new contracts, including those from Hero MotoCorp and export customers.

Acquisitions remain part of the growth strategy. Earlier acquisitions, including SJS Decoplast and Walter Pack India, contributed 77.3% of revenue.

SJS reported net cash of Rs 159 crore as of Q2 FY26 and carries no debt, allowing it to fund expansion through internal accruals.

Financial Performance

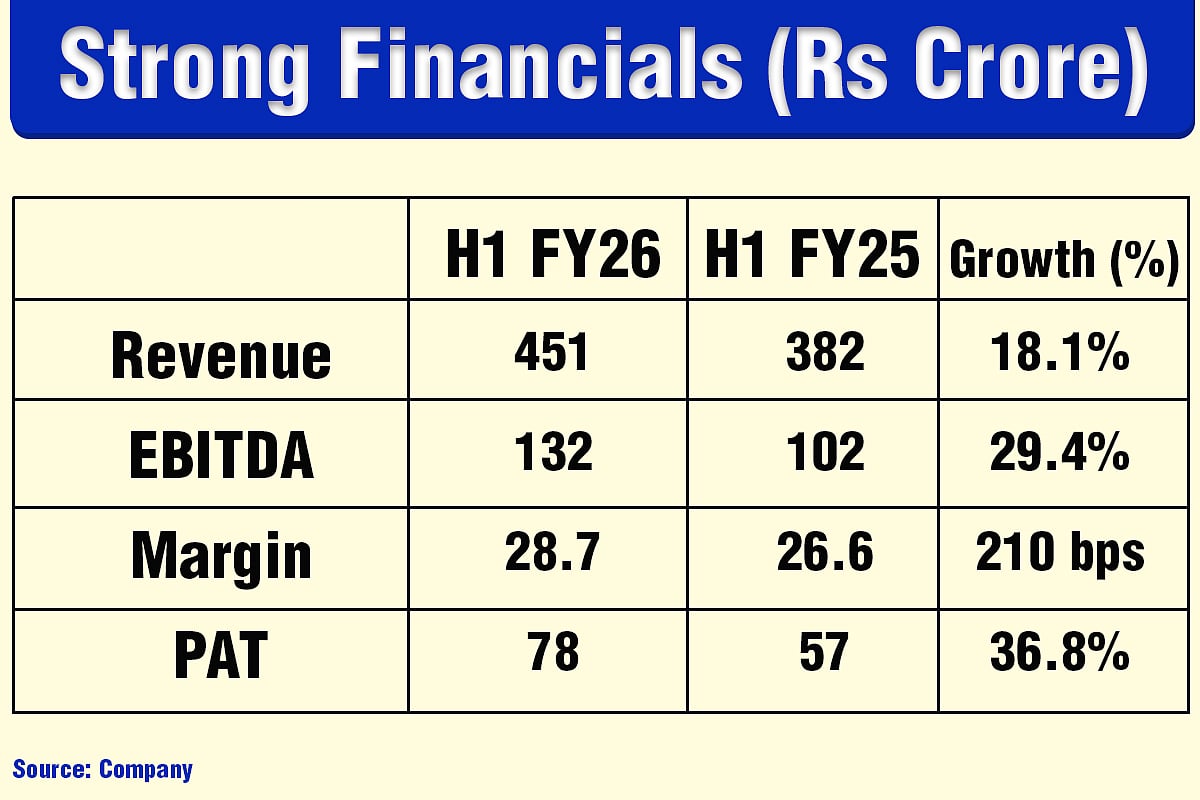

SJS reported revenue growth of 31% and net profit growth of 40% in FY25. In H1 FY26, revenue rose 18.1% year-on-year to Rs 451 crore.

Ebitda increased 29.4% to Rs 132 crore, while margin rose 210 basis points to 28.7%. Net profit grew 36.8% to Rs 78 crore.

The company expects to grow more than 2.5 times the industry rate, supported by premiumisation, exports and new contracts. Its order book covers more than 90% of forecast FY26 revenue.

Return on equity stood at 20%, and return on capital employed at 34% as of H1 FY26. At Rs 1,752 a share, SJS trades at about 40 times earnings. Quarterly revenue in Q2 FY26 was close to the company’s full-year FY21 revenue.

Disclaimer: The views expressed in this article are solely those of the author and do not necessarily reflect the opinion of NDTV Profit or its affiliates. Readers are advised to conduct their own research or consult a qualified professional before making any investment or business decisions. NDTV Profit does not guarantee the accuracy, completeness, or reliability of the information presented in this article.