- Silver rose 2.4% on Friday, nearing a record $59 an ounce this week

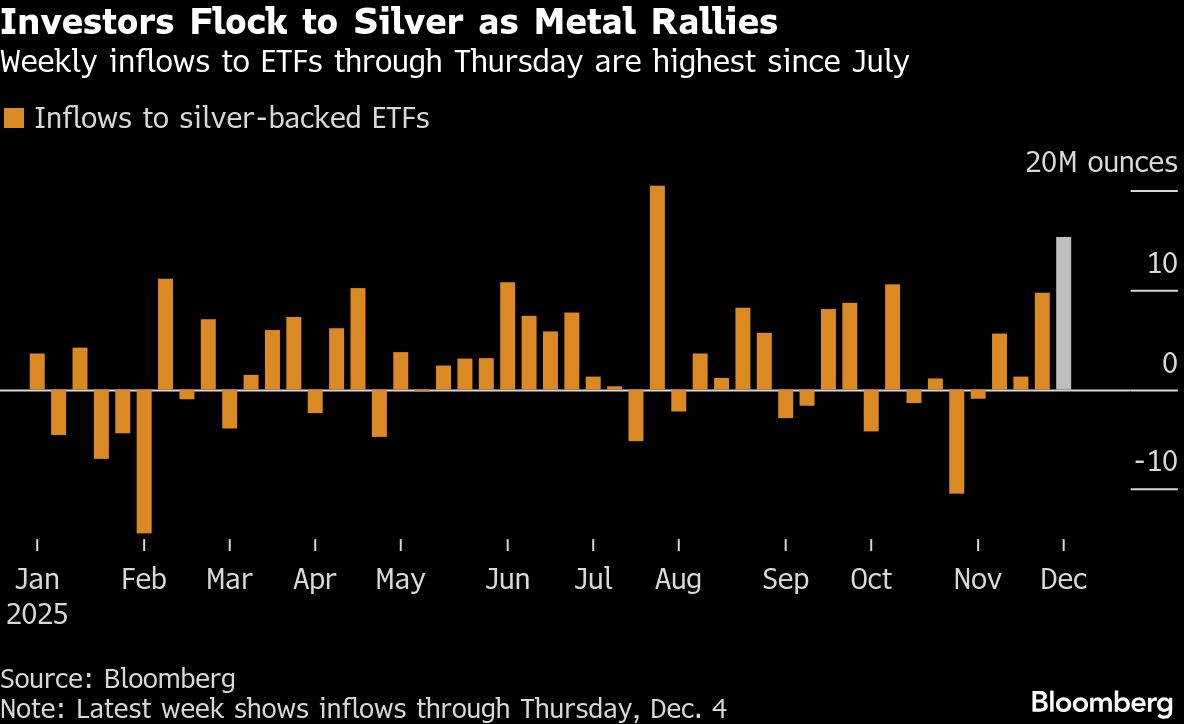

- Silver-backed ETFs saw highest weekly inflows since July, boosting prices

- Silver has doubled in value this year, outpacing gold's 60% rise

Silver was on track for a second weekly gain, as strong inflows to exchange-traded funds added more impetus to a scorching rally.

The white metal rose as much as 2.4% on Friday, holding close to a record of nearly $59 an ounce hit earlier in the week. Total additions to silver-backed ETFs in the four days through Thursday are already the highest for any full week since July, a strong signal of investor appetite despite signs silver's gains may be overdone.

“These flows can quickly amplify price moves and trigger short-term short squeezes,” said Dilin Wu, research strategist at Pepperstone Group Ltd. For much of this week, the metal's 14-day relative strength index has whipsawed either side of 70 — a threshold above which traders are likely to deem the metal as overbought.

Silver has roughly doubled in value this year, outpacing a 60% rise in gold. The rally accelerated in the last two months, in part thanks to a historic squeeze in London. While that crunch has eased in recent weeks as more metal was shipped to the world's biggest silver trading hub, other markets are now seeing supply constraints. Chinese inventories are near their lowest in a decade.

The metal's recent surge has also been supported by rising expectations the Federal Reserve will lower interest rates at its meeting next week. Swap contracts indicate a near-certainty the Fed will reduce the cost of borrowing — typically a positive for non-yielding precious metals. These bets withstood the latest US employment data, which showed jobless claims fell to a three-year low.

Silver could rise to $62 an ounce in the coming three months “on the back of Fed cuts, robust investment demand, and physical deficit,” Citigroup Inc. analysts including Max Layton wrote in a note.

Not just valued as an investment asset, silver also has many useful real-world properties that make it a component in a range of products, such as circuit boards, solar panels and coatings for medical devices. Global demand for the metal has outpaced output from mines for five consecutive years.

“Silver's outsized rally signals it's no longer gold's quiet sidecar,” said Hebe Chen, an analyst at Vantage Markets in Melbourne. “The market is waking up to structural scarcity and fast-rising industrial demand, not just the haven story.”

Silver rose 1.6% to $58.05 an ounce as of 9:27 a.m. in London, up more than 2% for the week, after a 13% surge the week before. Gold advanced 0.3% to $4,220.14 an ounce, while platinum and palladium also rose. The Bloomberg Dollar Spot Index inched 0.1% lower.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.