- Spot silver dropped up to 8.7% to $47.89 an ounce on Tuesday

- The increase in silver supply by the London Bullion Market Association has inversely impacted the metal's rate

- Notably, silver prices surged nearly 80% this year due to macro factors and a squeeze in the London market

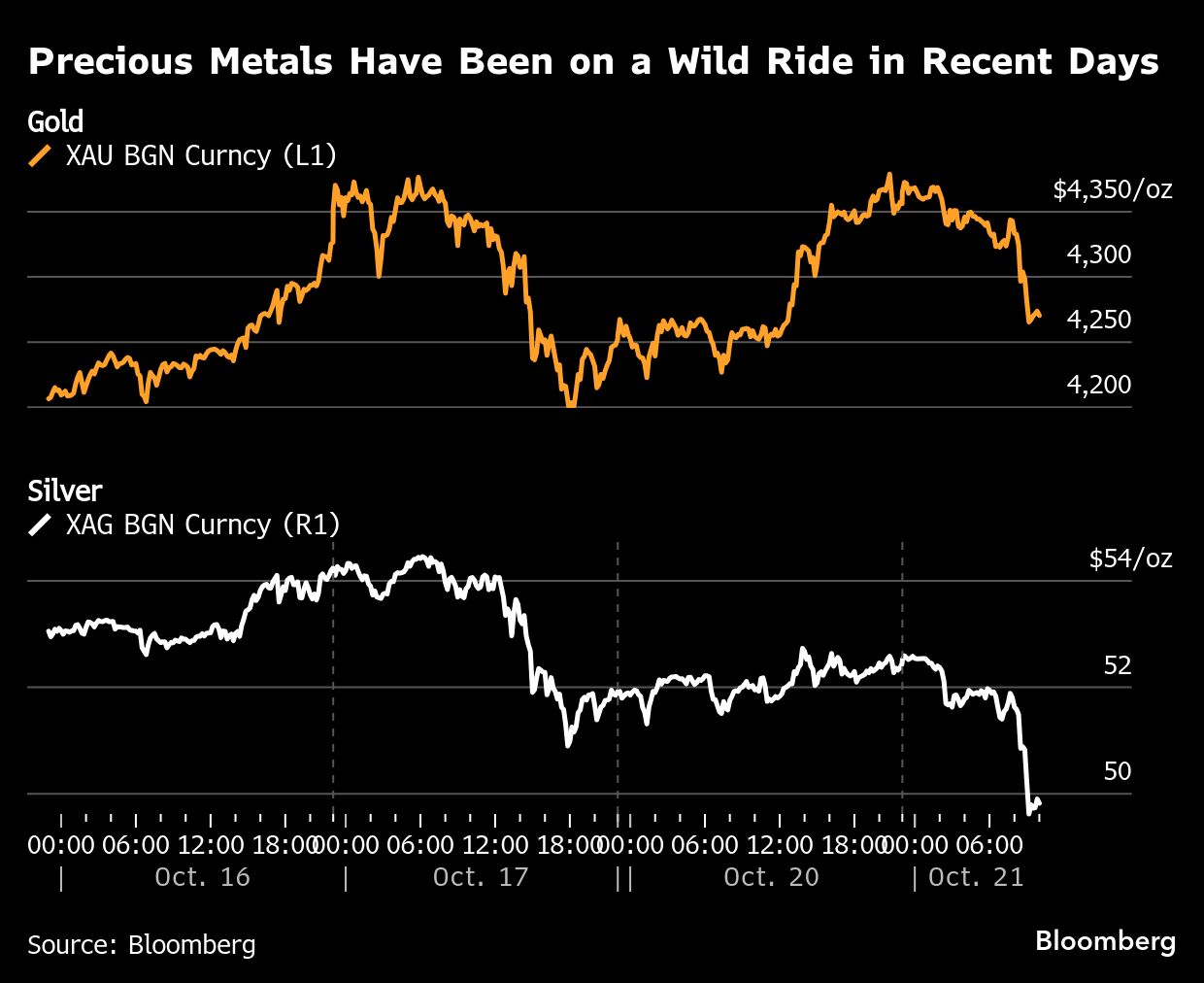

Gold and silver slid as traders took stock of record-breaking rallies, with technical indicators looking stretched while US-China tensions ease.

Spot gold fell as much as 6.3% to $4,082.03 an ounce, while spot silver dropped up to 8.7% to $47.89 an ounce.

Gold's ferocious rally has measures like relative strength indicating that prices have passed well into overbought territory. A strengthening US dollar has also made precious metals more expensive for most buyers. Silver plummeted as much as 6.2%.

“In the last couple of trading sessions traders have increasingly been looking over their shoulders, as concerns about a correction and consolidation have arisen,” said Ole Hansen, commodities strategist at Saxo Bank AS. “It's during corrections that a market's true strength is revealed, and this time should be no different, with an underlying bid likely keeping any pullback limited.”

Demand for precious metals as haven assets has cooled as US President Donald Trump and China's Xi Jinping are set to meet next week to iron out their differences on trade, and a seasonal buying spree in India has ended.

Meanwhile, with the ongoing US government shutdown, commodity traders have also been left without one of their most valuable tools — a weekly report from the Commodity Futures Trading Commission that indicates how hedge funds and other money managers are positioned in US gold and silver futures. Without the data, speculators may be more likely to build abnormally large positions one way or another.

“The absence of positioning data comes at a delicate time, with a potential build-up in speculative long exposure in both metals making both more vulnerable to correction,” Hansen said.

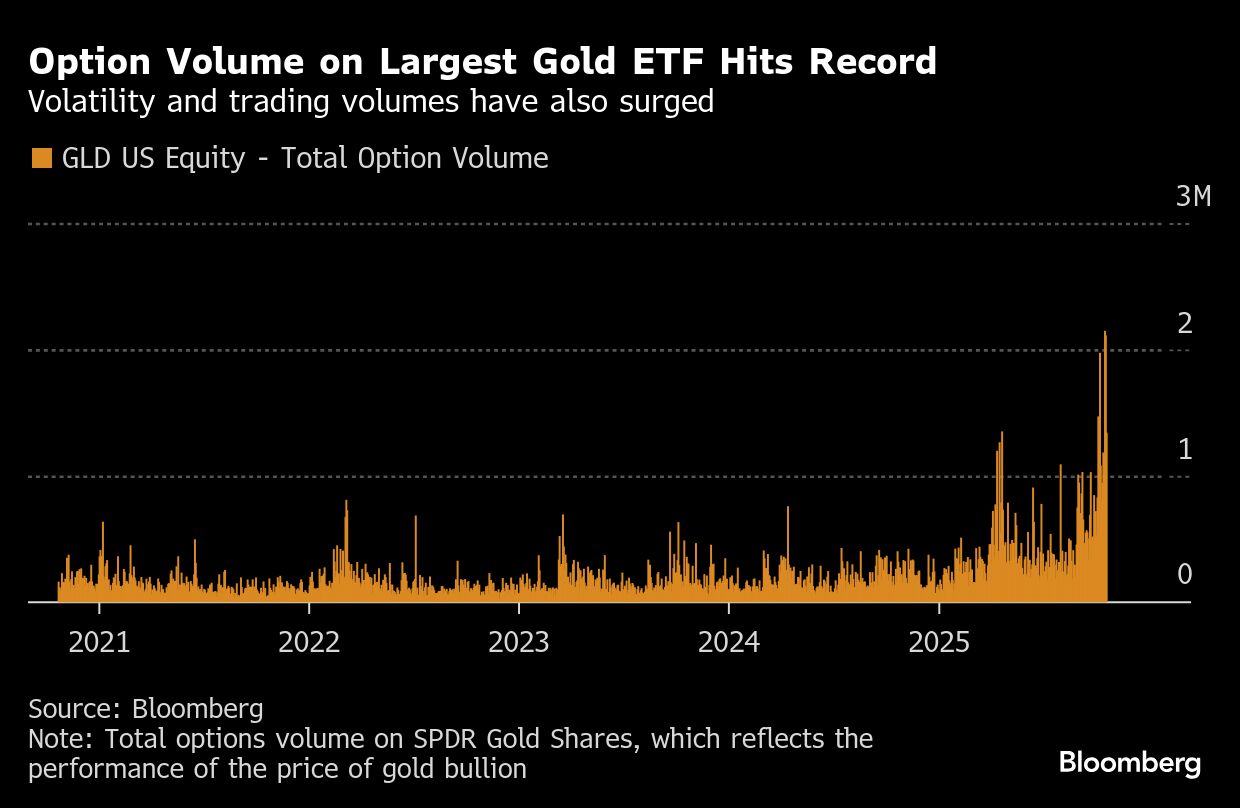

Volatility in precious metals has surged in recent days, with traders seeking to hedge against potential price drops in other parts of their portfolios, or profit from the fall. More than 2 million options contracts linked to the world's largest gold-backed exchange traded fund were traded on both Thursday and Friday of last week, surpassing a previous record.

Silver has surged almost 80% this year — with gains driven by some of the same macro factors supporting gold, as well as a historic squeeze in the London market. Benchmark prices are trading above New York futures, which has prompted traders to ship metal to the UK capital to ease tightness. On Tuesday, silver in vaults linked to the Shanghai Futures Exchange saw the biggest one-day outflow of silver since February, while New York stockpiles have also fallen.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.