- Silver hit a new peak at $58.23 an ounce amid ongoing supply tightness concerns

- Silver has nearly doubled in value this year, outpacing gold's 60% rally

- Low inventories in Shanghai and high borrowing costs reflect global silver shortages

Silver jumped to a fresh peak on Monday with traders placing speculative bets on ongoing supply tightness. Gold inched lower.

The white metal rose as high as $58.23 an ounce after soaring almost 6% on Friday. It has climbed for six consecutive sessions and close to doubled in value this year, outpacing the roughly 60% rally in gold.

A record amount of silver flowed into London in October to ease a historic squeeze in the world's biggest trading hub for the metal, but this has put other centers under pressure. Inventories in warehouses linked to the Shanghai Futures Exchange recently hit the lowest in nearly a decade, and the cost of borrowing the metal over one month remains elevated.

“Shortages in the global market as a result of the recent squeeze in London are still being felt,” said Daniel Hynes, a commodity strategist from ANZ Group Holdings Ltd. “With gold taking a breather, it appears investors have turned their attention to silver.”

Both metals have been boosted by increased expectations that the US Federal Reserve will cut interest rates this month. Markets are fully pricing in a quarter-point rate cut on continued weakness in the American labor market and a crescendo of dovish comments by Fed officials over the last week.

The release of economic data delayed by the US government's six-week shutdown has also supported the case for lower borrowing costs, which typically benefit non-yielding precious metals.

President Donald Trump said Sunday he has decided on his pick for the next Fed chair, a candidate that the market expects will push for lower rates.

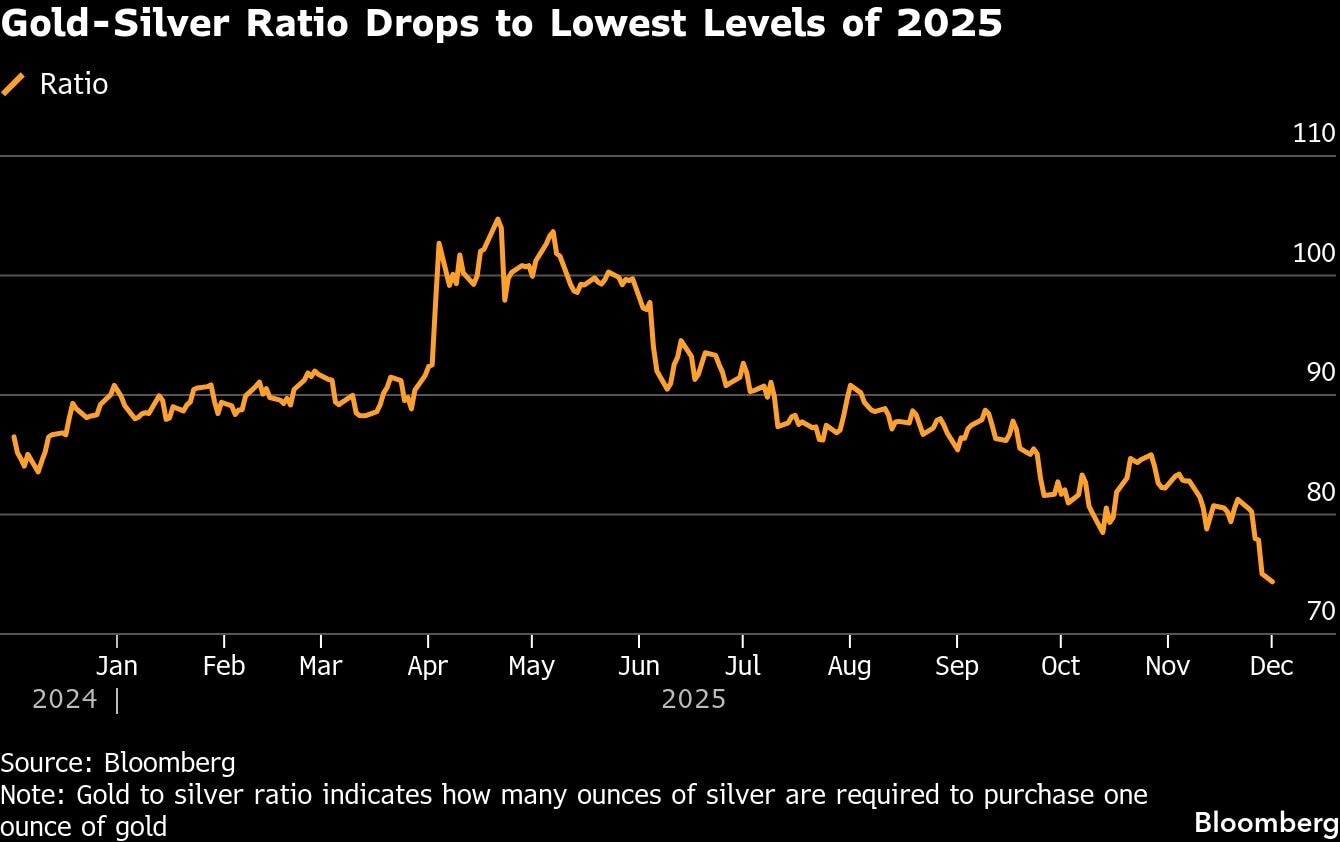

“The move last week has been speculatively driven, with accelerating upside momentum attracting more and more fast money,” said David Wilson, director of commodities strategy at BNP Paribas SA. “Key to watch is the fact that the gold-silver ratio has got down close to 70,” he said, adding that investors will be watching how expensive silver is getting relative to gold.

The ratio indicates how many ounces of silver are needed to buy one ounce of gold.

The spread between the cost of call options on silver futures, which allow investors to bet on the upside in prices, and put options, which allow them to bet on the downside, leaped to the highest since 2022 in recent days, indicating a surge in the cost of capitalizing on price spikes.

Traders are also monitoring any potential tariff on silver after the precious metal was added to the US Geological Survey list of critical minerals last month. Fear of a sudden premium in America has made some traders hesitant about sending the metal out of the country, offering little prospect of relief should the global market tighten further.

Silver mining stocks also advanced on Monday. Coeur Mining Inc. gained as much as 3.5% while Pan American Silver Corp. rose 2.5%. London-listed Fresnillo Plc jumped more than 8%.

In Australia, Sun Silver Ltd. jumped as much as 21% and Silver Mines Ltd. nearly 13%, while Hong Kong-listed China Silver Group Ltd. rose 14% before paring some gains.

Global markets were also taking stock after an hours-long trading disruption on the Chicago Mercantile Exchange on Friday. With futures and options contracts on the Comex affected by a data-center fault, some metals traders said they reverted to calling brokers and dealers by phone to hedge exposures.

Silver traded 3.6% higher at $58.51 an ounce as of 11:28 a.m. in New York. Gold edged 0.06% lower to $4,237.09 an ounce. The Bloomberg Dollar Spot Index slipped 0.1%. Platinum and palladium fell.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.