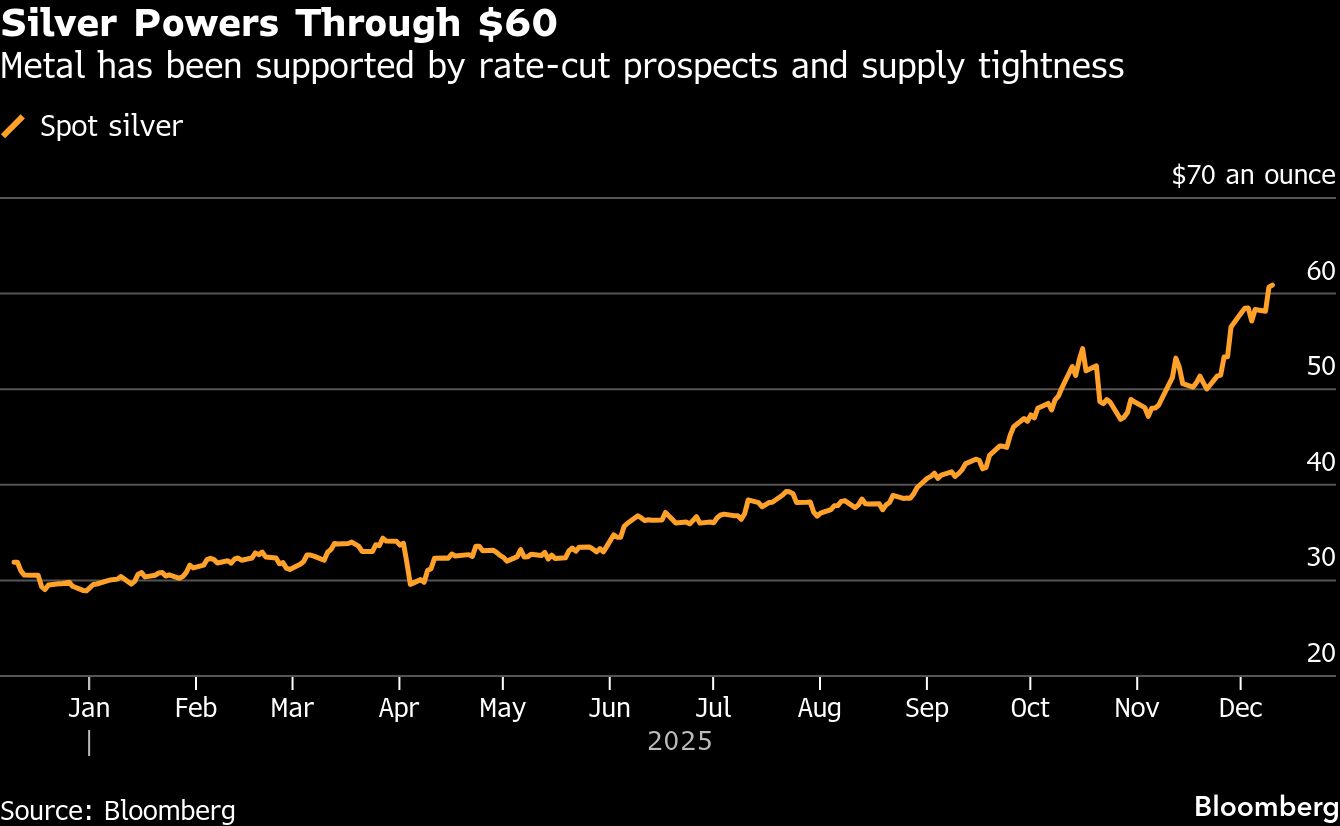

- Silver rose above $60 an ounce for the first time, extending recent gains

- Traders expect Federal Reserve to cut rates, benefiting non-yielding metals

- Silver has more than doubled this year, outpacing gold’s 60% rise

Silver extended gains after breaking above $60 an ounce for the first time on Tuesday, with traders betting on further monetary easing by the Federal Reserve and continued supply tightness.

The white metal rose to a record $60.9213 an ounce on Wednesday, building on a 4.3% increase in the previous session. Silver's rapid advance in recent days has been supported by expectations the US central bank will deliver a quarter-point rate reduction at the end of its Dec. 9-10 meeting. Lower borrowing costs are a tailwind for non-yielding precious metals.

Traders are also looking beyond this week's Fed decision in search of clues on US monetary policy next year. Kevin Hassett, the frontrunner in President Donald Trump's search to replaced Jerome Powell as Fed chair, said Tuesday that he sees plenty of room to substantially lower rates.

Silver has more than doubled in value this year – eclipsing gold's 60% rise – and its rally has gathered momentum since a historic supply squeeze in October. Though this crunch has eased as more metal flows into London vaults, borrowing rates remain elevated — an indication of lingering tightness. Other markets are now seeing supply constraints, with Chinese inventories at decade lows.

The rally has also been supported by inflows to exchange-traded funds. Last week, more money flowed into silver-backed ETFs than in any single week since July, a strong indicator that investors believe the rally has further to run.

Traders are also seeking clarity on whether the US will impose tariffs on silver, after the white metal was added to the country's list of critical minerals last month. That worry has kept some metal onshore, maintaining inventories in Comex warehouses near a historic high despite their retreat from a peak in October.

Silver was up 0.1% at $60.7465 an ounce as of 8:19 a.m. in Singapore. Gold was steady at $4,208.80 an ounce, with platinum and palladium also little changed. The Bloomberg Dollar Spot Index was flat after closing the previous session up 0.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.