Pesticides maker Sikko Industries Ltd., which is only listed on the NSE, has drawn market interest since announcing a stock split and bonus issue of shares last week.

The board on Saturday approved the sub-division of one fully paid-up equity share of face value of Rs 10 each into 10 equity shares of face value of Rs 1 each fully paid-up.

The stock split will happen within three months from the date of approval by shareholders and is subject to the completion of the statutory requirements. A stock split enhances the liquidity of shares in the market.

The company will also issue bonus free equity shares in the ratio of 1:1 i.e., one bonus equity share of Rs 1 each for every one equity share of Rs 1 each fully paid up. The bonus issue will be credited within two months of the date of the board approval.

The record date and ex date for the corporate actions will be announced later.

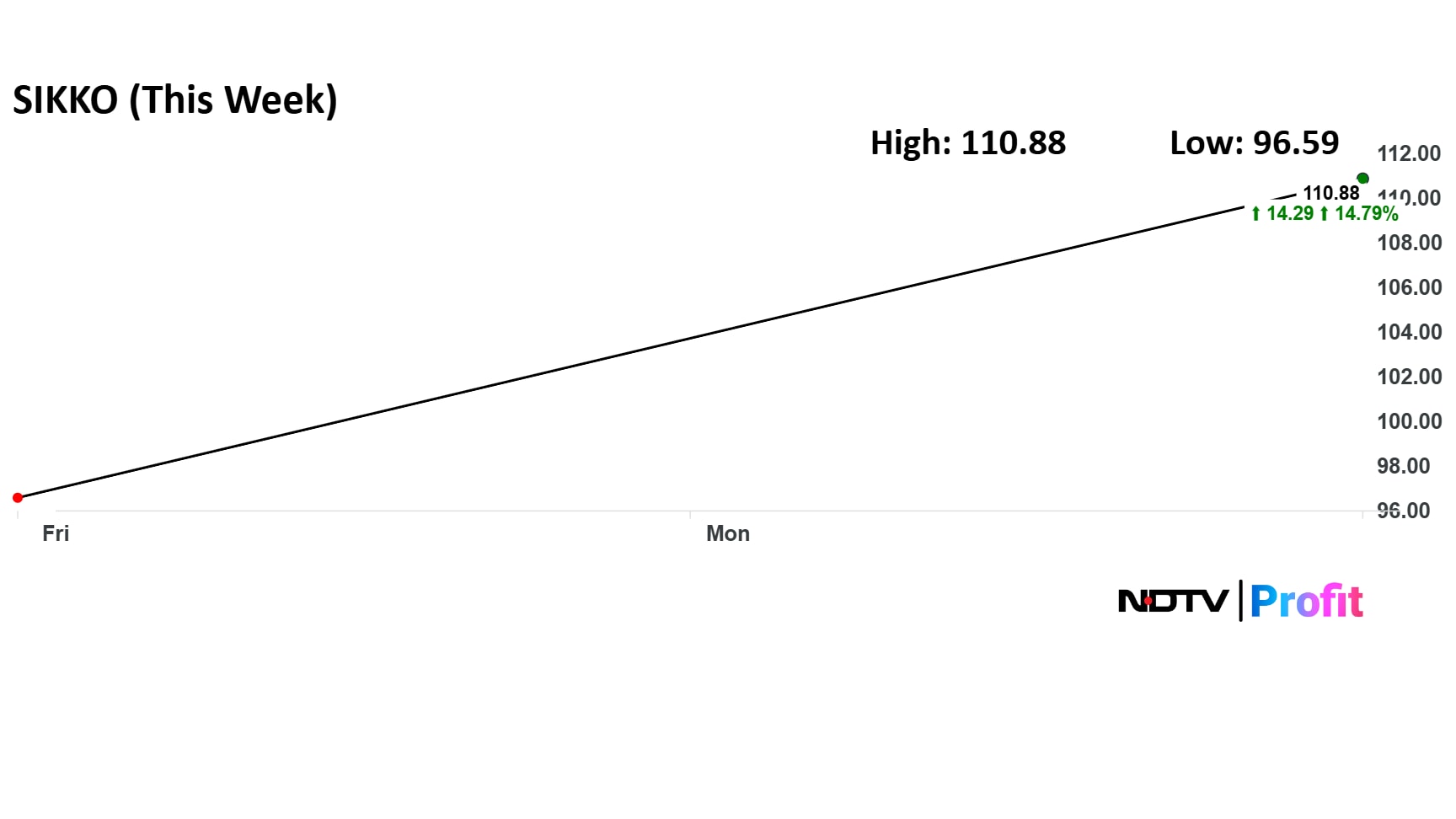

Sikko Industries' share price has rallied over 14% since Friday's closing. The scrip jumped 10% on Thursday.

The market buzz has brought the stock into NSE's Long Term Additional Surveillance Measure (LTASM) - Stage 1.

The company's current market cap stood at Rs 240 crore.

Sikko Industries manufactures, trades and exports bio-agro chemicals, pesticides, fertilisers, seeds, sprayers, packaging, machinery and FMCG products, etc.

In August, a Hong Kong-based operational creditor dragged the company to the National Company Law Tribunal (NCLT), Ahmedabad Bench, for an alleged default in payment of operational dues amounting to Rs 6.56 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.