Jefferies has given Siemens Ltd. a 'buy' rating, projecting a significant 56% upside with a price target of Rs 7,215. The current price stands at Rs 4,619.75, the brokerage noted.

Siemens will see margin expansion driven by operating leverage as revenues rise due to increased spending in transmission and distribution, decarbonisation, automation, and digitalisation, the brokerage said.

Public capital expenditure has been picking up since November 2024, along with private capex in new-age segments. The demerger of Siemens' Energy division is expected to unlock further value, making Siemens a strong play in the power transmission sector, which is seeing the highest capex growth among sub-segments.

The demerger of Siemens' Energy division could potentially add 8-21% to the current market price. Comparable companies like Hitachi Energy and GE Vernova T&D are trading at premiums, suggesting a significant upside for Siemens if its energy division trades at similar multiples. This demerger is expected to enhance Siemens' valuation and focus on its core businesses, the brokerage noted.

Jefferies projects a 29% earnings per share at compound annual growth rate for Siemens over FY24-27E, with return on equity moving to over 20%. The price target of Rs 7,215 values the share at 55 times price-to-earnings ratio for March 2027E, in line with the 10-year average.

However, downside risks include faster-than-expected fixed cost rises and potential weakening of the power capex cycle.

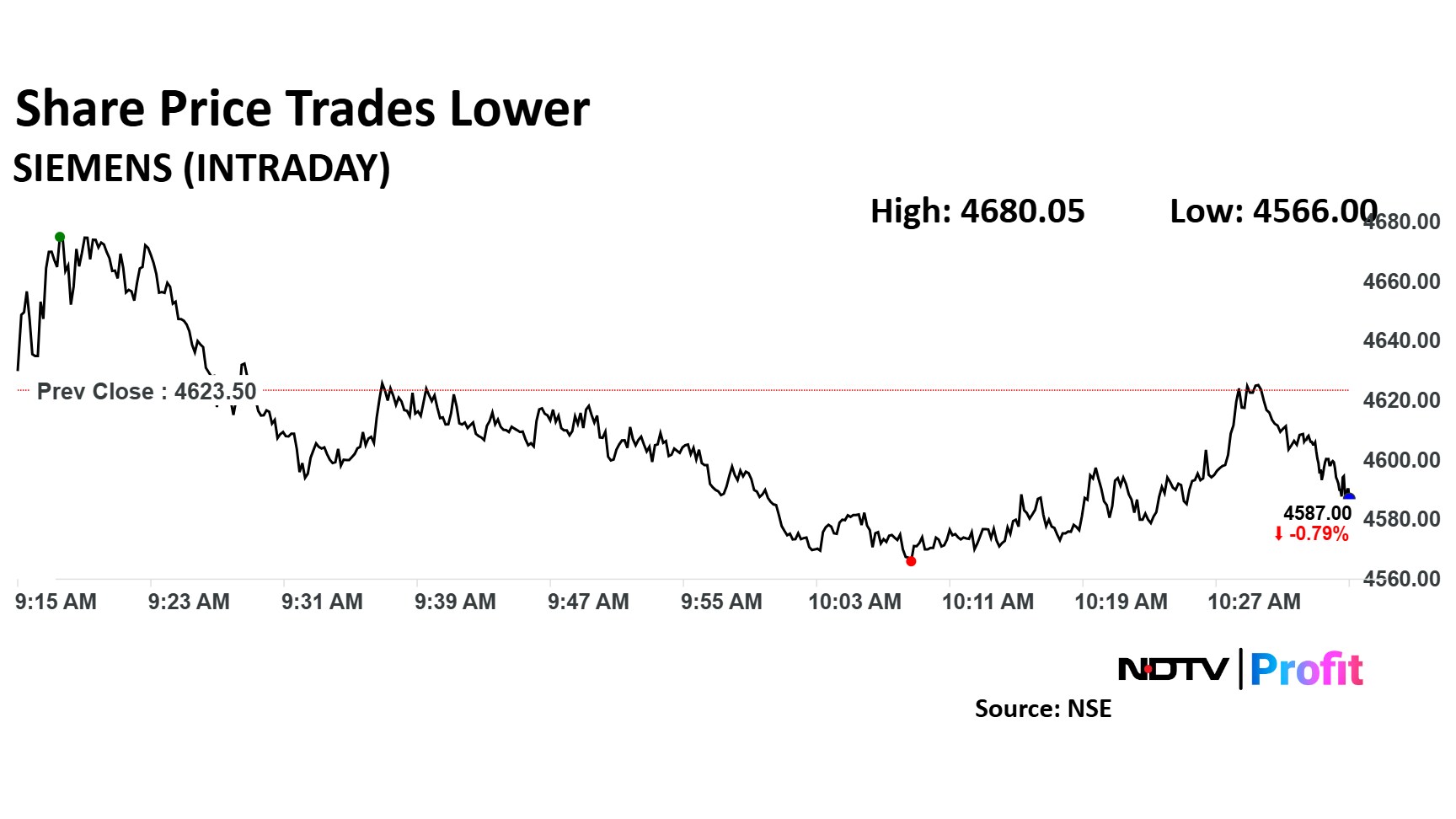

Siemens Share Price

The scrip fell as much as 1.24% to 4,566 apiece. It pared losses to trade 0.30% lower at Rs 4,609 apiece, as of 10:37 a.m. This compares to a 0.27% decline in the NSE Nifty 50.

It has fallen 29.28% in the last 12 months. Total traded volume so far in the day stood at 0.21 times its 30-day average. The relative strength index was at 50.68.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.