Share price for Siemens rose over 4% on Wednesday, after the company reported its revenue rose in the second quarter of the ongoing fiscal.

Revenue was up 2.5% at Rs 3,809 crore versus Rs 3,716 crore. However, net profit declined nearly 25% to Rs 674 crore in comparison with Rs 896 crore from the year ago period. The company follows an October-September cycle, which makes the January-March period its second quarter.

Ebitda was down 29.4% to Rs 386 crore, against Rs 547 crore in the same period last year and margin contracted to 10.1%, against 14.7%.

There was a growth in new orders by 44% to Rs 5,305 crore versus Rs 3,697 crore, due to the ongoing normalisation of demand in digital industries, and due to normal project delivery schedules in the mobility business.

The decline in profit from operations was due to under absorption of fixed costs and higher cost of material in the digital industries business.

Bank of America has reiterated its 'underperform' rating for Siemens Ltd., citing significant execution challenges despite robust order inflows.

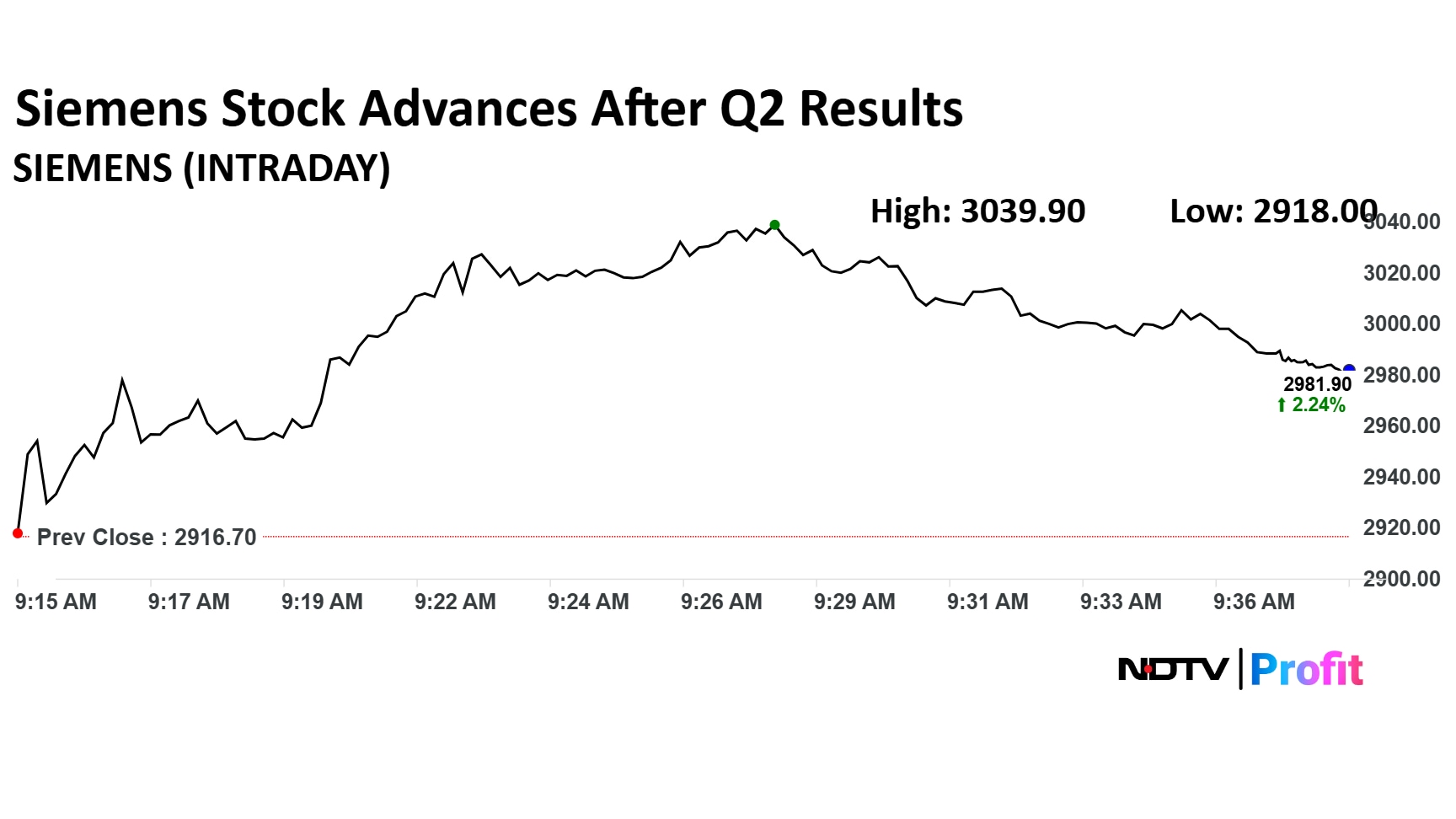

Siemens Share Price

Shares of Siemens rose as much as 4.22% to Rs 3,039.90 apiece, the highest level since April 7, 2025. They pared gains to trade 3.71% higher at Rs 3,026 apiece, as of 9:30 a.m. This compares to a 0.49% advance in the NSE Nifty 50.

The stock has fallen 53.95% on a year-to-date basis, and is up 54.81% in the last 12 months. Total traded volume so far in the day stood at 3.6 times its 30-day average. The relative strength index was at 33.39.

Out of 25 analysts tracking the company, 15 maintain a 'buy' rating, five recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 14.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.