Shriram Finance shares are buzzing in trade on Monday after the non-banking financial company (NBFC) posted its September quarter results, which showed strong momentum.

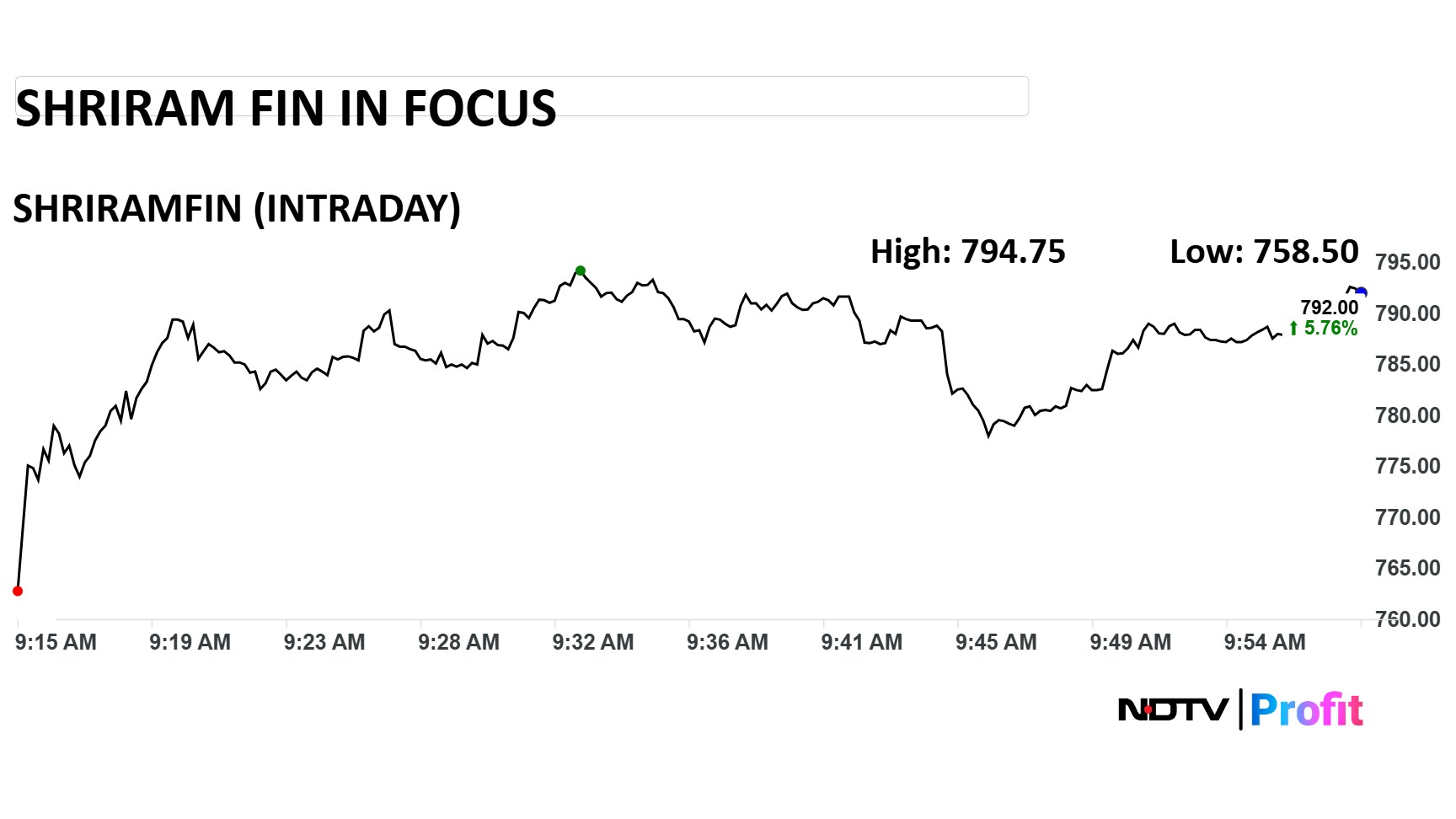

The stock is trading at Rs 789, which accounts for gains of more than 5%. The shares had reached an intraday high of Rs 794, which compares to Friday's closing price of Rs 748.

The sharp rally in Shriram Finance comes on the back of second-quarter earnings that witnessed margin improvement on lower cost of funds.

Lower credit costs also aided the NBFC's profitability metrics, while operating expenses were lowered thanks to branch consolidation and lower employee count.

Photo: NDTV Profit

In the wake of Shriram Finance earnings, CLSA has maintained an 'outperform' rating on the counter while hiking the target price from Rs 735 to Rs 840.

JPMorgan, too, has maintained an 'overweight' rating on Shriram Finance while increasing the target price from Rs 740 to Rs 840.

Both brokerages have highlighted Shriram Finance's lower credit cost in the September quarter as well as stable asset quality. JPMorgan adds that there could be further re-rating on earnings upgrades.

Going forward, Shriram Finance expects NIMs to improve to 8.4% by the fourth quarter of this financial year, while the NBFC is targeting 16% asset under management (AUM) growth in the second half of the financial year ending March 2026.

Currently trading at a relative strength index of 75, which suggests the stock could be in an overbought territory, Shriram Finance has given returns of more than 36% on a year-to-date basis.

Thirty-four out of the 39 analysts tracking the company have a 'buy' rating on the stock. Three recommend a 'hold' while two recommend 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 809, implying an upside of 3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.