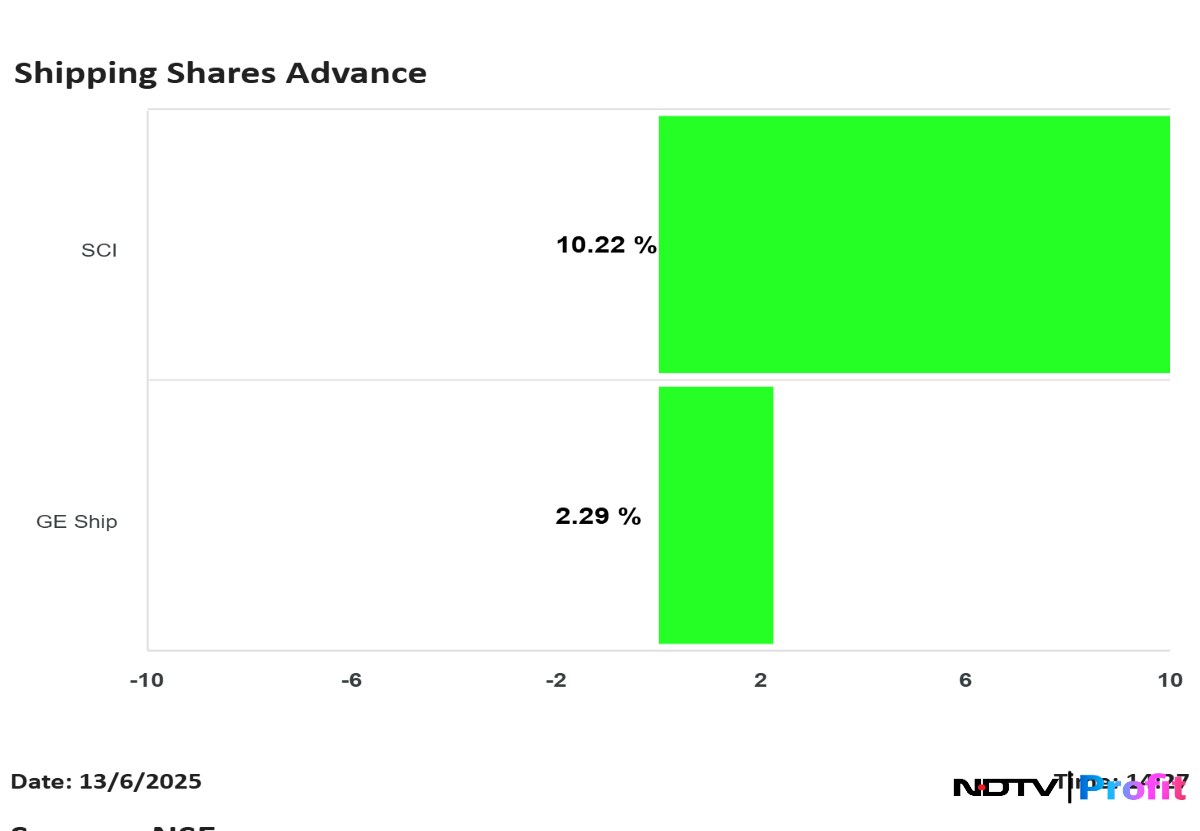

Shares of Shipping Corp. of India and Great Eastern Shipping Co. rose on Friday, bucking the market trend amid escalating geopolitical tensions in the Middle East. This comes as investors anticipate a spike in tanker and container freight rates after Israel's military strike on Iran.

Shipping Corporation of India shares rose nearly 15% to Rs 236.50, while GE Shipping rose 7.59% to Rs 1,049 per share. This is the highest level in six months for both Shipping Corporation and GE Shipping.

The advance in stock comes as markets expect disruptions in supply chain and rising transportation premium across critical oil shipping routes.

Geopolitical tensions rose after Israel attacked Iran's strategic location which caused the death of several commanders and scientists.

Israel has declared a state of emergency on anticipation of a retaliatory attack from Iran. Iran's Supreme Leader Ayatollah Ali Khamenei said that the country will respond, as reported by Bloomberg.

There are fears that Iran will close off the Strait of Hormuz, which is a critical checkpoint for global oil shipments and any disruption in route could impact the movement of materials.

After the attack, the markets crashed with the Nifty 50 falling as much as 1.67% to 24,473, the lowest level since May 22. The Sensex declined 1.64% to 80,354.59, the lowest level since May 9.

Additionally, oil prices in the international markets advanced as traders flock to the safe-haven assets after geopolitical tension rose again, following Israel's air strikes in Iran.

Brent crude August future contract surged 13.8% to $78.50 a barrel, the highest level since Jan. 27. It was trading 8.72% higher at $75.36 a barrel as of 9:32 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.