A sudden jump in the market saw traders clambering for puts in the market ahead of Thursday's weekly expiry. The benchmark Nifty 50 index closed above the 25,200 mark, pushing investors to unwind their calls and take up positions at 25,500 levels.

The Nifty July Futures witnessed short covering, reducing its open interest by over Rs 900 crore. The July Nifty futures open interest stood at Rs 32,000 crore at the close on Wednesday.

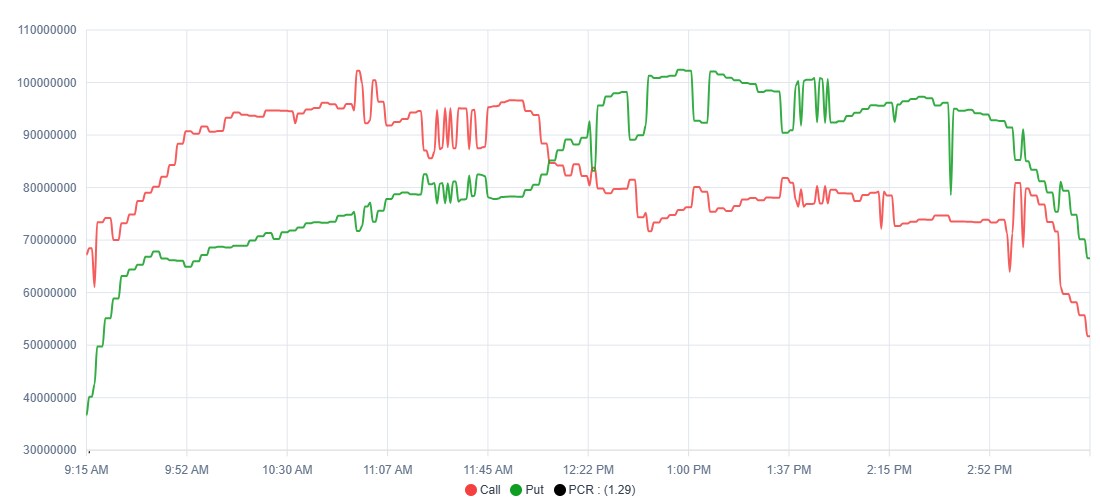

As the market turned around post noon, aggressive put writing began pushing the shorts and call writers to cover their positions.

The options contract was most active, as aggressive put writing in the afternoon saw the market put-call ratio rise to 1.29.

Nifty options are seeing intraday volatility with significant position unwinding at the end of the day.

Nifty 50 shows extensive put writing and unwinding of call positions. Significant put positions were built in at 25,200, and call writers moved their positions to 25,500.

The premium on the put jumped significantly on Wednesday; the at-the-money 25,200 strike saw the premium fall from Rs 147.6 on Tuesday to Rs 36.45 at the end of Wednesday. The premium hit a high of Rs 131 during intraday trade.

There was significant unwinding of the call options with the call premium at the 25,200 strike, which opened at Rs 165 and ended the day at Rs 63.60 after an intraday high of Rs 172.6.

The trading range for Nifty has moved higher to between 25,200 and 25,500 by the end of the trading day after call positions shifted higher to 25,500 levels ahead of the weekly expiry on Thursday.

ICICI Bank and HDFC Bank continue to high trading and delivery trades of over 70% in their counter. Nifty Bank ended the day 0.8% higher.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.