HDFC Bank Shares Trade At Three-Month Low — Here's Why

This dip comes even as India’s largest private sector lender reported robust growth across key business indicators for the third quarter ended December, according to its latest operational update.

%20011123-2.jpg?rect=0%2C0%2C1611%2C906&auto=format%2Ccompress&fmt=avif&mode=crop&ar=16%3A9&q=60)

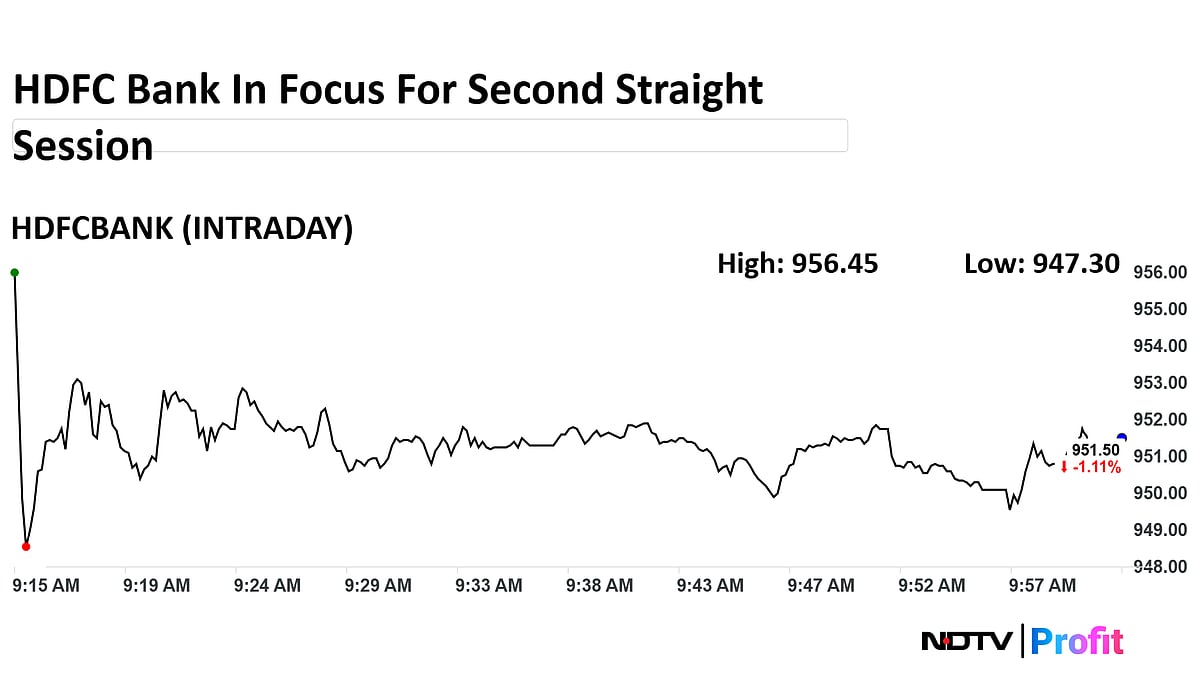

Shares of HDFC Bank remain to be in focus for the second consecutive session. This is after its American Depositary Receipts fell 6.33% to $34.17 on Tuesday. Additionally, the private bank has 3.93 million shares traded in a block deal today.

HDFC Bank's stock is trading more than a percent lower at Rs 951.55 apiece. The bank is one of the top losing stocks on the Nifty 50 currently. Since it is one of the biggest contributors, this dip is dragging the entire index lower.

This dip comes even as India’s largest private sector lender reported robust growth across key business indicators for the third quarter ended December, according to its latest operational update.

The bank’s gross advances surged 11.9% year-on-year to Rs 28.4 lakh crore, signaling sustained credit demand. Average advances for the quarter stood at Rs 28.6 lakh crore, up 9% from the same period last year.

On the deposit front, momentum remained strong. Average deposits grew 12.2% year-on-year to Rs 27.5 lakh crore, while average CASA deposits rose 9.98% to Rs 8.9 lakh crore.

Shares of HDFC Bank have fallen 42.85% in the last 12 months, and currently trades with a relative strength index of 52, which suggests neutral market sentiment.

Out of 48 analysts tracking the company, 46 maintain a 'buy' rating, two recommend a 'hold,' while none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target of Rs 1,157 implies an upside of 16.9%.