India’s equity benchmarks swung between gains and losses before ending the trading session higher due to a late surge before the closing bell. The benchmarks hit record highs in intra-day trade. Decline in metal stocks and index heavyweight RIL capped some of the gains.

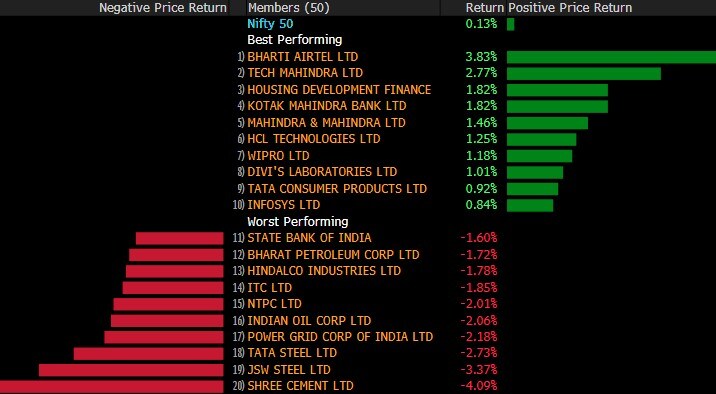

The S&P BSE Sensex gained 0.28% to 54,554.66. The 30-stock index registered a record of 54,779.66 before slipping to 54,308.77 levels in intraday trade. The NSE Nifty 50 advanced 0.13% to 16,280.10. Nifty 50 also hit a record of 16,359.25 in intraday trade.

The broader indices underperformed their larger peers with the S&P BSE MidCap index slipping nearly 1% and the S&P BSE SmallCap shedding over 2%. Thirteen of the 19 sectoral indices compiled by the BSE Ltd declined, led by S&P BSE Metal index which fell nearly 3%.

India’s equity benchmarks swung between gains and losses before ending the trading session higher due to a late surge before the closing bell. The benchmarks hit record highs in intra-day trade. Decline in metal stocks and index heavyweight RIL capped some of the gains.

The S&P BSE Sensex gained 0.28% to 54,554.66. The 30-stock index registered a record of 54,779.66 before slipping to 54,308.77 levels in intraday trade. The NSE Nifty 50 advanced 0.13% to 16,280.10. Nifty 50 also hit a record of 16,359.25 in intraday trade.

The broader indices underperformed their larger peers with the S&P BSE MidCap index slipping nearly 1% and the S&P BSE SmallCap shedding over 2%. Thirteen of the 19 sectoral indices compiled by the BSE Ltd declined, led by S&P BSE Metal index which fell nearly 3%.

The market breadth was skewed in favour of the bears. About 762 stocks advanced, 2,496 declined and 116 stocks remained unchanged.

"Midcap and smallcap stocks continued to see selling pressure as investors booked some profit in the backdrop of rising delta variant coronavirus cases in various parts of the world. We believe that underlying strength of domestic market remains intact and any meaningful correction in the market should be taken as an opportunity to buy", wrote Binod Modi, Head Strategy, Reliance Securities.

"Even as markets witnessed sharp volatility, benchmark Nifty surpassed intraday resistance of 16,300. The sharp intraday correction from 16,359 to 16,202 clearly indicates uncertainty between bulls and bears. In the broader market, over 1,500 stocks traded in the red, whereas about 265 stocks closed in positive which is broadly negative for the market. Technically, on daily charts the Nifty has formed a Doji kind of formation which indicates strong possibility of intraday correction if the index succeeds to trade below 16,180. We are of the view that as long as it's trading above 16,180 the uptrend texture is bullish and likely to continue up to 16,350. Further upside may also continue which could lift the index up to 16,400. On the other side, below 16,180, the correction wave will continue up to 16,150-16,120 levels", Shrikant Chouhan, Executive Vice President, Equity Technical Research, Kotak Securities wrote in a note

Shares of Manappuram Finance Ltd. declined 3.76% after the company reported net income for the first quarter that missed the average analyst estimate.

June Quarter Results (Consolidated)

Net income at Rs 436.85 crore vs estimate of Rs 456 crore (Bloomberg Consensus)

Revenue at Rs 1,563.30 crore vs estimate of Rs 1,095 crore

Total costs at Rs 987.37 crore vs Rs 1,008.17 crore QoQ

Other income at Rs 10.44 crore vs Rs 7.93 crore QoQ

Shares of Jindal Steel and Power Ltd. shed 5.21% to Rs 396.35 apiece after the company reported net income for the first quarter that met the average analyst estimate.

June Quarter Results

Net income at Rs 2,543.27 crore vs estimate of Rs 2,562 crore (Bloomberg Consensus)

Revenue at Rs 10,609.50 crore vs estimate of Rs 11,008 crore

Total costs at Rs 7,233.55 crore vs Rs 6,793.91 crore QoQ

Other income at Rs 33.67 crore vs Rs 20.80 crore QoQ

Of the 25 analysts tracking the company, 21 maintained ‘buy’, 3 maintained ‘hold’ and 1 analyst maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 35.7%. Shares of Jindal Steel gained 87% in 2021 so far compared to 75% increase for S&P BSE Metal

Shares of Coal India Ltd. shed 1.75% to Rs 140.75 apiece after the company reported net income for the first quarter that missed average analyst estimate.

June Quarter Results (Consolidated)

Net income at Rs 3,174.14 crore vs estimate of Rs 3,973 crore (Bloomberg Consensus)

Revenue at Rs 23,293.65 crore vs estimate of Rs 25,659 crore

Total costs at Rs 21,626.48 crore vs Rs 21,565.15 crore QoQ

Other income at Rs 680.87 crore vs Rs 1,273.98 crore QoQ

Shares of Tejas Networks Ltd. advanced 5% to Rs 360.75 apiece. This is the fourteen consecutive session in which the stock has gained by same magnitude.

The company announced an open offer for the acquisition of 4,02,55,631 fully paid-up equity shares of face value of Rs 10 each by Panatone Finvest and Akashastha Technology along with Tata Sons.

The open offer is scheduled to begin on September 23 and close on October 6, as per regulatory filing. The Relative Strength Index is 95 suggesting that the stock may be overbought. Shares of Tejas Networks gained 163% in 2021 so far.

Whirlpool of India Ltd. reported revenue for the June quarter that met average analyst estimate.

First Quarter Results (Standalone)

Net income at Rs 23.34 crore vs Rs 123.82 crore QoQ

Revenue at Rs 1,340.61 crore vs estimate of Rs 1,310 crore (Bloomberg Consensus)

Total costs at Rs 1,321.92 crore vs Rs 1,626,20 crore QoQ

Other income at Rs 14 crore vs Rs 13.15 crore QoQ

Of the 15 analysts tracking the company, 6 maintained ‘buy’, 3 maintained ‘hold’ and 6 maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 7.7%. Shares of Whirlpool declined 19% in 2021 so far.

Shares of Bharti Airtel gained 4.80% to hit a record of Rs 628 apiece. Shares of Bharti Airtel added 15.90% in the last month compared to 8.58% gains for S&P BSE Telecom index. The Relative Strength Index is 74 suggesting that the stock may be overbought.

Shares of Bharti Airtel gained 4.80% to hit a record of Rs 628 apiece. Shares of Bharti Airtel added 15.90% in the last month compared to 8.58% gains for S&P BSE Telecom index. The Relative Strength Index is 74 suggesting that the stock may be overbought.

Of the 33 analysts tracking the company, 32 maintained ‘buy’ and 1 analysts maintained ‘hold’ recommendations. 12 analysts increased, 2 reduced and 15 analysts held on to their price targets over the past month. The overall consensus price of analysts tracked by Bloomberg implied an upside of 16%.

India’s equity benchmarks pared gains after hitting new highs weighed down by metal stocks and index heavyweight Reliance.

The S&P BSE Sensex remained almost unchanged at 54,443.30. This after the 30-stock index registered a record intraday high of 54,779.66. The NSE Nifty 50 shed 0.1% to 16,243.50 after hitting a record of 16,359.25 in intraday trade.

The broader indices underperformed their larger peers with the S&P BSE MidCap index slipping 1.18% and the S&P BSE SmallCap shedding nearly 2.5%. Fifteen of the 19 sectoral indices compiled by the BSE Ltd declined, led by S&P BSE Metal index which shed over 2%.

India’s equity benchmarks pared gains after hitting new highs weighed down by metal stocks and index heavyweight Reliance.

The S&P BSE Sensex remained almost unchanged at 54,443.30. This after the 30-stock index registered a record intraday high of 54,779.66. The NSE Nifty 50 shed 0.1% to 16,243.50 after hitting a record of 16,359.25 in intraday trade.

The broader indices underperformed their larger peers with the S&P BSE MidCap index slipping 1.18% and the S&P BSE SmallCap shedding nearly 2.5%. Fifteen of the 19 sectoral indices compiled by the BSE Ltd declined, led by S&P BSE Metal index which shed over 2%.

The market breadth was skewed in favour of the bears. About 657 stocks advanced, 2,553 declined and 118 stocks remained unchanged.

India’s equity benchmarks pared gains after hitting new highs weighed down by metal stocks and index heavyweight Reliance.

The S&P BSE Sensex remained almost unchanged at 54,443.30. This after the 30-stock index registered a record intraday high of 54,779.66. The NSE Nifty 50 shed 0.1% to 16,243.50 after hitting a record of 16,359.25 in intraday trade.

The broader indices underperformed their larger peers with the S&P BSE MidCap index slipping 1.18% and the S&P BSE SmallCap shedding nearly 2.5%. Fifteen of the 19 sectoral indices compiled by the BSE Ltd declined, led by S&P BSE Metal index which shed over 2%.

India’s equity benchmarks pared gains after hitting new highs weighed down by metal stocks and index heavyweight Reliance.

The S&P BSE Sensex remained almost unchanged at 54,443.30. This after the 30-stock index registered a record intraday high of 54,779.66. The NSE Nifty 50 shed 0.1% to 16,243.50 after hitting a record of 16,359.25 in intraday trade.

The broader indices underperformed their larger peers with the S&P BSE MidCap index slipping 1.18% and the S&P BSE SmallCap shedding nearly 2.5%. Fifteen of the 19 sectoral indices compiled by the BSE Ltd declined, led by S&P BSE Metal index which shed over 2%.

The market breadth was skewed in favour of the bears. About 657 stocks advanced, 2,553 declined and 118 stocks remained unchanged.

Shares of Motherson Sumi Systems Ltd. declined 3.77% to Rs 222.20 apiece after reporting June Quarter numbers.

June Quarter Numbers (Consolidated, QoQ)

Net profit at Rs 289.63 crore vs Rs 713.62 crore QoQ

Revenue at Rs 16,157.35 crore vs estimate of Rs 16,385 crore (Bloomberg consensus)

Total costs at Rs 15,809.40 crore vs Rs 16,142.89 crore QoQ

Other income at Rs 154.78 crore vs Rs 61.55 crore QoQ

Of the 30 analysts tracking the company, 20 maintained ‘buy’, 7 maintained ‘hold’ and 3 analysts maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 21.4%. Shares of Motherson Sumi advanced 37.7% in 2021 so far as compared to 15.5% for Sensex.

Shares of Laxmi Organic Industries Ltd. added 9,87% to Rs 299.55 apiece after reporting a sequential growth in net profit in June quarter post market hours on Monday.

First Quarter Results

Net profit at Rs 102.32 crore vs Rs 36.37 crore QoQ

Revenue at Rs 736.35 crore vs Rs 519.52 crore QoQ

Total costs at Rs 604.76 crore vs Rs 472.54 crore QoQ

Other income at Rs 4.27 crore vs Rs 1.75 crore QoQ

Reliance Industries Ltd. is weighing a bid for Deutsche Telekom AG’s Netherlands subsidiary, Bloomberg News reported citing people familiar with the matter.

The Mukesh Ambani-led firm is working with an adviser to evaluate an offer for T-Mobile Netherlands BV, the people told Bloomberg, asking not to be identified discussing confidential information.

Deutsche Telekom is seeking about 5 billion euros ($5.9 billion) in any sale, the people said.

Shares of Kalyan Jewellers India Ltd. shed nearly 2% to Rs 65.65 apiece after it reported net loss in the first quarter.

June Quarter Results (Consolidated)

Net loss at Rs 51.31 crore vs net profit of Rs 73.87 crore QoQ

Revenue at Rs 1,636.76 crore vs Rs 3,056.6 crore QoQ

Other income at Rs 4.7 crore vs Rs 12.27 crore QoQ

Total costs at Rs 1,706.43 crore vs Rs 2,970.4 crore QoQ

Tepid start to the initial public offerings of Aptus Value Housing Finance and Chemplast Sanmar.

The IPOs of Aptus Value and Chemplast Sanmar were both subscribed 0.13 times, when markets closed Tuesday.

Follow the subscription updates live:

Retail investor interest in CarTrade Tech Ltd.'s initial public offering picked on the Day 2 of the subscription. The IPO was subscribed 0.69 times when the markets closed.

Nuvoco Vistas Corp's three-day IPO continues to witness muted demand with the offer getting subscribed 0.26 times at the time of closing bell.

Follow the subscription updates live:

Shares of Gujarat State Petronet Ltd. added nearly 6% to Rs 343.80 after reporting net income for the first quarter that beat the average analyst estimate post market hours Monday.

June Quarter Results (Standalone)

Net income at Rs 232.27 crore vs estimate of Rs 216 crore (Bloomberg Consensus)

Revenue at Rs 527.24 crore vs estimate of Rs 490 crroe

Total costs at Rs 214.91 crore vs Rs 187.88 crore QoQ

Other income at Rs 3.79 crore vs Rs 6.09 crore QoQ

Motilal Oswal

Maintains ‘buy’ with a target price of Rs 500, a potential upside of 53.84%

Transmission volume marginally above expectations .

Volumes likely to grow further as demand for the CGD sector continued to normalise.

Upcoming LNG terminals in Gujarat, rise in demand due to focus on reducing industrial pollution and commissioning of the Mehsana-Bhatinda pipeline are likely to trigger growth in volumes.

Company can easily record an 8-10% CAGR in transmission volumes over the next 5-6 years.

JM Financial

Maintains ‘buy’ with the target price raised to Rs 390 from Rs 330 earlier

Higher than expected transaction volumes aided quarterly performance.

Most of the company’s value driven from its stake in Gujarat Gas, which is expected to deliver volume growth and sustain pricing power.

Implied transmission Ebitda was tad below expectations due to higher opex.

Nirmal Bang

Maintains ‘buy’ with the target price increased to Rs 498 from Rs 480 earlier.

Incremental supplies from Mundra LNG terminal and additional volume from Swan Energy’s LNG terminal to aid growth.

Robust growth in Indian gas demand remains a positive for the company’s transmission business.

Key Risks: Gas supply/demand falling short of expectations.

Of the 33 analysts tracking the company, 28 maintained ‘buy’, 3 maintained ‘hold’ and 2 analysts maintained ‘sell’ recommendations. The overall consensus price of analysts tracked by Bloomberg implied an upside of 12.9%.

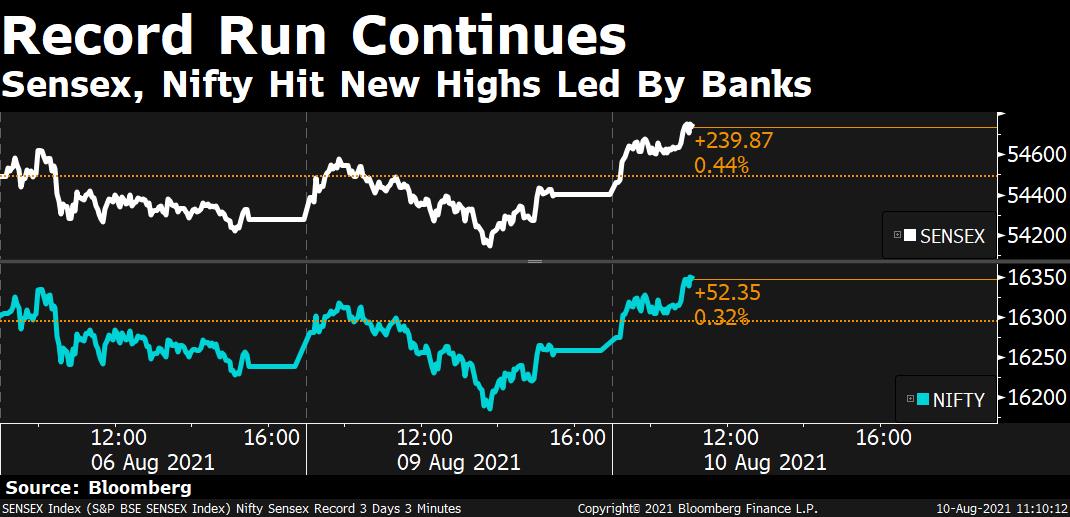

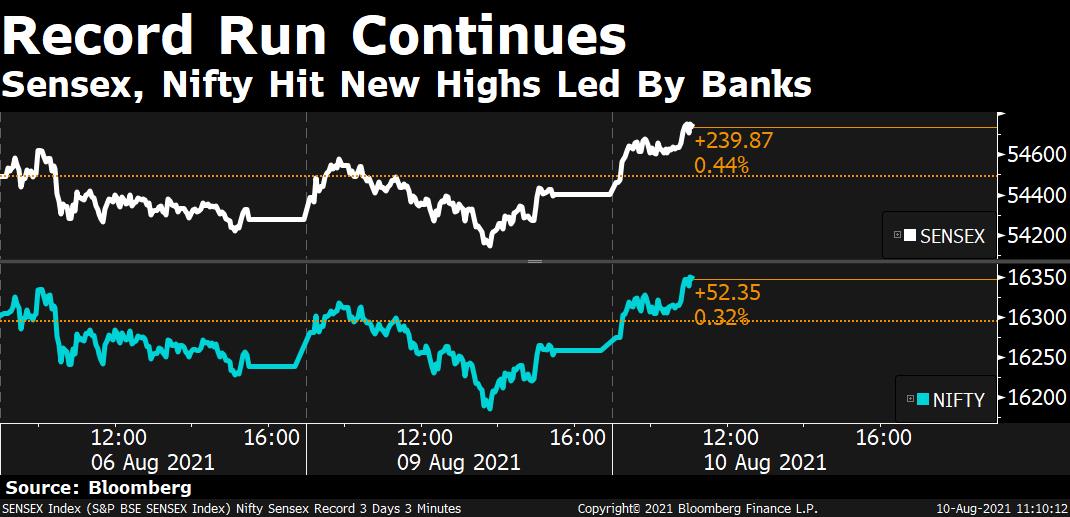

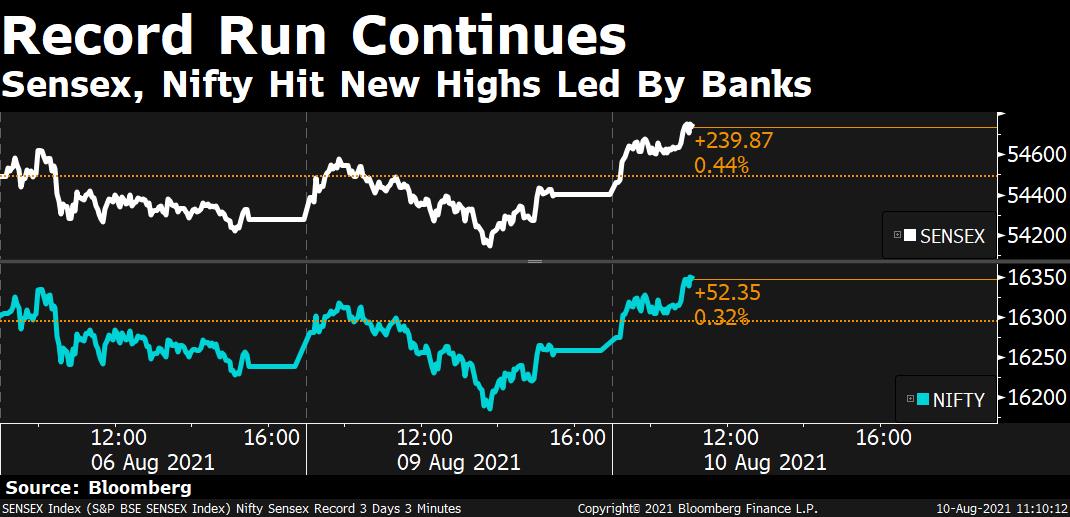

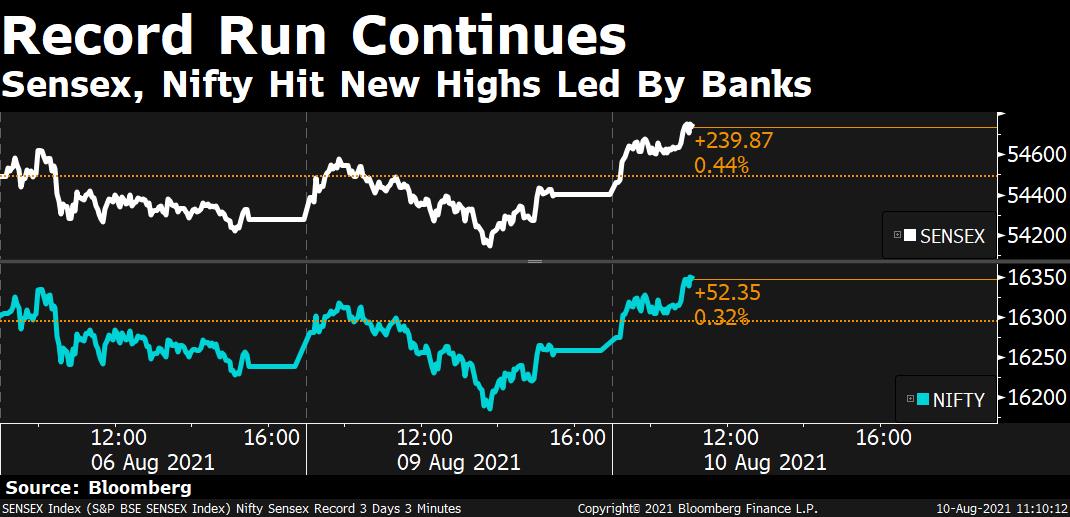

Banking and technology stocks led the gains as key stock benchmarks hit new highs.

The S&P BSE Sensex advanced 0.68% to hit a new high of 54,770.80 in intraday trade. The NSE Nifty50 also advanced 0.54% to hit a record of 16,346.75

Banking and technology stocks led the gains as key stock benchmarks hit new highs.

The S&P BSE Sensex advanced 0.68% to hit a new high of 54,770.80 in intraday trade. The NSE Nifty50 also advanced 0.54% to hit a record of 16,346.75

Shares of AU Small Finance Bank, Kotak Mahindra Bank advanced over 1.5% while IndusInd Bank and index heavyweight HDFC Bank also gained 0.7%.

Banking and technology stocks led the gains as key stock benchmarks hit new highs.

The S&P BSE Sensex advanced 0.68% to hit a new high of 54,770.80 in intraday trade. The NSE Nifty50 also advanced 0.54% to hit a record of 16,346.75

Banking and technology stocks led the gains as key stock benchmarks hit new highs.

The S&P BSE Sensex advanced 0.68% to hit a new high of 54,770.80 in intraday trade. The NSE Nifty50 also advanced 0.54% to hit a record of 16,346.75

Shares of AU Small Finance Bank, Kotak Mahindra Bank advanced over 1.5% while IndusInd Bank and index heavyweight HDFC Bank also gained 0.7%.

The NSE Nifty IT Index advanced 0.87% with Tech Mahindra, Coforge and Wipro leading the gains. All the constituents of the Nifty IT index advanced.

Banking and technology stocks led the gains as key stock benchmarks hit new highs.

The S&P BSE Sensex advanced 0.68% to hit a new high of 54,770.80 in intraday trade. The NSE Nifty50 also advanced 0.54% to hit a record of 16,346.75

Banking and technology stocks led the gains as key stock benchmarks hit new highs.

The S&P BSE Sensex advanced 0.68% to hit a new high of 54,770.80 in intraday trade. The NSE Nifty50 also advanced 0.54% to hit a record of 16,346.75

Shares of AU Small Finance Bank, Kotak Mahindra Bank advanced over 1.5% while IndusInd Bank and index heavyweight HDFC Bank also gained 0.7%.

Banking and technology stocks led the gains as key stock benchmarks hit new highs.

The S&P BSE Sensex advanced 0.68% to hit a new high of 54,770.80 in intraday trade. The NSE Nifty50 also advanced 0.54% to hit a record of 16,346.75

Banking and technology stocks led the gains as key stock benchmarks hit new highs.

The S&P BSE Sensex advanced 0.68% to hit a new high of 54,770.80 in intraday trade. The NSE Nifty50 also advanced 0.54% to hit a record of 16,346.75

Shares of AU Small Finance Bank, Kotak Mahindra Bank advanced over 1.5% while IndusInd Bank and index heavyweight HDFC Bank also gained 0.7%.

The NSE Nifty IT Index advanced 0.87% with Tech Mahindra, Coforge and Wipro leading the gains. All the constituents of the Nifty IT index advanced.

Shares of Shree Cement shed 3.79%, the steepest decline in over 3 months to Rs 27,200 apiece after it reported its June quarter earnings post market hours on Monday.

Shree Cement Q1FY22 (Standalone, QoQ)

Revenue at Rs 3,449.49 crore Vs estimate of Rs 3,345.3 crore (Bloomberg Consensus)

Net profit at Rs 661.72 crore Vs estimate of Rs 597 crore

Ebitda at Rs 1,013.51 crore Vs estimate of Rs 1,031.5 crore

Margin at 29.4% Vs estimate of 29.4%

Jefferies

Maintains 'hold' with the target price raised to Rs 27,000 from Rs 25000 earlier

Higher than expected realisations offset by energy price inflation and other costs.

Strong realization in the East likely to have aided growth in blended realisations.

Low-cost inventory buffer which aided the sector in earlier quarters has been exhausted as steep increase in petcoke/coal prices are putting pressure on margins.

Prabhudas Lilladher

Maintains ‘hold’ with the target price reduced to Rs 28,400 from Rs 28,625.

Higher costs and lower volumes weighed on June Quarter performance.

Expect differential in margins over its peers to continue to shrink.

Majority of growth likely to be led by greenfield expansions.

Motilal Oswal

Maintains ‘neutral’ with the target price of Rs 28,550.

Faster volume growth needed to improve RoE

Company lagging behind peers in terms of volume growth

Increasing exposure in East region likely to keep margins in check due to muted pricing outlook.

India’s equity benchmarks edged higher led by gains in Reliance and banking stocks.

The S&P BSE Sensex gained 0.45% to 54,649.25. The 30-stock index advanced to 54,683.45 in intraday trade, close to the all-time high of 54,717.24. The NSE Nifty 50 advanced by a similar magnitude to 16,320.75.

India’s equity benchmarks edged higher led by gains in Reliance and banking stocks.

The S&P BSE Sensex gained 0.45% to 54,649.25. The 30-stock index advanced to 54,683.45 in intraday trade, close to the all-time high of 54,717.24. The NSE Nifty 50 advanced by a similar magnitude to 16,320.75.

The broader indices almost mirrored their larger peers with S&P BSE MidCap and S&P BSE Smallcap indices adding 0.3%. Fifteen out of the 19 sectoral indices compiled by the BSE Ltd gained, led by S&P BSE BankEx, up 0.8%.

The market breadth was skewed in favour of the bulls. About 1,418 stocks advanced, 1,128 declined and 89 remained unchanged.

Astron Paper & Board Mill had about 8.78 million shares change hands on NSE, according to data compiled by Bloomberg.

Buyers, sellers not immediately known

Asian Granito India holds 18.9% as of June 30

Hinduja Global Solutions Ltd. signed definitive agreements to divest its Healthcare Services business to funds affiliated with Baring Private Equity Asia in a transaction based on enterprise value of $1.2 billion, according to statement on exchanges.

The Hinduja Group’s business process management firm expects to complete the transaction within 90 days, subject to shareholder and other regulatory approvals

HGS will transfer all client contracts, employees and assets related to healthcare business to BPEA; will focus on strengthening its Consumer Engagement Solutions, HGS Digital and HRO/Payroll businesses

Healthcare Services vertical has over 20,000 employees across India, the Philippines, U.S. and Jamaica; recorded revenue of approximately $400 million in FY2021

Indian bond traders will await a Rs 11,600 crore sale of state debt to gauge demand amid an overnight rise U.S. yields. The rupee may open lower along with other emerging Asian currencies.

10-year yields fell 1bp to 6.22% on Monday; 5-year yields fell 4bps to 5.74%

USD/INR rose 0.2% to 74.2675

Foreigners invested net $498 million in Indian equities last week, according to data from the Central Depository Services

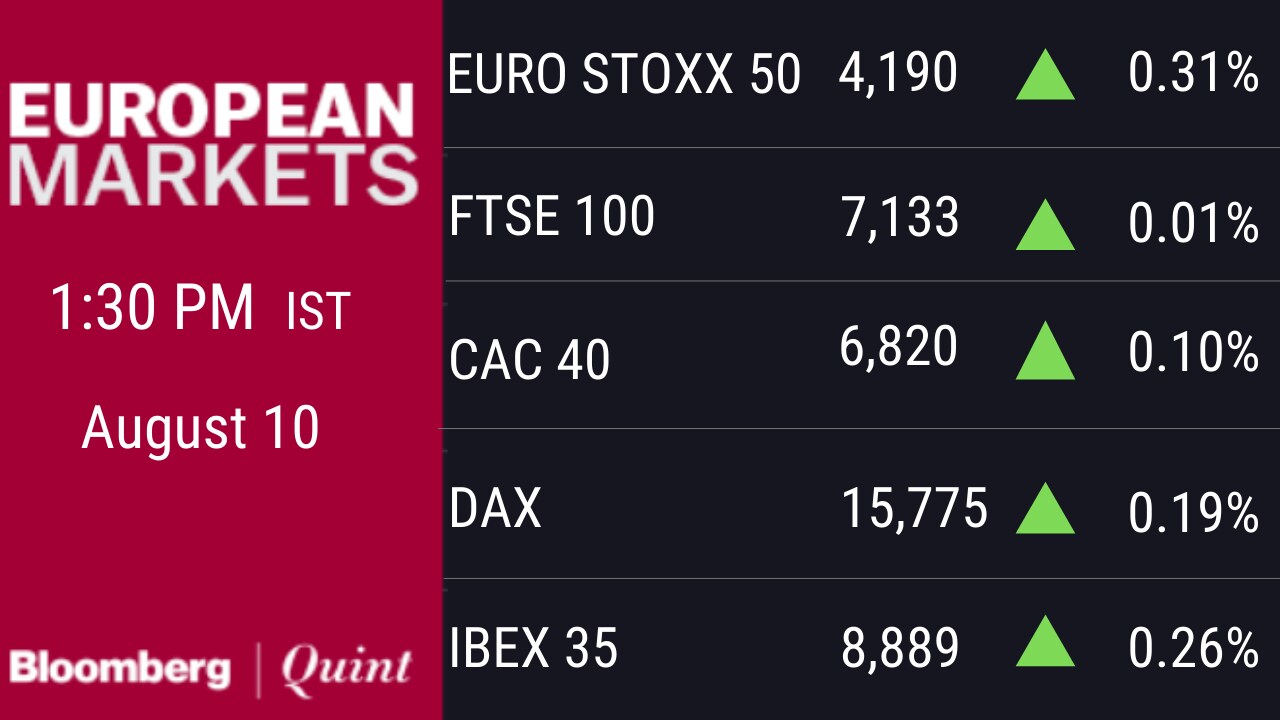

Asian stocks drifted Tuesday and commodity markets steadied after Monday’s selloff as investors weighed talk of stimulus withdrawal and a resurgence in the delta virus variant.

Equities rose in Japan, which reopened after a holiday. Stocks in Hong Kong fluctuated, while those in China and South Korea dipped. U.S. futures edged lower. Earlier, the S&P 500 closed little changed, while the Nasdaq 100 ticked up.

India’s SGX Nifty 50 Index futures for August delivery fell 0.1% to 16,251.00, while MSCI Asia Pacific Index declined 0.1%. The NSE Nifty 50 added 0.1% Monday to 16,258.25.

Gold was steady after Monday’s volatility and Bitcoin traded back around $46,000. The dollar and treasury yields held overnight gains. Crude oil pared a decline after it touched the lowest in three weeks on concern the delta strain will hamper demand growth.

Back home, Shree Cement, Indian Hotels, Gujarat Petronet may react as the companies reported quarterly results after the market closed Monday. Coal India, Power Grid, Lupin, Motherson Sumi, Siemens are among the companies scheduled to report earnings Tuesday. Central Bank, Godrej Agrovet, ICICI Lombard, IDBI Bank are holding their annual shareholders’ meeting. Foreign investors bought net Rs 158 crore of stocks on Aug. 6, according to NSDL website.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.