India's benchmark stock indices advanced after falling through Friday—the last session of Samvat 2079—following the weakness in global peers. Both the Nifty and Sensex reported over 9% returns in Samvat 2079.

Globally, risk appetite took a hit after Fed Chair Jerome Powell warned interest rates may have to climb further, stunting a rally in stocks and bonds and sending investors back to the dollar. This saw the rupee hit a fresh record low and the 10-year government bond yield rose. On a weekly basis, the headline indices advanced for the second time.

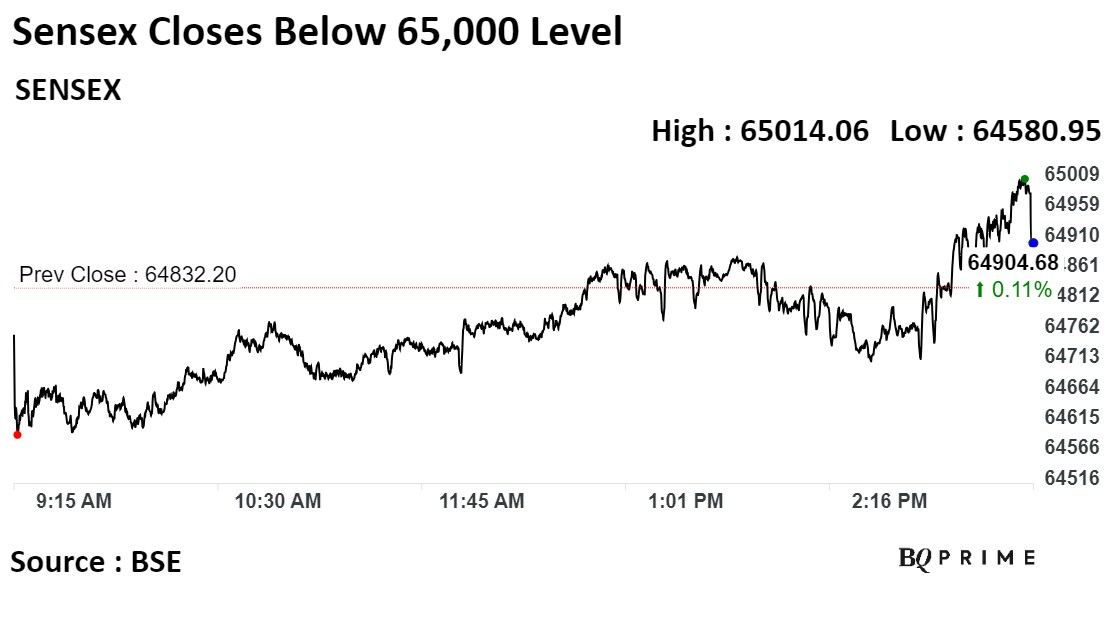

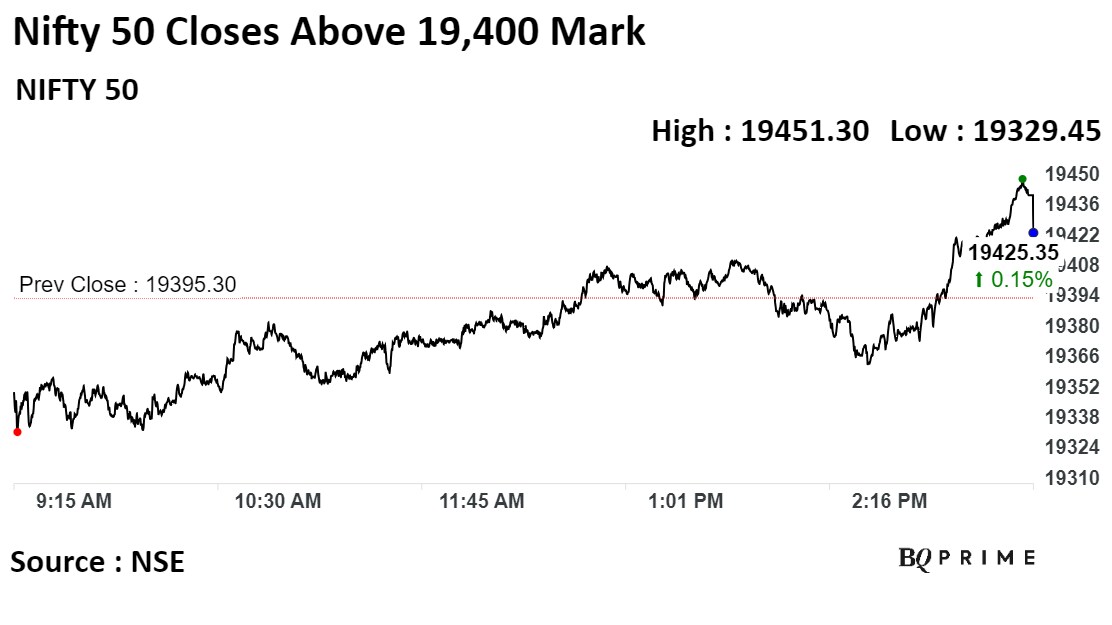

Sensex closed near 65,000 level, over 400 points up from its day's low, whereas the Nifty 50 was above the 19,400 mark, over 70 points from the lowest point of the day.

"The Indian market texture indicates that the ‘buy on dips' strategy will continue to work," said Dr VK Vijayakumar, chief investment strategist at Geojit Financial Services.

The S&P BSE Sensex closed up 73 points, or 0.11%, at 64,904.68, while the NSE Nifty 50 ended 30 points, or 0.15%, higher at 19,425.35.

Shares in Asia fell after Powell warned interest rates may have to climb further, stunting a rally in stocks and bonds, and sending investors back to the dollar.

All major equity gauges in the region were in the red, tracking a drop for the S&P 500 on Thursday. Hong Kong's stocks were among the biggest losers after weak profit reports from chipmaker SMIC and casino operator Wynn Macau.

The U.S. benchmark slipped 0.8%, ending eight days of gains—its best run since 2021. The Nasdaq 100 fell by the same margin, and contracts for the two U.S. indexes edged lower early Friday.

Looking Back At Samvat 2079

Nifty rose 10.30% in Samvat 2079, whereas Sensex scaled 9.26%. Nifty Realty and Nifty Auto were the top gainers in the Samvat gone by. Nifty Realty advanced 54.68% and Nifty Auto gained 27.99%.

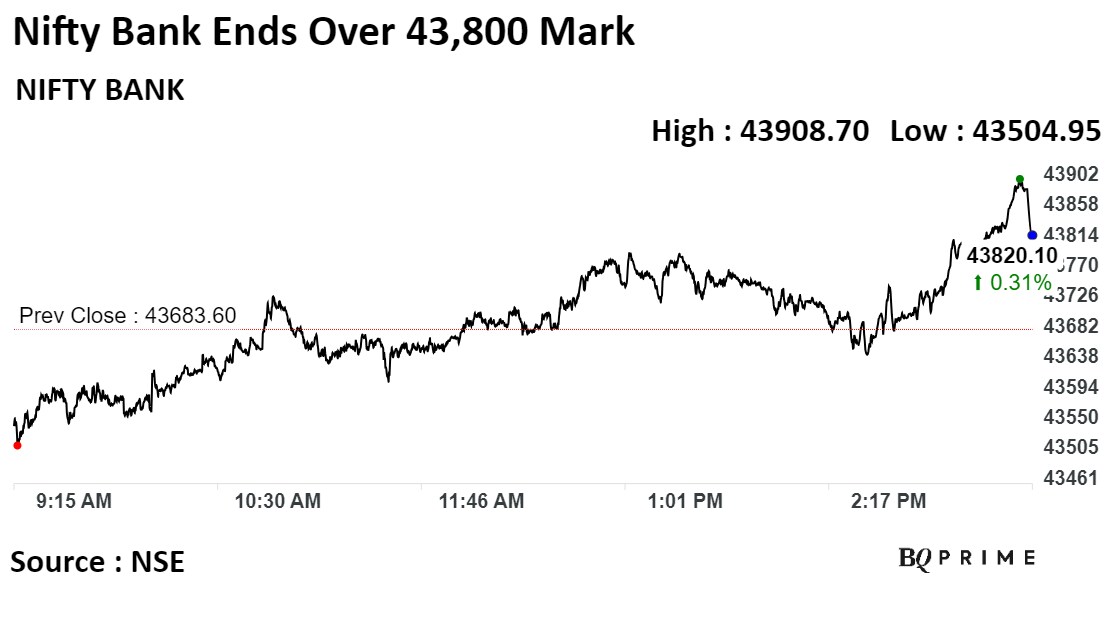

"In Samvat 2080, financials are likely to do well, supported by attractive valuations and impressive growth," said Dr Vijayakumar.

Sustained FII selling in financials, which is impacting the sector, will be only temporary. For investors with a two-year time horizon, the leading private banks and three or four PSU banks are good buys with return potential, he added.

HDFC Bank Ltd., NTPC Ltd., Axis Bank Ltd., ITC Ltd. and Bajaj Finance Ltd. were positively adding to the changes in the Nifty 50.

Mahindra & Mahindra Ltd., Infosys Ltd., Tata Consultancy Services Ltd., HCL Technologies Ltd., and Titan Co. were negatively contributing to the change.

The indices advanced for the second time on Friday. The S&P BSE Sensex rose 0.84% and NSE Nifty 50 was higher by 1.01% this week.

Last week, the headline indices snapped two weeks of losses as the S&P BSE Sensex rose 0.91% and NSE Nifty 50 advanced by 0.96%.

Most sectors advanced this week with Nifty Pharma index gaining over 4%, followed by Nifty Realty and Nifty Metal.

The broader markets outperformed; the S&P BSE MidCap index was up 0.33%, whereas S&P BSE SmallCap index was 0.38% higher.

Thirteen out of the 20 sectors compiled by BSE Ltd. advanced, while seven declined. S&P BSE Utilities and S&P BSE Power rose the most. S&P BSE Auto fell the most.

The market breadth was skewed in the favour of buyers. About 1,924 stocks rose, 1,764 declined, while 132 remained unchanged on the BSE.

The Nifty Smallcap 250 gained 35.07%, whereas the Nifty Midcap 150 was up 30.27% in Samvat 2079. "The mid and small-cap rally is partly driven by retail exuberance and since the valuations in this broader market is high, investors have to exercise some caution," said Dr Vijayakumar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.