Volatility has returned to the Indian market after it saw some stability last week. Sensex and Nifty 50 began the new financial year with a gap-down open followed by some recovery on Tuesday, before a fresh round of selloff that pushed the two indices as low as 1.5%. The indices were dragged down by weakness in IT and private banking shares.

Nifty 50 fell as much as 1.47% to 23,173.10 and Sensex was down 1.72% to 76,081.80. Volatility index VIX had risen over 10% just before midday.

This comes after the indices posted a positive return for the second straight fiscal. Nifty rose over 6.99% in financial year 2025 and Sensex was up 6.78% indicating an over 10% recovery from its lowest point in fiscal 2025.

Trump Tariffs Round The Corner

Market volatility aligns with analyst and market expectations regarding uncertainty over the impact of US tariffs on domestic economy and global trade.

"Potential tariff announcements and their economic fallout remain key concerns influencing sentiment," said Krishna Appala, senior research analyst, Capitalmind Research. These tariffs could trigger a wider global trade conflict, including implications for India. Investors are cautious about how the new reciprocal tariffs might impact global trade, including India, potentially escalating the trade war.

While India and the US are negotiating a trade deal to minimise the impact, no final agreement has been reached. The latest reports suggest that talks are progressing well, and both nations are nearing a favorable deal.

However, the absence of an official announcement has left traders, particularly retail investors, anxious about how Dalal Street will react once the reciprocal tariffs take effect.

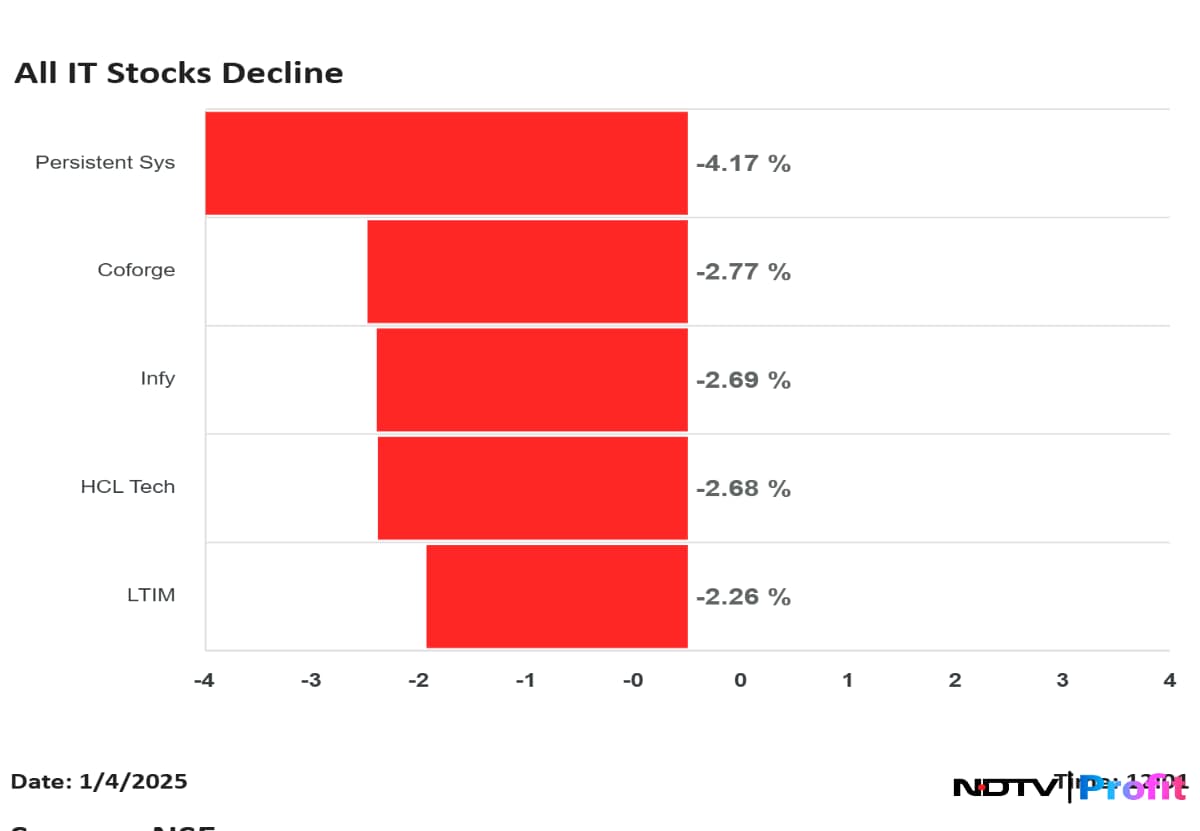

Tech Stocks Weigh

US President Donald Trump's tariff announcements on April 2 is expected to impact the IT demand and also bring down the market sentiment. This uncertainty pulled the Nifty IT index down nearly 3%.

Infosys Ltd. was the worst Nifty performer after it fell 3.36% to Rs 1,517.85 apiece, while Persistent Systems Ltd. was the worst performer in the Nifty IT index. HCL Technologies Ltd., Tata Consultancy Servives Ltd. and Tech Mahindra Ltd. were also down over 2%.

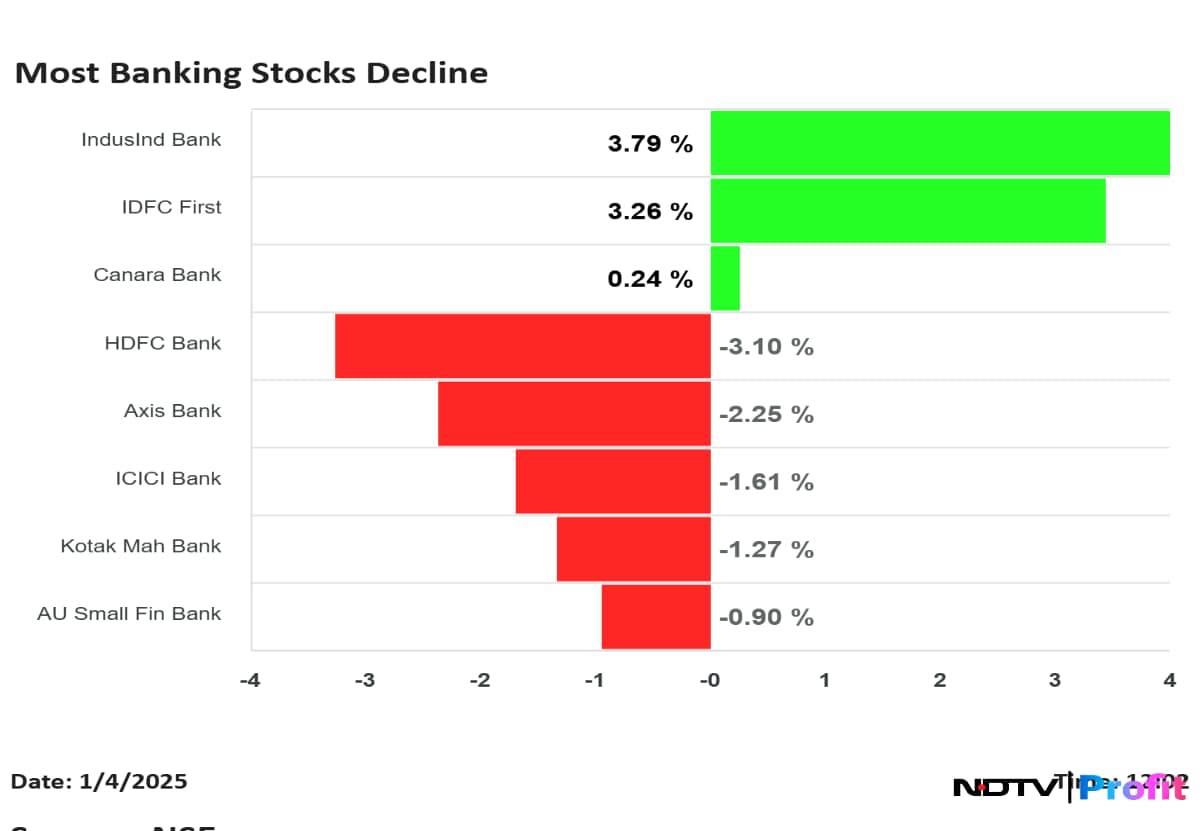

Bank Stocks Take A Hit

Private lenders were also on the receiving end, with HDFC Bank Ltd. declining the most. HDFC Bank and Axis Bank Ltd. fell nearly 3% each. Financial stocks Bajaj Finance Ltd. and Bajaj Finserv Ltd. have also fallen 2% each.

Nifty PSU index also declined after seeing some recovery. The decline was led by Punjab & Sind Bank and UCO Bank.

FIIs Selling Resumes

The foreign institutional investors turned net sellers on Friday after a brief buying streak. The FPIs have offloaded equities worth Rs 4,352.82 crore on Friday after it bought shares worth Rs 32,488.69 crore. So far in March, the FPIs have net offloaded equities worth Rs 3,973 crore, according to the National Securities Depository Ltd.'s data.

Mixed US Markets

Wall Street ended mixed on Monday with the S&P 500 and the Dow Jones Industries Average ending in green. On the other hand, tech heavy Nasdaq index closed in the red. For the first quarter the S&P 500 and the Nasdaq Composite posted their worst quarterly performance since 2022. In addition, both the benchmarks posted their biggest monthly percentage drop in over two years.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.