SBI Cards and Payment Services Ltd. shares fell over 6% on Monday after a fall in net profit in the first quarter of the current fiscal.

The bottom line fell 6.5% to Rs 556 crore in the June quarter, compared to Rs 594 crore in the year-ago period. Provision expense rose 23% year-on-year and 9% sequentially to Rs 1,351 crore.

Asset quality ratios were stable. Gross NPA was 3.07% compared to 3.08% in the previous quarter. Net NPA was flat at 1.42%.

Spends soared 21% to Rs 93,244 crore, supported by continued revival in corporate spends and some pickup in retail spends. Receivables rose 7% to Rs 56,607 crore.

The results came on Sunday, July 27.

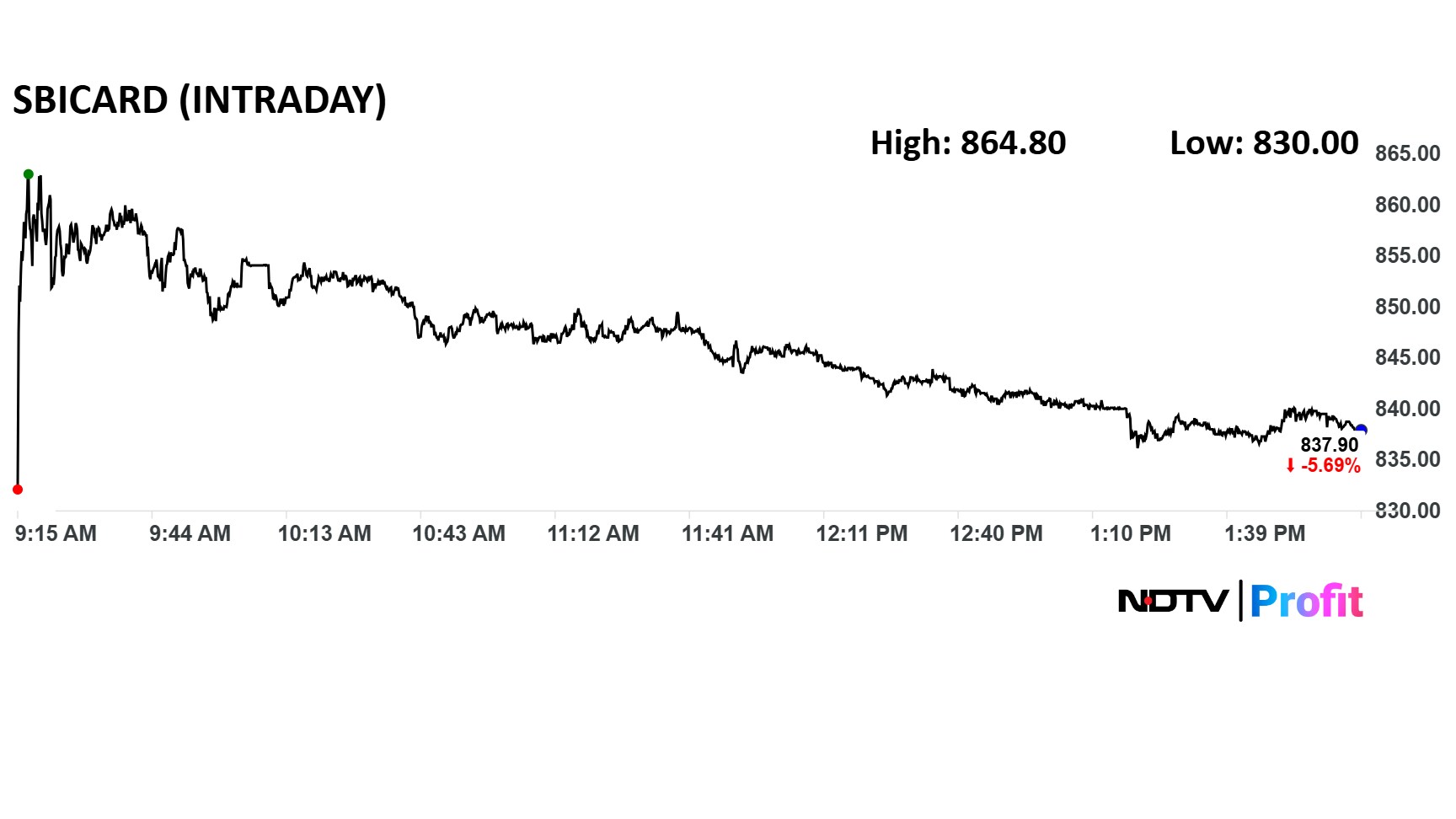

SBI Cards Share Price Movement

SBI Cards' share price declined 6.6% intraday to Rs 830 apiece.

SBI Cards' share price declined 6.6% intraday to Rs 830 apiece. The scrip was trading 5.7% lower by 2:10 p.m. The benchmark NSE Nifty 50 was down 0.6%. The total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 41.

The stock has risen 26% in the last 12 months and 16% on a year-to-date basis.

Seven out of the 29 analysts tracking SBI Cards have a 'buy' rating on the stock, 10 recommend a 'hold,' and 12 suggest a 'sell,' according to Bloomberg data. The average 12-month analyst price target of Rs 880 implies a potential upside of 5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.