SBI Cards and Payment Services Ltd.'s net interest margin can compress further as funding costs remain high, availability of funds becomes a challenge and ability to pass on rate increases remains limited, according to brokerages.

While the credit card company tries to consolidate and clean-up its portfolio and stays cautious on customer acquisition, its market share in cards-in-force would continue to decline, HSBC Global Research said in a note. "This would also impact its spend market share eventually."

SBI Cards' fourth-quarter profit increased 11% year-on-year to Rs 662.4 crore for the quarter-ended March, surpassing analysts' estimates.

SBI Cards Q4 FY24 Earnings Highlights

Total income up 14% at Rs 4,474.6 crore. (YoY)

Net profit up 11% at Rs 662.4 crore (Bloomberg estimate: Rs 577.7 crore). (YoY)

GNPA expands 12 basis points to 2.76% (QoQ).

Net NPA expands 2 bps to 0.99% (QoQ).

Here's What Brokerages Say

HSBC Global Research

HSBC Global Research downgraded the stock to 'reduce' from 'hold' as the research firm sees multiple headwinds to its earnings.

It has cut the target price to Rs 650 from Rs 740 apiece, implying a potential downside of 14.26%.

Management guided for elevated credit costs for the first half of fiscal 2025. Asset-quality outlook remains uncertain after that too. Any pick-up in stress in unsecured loans would keep the credit costs elevated.

The earnings cut is led by moderation in the NIM as HSBC builds in a 'higher for longer view'.

The research firm also revised the credit-cost estimate to 7.6%, 7% and 6.4% for fiscal 2025, 2026 and 2027 from 7.25%, 7% and 6.7%.

SBI Cards' market share in cards in force declined in the fourth quarter as it discontinued inactive cards or ones which did not meet the know-your-customer requirements.

Nomura

Nomura maintains a 'reduce' rating on SBI Cards with a target price of Rs 640 apiece.

The improved performance was mainly driven by declining operating expense due to moderation in corporate spends and non-festive quarter.

Potential rate cut in the second half of fiscal 2025, if any, would be a catalyst for profitability improvement but in fiscal 2026 only.

Lower card addition in recent quarters may negatively impact growth in spends as retail spends per card continues to plateau ahead.

Growth in rental spends has come down, in line with the research firm's expectation and is trending at roughly half of retail spends growth.

Asset quality woes continued as credit cost and write-offs inched up to 7.9% and 6.9% respectively.

Expects credit cost to remain elevated at 7.3% in fiscal 2025.

Lower recent card additions may negatively impact spending growth.

Profitability to remain under pressure in fiscal 2025.

Cuts earnings-per-share estimates by 4% and 1% fiscals 2025 and 2026.

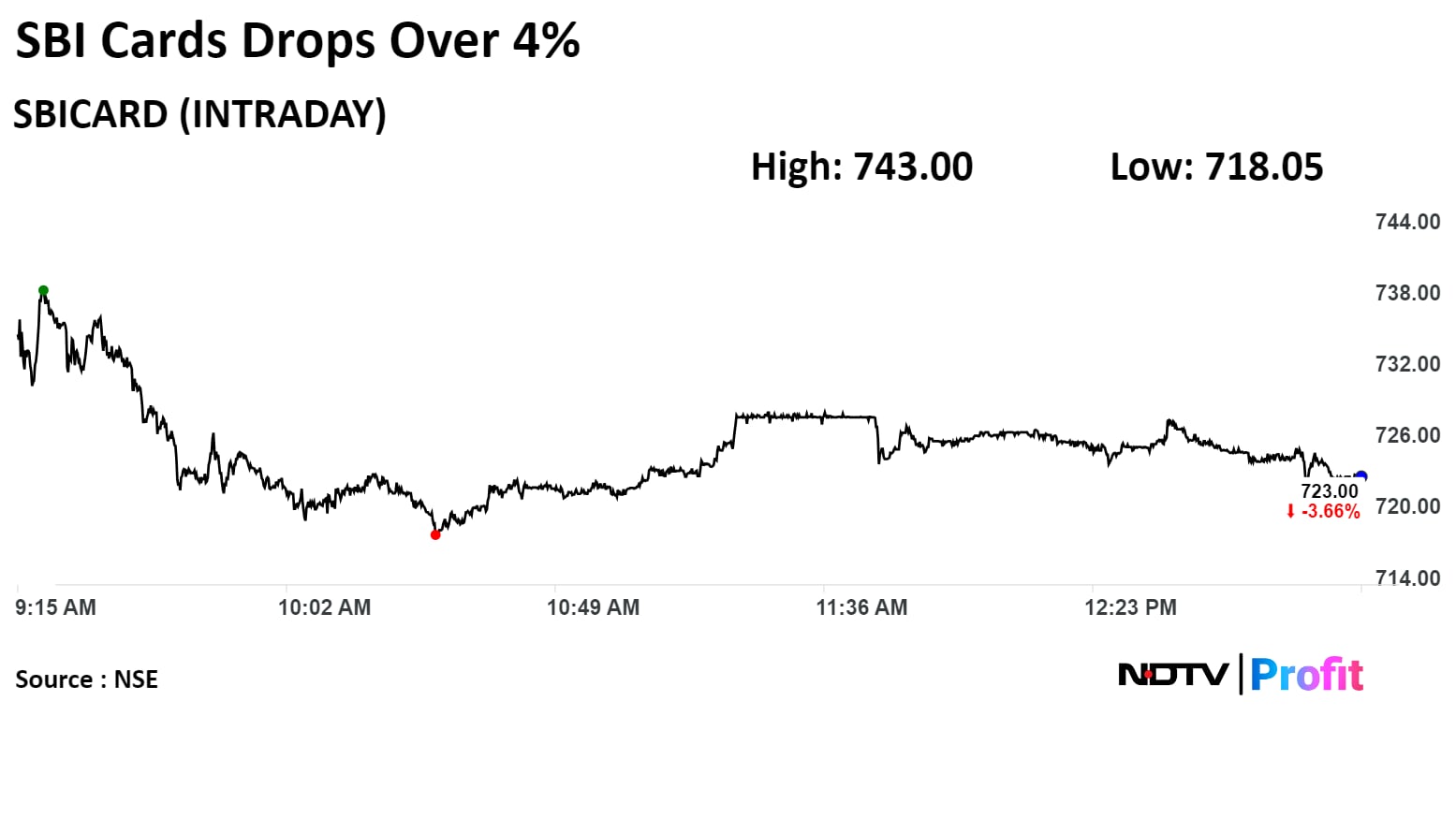

SBI Cards' stock declined as much 4.32% during the day to Rs 718.05 apiece on the NSE. It was trading 5.68% lower as compared to a 0.65% advance in the benchmark Nifty 50 as of 1:10 p.m.

The share price has fallen 7.41% in the last 12 months and 4.83% on a year-to-date basis. The total traded volume so far in the day stood at five times its 30-day average. The relative strength index was at 48.28.

Out of 29 analysts tracking the company, eight maintain a 'buy' rating on the stock, as many recommend 'hold' and 13 suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.