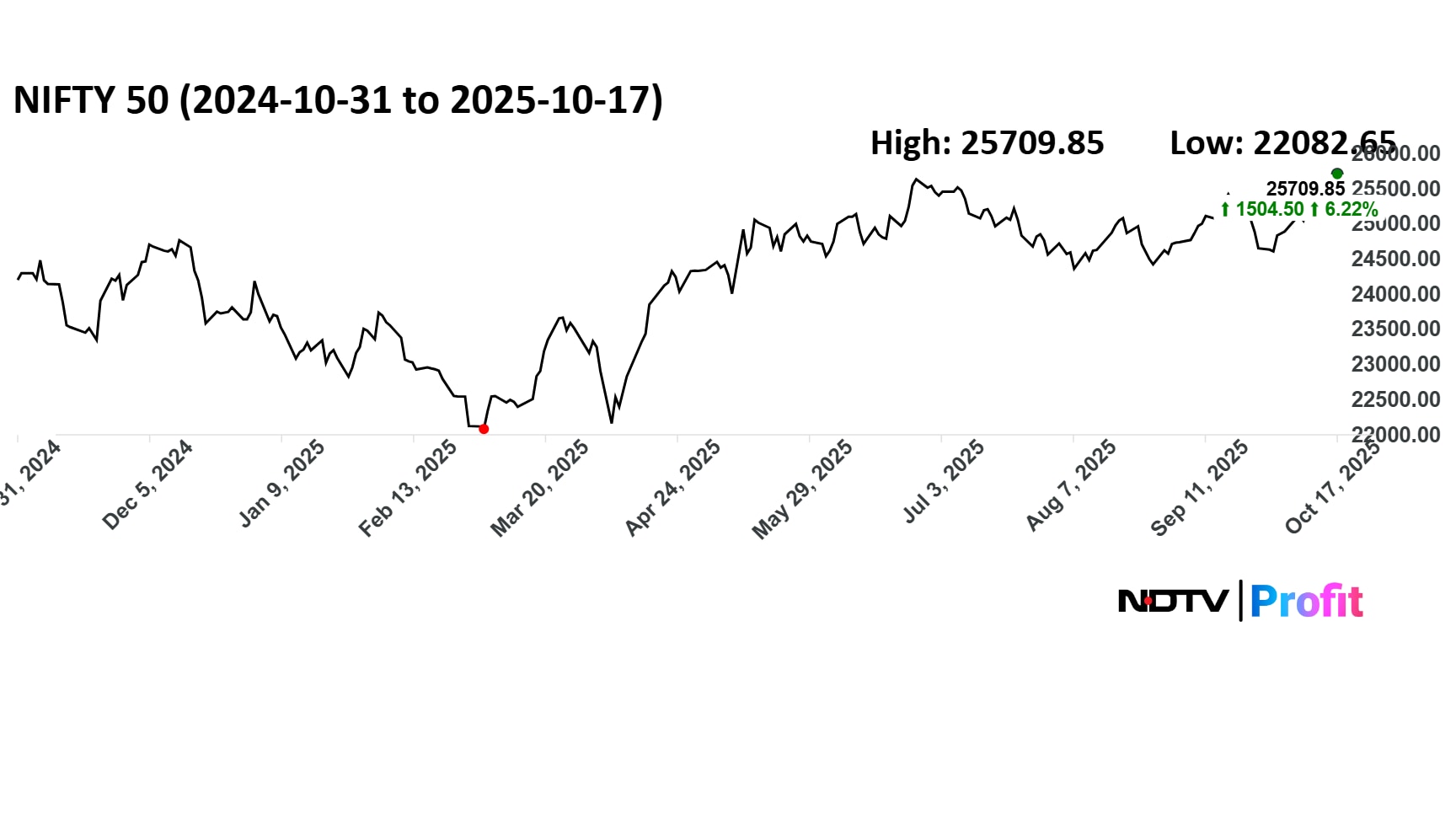

Samvat 2082 has arrived and India's stock market is poised to maintain its momentum. From last Diwali, the market has shown a mixed to positive trend for the period. The benchmark Nifty 50 index delivered a moderate return of 6%. The Nifty Bank was the standout performer among the major indices, posting a strong gain of 12%.

The Nifty Midcap100 also ended in positive territory with a 5% gain. However, the smaller-cap segment underperformed significantly, with the Nifty Smallcap 250 declining by 4%. Notably, both the Nifty and Sensex are closing in on their life highs touched in September 2024.

Sectoral Performance

Sectoral indices exhibited considerable divergence. Nifty Auto (16%) and Nifty PSU Bank (14%) were the top-performing sectors, followed by Nifty Metal (9%). On the losing side, the performance of defensive and global-facing sectors was notably weak.

Nifty IT (-13%) and Nifty Energy (-10%) were the biggest laggards. Other declining sectors included Nifty Realty (-6%), Nifty FMCG (-4%), and Nifty Pharma (-2%).

Within the high-performing sectors, key gainers were Maruti Suzuki (48%) in Auto, Indian Bank (32%) in PSU Bank, and Lloyds Metals and Energy (36%) in Metal.

The weaker sectors also saw sharp individual stock movements. For example, the declining Nifty IT index was dragged by Tata Consultancy Services (-25%), while Coforge (14%) provided some positive outliers.

Similarly, in the negative Nifty Pharma index, Laurus Labs (83%) was a major outperformer, contrasting sharply with laggards like Piramal Pharma (-28%). The Nifty FMCG drop was driven by losses in Colgate Palmolive (-25%) and Varun Beverages (-23%).

Top Nifty 50 Performers, Laggards

The Nifty 50 index saw strong performance from finance and auto stocks. Bajaj Finance led the pack with a staggering 55% gain, followed by Maruti Suzuki (48%), Bharat Electronics (45%), InterGlobe Aviation (44%), and Eicher Motors (44%).

During the same period, the top Nifty losers were led by Trent (-32%), followed by major IT stocks Tata Consultancy Services (-25%) and Infosys (-18%), Tata Motors (PV) (-21%), and NTPC (-16%).

Midcap And Smallcap

In the Nifty Midcap Index, finance and exchange stocks dominated the gainers' list: L&T Finance (82%), Fortis Healthcare (74%), Muthoot Finance (72%), One 97 Communication (69%), and BSE (67%). The midcap losers included Sona BLW (-33%), Tata Technologies (-32%), Tube Investments (-30%), RVNL (-30%), and IndusInd Bank (-29%).

The Nifty Smallcap Index saw the highest individual gains, with Ather Energy shares soaring by 129% and Force Motors by 123%. Authum Investment (91%), Laurus Labs (83%), and Mannapuram Finance (81%) were also top performers.

However, small-cap volatility was also evident among the losers: Tejas Networks (-56%), Praj Industries (-54%), Vedant Fashion (-51%), Akum Drugs (-45%), and Brainbees Solution (-42%) saw significant declines.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.