Samsung’s Profit Triples On Supercharged AI Memory Market

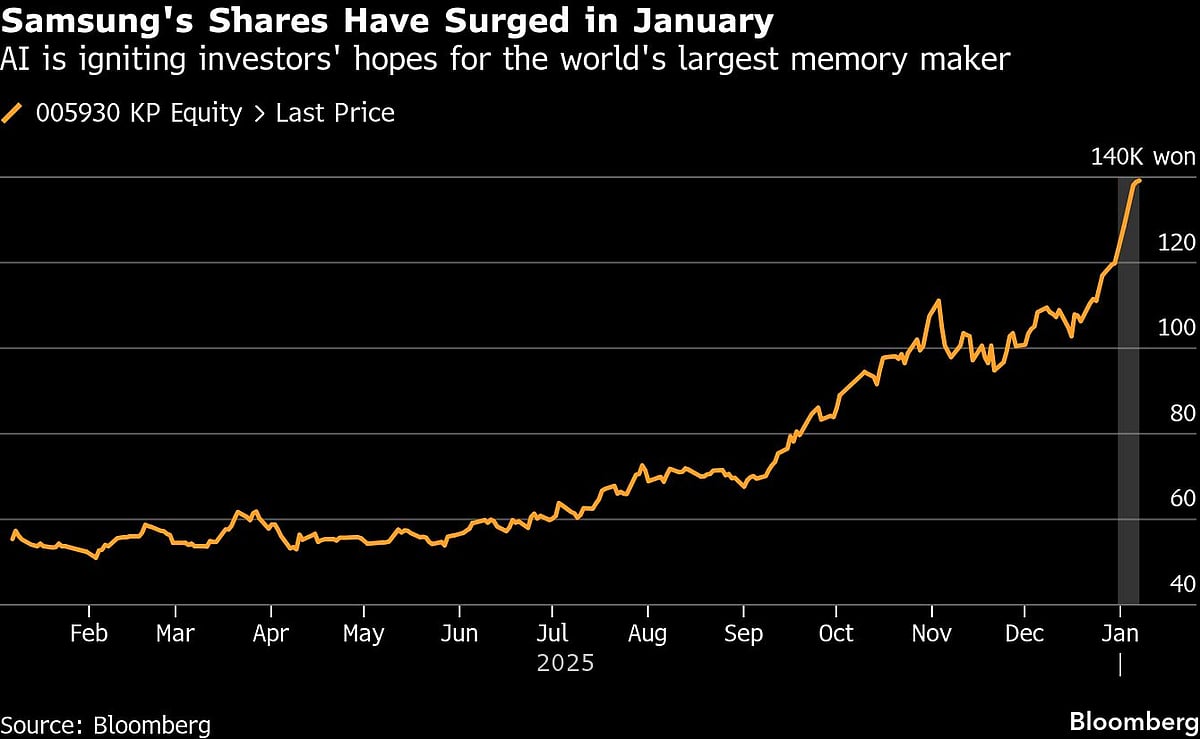

Samsung’s shares have more than doubled in value in 2025 and surged again this month.

Samsung Electronics Co.’s quarterly profit more than tripled to a record high after global demand for AI servers sharply lifted memory chip prices.

South Korea’s largest company reported a preliminary operating profit of 20 trillion won ($13.8 billion) in the three months through December, up 208% and beating the average analyst estimate. Revenue rose 23% to 93 trillion won, also a record. Its shares slid 1.6% in pre-market trade on Nextrade on Thursday, following an 18% gain so far this year.

Memory makers like Samsung are diverting production away from everyday tech to build more lucrative high-end chips for AI giants like Nvidia Corp. amid a global rush to rollout massive data centers. That’s created a severe shortage in standard memory for laptops and servers, causing prices for both DRAM and NAND to surge.

“Hyperscalers and cloud providers are buying a lot of DRAM and they are willing to pay a price premium,” said Sanjeev Rana, head of research at CLSA Securities Korea.

Average selling prices of DRAM jumped more than 30% sequentially in the December quarter, while those of NAND rose about 20%, he said, adding that prices are likely to remain very strong throughout 2026 and possibly through the first half of 2027. “Even after that, we may not see much correction because demand is just too strong and supply is tight,” he said.

Samsung’s shares have more than doubled in value in 2025 and surged again this month, reflecting hopes for a blowout year after rival Micron Technology Inc. gave an upbeat forecast. More than 10 analysts tracked by Bloomberg raised their target price for Samsung in the past week alone.

Memory is required in new arenas including humanoids and driverless cars, while devices touting AI capabilities are also contributing to soaring demand for DRAM and NAND, said Jeff Kim, head of research at KB Securities Co.

“It’s too early to talk about demand peak-out,” he said. “Investors should buy and hold memory stocks. If the stocks fall after the 20 trillion won earnings figure, it’s an opportunity to buy.”

The company will provide a full financial statement with net income and divisional breakdowns on Jan. 29.

This week, Samsung executives at the CES trade show stressed the scope of the memory chip supply crunch, with President Wonjin Lee saying consumer electronics prices are already rising and “there’s going to be issues around semiconductor supplies.”

Counterpoint Research forecasts a 40% price rise for DDR5 — the latest generation of conventional DRAM used in computers and servers — in the current quarter compared with the prior three months, followed by an additional 20% growth in the second quarter.

Samsung, which has trailed SK Hynix Inc. and Micron high-bandwidth memory, delivered its cutting-edge HBM4 samples to Nvidia last year for qualification testing. That’s raised hope that Samsung may be able to close the gap with its rivals in a race to begin mass production in the first half of this year to support Nvidia’s upcoming Rubin processors. CLSA’s Rana expects Samsung’s total HBM shipments to triple in 2026 as HBM4 enters commercial supply.