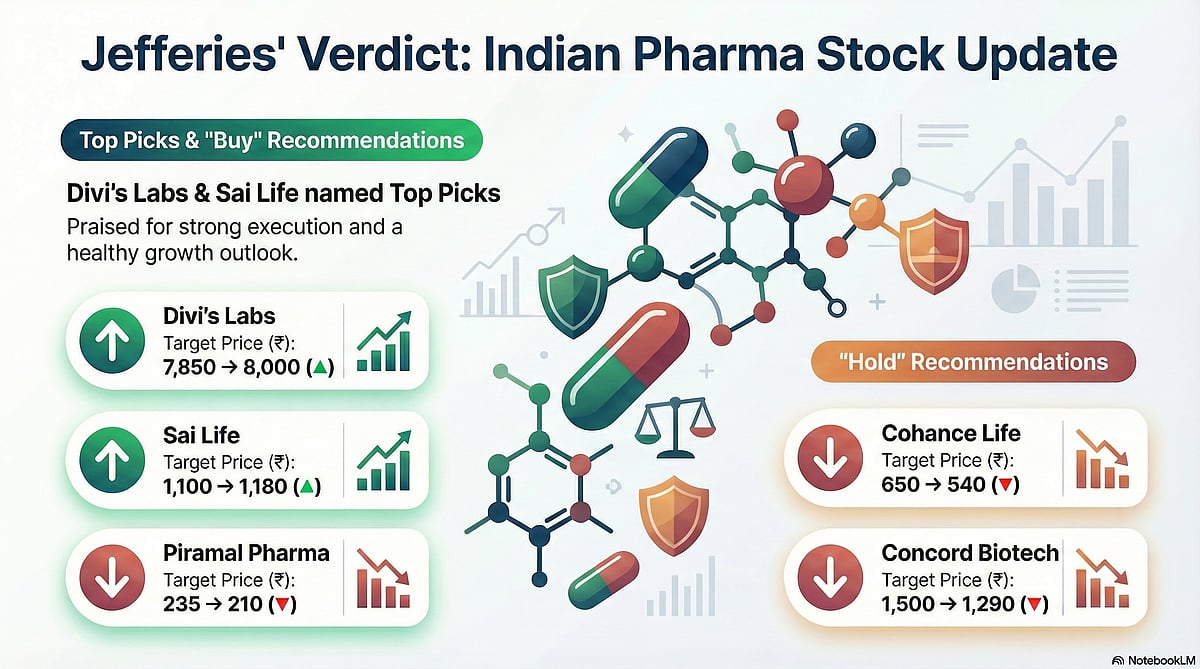

Sai Life, Divi's Labs Emerge As Jefferies' Top Picks In CRDMO; Piramal Pharma, Cohance See Target Price Cut

Jefferies highlighted long-term growth prospects for these stocks, though it advises short-term selectivity.

The pharma pack will be in focus heading into trade on Friday after Jefferies' latest note that witnessed target price hikes for key stocks such as DIvi's Laboratories, Sai Life Science while Piramal Pharma, Cohance saw their price targets cut.

In its latest note, the brokerage firm has come out with a note on companies that are involved in contract research, development, and manufacturing organisation (CRDMO) space.

Jefferies highlighted long-term growth prospects for these stocks, though it advises short-term selectivity.

It noted that 2025 was a difficult year for the CRDMO space owing to destocking challenges.

But looking ahead, 2026 is expected to be a mixed year, with volatility from patent expiries and destocking uncertainties likely coming into play.

However, Jefferies believes the passage of the Biosecure Act will boost mid-to-long-term growth prospects for the industry. It also believes a soft base will kick in H2CY26 for most names and improve growth optics

Keeping that in mind Jefferies has raised target price for Divi's Labs, from an earlier target of Rs 7,850 to a fresh target of Rs 8,000 while maintaing a 'buy' rating on the counter.

The firm has also retained a 'buy' call on Sai Life, hiking target price from Rs 1,100 to Rs 1,180. Jefferies also maintained a 'buy' on Piramal Pharma, but has cut target price from Rs 235 to Rs 210.

The brokerage has maintained 'hold' in both Cohance Life and Concord Biotech. Target price for Cohance was cut from Rs 650 to Rs 540 while Concord's new target price stands at Rs 1,290, down from Rs 1,500 earlier.

Jefferies' top picks in the CRDMO space are Sai Lifesciences and Divi’s for strong execution and healthy growth outlook.

Jefferies' update on CRDMO stocks. (Photo: Notebook LM)