- Shares of Sagility India Ltd rose 5% amid a promoter stake sale worth Rs 3,600 crore

- Promoters plan to sell 469 million shares at a floor price of Rs 46.40 per share

- Sagility BV holds 67.38% stake and will face a 180-day lock-up after the deal

The shares of Sagility India Ltd. rose 5% as the promoters of the company look to offload stake worth Rs 3,600 crore via open market transactions.

According to Bloomberg, 17% of the technology-enabled healthcare services company, has traded on Friday in 11 block deals. However, details of buyers and sellers could not be confirmed.

Sagility BV will offload 469 million equity shares under the base offer of up to Rs 2,176 crore, with an upsize option of 300 million shares worth Rs 1,392 crore, according to a termsheet accessed by NDTV Profit.

The floor price is set at Rs 46.40 per share, an 8% discount to Thursday's closing price of Rs 50.44 on the NSE.

IIFL Capital Services Ltd. is the sole broker and placement agent in the deal.

The promoter will be subject to a 180-day lock-up of remaining equity after the block deal. Sagility BV held a 67.38% stake as of September, after paring its stake from over 82% earlier this year. The company is owned by New York-based private equity firm EQT Capital.

Foreign investors have a shareholding of 5.59% in Sagility, while domestic institutions own 14.88%.

The company offers technology-enabled services to US health insurance companies (payers) and healthcare providers like hospitals and physicians.

Sagility reported a 25% year-on-year rise in consolidated revenue at Rs 1,659 crore in the September quarter. Net profit jumped 84% to Rs 301 crore. It announced an interim dividend of Rs 0.05 per share for FY 26.

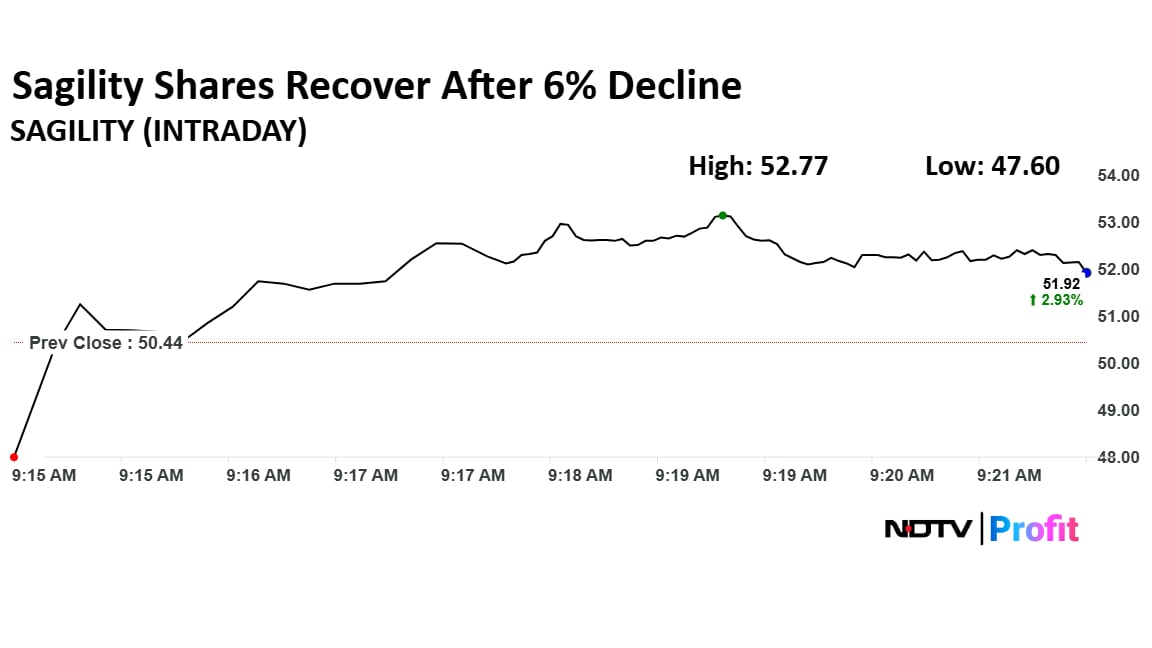

Sagility Share Price Today

The scrip rose as much as 4.62% to Rs 52.77 apiece on Friday after it fell 5.63% to Rs 47.60 just after market open, as of 9:26 a.m. This compares to a 0.31% decline in the NSE Nifty 50 Index.

It has risen 82.92% in the last 12 months and 3.63% year-to-date. Total traded volume so far in the day stood at 54.60 times its 30-day average. The relative strength index was at 62.42.

All seven analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target of Rs 63.86 implies an upside of 26.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.