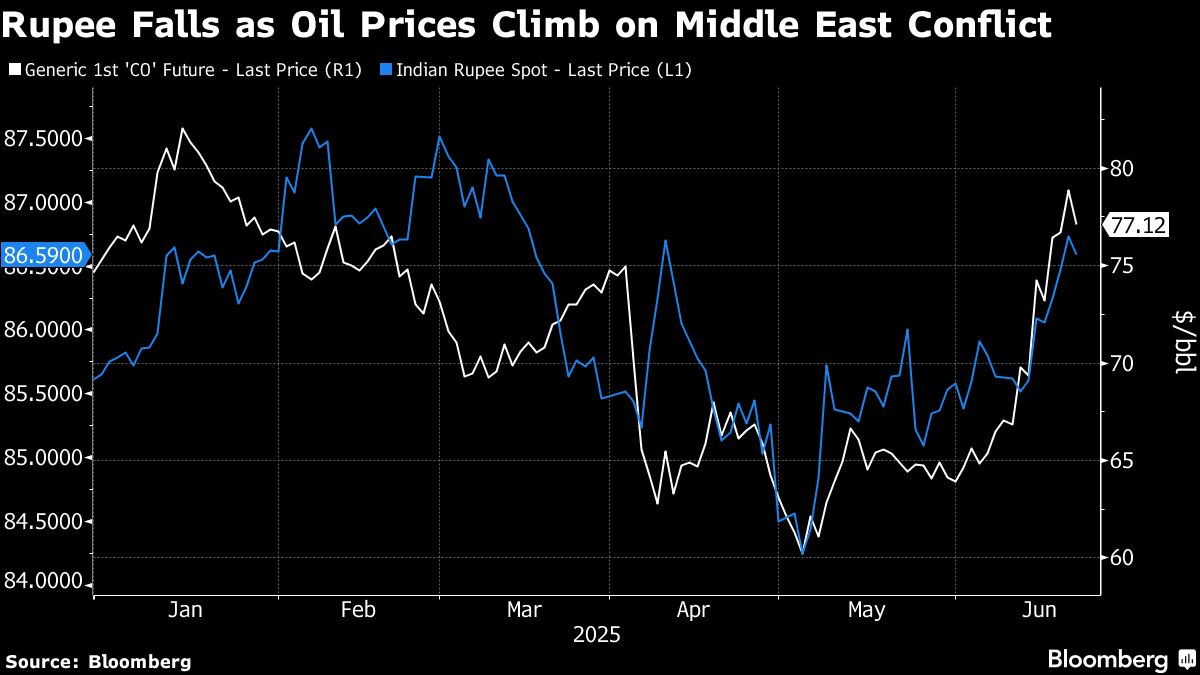

The Indian rupee's decline against the dollar is pushing it closer to a critical threshold, raising expectations that the nation's central bank may step in to stabilize the currency as global tensions mount.

The Reserve Bank of India is likely to intervene if the rupee weakens further toward 87 per dollar, according to Australia & New Zealand Banking Group Ltd. and MUFG Bank Ltd. The Indian unit is the worst hit Asian currency this quarter, weighed by surging oil prices.

While most emerging-market currencies have come under pressure since tensions flared up between Iran and Israel this month, the rupee is particularly vulnerable. India is the world's third-biggest importer of crude oil and rising prices put upward pressure on its current account deficit and inflation outlook.

“The 87 level is very much on the cards if the Middle East tensions rise and the crisis becomes a regional one,” said Dhiraj Nim, currency strategist at ANZ. “That would be tantamount to a shock, and the RBI won't like that. The RBI won't be comfortable with anything beyond 87 per dollar.”

The currency weakened to its lowest level in three months last week, before partially recovering to close at 86.59 Friday. A fall beyond 87 — a key level last breached in February — could potentially trigger sharper volatility, affect capital flows, and have broader implications for inflation and monetary policy.

The rupee's relatively unchecked slide since this year's high in May suggests the central bank has largely refrained from heavy intervention, allowing the market to absorb external shocks. That reflects a more hands-off approach it has adopted since Sanjay Malhotra took over as Governor in December.

“If there are quick and volatile one-sided moves toward key levels, the RBI will likely be more aggressive. 87 will be the first one to watch,” said Michael Wan, senior currency analyst at MUFG Bank. “The magnitude of intervention should still be smaller than under the previous governor on average.”

A sharper or prolonged decline in the rupee risks feeding into inflation just as policymakers aim to anchor price expectations and preserve room for more policy easing to support growth. Adding to the strain, foreign investors have been pulling their investments out of India's debt market and any further weakness in the currency may exacerbate the outflows.

“The rupee is one of the most sensitive currencies in the region due to higher oil prices,” said Mitul Kotecha, an FX strategist at Barclays Bank Plc. “Combined with ongoing foreign portfolio outflows and potential increased onshore importer demand, this has resulted in increased pressure on the rupee.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.