The Indian rupee ended at over three-week high against the US dollar on Tuesday, strengthening for the third straight session as banks persistently sold the greenback on account of foreign fund inflows.

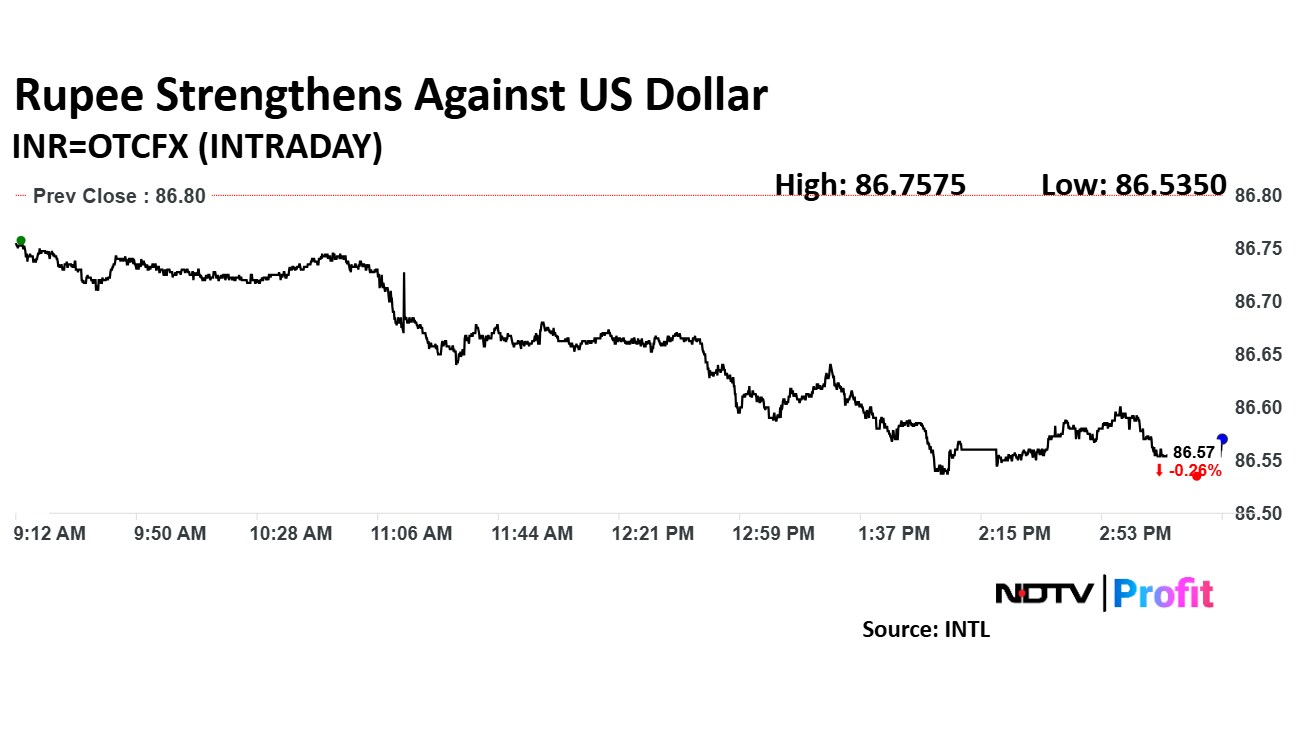

The local currency ended 23 paise higher at 86.57 against the US dollar, according to Bloomberg data. It opened six paise higher at 86.74.

During the session, the rupee strengthened 26 paise to 86.54, which is the highest level since Feb 21. The currency also breached the short-term resistance level of 86.60 a dollar in the session.

The domestic unit had ended at 86.80 a dollar on Monday as India reported a $14.05 billion merchandise trade deficit against an expectation of $21.35 billion in February.

State-run firms like REC Ltd., NTPC Ltd. and Canara Bank are set to raise Rs 14,000 crore at the start of the week, while Indian states mobilised another Rs 40,100 crore through a debt sale on Tuesday. Even non-banking financial companies are stepping up, issuing Rs 16,400 crore, far above the usual weekly threshold of Rs 10,000 crore, according to Amit Pabari, managing director of CR Forex Advisors.

The US dollar index regained some ground in the Asia session, which limited gains in the Indian unit. The index rose as worries about the US recession subsided after retail sales data. In the European session, the DXY went back in the red as the euro and pound sterling strengthened. As of 3:37 p.m., the dollar index was trading 0.09% down at 103.28.

The euro has hit a five-month high on hopes of a fiscal deal in Germany, Reuters reported. Germany's Chancellor-in-waiting Friedrich Merz said they received support from the Greens for their 500-billion euro fund to bolster Europe's largest economy.

Foreign portfolio investors seem to be investing in debt on expectation of a rate cut again in April. Tuesday was the second open-market-operation purchase from the Reserve Bank of India, providing liquidity to the market. The dollar-rupee buy-sell swap is on March 24, according to Anil Bhansali, executive director of Finrex Treasury Advisors LLP.

Crude oil future prices topped $72-a-barrel mark as tension in west Asia escalated. Israel launched military strikes at Gaza after two and half months of ceasefire, Bloomberg reported. As of 3:38 p.m., crude oil price was 1.36% higher at $72.04 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.