The Indian rupee extended its record fall but ended flat on Tuesday as foreign outflows and domestic growth concerns, coupled with Donald Trump's threat on the BRICS countries, weighed on the currency.

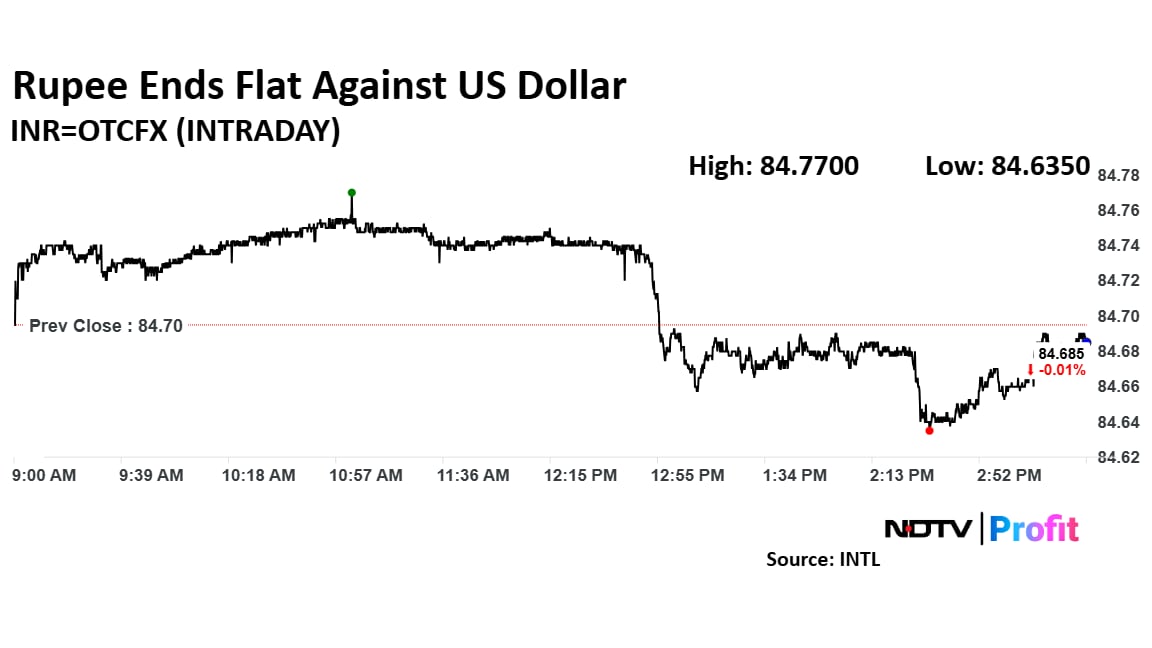

The rupee closed flat at 84.69 after hitting a record low of 84.75, according to Bloomberg data. The local unit closed at 84.7 against the greenback on Monday.

The currency continued its fall after India's economic growth grew at the slowest pace in nearly two years, adding pressure to the central bank policy meeting due later this week. The gross domestic product grew 5.4% in the July-September quarter, compared to 6.7% in the April-June quarter.

The Indian currency was also weighed down by a continued outflow of domestic stocks. The FPIs offloaded stocks worth approximately Rs 238.3 crore on Monday after having sold stocks over Rs 21,600 crore in November, according to data on National Securities Depository Ltd.

Political instability in the Eurozone has further fuelled the dollar index's rise to 106.24. Marine Le Pen pledged to topple Prime Minister Michel Barnier's government after he failed to meet her demands on a new budget.

The RBI has been proactive in curbing rupee depreciation by selling dollars from its reserves, according to Amit Pabari, managing director, CR Forex Advisors. "The current situation is more complex, as aggressive FII outflows and continuous dollar sales by the RBI have triggered a liquidity crunch in the banking system."

Technically, 84.50 is a critical support level for USD/INR, Pabari said. "Unless the rupee decisively breaches this threshold, it is likely to remain under pressure in the near term."

Trump demanded a “commitment” from BRICS nations that they will not create a new currency as an alternative, or endorse any other currency to replace the dollar.

“We require a commitment from these countries that they will neither create a new BRICS currency, nor back any other currency to replace the mighty US dollar or, they will face 100% tariffs, and should expect to say goodbye to selling into the wonderful US economy,” Trump said in a social media post on Saturday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.