Goldman Sachs has raised Reliance Industries Ltd.'s target price, citing higher returns from new businesses and a faster turnaround of capex to Ebitda.

The brokerage has reiterated a 'buy' call on the stock and revised the target price to Rs 3,400 apiece in their base case, implying an upside of 16% from their previous target price.

That is because the brokerage sees the company's consolidated returns at an inflection point and estimates that the oil-to-telecom conglomerate's cash return on cash invested, or CROCI, will expand by 270 bps to 12% in FY27, the highest since 2011.

Having frontloaded a large portion of the capex for the retail business, the brokerage estimates retail Ebitda to nearly double again between FY24 and FY27, with the share of consolidated Ebitda increasing to 14.3% in FY27 from 12.4% in FY23, while capex intensity will decline sequentially.

The investment bank expects the high Ebitda growth trajectory of the conglomerate to be sustained in the medium term, driven by retail Ebitda, a 22% Ebitda CAGR in the telecom business, petrochemical margin recovery, and sustained strength in diesel cracks.

Over the past decade, free cash flow has largely remained negative on the back of a series of high capex cycles. The investment firms expect FCF to turn positive in FY25E, with capex likely peaking out in FY23.

Returns inflection has been a key driver for RIL shares outperformance, Goldman Sachs said. "Our analysis suggests that returns have been a key driver of share price performance historically."

Risk-reward is still favourable, and the stronger pipeline of catalysts ahead comes from:

A potential telecom tariff hike in 2H CY24.

Stronger same-store sales growth in retail as new stores fully ramp up.

Potential start of a new energy giga complex in 2HCY24.

Potential value unlocking through a listing of consumer (Jio/Retail) businesses.

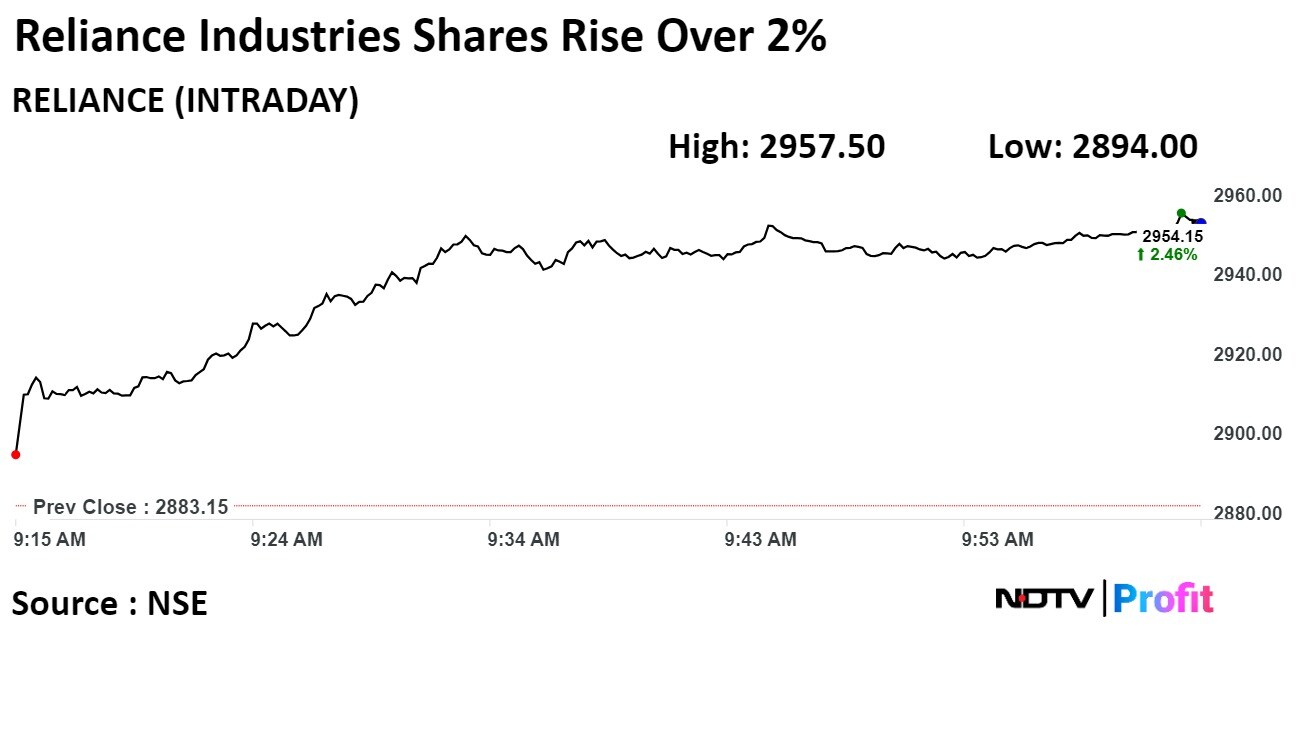

Shares of RIL rose as much as 2.47% during the day to Rs 2,954.4 apiece on the NSE. It was trading 2.38% higher at Rs 2,951.7 per share, compared to a 0.59% advance in the benchmark Nifty 50 as of 10:00 a.m.

The share price has risen 44.8% in the last 12 months. The total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 55.

Twenty nine out of the 35 analysts tracking the company have a 'buy' rating on the stock, four recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 2%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.