Reliance Industries Ltd. share price jumped nearly 3% during early trade on Monday after its second quarter results, which came after market hours last week, met Street expectations.

The oil-to-telecom conglomerate reported a 33% sequential fall in consolidated net profit for the quarter ended September to Rs 18,165 crore. The fall in profit followed an exceptional other income of Rs 15,119 crore in the previous quarter, which included Rs 8,924 crore from the sale of listed investments, the company said.

Other than retail, all other segments reported largely inline set of numbers.

The oil-to-chemicals business posted Ebitda of Rs 15,008 crore, up from Rs 14,511 crore in the preceding quarter. The increase was driven by stronger fuel cracks and improved polymer spreads, partly offset by weaker polyester margins.

The retail business recorded Ebitda of Rs 6,817 crore, compared with Rs 6,381 crore in the June quarter. Festive demand lifted sales across grocery, fashion and consumer electronics.

Reliance Jio Platforms' revenue and profit rose 4%.

Capex jumped to to a 10 quarter high to Rs 40,000 crore.

Analysts at Morgan Stanley said the FY26 guidance was optimistic and the setup for the December quarter "looks very strong, notably retail and fuel refining".

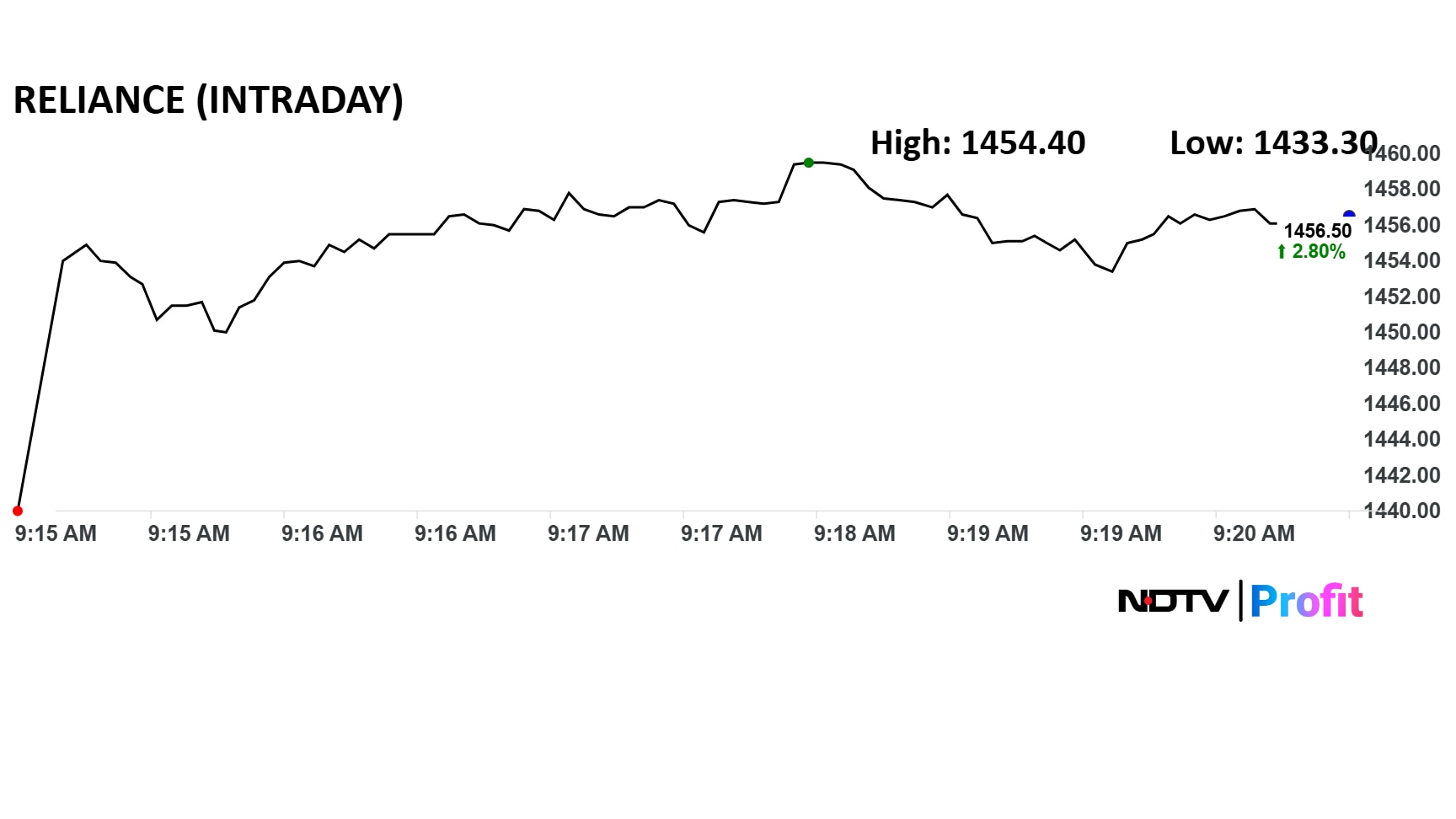

RIL Share Price Movement

Reliance share price advanced over 3% intraday to Rs 1,460 apiece. The benchmark Nifty 50 was up 0.8%. RIL was the lead contributor on the index. The market cap added Rs over 52,000 crore.

The stock has risen 7% in the last 12 months and 20% on a year-to-date basis. The relative strength index was at 58.

Of the 38 analysts tracking RIL, 36 have a 'buy' rating and two have 'sell', according to Bloomberg data. The average of 12-month price targets indicates a an upside potential of 16% over the previous close.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.