UBS Research expects the earnings downgrade cycle of Reliance Industries Ltd. to reverse given the improving outlook for its consumer businesses.

The oil-to-chemical conglomerate's FY24 and FY25 consensus earnings have been revised downward by 19% and 27%, respectively, over the past two years, UBS said in a report on March 21. This was because the performance of its consumer businesses fell short of street's expectations, it said.

However, with the improved earnings visibility of consumer businesses, UBS has reiterated its 'buy' call with a target price of Rs 3,420 per share. This implies a 13% upside from the current market price of Rs 3,902 apiece.

The improvement is primarily due to the increased possibility of tariff hikes and sustained momentum in revenue, UBS said. "Consumer businesses could contribute around 85% of incremental Ebitda over FY24-26."

The Mukesh Ambani-led conglomerate's telecom arm, Reliance Jio's, strong subscriber addition could drive a 20% CAGR in Reliance's Digital Ebitda over FY24–26. Vodafone Idea Ltd.'s potential successful fundraise would incentivise Jio and Bharti Airtel Ltd. to increase their tariffs.

With improvements in discretionary spending, favourable raw material prices, and a focus on driving premium products, the brokerage has raised Reliance Retail's FY26 Ebitda estimates by 6%.

UBS believes that improving earnings could generate sufficient free cash to fund planned investments and reduce debt by $10 billion over the next two years.

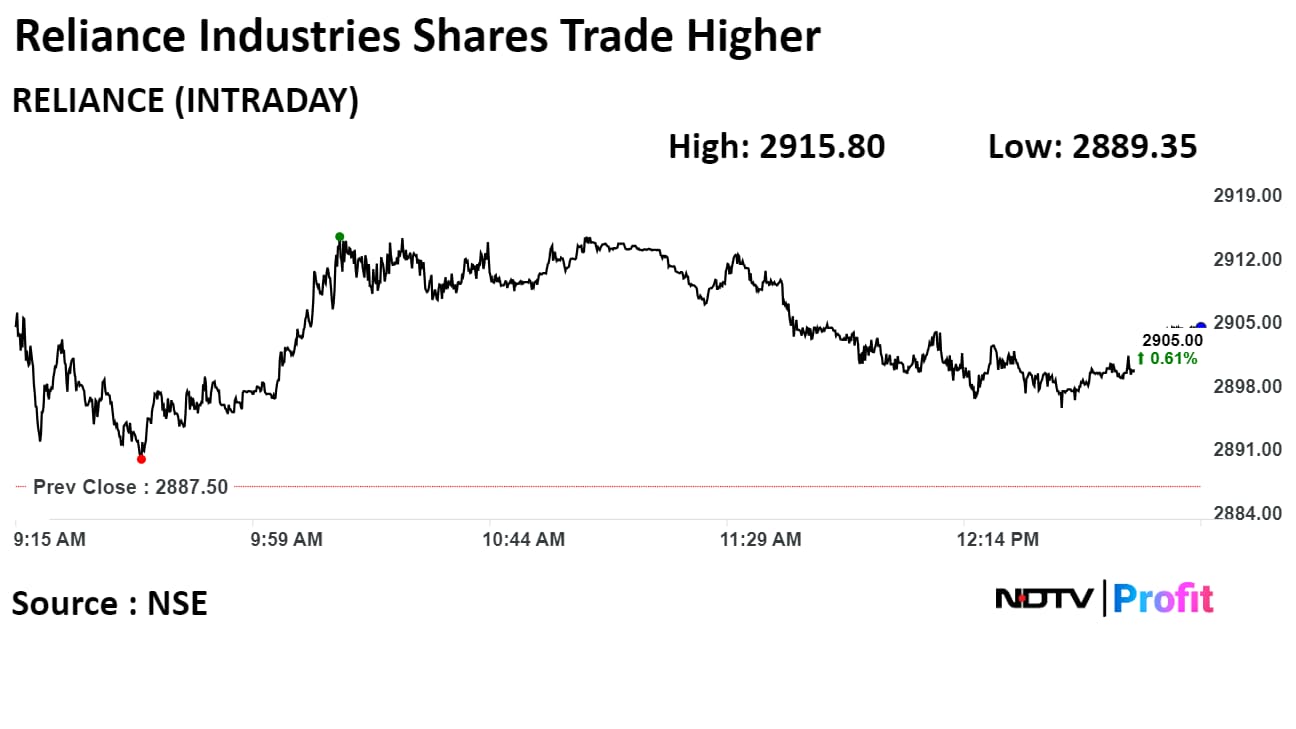

Shares of Reliance Industries rose as much as 0.98% during the day to Rs 2,915.8 apiece on the NSE. It was trading 0.6% higher at Rs 2,904.7 apiece, compared to a 0.73% advance in the benchmark Nifty 50 as of 12:56 a.m.

The stock has risen 40.4% in the past 12 months. The relative strength index was at 50.2.

Twenty eight out of the 34 analysts tracking the company have a 'buy' rating on the stock, four recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.