Investors are flocking to the riskiest parts of the US stock market, raising questions about the sustainability of its record-setting rebound and pointing to potential losses for retail traders.

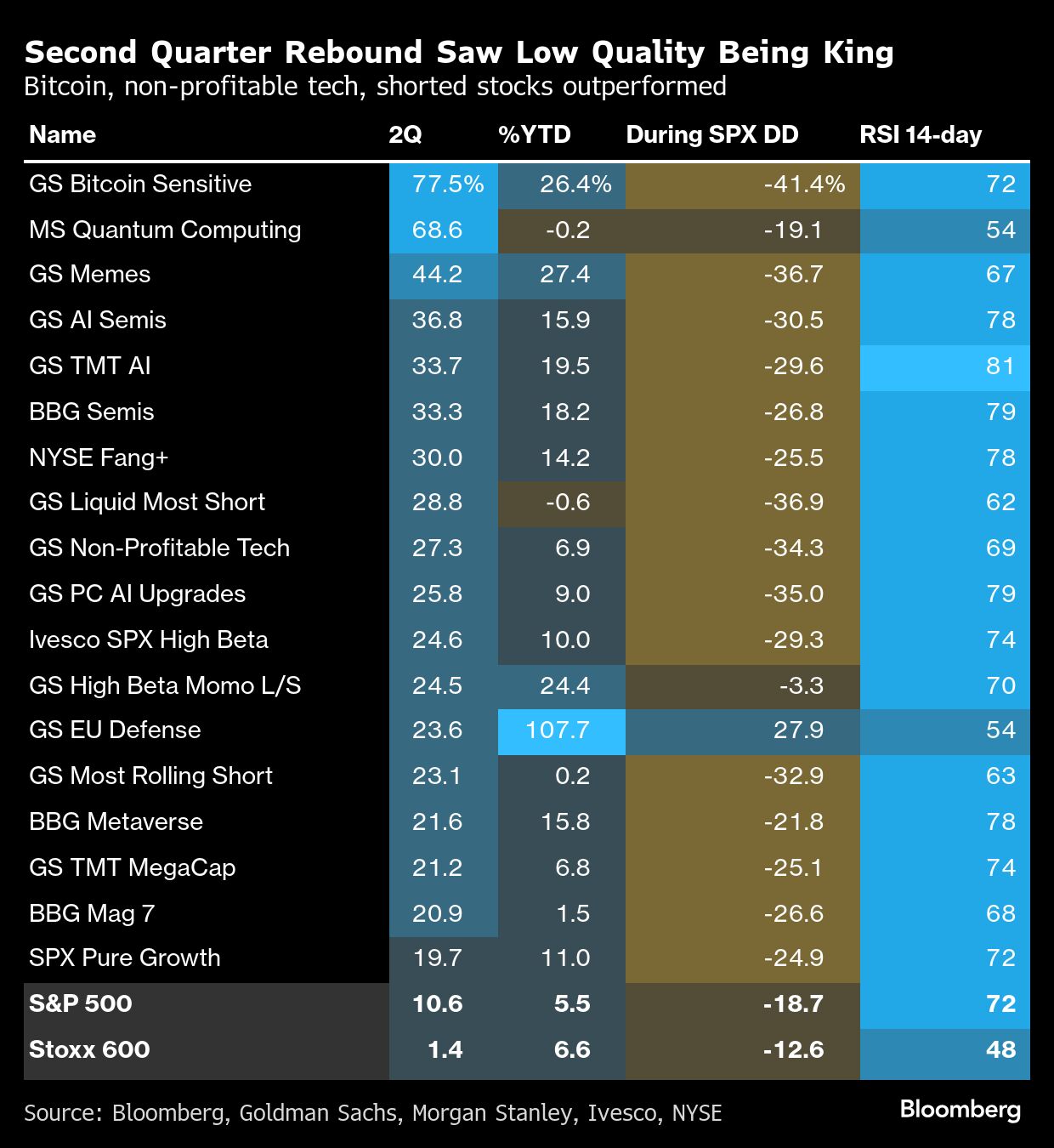

“The second quarter snap-back rally was led by the perceived lower quality baskets — the Dash to Trash,” said Mark Taylor, a sales trader at Panmure Liberum Limited. “This pointed to retail buyers continuing to buy dips aggressively and the pain trade of positioning flipping to performance chasing.”

Bitcoin-linked firms have rallied 78%, while quantum computing shares are up 69% and meme stocks have advanced 44% — all volatile corners of the market where investors are betting on future returns that may not materialize. A basket of highly shorted securities rallied 29%.

The S&P 500 rallied last quarter, turning a 14% decline into an 11% gain, and the Nasdaq 100 raced back to record highs. The rebound was driven by a surge of trade deal optimism and rising expectations of interest-rate cuts.

More broadly, investors showed a preference for cyclical exposure and bet on sectors such as industrials and construction in Europe, as well as autos, capital goods and banks in the US. Semiconductors and software have also done well.

Taylor noted that falling yields and lower volatility encouraged systematic funds, which buy stocks based on rules and models, to chase momentum. “There was some evidence of broadening breadth at times, but the beta chasing continued right into the last days of the first half,” he said.

Many of the riskier parts of the market have now reached overbought levels. They are often the subject of more short-term trades, and the risk of profit taking or renewed short selling has now increased.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.