Shares of Reliance Infrastructure Ltd. fell over 2% on Wednesday despite positive news for the company. However, the stock went on to erase loss and trade higher.

The company's defence arm on Tuesday hashed out more details about its strategic partnership on guided munition or terminally guided munition with German firm Diehl Defence.

"The main purpose of the current Strategic Cooperation Agreement is to focus on the urgent supply of the 'System Vulcano 155mm Precision Guided Munition' for the Indian Armed Forces," the company said in an exchange filing on Tuesday.

The companies also set into motion the 'System Vulcano 155 mm under Make in India-II' initiative.

Reliance Defence will be the prime contractor for the Indian customer and Diehl Defence will be strategic partner. The overall indigenous content in the project under the 'Make in India' scheme will be more than 50%.

The company expects this partnership to also benefit from Reliance setting up a greenfield manufacturing facility in the Watad Industrial Area in Ratnagiri, Maharashtra, which will eventually have an annual capacity to produce up to 2,00,000 artillery shells, 10,000 tonnes of explosives and 2,000 tonnes of propellant.

The partnership between Reliance Defence and Diehl Defence is based on a cooperation agreement, which was signed in 2019. The agreement was on the supply of guided munitions to the Indian armed forces.

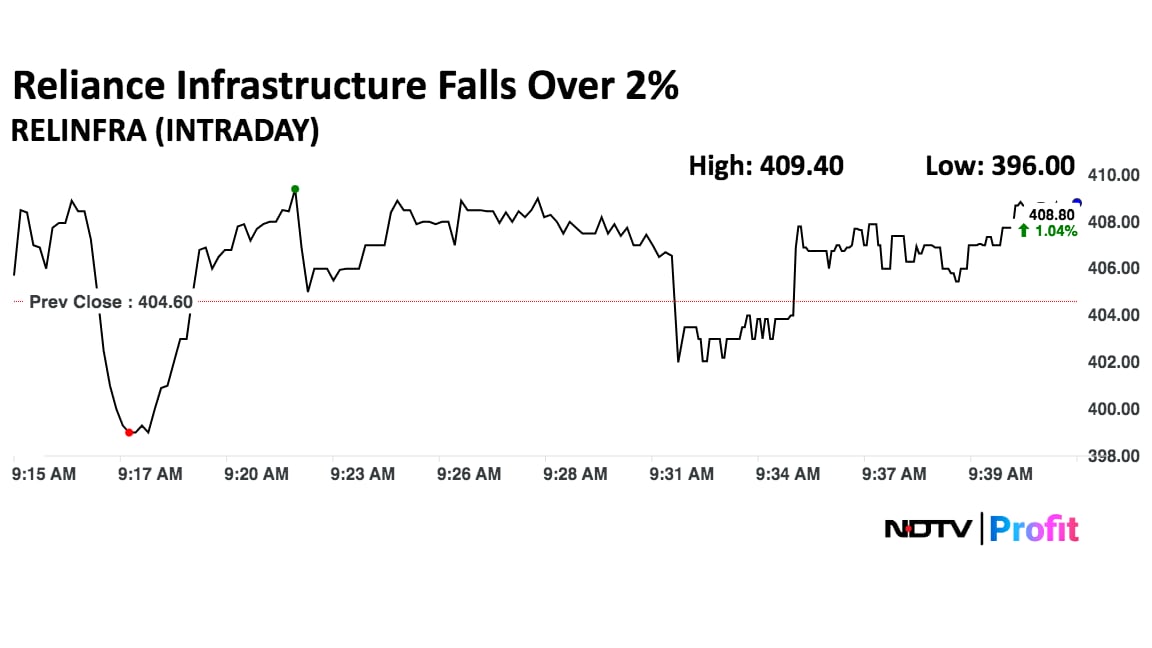

Reliance Infrastructure Share Price

Shares of Reliance Infrastructure fell as much 2.13% to Rs 396 apiece, compared to a 0.12% advance in the NSE Nifty 50. However, as of 9:40 a.m. the shares were trading 0.60% higher, erasing losses.

It has risen 115% in the last 12 months and 33.49% year-to-date. Total traded volume so far in the day stood at 1.28 times its 30-day average. The relative strength index was at 55.55.

Out of five analysts tracking the company, three maintain a 'buy' rating and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 28.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.