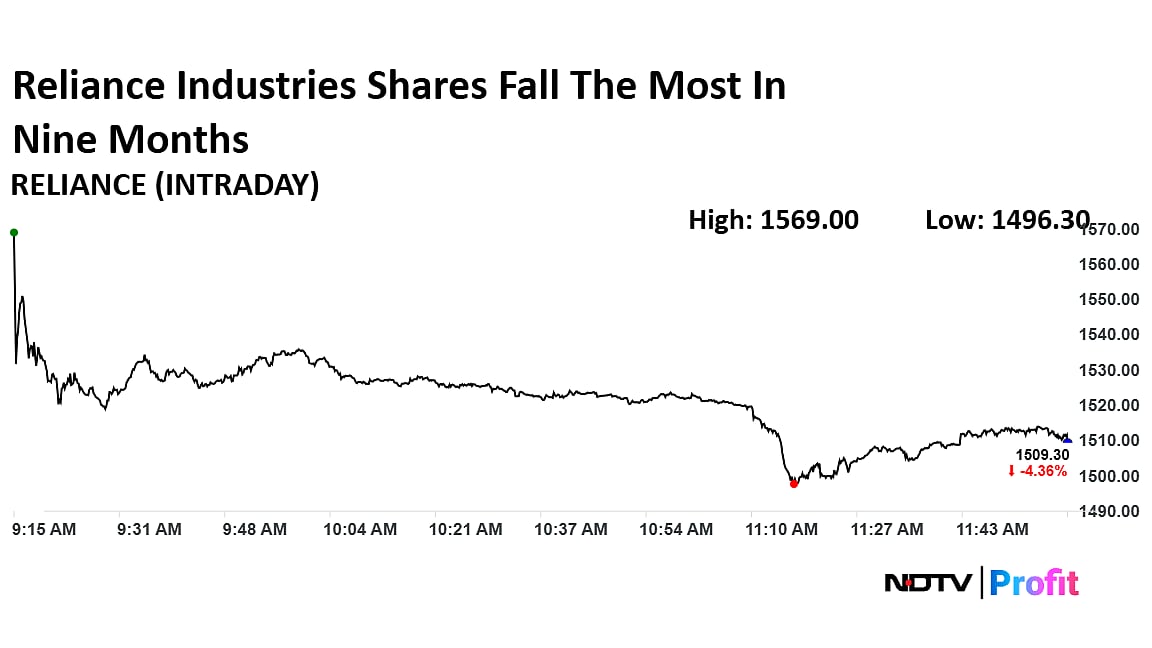

Reliance Industries Shares Fall The Most In Nine Months

The shares of Reliance Industries have also hit nearly two-month low.

The shares of Reliance Industries Ltd. fell 5% on Tuesday posting its largest intra-day fall in nine months. The shares have extended its decline for the second day after it fell nearly 1% in the previous session.

The shares of Reliance Industries have also hit nearly two-month low.

The latest decline was triggered by market concerns following reports around Reliance’s crude sourcing. According to Bloomberg, Reliance Industries is buying Russian oil for its refinery, with at least three tankers carrying Russian crude indicating the RIL refinery as their next destination.

The report also noted that the refiner had restarted some purchases linked to domestic production, with nearly 2.2 million barrels of Urals crude reportedly being supplied to Reliance.

However, Reliance Industries moved to clarify the situation. The company stated that its Jamnagar refinery has not received any cargo of Russian oil in the past three weeks and is not expecting any deliveries of Russian crude in January. The clarification helped address immediate concerns, though the stock remained under pressure intra-day.

In addition to this CLSA has removed Reliance Industries from its India portfolio.

Reliance Industries Share Price Today

The scrip fell as much as 5.18% to Rs 1,496.30 apiece on Tuesday, the lowest level since Nov. 11. It pared gains to trade 4.18% lower at Rs 1,512.40 apiece, as of 11:57 a.m. This compares to a 0.26% decline in the NSE Nifty 50 Index.

It has risen 24.20% in the last 12 months. Total traded volume so far in the day stood at 6 times its 30-day average. The relative strength index was at 40.05.

Out of 37 analysts tracking the company, 35 maintain a 'buy' rating and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target stands at Rs 1,703 indicating an upside of 12.7%.