Reliance Industries Ltd.'s share price on Thursday traded close to its 52-week low amid a sharp downturn in Indian equities following the US Federal Reserve's interest rate decision and guidance.

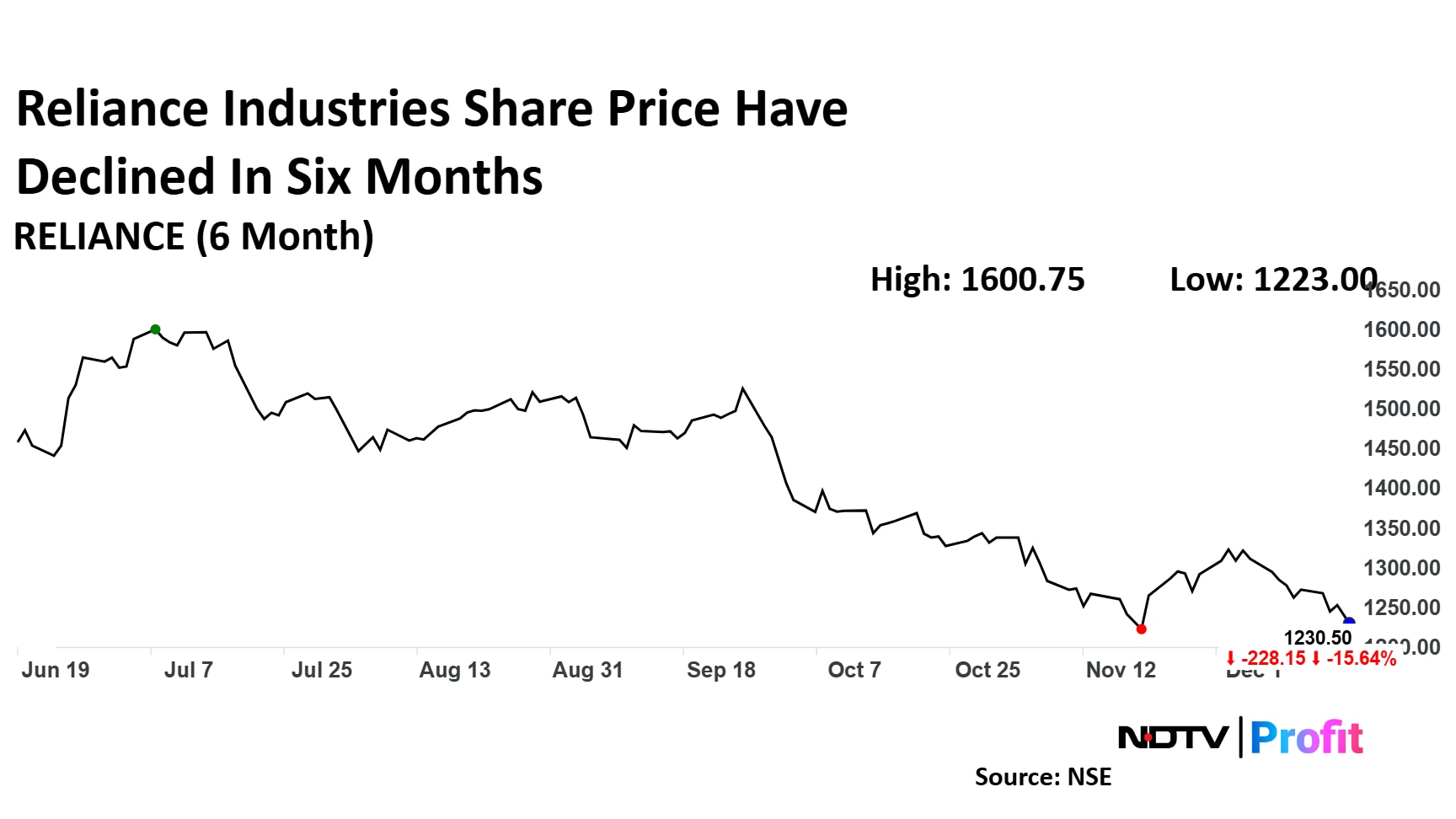

The stock fell as much as 1.93% intraday to Rs 1,229, close to the 52-week low of Rs 1,217.25 it hit on Nov. 24.

It settled at Rs 1,230.45 apiece on the NSE. The benchmark Nifty 50 closed 1% lower.

Thirty three out of the 39 analysts tracking Reliance Industries have a 'buy' rating on the stock, three each recommend a 'hold' and 'sell', according to Bloomberg data. The average of 12-month analysts' price target of Rs 1,596 implies a potential upside of 3.4%.

Mukesh Ambani's flagship company has underperformed the market in the last three months and is in sight to post negative yearly returns.

The third most prominent index heavyweight with 8% weight in the Nifty 50 has corrected 16% in the last three months thereby dragging the Nifty down by over 5.7% during the same period.

Reliance has been the biggest loser in terms of contribution to the Nifty 50 index during this period followed by ITC and HUL.

The oil-to-retail conglomerate has been underperforming since its Annual General Meeting when it disappointed the shareholders with no clear timeline for monetisation of Reliance Retail and Reliance Jio. The company though announced a surprise bonus of 1:1 on the day of the AGM to calm investor nerves but stock continues to be an underperformer. The company has posted a negative return of 2.3% in 2024 so far for the first time since 2014.

Reliance is facing heat from multiple levels. Its retail operations are undergoing restructuring and consolidation and that has delayed the shareholder unlocking plans for the company which is facing competition from quick commerce and structural retail shift.

The oil & gas and petchem business is under margin pressure and the new energy business, which has a large chunk of capex, is underway but operationalisation is behind schedule.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.