Redington shares surged during early trade on Friday as iPhone 17 sales began in India and the tradimg volumes of the scrip surged. Redington is an official authorized distributor and reseller of Apple products in India and other regions.

The total traded volume stood at 11 times its 30-day average, with a turnover of Rs 840 crore on the NSE. Over 2.75 crore shares were traded in terms of the number of shares traded. The stock had risen over 18% this week and risen over 19% during this month.

Hundreds of iPhone customers flocked to the Apple Store in Mumbai's Bandra Kurla Complex for the launch of the iPhone 17 series phones. The interest was so high leading to a scuffle outside the BKC store.

The shares have surges to its two-month high after Apple began the sales of iPhone 17 series. The price range of the phone is Rs 82,900 to Rs 2,29,900, which will be available in India for customers who have pre-booked the device.

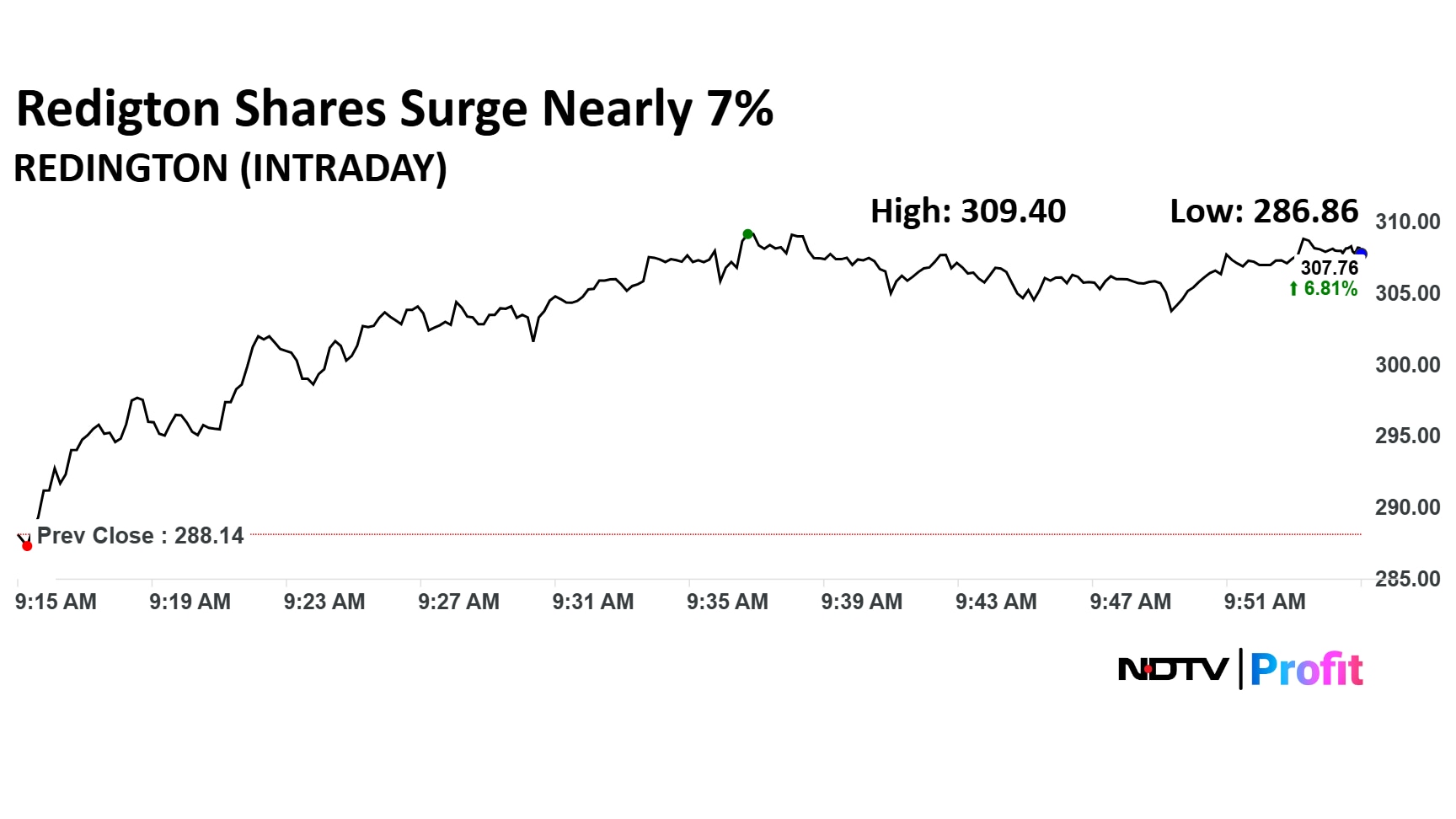

Redington Share Price

Redignton stock rose as much as 7.38% during trade so far to Rs 309.4 apiece on the NSE. It was trading 7.01% higher at Rs 308.33 apiece, compared to an 0.40% decline in the benchmark Nifty 50 as of 10:06 a.m.

It has risen 62.15% in the last 12 months and 55.65% on a year-to-date basis. The total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 71.

Two out of the four analysts tracking the company have a 'buy' rating on the stock, one recommend a 'hold' and one suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 257.5, implying a downside of 15.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.