Sensex, Nifty End Marginally Lower As Yes Bank Slumps 30%

Catch all the live updates of share prices, index moves, corporate announcements and more from Indian equity markets.

KEY HIGHLIGHTS

- Oldest First

BQ Live

Closing Bell: Sensex, Nifty End Marginally Lower

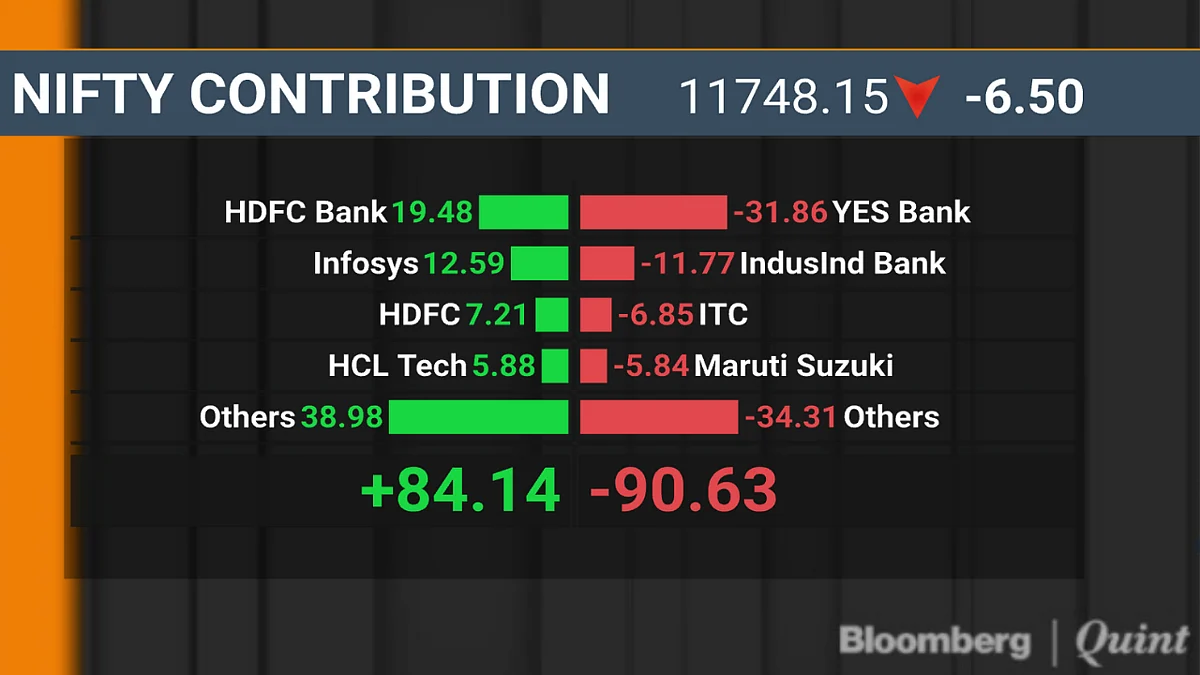

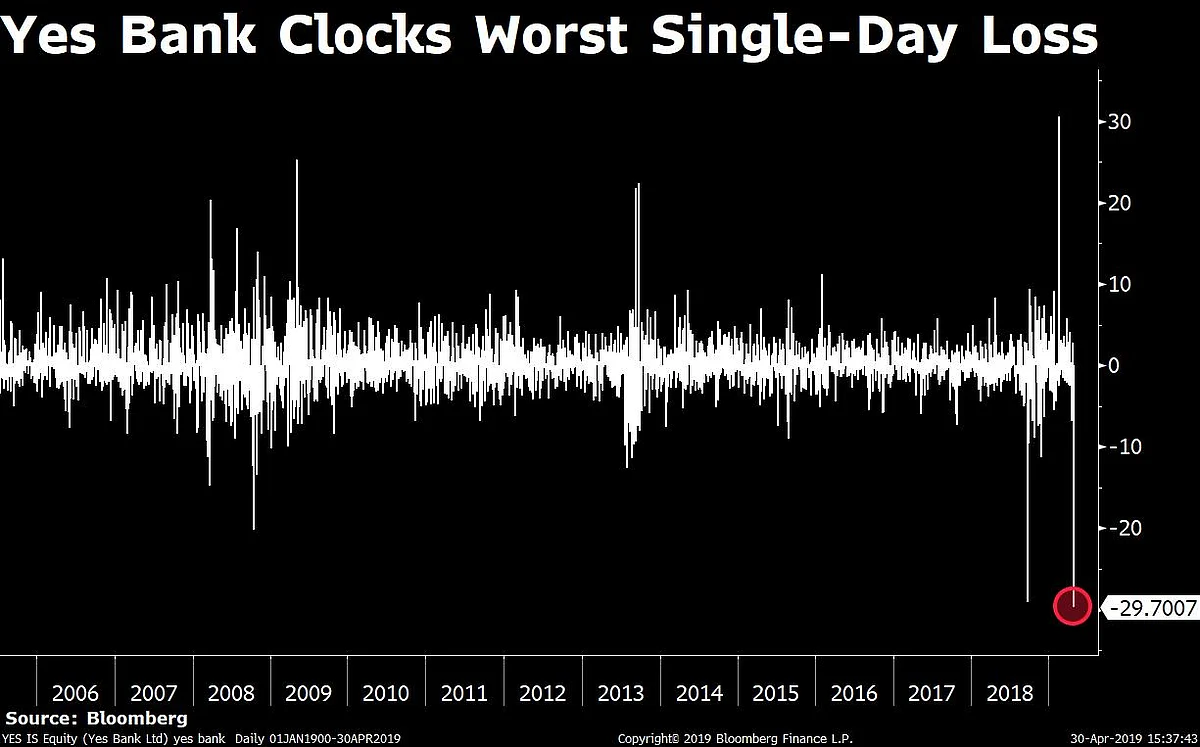

Indian equity benchmarks ended marginally lower after the gains in HDFC Bank Ltd. and Infosys Ltd. were pressured by Yes Bank Ltd.’s 30-percent fall.

The S&P BSE Sensex ended 0.09 percent lower at 39,031.55 and the NSE Nifty 50 closed at 11,748.15, down 0.06 percent. The broader market index represented by the NSE 500 Index ended 0.26 percent lower.

The market breadth was tilted in favour of sellers. About 1,326 stocks fell and 468 shares declined on National Stock Exchange.

Seven out of 11 sectoral gauges compiled by NSE ended lower, led by the NSE Nifty PSU Bank Index’s 3.3 percent decline. On the flipside, the NSE Nifty Media Index was the top sectoral gainer, up 1.41 percent.

Block Deal Alert: Ashok Leyland

About 15.5 lakh shares of Ashok Leyland changed hands in a single block, Bloomberg data showed. Buyers and sellers were not known immediately.

Exide Industries Swings After Q4 Results Announcement

Shares of Exide Industries fluctuated between gains and losses to trade 0.9 percent lower at Rs 212.90 after announcing its March quarter results.

Key Earnings Highlights (Q4, YoY)

- Revenue up 5.7 percent to Rs 2,598.7 crore

- Net profit up 11.1 percent to Rs 210.7 crore

- Ebitda up 10.4 percent to Rs 373.3 crore

- Margin at 14.4 percent versus 13.7 percent

Kotak Mahindra Bank Q4 Profit Meets Estimates

Kotak Mahindra Bank Ltd.’s profit rose 25 percent on a yearly basis in March quarter to Rs 1,408 crore, according to its stock exchange filing. The analysts tracked by Bloomberg had pegged the bottomline at Rs 1,394 crore.

Key Earnings Highlights (Q4, YoY)

- Net Interest Income up 18 percent to Rs 3,048 crore

- GNPA at 2.14 percent vs 2.07 percent (QoQ)

- NNPA at 0.75 percent versus 0.71 percent (QoQ)

- Provisions down 44 percent to Rs 171 crore

- NIM at 4.48 percent versus 4.33 percent

Shares of Kotak Mahindra Bank fell as much as 1.5 percent to Rs 1,358.50 after the results announcement.

PNB Housing Finance Says Has An Option To Deleverage Through Securitisation

- Current capitalisation level is adequate with sufficient cushion over minimum CRAR required as per regulations

- Company is planning to raise capital to achieve target growth

- Would be presenting capital raising plan to the Board over the next few weeks.

- Sufficient room to raise Tier 2 capital to further improve the CRAR

- Corporate Loan book of the Company is 21 percent of the AUMs

- Our lending in this space is primarily to marquee players

- As on March 31, the company's Stage 3 proportion in this book is around 0.17 percent (unaudited and provisional)

Source: Company Filings