Shares of RBL Bank fell to their lowest in a year and half on Monday after the recently announced discontinuation of the co-branded credit card partnership between the lender and Bajaj Finance Ltd. sparked reactions among brokerages.

The stock fell nearly 5% to Rs 147.50, marking its lowest level since May 2023. While Morgan Stanley took a more cautious stance on the bank, highlighting challenges in the MFI and credit card segments, Citi pointed to opportunities for RBL Bank to pivot towards diversified growth.

Morgan Stanley maintained an 'underweight' rating on RBL Bank post the development. The brokerage underscored that Bajaj Finance was a key channel for RBL Bank's credit card issuance, contributing significantly to its market share.

The discontinuation could impede RBL's ability to scale its credit card portfolio in the medium term, despite its plans to grow organically and partner with new players like Mahindra Finance, TVS Finance, and IRCTC, said Morgan Stanley.

At a price-to-book valuation of 0.6 times, Morgan Stanley found RBL Bank's shares cheap, but unattractive, citing a tough earnings outlook, particularly in the microfinance institution segment.

Citi, meanwhile, had a slightly more optimistic perspective, but also acknowledged the potential challenges. The brokerage viewed the partnership discontinuation as a near-term headwind, but was encouraged by RBL's efforts to diversify its partnerships and reduce dependence on any single collaborator.

Citi highlighted that while the co-branded cards contributed to scale, the partnership had been witnessing reduced synergies over the last few quarters, which likely led to the mutual decision. The firm saw RBL Bank trading at attractive valuations and believed execution on new partnerships, combined with its credit card business' resilience, could provide long-term upside, if managed effectively.

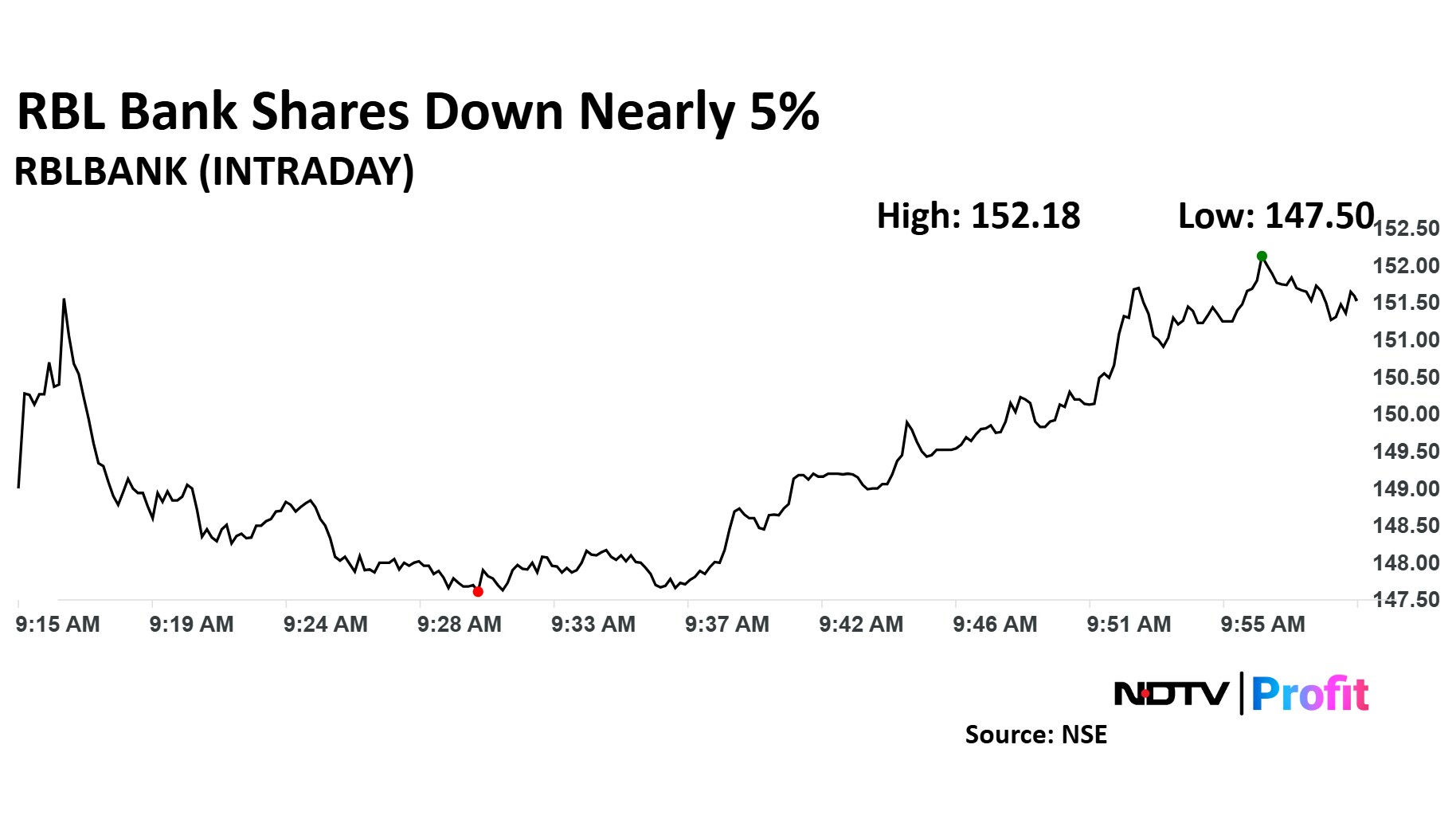

RBL Bank Share Price Today

Share price of RBL Bank fell as much as 4.83% to Rs 147.50 apiece, the lowest level since May 26, 2023. It pared losses to trade 2.26% lower at Rs 151.48 apiece, as of 10:01 a.m. This compares to a 0.03% advance in the NSE Nifty 50.

It has fallen 46.79% on a year-to-date basis. Total traded volume so far in the day stood at 4.2 times its 30-day average. The relative strength index was at 30.31.

Out of 23 analysts tracking the company, 11 maintained a 'buy' rating, six recommended a 'hold' and six suggested 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 39%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.