Share price of Rallis India Ltd. fell to hit a seven-month low on Monday, after the company reported a 54.2% decline in net profit in the third quarter of this fiscal.

The agri-inputs company recorded a consolidated net profit of Rs 11 crore for the quarter ended December, compared to Rs 24 crore in the same quarter of the previous fiscal, according to its stock exchange notification.

Revenue decreased by 12.71% year-on-year for the three months ended December, reaching Rs 522 crore. Operating income, or earnings before interest, taxes, depreciation, and amortisation fell 27.9% year-on-year to Rs 44 crore. The Ebitda margin contracted to 8.4% from 10.2% in the same period the previous year. The margins were impacted due to volume drop and pricing pressure in exports.

The fall in revenue comes after the crop care revenue declined 13%, while the seeds revenue fell by 7%. In addition, the subsidiary of Tata Chemical in its investor presentation on Saturday said that the nine-month revenue was flat due to weak export demand.

"Exports business continues to face headwinds with business registering a de-growth of 38%, resulting in overall revenue de-growth of 13% and drop in profitability," said Dr Gyanendra Shukla, managing director and chief executive officer at Rallis India.

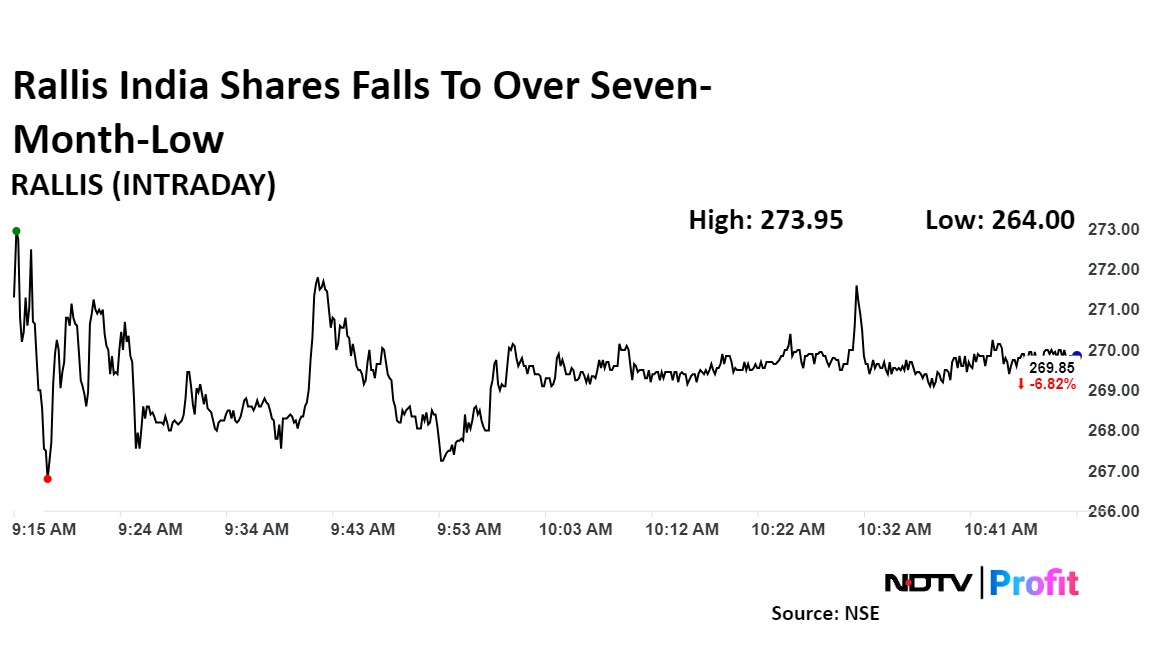

Rallis India Shares Fall Nearly 9%

The shares of Rallis India fell as much as 8.84% to Rs 264 apiece, the lowest level since June 5, 2024. They pared losses to trade 6.87% lower at Rs 269.70 apiece, as of 10:46 a.m. This compares to a 0.25% advance in the NSE Nifty 50.

The stock has risen 3% in the last 12 months. Total traded volume so far in the day stood at 7 times its 30-day average. The relative strength index was at 31.

Out of 15 analysts tracking the company, three maintain a 'buy' rating, four recommend a 'hold' and eight suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 2.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.