Shares of ITC Ltd., Sun Pharmaceuticals Industries Ltd. and Honasa Consumers Ltd. were in focus on Friday, after the companies announced their fourth quarter results.

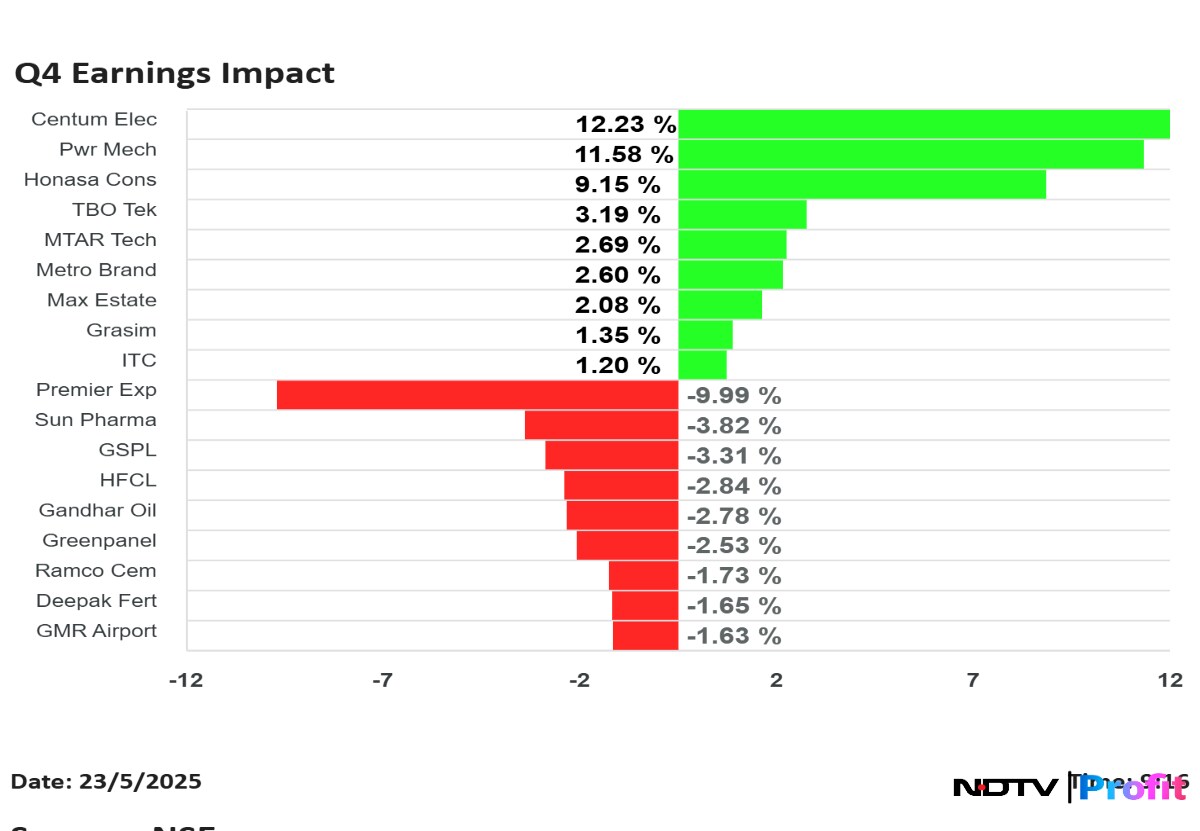

Centum Electronics Ltd. shares rose the most, while Premier Explosives Ltd. fell the most, among the companies that announced their results for the quarter ended March.

Earnings Post Market Hours

Sun Pharma Q4 FY25 (Consolidated, YoY)

Share price falls 4.78% at Rs 1,636.60

Revenue up 8% at Rs 12,959 crore versus Rs 11,983 crore (Bloomberg estimate: Rs 13,254 crore).

Ebitda up 22.4% at Rs 3,716 crore versus Rs 3,035 crore (Bloomberg estimate: Rs 3,650 crore).

Margin at 28.7% versus 25.3% (Bloomberg estimate: 27.5%).

Net profit down 19% at Rs 2,154 crore versus Rs 2,659 crore (Bloomberg estimate: Rs 2,794 crore).

Exceptional loss of Rs 362 crore vs Rs 102 crore (YoY).

India formulation sales at Rs 42,130 million, up 13.6%.

US formulation sales at US$ 464 million, down 2.5%.

Global specialty sales at US$ 295 million, up 8.6%.

Emerging markets formulation sales at US$ 261 million, up 6.3%.

Rest of World formulation sales at US$ 200 million, up 2.0%.

ITC Q4FY25 Result Highlights (Standalone, YoY)

Share price rises 1.85% at Rs 434.

Revenue up 9.4% to Rs 17,248.15 crore versus Rs 15,733.6 crore (Bloomberg estimate: Rs 16,980 crore).

Ebitda up 2.5% to Rs 5,986 crore versus Rs 5,841.5 crore (Bloomberg estimate: Rs 6,018 crore).

Margin at 34.7% versus 37.1% (Bloomberg estimate: 35.4%).

Net profit from continued operations up 0.8% to Rs 4,874 crore versus Rs 4,837 crore (Bloomberg estimate: Rs 4,942 crore).

Segmental performance:

FMCG business grew 5%.

Agri business grew 17.7%.

Paper business grew 5.5%.

Honasa Consumer Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 14.12% at Rs 314.

Revenue up 13.3% to Rs 533.5 crore versus Rs 471 crore (Bloomberg estimate: Rs 512 crore).

Ebitda down 17.6% to Rs 27.1 crore versus Rs 32.9 crore (Bloomberg estimate: Rs 17.6 crore).

Margin at 5.1% versus 7% (Bloomberg estimate: 3.4%).

Net profit down 17.8% to Rs 25 crore versus Rs 30.4 crore (Bloomberg estimate: Rs 16 crore).

Ebitda down due to 20% uptick in other expenses.

Power Mech Projects Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 15.30% at Rs 3,398.90.

Revenue up 42.4% at Rs 1,853 crore versus Rs 1,302 crore.

Ebitda down 1.8% at Rs 215.7 crore versus Rs 219.6 crore.

Margin at 11.6% versus 16.9%.

Net profit up 38.7% at Rs 117 crore versus Rs 84.5 crore.

Other income rose by 60% to Rs 16.73 crore from Rs 10.33 crore.

Ebitda down due to rise in contract execution expenses by 60% and employee expenses by 18%.

Grasim Industries Q4 FY25 (Standalone, YoY)

Share price rises 2.44% at Rs 2,739.90.

Revenue up 31.89% at Rs 8,925 crore versus Rs 6,767 crore.

Ebitda down 58.17% at Rs 220 crore versus Rs 526 crore.

Ebitda margin down 530 bps at 2.46% versus 7.77%.

Net loss at Rs 288 crore versus loss of Rs 441 crore.

Exceptional loss of Rs 114 crore versus Rs 715 crore.

Metro Brands Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 4.21% at Rs 1,239.20.

Revenue up 10.3% at Rs 643 crore versus Rs 583 crore (Bloomberg estimate: Rs 645 crore).

Ebitda up 24.3% at Rs 197 crore versus Rs 159 crore (Bloomberg estimate: Rs 183 crore).

Margin at 30.7% versus 27.2% (Bloomberg estimate: 28.4%).

Net profit down 39% at Rs 94.8 crore versus Rs 155 crore (Bloomberg estimate: Rs 88.6 crore).

Current Tax Expense of Rs 31 crore vs Tax Credit of Rs 50.79 crore.

Gujarat Petronet Q4 FY25 Earnings Highlights (Standalone, QoQ)

Share price falls 3.94% at Rs 333.80.

Revenue down 8.6% at Rs 238 crore versus Rs 260 crore.

Ebitda down 35.2% at Rs 125 crore versus Rs 193 crore.

Margin at 52.4% versus 74%.

Net profit down 47.8% at Rs 70.7 crore versus Rs 136 crore.

TBO TEK Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 4.59% at Rs 1,254.

Revenue up 20.9% at Rs 446 crore versus Rs 369 crore.

Ebitda up 2.6% at Rs 64.7 crore versus Rs 63.1 crore.

Margin at 14.5% versus 17.1%.

Net profit up 21.2% at Rs 58.9 crore versus Rs 48.6 crore.

Ramco Cements Q4FY25 Results Highlights (Consolidated, YoY)

Share price falls 2.96% at Rs 958.55.

Revenue down 10.5% at Rs 2,397 crore versus Rs 2,678 crore.

Ebitda down 23.8% at Rs 319 crore versus Rs 419 crore.

Margin at 13.3% versus 15.6%.

Net profit down 78.8% at Rs 27.4 crore versus Rs 129 crore.

Exceptional gain of Rs 10.8 crore in Q4 FY25.

Centum Electronics Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 19.74% at Rs 2,465.

Revenue up 28.8% at Rs 365.6 crore versus Rs 283.8 crore.

Ebitda at Rs 38.3 crore versus Rs 5 crore.

Margin at 10.5% versus 1.8%.

Net profit at Rs 21.5 crore versus a loss of Rs 6.8 crore.

Exceptional gain of Rs 4.4 crore vs loss of Rs 4.8 crore.

Deferred tax credit of Rs 7.4 crore versus Rs 1.4 crore.

Greenpanel Industries Q4 FY25 Results Highlights (YoY)

Share price falls 3.31% at Rs 243.30.

Revenue down 5.6% at Rs 374.5 crore versus Rs 396.5 crore.

Ebitda down 6.9% at Rs 47.9 crore versus Rs 51.5 crore.

Margin at 12.8% versus 13%.

Net profit down 1.4% at Rs 29.4 crore versus Rs 29.8 crore.

Deepak Fertilisers and Petrochemicals Corporation Q4 Highlights (Consolidated, YoY)

Share price falls 2.59% at Rs 1,326.30.

Revenue up 27.9% to Rs 2,667.35 crore versus Rs 2,086.28 crore.

Ebitda up 10% to Rs 479.99 crore versus Rs 437.89 crore.

Margin at 18.0% versus 21.0%.

Net profit up 23% to Rs 277.24 crore versus Rs 225.12 crore.

To pay dividend of Rs 10 per share.

HFCL Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 5.79% at Rs 79.61.

Revenue down 39.6% at Rs 801 crore versus Rs 1,326 crore.

Ebitda loss at Rs 36 crore versus a profit of Rs 195.7 crore.

Net loss at Rs 81.4 crore versus a profit of Rs 110 crore.

Premier Explosives Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 9.99% at Rs 546.20.

Revenue down 14.7% at Rs 74.1 crore versus Rs 86.8 crore.

Ebitda down 39.8% at Rs 9.6 crore versus Rs 15.9 crore.

Margin at 12.9% versus 18.3%.

Net profit down 44.7% at Rs 3.7 crore versus Rs 6.8 crore.

MTAR Technologies Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 4.83% at Rs 1,743.60.

Revenue up 28.1% at Rs 183 crore versus Rs 142.9 crore.

Ebitda up 86.3% at Rs 34.1 crore versus Rs 18.3 crore.

Margin at 18.6% versus 12.8%.

Net profit down at Rs 13.7 crore versus Rs 4.8 crore.

Gandhar Oil Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 5.21% at Rs 156.24.

Revenue up 2.4% at Rs 962 crore versus Rs 939 crore.

Ebitda up 0.3% at Rs 33.6 crore versus Rs 33.5 crore.

Margin at 3.5% versus 3.6%.

Net profit up 27.5% at Rs 11.6 crore versus Rs 9.1 crore.

Max Estates Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 3.08% at Rs 474.85.

Revenue up 32.6% at Rs 39.8 crore versus Rs 30 crore.

Ebitda up 16.2% at Rs 9.1 crore versus Rs 7.8 crore.

Margin at 22.8% versus 26%.

Net profit at Rs 17.3 crore versus loss of Rs 1.5 crore.

GMR Airports Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 1.97% at Rs 87.20.

Revenue up 17% at Rs 2,863 crore versus Rs 2,447 crore.

Ebitda up 24% at Rs 1,012 crore versus Rs 817 crore.

Margin at 35.3% versus 33.4%.

Net loss of Rs 253 crore versus loss of Rs 168 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.