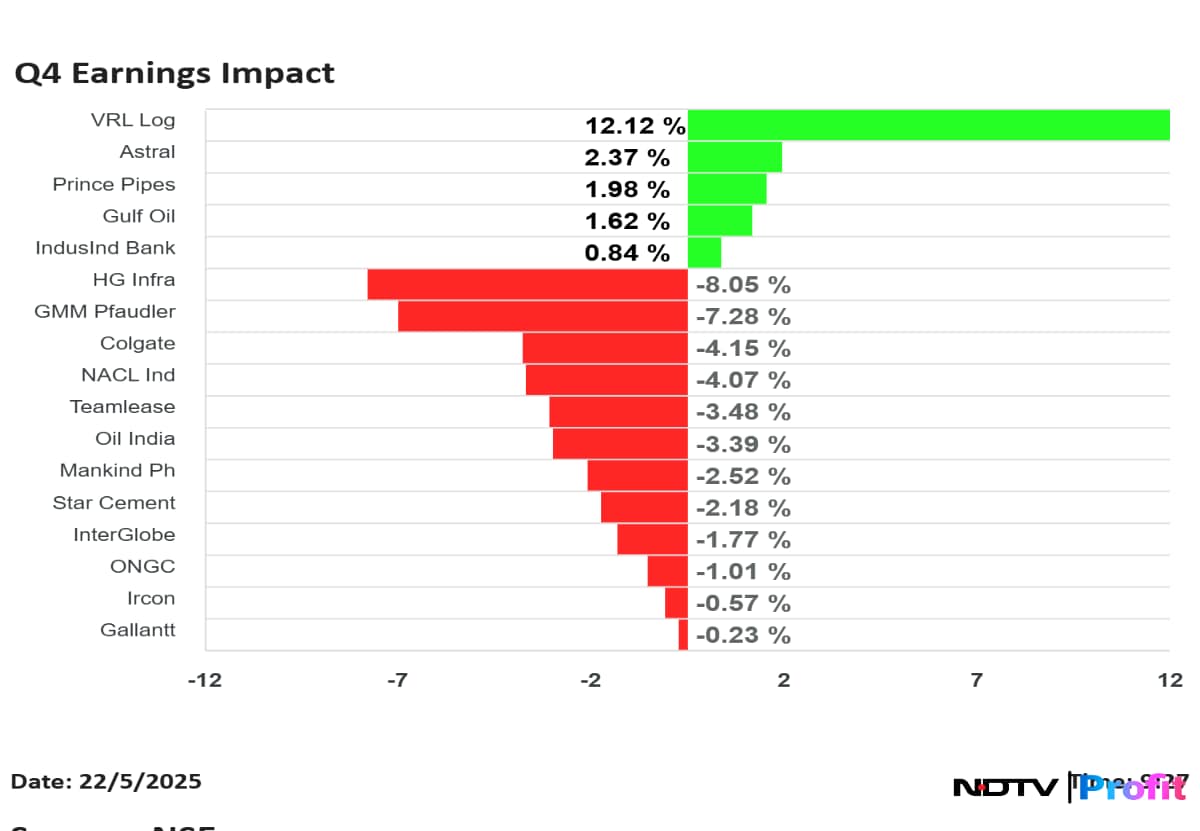

Shares of IndusInd Bank Ltd., InterGlobe Aviation Ltd. and Ircon Ltd. were in focus on Thursday, after the companies announced their fourth quarter results.

VRL Logistics Ltd. shares rose the most, while H.G. Infra Engineering Ltd. fell the most, among the companies that announced their results for quarter ended March.

IndusInd Bank Q4 Highlights (Consolidated, YoY)

Share price fell 5.73% at Rs 725.80.

Loss of Rs 2,329 crore versus net profit of Rs 2,349 crore (Bloomberg estimate: Loss of Rs 318 crore).

NII down 43% at Rs 3,048 crore versus Rs 5,376 crore.

Provisions up 165% at Rs 2,522 crore versus Rs 950 crore (Estimate: Rs 3,371 crore).

NIM at 2.25% versus 3.96% (QoQ).

Operating loss at Rs 4,909 crore vs operating profit of Rs 4,082 crore.

GNPA at 3.13% versus 2.25% (QoQ).

NNPA at 0.95% versus 0.68% (QoQ).

ONGC Q4 FY25 Results Highlights (Standalone, QoQ)

Share price falls 1.25% at Rs 245.56.

Revenue up 3.8% to Rs 34,982 crore versus Rs 33,717 crore (Bloomberg estimate: Rs 33,709 crore).

Ebitda down 0.3% to Rs 19,007.5 crore versus Rs 19,057 crore (Bloomberg estimate: Rs 17,974 crore).

Margin at 54.3% versus 56.5% (Bloomberg estimate: 53.3%).

Net profit down 21.7% to Rs 6,448 crore versus Rs 8,240 crore (Bloomberg estimate: Rs 8,810 crore).

InterGlobe Aviation Q4 FY25 Earnings Highlights (YoY)

Share price falls 2.42% at Rs 5,329.50.

Revenue up 24.3% to Rs 22,151 crore versus Rs 17,825 crore (Bloomberg estimate: Rs 21,887 crore).

Ebitdar (adjusted for forex) at Rs 6,817 crore versus Rs 4,545 crore.

Ebitdar margin at 30.8% versus 25%.

Net profit up 62% to Rs 3,067 crore versus Rs 1,895 crore (Bloomberg estimate: Rs 2,574 crore).

Strong growth aided by higher air traffic, lower fuel cost and higher ticket prices.

Net profit also aided by higher other income – jump 39% YoY to Rs 946 crore.

IndiGo says capacity growth for Q1FY26 to be in mid-teens.

Colgate Palmolive India Q4 FY25 Results Highlights (YoY)

Share price falls 5.05% at Rs 2,525.

Revenue down 1.9% at Rs 1,462 crore versus Rs 1,490 crore (Bloomberg estimate: Rs 1,522 crore)

Ebitda down 6.4% at Rs 498.1 crore versus Rs 532.2 crore (Bloomberg estimate: Rs 501 crore)

Margin at 34.1% versus 35.7% (Bloomberg estimate: 32.9%)

Net profit down 6.5% at Rs 355 crore versus Rs 380 crore (Bloomberg estimate: Rs 361 crore

Ebitda down due to an 8% and 7% uptick in Employee Expenses and Advertising Expenses.

Ircon International Q4 FY25 Results Highlights (Standalone, YoY)

Share price falls 3.26% at Rs 183.50.

Revenue down 11.1% to Rs 3,243 crore versus Rs 3,649 crore

Ebitda down 44.5% to Rs 137 crore versus Rs 247.00 crore

Margin at 4.2% versus 6.8%

Net Profit down 23.8% to Rs 218 crore versus Rs 286 crore

GMM Pfaudler Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 8.45% at Rs 1,158.80.

Revenue up 8.9% at Rs 806.6 crore versus Rs 740.7 crore

Ebitda down 7.3% at Rs 83.2 crore versus Rs 89.8 crore

Margin at 10.3% versus 12.1%

Net Loss at Rs 27 crore versus a profit of Rs 27.6 crore

Exceptional Loss of Rs 47 crore.

Other income at loss of 4.73 crore versus Rs 10.53 crore.

EBITDA down due to higher Other Expenses (+12%), Labour Charges (+17%) and Cost of Materials (+6%).

Astral Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 2.71% at Rs 1,415.

Revenue up 3.5% at Rs 1,681 crore versus Rs 1,625 crore (Bloomberg estimate: Rs 1746 crore)

Ebitda up 3.6% at Rs 301.9 crore versus Rs 291.5 crore (Bloomberg estimate: Rs 290 crore)

Margin at 18% versus 17.9% (Bloomberg estimate: 16.6%)

Net Profit down 1.3% at Rs 179.3 crore versus Rs 181.6 crore (Bloomberg estimate: Rs 169 crore)

National Aluminium Company Q4 FY25 Results Highlights (Consolidated, QoQ)

Share price falls 5% at Rs 180.72.

Revenue up 13% to Rs 5,267.83 crore versus Rs 4,662.22 crore

Ebitda up 27.4% to Rs 2,829.74 crore versus Rs 2,222 crore

Margin at 53.7% versus 47.7%

Net profit up 32% to Rs 2,067.23 crore versus Rs 1,566.32 crore

Chemicals revenue up 0.8% to Rs 2,536.66 crore

Aluminium revenue up 25% to Rs 3,250.26 crore

Prince Pipes Q4 FY25 Earnings Highlights (YoY)

Share price rises 3.46% at Rs 306.20.

Revenue down 2.8% at Rs 720 crore versus Rs 740 crore

Ebitda down 40.6% at Rs 54.7 crore versus Rs 92 crore

Margin at 7.6% versus 12.4%

Net profit down 56% at Rs 24 crore versus Rs 54.6 crore

Volumes degrew by 2%.

EBITDA down due to uptick in Employee Expenses by 24% and Cost of Materials by 3%.

Teamlease Services Q4 FY25 Results Highlights (Consolidated, QoQ)

Share price rises 5.27% at Rs 2,092.

Revenue down 2.2% at Rs 2,858 crore versus Rs 2,921 crore (Bloomberg estimate: Rs 2,909 crore)

EBIT up 58% at Rs 34.1 crore versus Rs 21.6 crore

EBIT Margin at 1.2% versus 0.7%

Net Profit up 23% at Rs 35 crore versus Rs 28.4 crore (Bloomberg estimate: Rs 36 crore)

EBIT up due to fall in Employee Expenses of 3%

VRL Logistics Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 12.88% at Rs 631.

Revenue up 5.3% to Rs 809 crore versus Rs 768 crore (Bloomberg estimate: Rs 839 crore)

Ebitda up 78.1% to Rs 187 crore versus Rs 105 crore (Bloomberg estimate: Rs 152 crore)

Margin at 23.1% versus 13.7% (Bloomberg estimate: 18.1%)

Net Profit up 245% to Rs 74.2 crore versus Rs 21.5 crore (Bloomberg estimate: Rs 48.5 crore)

EBITDA up due to reduction in Freight, Handling and Servicing Cost by 9%

Increase in Freight Rates and Discontinuation of low margin business leads to improvement in realisation and margins.

Oil India Q4 FY25 Results Highlights (Standalone, QoQ)

Share price falls 4.34% at Rs 408.

Revenue up 5.3% to Rs 5,519 crore versus Rs 5,240 crore (Bloomberg estimate: Rs 5,371 crore).

Ebitda down 7% to Rs 1,984 crore versus Rs 2,133 crore (Bloomberg estimate: Rs 2,266 crore).

Margin at 35.9% versus 40.7% (Bloomberg estimate: 42.2%).

Net Profit up 30.2% to Rs 1,591 crore versus Rs 1,222 crore (Bloomberg estimate: Rs 1,629 crore).

H.G. Infra Engineering Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 9.07% at Rs 1,140.10.

Revenue down 20.3% at Rs 1,361 crore versus Rs 1,708 crore

Ebitda down 28% at Rs 239.3 crore versus Rs 332.4 crore

Margin at 17.6% versus 19.5%

Net profit down 22.7% at Rs 146.9 crore versus Rs 190 crore

Star Cement Q4 Highlights (Consolidated, YoY)

Share price falls 3.57% at Rs 223.01.

Revenue up 15.2% to Rs 1,052.09 crore versus Rs 913.53 crore.

Ebitda up 46% to Rs 262.72 crore versus Rs 179.71 crore.

Margin at 25.0% versus 19.7%.

Net Profit up 41% to Rs 123.17 crore versus Rs 87.57 crore.

Gallantt Ispat Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 1.85% at Rs 485.

Revenue down 8.9% at Rs 1,072 crore versus Rs 1,177 crore

Ebitda down 0.2% at Rs 183 crore versus Rs 183.5 crore

Margin at 17.1% versus 15.6%

Net profit up 22% at Rs 116 crore versus Rs 95.4 crore

Other Income aided Profit, Other Income to 11.62 crore versus Rs 3.36 crore.

Mankind Pharma Q4 Highlights (Consolidated, YoY)

Share price falls 3.22% at Rs 2,450

Revenue up 27.1% to Rs 3,079.37 crore versus Rs 2,422.24 crore (Bloomberg estimate: Rs 3,096 crore)

Ebitda up 17% to Rs 683.19 crore versus Rs 586.30 crore (Bloomberg estimate: Rs 791 crore).

Margin at 22.2% versus 24.2% (Bloomberg estimate: 25.6%)

Net profit down 10% to Rs 425 crore versus Rs 471.6 crore (Bloomberg estimate: Rs 366 crore)

GULF OIL Highlights Q4 Earnings (Consolidated, YoY)

Share price rises 2.79% at Rs 1,235.

Revenue up 9.6% at Rs 952.7 crore versus Rs 869.6 crore

Ebitda up 9.8% at Rs 128.8 crore versus Rs 117.3 crore

Margin Flat At 13.5%

Net Profit up 6.9% at Rs 92.2 crore versus Rs 86.2 crore

To pay final dividend of Rs 28 per share

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.