Shares of Coforge Ltd., Cigniti Technologies Ltd. and The Indian Hotel Co. were in focus on Tuesday, after the companies announced their fourth quarter results.

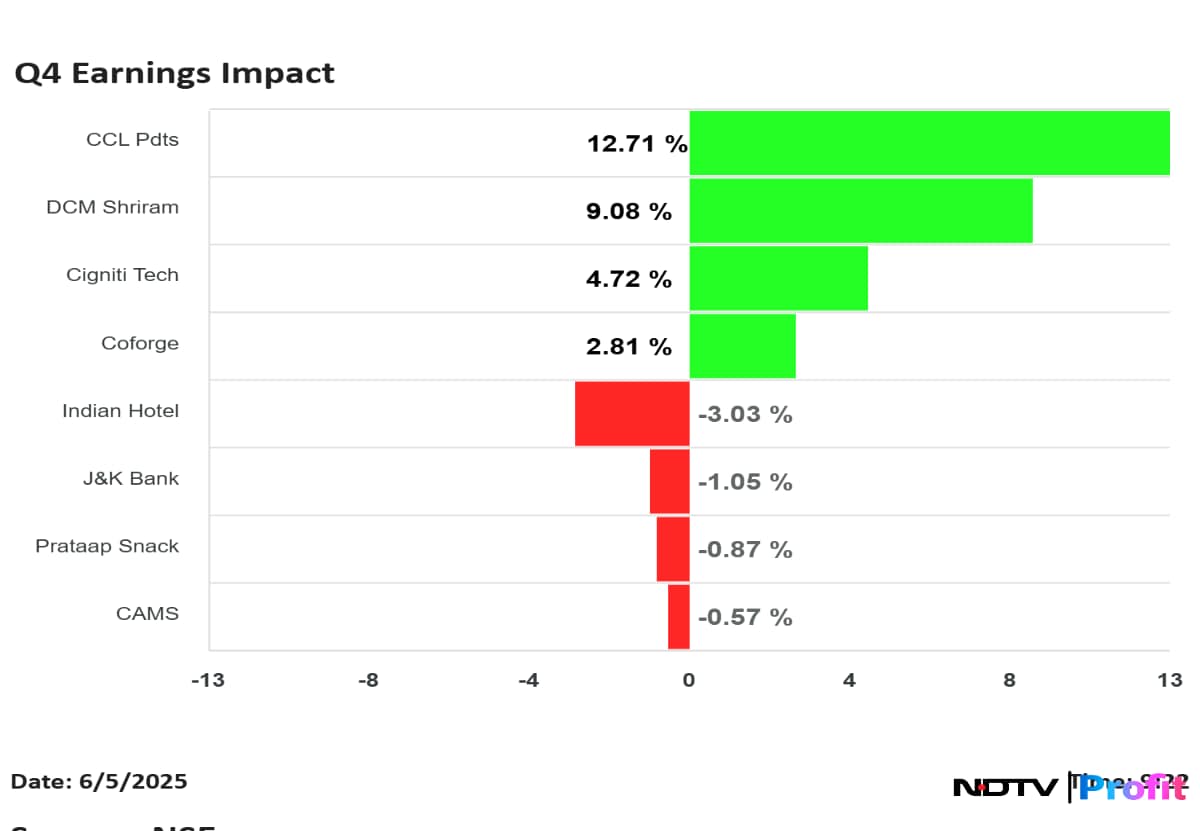

CCL Products Ltd. shares rose the most, while The Indian Hotel Co. fell the most, among the companies that announced their results for quarter ended March.

Computer Age Management Services Q4 Highlights (Consolidated, QoQ)

Share price falls 1.52% at Rs 3,750.

Revenue down 3.68% at Rs 356 crore versus Rs 370 crore (Bloomberg estimate: Rs 364 crore).

EBIT down 11% at Rs 136 crore versus Rs 153 crore (Bloomberg estimate: Rs 166 crore).

EBIT margin at 38.3% versus 41.5% (Bloomberg estimate: 45.7%).

Net profit down 9% at Rs 114 crore versus Rs 125.5 crore (Bloomberg estimate: Rs 117 crore).

Coforge Q4 Highlights (Consolidated, QoQ)

Share price rose 6.70% at Rs 7,999.

Revenue up 4.6% to Rs 3,409 crore versus Rs 3,258 crore (Bloomberg estimate: Rs 3,527 crore).

EBIT up 26% at Rs 401 crore versus Rs 318 crore (Bloomberg estimate: Rs 584 crore).

EBIT margin at 11.8% versus 9.8% (Bloomberg estimate: 16.6%).

Net profit up 21% to Rs 261.2 crore versus Rs 215.5 crore (Bloomberg estimate: Rs 282.4 crore).

Fixed June 4 as a record date for splitting each share into 2.

Expects robust growth FY26 despite macroeconomic uncertainty.

Expects growth in FY26 to come from multiple quadrants.

Demand outlook has worsened for travel industry.

Indian Hotels Q4 Highlights (Consolidated, YoY)

Share price falls 3.22% to Rs 776.

Revenue up 27.3% to Rs 2,425 crore versus Rs 1,905 crore (Bloomberg estimate: Rs 2,418.5 crore).

Ebitda up 30% to Rs 857 crore versus Rs 659 crore (Bloomberg estimate: Rs 874 crore).

Margin at 35.3% versus 34.6% (Bloomberg estimate: 36.1%).

Net profit up 25% to Rs 522 crore versus Rs 553.4 crore (Bloomberg estimate: Rs 553 crore).

In 2026, the company plans to invest Rs 1,200 crore on asset upgrades, new projects, the Taj Brand and Digital Tools.

Aims for double-digit revenue growth led by strong same-store sales, new business and 30 hotel openings.

Sector outlook remains strong, with demand outpacing supply, a recovery of foreign tourist arrivals and steady momentum across leisure, social and MICE segments.

CCL Products Q4 Highlights (Consolidated, YoY)

Share price up 15.91% at Rs 687.

Revenue up 15% to Rs 836 crore versus Rs 727 crore (Bloomberg estimate: Rs 827 crore).

Ebitda up 38.2% at Rs 163 crore versus Rs 118 crore (Bloomberg estimate: Rs 130 crore).

Margin at 19.5% versus 16.2% (Bloomberg estimate: 15.7%).

Net profit up 56% to Rs 102 crore versus Rs 65.2 crore (Bloomberg estimate: Rs 68 crore).

Cigniti Technologies Q4 Highlights (Consolidated, QoQ)

Share price rises 8.44% at Rs 1,492.

Revenue up 2.7% to Rs 530.3 crore versus Rs 516.4 crore.

EBIT up 5% to Rs 81.2 crore versus Rs 77 crore.

Margin at 15.3% versus 14.9%.

Net profit up 15% to Rs 73 crore versus Rs 63.5 crore.

Pratap Snacks Q4 (Consolidated, YoY)

Share price falls 2.41% at Rs 1,179.80.

Revenue up 3.1% to Rs 398 crore versus Rs 386 crore.

Ebitda down 94.38% to Rs 1.85 crore versus Rs 32.93 crore.

Margin at 0.46% versus 8.53%.

Net loss at Rs 12 crore versus profit of Rs 12 crore.

DCM Shriram Q4 Highlights (Consolidated, YoY)

Share price rises 10.81% at Rs 1,126.95.

Revenue up 20% to Rs 2,876 crore versus Rs 2,399 crore.

Ebitda up 52.8% to Rs 405 crore versus Rs 265 crore.

Margin at 14% versus 11%.

Net profit up 52% to Rs 179 crore versus Rs 118 crore.

J&K Bank Q4 Highlights (Standalone, YoY)

Share price rises 1.22% at Rs 97.53.

Net interest income up 13% to Rs 1,480 crore versus Rs 1,306 crore.

Net profit down 8.5% to Rs 584 crore versus Rs 639 crore.

Operating profit up 20.5% to Rs 800 crore versus Rs 664 crore.

Gross NPA at 3.37% versus 4.08% (QoQ).

Net NPA at 0.79% versus 0.94% (QoQ).

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.